Finance

What Is An ERP System In Accounting

Published: October 10, 2023

Learn how an ERP system can streamline your accounting processes and improve financial management in your business. Discover the benefits of implementing an ERP system in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of ERP System in Accounting

- Benefits of using an ERP System in Accounting

- Key Features of an ERP System in Accounting

- Common Modules in an ERP System for Accounting

- Implementation Process of an ERP System in Accounting

- Challenges and Limitations of ERP Systems in Accounting

- Best Practices for Implementing ERP Systems in Accounting

- Conclusion

Introduction

Welcome to the world of finance and accounting, where numbers rule and accuracy is key. In this fast-paced industry, businesses need to keep track of their financial transactions, manage their accounts, and make informed decisions. To streamline these processes, many organizations turn to enterprise resource planning (ERP) systems designed specifically for accounting.

An ERP system in accounting is a software solution that integrates various accounting functions and streamlines financial processes. It provides a centralized platform where businesses can manage their financial data, generate reports, and ensure compliance with accounting standards. With the ability to automate tasks and provide real-time insights, ERP systems have become indispensable tools for modern accounting practices.

Whether you are a small business owner or a finance professional, understanding how an ERP system can benefit your accounting processes is crucial. This comprehensive article will delve into the definition of an ERP system in accounting, explore its key features, highlight the benefits and limitations, and provide best practices for implementation.

So, let’s dive into the world of ERP systems in accounting to discover how they can revolutionize your financial management and propel your business forward.

