Home>Finance>Why Do Many Banks Consider Student Loans Risky Investments?

Finance

Why Do Many Banks Consider Student Loans Risky Investments?

Published: January 20, 2024

Learn why student loans are seen as risky investments by banks and how it relates to the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where banks and financial institutions play a crucial role in managing risks and making sound investment decisions. When it comes to determining the profitability and viability of certain financial products, banks meticulously assess the associated risks. One area that has been a topic of discussion and consideration in recent years is student loans.

In today’s society, pursuing higher education has become increasingly important for individuals seeking to secure better opportunities and build successful careers. As a result, student loans have become a significant part of the financial landscape, with millions of students relying on these loans to fund their education. However, many banks view student loans as risky investments, and there are several factors that contribute to this perception.

The nature of student loans is unique and inherently risky for banks. Unlike other types of loans, student loans generally have longer repayment periods and are often issued to individuals with limited credit history or income. Furthermore, the repayment of student loans is contingent upon the borrower’s ability to secure a stable and well-paying job after graduation.

The risks associated with student loans are multi-fold. They stem from the potential for default or non-repayment of the loan, as well as the uncertainty surrounding the borrower’s future income and employment prospects. Additionally, there are various economic factors that can impact a borrower’s ability to repay their student loans, such as fluctuations in the job market, changes in income levels, or unforeseen circumstances.

Regulation and oversight of student loans also play a role in the perception of risk by banks. The government heavily regulates student loans, and there are specific repayment plans, forgiveness programs, and deferment options available to borrowers. While these programs can be beneficial for students, they create uncertainty for banks regarding potential losses and repayment schedules.

Considering these factors, it is no wonder that many banks approach student loans with caution. They carefully evaluate the risks involved and develop strategies to manage these risks effectively. In the following sections, we will delve deeper into the reasons why banks view student loans as risky investments and explore the various strategies they employ to mitigate these risks.

The Nature of Student Loans

Student loans are a unique type of loan specifically designed to finance the costs of higher education for students. Unlike other forms of debt, such as mortgages or auto loans, student loans typically have longer repayment terms and may offer more flexible repayment options.

One of the key characteristics of student loans is that they are often issued to individuals who have limited credit history or income. Since many students have not yet entered the workforce or established a credit profile, banks consider them to be higher-risk borrowers. This raises concerns about their ability to make timely loan payments or repay the loan in full.

Additionally, student loans are typically unsecured loans, meaning they are not backed by collateral such as a house or car. Without collateral, banks cannot seize assets if a borrower defaults on their loan. This lack of security increases the risk for lenders, as they have no tangible assets to recoup their losses in the event of non-payment.

Another factor that contributes to the unique nature of student loans is the extended repayment periods. Unlike other loans that are typically repaid within a few years, student loans can have repayment terms of 10 years or more. This long repayment horizon further amplifies the risk for banks, as it increases the likelihood of unforeseen circumstances that may hinder the borrower’s ability to repay the loan.

Furthermore, the repayment of student loans is contingent upon the borrower’s ability to secure a stable and well-paying job after graduation. While many borrowers hope to enter the job market immediately and start making repayments, the reality is often different. Economic conditions, such as a downturn in the job market or a mismatch between graduates’ skills and job market demands, can significantly impact the repayment ability of borrowers.

Overall, the nature of student loans presents inherent risks for banks. Lending to individuals with limited credit history, offering unsecured loans, and relying on uncertain future income make student loans a challenging and potentially risky investment for financial institutions.

Risks Associated with Student Loans

When it comes to student loans, there are several risks that banks and financial institutions must consider. Understanding these risks is crucial for assessing the potential impact on loan repayment and determining the overall risk profile of their loan portfolios.

One of the primary risks associated with student loans is the high rate of default. Default occurs when borrowers fail to make payments on their loans for an extended period of time. Research shows that student loan defaults have been on the rise in recent years, posing a significant concern for banks.

There are several factors that contribute to the increased likelihood of default on student loans. Firstly, as mentioned earlier, many student borrowers have limited credit history and income, making them more vulnerable to financial difficulties. Additionally, some borrowers may struggle to find employment or secure well-paying jobs after graduation, leading to difficulty in repaying their loans.

