Home>Finance>Why Are Threats To Accounting Information Systems Increasing?

Finance

Why Are Threats To Accounting Information Systems Increasing?

Modified: December 30, 2023

Find out why threats to accounting information systems are on the rise and how it affects the finance industry. Stay informed and protect your financial data.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- The Growing Importance of Accounting Information Systems

- The Vulnerabilities of Accounting Information Systems

- Common Threats to Accounting Information Systems

- Cybersecurity Risks and Attacks

- Internal Threats and Fraudulent Activities

- External Threats and Malicious Attacks

- Regulatory Compliance Challenges

- Impact of Threats on Accounting Information Systems

- Mitigation Strategies and Best Practices

- Conclusion

Introduction

Accounting information systems play a crucial role in financial management, recording transactions, maintaining financial records, and generating reports. In today’s digital age, these systems are increasingly becoming the backbone of financial operations for businesses of all sizes.

However, along with the advancements in technology and the increasing reliance on digital platforms, the threats to accounting information systems have also been on the rise. Cyberattacks, data breaches, fraud, and regulatory compliance challenges are becoming more prevalent and sophisticated, posing significant risks to the integrity and security of these systems.

This article will delve into the reasons why threats to accounting information systems are increasing and the impact they can have on businesses. It will also explore common threats faced by these systems, the risks associated with them, and the best practices for mitigating those risks.

By understanding the gravity of the situation and implementing appropriate measures, businesses can fortify their accounting information systems and protect their financial data, ensuring the trustworthiness and confidentiality of their financial records and reports.

The Growing Importance of Accounting Information Systems

In an increasingly complex business environment, accounting information systems have become essential for efficient financial management. These systems automate various accounting processes, from recording transactions to generating financial statements, helping businesses streamline their operations and make informed financial decisions.

One of the key advantages of accounting information systems is their ability to provide real-time access to financial data. This allows businesses to monitor their financial position, track revenues and expenses, identify trends, and evaluate the financial performance of different business units. With up-to-date information readily available, decision-makers can make timely adjustments and take informed actions to drive financial growth.

Moreover, accounting information systems enable businesses to ensure financial accuracy and compliance with industry regulations. These systems are built with internal controls to detect errors, prevent fraudulent activities, and maintain the integrity of financial data. By automating key financial tasks, such as journal entries and account reconciliations, these systems reduce the risk of human error and enhance the reliability of financial information.

Another significant aspect of accounting information systems is their role in financial reporting. These systems facilitate the preparation of financial statements, including balance sheets, income statements, and cash flow statements. By automating the consolidation process and generating accurate financial reports, businesses can present their financial performance to stakeholders, such as investors and regulatory authorities, with confidence and transparency.

Furthermore, accounting information systems play a crucial role in managing financial transactions. With integrated modules for accounts payable, accounts receivable, and general ledger, these systems enable businesses to efficiently process invoices, track payment cycles, and manage cash flow. This level of financial visibility and control ensures that businesses can optimize their working capital and make strategic decisions to improve liquidity.

In summary, accounting information systems have become indispensable for modern businesses. Their ability to automate financial processes, provide real-time access to data, ensure compliance, and facilitate financial reporting make them vital tools for financial management. As businesses embrace digital transformation, the reliance on these systems will only continue to grow, emphasizing the critical importance of protecting them from potential threats and vulnerabilities.

The Vulnerabilities of Accounting Information Systems

Accounting information systems are not immune to vulnerabilities and weaknesses that can be exploited by threat actors. Understanding these vulnerabilities is crucial to identifying potential risks and implementing effective security measures to protect against them.

One of the primary vulnerabilities of accounting information systems is the presence of outdated or unsupported software. Legacy systems or software versions that are no longer receiving updates are more susceptible to security breaches as they lack the latest security patches and bug fixes. Hackers can exploit known vulnerabilities in these systems to gain unauthorized access to financial data.

