Home>Finance>Why Don’t I Ever Have A Minimum Payment Due On My Credit Card

Finance

Why Don’t I Ever Have A Minimum Payment Due On My Credit Card

Modified: March 1, 2024

Discover why you never have a minimum payment due on your credit card and how it affects your finances. Find out the reasons and implications now.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Credit cards are a ubiquitous financial tool, offering convenience and flexibility for making purchases and managing expenses. One of the key features of credit cards is the minimum payment due, which represents the smallest amount a cardholder must pay by a specific date to keep the account in good standing. However, it's not uncommon for individuals to find themselves in a situation where they don't have a minimum payment due on their credit card statement. This scenario can be puzzling, especially for those accustomed to the regular cadence of minimum payment obligations.

Understanding the dynamics behind minimum payments on credit cards is crucial for maintaining financial health and making informed decisions about managing credit card balances. Whether you're a seasoned credit card user or new to the world of personal finance, comprehending the reasons behind the absence of a minimum payment due can provide valuable insights into your financial habits and the factors influencing your credit card statements.

In this comprehensive guide, we'll delve into the nuances of minimum payments on credit cards, exploring the factors that influence their calculation, the benefits of paying the full balance, and the reasons why you may find yourself without a minimum payment due on your credit card statement. Additionally, we'll outline actionable steps to take if you encounter this scenario, empowering you to navigate your credit card obligations with confidence and clarity.

By unraveling the mysteries surrounding minimum payments and equipping yourself with the knowledge to address unique situations, you'll be better prepared to make informed decisions about managing your credit card accounts and optimizing your financial well-being. Let's embark on this enlightening journey to demystify the absence of minimum payments on credit card statements and empower you with the tools to navigate the intricacies of credit card management.

