Home>Finance>Who Fills Out An Application For A Health Insurance?

Finance

Who Fills Out An Application For A Health Insurance?

Published: October 30, 2023

Looking for health insurance? Discover who typically fills out an application and find the right plan for your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Application Process

- Individuals Applying for Personal Health Insurance

- Employees Applying for Employer-Sponsored Health Insurance

- Dependents Applying for Health Insurance

- Qualifying for Government Assistance Programs

- Factors to Consider When Filling Out an Application

- Tips for Completing a Health Insurance Application

- Common Challenges in Completing Health Insurance Applications

- Conclusion

Introduction

Health insurance is an essential aspect of managing one’s healthcare needs and financial well-being. Whether you are an individual seeking coverage for yourself, an employee applying for employer-sponsored insurance, or a dependent looking for coverage, understanding the application process is crucial.

Applying for health insurance may initially seem like a daunting task, with various forms to fill out, questions to answer, and requirements to meet. However, with a clear understanding of the process and some helpful tips, you can navigate the application process with ease.

In this article, we will explore the different individuals who may need to fill out a health insurance application and delve into the specific considerations and challenges each group may face. We will also discuss the importance of accurately responding to application questions and provide guidance on completing the application successfully.

Whether you are looking for personal health insurance, employer-sponsored coverage, or government assistance programs, this article aims to demystify the application process and empower you to make informed decisions about your healthcare coverage.

By the end of this article, you will have a comprehensive understanding of who fills out health insurance applications and the factors to consider when completing them. Let’s get started!

Understanding the Application Process

Before diving into the specifics of who fills out health insurance applications, let’s first grasp the overall application process. Health insurance applications serve as a means for insurers to gather relevant information about individuals and their healthcare needs to determine eligibility and coverage options.

Typically, health insurance applications include detailed questions about personal information, medical history, current health conditions, and any dependents who require coverage. The application process may vary depending on the type of health insurance sought, such as individual plans, employer-sponsored plans, or government assistance programs.

It’s important to note that health insurance applications may be completed online through insurers’ websites or through paper-based forms. Many insurers offer user-friendly online portals that streamline the application process and allow for easy submission of required documents.

Once you have submitted your application, the insurer will review the information provided to assess your eligibility for coverage. This may involve verifying the accuracy of the information provided, conducting underwriting processes, and considering any pre-existing conditions that may affect coverage or premiums.

After the insurer reviews your application, they will notify you of their decision, outlining the coverage options available to you, associated costs, and any additional documentation required to proceed with enrollment. It’s crucial to review these options carefully, comparing coverage, costs, and network providers before making a final decision.

Understanding the application process is the first step towards successfully obtaining health insurance coverage. Now let’s explore the different groups of individuals who need to fill out health insurance applications and the considerations specific to each.

Individuals Applying for Personal Health Insurance

For individuals who do not have access to employer-sponsored health insurance or government assistance programs, applying for personal health insurance is a critical step in securing coverage.

When filling out a personal health insurance application, you will be required to provide detailed information about your personal demographics, such as your name, address, date of birth, and contact information. You may also need to disclose your Social Security number or other identification numbers for verification purposes.

In addition to personal information, the application will likely inquire about your medical history, including any pre-existing conditions or chronic illnesses. It’s essential to answer these questions truthfully and accurately, as omitting or providing false information could result in denial of coverage or costly penalties once discovered.

When considering personal health insurance, take the time to evaluate your healthcare needs and budget. Consider factors such as the desired level of coverage, the size of the provider network, and the monthly premium and out-of-pocket costs.

If you have any ongoing medications or require specific treatments, ensure that the health insurance plan you choose provides adequate coverage and benefits for those needs. Research the coverage limits and any associated copayments or deductibles to better estimate your out-of-pocket expenses.

It’s also important to review the provider network associated with the health insurance plan. Ensure that the plan includes a network of doctors, hospitals, and specialists in your area to provide the necessary care. If you have established relationships with specific healthcare providers, confirm that they are in-network to avoid potential costs associated with out-of-network care.

