Finance

Who Is A Certifying Officer For Savings Bonds

Modified: February 21, 2024

Get to know who qualifies as a Certifying Officer for Savings Bonds in the field of finance. Expert insights on the responsibilities and qualifications of these officers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Certifying Officer for Savings Bonds

- Roles and Responsibilities of a Certifying Officer

- Qualifications and Eligibility Criteria for Being a Certifying Officer

- Appointment Process for Certifying Officers

- Training and Continuing Education Requirements for Certifying Officers

- Duties and Obligations of a Certifying Officer

- Authority and Limitations of a Certifying Officer

- Penalties and Liabilities for Certifying Officers

- Importance of Certifying Officers in the Savings Bonds Program

- Conclusion

Introduction

When it comes to investing in savings bonds, there are various individuals involved in the process. One key figure in this system is the Certifying Officer for Savings Bonds. This article aims to provide a comprehensive overview of the role and responsibilities of a Certifying Officer, their qualifications, and the importance of their role in the savings bonds program.

Savings bonds are a popular investment tool offered by the government to individuals looking for a secure and low-risk option to grow their savings. To ensure the integrity of the savings bonds program, Certifying Officers play a crucial role in the certification and verification of savings bond transactions. They are responsible for confirming the identity of bondholders and overseeing the issuance and redemption of savings bonds.

Being appointed as a Certifying Officer is an important responsibility as they are entrusted with the task of upholding the highest standards of integrity and accuracy in the savings bonds program. In this article, we will explore the qualifications required to become a Certifying Officer, their roles and responsibilities, as well as the process of appointment and training.

By understanding the role of a Certifying Officer and the significance of their responsibilities, investors and bondholders can have confidence in the savings bonds program and make informed decisions when investing in these financial instruments.

Definition of a Certifying Officer for Savings Bonds

A Certifying Officer for Savings Bonds is an individual designated by the Treasury Department or another authorized agency to authenticate and certify certain transactions related to savings bonds. These officers play a crucial role in ensuring the accuracy and integrity of savings bond transactions by verifying the identity of bondholders, certifying transactions, and safeguarding against fraudulent activities.

Certifying Officers act as the gatekeepers of the savings bonds program, ensuring that only legitimate transactions and individuals are involved. They are responsible for verifying the authenticity of bondholders’ signatures, confirming their identity through appropriate documentation, and certifying the issuance, transfer, redemption, and reissue of savings bonds. This process helps in maintaining the integrity of the savings bonds program and protecting investors from potential fraud or unauthorized transactions.

Additionally, Certifying Officers are responsible for keeping accurate records of savings bond transactions and maintaining the confidentiality of sensitive information. They must adhere to strict guidelines and policies set by the governing authorities and follow established procedures to ensure the proper handling and storage of bond records.

Overall, a Certifying Officer is a trusted individual who holds a significant level of responsibility in the savings bonds program. Their role is critical in maintaining the trust and confidence of investors by certifying and safeguarding the legitimacy of savings bond transactions.

Roles and Responsibilities of a Certifying Officer

Certifying Officers for Savings Bonds have a range of important roles and responsibilities within the savings bonds program. These responsibilities are crucial in maintaining the integrity and security of savings bond transactions. The primary roles and responsibilities of a Certifying Officer include:

- Verifying Identity: One of the key responsibilities of a Certifying Officer is to verify the identity of bondholders. They carefully examine identification documents, such as passports or driver’s licenses, to ensure that the individual presenting the documents is the rightful owner of the savings bond.

- Certifying Transactions: Certifying Officers are responsible for certifying various types of savings bond transactions, including the issuance, transfer, redemption, and reissue of bonds. They carefully review and authenticate the necessary documents and ensure that all transactions comply with the regulations and guidelines set by the governing authorities.