Understanding Minimum Payments on Credit Cards

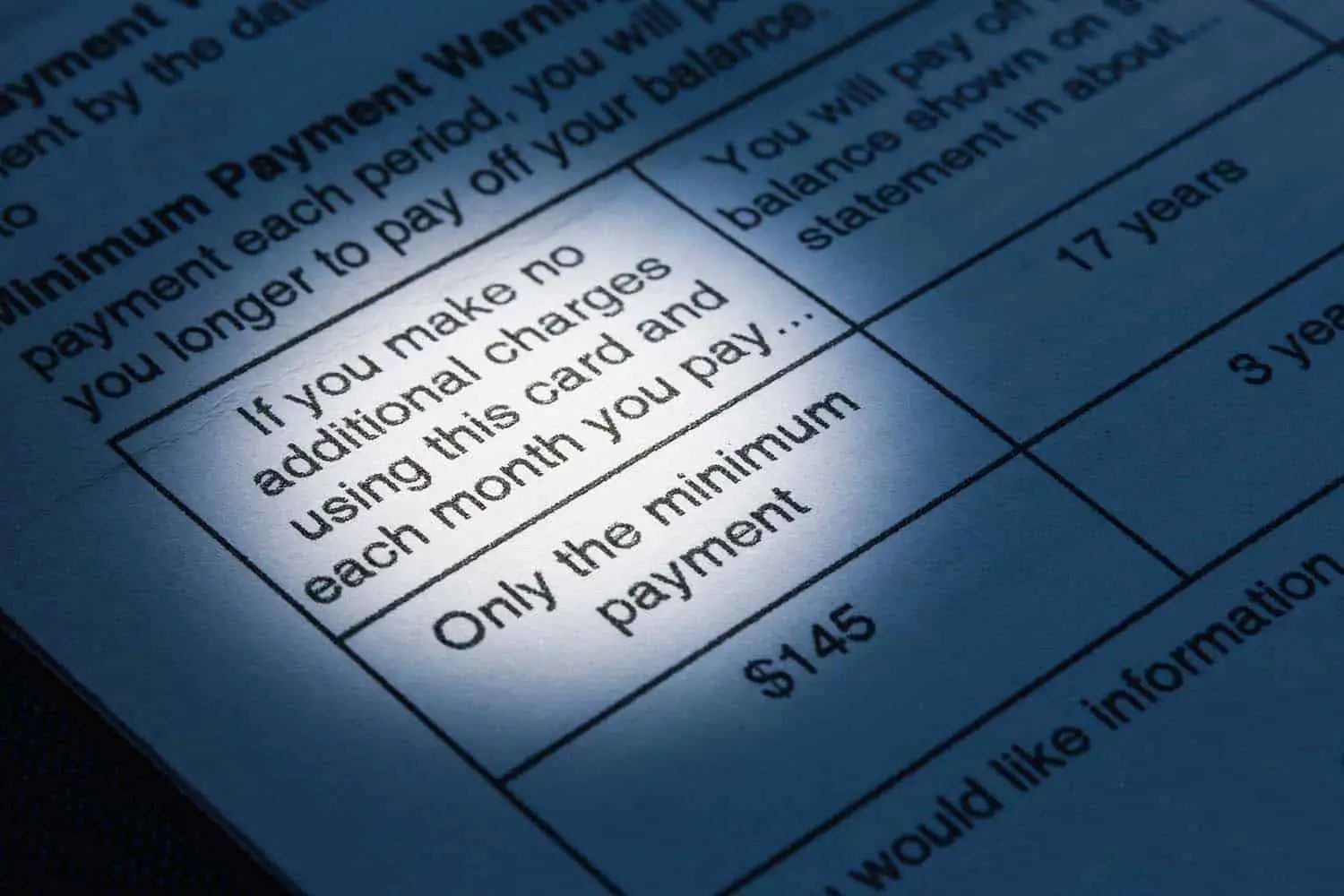

Minimum payments on credit cards represent the smallest amount that cardholders must pay by the due date to keep their accounts in good standing. Typically, this amount is calculated as a percentage of the total balance, often ranging from 1% to 3% of the outstanding balance, with a minimum dollar amount specified in the cardholder agreement. While minimum payments provide a degree of flexibility in managing credit card balances, it’s important to recognize that they are designed primarily to ensure that cardholders fulfill their basic repayment obligations, rather than to expedite the repayment of the total balance.

When cardholders only make the minimum payment, the remaining balance accrues interest, potentially leading to long-term debt and increased interest costs. Understanding the implications of minimum payments is essential for making informed decisions about managing credit card balances and optimizing financial well-being.

Moreover, comprehending the factors that influence the calculation of minimum payments is crucial. These factors may include the total balance, the annual percentage rate (APR), and any fees or charges incurred during the billing cycle. By understanding the mechanics behind minimum payments, cardholders can gain insights into the dynamics of credit card debt and develop strategies to effectively manage their financial responsibilities.

It’s important to note that while minimum payments offer a degree of flexibility, paying only the minimum can lead to prolonged debt and increased interest costs. As such, it’s advisable to aim for paying more than the minimum to reduce the overall balance and minimize interest charges. By understanding the role of minimum payments and their implications, cardholders can make informed decisions that align with their financial goals and priorities.

Factors Affecting Minimum Payments

The calculation of minimum payments on credit cards is influenced by several key factors, each of which plays a crucial role in determining the amount due on a cardholder’s statement. Understanding these factors is essential for gaining insights into the dynamics of minimum payments and their implications for managing credit card balances effectively.

- Total Balance: The total balance on a credit card, including both the principal amount and any accrued interest, directly impacts the minimum payment due. As the total balance increases, the minimum payment also rises proportionally, reflecting the greater amount owed by the cardholder.

- Annual Percentage Rate (APR): The APR, which represents the annualized interest rate applied to outstanding balances, significantly influences minimum payments. Higher APRs result in larger interest charges, leading to higher minimum payment requirements to ensure that a portion of the principal balance is repaid each billing cycle.

- Fees and Charges: Any fees or charges incurred during the billing cycle, such as late fees or over-limit fees, contribute to the total balance and consequently impact the calculation of minimum payments. These additional charges can elevate the minimum payment due, necessitating a higher repayment amount to cover the total balance and associated fees.

- Percentage-Based Calculation: Many credit card issuers calculate minimum payments as a percentage of the total balance, typically ranging from 1% to 3% of the outstanding amount. This percentage-based approach ensures that minimum payments adjust in response to fluctuations in the total balance, aligning with the cardholder’s repayment obligations.

By considering these factors collectively, credit card issuers determine the minimum payment due for each billing cycle, reflecting the cardholder’s financial obligations and the dynamics of their credit card account. Recognizing the influence of these factors empowers cardholders to make informed decisions about managing their credit card balances and optimizing their repayment strategies to align with their financial goals.

Benefits of Paying the Full Balance

While making the minimum payment on a credit card ensures that the account remains in good standing, there are numerous advantages to paying the full balance each month. Opting to settle the entire outstanding amount offers several benefits that contribute to improved financial well-being and long-term stability.

