Home>Finance>How To Fill Out 941-X For Employee Retention Credit

Finance

How To Fill Out 941-X For Employee Retention Credit

Published: January 13, 2024

Learn how to fill out Form 941-X for the Employee Retention Credit and boost your finance strategy. Maximize tax savings and optimize your business finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Form 941-X?

- Overview of Employee Retention Credit

- Eligibility Criteria for Employee Retention Credit

- Step-by-Step Guide to Filling out Form 941-X

- Part 1: Identifying Information

- Part 2: Explanation of Adjustments

- Part 3: Claiming the Employee Retention Credit

- Part 4: Supporting Documentation

- Part 5: Signature and Date

- Tips for Completing Form 941-X Accurately

- Common Mistakes to Avoid

- Conclusion

Introduction

Welcome to our comprehensive guide on how to fill out Form 941-X for the Employee Retention Credit. As a business owner, understanding and utilizing available tax credits is essential for minimizing your tax liability and maximizing your financial resources.

Form 941-X is a document used to correct errors or make adjustments to previously filed Form 941, which is the Employer’s Quarterly Federal Tax Return. The Employee Retention Credit (ERC) was introduced to provide financial relief to businesses impacted by the COVID-19 pandemic. This credit allows eligible employers to claim a percentage of qualified wages paid to employees, helping to offset the financial burden caused by the downturn in business.

In this article, we will provide you with a step-by-step guide on how to fill out Form 941-X to claim the Employee Retention Credit accurately. We will also discuss the eligibility criteria for the credit and provide some valuable tips to ensure you complete the form correctly. Whether you are a small business owner or a tax professional assisting clients, this guide will equip you with the knowledge and tools you need to navigate the process seamlessly.

What is Form 941-X?