Definition of ERP System in Accounting

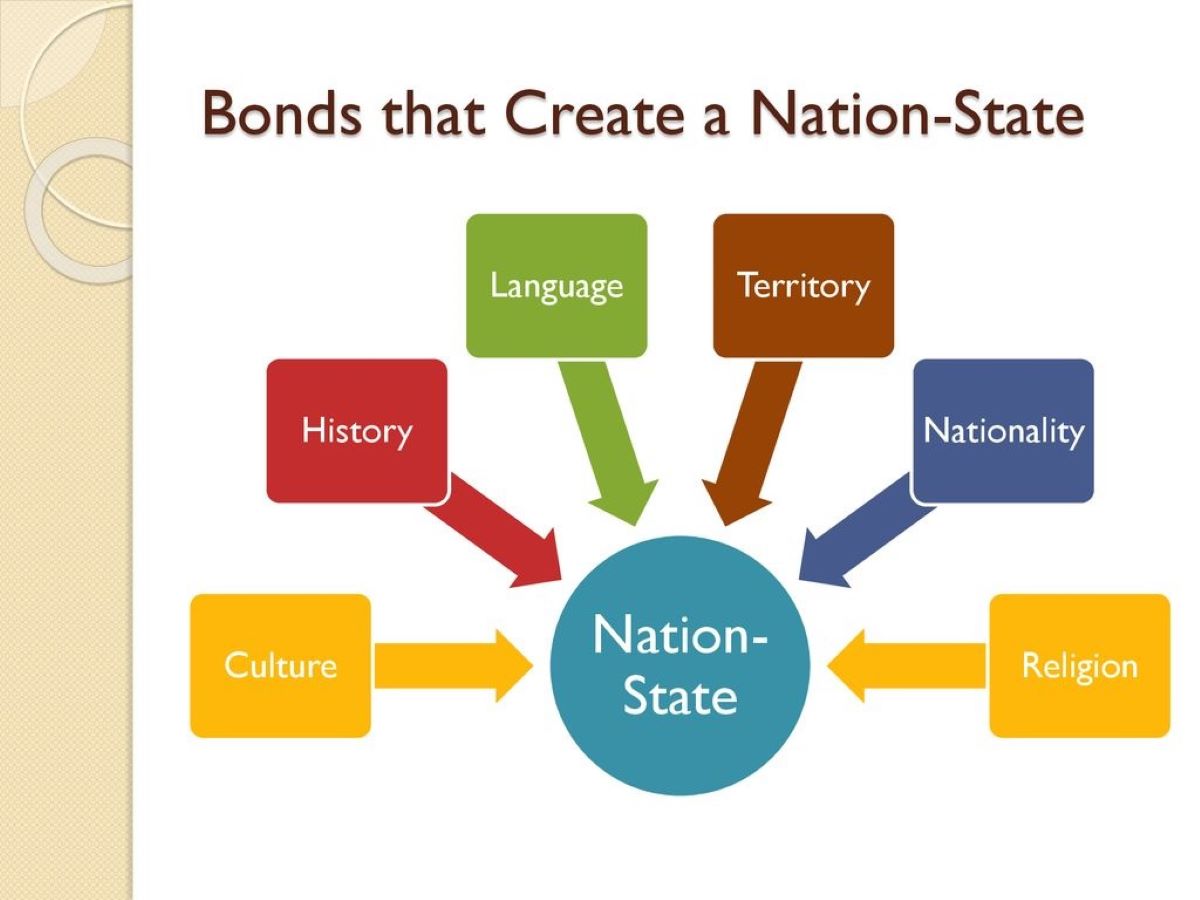

An ERP system in accounting is a software solution that combines various accounting functions into a single integrated system. It allows businesses to effectively manage and track their financial transactions, streamline processes, and improve overall efficiency. By integrating multiple functions such as general ledger, accounts payable, accounts receivable, payroll, and financial reporting, an ERP system provides a comprehensive view of a company’s financial data.

One of the key advantages of an ERP system in accounting is its ability to automate repetitive tasks. This includes processes like data entry, invoice generation, and financial statement preparation. By automating these tasks, businesses can save time, reduce human error, and improve overall accuracy. Additionally, an ERP system provides real-time visibility into financial data, allowing users to make informed decisions based on up-to-date information.

The core functionality of an ERP system in accounting typically includes general ledger management, which records all financial transactions and provides a centralized view of the company’s financial health. Accounts payable and receivable modules manage the company’s payables and receivables, including invoice processing, payment management, and customer/vendor relationship management.

Payroll management is another important module in an ERP system, which ensures accurate and timely payment of employee salaries, tax deductions, and benefits. Financial reporting and analysis modules provide comprehensive reports and analytics, enabling businesses to gain insights into their financial performance, identify trends, and make informed decisions.

Overall, the main goal of an ERP system in accounting is to provide a unified and streamlined approach to financial management. It eliminates the need for disparate systems, manual data entry, and cumbersome spreadsheets, resulting in improved accuracy, efficiency, and cost savings.

Benefits of using an ERP System in Accounting

Implementing an ERP system in accounting can bring numerous benefits to businesses of all sizes. Let’s explore some of the key advantages:

- Streamlined processes: An ERP system integrates various accounting functions into a unified platform, eliminating the need for multiple systems and manual data entry. This streamlines processes, reduces errors, and increases efficiency.

- Improved accuracy: With automated data entry and real-time updates, an ERP system ensures accurate financial information. This reduces the risk of human error and improves the reliability of financial reports.

- Real-time visibility: An ERP system provides real-time visibility into financial data, allowing businesses to make informed decisions based on up-to-date information. This empowers users to identify trends, spot potential issues, and take proactive measures.

- Enhanced reporting and analysis: ERP systems offer robust reporting and analysis capabilities, allowing businesses to generate comprehensive financial reports, analyze key performance indicators, and gain insights into their financial health.

- Better compliance: ERP systems help companies stay compliant with accounting regulations and standards. They provide features like automated tax calculations, audit trails, and compliance reporting, reducing the risk of non-compliance penalties.

- Cost savings: By automating tasks, reducing errors, and improving efficiency, an ERP system can lead to cost savings in terms of time, resources, and operational expenses.

- Improved decision-making: With accurate and up-to-date financial information readily available, businesses can make better-informed decisions. This includes financial planning, budgeting, and forecasting, as well as strategic decision-making for growth and expansion.

- Scalability and flexibility: ERP systems are designed to support the growth and changing needs of businesses. They can easily scale as a company expands and can be customized to meet specific requirements and industry regulations.

By leveraging the benefits of an ERP system in accounting, businesses can optimize their financial management processes, improve decision-making, and achieve sustainable growth in a competitive market.

Key Features of an ERP System in Accounting

An ERP system in accounting offers a range of features designed to streamline financial management processes and provide businesses with a comprehensive view of their financial data. Let’s explore some of the key features:

- General Ledger Management: The general ledger module is the heart of an ERP system in accounting. It tracks all financial transactions, ensures accurate recording and categorization of transactions, and provides a centralized view of the company’s financial health.

