Home>Finance>Why Do Some Employers Look At Credit Reports Before Hiring A New Employee?

Finance

Why Do Some Employers Look At Credit Reports Before Hiring A New Employee?

Published: January 5, 2024

Find out why employers in the finance industry consider credit reports when hiring, and how it impacts the selection process for new employees.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Role of Credit Reports in Hiring

- Assessing Financial Responsibility

- Evaluating Trustworthiness and Integrity

- Measuring Ability to Handle Job Responsibilities

- Identifying Potential Warning Signs

- Legal Considerations and Employer Responsibilities

- Criticisms and Concerns surrounding Credit Checks

- Conclusion

Introduction

Imagine you have found the perfect job opportunity, and everything seems to be going well during the interview process. You have the qualifications, experience, and references to back you up. But then, the employer drops a bombshell – they want to check your credit report before making a final decision on your employment. You may be left wondering, why do some employers look at credit reports before hiring a new employee?

It may seem invasive and unrelated to job performance, but for many employers, credit reports play a significant role in their hiring process. Understanding the reasons behind this practice can help job seekers better navigate the job market and be prepared for potential credit checks.

It is important to note that not all employers perform credit checks, and the decision to do so varies across industries and positions. However, in certain fields such as finance, consulting, government, or roles that handle sensitive financial information, examining a candidate’s credit report may be a common practice.

So why are employers interested in your credit report? Let’s explore some of the key reasons behind this practice.

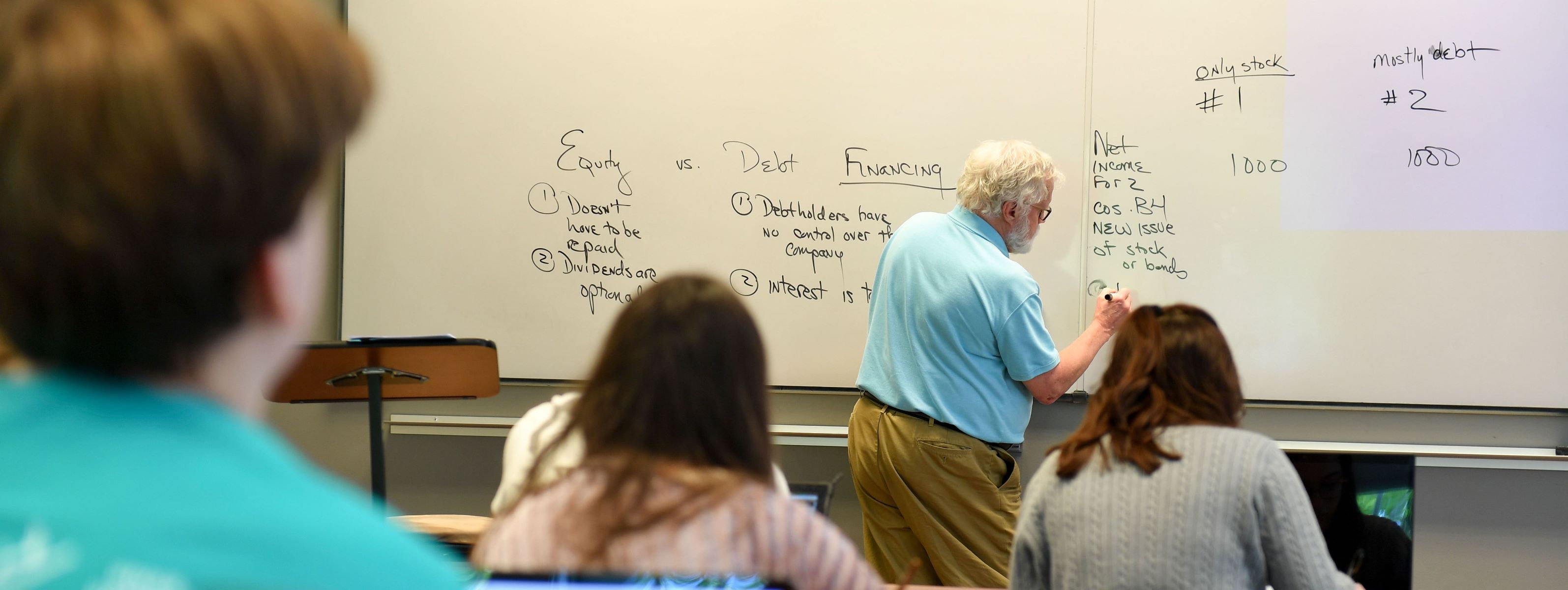

Understanding the Role of Credit Reports in Hiring

Credit reports provide a comprehensive snapshot of an individual’s financial history, including their payment history, outstanding debts, and credit utilization. Employers often see these reports as a way to evaluate a candidate’s financial responsibility, trustworthiness, and ability to handle job responsibilities.