Another risk associated with student loans is the potential for delinquency. Delinquency refers to the failure to make timely loan payments, and it can have negative consequences for both borrowers and lenders. Even if a borrower does not default on their loan, consistent delinquency can still impact their credit score and financial stability.

Economic factors also play a significant role in the risks associated with student loans. Economic downturns or recessions can lead to increased unemployment rates and decreased job prospects, making it more challenging for borrowers to repay their loans. These external economic factors are beyond the control of borrowers and lenders, making loan repayment uncertain and potentially risky.

The regulatory environment surrounding student loans also contributes to the risks. Government regulations and programs aimed at providing relief to borrowers, such as income-driven repayment plans or loan forgiveness options, can create uncertainty for banks. These programs can result in potential loss of principal or extended repayment terms, impacting the profitability and risk profile of student loans.

Lastly, demographic factors can also pose risks for banks. Changing demographics, including declining birth rates or demographic shifts, can impact the demand for higher education and, consequently, the demand for student loans. These shifts in demand can affect the repayment capacity of borrowers and the value of student loan portfolios.

In summary, there are several risks associated with student loans, ranging from high default rates and potential delinquency to economic factors, regulatory changes, and demographic shifts. Banks must carefully assess these risks to make informed decisions regarding their involvement in the student loan market.

Default Rates and Loan Repayment

Default rates and loan repayment are critical factors to consider when evaluating the risks associated with student loans. Default occurs when borrowers fail to make their loan payments for an extended period, often resulting in serious consequences for both borrowers and lenders.

Default rates on student loans have been a growing concern in recent years. According to the U.S. Department of Education, the overall default rate for federal student loans in the United States is around 10%. This means that approximately 1 in 10 borrowers default on their loans within three years of entering repayment.

Several factors contribute to the high default rates on student loans. One factor is the financial burden faced by borrowers. Many students graduate with significant loan balances, and the monthly payments required to repay these loans can be challenging to manage. As a result, some borrowers may struggle to keep up with their payments, increasing the likelihood of default.

Another contributing factor is the lack of employment or income stability for borrowers. Securing a well-paying job immediately after graduation is not guaranteed, and some borrowers may experience periods of unemployment or underemployment. The absence of a stable income stream can make it difficult for borrowers to consistently repay their student loans on time.

Loan repayment options and plans also impact default rates. Standard repayment plans, where borrowers make fixed monthly payments over a set period, may not be feasible for all borrowers. To address this, income-driven repayment plans have been introduced, which adjust borrowers’ monthly payments based on their income and family size. While these plans provide flexibility, they can extend the repayment period and potentially increase the chances of default if borrowers do not earn enough to keep up with their adjusted payments.

It is important to note that defaulting on student loans can have severe consequences for borrowers. It can negatively impact their credit scores, making it challenging to secure future loans or credit. Additionally, the government has the authority to garnish wages or withhold tax refunds to recoup outstanding loan balances, further exacerbating financial difficulties for borrowers.

Loan default rates are closely monitored by financial institutions as they assess the risk associated with student loans. Higher default rates can indicate a higher likelihood of losses for the bank, influencing their decisions to approve or decline loan applications or adjust interest rates accordingly.

Overall, default rates and loan repayment are significant considerations when assessing the risks associated with student loans. Banks must carefully evaluate borrowers’ repayment capacity, monitor default rates, and implement strategies to mitigate the potential impact of defaults on their loan portfolios.

Economic Factors Impacting the Repayment Ability

The ability of borrowers to repay their student loans is heavily influenced by various economic factors. These factors can significantly impact job prospects, income levels, and overall financial stability, thus affecting the repayment ability of borrowers. Understanding these economic factors is crucial for banks to assess the risks associated with student loans.

One key economic factor that affects loan repayment is the state of the job market. During periods of economic downturn or recession, job opportunities may become scarce, making it challenging for borrowers to secure employment upon graduation. Limited job prospects can lead to increased unemployment rates among recent graduates and impede their ability to generate the income needed to make loan payments.