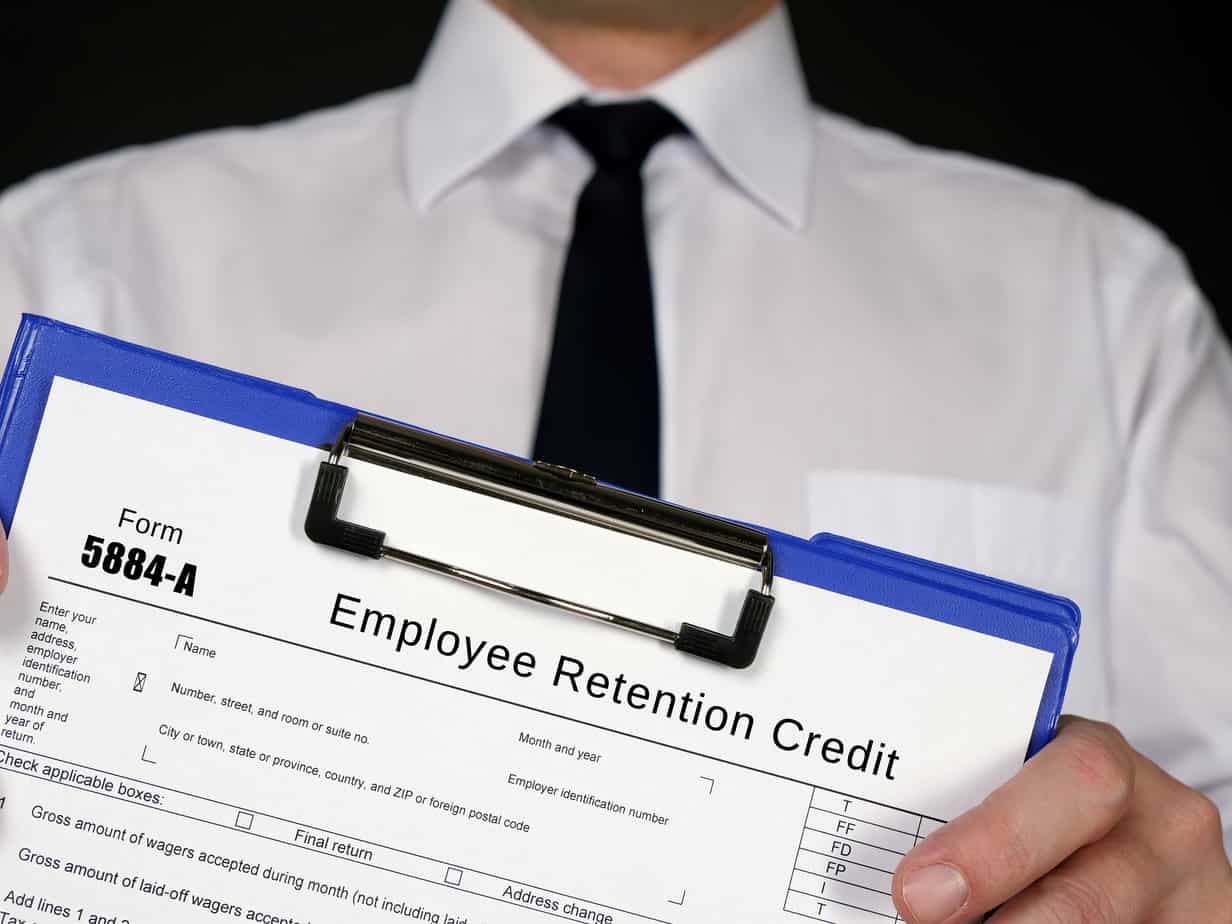

Form 941-X is the form used to correct errors or make adjustments to previously filed Form 941, which is the Employer’s Quarterly Federal Tax Return. This form is specifically used to claim the Employee Retention Credit (ERC) or to correct any mistakes related to the credit.

The ERC was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide financial relief to businesses affected by the COVID-19 pandemic. It allows eligible employers to claim a credit against their payroll taxes for a percentage of qualified wages paid to employees. The credit is designed to help businesses retain their employees during times of economic hardship.

If you have already filed Form 941 and now need to claim the Employee Retention Credit or make adjustments to the credit amount, you will need to use Form 941-X. This form allows you to correct any errors on your original Form 941 and reconcile any differences in the reported payroll tax liabilities and the amount of credit you are eligible for.

It’s important to note that you should only use Form 941-X to correct errors or make adjustments related to the Employee Retention Credit. If you have other corrections or adjustments to make, such as changes to your reported wages, tax liability, or credits unrelated to the ERC, you should use Form 941 to file your corrections.

When filling out Form 941-X, you will need to provide detailed information about the adjustments you are making, including explanations for each adjustment and supporting documentation. It’s crucial to accurately complete the form, as any errors or discrepancies can lead to delays in processing or potential penalties.

Next, we will provide an overview of the Employee Retention Credit and discuss the eligibility criteria for claiming the credit.

Overview of Employee Retention Credit

The Employee Retention Credit (ERC) is a tax credit introduced by the CARES Act to provide financial relief to businesses impacted by the COVID-19 pandemic. It allows eligible employers to claim a percentage of qualified wages paid to employees, helping to offset the financial burden caused by the downturn in business.

The ERC is available to businesses of all sizes, including tax-exempt organizations, that experience one of two qualifying conditions:

- Businesses fully or partially suspended due to government orders

- Businesses experiencing a significant decline in gross receipts

If your business meets either of these qualifying conditions, you can claim the Employee Retention Credit for wages paid between March 13, 2020, and December 31, 2021. The credit can be up to 70% of qualified wages, with a maximum credit of $7,000 per employee per quarter.

To determine if your business experienced a significant decline in gross receipts, you compare your current quarter’s gross receipts with the same quarter in the previous year. If your gross receipts for the current quarter are less than 80% of the gross receipts from the same quarter in the previous year, you meet the decline in gross receipts criteria.

Qualified wages include wages paid to employees during the eligible period, including the cost of healthcare benefits provided by the employer. However, there are certain limitations on which employees’ wages qualify for the credit. For example, wages paid to family members or major shareholders may not be eligible.

It’s important to note that if you receive a loan under the Paycheck Protection Program (PPP), you are not eligible to claim the Employee Retention Credit for the same wages. However, if you did not claim the credit for wages paid in certain periods because you had received PPP funds, you can retroactively claim the credit for those wages by amending your Form 941 using Form 941-X.

Now that we have an understanding of the ERC and its eligibility criteria, let’s dive into how to fill out Form 941-X to claim this important credit.

Eligibility Criteria for Employee Retention Credit

In order to claim the Employee Retention Credit (ERC), businesses must meet specific eligibility criteria outlined by the Internal Revenue Service (IRS). Understanding these criteria is crucial to determine if your business qualifies for the credit.

There are two main qualifying conditions for the ERC:

- Business suspension: Your business must have been fully or partially suspended due to orders from a governmental authority limiting commerce, travel, or group gatherings due to COVID-19. This applies to businesses that had to close their physical locations or operations due to government mandates or faced significant restrictions on operations.