One of the main reasons employers look at credit reports is to assess a candidate’s financial responsibility. By examining an individual’s credit history, employers can gain insight into their ability to manage money and make sound financial decisions. A candidate with a strong credit history and a track record of responsible financial behavior may be viewed as more reliable and trustworthy, especially in positions that involve handling company finances or customer transactions.

Additionally, credit reports can provide clues about a candidate’s integrity. Employers may believe that individuals with a history of delinquent payments, bankruptcy filings, or high levels of debt may be more susceptible to financial pressures or unethical behavior, which could potentially compromise their position or the company’s reputation.

Moreover, credit reports can serve as an indicator of an individual’s ability to handle job responsibilities. For example, a candidate applying for a position that requires managing budgets, making financial decisions, or having access to financial information may be subject to a credit check. Employers may believe that individuals who are financially responsible in their personal lives are more likely to exhibit those same traits in their professional capacity.

Understanding the role of credit reports in hiring is essential for job seekers, as it allows them to be prepared for any credit checks that may arise during the application process. While a candidate’s credit history is not always a decisive factor in the hiring decision, it can play a significant role in certain industries or positions.

Assessing Financial Responsibility

One of the primary reasons employers look at credit reports is to assess the financial responsibility of job candidates. By reviewing an individual’s credit history, employers can gain insights into their ability to manage money and make responsible financial decisions.

Credit reports provide a wealth of information about an individual’s financial behaviors. They detail a person’s payment history, outstanding debts, credit utilization, and any instances of bankruptcy or delinquency. Employers often view a positive credit history, with a record of timely payments and low levels of debt, as an indicator of financial responsibility. On the other hand, a negative credit history, with missed payments, large debts, or frequent financial struggles, may raise concerns about an individual’s ability to handle their own finances.

Assessing financial responsibility is particularly relevant for positions that involve handling company finances, managing budgets, or making financial decisions. Employers want to ensure that individuals entrusted with financial responsibilities can demonstrate sound judgment and responsible behavior. A candidate who has demonstrated responsibility in their personal financial matters is more likely to exhibit the same traits in their professional capacity.

However, it is essential for employers to be cautious when using credit reports as a measure of financial responsibility. Credit reports do not provide a complete picture of an individual’s financial circumstances. They do not consider external factors such as medical emergencies, job loss, or other unforeseen events that may have contributed to negative credit history. It is crucial for employers to consider the context and be mindful of potential biases that may arise from relying solely on credit reports.

Job seekers should be aware that their credit history may be assessed during the hiring process, especially in positions that involve financial responsibilities. Maintaining a positive credit history by making timely payments and managing debts responsibly can help enhance their chances of impressing potential employers.

Evaluating Trustworthiness and Integrity

Another crucial aspect that employers consider when looking at credit reports is evaluating the trustworthiness and integrity of job candidates. They believe that an individual’s financial history can provide valuable insights into their character traits and ethical behavior.

Employers often perceive individuals with a solid credit history as more dependable and trustworthy. A positive credit report, characterized by a track record of on-time payments and responsible financial behavior, indicates that an individual is reliable and can be trusted with sensitive information, financial transactions, or handling company resources.

On the other hand, employers may view negative financial behaviors, such as late payments, defaults on loans, or excessive debt, as warning signs of a lack of integrity. They might believe that individuals with a problematic credit history could be prone to financial pressures or unethical conduct, potentially jeopardizing their position or the reputation of the company.

It is important to note that the assumption that credit history is indicative of a person’s trustworthiness and integrity has been a topic of debate. Critics argue that it is unfair and discriminatory to make assumptions about a person’s character solely based on their credit history, as financial struggles can be influenced by various factors, such as medical expenses, unemployment, or other uncontrollable circumstances.

As a job seeker, it is essential to be aware of the potential impact of your credit history on the perception of your trustworthiness and integrity. Maintaining a positive credit record, practicing responsible financial habits, and addressing any discrepancies or errors on your credit report can help mitigate any concerns that employers may have.