Moreover, the type of job a borrower obtains plays a critical role in their repayment ability. Some fields may offer higher starting salaries and greater income growth potential, making it easier for borrowers to handle their loan payments. Conversely, lower-paying jobs or jobs in industries with limited growth potential can make it more difficult for borrowers to meet their financial obligations.

The overall economic health of the country or region also has an impact on the repayment ability of borrowers. In a thriving economy, borrowers may have better access to job opportunities, higher wages, and increased stability. On the other hand, during economic downturns or periods of economic uncertainty, borrowers may face challenges in finding employment or experience reduced income, making it harder for them to meet their loan obligations.

Another economic factor to consider is the cost of living. Different regions have varying costs of living, including expenses related to housing, transportation, and daily necessities. Higher costs of living can put additional financial strain on borrowers, leaving them with less disposable income to allocate towards their student loan payments.

Additionally, socioeconomic factors and disparities also impact the repayment ability of borrowers. Individuals from disadvantaged backgrounds or marginalized communities may face additional hurdles in achieving financial stability. Factors such as income inequality, limited access to quality education, and discrimination can further hinder the repayment ability of borrowers from these communities.

Changes in interest rates also have implications for student loan repayment. If interest rates rise, it can increase the amount of interest that accrues on the loan, potentially making it more challenging for borrowers to repay their loans within the desired timeframe.

Overall, economic factors such as job market conditions, income levels, cost of living, and socioeconomic disparities significantly impact the repayment ability of student loan borrowers. Banks must consider these economic factors when assessing the risks associated with student loans and implementing strategies to mitigate potential challenges that borrowers may face.

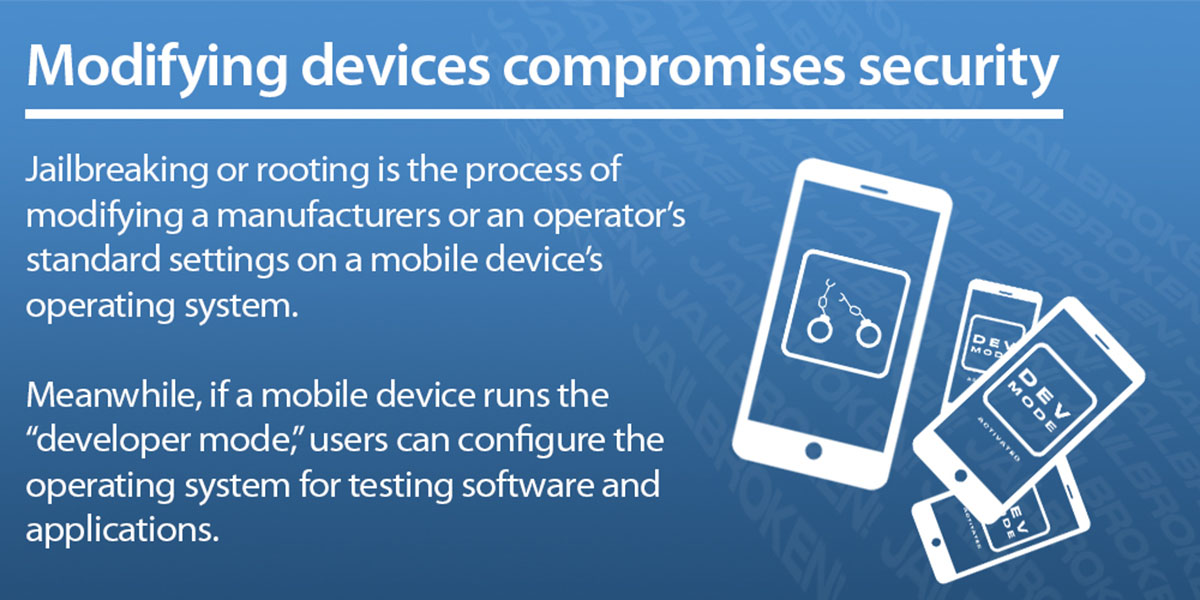

Regulation and Oversight of Student Loans

Student loans are subject to extensive regulation and oversight to protect borrowers and ensure fair lending practices. This regulatory framework plays a crucial role in shaping the landscape of student loans and has implications for the risks associated with these loans.