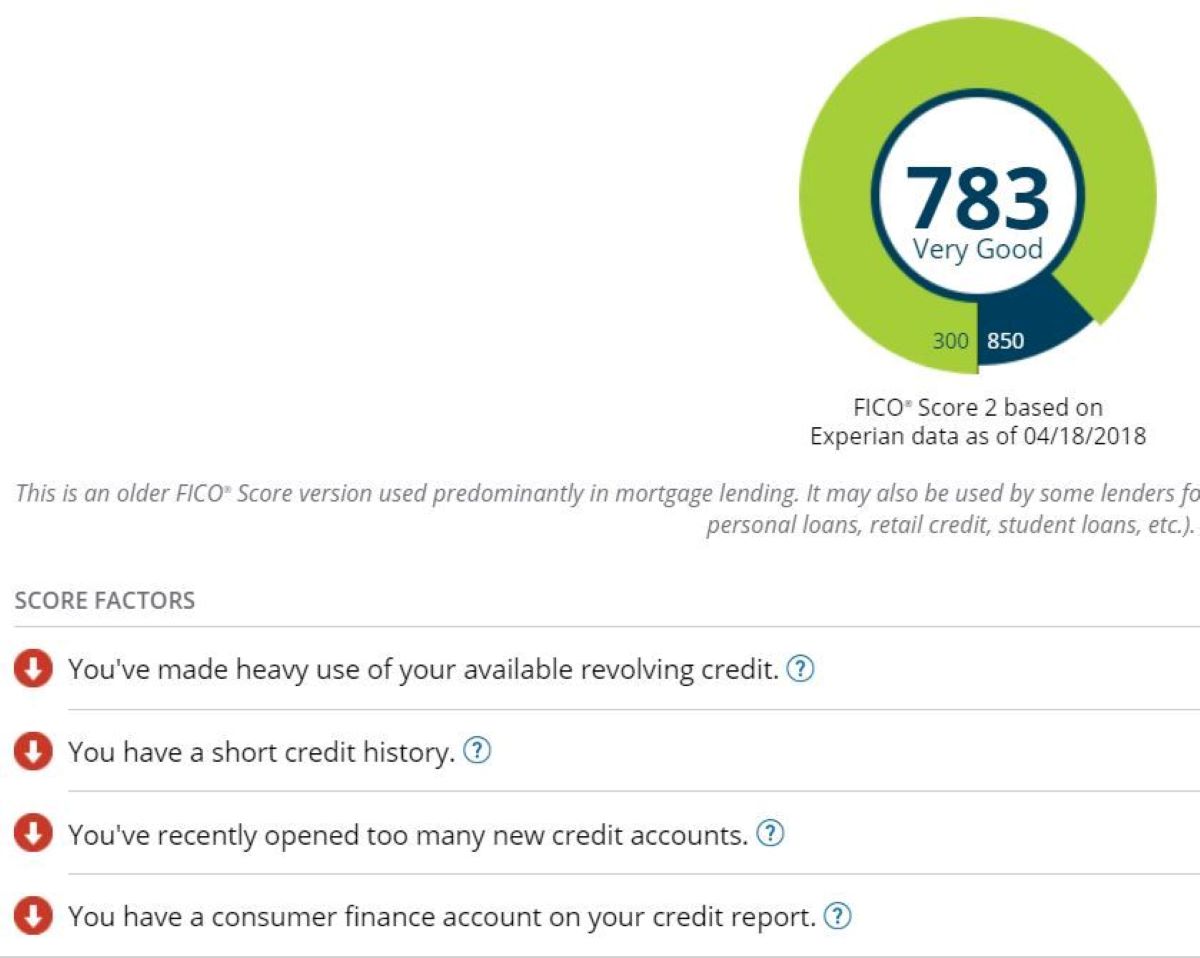

Another vulnerability lies in weak authentication and access controls. If user passwords are weak or easily guessable, unauthorized individuals can gain entry into the system, compromising the confidentiality and integrity of financial information. Insufficient segregation of duties, where a single individual has access to all financial processes, can also increase the risk of fraud or unauthorized activities.