Ultimately, while credit reports can offer insight into an individual’s financial behaviors, employers should use them as just one factor among many when evaluating trustworthiness and integrity. It is important for employers to consider a candidate’s qualifications, experience, references, and overall character during the hiring process to ensure a fair and comprehensive assessment.

Measuring Ability to Handle Job Responsibilities

One of the key reasons why employers look at credit reports is to gauge a candidate’s ability to handle job responsibilities. Credit reports can provide insights into an individual’s financial management skills and their capacity to handle financial obligations, which are often transferable to professional responsibilities.

For positions that involve financial management, budgeting, or handling financial transactions, employers want to ensure that candidates are capable of managing money responsibly. By reviewing credit reports, employers can assess whether an individual has a history of making timely payments, managing debt effectively, and demonstrating overall financial competence.

A positive credit history, showcasing a consistent track record of meeting financial obligations, can indicate that an individual possesses the skills necessary to handle job responsibilities effectively. It suggests financial discipline, attention to detail, and the ability to prioritize financial obligations. Employers may view these traits as crucial for roles that require managing finances, making financial decisions, or having access to sensitive financial information.

On the other hand, a negative credit history, such as a pattern of late payments, high debt levels, or bankruptcy, may raise concerns about an individual’s ability to handle financial responsibilities in the workplace. Employers may worry about the potential risk of financial mismanagement or irresponsible behavior if a candidate has demonstrated a lack of control or poor decision-making in their personal financial matters.

It is important to note that the ability to handle job responsibilities goes beyond just financial matters. Employers should consider other factors such as qualifications, experience, and demonstrated skills when evaluating a candidate’s capability to fulfill the requirements of the position. Credit reports should be used as a supplementary tool in assessing the overall suitability of a candidate.

As a job seeker, it is beneficial to be aware that your credit history may be taken into account when applying for positions that involve financial responsibilities. Building and maintaining a positive credit history through responsible financial management can enhance your chances of being considered a strong candidate for such roles.

Identifying Potential Warning Signs

Another reason why some employers look at credit reports before hiring a new employee is to identify potential warning signs that could impact job performance or pose risks to the company.

By examining credit reports, employers may come across specific financial indicators that raise concerns about a candidate’s suitability for the role. While credit reports do not provide a complete representation of a person’s character or abilities, they can serve as an additional tool to identify potential red flags.

One common warning sign that employers may look for is a history of delinquent payments. Consistently missing payments or having a pattern of late payments may indicate a lack of responsibility or organizational skills. This could raise concerns about an individual’s ability to meet deadlines, follow instructions, or fulfill job-related tasks promptly.

Similarly, employers may be cautious about candidates with substantial amounts of outstanding debt. A high level of debt could suggest financial instability, which may impact an individual’s focus, concentration, and overall performance on the job. Employers may worry that financial stress or other related issues may distract an employee from their responsibilities or even make them vulnerable to potential bribery or corruption.

Bankruptcy filings can also be considered a warning sign for some employers. While it is important to approach bankruptcy without making assumptions about a candidate’s character, some employers may view it as an indicator of financial mismanagement or irresponsible behavior. They may be concerned that previous financial difficulties could impact an individual’s decision-making abilities or create potential conflicts of interest.

It is crucial for job seekers to address any potential warning signs on their credit reports proactively. If there are legitimate reasons behind negative credit history or financial struggles, such as medical emergencies or unemployment, it is essential to provide context and explanations to potential employers. Transparency and open communication can help alleviate any concerns and present a more comprehensive picture of your capabilities.

While credit reports can provide valuable information, employers should also consider other factors, such as qualifications, experience, and interviews, when evaluating a candidate’s suitability for a position. Credit reports should be used as part of a holistic assessment to make informed decisions without relying solely on financial indicators.

Legal Considerations and Employer Responsibilities

When it comes to conducting credit checks as part of the hiring process, employers must navigate legal considerations and adhere to their responsibilities to ensure fairness and compliance.

In many countries, including the United States, there are laws and regulations in place that govern the use of credit reports in employment decisions. These laws aim to protect job seekers from discrimination and privacy breaches. Employers must understand and abide by these laws to avoid legal complications.

One important consideration is the Fair Credit Reporting Act (FCRA) in the United States. The FCRA imposes requirements on employers who wish to access an individual’s credit report for employment purposes. It mandates that employers must obtain written consent from job applicants and inform them if the decision not to hire is based on information obtained from the credit report.