When completing the application, carefully read and understand the terms and conditions, coverage limitations, and any exclusions. This will help you make an informed decision about the health insurance plan that best fits your needs.

Remember, personal health insurance is a valuable investment in your health and financial security. Take the time to fill out the application accurately, evaluate your options, and choose a plan that aligns with your individual healthcare needs and budget.

Employees Applying for Employer-Sponsored Health Insurance

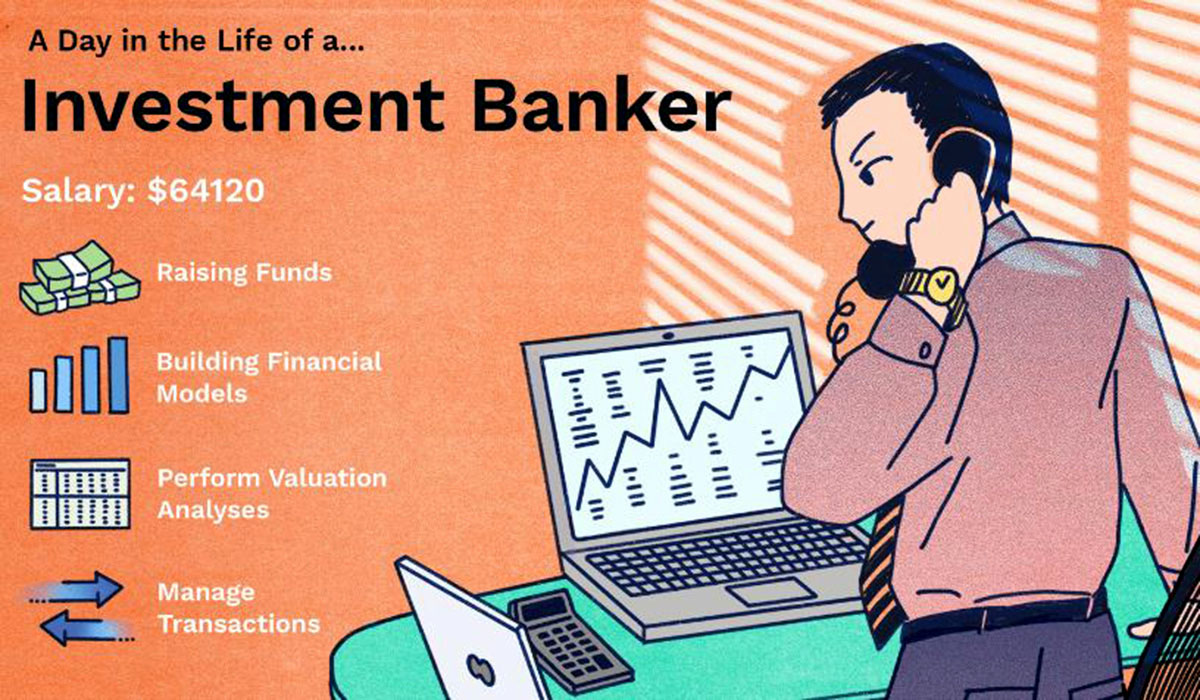

One common way to obtain health insurance coverage is through an employer-sponsored health insurance plan. Many employers offer these plans as part of their employee benefits package, providing employees with the opportunity to secure comprehensive coverage at a potentially lower cost.

When applying for employer-sponsored health insurance, the first step is typically to review the options available to you. Employers often offer a range of coverage options, such as different types of health plans (e.g., HMO, PPO) and different tiers of coverage (e.g., individual, family).

Before applying, it’s important to consider your healthcare needs and assess which coverage option aligns best with those needs. Evaluate factors such as the premiums, deductibles, and co-pays associated with each plan. Additionally, review the provider network to ensure that your preferred doctors and hospitals are included.

Once you have selected the appropriate plan, you will typically complete an enrollment application provided by your employer or their designated insurance provider. The application will require personal information, such as your name, address, and social security number.

