Home>Finance>Why Don’t I Have A Minimum Payment On My Credit Card

Finance

Why Don’t I Have A Minimum Payment On My Credit Card

Published: February 26, 2024

Learn why you may not have a minimum payment on your credit card and how it affects your finances. Understand the implications of this situation and how to manage it effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

When it comes to managing credit card payments, one may wonder why there isn’t a minimum payment on their credit card statement. Understanding the concept of minimum payments and the factors influencing their presence or absence is crucial for responsible financial management. This article delves into the intricacies of minimum payments, the reasons behind not having one, and provides valuable insights into managing credit card payments effectively.

Many individuals are accustomed to seeing a minimum payment listed on their credit card statement, serving as a baseline amount to be paid each month. However, there are instances where a credit card statement does not include a minimum payment requirement. This scenario can lead to confusion and prompts the question: “Why don’t I have a minimum payment on my credit card?”

Through a comprehensive exploration of this topic, we aim to shed light on the absence of a minimum payment, the implications it may have, and the proactive steps individuals can take to navigate credit card payments without a specified minimum. By gaining a deeper understanding of this aspect of credit card management, individuals can make informed decisions and effectively leverage their credit resources.

**

Understanding Minimum Payments

**

To comprehend the absence of a minimum payment on a credit card statement, it’s essential to first grasp the concept of minimum payments. A minimum payment is the lowest amount a cardholder is required to pay by a specified due date to keep their account in good standing. This payment is typically calculated as a percentage of the outstanding balance, often with a minimum dollar amount, and includes any fees and accrued interest.

Minimum payments serve as a safety net, ensuring that cardholders at least cover a portion of their outstanding balance each month. Failing to meet this minimum requirement can result in late fees, penalty interest rates, and a negative impact on one’s credit score. However, in certain cases, a credit card statement may not display a minimum payment, leading to a sense of ambiguity and prompting individuals to seek clarity on the matter.

Understanding the significance of minimum payments is crucial for responsible financial management. It underscores the importance of regular, timely payments to avoid incurring additional fees and interest, thereby contributing to a healthy credit history. By comprehending the purpose and implications of minimum payments, individuals can make informed decisions regarding their credit card obligations and overall financial well-being.

**

Factors Affecting Minimum Payments

**

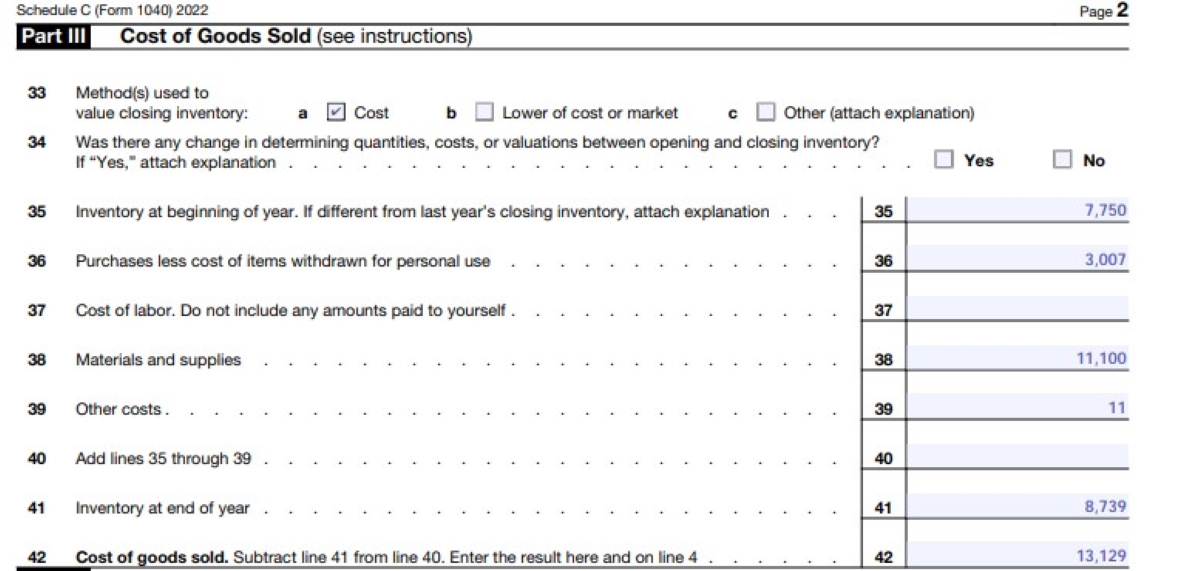

Several factors can influence the presence or absence of a minimum payment on a credit card statement. Understanding these factors provides clarity on why a minimum payment may not be specified in certain instances.

1. Balance Type: The type of balance on a credit card, such as purchases, cash advances, or balance transfers, can impact the calculation of the minimum payment. For example, a credit card statement may not include a minimum payment if it solely consists of a promotional balance transfer with no associated minimum payment requirement.

2. Promotional Periods: Credit card issuers often offer promotional periods with special terms, such as 0% interest on balance transfers or purchases. During these promotional periods, the standard minimum payment requirement may be waived, leading to the absence of a specified minimum payment on the statement.

3. Account Status: If a credit card account is in a specific status, such as being in forbearance or under a hardship program, the issuer may suspend the minimum payment requirement for the duration of the arrangement. This temporary suspension can result in the omission of a minimum payment from the statement.