- Decline in gross receipts: If your business did not experience a full or partial suspension but saw a significant decline in gross receipts, you may still be eligible for the ERC. A significant decline is defined as a 20% or more decline in gross receipts for a calendar quarter compared to the same quarter in the previous year. This eligibility criterion allows businesses that experienced a substantial decrease in revenue to qualify for the credit.

It’s important to note that to claim the ERC, your business must continue paying wages to employees during the eligible period. Qualified wages include wages paid to employees who are not providing services due to a full or partial suspension or significant decline in gross receipts. However, there are certain limitations on which employees’ wages can be included in the calculation of the credit.

When determining the eligibility for the ERC, it is essential to keep in mind that businesses that receive Paycheck Protection Program (PPP) loans are not eligible to claim the credit. However, recent updates allow businesses to claim the credit for wages not covered by forgiven PPP funds or wages not used to claim other tax credits.

Additionally, the ERC is available to most employers, including for-profit businesses of all sizes, tax-exempt organizations, and government entities, as long as they meet the eligibility criteria.

It is important to review the specific guidelines provided by the IRS and consult with a tax professional to ensure your business qualifies for the Employee Retention Credit. Understanding the eligibility criteria is crucial for accurately claiming the credit and maximizing its benefits for your business.

Now that we have discussed the eligibility criteria, let’s move on to the step-by-step process of filling out Form 941-X to claim the Employee Retention Credit.

Step-by-Step Guide to Filling out Form 941-X

Filling out Form 941-X to claim the Employee Retention Credit (ERC) requires careful attention to detail and thorough understanding of the form’s sections and requirements. Follow this step-by-step guide to ensure you accurately complete the form and maximize your benefits:

- Part 1: Identifying Information: Provide your business’s name, address, employer identification number (EIN), and the quarter and year you are amending.

- Part 2: Explanation of Adjustments: In this section, you will explain the adjustments you are making on Form 941-X. You must clearly identify the changes and provide detailed descriptions for each adjustment made.

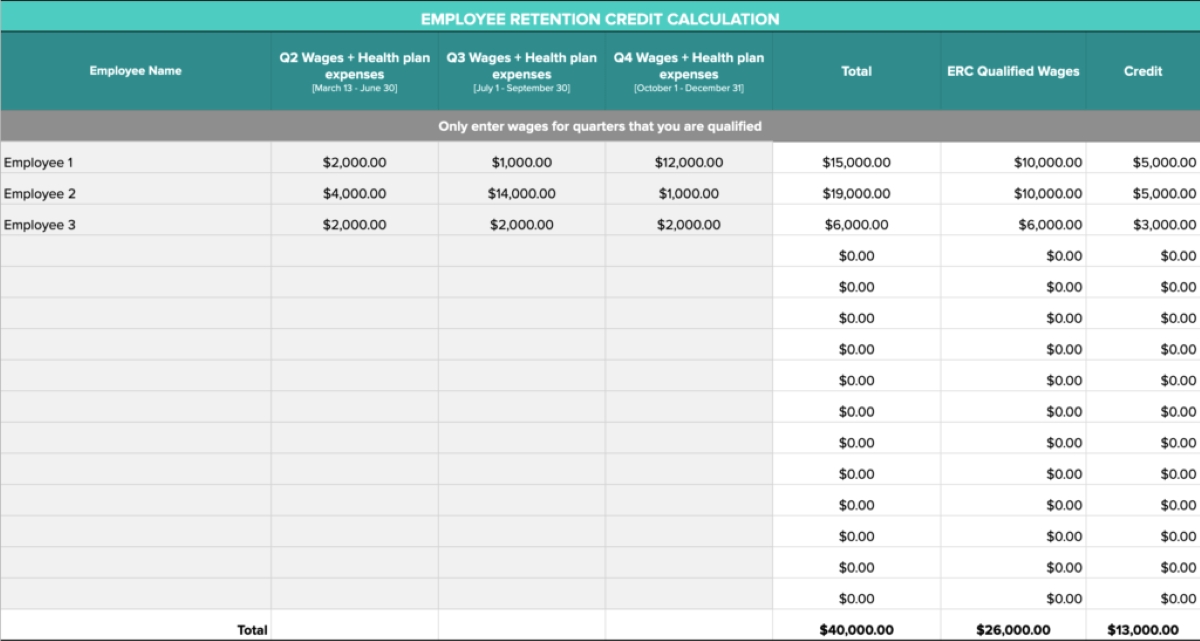

- Part 3: Claiming the Employee Retention Credit: Here, you will calculate the Employee Retention Credit by filling in the required information for each eligible quarter, including the number of eligible employees, qualified wages paid, and any other applicable information.