- Maintaining Records: Certifying Officers are responsible for maintaining accurate and up-to-date records of savings bond transactions. They keep detailed records of bondholders’ information, transaction dates, and transaction amounts. These records serve as a crucial resource for auditing, tracking, and resolving any issues or discrepancies that may arise.

- Ensuring Compliance: Certifying Officers play a key role in ensuring compliance with the policies, procedures, and regulations governing savings bond transactions. They must stay up-to-date with any changes or updates in the rules and guidelines governing savings bonds and ensure that all transactions are executed in accordance with these regulations.

- Safeguarding Confidentiality: Given the sensitive nature of savings bond transactions, Certifying Officers must prioritize the security and confidentiality of the information they handle. They are responsible for implementing appropriate security measures, both physical and digital, to protect bondholder information and prevent unauthorized access or misuse.

By fulfilling these roles and responsibilities, Certifying Officers contribute to the overall integrity, security, and trustworthiness of the savings bonds program. Their diligent efforts ensure that only legitimate transactions are certified, protecting bondholders and the program as a whole from potential fraudulent activities.

Qualifications and Eligibility Criteria for Being a Certifying Officer

To become a Certifying Officer for Savings Bonds, individuals must meet certain qualifications and eligibility criteria. These requirements are in place to ensure that only qualified and trustworthy individuals are entrusted with the responsibilities of certifying savings bond transactions. The qualifications and eligibility criteria include:

- Educational Background: Most agencies require a minimum educational qualification, such as a high school diploma or equivalent, to become a Certifying Officer. Some agencies may prefer candidates with a bachelor’s degree or higher in a relevant field, such as finance or accounting.

- Financial Knowledge: A sound understanding of financial concepts, particularly in the field of savings bonds, is essential for a Certifying Officer. They should have a good grasp of bond issuance, redemption, transfer processes, and compliance guidelines governing savings bonds.

- Integrity and Trustworthiness: Certifying Officers are entrusted with sensitive financial information and transactions. Therefore, agencies typically conduct thorough background checks to ensure that candidates have a high level of integrity and trustworthiness. This may include reviewing criminal records and credit history.

- Attention to Detail: Given the importance of accuracy in certifying savings bond transactions, Certifying Officers must possess excellent attention to detail. They must be meticulous in reviewing documents, verifying information, and maintaining accurate records to avoid errors or discrepancies.

- Strong Communication Skills: Effective communication is crucial for Certifying Officers to interact with bondholders, explain transaction processes, and address any concerns or inquiries. Strong verbal and written communication skills are essential to perform their duties effectively.

- Legal Citizenship or Residency: To become a Certifying Officer, individuals must usually be legal citizens or permanent residents of the country where the savings bonds program operates. This requirement ensures that bond transactions are certified by individuals with a vested interest in the country’s financial systems.

It is important to note that exact qualifications and eligibility criteria may vary depending on the jurisdiction and agency overseeing the savings bond program. Individuals interested in becoming Certifying Officers should consult the specific requirements set forth by the respective authorities or agencies.

