Home>Finance>How Long Before A New Credit Card Shows On Credit Report

Finance

How Long Before A New Credit Card Shows On Credit Report

Modified: December 29, 2023

Learn how long it takes for a new credit card to appear on your credit report and impact your finance. Find out the timeline and what to expect.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

##

Introduction

Welcome to the world of credit! If you’re considering applying for a new credit card, you might be wondering how long it will take for that information to show up on your credit report. Understanding this timeline is essential, as it can impact your overall credit profile and financial decisions.

When you apply for any type of credit, whether it’s a credit card, loan, or mortgage, the lender will review your credit report and credit score to assess your creditworthiness. The information contained in your credit report plays a crucial role in determining whether you’re approved for credit and what terms you’ll receive.

In this article, we’ll explore the process of how credit card information is reported and the factors that can affect the time it takes for a new credit card to show up on your credit report. We’ll also discuss the typical timeframe that you can expect and how this new credit card may impact your credit score. Lastly, we’ll touch on the importance of monitoring your credit report for accuracy.

Understanding the intricacies of credit reports and how they work will empower you to make informed decisions about your financial future. So, let’s dive in and explore the fascinating world of credit reporting and its impact on your credit profile.

##

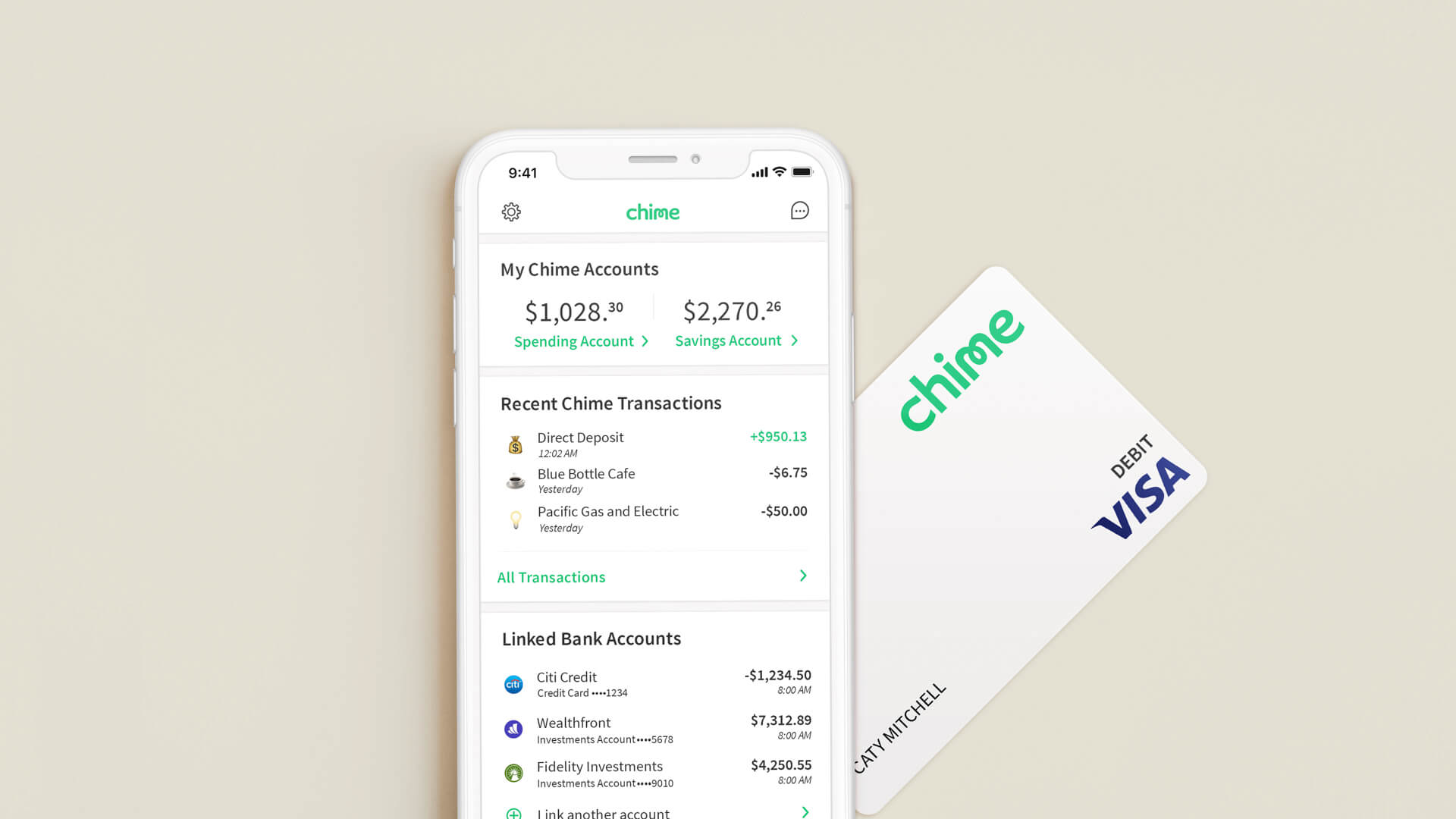

Understanding Credit Reports

A credit report is a detailed record of your credit history and financial behavior. It contains information such as your personal details, credit accounts, payment history, public records, and inquiries made by lenders when you apply for credit. Credit reporting agencies, such as Equifax, Experian, and TransUnion, gather this information from various sources and compile it into your credit report.