- Part 4: Supporting Documentation: Attach supporting documentation to substantiate the adjustments and credits claimed on Form 941-X. This may include payroll records, financial statements, and any other relevant documents.

- Part 5: Signature and Date: Sign and date the form to certify that the information provided is accurate and complete.

Remember, accuracy is key when filling out Form 941-X. Double-check all information, calculations, and documentation before submitting the form to the IRS. Any errors or discrepancies may lead to processing delays or potential penalties.

It’s important to note that Form 941-X is used specifically for making adjustments related to the Employee Retention Credit. If you have other corrections or adjustments to make that are unrelated to the ERC, you should use Form 941 for those corrections.

Now let’s take a closer look at each section of Form 941-X to provide you with a better understanding of what information is required in each part.

Part 1: Identifying Information

In Part 1 of Form 941-X, you will provide the identifying information for your business and the quarter you are amending. This section ensures that the IRS can accurately identify your business and match it with the original Form 941.

Here’s a step-by-step breakdown of the information required in Part 1:

- Business Name: Enter the legal name of your business. Make sure the name matches exactly as it appeared on the original Form 941 you are amending.

- Business Address: Provide the full address of your business, including street address, city, state, and ZIP code. Ensure the address matches the address on the original Form 941.

- Employer Identification Number (EIN): Enter your unique EIN assigned by the IRS. The EIN is a nine-digit number used to identify your business for tax purposes. It should match the EIN reported on the original Form 941.

- Quarter and Year: Specify the quarter and year for which you are amending Form 941. For example, if you are amending the first quarter of 2022, you would enter “Q1 2022”.

It’s crucial to accurately provide all the required identifying information in Part 1 to ensure proper identification and processing of your amended Form 941-X.

Once you have filled in the necessary information, carefully review it for accuracy before proceeding to the next section. Any mistakes or discrepancies in the identifying information can lead to delays or potential issues with the processing of your form.

Now that you have completed Part 1, we will move on to Part 2, where you will provide an explanation of the adjustments made on Form 941-X.

Part 2: Explanation of Adjustments

In Part 2 of Form 941-X, you will provide a detailed explanation of the adjustments you are making on the form. This section allows you to communicate the specific changes and provide supporting documentation for each adjustment.

Here’s a step-by-step breakdown of how to complete Part 2:

- Line 1: Enter the line number from Form 941 that you are adjusting. Specify whether you are increasing or decreasing the amount reported on the original Form 941 in the “Increase (Inc.)” or “Decrease (Dec.)” column.

- Code: Enter the appropriate adjustment code that corresponds to the adjustment you are making. The adjustment codes are listed on the Instructions for Form 941-X provided by the IRS. Choose the code that best matches the nature of your adjustment.

- Description: Provide a detailed explanation of the adjustment you are making in this section. Clearly state the reason for the adjustment and provide any necessary supporting documentation.

When explaining your adjustments, be concise yet thorough. Include all relevant details and supporting documents to support your claims. Remember that the IRS will review this information to ensure the accuracy and validity of your adjustments.

It is essential to accurately document and explain each adjustment in this section. Providing clear and detailed explanations along with supporting documentation will help prevent delays or potential issues with the processing of your amended Form 941-X.

After completing Part 2, you will proceed to Part 3, where you will calculate and claim the Employee Retention Credit (ERC). We will provide a detailed guide on how to complete Part 3 in the next section.

Part 3: Claiming the Employee Retention Credit

In Part 3 of Form 941-X, you will calculate and claim the Employee Retention Credit (ERC) for each eligible quarter. This section requires you to provide detailed information about the eligible employees, qualified wages paid, and any other required information related to the credit.

Here’s a step-by-step breakdown of how to complete Part 3:

- Column (a) – Quarter: Enter the quarter for which you are claiming the ERC. For example, if you are claiming the credit for the first quarter of 2022, you would enter “Q1”.

- Column (b) – Qualified Wages: Enter the total qualified wages paid to eligible employees during the specified quarter. Qualified wages are those paid to employees who meet the criteria outlined by the IRS for the ERC. Make sure to include only eligible wages in this column.

- Column (c) – Average FTEs: Provide the average full-time equivalent (FTE) employees during the specified quarter. This is calculated by dividing the total hours of service by 40 for each employee and then summing up the FTEs for all eligible employees.