Additionally, inadequate network security measures can leave accounting information systems vulnerable to external attacks. Improperly configured firewalls, lack of intrusion detection systems, or unencrypted network communications can allow hackers to gain unauthorized access, intercept sensitive data, or launch denial-of-service (DoS) attacks, disrupting business operations.

Social engineering is another significant vulnerability in accounting information systems. Phishing emails, pretexting, or impersonation tactics can trick employees into disclosing sensitive information or unknowingly downloading malicious software. This can open the door for unauthorized access to the system or allow cybercriminals to gain control over financial processes.

Moreover, human error and negligence can introduce vulnerabilities to accounting information systems. For instance, employees accidentally sharing sensitive financial data through insecure channels or falling victim to social engineering attacks can compromise the system’s security. Lack of proper training and awareness among employees regarding cybersecurity best practices can leave a company’s accounting information systems exposed to potential threats.

Lastly, inadequate backup and disaster recovery plans can make accounting information systems vulnerable to data loss or disruption. Without regular backups and a well-defined recovery strategy, a system failure, natural disaster, or cyberattack can result in permanent data loss or prolonged downtime, impacting the company’s financial operations and reputation.

In summary, accounting information systems are susceptible to various vulnerabilities, ranging from outdated software and weak authentication controls to social engineering and human error. Recognizing and mitigating these vulnerabilities is crucial to ensure the security and integrity of financial data and protect against potential threats to these systems.

Common Threats to Accounting Information Systems

Accounting information systems face a range of threats that can compromise the confidentiality, integrity, and availability of financial data. Understanding these common threats is essential for developing robust security measures to safeguard these systems.

1. Malware Attacks: Malicious software, such as viruses, worms, and ransomware, poses a significant threat to accounting information systems. Malware can be introduced through phishing emails, infected attachments, or compromised websites, allowing hackers to gain unauthorized access, steal financial data, or encrypt files for ransom.

2. Insider Threats: Internal employees with authorized access to accounting systems can also pose a threat. These threats can range from unintentional errors to deliberate fraudulent activities. For example, an employee may manipulate financial records, embezzle funds, or leak sensitive information for personal gain or malicious intent.

3. Data Breaches: Accounting information systems often store a plethora of sensitive financial data, making them valuable targets for cybercriminals. A data breach can occur through external hacking attacks, weak passwords, or unpatched software vulnerabilities. The compromised data can be used for identity theft, financial fraud, or sold on the dark web.

4. Phishing Attacks: Phishing attacks involve the use of deceptive emails or messages to trick users into providing sensitive information or accessing malicious websites. Cybercriminals may impersonate legitimate financial institutions or individuals to obtain login credentials or financial data, which can later be used for unauthorized access or identity theft.

5. Denial-of-Service (DoS) Attacks: DoS attacks aim to overwhelm accounting information systems with a flood of traffic, rendering them unavailable to legitimate users. These attacks can disrupt financial operations, prevent timely reporting, and cause significant financial losses due to downtime.

6. Weak Authentication and Access Controls: Inadequate authentication measures, such as weak passwords, lack of two-factor authentication, or improperly configured access controls, can make it easier for unauthorized individuals to gain access to accounting systems. This can lead to unauthorized financial transactions, data manipulation, or theft of sensitive information.

7. Social Engineering Attacks: Social engineering techniques, such as pretexting, baiting, or tailgating, exploit human vulnerabilities to gain access to accounting systems. These attacks manipulate individuals into disclosing sensitive information or granting unauthorized access, bypassing technical security measures.

8. Physical Security Breaches: Neglecting physical security measures, such as unsecured server rooms or unauthorized access to physical storage media, can lead to theft, tampering, or destruction of accounting data. Physical breaches can also compromise the integrity and confidentiality of financial information.

9. Regulatory Compliance Breaches: Failure to comply with industry regulations, such as the Sarbanes-Oxley Act (SOX) or the General Data Protection Regulation (GDPR), can result in significant legal and financial consequences. Non-compliance with data protection and privacy regulations can lead to reputational damage and loss of customer trust.

10. Third-Party Risks: Accounting systems may interact with third-party software or services, opening the door to additional vulnerabilities. Inadequate security measures by third-party vendors can result in unauthorized access or data breaches, jeopardizing the integrity of financial information.

