Finance

Who Took The Bonds In Kaleidoscope

Published: October 11, 2023

Discover who took the bonds in Kaleidoscope and delve into the mysterious world of finance in this captivating thriller.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In a shocking turn of events, a significant number of bonds have mysteriously disappeared from the renowned financial institution, Kaleidoscope. This unfortunate incident has sent shockwaves through the finance world, leaving experts and investors in a state of confusion and concern.

Kaleidoscope, known for its impeccable reputation and solid track record of financial stability, is now facing a serious challenge in maintaining the trust and confidence of its clients. The abrupt disappearance of these bonds has triggered a thorough investigation, as investors demand answers and accountability.

This article aims to delve into the details surrounding the missing bonds, exploring the potential suspects, the ongoing investigation, and the implications it can have on the future of Kaleidoscope.

As the story unfolds, it becomes evident that the stakes are high. The financial world is closely watching the developments surrounding this incident, as it could have far-reaching consequences for both Kaleidoscope and the broader financial industry.

In the following sections, we will examine the background of Kaleidoscope, gain a deeper understanding of the bonds involved, explore the possible suspects, delve into the ongoing investigation, and ultimately, analyze the future implications this scandal may have on the financial sector.

Stay tuned, as we unravel the details behind ‘Who Took the Bonds in Kaleidoscope’.

Background

Kaleidoscope has long been recognized as one of the most reputable and esteemed financial institutions in the industry. With a rich history spanning several decades, the institution has built a strong foundation of trust and reliability among its clients and investors.

Founded by visionary financial experts, Kaleidoscope emerged during a time of economic uncertainty. Its founders aimed to create a financial institution that would provide stability, innovative investment opportunities, and unparalleled customer service. Over the years, Kaleidoscope has successfully fulfilled these promises, becoming a household name in the finance world.

With a diverse portfolio of services ranging from wealth management to corporate banking, Kaleidoscope prides itself on catering to the needs of both individual clients and large corporations. Its commitment to research and expertise in various financial sectors has allowed it to navigate market fluctuations, earning the trust and loyalty of its clientele.

As its reputation grew, Kaleidoscope gained widespread recognition for its bond offerings. These bonds provided investors with a secure and profitable avenue to diversify their portfolios. Known for their attractive interest rates and reliable returns, Kaleidoscope bonds proved to be an irresistible investment option for many.

Until now, Kaleidoscope had an impeccable track record in safeguarding client assets and upholding the highest level of integrity. However, the recent incident of missing bonds has tarnished the institution’s reputation, leaving both clients and industry experts baffled.

Investors who placed their trust, capital, and future in the hands of Kaleidoscope are now left questioning the security and reliability of their investments. This situation not only jeopardizes the financial stability of the institution but also raises concerns about the broader implications for the industry as a whole.

As the investigation into the missing bonds unfolds, it becomes imperative to understand the nature of these bonds and explore the possible reasons behind their disappearance. Only by delving into these details can we hope to gain clarity and shed light on the mystery surrounding ‘Who Took the Bonds in Kaleidoscope.’