- Column (d) – Credit per Quarter: Calculate the Employee Retention Credit for each quarter by multiplying the qualified wages (Column (b)) by the applicable percentage (up to 70%). This will give you the credit amount for each quarter.

- Line 5: Sum up the total credit claimed for all quarters in this line. This should be the total of Column (d) across all quarters.

When claiming the Employee Retention Credit, it’s important to accurately calculate and report the qualified wages and average FTEs for each eligible quarter. Be sure to refer to the IRS guidelines and consult a tax professional if you have any questions about what qualifies as eligible wages or how to determine FTEs.

Once you have completed Part 3 and calculated the total credit claimed, you will proceed to Part 4, where you will attach any required supporting documentation. We will cover this section in the next part of our guide.

Part 4: Supporting Documentation

In Part 4 of Form 941-X, you will attach supporting documentation to substantiate the adjustments and claims made on the form. This section is crucial for providing proof of your eligible wages, supporting calculations, and any other necessary documentation.

Here’s a step-by-step breakdown of how to complete Part 4:

- Attachments: In this section, indicate the number of pages of supporting documentation you are attaching to Form 941-X. You should include all relevant documents that support your adjustments, such as payroll records, financial statements, or any other documentation required by the IRS.

- Description: Provide a brief description of the supporting documentation you are attaching. This allows the IRS to quickly identify and understand the purpose of each document.

When assembling your supporting documentation, make sure it is organized and clearly labeled. Include only documents that are relevant to the adjustments and claims made on Form 941-X. This may include wage records, tax forms, receipts, or any other documents that support your case.

It’s important to maintain accurate records and retain copies of all supporting documentation for future reference. Additionally, keep in mind that the IRS may request additional documentation or verification to validate your claims. Therefore, make sure to keep a copy of all documents submitted.

Once you have attached the required supporting documentation, you will move on to Part 5, where you will sign and date the form to certify its accuracy. We will cover this final part in the next section of our guide.

Part 5: Signature and Date

In Part 5 of Form 941-X, you will sign and date the form to certify its accuracy and completeness. This final step is important as it signifies your agreement with the information provided and your acknowledgment of the penalties for willful falsification of documents.

Here’s a step-by-step breakdown of how to complete Part 5:

- Signature: Sign the form using your legal signature. If you are filing on behalf of a business, sign with your authority to represent the company.

- Name: Print your name legibly or provide the name of the authorized representative of the business.

- Title: State your title or position within the business if applicable.

- Date: Enter the date when you are signing the form. Make sure the date is current and reflects the day you are submitting the document.

By signing the form, you are attesting that the information provided is true, accurate, and complete to the best of your knowledge. It is essential to read and understand the implications of signing the form, as willful falsification of information may result in penalties and legal consequences.

Before signing, review the entire form and ensure that all sections are accurately completed. Make sure you have attached all necessary supporting documentation as indicated in Part 4.

Once you have completed Part 5 and signed the form, you are ready to submit the Form 941-X along with any required attachments to the IRS for processing.

Now that you have a comprehensive understanding of the step-by-step process for filling out Form 941-X, let’s move on to the next section where we will provide you with some valuable tips to ensure you complete the form accurately.

Tips for Completing Form 941-X Accurately

Completing Form 941-X accurately is crucial to ensure that your adjustments and claims for the Employee Retention Credit (ERC) are properly processed by the IRS. Here are some valuable tips to help you navigate the form correctly:

- Review the Instructions: Carefully read and familiarize yourself with the instructions provided by the IRS for Form 941-X. The instructions provide valuable insights into each section of the form and help clarify any questions or uncertainties.

- Double-Check Identifying Information: Ensure that the identifying information in Part 1 matches the information on the original Form 941 you are amending. Any discrepancies can lead to processing delays or issues.

- Provide Clear and Detailed Explanations: In Part 2, clearly explain each adjustment made on Form 941-X. Include any necessary supporting documentation to back up your claims and help the IRS understand the nature of the adjustment.

- Accurately Calculate the Employee Retention Credit: Take your time and accurately calculate the qualified wages, average full-time equivalents (FTEs), and the credit amount for each eligible quarter in Part 3. Refer to the IRS guidelines and consult with a tax professional if needed to ensure accurate calculations.

- Organize and Label Supporting Documentation: Attach all required supporting documentation in Part 4. Organize the documents in a logical order and label them clearly to make it easier for the IRS to review and validate your claims.