Furthermore, the FCRA requires employers to provide applicants with a copy of their credit report, along with a summary of their rights as outlined by the FCRA, if adverse action is taken based on the report’s findings. This allows candidates the opportunity to review the information and potentially address any errors or discrepancies.

It is essential for employers to handle credit reports with confidentiality and protect the privacy of job applicants. Access to credit reports should be limited to those individuals who are directly involved in the hiring process and have a legitimate need for the information. The information obtained should be kept secure and not shared with unauthorized parties.

Employers should also be mindful of potential biases that may arise from relying solely on credit reports. Financial difficulties can be influenced by various factors, and making assumptions about a candidate’s character or abilities based solely on their credit history may unfairly discriminate against certain individuals.

Overall, employers have a responsibility to use credit reports judiciously and ensure that their hiring practices comply with legal requirements. By understanding the legal considerations and fulfilling their responsibilities, employers can maintain fairness in the hiring process and protect the rights of job seekers.

Criticisms and Concerns surrounding Credit Checks

While credit checks have become a common practice in certain industries, they are not without criticisms and concerns. Many individuals, organizations, and advocacy groups have raised valid points regarding the potential drawbacks and biases associated with using credit reports as a hiring tool.

One of the main criticisms is that credit checks may perpetuate inequality and discrimination. Studies have shown that individuals from marginalized communities, including racial and ethnic minorities, tend to have lower credit scores on average. Relying heavily on credit reports in the hiring process may disproportionately disadvantage these groups, perpetuating systemic barriers to employment.

Furthermore, critics argue that credit checks do not always accurately reflect a person’s qualifications, skills, or ability to perform a job. Financial difficulties can arise due to various circumstances, such as medical emergencies, job loss, or other unforeseen events. Assessing a candidate’s credit history without considering the underlying reasons can result in unfair judgments and exclusion of highly qualified individuals.

There are also concerns about the privacy and security of sensitive personal information. Credit reports contain detailed financial data, and mishandling this information can lead to privacy breaches and identity theft. Employers must ensure that they have robust systems and protocols in place to safeguard this information and prevent unauthorized access.

Another point of contention is that credit checks may not be directly relevant to job performance, especially for positions that do not involve financial responsibilities. Critics argue that using credit reports as a hiring tool may be arbitrary and unrelated to a candidate’s ability to fulfill job requirements effectively.

Given these concerns, many advocates and lawmakers have called for increased regulation and restrictions on the use of credit checks in employment. Some jurisdictions have implemented legislation limiting or outright prohibiting the use of credit reports for certain positions, except in cases where financial responsibility is a legal requirement.

It is important for employers to consider these criticisms and concerns when utilizing credit checks in the hiring process. Taking a holistic approach that considers qualifications, skills, and experience, alongside other relevant factors, can help create a fair and inclusive evaluation of job candidates.

Conclusion

The practice of employers looking at credit reports before hiring a new employee is a complex and often controversial topic. While it is not universally adopted across all industries and positions, understanding the reasons behind this practice can help job seekers navigate the job market more effectively.

Credit reports provide insights into an individual’s financial responsibility, integrity, and their ability to handle job responsibilities. Employers view them as a tool to assess a candidate’s financial management skills and their likelihood of exhibiting responsible behavior in the workplace.

However, it is crucial to acknowledge the criticisms and concerns surrounding credit checks. Critics argue that credit checks can perpetuate inequality, discriminate against certain groups, and may not accurately reflect a person’s qualifications or job performance. Privacy and security issues also need to be taken into consideration.

A balanced approach is necessary to ensure fair and inclusive hiring practices. Employers should use credit checks as one factor among many when evaluating job candidates, considering qualifications, experience, and character in a holistic manner.

Furthermore, employers must comply with legal requirements and protect the privacy of job applicants, obtaining consent and providing necessary disclosures and opportunities for candidates to address any discrepancies in their credit reports.

For job seekers, understanding the potential impact of credit checks is crucial. Maintaining a positive credit history through responsible financial management can enhance job prospects, especially in positions that require financial responsibilities.

In conclusion, the use of credit reports in hiring decisions remains a topic of debate. Employers should be mindful of potential biases, consider the relevance of credit reports to the position in question, and prioritize fair and inclusive hiring practices. Simultaneously, job seekers should be aware of their credit histories and take steps to address any concerns expressed by potential employers.