Finance

Why Does Credit One Bank Keep Calling Me

Published: January 14, 2024

Discover the reasons why Credit One Bank keeps calling you and find out how it relates to your financial situation. Gain insight into credit and finance with expert advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Have you ever experienced the frustration of receiving multiple phone calls from Credit One Bank? If you’re nodding your head in agreement, you’re not alone. Many individuals have found themselves in a similar situation, wondering why Credit One Bank keeps reaching out. In this article, we will explore the reasons behind these calls and provide you with tips for efficiently dealing with them.

Credit One Bank is a well-known financial institution that specializes in credit cards and other banking services. With a customer base that spans across the United States, the bank has built a reputation for providing credit options to individuals with less-than-perfect credit scores. While Credit One Bank serves as a lifeline for many people seeking to rebuild their credit, it’s not uncommon to receive calls from them regarding various matters.

These phone calls often serve as reminders, alerts, or attempts to resolve issues related to your Credit One Bank credit card or account. However, frequent calls from any financial institution can be bothersome, leading to frustration and concern. It’s essential to understand the reasons behind these calls, so you can navigate the situation effectively while finding a resolution that satisfies both parties.

In the following sections, we will uncover some possible reasons for receiving phone calls from Credit One Bank and provide you with useful tips on how to deal with them. Remember, understanding the motives behind these calls can ultimately lead to a smoother experience and satisfactory resolution.

Understanding Credit One Bank

Credit One Bank is a financial institution that specializes in providing credit cards to individuals with less-than-perfect credit scores. Unlike traditional banks, Credit One Bank focuses on helping individuals rebuild their credit and establish a positive credit history.

Founded in 1984, Credit One Bank has grown to become one of the largest issuers of credit cards in the United States. The bank offers a range of credit cards with varying features and benefits, allowing customers to choose the card that best suits their needs.

One key aspect of Credit One Bank’s credit cards is that they often come with higher interest rates and annual fees compared to other credit card providers. This is because Credit One Bank takes on higher-risk customers with lower credit scores. By providing these individuals with access to credit, Credit One Bank gives them an opportunity to demonstrate responsible financial behavior and improve their creditworthiness over time.

It’s important to note that Credit One Bank operates as a separate entity from Capital One, another well-known financial institution. Despite the similarities in their names, they are not affiliated with each other.

As a credit card holder with Credit One Bank, you may receive phone calls from them for various reasons. These calls can range from routine account reminders, updates on your account activity, or attempts to address any issues or concerns that may have arisen.

Understanding the nature of Credit One Bank’s business and the purpose of these calls is essential for effectively managing your credit card account and maintaining a positive relationship with the bank.

Possible Reasons for Receiving Calls

Receiving phone calls from Credit One Bank can stem from a variety of reasons. Here are some possible explanations for why you may be receiving calls from the bank:

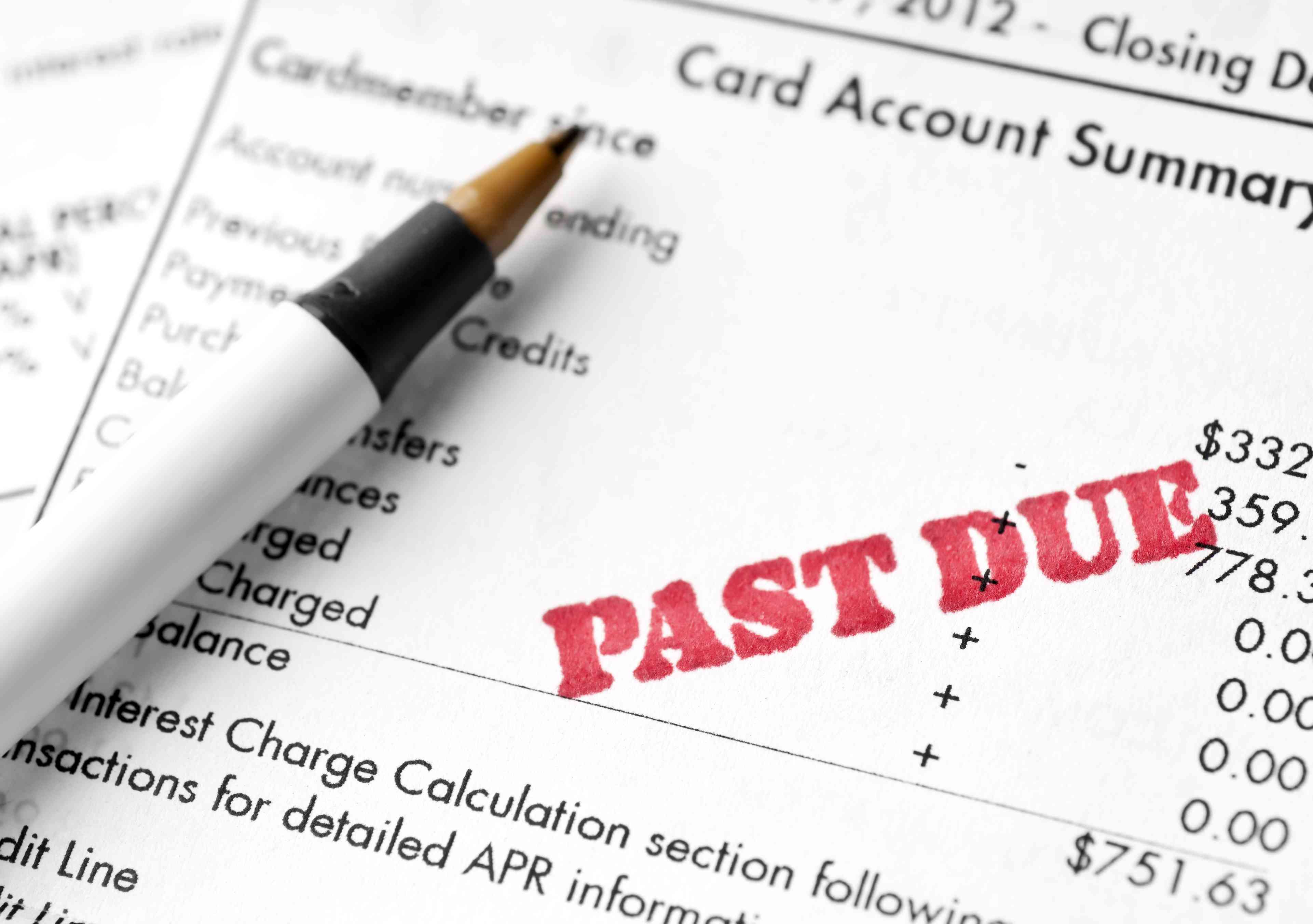

- Payment Reminders: One common reason for receiving calls is to remind you about upcoming credit card payments. Credit One Bank may reach out to ensure that you stay on top of your payment schedule and avoid late fees or penalties.

- Account Updates: The bank may also call to provide you with important updates regarding your account. This could include changes to your credit limit, interest rate adjustments, or any modifications to the terms and conditions of your credit card agreement.

- Fraud Prevention: As a proactive measure to protect your account, Credit One Bank may contact you if they notice any suspicious or potentially fraudulent activity on your credit card. These calls are meant to verify transactions and ensure the security of your financial information.

- Account Verification: There may be instances where Credit One Bank needs to verify certain details related to your account. This could involve confirming personal information, employment status, or other data to maintain the accuracy and integrity of your account information.

- Addressing Account Issues: If there are any issues or concerns with your credit card account, Credit One Bank may contact you to discuss potential solutions. This could include resolving billing errors, addressing disputed charges, or providing assistance with account-related inquiries.

- Marketing and Promotions: While less common, Credit One Bank may also reach out to inform you about new products, services, or promotional offers that they believe may be of interest to you. These calls are usually for marketing purposes and provide you with opportunities to explore additional benefits or rewards.

It’s important to note that Credit One Bank’s calls are typically aimed at providing excellent customer service, ensuring the smooth functioning of your credit card account, and maintaining a mutually beneficial relationship with you as a cardholder. Understanding these potential reasons can help you approach and address these calls with confidence and clarity.

Dealing with Credit One Bank Calls

When you receive calls from Credit One Bank, it’s natural to feel a mix of curiosity and apprehension. Here are some effective strategies for dealing with these calls:

- Answer the Call: Whenever possible, answer the calls from Credit One Bank. By doing so, you can address any concerns or questions they may have promptly. Ignoring calls can lead to unresolved issues or misunderstandings.

- Be Prepared: Before answering the call, take a moment to gather all the necessary information related to your credit card account. This may include recent transactions, billing statements, or any other relevant details. Being prepared will enable you to provide accurate information and engage in a productive conversation.

- Stay Calm and Polite: Maintain a calm and polite demeanor during the call. Remember, the representative on the other end is there to assist you. Avoid getting confrontational or aggressive, as it can hinder effective communication and problem-solving.

- Ask for Verification: If you’re unsure about the authenticity of the call or the person on the line, it’s perfectly acceptable to ask for verification. Request their name, employee identification number, and a return phone number to ensure that you’re speaking to a legitimate representative of Credit One Bank.