- Validate Data and Perform Quality Checks: Before submitting the form, double-check all entered data, calculations, and supporting documentation. Verify that the information is accurate, consistent, and complete to minimize potential errors that could impact the processing of your form.

- Retain Copies of Form 941-X and Supporting Documentation: Keep copies of the completed Form 941-X, along with all attached supporting documentation, for your records. This will be helpful in case of future inquiries or audits by the IRS.

By following these tips, you can enhance the accuracy and completeness of your Form 941-X submission and improve the likelihood of a smooth processing experience with the IRS.

Now that you have a better understanding of how to complete Form 941-X accurately, let’s move on to the next section where we will discuss some common mistakes you should avoid.

Common Mistakes to Avoid

When filling out Form 941-X for the Employee Retention Credit (ERC), it’s important to be aware of common mistakes that can hinder the accuracy and processing of your form. By avoiding these mistakes, you can save time, prevent processing delays, and ensure that your claim for the ERC is submitted correctly. Here are some common mistakes to avoid:

- Inaccurate or Incomplete Information: Double-check all entered information, calculations, and supporting documentation to ensure accuracy and completeness. Mistakes in identifying information, figures, or explanations may lead to delays or potential confusion during the processing of your form.

- Not Following the Instructions: Carefully read and follow the instructions provided by the IRS for Form 941-X. Failure to adhere to the instructions may result in confusion, incorrect completion of the form, and potential processing issues.

- Missing or Insufficient Supporting Documentation: Ensure that you include all necessary supporting documentation in Part 4. Missing or inadequate documentation may lead to rejection of your claim or delays in processing.

- Incorrect Calculation of the Employee Retention Credit: Take your time and double-check your calculations in Part 3. Accurate calculation of the qualified wages, average full-time equivalents (FTEs), and the credit amount for each eligible quarter is crucial to receive the correct credit and avoid potential discrepancies.

- Failure to Retain Copies: Keep copies of the completed Form 941-X and all attached supporting documentation for your records. Retaining copies ensures that you have documentation available in case of future inquiries or audits by the IRS.

- Not Seeking Professional Guidance: If you are unsure about any aspect of completing Form 941-X or claiming the ERC, consider seeking assistance from a tax professional or an accountant who has expertise in payroll taxes and tax credits.

By being cautious and avoiding these common mistakes, you can increase the accuracy and efficiency of your Form 941-X submission. It’s important to take the time to review and validate the information provided to ensure a smooth processing experience with the IRS.

Now that we have covered some common mistakes to avoid, let’s conclude our guide on completing Form 941-X for the Employee Retention Credit.

Conclusion

Completing Form 941-X for the Employee Retention Credit (ERC) may seem like a daunting task, but with the right guidance and attention to detail, you can navigate the process successfully. This comprehensive guide has equipped you with a step-by-step approach to accurately fill out Form 941-X, ensuring that you claim the ERC correctly and maximize your tax benefits.

Remember to carefully review the instructions provided by the IRS, double-check all information entered, and attach the necessary supporting documentation. Providing clear and detailed explanations for adjustments and accurate calculations for the ERC will help streamline the processing of your form and reduce the potential for errors or delays.

Additionally, avoid common mistakes such as incomplete or inaccurate information, missing documentation, and failure to retain copies of the completed form. Following these tips and guidelines will help you submit a thorough and accurate Form 941-X, increasing the chances of a smoother processing experience with the IRS.

If you have any uncertainties or specific questions about your eligibility or the process of completing Form 941-X, it’s always beneficial to consult a tax professional or an accountant who specializes in tax credits and payroll taxes. Their expertise and guidance can provide you with the necessary support to navigate any complexities and ensure compliance with IRS regulations.

By claiming the Employee Retention Credit through Form 941-X, you can leverage financial relief to help your business recover from the impacts of the COVID-19 pandemic. Take the time to understand the eligibility criteria, gather the required documentation, and complete the form accurately to maximize your benefits.

As regulations and guidelines may evolve over time, it’s important to stay informed and up to date with any changes in legislation or IRS requirements. Regularly check the IRS website for the latest updates and consult with professionals if needed to ensure compliance with any amendments that may impact your eligibility or the process of claiming the credit.

With thorough understanding, attention to detail, and the right resources, you can successfully navigate the process of filling out Form 941-X and claim the Employee Retention Credit effectively. By doing so, you can leverage this important tax credit to support your business and help it thrive in these challenging times.