By being aware of these common threats, businesses can take proactive steps to implement robust security measures, educate employees, and regularly assess risk to protect their accounting information systems from potential breaches and disruptions.

Cybersecurity Risks and Attacks

In today’s digital landscape, cybersecurity risks and attacks are prevalent and pose a significant threat to accounting information systems. Understanding these risks and the various types of cyberattacks is vital for businesses to develop effective defense mechanisms and protect their financial data.

1. Malware: Malicious software, such as viruses, worms, and ransomware, can infiltrate accounting information systems through infected emails, compromised websites, or malicious downloads. Malware can lead to data theft, unauthorized access, financial fraud, or the encryption of critical files, demanding ransom for their release.

2. Phishing and Social Engineering: Phishing attacks use deceptive emails, messages, or phone calls to trick individuals into revealing sensitive information, such as passwords or account details. Social engineering tactics exploit human vulnerabilities to manipulate individuals into providing access or confidential information, bypassing technical security measures.

3. Hacking and Unauthorized Access: Hackers may exploit vulnerabilities in accounting systems to gain unauthorized access and control over financial data. Weak passwords, unpatched software, misconfigured access controls, or unsecured network connections can provide entry points for hackers to infiltrate the system and carry out malicious activities.

4. Data Breaches: Data breaches involve unauthorized access to sensitive financial information stored within accounting systems. Cybercriminals may steal customer data, employee records, or financial transactions, which can result in identity theft, financial fraud, or reputational damage to companies.

5. Denial-of-Service (DoS) Attacks: DoS attacks aim to overwhelm accounting information systems with a flood of traffic, rendering them unavailable to legitimate users. These attacks disrupt financial operations, prevent timely reporting, and can cause significant financial losses due to system downtime.

6. Insider Threats: Employees or trusted individuals with authorized access to accounting systems can pose significant cybersecurity risks. They may intentionally or inadvertently compromise the system’s security, leak sensitive information, or engage in fraudulent activities for personal gain or malicious intent.

7. Man-in-the-Middle (MitM) Attacks: MitM attacks intercept communication between users and accounting systems to eavesdrop, alter, or manipulate data. Cybercriminals can gain access to financial transactions, login credentials, or other sensitive information, leading to unauthorized access and financial loss.

8. SQL Injection: SQL injection attacks exploit vulnerabilities in web applications that use SQL databases. Hackers can inject malicious SQL queries into input fields, gaining unauthorized access to the database and compromising financial data or performing unauthorized operations.

9. Zero-day Exploits: Zero-day exploits target unknown vulnerabilities in software or systems. Cybercriminals exploit these vulnerabilities before software vendors can release patches or resolve the issue, making it challenging for businesses to defend against such attacks.

10. Advanced Persistent Threats (APTs): APTs are sophisticated and prolonged cyberattacks that target specific organizations. These attacks involve a combination of multiple attack vectors, often originating from well-funded and strategic adversaries who aim to gain long-term access to accounting systems for espionage or financial gain.

By understanding various cybersecurity risks and the methods used in cyberattacks, businesses can implement proactive measures to detect, prevent, and mitigate these threats. This includes regular system updates, strong access controls, employee awareness training, network monitoring, and the use of robust security solutions to protect their accounting information systems.

Internal Threats and Fraudulent Activities

While external cyber threats are a significant concern, businesses must also be mindful of internal threats and fraudulent activities that can compromise the integrity and security of their accounting information systems. Internal threats can range from unintentional errors to deliberate actions by employees or trusted individuals with authorized access to financial systems.

1. Insider Fraud: One of the most common internal threats is insider fraud. This occurs when individuals with knowledge of the accounting system and its controls exploit their position for personal gain. Examples include manipulating financial records, creating fictitious accounts, or embezzling funds.

2. Data Manipulation: Employees may intentionally or unintentionally manipulate financial data within the accounting system. This can involve altering transaction records, changing numbers in financial statements, or misrepresenting financial performance. Such manipulation can result in incorrect reporting, misleading stakeholders, and potentially illegal activities.