- Accounts Payable and Receivable: These modules manage a company’s payables and receivables. They handle tasks such as invoice processing, payment management, vendor/customer relationship management, and aging analysis.

- Payroll Management: Payroll management ensures accurate and timely payment of employee salaries, tax deductions, and benefits. It handles tasks such as wage calculation, tax calculations, statutory compliance, and generation of payslips.

- Financial Reporting and Analysis: ERP systems provide robust reporting and analysis capabilities. They generate comprehensive financial reports, including balance sheets, income statements, cash flow statements, and more. These reports help businesses analyze their financial performance, identify areas for improvement, and make data-driven decisions.

- Bank Reconciliation: The bank reconciliation feature ensures that bank statements and business records match, reconciling any discrepancies. This helps businesses identify errors or missing transactions, preventing financial discrepancies.

- Fixed Asset Management: The fixed asset module allows businesses to manage and track their assets, including acquisition, depreciation, maintenance, and disposal. It provides visibility into the value, location, and condition of assets, ensuring accurate financial reporting.

- Budgeting and Forecasting: ERP systems enable businesses to create and manage budgets and forecasts. This feature helps in better financial planning, tracking expenses, and ensuring that the company’s financial goals align with its overall strategic objectives.

- Multi-currency Support: In today’s globalized economy, businesses often deal with multiple currencies. ERP systems provide multi-currency support, allowing businesses to calculate and report financial data in different currencies accurately.

- Audit Trails and Compliance: ERP systems help businesses maintain audit trails, ensuring transparency and accountability. This feature helps in compliance with regulatory requirements and internal control processes.

- Integration with Other Systems: An ERP system can integrate with other business systems, such as customer relationship management (CRM) and supply chain management (SCM), allowing seamless flow of data across different functions and improving overall organizational efficiency.

These key features of an ERP system in accounting provide businesses with the tools and capabilities necessary to manage their financial operations effectively, optimize decision-making, and drive growth.

Common Modules in an ERP System for Accounting

An ERP system for accounting typically consists of several modules that cover various aspects of financial management and streamline accounting processes. Let’s explore some of the common modules found in an ERP system for accounting:

- General Ledger: The general ledger module is the foundation of an ERP system. It records all financial transactions, categorizes them into different accounts, and provides a centralized view of the company’s financial health.

- Accounts Payable: The accounts payable module manages the company’s payables, including vendor invoices, payment processing, and vendor relationship management. It ensures timely payment to vendors, tracks outstanding balances, and enables efficient cash flow management.

- Accounts Receivable: The accounts receivable module handles the company’s receivables, including customer invoices, collection management, and customer relationship management. It helps track outstanding balances, automate invoice generation, and streamline the collection process.

- Cash Management: The cash management module allows businesses to effectively manage their cash flow and liquidity. It encompasses features such as bank reconciliation, cash forecasting, and cash position management, enabling accurate management of available funds.

- Fixed Assets: The fixed assets module tracks and manages the company’s fixed assets, including acquisition, depreciation, maintenance, and disposal. It helps businesses maintain an accurate record of asset values, calculate depreciation expenses, and ensure compliance with accounting regulations.

- Payroll: The payroll module automates the calculation and processing of employee wages, tax deductions, and benefits. It ensures accurate payment to employees, calculates and deducts taxes, generates payslips, and maintains relevant compliance with labor laws.

- Financial Reporting and Analysis: The financial reporting and analysis module generates comprehensive financial reports, including balance sheets, income statements, cash flow statements, and more. It provides businesses with valuable insights into their financial performance and helps in decision-making.

- Tax Management: The tax management module assists businesses in managing their tax obligations. It automates tax calculations, generates tax reports, and ensures compliance with tax laws and regulations. It helps businesses stay updated on tax-related activities and deadlines.

- Budgeting and Planning: The budgeting and planning module enables businesses to create, monitor, and manage budgets. It helps in tracking expenses, forecasting revenue, and aligning financial goals with the overall strategic objectives of the company.

- Compliance and Audit: The compliance and audit module ensures that businesses adhere to regulatory requirements. It assists in maintaining audit trails, managing compliance-related documentation, and facilitating internal and external audits.

