Home>Finance>Form 4506, Request For Copy Of Tax Return: Definition And Filing

Finance

Form 4506, Request For Copy Of Tax Return: Definition And Filing

Published: November 27, 2023

Need a copy of your tax return? Learn about Form 4506, the definition, and filing process. Ensure financial accuracy with this finance form.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

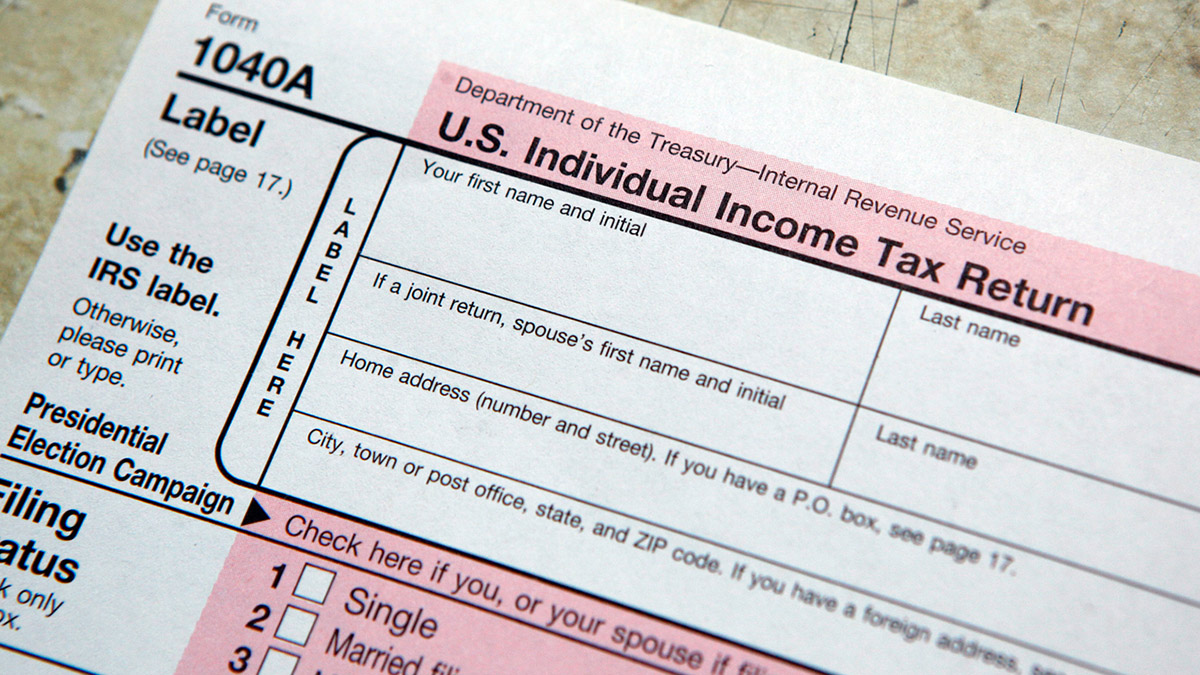

Form 4506: Request for Copy of Tax Return

As we navigate the landscape of personal finance, it’s essential to understand the various tools at our disposal to make wise decisions. One such tool that often goes unnoticed is Form 4506, also known as the Request for Copy of Tax Return. In this blog post, we will delve into the definition and filing process of Form 4506 and highlight its significance in the realm of personal finance.

Key Takeaways:

- Form 4506 is a document that allows individuals to request copies of their tax returns from the Internal Revenue Service (IRS).

- It can be utilized for a variety of purposes, including loan applications, legal proceedings, and financial planning.

Understanding Form 4506

Form 4506 serves as a vital resource for individuals seeking copies of their tax returns. Whether you require them for loan applications, legal proceedings, or financial planning purposes, this form enables you to access critical documents that can help inform your financial decisions.

The Filing Process

Filing Form 4506 is a relatively straightforward process. Here’s a step-by-step guide to help you navigate the paperwork:

- Gather essential information: Before initiating the filing process, ensure that you have the necessary information readily available. This includes your full name, Social Security number, address, and the tax years for which you are requesting copies.

- Obtain the form: Form 4506 can be found on the official IRS website or obtained from your local IRS office. It’s crucial to work with the most up-to-date version of the form to avoid any discrepancies.

- Complete the form: Fill out the required information on the form accurately. Pay close attention to the sections pertaining to the tax years you need copies for, as well as the reason for your request.

- Attach the necessary fee: Along with the completed form, you will need to include the appropriate fee. As of this writing, the fee for a copy of a tax return is $50 per return. Make sure to double-check the latest fee amount before submission.

- Submit the form: Once you have filled out the form and attached the fee, submit it to the address provided on the form or directly to the IRS office nearest to you.

The Significance of Form 4506

Form 4506 plays a crucial role in individuals’ financial lives by providing access to historical tax returns. Here are a few key reasons why this form holds significance:

- Financial planning: Having access to past tax returns can be invaluable when it comes to financial planning. By reviewing previous years’ returns, you can identify trends, analyze your financial situation, and make well-informed decisions for the future.

- Loan applications: When applying for a loan, lenders often require copies of your tax returns as part of the documentation process. Form 4506 allows you to obtain these copies efficiently, ensuring a smooth loan application process.

- Legal proceedings: In legal proceedings such as divorce or estate settlements, tax returns can play a pivotal role. Form 4506 ensures that you have access to these crucial documents to support your case or fulfill legal obligations.

Form 4506 is a powerful tool that empowers individuals in their financial decision-making. By understanding the process behind this form and leveraging it effectively, you can gain insights into your financial past, present, and future. So, don’t overlook the importance of Form 4506 as you embark on your personal finance journey.