3. Unauthorized Access: Employees with access privileges may abuse their authority or credentials to gain unauthorized access to sensitive financial information. This could involve accessing confidential records, customer data, or financial transactions that they are not authorized to view or modify. Unauthorized access can lead to data breaches, reputational damage, or regulatory non-compliance.

4. Information Leakage: Trusted individuals within an organization may leak sensitive financial information to external parties. This can occur through deliberate actions, such as selling confidential data to competitors, or unintentional disclosure, such as sharing financial data through insecure communication channels. Information leakage compromises the confidentiality and competitiveness of the organization.

5. Collusion: Collusion occurs when multiple individuals work together to commit fraudulent activities. For example, employees might collude to manipulate financial records, bypass controls, or facilitate unauthorized transactions. Collusion can be challenging to detect, as it involves a coordinated effort to avoid detection by internal controls.

6. Misuse of Authority: Employees in positions of authority may misuse their power to override controls or manipulate financial processes. This can include approving fraudulent transactions, overriding system warnings, or bypassing segregation of duties. Misuse of authority undermines accountability and can result in financial losses and compromised data integrity.

7. Inadequate Internal Controls: Weak or insufficient internal controls can create opportunities for internal threats and fraudulent activities. Lack of segregation of duties, poor oversight, and inadequate monitoring of financial processes can enable employees to exploit vulnerabilities in the accounting system undetected.

8. Lack of Ethical Conduct: Unethical behavior within the organization can pose a significant internal threat. This includes engaging in financial misconduct, disregarding professional standards, or ignoring ethical guidelines. Lack of ethical conduct compromises the trust of stakeholders, damages the reputation of the organization, and increases the risk of fraudulent activities.

To mitigate internal threats and fraudulent activities, organizations must implement robust internal controls, enforce segregation of duties, conduct regular audits, and promote a culture of ethics and integrity. It is crucial to provide ongoing training and awareness programs to employees, encouraging them to report suspicious activities and maintaining a strong, transparent, and accountable financial environment.

External Threats and Malicious Attacks

Accounting information systems face a constant barrage of external threats and malicious attacks from cybercriminals who aim to exploit vulnerabilities and gain unauthorized access to sensitive financial data. Understanding these external threats is crucial for businesses to adopt robust security measures and protect their accounting information systems.

1. Malware Attacks: External attackers frequently use various types of malware, including viruses, worms, and ransomware, to compromise accounting information systems. Malware can infiltrate the system through infected email attachments, compromised websites, or malicious downloads, allowing hackers to gain unauthorized access, steal financial data, or disrupt operations through ransomware encryption.

2. Phishing and Social Engineering: Phishing attacks exploit human vulnerabilities to trick individuals into revealing sensitive information or granting access to accounting systems. Cybercriminals impersonate credible entities to deceive employees into clicking on malicious links, providing login credentials, or disclosing valuable financial information.

3. Brute Force Attacks: In a brute force attack, hackers attempt to gain unauthorized access to accounting systems by systematically trying a large number of password combinations. Using automated tools, attackers try various combinations until they find the correct password, enabling them to gain entry and potentially compromise financial data.

4. Distributed Denial-of-Service (DDoS) Attacks: DDoS attacks overwhelm accounting information systems with a massive influx of traffic, causing the system to become unavailable to legitimate users. Cybercriminals launch DDoS attacks to disrupt financial operations, prevent timely reporting, and create chaos for businesses, which can result in significant financial losses during prolonged downtime.

5. SQL Injection: Attackers exploit vulnerabilities in web applications by injecting malicious SQL queries into input fields. This can lead to unauthorized access to databases, allowing hackers to extract sensitive financial data, alter information, or sabotage accounting processes.

6. Zero-day Exploits: A zero-day exploit targets unknown vulnerabilities in software or systems. Cybercriminals exploit these vulnerabilities before software vendors can release patches or resolve the issue, making it challenging for businesses to defend against zero-day attacks targeting their accounting systems.