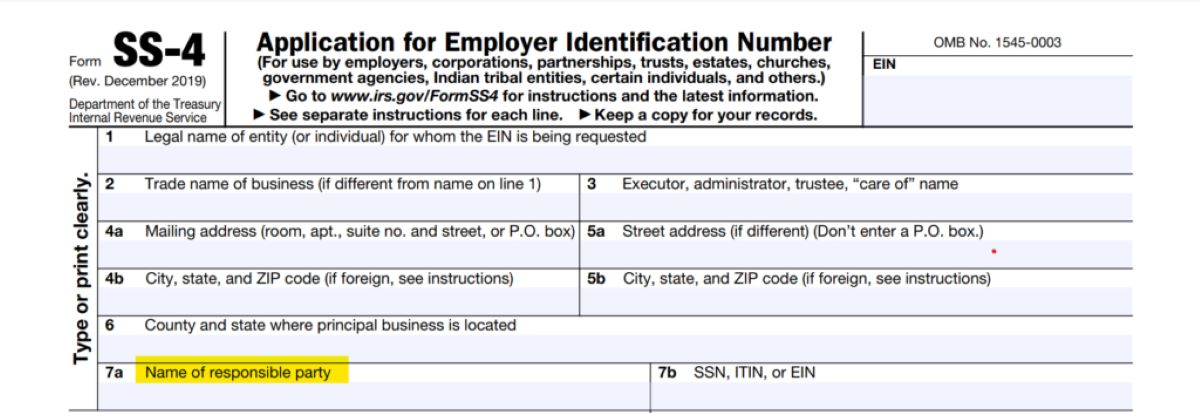

Appointment Process for Certifying Officers

The appointment process for Certifying Officers for Savings Bonds involves several steps to ensure that only qualified individuals are entrusted with the responsibility of certifying savings bond transactions. The exact process may vary depending on the jurisdiction and agency overseeing the savings bond program, but the following steps are commonly involved:

- Application Submission: Interested individuals must submit an application to the relevant authority or agency responsible for appointing Certifying Officers. The application typically includes personal information, educational background, and any relevant experience or qualifications.

- Background Check: As part of the appointment process, agencies often conduct thorough background checks on applicants. This includes reviewing criminal records, conducting credit checks, and verifying references to ensure the integrity and trustworthiness of potential Certifying Officers.

- Evaluation and Interview: Depending on the agency’s requirements, applicants may be evaluated based on their qualifications, experience, and suitability for the role. This evaluation may involve an interview to assess the candidate’s knowledge of savings bonds and their ability to fulfill the responsibilities of a Certifying Officer.

- Training: Once selected, individuals typically undergo training specific to the savings bond program. This training covers topics such as bond issuance, redemption, transfer procedures, compliance regulations, and record-keeping. The duration and format of the training may vary, but it equips individuals with the necessary knowledge and skills to perform their duties effectively.

- Appointment and Oath: After successfully completing the application process and training, selected individuals are officially appointed as Certifying Officers. They may be required to take an oath or sign a declaration of their commitment to upholding the highest standards of integrity, confidentiality, and accuracy in their role as Certifying Officers.

- Continuing Education: To ensure that Certifying Officers stay updated with the latest developments and changes in the savings bond program, many agencies mandate continuing education. This may involve attending workshops, seminars, or participating in online training programs to enhance their knowledge and skills.

It is important to note that the appointment process may also include periodic reassessment of Certifying Officers’ performance and compliance with established guidelines. This helps to maintain the quality and integrity of the savings bond program and ensures that the Certifying Officers continue to meet the requirements and expectations of their role.

Training and Continuing Education Requirements for Certifying Officers

To ensure Certifying Officers for Savings Bonds are equipped with the necessary knowledge and skills to perform their duties effectively, comprehensive training programs are typically provided. These programs cover various aspects of savings bond transactions, compliance regulations, and record-keeping. In addition to initial training, continuing education requirements are often in place to ensure Certifying Officers stay up-to-date with the latest developments in the savings bond program. The training and continuing education requirements for Certifying Officers include:

Initial Training: Upon appointment, Certifying Officers undergo training that covers the fundamental aspects of savings bond transactions. This training familiarizes them with the procedures for issuing, transferring, redeeming, and reissuing savings bonds. It also provides guidance on verifying bondholders’ identities, handling sensitive information, and maintaining accurate records.

Compliance Training: Certifying Officers receive training on the compliance regulations and guidelines governing savings bond transactions. This includes understanding anti-fraud measures, regulations for verifying bondholders’ identities, and maintaining confidentiality. Compliance training ensures that Certifying Officers possess the knowledge necessary to adhere to the highest standards of integrity and ethics in their role.

Record-Keeping and Documentation: As part of their training, Certifying Officers learn about proper record-keeping practices. They are trained on how to accurately document and store information related to savings bond transactions. This includes maintaining detailed records of bondholders’ information, transaction dates, and transaction amounts, as well as following guidelines for the secure storage of sensitive information.