The Kaleidoscope Bonds

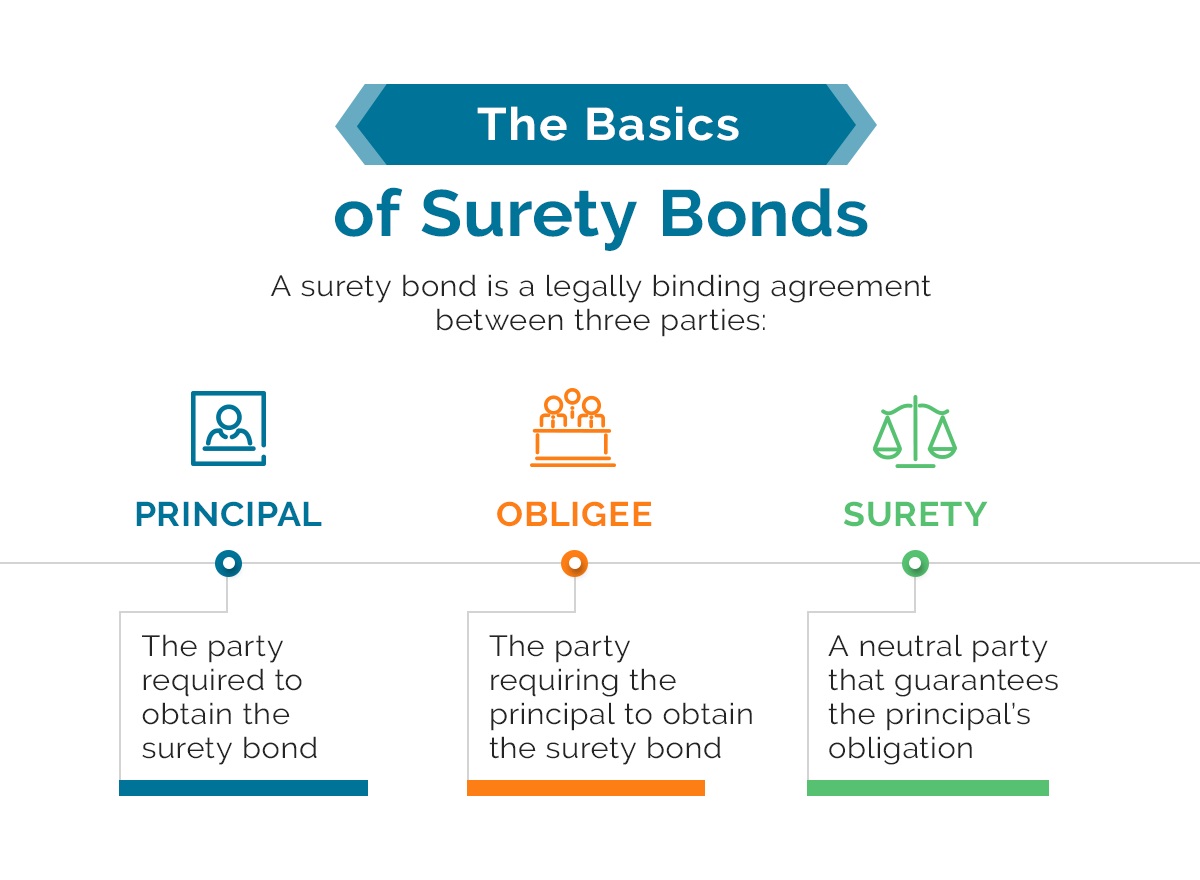

The Kaleidoscope bonds, known for their reliability and attractive returns, have been a popular investment option for both individual and institutional investors. These bonds are fixed-income securities issued by Kaleidoscope, promising regular interest payments and the return of principal upon maturity.

One of the unique features of the Kaleidoscope bonds is their diverse range of offerings. Investors have the flexibility to choose from various bond types, including government bonds, corporate bonds, municipal bonds, and asset-backed securities. Each bond type carries its own set of risks and rewards, allowing investors to align their investment strategies with their risk tolerance and financial goals.

With competitive interest rates and a reputation for timely interest payments, Kaleidoscope bonds have enjoyed a loyal investor base. The institution’s conservative approach to risk management and thorough due diligence processes have instilled confidence in investors. This has allowed Kaleidoscope to raise significant capital through bond issuances, fueling its growth and expansion in the financial market.

Investors who opt for Kaleidoscope bonds typically have a long-term investment horizon. These bonds often come with a maturity period ranging from several months to several years. The longer the bond’s maturity, the higher the potential returns for investors.

Moreover, the bonds are usually categorized based on their credit rating. Higher-rated bonds are considered more secure and low-risk, while lower-rated bonds offer potentially higher returns but also carry greater risk. Investors are provided with comprehensive information regarding the creditworthiness of the bonds, allowing them to make informed investment decisions.

However, with the recent incident of missing bonds, the reliability and security of the Kaleidoscope bonds have come under scrutiny. Investors who once considered these bonds as a safe haven for their investments are now grappling with doubt and uncertainty.

It is crucial for investigators to determine the extent of the missing bonds and ascertain whether they were intentionally misappropriated or simply lost due to negligence. The resolution of this mystery is not only essential for the affected investors but also for the reputation and future viability of Kaleidoscope as a financial institution.

As the investigation unfolds, it will be important to closely examine the processes and protocols in place for bond management at Kaleidoscope. Only by identifying potential vulnerabilities or gaps can the institution take the necessary steps to restore confidence and prevent similar incidents from occurring in the future.