7. Advanced Persistent Threats (APTs): APTs are complex and prolonged cyberattacks orchestrated by skilled adversaries. These attacks involve sophisticated techniques, including social engineering, phishing, and malware, to gain long-term access to accounting systems. APTs aim to steal sensitive financial data, carry out financial fraud, or conduct espionage for competitive advantage.

8. Supply Chain Attacks: Cybercriminals may target organizations indirectly through their supply chains. By compromising a third-party vendor or supplier, attackers can gain access to the accounting systems of interconnected organizations. Supply chain attacks can result in unauthorized access to financial records, data breaches, or fraudulent activities.

9. Insider Threats: While internal threats were covered in a separate section, malicious insiders can also pose external threats if they collude with external parties or sell their access credentials to cybercriminals. External collaborators can exploit these insiders’ knowledge to gain unauthorized access to accounting information systems.

To protect against external threats and malicious attacks, organizations should implement multi-layered security measures, including robust firewalls, intrusion detection systems, anti-malware software, and regular vulnerability assessments. Continuous employee training and awareness programs can help employees recognize and respond effectively to external threats, reducing the risk of successful attacks.

Regulatory Compliance Challenges

Compliance with industry regulations is a critical aspect of maintaining the integrity and security of accounting information systems. However, businesses often face various challenges when it comes to meeting regulatory requirements. Failure to address these challenges can result in legal and financial consequences, reputational damage, and loss of customer trust. Here are some common regulatory compliance challenges faced by organizations:

1. Evolving Regulatory Landscape: The regulatory landscape is continuously evolving, with new requirements and updates being introduced regularly. Staying abreast of these changes and ensuring compliance with multiple regulations, such as the Sarbanes-Oxley Act (SOX), General Data Protection Regulation (GDPR), and Payment Card Industry Data Security Standard (PCI DSS), can be complex and demanding for businesses.

2. Complexity of Regulations: Many industry regulations are complex and have extensive requirements. The language and technical jargon used in these regulations can be challenging to interpret and implement effectively. Organizations may struggle to understand the specific compliance obligations, resulting in difficulties in aligning their accounting information systems and processes accordingly.

3. Lack of Resources and Expertise: Compliance with regulatory requirements involves dedicating sufficient resources, including personnel, time, and expertise. Small to medium-sized businesses, in particular, may face resource constraints and struggle to allocate the necessary time and human resources to achieve and maintain compliance.

4. Data Privacy and Protection: Many industry regulations focus on data privacy and protection, such as the GDPR. Protecting sensitive financial data and ensuring compliance with regulations regarding data encryption, access controls, and data handling can be challenging for organizations, especially when managing large volumes of financial information.

5. Cross-Border Compliance: Global organizations face the challenge of ensuring compliance across multiple jurisdictions with different regulations and legal requirements. Transferring financial data across borders can raise compliance challenges related to data protection, privacy, and international regulations.

6. Vendor Management: Organizations often rely on third-party vendors for various aspects of their accounting information systems, such as cloud services or software providers. However, ensuring that these vendors also comply with relevant regulations and maintain adequate security controls can be a challenge. Managing vendor relationships, monitoring their compliance, and conducting regular assessments can be time-consuming and complex.

7. Training and Awareness: Compliance requires a company-wide understanding of regulatory requirements and the importance of adhering to them. Organizations may face challenges in providing adequate training and awareness programs to employees to ensure they understand their roles, responsibilities, and the potential consequences of non-compliance.

8. Auditing and Reporting: Compliance often involves regular audits and reports to demonstrate adherence to regulatory requirements. Generating accurate and comprehensive reports, tracking and documenting compliance activities, and addressing any identified gaps can be a complex and time-consuming process for organizations.

To overcome these compliance challenges, organizations should develop a comprehensive compliance program that includes regular risk assessments, proactive monitoring, effective training programs, and strong governance frameworks. Collaborating with legal and compliance professionals, as well as engaging external experts, can provide valuable guidance and support in navigating the complex regulatory landscape and ensuring ongoing compliance.