Security and Fraud Prevention: Training programs for Certifying Officers often include modules on security and fraud prevention. This training educates them on the various types of fraudulent activities that may occur and provides strategies for identifying and preventing fraud. By developing a deep understanding of potential threats and implementing robust security measures, Certifying Officers can safeguard the savings bond program and protect the interests of bondholders.

Continuing Education: To stay updated with the latest developments in the savings bond program, Certifying Officers are typically required to engage in continuing education activities. This may involve attending workshops, seminars, or online training programs that cover emerging trends, regulatory changes, and best practices in savings bond certification. Continuing education ensures that Certifying Officers maintain their knowledge and skills, enabling them to effectively carry out their responsibilities.

By adhering to training and continuing education requirements, Certifying Officers demonstrate their commitment to professional growth and staying informed about the evolving landscape of savings bond transactions. This not only enhances their own expertise but also helps to maintain the integrity and trustworthiness of the savings bond program as a whole.

Duties and Obligations of a Certifying Officer

As a Certifying Officer for Savings Bonds, individuals have several important duties and obligations that contribute to the proper functioning and integrity of the savings bond program. These duties and obligations are critical in ensuring the accuracy of savings bond transactions and protecting the interests of bondholders. The key duties and obligations of a Certifying Officer include:

- Verify Bondholder Identity: Certifying Officers are responsible for verifying the identity of individuals involved in savings bond transactions. They carefully review identification documents, such as passports or driver’s licenses, to confirm that the bondholder is the legitimate owner of the savings bond.

- Certify Transactions: One of the primary duties of a Certifying Officer is to certify various types of savings bond transactions. This includes carefully reviewing and authenticating the necessary documents related to bond issuance, transfer, redemption, and reissue. By certifying transactions, Certifying Officers ensure that only legitimate activities are conducted within the savings bond program.

- Maintain Accurate Records: Certifying Officers have an obligation to maintain accurate and up-to-date records of all savings bond transactions. They carefully document bondholders’ information, transaction dates, and transaction amounts. This obligation ensures that there is a clear and traceable history of all savings bond activities and facilitates auditing, tracking, and resolution of any issues that may arise.

- Follow Legal Guidelines: Certifying Officers must comply with all applicable laws, regulations, and guidelines governing savings bond transactions. They are obligated to adhere to established procedures and follow strict protocols to ensure that all activities are carried out in a legal and ethical manner. This includes verifying bondholders’ identities, maintaining confidentiality, and reporting any suspicious or fraudulent activities.

- Ensure Confidentiality: Certifying Officers handle sensitive financial information as part of their role. They have an obligation to maintain the confidentiality and security of this information, ensuring that it is protected from unauthorized access or misuse. This duty involves implementing appropriate security measures and following established protocols for the handling and storage of bondholder information.

- Exercise Due Diligence: Certifying Officers are expected to exercise due diligence in their role to prevent fraud or unauthorized activities. This includes carefully reviewing documents, verifying information, and conducting thorough examinations and assessments of savings bond transactions. By exercising due diligence, Certifying Officers help safeguard the savings bond program and protect the interests of bondholders.

By fulfilling these duties and obligations, Certifying Officers contribute to the overall trustworthiness and reliability of the savings bond program. Their diligent and meticulous approach helps maintain the integrity of savings bond transactions and ensures that bondholders can have confidence in the program.

Authority and Limitations of a Certifying Officer

A Certifying Officer for Savings Bonds holds a certain level of authority in the savings bond program. They have the power to verify identities, certify transactions, and maintain accurate records. However, it is important to understand that Certifying Officers also have limitations to ensure the proper functioning and integrity of the savings bond program. The authority and limitations of a Certifying Officer include:

- Identity Verification: Certifying Officers have the authority to verify the identity of bondholders. They carefully examine identification documents and use their professional judgment to ensure that the person presenting the documents matches the information on record. This authority ensures the legitimacy and security of savings bond transactions.