The government is heavily involved in the regulation of student loans, particularly in many countries such as the United States. In the United States, the federal government is the largest provider of student loans. It sets the terms and conditions of these loans, including interest rates, repayment plans, and eligibility criteria.

One aspect of regulation is the establishment of repayment plans. There are various repayment options available to borrowers to suit their financial circumstances. These include standard repayment plans, income-driven repayment plans, and extended repayment plans. Income-driven repayment plans are particularly beneficial for borrowers who have low income or face financial hardship, as the repayment amount is tied to their earnings and often results in lower monthly payments.

Loan forgiveness programs are another aspect of regulation that impacts the risk of student loans. These programs provide for the cancellation or forgiveness of a portion of the loan balance under certain conditions, such as working in specific public service professions or making a specified number of on-time payments. While these programs can be advantageous for borrowers, they introduce uncertainty for banks and lenders, as they may result in potential losses or protracted repayment schedules.

Government oversight also ensures fair lending practices and safeguards against predatory lending. Regulations focus on preventing abusive practices, such as aggressive marketing tactics, misleading information, and excessive fees. These measures protect borrowers from being taken advantage of and help maintain trust in the student loan market.

Additionally, regulators monitor and enforce compliance with loan servicers, who are responsible for managing the administrative tasks associated with student loans, such as collecting payments and assisting borrowers with repayment options. The oversight of loan servicers helps ensure the proper handling of borrower accounts and adherence to consumer protection regulations.

Overall, regulation and oversight of student loans play a significant role in shaping the risk landscape. While these regulations aim to protect borrowers and provide solutions for loan repayment, they introduce considerations for banks, as they must evaluate the potential impact of government programs and changes in regulations on their loan portfolios.

It is worth noting that regulations and oversight vary from country to country, and it is essential for banks to stay informed about the specific rules and requirements in the jurisdictions they operate in.

Financial Institutions’ Perspective on Risk

Financial institutions, including banks, approach the topic of student loans with a careful and calculated perspective on risk. As they evaluate the profitability and viability of student loans as investments, several key factors influence their outlook.

One primary concern for financial institutions is the risk of default on student loans. Default occurs when borrowers fail to make their loan payments for an extended period, resulting in potential losses for the lender. High default rates can have a significant impact on the profitability and risk profile of a bank’s loan portfolio.

Financial institutions also consider the uncertainties surrounding the repayment ability of borrowers. Since student loans are typically issued to individuals with limited credit history or income, their future income prospects can be uncertain. This uncertainty makes it challenging for banks to assess the borrower’s repayment capacity and introduces potential risks.

Additionally, the unique characteristics of student loans, such as longer repayment periods and the absence of collateral, contribute to the perception of risk from a financial institution’s perspective. The longer repayment terms increase the likelihood of unforeseen circumstances that may hinder repayment, while the lack of collateral limits the bank’s ability to recover their funds in the event of default.

Regulation and oversight of student loans are also major factors influencing financial institutions’ perspective on risk. While government regulations aim to protect borrowers and provide repayment options, they also introduce uncertainties and potential losses for lenders. The various repayment plans, forgiveness programs, and deferment options available can impact the profitability and predictability of student loans for financial institutions.

Moreover, changing economic conditions and market dynamics pose additional risks for financial institutions. Economic downturns, job market fluctuations, and income volatility can all impact the repayment ability of borrowers. These external factors are beyond the control of banks and have implications for the risk and profitability of their student loan portfolios.

To mitigate these risks, financial institutions employ meticulous risk management strategies. They carefully assess the creditworthiness of borrowers, evaluate their repayment capacity, and consider factors such as academic performance, program of study, and career prospects. By diversifying their loan portfolios and implementing robust risk assessment frameworks, financial institutions aim to balance the potential risks associated with student loans.

Overall, financial institutions view student loans as a complex investment due to the inherent risks involved. From default rates and repayment uncertainties to the influence of regulation and economic factors, these perspectives shape banks’ risk appetite and strategies for managing student loan portfolios.