These common modules in an ERP system for accounting provide businesses with a comprehensive suite of tools to manage various financial aspects, streamline processes, and ensure accurate financial reporting.

Implementation Process of an ERP System in Accounting

The implementation of an ERP system in accounting is a complex and critical process that requires careful planning, coordination, and collaboration between various stakeholders. Here is a general overview of the implementation process:

- Needs Assessment: The first step in implementing an ERP system is to assess the specific needs and requirements of the business. This involves evaluating current accounting processes, identifying pain points, and determining the key objectives the ERP system should address.

- Vendor Selection: Once the needs assessment is complete, businesses can start researching and selecting an ERP system vendor. It is important to consider factors such as vendor reputation, system functionality, scalability, support, and cost.

- System Design: The next phase involves designing the system architecture and configuration. This includes mapping the existing accounting processes to the modules and functionalities of the ERP system, defining workflows, and setting up chart of accounts and other relevant configurations.

- Data Migration: During this phase, businesses need to transfer existing data from their legacy systems to the new ERP system. Data migration involves extracting, cleansing, and transforming data to ensure its compatibility with the ERP system. It is crucial to run extensive tests to verify data accuracy and integrity.

- System Configuration: Once the data migration is complete, the system needs to be configured based on the specific needs of the business. This includes setting up user permissions, defining workflows, configuring modules, and customizing reports.

- Testing: Rigorous testing is essential to ensure the ERP system functions correctly and meets the business requirements. This involves conducting various tests, including unit testing, integration testing, and user acceptance testing. Any issues or bugs discovered during testing should be addressed and resolved.

- Training: To ensure successful adoption of the ERP system, training sessions should be conducted for end-users. Training should cover system navigation, module-specific features, and best practices for utilizing the system effectively.

- Go-Live and Support: Once the system has been thoroughly tested and users have received training, it is time to go live with the ERP system. Businesses should establish a support system and provide ongoing assistance to users to address any immediate concerns or issues that arise.

- Continuous Improvement: The implementation process doesn’t end with the go-live phase. It is important to continuously monitor and evaluate the system’s performance, gather feedback from users, and implement necessary improvements. Regular system updates and maintenance are also essential to ensure optimal performance.

Proper planning, stakeholder involvement, and effective change management are crucial for a successful ERP system implementation. By following a well-defined implementation process, businesses can optimize their accounting operations and reap the benefits of an integrated and efficient financial management system.

Challenges and Limitations of ERP Systems in Accounting

While ERP systems offer numerous benefits in accounting, they are not without their challenges and limitations. It’s important to be aware of these potential drawbacks to ensure a successful implementation and usage. Here are some common challenges and limitations of ERP systems in accounting:

- Complexity: ERP systems are complex software solutions that require significant planning, resources, and expertise to implement and maintain. The complexity of the system can make it challenging for organizations, especially smaller businesses with limited IT capabilities, to effectively manage and utilize the system.

- Customization: While most ERP systems offer a wide range of features, they may not always meet every business’s unique requirements out-of-the-box. Customizing the system to align with specific needs can be complex and costly, as it often requires significant development and customization efforts.

- Costs: ERP systems can be expensive, especially when considering licensing fees, implementation costs, customization, training, and ongoing maintenance. Smaller businesses may find it challenging to justify the investment required for an ERP system, especially if their accounting needs are relatively simple.

- Resistance to Change: Implementing an ERP system often requires changes to existing business processes. Resistance to change from employees can hinder the successful adoption and utilization of the system. Proper change management strategies and employee buy-in are essential to overcome this challenge.

- Data Migration and Integration: Transferring data from legacy systems into the new ERP system can be complex and time-consuming. Data cleansing, transformation, and ensuring data integrity during the migration process can pose challenges. Integration with other systems within the organization’s technology ecosystem also requires careful planning and execution.

- User Training and Adoption: Proper training of personnel is critical to maximizing the benefits of an ERP system. However, training a diverse range of users, with varying levels of technical proficiency and responsibilities, can be a challenge. Ensuring everyone is adequately trained and embracing the new system may require ongoing support and reinforcement.

- System Performance and Scalability: As businesses grow and their accounting needs increase, system performance and scalability become crucial. The ERP system should be able to handle increased data volumes, user load, and transactional demands without compromising performance. Ensuring appropriate infrastructure and system architecture are in place is essential for long-term success.