Your credit report serves as a snapshot of your creditworthiness and is used by lenders, landlords, insurance companies, and even potential employers to assess your financial reliability. It’s crucial to have a good understanding of what’s included in your credit report and how it can impact your financial life.

Within your credit report, you’ll find a section dedicated to your credit accounts. This section lists details about your credit cards, loans, mortgages, and other credit-related accounts. It includes information such as the account balance, credit limit, payment history, and account status (such as open, closed, or in collections).

Each month, your creditors report updates about your credit accounts to the credit bureaus, which are then reflected in your credit report. However, the timing of when these updates are transmitted can vary, depending on the creditor’s reporting cycle and practices. This is crucial to understand when you’re awaiting the appearance of a new credit card on your credit report.

Next, let’s take a closer look at how credit card information is reported and the factors that can influence the timeline.

##

How Credit Card Information is Reported

When you are approved for a new credit card, the credit card issuer will typically report the details of the account to the credit bureaus. This includes information such as the opening date, credit limit, account balance, and payment history.

Credit card issuers have reporting cycles, usually on a monthly basis, during which they send updates to the credit bureaus. However, the exact reporting practices can vary between issuers. Some may report the new account immediately, while others may wait until the first billing cycle is complete.

It’s essential to note that not all credit card issuers report to all three major credit bureaus (Equifax, Experian, and TransUnion). Some issuers may only report to one or two of them. As a result, the new credit card account may show up on one or two credit reports, but not all three.

Another factor to consider is the speed at which the credit bureaus update their information. While some bureaus may update credit reports relatively quickly, others may take longer. This can further influence the timing of when the new credit card shows up on your credit report.

In some cases, you may have the option to request that the credit card issuer expedite the reporting process. However, this is not always guaranteed, as it ultimately depends on the policies and practices of the specific issuer.

Now that we understand how credit card information is reported, let’s explore the factors that can affect the time it takes for a new credit card to show up on your credit report.

##

Factors Affecting Reporting Time

Several factors can influence the time it takes for a new credit card to show up on your credit report. Understanding these factors can help set realistic expectations and manage your financial decisions accordingly. Here are some key factors to consider:

- Reporting Cycle: As mentioned earlier, credit card issuers typically have reporting cycles, during which they update the information about your credit accounts. The timing of these cycles can impact when the new credit card is reported to the credit bureaus. If you applied for the credit card just after the reporting cycle, it may take up to a month for the account to show up on your credit report.

- Credit Bureau Processing: After the credit card issuer reports the new account, the credit bureaus need to process and update the information in their records. This processing time can vary between bureaus and may impact when the new credit card appears on your credit report.

- Lender Policies: Each credit card issuer has its own policies and procedures regarding reporting new accounts. Some issuers may report the new credit card immediately, while others may wait until the first billing cycle is complete. It’s essential to familiarize yourself with the specific policies of the issuer to have an idea of when the account will show up on your credit report.

- Credit Bureau Updates: The credit bureaus update credit reports at different intervals. While some bureaus may update information within a few days, others may take longer—sometimes up to a month. This variation in update frequency can influence the timing of when the new credit card appears on your credit report.

It’s important to note that these factors are not within your control. However, having awareness of them can help you understand why there might be a delay in the appearance of a new credit card on your credit report. Patience is key, and it’s crucial to ensure you continue to manage your credit responsibly during this waiting period.

Now let’s explore the typical timeframe for a new credit card to show up on your credit report.

##

Typical Timeframe for New Credit Cards to Show on Credit Report

The timeframe for a new credit card to appear on your credit report can vary depending on several factors, as mentioned earlier. However, in most cases, you can expect the new credit card to show up on your credit report within 30 to 60 days after approval.

During this period, the credit card issuer will report the new account to the credit bureaus, and the bureaus will process and update the information in your credit report. Keep in mind that this timeframe is an estimate, and there can be variations depending on the reporting practices of the issuer and the processing speed of the credit bureaus.

If you’re concerned about the timing or need the new credit card to appear on your credit report sooner, it’s advisable to contact the credit card issuer. They may be able to provide you with more details about their specific reporting timelines and any available options to expedite the process. However, it’s important to note that not all issuers offer the option to expedite reporting.

Remember that while waiting for the new credit card to show up on your credit report, it’s crucial to continue managing your credit responsibly. Make on-time payments and keep your credit utilization low to maintain a healthy credit profile. Although the new credit card may not yet be visible on your credit report, your responsible credit behavior will still benefit your overall creditworthiness.

Now that we understand the typical timeframe for a new credit card to show up on your credit report, let’s examine the potential impact it may have on your credit score.