4. Account Activity: Unusual account activity, such as a zero balance or a credit balance due to returns or overpayments, can lead to the exclusion of a minimum payment from the statement. In such cases, the absence of a balance to be paid may result in the non-display of a minimum payment requirement.

5. Account Terms and Conditions: The terms and conditions of a credit card account, including any special provisions or agreements, can dictate the presence or absence of a minimum payment on the statement. Cardholders should review their account terms to understand the circumstances under which a minimum payment may not be specified.

By considering these factors, individuals can gain insight into why a minimum payment may not be listed on their credit card statement. This understanding empowers cardholders to navigate their credit obligations effectively and proactively engage with their card issuer when clarification is needed.

**

Benefits of Not Having a Minimum Payment

**

The absence of a minimum payment on a credit card statement can offer several advantages for cardholders, providing a unique financial opportunity under specific circumstances.

1. Flexibility: Without a specified minimum payment, cardholders have greater flexibility in managing their finances. They can choose to pay off their entire balance without being bound by a minimum requirement, allowing for more strategic debt repayment and financial planning.

2. Interest Savings: In the absence of a minimum payment, cardholders can proactively reduce their outstanding balance, thereby minimizing the accrual of interest. By paying more than the minimum, individuals can expedite debt reduction and potentially save on interest costs over time.

3. Promotional Benefits: When a credit card statement omits a minimum payment during a promotional period, such as a 0% interest offer, cardholders can take advantage of the promotional terms without being encumbered by a minimum payment obligation. This enables them to leverage the promotional benefits to their fullest extent.

4. Financial Control: The absence of a minimum payment empowers cardholders to take full control of their financial obligations. It encourages proactive financial management and responsible debt repayment, allowing individuals to tailor their payments based on their specific financial circumstances and goals.

5. Credit Score Maintenance: While the absence of a minimum payment does not directly impact credit scores, it can indirectly contribute to credit score maintenance by enabling timely and complete balance payments. By proactively managing their credit card balances, individuals can uphold a positive credit history and demonstrate responsible credit utilization.

Understanding and leveraging the benefits of not having a minimum payment can empower cardholders to make informed decisions regarding their credit card obligations. It provides an opportunity to exercise greater financial control, optimize debt repayment strategies, and capitalize on promotional offers without the constraints of a minimum payment requirement.

**

Tips for Managing Credit Card Payments Without Minimums

**

When faced with credit card statements that do not specify a minimum payment, individuals can employ strategic approaches to effectively manage their credit card payments and maintain financial stability. The following tips offer guidance for navigating credit card obligations without the presence of a minimum payment requirement:

1. Proactive Balance Monitoring: Regularly monitor credit card balances to stay informed about outstanding amounts and upcoming payment due dates. Maintaining awareness of balances enables proactive financial planning and timely payments, even in the absence of a minimum payment prompt.

2. Customized Payment Scheduling: Establish a personalized payment schedule aligned with individual financial capabilities and budgeting preferences. By setting specific payment dates and amounts, cardholders can ensure consistent debt repayment without relying solely on minimum payment cues.

3. Debt Reduction Strategy: Prioritize debt reduction by allocating funds to pay off credit card balances beyond the minimum requirement. Without the constraint of a minimum payment, individuals can focus on reducing their overall debt burden and mitigating interest costs over time.

4. Utilize Auto-Pay Options: Take advantage of auto-pay features offered by credit card issuers to automate monthly payments. By setting up automatic payments for the full balance or a predetermined amount, cardholders can streamline their payment process and avoid missed payments.

5. Leverage Financial Tools: Explore financial management tools and resources, such as budgeting apps and online calculators, to facilitate effective credit card payment planning. These tools can aid in budget allocation, debt payoff projections, and optimizing payment strategies without relying solely on minimum payment indications.

6. Communication with Issuer: Engage in open communication with the credit card issuer to seek clarification on payment expectations and account terms. If the absence of a minimum payment prompts uncertainty, contacting the issuer for guidance can help alleviate concerns and ensure informed decision-making.

By implementing these tips, individuals can navigate credit card payments without the presence of a minimum payment, fostering proactive financial management and responsible debt repayment. These strategies empower cardholders to exercise greater control over their credit obligations and make informed decisions aligned with their financial goals.

**

Conclusion

**

The absence of a minimum payment on a credit card statement presents a unique financial landscape, offering cardholders an opportunity to exercise greater control over their debt repayment strategies and financial management. Understanding the factors influencing the presence or absence of a minimum payment, as well as the benefits and implications associated with its absence, is crucial for informed decision-making and responsible credit card utilization.

By gaining insights into the nuances of credit card payments without minimums, individuals can proactively monitor their balances, customize payment schedules, and prioritize debt reduction strategies. This proactive approach empowers cardholders to leverage financial tools, such as auto-pay options and budgeting resources, to optimize their credit card payment planning and maintain financial stability.

Furthermore, clear communication with credit card issuers can provide clarity and guidance when navigating credit card payments without a specified minimum. Engaging in open dialogue with issuers ensures that cardholders are well-informed about their account terms and obligations, fostering a collaborative approach to responsible credit management.

In conclusion, the absence of a minimum payment on a credit card statement represents an opportunity for individuals to exercise financial autonomy, strategically manage their debt, and capitalize on promotional benefits without the constraints of a minimum payment requirement. By embracing proactive financial planning and leveraging available resources, cardholders can navigate credit card payments effectively, contributing to a healthy financial outlook and responsible credit utilization.