In addition to personal information, the application may include questions about your current health status and any pre-existing conditions. It’s important to answer these questions accurately, as providing false information may result in coverage denial or penalties.

Employer-sponsored health insurance often operates on an annual enrollment period, during which employees can choose or change their coverage. Outside of this enrollment period, you may still be able to enroll or make changes to your coverage if you experience a qualifying life event, such as marriage, birth of a child, or a change in employment status.

Once you have submitted your application, the employer or insurance provider will review it and notify you of your enrollment status. If approved, you will typically receive information about your coverage start date, premium amounts, and any additional steps required to finalize your enrollment.

Employer-sponsored health insurance is a valuable benefit that provides employees with access to comprehensive coverage at potentially lower costs. Take the time to understand your options, carefully complete the application, and ensure you have the necessary information to make informed decisions about your healthcare coverage.

Dependents Applying for Health Insurance

In many cases, dependents, such as spouses and children, can be included in an individual’s health insurance plan. This allows for comprehensive coverage for the entire family under a single policy.

When applying for health insurance as a dependent, the process typically involves completing an application form provided by the main policyholder. The application may require personal information, such as the dependent’s name, date of birth, and social security number.

It’s essential to ensure that the information provided for dependents is accurate and up to date. Errors or inconsistencies may impact the eligibility and coverage for the dependent. It’s also important to notify the main policyholder and the insurance provider of any changes in dependent status, such as the birth of a child or a change in marital status.

In some cases, dependents may have the option to choose different coverage options within the family plan. For example, a spouse may have the choice between being covered as a dependent or obtaining their own coverage through their own employment. It’s important to evaluate the options available and choose the most suitable coverage for each dependent.

When filling out the application as a dependent, carefully read and understand the terms and limitations of coverage for each family member. Be aware of any restrictions or requirements that may apply, such as health history disclosures or network restrictions.

It’s also important to consider the financial implications of adding dependents to a health insurance plan. Review the premium costs, deductibles, and co-pays associated with the coverage for each dependent. Consider factors such as the healthcare needs and anticipated expenses for each family member to determine the most appropriate coverage option.

When completing the dependent application, you may need to provide additional documentation, such as marriage certificates or birth certificates, to validate the dependent status. Be sure to follow any instructions provided by the insurance provider regarding the submission of supporting documents.

By carefully completing the dependent application and understanding the options available, you can ensure that your dependents have the necessary health insurance coverage to meet their healthcare needs.

Qualifying for Government Assistance Programs

In order to ensure that everyone has access to essential healthcare coverage, government assistance programs exist to provide financial support to individuals and families who meet certain eligibility criteria.

One of the most well-known government assistance programs in the United States is Medicaid. Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. Eligibility requirements for Medicaid vary by state and may be based on factors such as income level, household size, and other specific criteria.

When applying for Medicaid or other government assistance programs, individuals and families must complete an application form and provide relevant supporting documentation. This may include proof of income, identification, proof of citizenship or legal residency, and other necessary documents.

It’s important to carefully review the eligibility criteria for the specific government assistance program you are applying for. Understanding the income limits, household size requirements, and any other program-specific criteria will help ensure that you meet the qualifications.

Some government assistance programs also have open enrollment periods during which individuals and families can apply for coverage. It’s important to be aware of these enrollment periods and submit your application within the designated timeframe to ensure timely consideration.

When completing the application for government assistance programs, provide accurate and truthful information to avoid any issues with eligibility determination. It’s important to promptly respond to any requests for additional information or verification of eligibility to expedite the application process.

In addition to Medicaid, other government assistance programs, such as the Children’s Health Insurance Program (CHIP) and the Affordable Care Act (ACA) marketplace, provide options for individuals and families to obtain affordable health insurance coverage.

Exploring these programs and their eligibility guidelines can help individuals and families determine if they qualify for government assistance and access the healthcare coverage they need.