##

Impact of New Credit Cards on Credit Score

Adding a new credit card to your credit profile can have both short-term and long-term impacts on your credit score. Understanding these effects is crucial for managing your credit responsibly. Here’s how a new credit card can potentially impact your credit score:

- Credit Utilization: Your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit, is an important factor in determining your credit score. When you get a new credit card, it increases your total available credit, which can lower your credit utilization ratio. This lower ratio can have a positive impact on your credit score, as it shows that you’re utilizing your credit responsibly.

- Payment History: Your payment history makes up a significant portion of your credit score. When you add a new credit card, it provides you with the opportunity to establish a positive payment history if you make your payments on time. Conversely, if you miss payments or make late payments, it can have a negative impact on your credit score.

- Length of Credit History: The length of your credit history also plays a role in determining your credit score. When you add a new credit card, it can initially shorten the average age of your credit accounts. However, as you continue to have the card and use it responsibly over time, it can contribute to a longer credit history, which can have a positive impact on your credit score.

- Credit Inquiries: When you apply for a new credit card, it typically results in a hard inquiry on your credit report. This inquiry can have a temporary negative impact on your credit score, usually by a few points. However, the impact is minimal and typically recovers within a few months.

- Credit Mix: A diverse credit mix, which includes different types of credit accounts, can be beneficial for your credit score. Adding a new credit card can help diversify your credit mix if you only have other types of credit, such as loans. However, it’s important to remember that credit mix is not as significant a factor as payment history and credit utilization.

It’s essential to note that the impact on your credit score will depend on various factors, including your overall credit history, credit utilization, and payment behavior. Additionally, any negative impact from a new credit card is typically temporary and can be outweighed by responsible credit management.

Always strive to use your new credit card responsibly, make timely payments, and keep your credit utilization low. This will help maintain and improve your credit score over time.

Now let’s explore the importance of monitoring your credit report for accuracy.

##

Monitoring Credit Report for Accuracy

Monitoring your credit report for accuracy is an essential step in maintaining a healthy credit profile. Your credit report contains valuable information that lenders and creditors use to assess your creditworthiness. Checking your credit report regularly can help you identify and address any errors or inconsistencies that could potentially affect your credit score and financial well-being.

Here are a few reasons why monitoring your credit report is important:

- Identifying Errors and Fraud: Errors and fraudulent activity can occur on your credit report, which can negatively impact your credit score and ability to obtain credit. By reviewing your credit report regularly, you can identify any inaccuracies, such as accounts that don’t belong to you or incorrect payment information. Additionally, monitoring your credit report can help you detect signs of identity theft or unauthorized accounts opened in your name.

- Addressing Inaccuracies Promptly: If you spot any errors on your credit report, it’s crucial to address them promptly. Contact the credit bureaus and provide them with the necessary documentation to correct the inaccuracies. Disputing and resolving errors in a timely manner can prevent long-term damage to your credit score and financial reputation.

- Tracking Credit Progress: Monitoring your credit report allows you to keep track of your progress in building and maintaining good credit. By regularly reviewing your credit history, you can see if your efforts to make on-time payments, reduce credit utilization, and manage your credit responsibly are reflected accurately. This helps you stay motivated and continue on the path to improving your credit.

- Being Prepared for Credit Applications: If you’re planning to apply for credit, such as a loan or mortgage, it’s important to review your credit report beforehand. This allows you to address any potential issues or errors that could affect your application. Being proactive and resolving any inconsistencies ahead of time can improve your chances of obtaining favorable credit terms.

- Monitoring for Unauthorized Inquiries: Regularly monitoring your credit report allows you to keep an eye out for any unauthorized credit inquiries. If you notice inquiries from unfamiliar creditors, it could be a sign of attempted fraud or identity theft. By catching these inquiries early, you can take the necessary steps to protect yourself and prevent further unauthorized activity.

Remember, you have the right to access your credit report for free once a year from each of the three major credit bureaus. Take advantage of this opportunity and make it a habit to review your credit report regularly.

By monitoring your credit report for accuracy, you can take control of your financial health and ensure that your credit profile is a true reflection of your creditworthiness.

Now, let’s wrap up our discussion.

##

Conclusion

Understanding how long it takes for a new credit card to show up on your credit report is important for managing your credit effectively. While there is no exact timeframe, you can typically expect the new credit card to appear within 30 to 60 days after approval.

Factors such as reporting cycles, credit bureau processing, and lender policies can influence the reporting time. It’s also important to recognize the potential impact a new credit card can have on your credit score, including changes in credit utilization, payment history, and credit mix.

Monitoring your credit report regularly is a crucial step towards maintaining a healthy credit profile. By reviewing your credit report, you can identify errors, address inaccuracies promptly, track your credit progress, and be prepared for credit applications.

Remember, responsible credit management involves making on-time payments, keeping your credit utilization low, and reviewing your credit report for accuracy. By doing so, you can build and maintain a strong credit history, which will benefit you in various financial endeavors.

Now that you have a better understanding of the timeline and impact of a new credit card on your credit report, you can approach credit applications and credit management with confidence and make informed financial decisions.