- Certifying Transactions: Certifying Officers have the authority to certify various savings bond transactions, including the issuance, transfer, redemption, and reissue of bonds. They review and authenticate the necessary documents to ensure compliance with regulations and guidelines set by the governing authorities. This authority helps in maintaining the accuracy and integrity of the savings bond program.

- Record Maintenance: Certifying Officers have the authority to maintain accurate and up-to-date records of savings bond transactions. They keep detailed records of bondholders’ information, transaction dates, and transaction amounts. This authority allows for proper tracking, auditing, and resolution of any issues or disputes that may arise.

- Compliance with Regulations: Certifying Officers have the responsibility to comply with all applicable laws, regulations, and guidelines governing savings bond transactions. They must adhere to established procedures and follow prescribed protocols to ensure that all activities are conducted in a legal and ethical manner. This authority helps maintain the integrity and compliance of the savings bond program.

- Confidentiality Obligations: Certifying Officers have the authority to handle sensitive financial information but also have the obligation to maintain its confidentiality and security. They implement appropriate security measures and follow established protocols for the handling and storage of bondholder information. This authority ensures the privacy and protection of investor data.

- Limitations on Decision-Making: While Certifying Officers have authority in their role, their decision-making is limited to the scope of their responsibilities. They cannot make binding decisions regarding savings bond policies, interest rates, or other program-related matters beyond their designated duties. They must adhere to the guidelines and directives set by the governing authorities.

It is important for Certifying Officers to understand their authority and limitations to maintain the transparency and trustworthiness of the savings bond program. By exercising their authority responsibly and adhering to their limitations, Certifying Officers play a vital role in ensuring the accuracy, security, and compliance of savings bond transactions.

Penalties and Liabilities for Certifying Officers

As Certifying Officers for Savings Bonds, individuals hold a significant level of responsibility in ensuring the accuracy and integrity of savings bond transactions. Failure to fulfill their duties and obligations can result in penalties and liabilities. Understanding these consequences is crucial for Certifying Officers to perform their roles effectively and to maintain the trust of bondholders. The penalties and liabilities for Certifying Officers include:

- Civil Penalties: In cases where Certifying Officers have been negligent or have failed to adhere to the established guidelines, civil penalties may be imposed. These penalties can include fines, sanctions, or other forms of disciplinary action. The severity of the penalties may vary depending on the nature and extent of the violation.

- Legal Liabilities: Certifying Officers can face legal liabilities if their actions or omissions result in financial losses or harm to bondholders or the savings bond program. They can be held legally responsible for any damages incurred as a result of their negligence, misconduct, or fraudulent activities.

- Reputation Damage: If Certifying Officers fail to fulfill their duties adequately or are involved in any misconduct, it can negatively impact their professional reputation and credibility. Damage to their reputation can hinder future career prospects and may result in loss of trust from bondholders and the savings bond program itself.

- Suspension or Removal: In cases of serious misconduct or repeated violations, Certifying Officers may be suspended or removed from their position. This can occur as a result of internal investigations, consequences from regulatory authorities, or a loss of confidence from supervisory agencies.

- Criminal Charges: In instances of intentional fraud, embezzlement, or other criminal activities, Certifying Officers may face criminal charges. If found guilty, they may be subject to imprisonment, fines, or other penalties as determined by the legal system.

- Financial Liabilities: Certifying Officers may be personally liable for any financial losses suffered by bondholders due to their negligence, errors, or fraudulent activities. This can potentially lead to significant financial liabilities, including being required to compensate bondholders for their losses.

It is essential for Certifying Officers to understand the potential penalties and liabilities associated with their role. By carrying out their duties with diligence, professionalism, and adherence to regulations, Certifying Officers can mitigate these risks and safeguard the interests of bondholders and the savings bond program.