Remember, government assistance programs are designed to support individuals and families in need. If you believe you may be eligible, take advantage of these programs to secure the necessary healthcare coverage for yourself and your loved ones.

Factors to Consider When Filling Out an Application

When filling out a health insurance application, there are several important factors to consider to ensure accuracy and maximize your chances of obtaining the right coverage for your needs:

- Personal Information: Provide accurate personal information, including your full name, address, and contact details. Double-check your information for any typos or errors that could potentially result in delays or complications in the application process.

- Medical History: Be truthful and thorough when providing your medical history. Include any pre-existing conditions, chronic illnesses, or recent surgeries. Accuracy is crucial, as any false or omitted information may result in denial of coverage or penalties in the future.

- Dependent Information: If applying for coverage for dependents, ensure that you provide their complete and accurate information. This includes their names, dates of birth, and any necessary supporting documentation to validate their dependent status.

- Comparing Coverage Options: When completing the application, take the time to compare different coverage options available to you. Consider factors such as monthly premiums, deductibles, co-pays, and coverage limits. Evaluate the benefits and limitations of each option to make an informed decision.

- In-Network Providers: Check the list of in-network providers associated with the health insurance plan. Ensure that your preferred doctors, specialists, and hospitals are included in the network to avoid potentially higher out-of-pocket costs associated with out-of-network care.

- Costs: Carefully review the costs associated with the health insurance plan, including monthly premiums, deductibles, co-pays, and any additional fees. Consider your budget and healthcare needs to determine the most affordable and suitable option.

- Coverage Limitations: Take the time to understand the coverage limitations and exclusions outlined in the plan. Different health insurance plans may have varying restrictions on treatments, medications, or procedures covered. Ensure that the plan provides the necessary coverage for your unique healthcare needs.

- Special Circumstances: If you have specific circumstances that may impact your eligibility or coverage, such as a recent change in employment or loss of previous coverage, provide accurate and detailed information. This will help the insurance provider assess your situation and provide appropriate guidance.

- Deadlines: Pay attention to any deadlines associated with the application process. Missing a deadline may result in delays or being locked out of enrollment periods, potentially leaving you without coverage until the next enrollment period.

- Seek Assistance if Needed: If you find the application process overwhelming or have questions, don’t hesitate to seek assistance from insurance brokers, customer service representatives, or healthcare navigators. These professionals can provide guidance and help ensure that your application is complete and accurate.

By carefully considering these factors and completing the application accurately, you can increase your chances of obtaining the right health insurance coverage to meet your individual needs and budget.

Tips for Completing a Health Insurance Application

Completing a health insurance application can sometimes feel overwhelming, but with these helpful tips, you can navigate the process smoothly and efficiently:

- Read the Instructions: Take the time to read the application instructions thoroughly. Familiarize yourself with the requirements, deadlines, and any specific guidelines provided by the insurance provider.

- Gather Necessary Documents: Collect all the necessary documents before starting the application. This may include identification cards, proof of address, social security numbers, income statements, and any other documentation required by the insurer.

- Keep Copies: Make copies of all the completed application forms and supporting documents. This will serve as a reference and backup in case any issues or discrepancies arise.

- Fill Out the Application Completely: Ensure that you complete each section of the application and provide accurate information. Leaving any sections blank or providing incomplete information may result in delays or potential denial of coverage.

- Be Accurate and Honest: Answer all questions truthfully and accurately. Providing false information or omitting important details can have serious consequences, including denial of coverage or potential legal repercussions.

- Proofread: Double-check your application for any errors or typos. Even minor mistakes can cause unnecessary delays or complications. Pay extra attention to dates, addresses, and other critical information.

- Ask for Help: If you are unsure about any aspect of the application, seek assistance. Contact the insurance provider’s customer service or consult an insurance broker to address any questions or concerns you may have.

- Submit the Application on Time: Be mindful of any application deadlines and submit your application within the designated timeframe. Failure to do so may result in delayed coverage or the need to wait for the next enrollment period.