Banks’ Strategies to Manage Student Loan Risks

Banks implement various strategies to manage the risks associated with student loans effectively. By carefully assessing the risks, employing risk mitigation measures, and implementing sound loan management practices, banks aim to navigate the unique challenges presented by student loans.

One key strategy is to thoroughly evaluate the creditworthiness of borrowers. Banks assess factors such as credit history, income potential, and academic performance to gauge the borrower’s ability to repay the loan. By conducting comprehensive risk assessments, banks can make informed decisions on loan approvals, loan amounts, and interest rates.

Additionally, banks diversify their loan portfolios to spread out the risk. They may limit exposure to certain institutions, programs, or geographical regions. By diversifying their lending activities, banks mitigate the impact of potential loan defaults or economic downturns on their overall loan portfolio.

Another strategy banks employ is proactive monitoring and early intervention. They continuously monitor borrower accounts to identify any signs of delinquency or default. Through early detection, banks can intervene with personalized repayment solutions or financial counseling to help borrowers stay on track with their loan payments.

Banks also emphasize the importance of financial literacy and education for borrowers. They provide resources and tools to help educate borrowers on budgeting, loan management, and financial planning. By empowering borrowers with knowledge, banks aim to increase financial awareness and reduce the likelihood of default.

Furthermore, many banks offer flexible repayment options to accommodate borrowers’ financial situations. Income-driven repayment plans, for example, adjust the monthly payment amount based on the borrower’s income and family size. These plans provide borrowers with more manageable payments, reducing the risk of default and increasing the likelihood of successful loan repayment.

Loan servicing is another critical aspect of risk management for banks. Banks may outsource loan servicing to specialized companies that handle borrower communications, payment collection, and assistance with repayment. These servicers ensure that loan accounts are properly managed, reducing the administrative burden on banks and enhancing the borrower experience.

Lastly, banks closely monitor changes in regulations and government policies related to student loans. By staying up-to-date with developments in the regulatory landscape, banks can adapt their strategies and loan management practices accordingly. This includes adjusting loan operations to comply with new regulations and leveraging government programs or initiatives to lower default risks.

In summary, banks employ a combination of risk assessment, diversification, proactive monitoring, financial education, flexible repayment options, and effective loan servicing to manage the risks associated with student loans. By implementing these strategies, banks aim to navigate the unique challenges of student loan financing while ensuring the financial stability of their loan portfolios and borrowers.

Conclusion

Student loans present unique challenges and risks for banks and financial institutions. The nature of these loans, with longer repayment terms, limited credit history of borrowers, and potential uncertainties surrounding future income, make them a perceived risky investment. Factors like high default rates, economic fluctuations, and government regulation further contribute to the complexity of managing student loan risks.

However, financial institutions are not deterred by these challenges. They employ various strategies to effectively manage and mitigate the risks associated with student loans. These strategies include thorough risk assessments, diversification of loan portfolios, proactive monitoring, financial education for borrowers, flexible repayment options, and sound loan servicing practices.

To navigate the unique risks of student loans, banks carefully evaluate the creditworthiness of borrowers, considering factors such as income potential, academic performance, and credit history. They diversify their loan portfolios to spread out risks and minimize the impact of potential loan defaults or economic downturns. Proactive monitoring and early intervention help banks identify and address delinquency or default risks in a timely fashion.

Financial literacy and education play a vital role in managing risks, as banks provide resources and tools to educate borrowers on proper financial management. Flexible repayment options, such as income-driven repayment plans, provide borrowers with more manageable payments, reducing the likelihood of default and enabling successful loan repayment.

Effective loan servicing and close monitoring of regulatory changes also contribute to risk management for banks. By staying updated with industry regulations, banks can adapt their strategies and loan management practices to remain compliant and leverage government programs or initiatives to mitigate default risks.

In conclusion, while student loans pose inherent risks for banks, financial institutions are committed to managing these risks effectively. Through diligent risk assessment, diversification, proactive monitoring, borrower education, flexible repayment options, and effective loan servicing, banks strive to balance risk and reward in the student loan market. By doing so, they can continue to support students’ educational pursuits while maintaining the stability of their loan portfolios.