Possible Suspects

In any case of missing assets, it is important to consider potential suspects who may have had access and motive to misappropriate the Kaleidoscope bonds. While the investigation is ongoing, several individuals and entities have emerged as possible suspects in this perplexing case.

- Internal Employees: As with any financial institution, the first group to scrutinize is the internal employees of Kaleidoscope. This includes executives, traders, and even lower-level employees who may have had access to the bonds. A disgruntled employee seeking personal financial gain or a group colluding to defraud the institution cannot be ruled out as possible suspects.

- External Hackers: In today’s digital age, cybersecurity threats loom large. External hackers with sophisticated hacking skills may have exploited vulnerabilities in Kaleidoscope’s systems to gain unauthorized access to the bonds. Their motive could range from financial gain to simply causing havoc and tarnishing the institution’s reputation.

- Competing Financial Institutions: The competitive nature of the financial industry raises the possibility of rival institutions orchestrating the disappearance of the bonds to undermine Kaleidoscope’s credibility. This scenario is less likely but cannot be entirely dismissed, as it has been observed in the past that competitors resort to such tactics to gain a competitive advantage.

- Third-Party Service Providers: Kaleidoscope may have engaged external vendors or service providers to handle various aspects of bond management. These third parties could have played a role in the disappearance, either due to negligence or malicious intent. It is crucial for investigators to thoroughly examine the activities and responsibilities of these service providers.

- Internal Fraud Syndicates: A more intricate possibility is the existence of internal fraud syndicates operating within the institution. These organized groups collaborate to defraud the institution by misappropriating assets or manipulating financial records. Such syndicates are difficult to detect and require meticulous investigation to unearth.

While these are some of the potential suspects, it is important to approach the investigation with open-mindedness and not make assumptions prematurely. The truth behind the disappearance of the Kaleidoscope bonds may lie within a combination of factors or involve unexpected parties.

It is the responsibility of the investigators, with their expertise and careful examination of evidence, to uncover the truth and bring the responsible parties to justice. Only then can the affected investors and the financial industry as a whole regain their confidence in the integrity and security of financial institutions.

Investigation

The investigation into the missing bonds at Kaleidoscope is underway, with the primary objective of uncovering the truth and holding the responsible parties accountable. A comprehensive and thorough investigation is crucial in order to restore confidence in the institution and provide justice to the affected investors.

The investigation process involves a multi-faceted approach, utilizing both internal resources and external expertise. The following steps are generally taken during such investigations:

- Evidence Collection: Investigators start by gathering all available evidence related to the disappearance of the bonds. This includes reviewing financial records, transaction logs, access logs, and any other relevant documents. The collection of electronic data is particularly crucial in today’s digital age.

- Forensic Analysis: Forensic experts are brought in to analyze the collected evidence. They employ various techniques and tools to uncover hidden information, detect patterns, and identify potential suspects. This analysis helps in reconstructing the sequence of events and understanding the modus operandi of the perpetrators.

- Interviews and Interrogations: Investigators conduct interviews and interrogations with relevant individuals, including employees, executives, and external service providers. These conversations aim to gather information, verify facts, and identify potential inconsistencies or discrepancies.

- Collaboration with Law Enforcement Agencies: In cases involving suspected criminal activity, collaboration with law enforcement agencies becomes crucial. Investigators work closely with local authorities, sharing information and tapping into their legal resources to expedite the investigation process.

- Review of Internal Processes: Investigators closely examine the internal processes and protocols of Kaleidoscope to identify any loopholes or weaknesses that may have contributed to the disappearance of the bonds. This review helps in implementing necessary changes to prevent similar incidents in the future.

- Cooperation with Financial Regulators: Investigators maintain open lines of communication and cooperate with financial regulatory bodies to ensure compliance with industry standards and regulations. This collaboration assists in aligning the investigation process with legal requirements and facilitates a more comprehensive examination.

The investigation is a complex and time-consuming process, as it requires sifting through extensive amounts of data and conducting detailed analyses. Patience and meticulousness are key to ensuring that no stone is left unturned in the pursuit of justice.