Impact of Threats on Accounting Information Systems

The impact of threats on accounting information systems can be significant, affecting the overall financial stability, reputation, and operation of a business. Understanding these impacts is crucial for organizations to fully grasp the importance of implementing robust security measures and taking proactive steps to mitigate risks. Here are some common impacts of threats on accounting information systems:

1. Financial Losses: Threats such as data breaches, fraud, or cyberattacks can result in significant financial losses. Stolen financial information, fraudulent transactions, or ransomware attacks can lead to direct monetary losses through unauthorized access, theft, or disruption of financial operations. Additionally, businesses may incur costs related to remediation, legal fees, customer notification, and reputational damage.

2. Data Integrity and Accuracy: Threats can compromise the integrity and accuracy of financial data stored within accounting information systems. Unauthorized access, data manipulation, or malware attacks can alter or delete data, leading to inaccurate financial records. This can result in incorrect financial reporting, misinformed decision-making, and potential violations of regulatory requirements.

3. Reputational Damage: The impact of threats extends beyond financial implications. A data breach or misuse of financial information can severely damage a company’s reputation. Loss of customer trust, negative media coverage, and public perception of incompetence in protecting sensitive financial data can have long-lasting repercussions and negatively affect relationships with customers, partners, and stakeholders.

4. Legal and Regulatory Consequences: Non-compliance with industry regulations, such as the Sarbanes-Oxley Act (SOX) or the General Data Protection Regulation (GDPR), can result in significant legal and financial consequences. Regulatory authorities may impose fines, penalties, or mandatory remediation measures. Organizations may also face lawsuits and legal action from affected parties, resulting in additional costs and damage to their reputation.

5. Disruption of Business Operations: Malicious attacks, such as ransomware or denial-of-service (DoS) attacks, can disrupt accounting information systems and halt financial operations. Downtime can lead to delayed financial reporting, hindered transaction processing, and interrupted cash flow management. This can negatively impact the overall efficiency, productivity, and profitability of the business.

6. Loss of Intellectual Property: Threats to accounting information systems may lead to the loss or theft of intellectual property, including trade secrets, financial analysis, or proprietary financial models. Competitors or cybercriminals may exploit this stolen information, gaining an advantage or engaging in fraudulent activities that harm the organization’s competitive position.

7. Regulatory Non-Compliance: Inadequate security measures and compliance with regulations can result in regulatory non-compliance. Failure to protect sensitive financial data, adhere to privacy requirements, or implement proper financial controls can lead to fines, loss of licenses, and restrictions on business activities. Non-compliance can also sour relationships with stakeholders and hinder business growth opportunities.

8. Employee Morale and Trust: The impact of threats on accounting information systems can extend to employee morale and trust within the organization. Breaches or instances of fraud can erode employee trust in the company’s ability to protect their financial data and maintain a secure work environment. This can lead to decreased productivity, increased turnover rates, and a negative overall working environment.

It is crucial for organizations to recognize the potential impacts of threats on their accounting information systems and take proactive measures to prevent and mitigate risks. Implementing robust security controls, conducting regular risk assessments, educating employees, and staying informed about emerging threats can help minimize the impact of threats and protect the integrity and security of financial data.

Mitigation Strategies and Best Practices

Implementing effective mitigation strategies and adopting best practices is crucial for safeguarding accounting information systems from threats and ensuring the integrity and security of financial data. Here are some key strategies and best practices that organizations can implement:

1. Strong Authentication and Access Controls: Implementing strong authentication mechanisms, such as two-factor authentication, can reduce the risk of unauthorized access. Additionally, enforcing strict access controls, including granting access on a need-to-know basis and implementing segregation of duties, can minimize the potential for fraudulent activities.

2. Regular Software Updates and Patch Management: Keeping accounting software and systems up to date with the latest security patches helps mitigate vulnerabilities. Organizations should establish a patch management process to promptly install updates and security fixes to minimize the risk of exploitation by cybercriminals.

3. Employee Awareness and Training: Educate employees on cybersecurity best practices, including recognizing phishing attacks, using strong passwords, and understanding the importance of maintaining the security of financial data. Regular training sessions and awareness programs can help ensure that employees are informed and equipped to detect and respond to potential threats.