Importance of Certifying Officers in the Savings Bonds Program

Certifying Officers play a crucial role in the savings bonds program, ensuring the smooth and secure functioning of savings bond transactions. Their importance lies in several key aspects that contribute to the integrity and trustworthiness of the program. Understanding the significance of Certifying Officers helps investors and bondholders recognize the value they bring to the savings bond program. The importance of Certifying Officers includes:

- Identity Verification: Certifying Officers verify the identities of bondholders, providing assurance that savings bond transactions involve legitimate individuals. This helps prevent identity theft and fraudulent activities, ensuring the integrity of the program and protecting bondholders’ interests.

- Transaction Certification: Certifying Officers certify savings bond transactions, guaranteeing that the issuance, transfer, redemption, and reissuance processes adhere to the program’s regulations and guidelines. By certifying transactions, they provide confidence to bondholders that their activities are compliant with the established rules.

- Fraud Prevention: Certifying Officers serve as a line of defense against fraudulent activities within the savings bond program. They diligently review documents, verify information, and exercise due diligence to identify any signs of fraud. This helps protect bondholders from unauthorized transactions and safeguards the program’s reputation.

- Accuracy and Record-Keeping: Certifying Officers maintain accurate records of savings bond transactions, ensuring their traceability and providing a historical record of bondholders’ activities. This assists in tracking and resolving any discrepancies or issues and promotes transparency and accountability within the program.

- Compliance and Regulation: Certifying Officers ensure compliance with regulatory requirements and guidelines governing savings bond transactions. By following established procedures and adhering to regulations, they maintain the program’s integrity and protect bondholders’ interests. Their commitment to compliance is essential in upholding the credibility of the savings bond program.

- Investor Confidence: Certifying Officers contribute to the overall investor confidence in the savings bond program. Their presence and diligent efforts help instill trust in the system, providing assurance to bondholders that their investments are secure and protected from fraudulent activities. This confidence encourages individuals to participate in the savings bond program and contribute to their financial growth and stability.

The important role of Certifying Officers ensures that savings bond transactions are conducted in a trustworthy and secure manner. Their diligence, expertise, and adherence to regulations create a reliable environment for bondholders to invest, grow their savings, and have peace of mind. By maintaining the integrity of the savings bond program, Certifying Officers play a vital role in fostering a strong and resilient financial system.

Conclusion

Certifying Officers for Savings Bonds play a pivotal role in ensuring the accuracy, integrity, and security of savings bond transactions. Their responsibilities encompass verifying bondholders’ identities, certifying transactions, maintaining accurate records, adhering to regulations, and protecting the interests of bondholders. Through their expertise and commitment to their duties, Certifying Officers uphold the highest standards of professionalism and contribute to the overall credibility of the savings bond program.

The qualifications, training, and continuing education requirements for Certifying Officers ensure that they possess the necessary knowledge and skills to perform their duties effectively. By staying up-to-date with the latest developments and regulations, Certifying Officers are equipped to handle the complexities of the savings bond program and safeguard the interests of bondholders.

The penalties and liabilities associated with the role of Certifying Officers underscore the importance of their responsibilities. By adhering to their obligations and exercising due diligence, Certifying Officers mitigate risks, protect against fraud, and maintain the trust and confidence of bondholders.

The presence of Certifying Officers in the savings bond program is paramount. They verify identities, certify transactions, prevent fraudulent activities, maintain accurate records, ensure compliance, and foster investor confidence. The role they play helps build a strong financial system that promotes trust, integrity, and stability.

In conclusion, Certifying Officers serve as the guardians of the savings bond program. Their commitment to accuracy, security, and compliance is essential in maintaining the integrity of savings bond transactions and protecting the interests of bondholders. By upholding their roles and responsibilities with diligence, Certifying Officers play a critical part in ensuring the continued success and trustworthiness of the savings bond program.