- Follow Up: After submitting your application, follow up with the insurance provider to ensure that they have received it and that there are no outstanding requirements or additional steps needed to process your application.

- Keep a Record: Maintain a record of all communication and documentation related to your health insurance application. This includes receipts, confirmation emails, and any correspondence with the insurance provider.

Remember, completing a health insurance application is a crucial step in securing the coverage you need for your healthcare needs. By following these tips, you can increase your chances of a successful application process and ensure that you receive the appropriate health insurance coverage.

Common Challenges in Completing Health Insurance Applications

While completing a health insurance application may seem straightforward, there are a few common challenges that individuals often encounter. Being aware of these challenges can help you navigate the process more effectively. Here are some of the most common challenges and tips to overcome them:

- Complexity of the Application: Health insurance applications can be lengthy and complex, with numerous questions and sections to complete. Take your time to read and understand each question before providing a thorough and accurate response.

- Understanding Medical Terminology: The use of medical jargon and terminology in health insurance applications can be confusing. If you encounter unfamiliar terms, seek clarification from your healthcare provider or insurance company to ensure accurate responses.

- Gathering Required Documentation: Health insurance applications often require supporting documentation, such as proof of income or identification. It can be challenging to gather all the necessary documents. Create a checklist of required documents and gather them in advance to streamline the application process.

- Time Constraints: Meeting application deadlines can be challenging, especially if you have a busy schedule. Start the application process early to allow ample time for gathering information and completing the application thoroughly.

- Providing Accurate Information: It’s crucial to provide accurate and up-to-date information in your application. Mistakes or omissions can lead to delays, rejections, or even allegations of fraud. Double-check all information before submitting your application.

- Understanding Plan Options: Choosing the right health insurance plan can be daunting. Review the plan options carefully, considering factors such as deductibles, co-pays, and network coverage. If unsure, seek guidance from insurance agents or utilize online tools to compare plans.

- Language Barriers: Language barriers can make completing the application difficult for non-native speakers. Seek assistance from bilingual family members, friends, or professional interpreters to ensure accurate communication and understanding.

- Navigating Online Applications: If completing an online application, navigating through the digital platform may present challenges, especially for those who are less tech-savvy. Take your time, read instructions carefully, and seek technical support if needed.

- Lack of Access to Information: Some applicants may not have access to important information, such as medical records or previous insurance policy details. Contact healthcare providers or previous insurers to obtain the necessary information for a complete application.

- Complex Family Situations: Applying for health insurance as a family with unique circumstances, such as blended families or children from multiple relationships, can present additional challenges. Provide accurate information for each family member and seek guidance from the insurer to ensure appropriate coverage for everyone.

By understanding and preparing for these common challenges, you can overcome potential obstacles and successfully complete your health insurance application. Remember, if you encounter difficulties, don’t hesitate to seek assistance from insurance representatives or professionals who can provide guidance throughout the process.

Conclusion

Completing a health insurance application is a critical step in obtaining the necessary coverage to protect your health and financial well-being. Whether you are applying for personal health insurance, employer-sponsored coverage, or government assistance programs, understanding the application process is essential.

Throughout this article, we explored the different individuals who may need to fill out health insurance applications and discussed the specific considerations and challenges each group may face. We also provided tips for completing the application successfully, despite the common challenges that can arise.

When filling out an application, it’s crucial to provide accurate information, understand the plan options, and consider factors such as costs, coverage limitations, and in-network providers. Taking the time to evaluate your healthcare needs, gather the necessary documents, and ask for assistance when needed will help streamline the application process.

Remember, maintaining truthful and accurate information in your health insurance application is essential. Any false information or omissions may have serious consequences, including denial of coverage or potential legal repercussions.

By following the tips and insights provided in this article, you can navigate the application process with confidence and increase your chances of obtaining suitable health insurance coverage.

Health insurance is an invaluable asset that provides financial protection and ensures access to necessary healthcare services. Take the time to understand your options, complete the application accurately, and secure the coverage that aligns with your healthcare needs and budget.