4. Robust Firewall and Intrusion Detection Systems: Deploying and maintaining firewalls and intrusion detection systems provides an additional layer of defense against external threats. These systems help monitor network traffic, detect suspicious activities, and block unauthorized access to accounting systems.

5. Encryption and Data Privacy: Employ encryption mechanisms to protect sensitive financial data both during transmission and storage. Implement end-to-end encryption for communication channels and ensure that data is encrypted before being stored. Adhere to data privacy regulations, such as the GDPR, and regularly review data handling practices to maintain compliance.

6. Regular Data Backups and Disaster Recovery Planning: Establish and maintain a robust backup strategy to ensure data availability and recovery in the event of system failures, natural disasters, or cyberattacks. Regularly test the effectiveness of backup and recovery procedures to minimize the impact of potential data loss or system disruptions.

7. Vendor Management and Due Diligence: Conduct thorough assessments of third-party vendors and service providers to ensure they maintain appropriate security controls and comply with relevant regulations. Include robust security and compliance requirements in vendor contracts and conduct periodic audits to assess ongoing adherence to these requirements.

8. Incident Response and Contingency Planning: Develop and implement an incident response plan to outline the steps to be taken in the event of a security incident. Establish roles and responsibilities, define communication protocols, and conduct periodic drills to test and improve the effectiveness of the response plan. Additionally, develop and maintain a comprehensive business continuity and disaster recovery plan to ensure minimal disruption to financial operations in the event of a security incident.

9. Regular Risk Assessments and Audits: Conduct regular risk assessments to identify vulnerabilities, evaluate the effectiveness of existing controls, and develop mitigation strategies. Engage independent auditors to conduct periodic audits of accounting information systems to assess compliance, identify gaps, and provide recommendations for improvement.

10. Continual Monitoring and Intrusion Detection: Implement real-time monitoring tools and intrusion detection systems to identify potential threats and anomalous activities within accounting systems. Continual monitoring allows for the prompt detection and response to potential security incidents, minimizing the potential impact on financial data.

By implementing these mitigation strategies and best practices, organizations can enhance the security of their accounting information systems and reduce the risk of cyber threats, data breaches, and financial fraud. It is essential to establish a comprehensive security framework and adopt a proactive approach to maintain the integrity and security of financial data in an ever-evolving threat landscape.

Conclusion

The increasing threats to accounting information systems pose significant risks to businesses in terms of financial losses, data breaches, and regulatory non-compliance. It is imperative for organizations to understand the importance of implementing robust security measures and adopting best practices to protect their accounting information systems.

Accounting information systems play a crucial role in financial management, providing real-time access to financial data, ensuring accuracy and compliance, and facilitating financial reporting and decision-making. However, these systems are vulnerable to various threats, including cyberattacks, internal fraud, and regulatory compliance challenges.

To mitigate these threats, organizations must implement a comprehensive framework of security controls, including strong authentication mechanisms, regular software updates, and employee awareness training. Encryption of data, regular backups, and disaster recovery planning are vital for ensuring data integrity and availability. Vendor management, due diligence, and periodic audits help assess and maintain the security of third-party services.

Compliance with industry regulations is also critical. Organizations must navigate the evolving regulatory landscape, address the complexity of regulations, and allocate the necessary resources and expertise to maintain compliance. Failure to do so can result in legal and financial consequences, reputational damage, and loss of customer trust.

The impact of threats on accounting information systems includes financial losses, compromised data integrity, reputational damage, and disruption of business operations. These threats can also lead to regulatory non-compliance and erosion of employee morale and trust.

In conclusion, protecting accounting information systems requires a multi-faceted approach that includes implementing strong security measures, adhering to regulatory requirements, conducting regular risk assessments, maintaining robust backup and recovery plans, and fostering a culture of cybersecurity awareness. By recognizing the challenges and implementing effective mitigation strategies, organizations can safeguard their accounting information systems and protect the integrity, confidentiality, and availability of their financial data.