- Dependency on Vendor Support: The successful implementation and usage of an ERP system heavily rely on the support provided by the vendor. Businesses need to have a reliable and responsive vendor that offers regular updates, bug fixes, and technical support to address any issues or concerns that may arise.

Despite these challenges and limitations, when managed effectively, ERP systems can significantly improve accounting processes and financial management. It is essential for businesses to carefully evaluate the associated challenges and have strategies in place to mitigate them, ensuring a successful implementation and utilization of the ERP system.

Best Practices for Implementing ERP Systems in Accounting

Implementing an ERP system in accounting requires careful planning, execution, and ongoing management. To ensure a successful implementation and maximize the benefits of the system, consider the following best practices:

- Define Clear Goals and Objectives: Clearly define the goals and objectives you want to achieve with the ERP system implementation. This will help guide the entire implementation process and ensure that the system is aligned with your business needs.

- Thoroughly Assess and Prepare Data: Before migrating data to the new ERP system, conduct a thorough assessment of existing data to ensure accuracy and cleanliness. Cleanse and normalize the data as necessary to avoid any inconsistencies or errors during the migration process.

- Involve Key Stakeholders: Involve key stakeholders from various departments and levels within the organization throughout the implementation process. Their input and feedback will be valuable for customizing the system, identifying any potential issues, and gaining buy-in from end users.

- Align Processes with Best Practices: Review and analyze your existing accounting processes and identify areas for improvement. Take the opportunity to align your processes with best practices and leverage the capabilities of the ERP system to optimize efficiency and accuracy.

- Invest in Training and Change Management: Provide thorough training to end users on how to effectively use the ERP system. Develop a comprehensive change management plan to address concerns, manage resistance, and ensure successful adoption of the system.

- Perform Rigorous Testing: Prior to going live, conduct rigorous testing to ensure the system functions as expected and meets the business requirements. Test different scenarios, workflows, and edge cases to identify and resolve any issues before the system is fully operational.

- Establish Ongoing Support and Maintenance: Plan for ongoing support and maintenance of the ERP system. Identify internal resources or consider outsourcing support to a reliable vendor. Regularly update and monitor the system, address any issues promptly, and stay up-to-date with system upgrades and patches.

- Monitor and Evaluate Performance: Continuously monitor and evaluate the performance of the ERP system in meeting your accounting needs. Regularly assess the system’s effectiveness, gather user feedback, and identify areas for improvement. Make necessary adjustments and enhancements to optimize efficiency and value.

- Stay Engaged with the ERP Community: Participate in user groups, forums, and conferences related to the ERP system you have implemented. Engaging with the ERP community can provide valuable insights, best practices, and learning opportunities to further enhance your accounting operations.

By following these best practices, businesses can increase the chances of a successful ERP system implementation, unlock the full potential of the system’s capabilities, and drive improvement in their accounting processes and financial management.

Conclusion

Implementing an ERP system in accounting can revolutionize the way businesses manage their financial operations. By integrating various accounting functions into a unified system, companies can streamline processes, improve accuracy, enhance decision-making, and achieve greater efficiency.

In this comprehensive article, we have explored the definition of an ERP system in accounting and its key features. We have discussed the benefits of using an ERP system, including streamlined processes, improved accuracy, real-time visibility, enhanced reporting and analysis, and better compliance.

However, implementing an ERP system in accounting also comes with its challenges and limitations. Complexity, customization, costs, resistance to change, and data migration are some of the common hurdles businesses may face. By being aware of these challenges and following best practices, such as defining clear goals, involving key stakeholders, investing in training and change management, and ongoing support and maintenance, businesses can overcome these obstacles and ensure a successful ERP system implementation.

An effective ERP system in accounting can empower businesses to optimize their financial management processes, make informed decisions, and drive growth. It provides a centralized platform for managing financial transactions, automating tasks, and generating comprehensive reports.

As you embark on your journey towards implementing an ERP system in accounting, remember to carefully evaluate your specific needs, select the right vendor, and approach the implementation process with thoughtful planning and thorough execution. With the right strategy, support, and ongoing evaluation, an ERP system in accounting can become a powerful tool to streamline your financial operations, enhance efficiency, and contribute to the overall success of your business.