- Take Notes: Keep a pen and paper handy during the call to jot down any relevant information, such as the representative’s name, important dates, reference numbers, or steps discussed to resolve any issues. These notes can serve as a reference in case you need to follow up or escalate the matter.

- Seek Clarification: If you don’t understand something during the call or need further clarification, don’t hesitate to ask. Clear communication is key to resolving any concerns or inquiries effectively. Discuss any questions or doubts you may have to ensure that you have a comprehensive understanding of the situation.

- Follow-Up if Needed: If the call ends without a complete resolution or you require additional assistance, don’t hesitate to follow up with Credit One Bank. Use the contact information provided on their website or in any official correspondence to reach out and provide further details or seek clarification.

Remember, open and proactive communication is essential when dealing with Credit One Bank calls. By following these guidelines, you can navigate these conversations with confidence and ensure a smoother resolution to any concerns or inquiries you may have.

Tips for Resolving Issues with Credit One Bank Calls

Resolving issues that arise during Credit One Bank calls can sometimes be challenging. However, by following these helpful tips, you can increase the chances of finding a satisfactory resolution:

- Document Everything: Keep a record of all interactions with Credit One Bank, including dates, times, and names of representatives you spoke with. Note down the details discussed, any promises made, and any actions agreed upon during the call. This documentation will be valuable if you need to escalate the issue later.

- Stay Organized: Maintain a dedicated folder or digital file to store all correspondence, documents, and statements related to your Credit One Bank account. Having everything easily accessible will streamline the process if you need to refer to specific information during a call or when filing a complaint.

- Ask for a Supervisor: If you feel that your concerns are not being adequately addressed or that the representative you are speaking with is unable to assist, politely ask to speak with a supervisor or a higher authority. Supervisors often have more experience and decision-making power to help resolve complex issues.

- Be Patient: Resolving issues can take time. Credit One Bank may need to investigate certain matters or consult with different departments to find a solution. Practice patience and allow the bank sufficient time to address your concerns before escalating the matter further.

- Keep Emotions in Check: It’s normal to feel frustrated or upset during a challenging call. However, try to keep your emotions in check and remain composed. Express your concerns in a clear and concise manner, focusing on finding a solution rather than venting your frustrations. Remember, maintaining a respectful and professional tone will work in your favor.

- Utilize Online Resources: Credit One Bank’s website often contains helpful resources, including frequently asked questions (FAQs) and self-service options. Before reaching out to the bank, explore the website to see if you can find answers to your questions or perform necessary actions online, such as submitting a dispute or updating your contact information.

- Consider Mediation: If you are unable to reach a resolution through direct communication with Credit One Bank, you might consider utilizing mediation services. These services provide a neutral third party who can help facilitate communication between you and the bank, increasing the chances of finding a mutually agreeable solution.

- Know Your Rights: Familiarize yourself with your rights as a credit card holder. Understanding your rights and the bank’s obligations can help you navigate potential disputes with Credit One Bank and ensure that you are treated fairly and within legal boundaries.

By following these tips, you empower yourself to address and resolve any issues that arise during Credit One Bank calls. Remember, clear communication, documentation, and patience are key to finding a satisfactory outcome.

Conclusion

Receiving calls from Credit One Bank can be a regular occurrence for credit card holders. Understanding the reasons behind these calls and knowing how to effectively handle them can help alleviate any concerns or frustrations you may have.

In this article, we discussed the possible reasons for receiving calls from Credit One Bank, such as payment reminders, account updates, fraud prevention, account verification, addressing account issues, and marketing and promotions. By understanding these motives, you can approach these calls with clarity and confidence.

We also provided you with valuable tips for dealing with Credit One Bank calls, including answering the calls, being prepared, staying calm and polite, asking for verification if needed, taking notes, seeking clarification, and following up if necessary. These strategies will help you navigate the conversations and ensure effective communication with the bank’s representatives.

Furthermore, we shared tips for resolving any issues that may arise during these calls. From documenting everything and staying organized to asking for a supervisor when needed and utilizing online resources, these tips will assist you in finding a satisfactory resolution to any concerns or inquiries.

Remember, effective communication, patience, and knowing your rights as a credit card holder are key throughout this process. By implementing these strategies, you can maintain a positive relationship with Credit One Bank and ensure that you are addressing any issues or questions efficiently.

Overall, receiving calls from Credit One Bank shouldn’t be a cause for alarm. With the right approach and understanding, you can navigate these calls seamlessly and achieve a mutually beneficial outcome.