Ultimately, the successful completion of the investigation relies on the expertise and dedication of the investigators, as well as the cooperation of all parties involved. Only through a meticulous and transparent investigation can the truth behind the missing bonds at Kaleidoscope be revealed.

Conclusion

The case of the missing bonds at Kaleidoscope has sent shockwaves through the financial industry, raising concerns about the security and reliability of investments in reputable institutions. The investigation into who took the bonds has been a critical step in addressing the issue and restoring confidence in the institution.

While the investigation is ongoing, it is important to acknowledge the impact this incident has had on the affected investors and the broader financial community. The disappearance of these bonds has not only put their financial stability at risk but has also questioned the integrity of the financial system as a whole.

As investigators diligently collect evidence, analyze data, and interview relevant individuals, it is crucial for them to remain impartial and committed to uncovering the truth. Their expertise and dedication are essential in bringing the responsible parties to justice and ensuring that such incidents are prevented in the future.

Furthermore, it is imperative for Kaleidoscope to address any potential weaknesses in its internal processes and security measures. Implementing robust controls and safeguards will help restore trust among its clients and demonstrate a commitment to maintaining the highest standards of financial integrity.

For the affected investors, this incident serves as a reminder of the importance of due diligence and diversification in their investment strategies. Conducting thorough research, monitoring investments closely, and seeking advice from trusted financial professionals can help mitigate risks and protect their assets.

Lastly, the broader financial industry must take this incident as an opportunity to reflect on the importance of transparency, accountability, and the protection of investor interests. Regulatory bodies must continue to strengthen their oversight and enforcement measures to prevent similar incidents in the future and maintain the integrity of the financial system.

As the investigation continues, all parties involved eagerly await the resolution of this mysterious disappearance. The findings and subsequent actions taken will shape the future of Kaleidoscope and set a precedent for maintaining trust, security, and accountability within the financial industry.

It is hoped that lessons learned from this incident will serve as a catalyst for strengthening the overall resilience of the financial system and providing a sense of security for investors worldwide.

Future Implications

The case of the missing bonds at Kaleidoscope not only has immediate consequences but also carries long-term implications for the institution and the broader financial industry. Here are some potential future implications that may arise as a result of this incident:

- Reputation Damage: The reputation of Kaleidoscope has undoubtedly been tarnished by this incident. Rebuilding trust and restoring confidence among investors will be crucial for the institution’s survival. This incident serves as a reminder that even reputable financial institutions are not immune to risks, and hence, maintaining a strong reputation is pivotal for long-term success.

- Enhanced Security Measures: The missing bonds at Kaleidoscope highlight the need for strengthened security measures across the financial industry. Institutions will likely invest more in cybersecurity, fraud prevention, and risk management to mitigate the possibility of future incidents. This incident serves as a stark reminder that complacency in security measures can have severe consequences.

- Regulatory Scrutiny: Regulatory bodies will likely increase their scrutiny of financial institutions in the wake of this incident. Stricter compliance requirements and more frequent audits may be implemented to ensure that industry standards are upheld and investors’ interests are protected. This focus on regulatory oversight aims to prevent similar incidents and maintain integrity within the financial system.

- Investor Skepticism: The missing bonds incident may lead to increased skepticism among investors. They may become more cautious in selecting financial institutions and investment products, demanding greater transparency and reassurances. Investors will likely prioritize due diligence and seek institutions that have a robust track record of security and reliability.

- Innovation in Financial Asset Management: This incident may also drive innovation in the field of financial asset management. Financial institutions will likely invest in advanced technologies, such as blockchain and artificial intelligence, to enhance security, transparency, and traceability of assets. These technological advancements aim to minimize the risk of asset misappropriation and provide investors with greater peace of mind.

- Industry Collaboration: The incident may foster increased collaboration among financial institutions, industry associations, and regulatory bodies. Sharing best practices, exchanging information about potential risks, and collaborating on cybersecurity initiatives will be essential. By working together, the industry can enhance its collective ability to prevent and respond to similar incidents.

The future implications of the missing bonds case at Kaleidoscope extend beyond the institution itself. The lessons learned from this incident will shape the financial industry’s approach to security, reputation management, and investor protection. It serves as a reminder that continuous vigilance and proactive risk management are paramount in maintaining a resilient and trustworthy financial system.