- Interest Savings: Paying the full balance eliminates the accrual of interest on the carried-over amount, resulting in substantial interest savings over time. By avoiding interest charges, cardholders can allocate more of their financial resources toward savings, investments, or other essential expenses.

- Debt Reduction: Clearing the entire balance each month contributes to reducing overall debt and promotes a healthier financial position. By proactively managing credit card balances, individuals can avoid the pitfalls of long-term debt accumulation and the associated financial stress.

- Improved Credit Score: Consistently paying the full balance reflects positively on a cardholder’s credit utilization ratio, a key factor in credit scoring models. Maintaining a low credit utilization ratio by paying the full balance can enhance credit scores, opening doors to favorable lending terms and financial opportunities in the future.

- Financial Discipline: Embracing the practice of paying the full balance cultivates financial discipline and responsible money management. By prioritizing full repayment, individuals develop positive financial habits that contribute to long-term financial stability and resilience.

- Peace of Mind: Eliminating the burden of carrying over credit card balances provides peace of mind and reduces financial stress. Knowing that the credit card balance is cleared each month alleviates concerns about interest accumulation and long-term debt, fostering a sense of financial security.

By recognizing the benefits of paying the full balance, individuals can make informed decisions about their credit card management practices, striving to achieve financial empowerment and stability. While meeting the minimum payment is essential, embracing the habit of settling the entire balance each month can yield significant advantages and contribute to a sound financial future.

Why You May Not Have a Minimum Payment Due

Encountering a situation where you don’t have a minimum payment due on your credit card statement can stem from several factors, each of which reflects unique aspects of your financial activity and the dynamics of your credit card account. Understanding the reasons behind the absence of a minimum payment due can provide valuable insights into your financial habits and the management of your credit card balances.

- Zero Balance: If your credit card statement reflects a zero balance, you may not have a minimum payment due for that billing cycle. This scenario typically occurs when you’ve cleared the entire outstanding balance, resulting in a temporary absence of a minimum payment obligation.

- Recent Payments: Making a substantial payment shortly before the statement closing date can reduce the outstanding balance to a level that does not necessitate a minimum payment for the upcoming billing cycle. Timely and proactive repayments can lead to situations where no minimum payment is due on the subsequent statement.

- Credit Balance: In some cases, a credit balance on your credit card account, resulting from refunds, returns, or overpayments, can negate the need for a minimum payment. The presence of a credit balance effectively offsets any minimum payment obligation for the relevant billing period.

- Account Suspension: If your credit card account is temporarily suspended or under certain review processes, such as fraud investigations or account maintenance activities, you may not have a minimum payment due until the account is fully reinstated for regular transactions.

- Introductory Offers: Certain credit card promotions, such as introductory 0% APR offers or promotional balance transfer arrangements, may result in periods where no minimum payment is due, particularly during the promotional term specified in the card agreement.

By recognizing these diverse scenarios, you can gain clarity on why you may not have a minimum payment due on your credit card statement. While the absence of a minimum payment obligation can be advantageous in the short term, it’s essential to maintain proactive financial management and monitor your credit card activity to ensure continued financial well-being and responsible credit utilization.

Steps to Take if You Don’t Have a Minimum Payment Due

Encountering a situation where no minimum payment is due on your credit card statement presents an opportunity to proactively manage your financial obligations and optimize your credit card utilization. While the absence of a minimum payment requirement can be perceived as a positive development, it’s essential to take strategic steps to leverage this scenario effectively and maintain responsible credit management practices.

- Review Your Financial Position: Take this opportunity to assess your overall financial standing and evaluate your credit card balances, outstanding debts, and upcoming expenses. By gaining a comprehensive understanding of your financial position, you can make informed decisions about allocating resources and addressing any potential financial priorities.

- Consider Additional Repayments: If you don’t have a minimum payment due, consider making additional repayments toward your credit card balance to expedite debt reduction and minimize interest charges. By proactively reducing the outstanding balance, you can enhance your financial well-being and move closer to achieving a debt-free status.

- Allocate Funds Wisely: Evaluate your available funds and consider allocating them strategically to address high-interest debts, build emergency savings, or invest in long-term financial goals. By prioritizing your financial resources, you can optimize your financial position and lay the groundwork for sustained financial stability.

- Monitor Your Credit Activity: Maintain a vigilant approach to monitoring your credit card activity, ensuring that all transactions are accurate and in line with your financial expectations. Regularly reviewing your credit card statements and transaction history can help detect any irregularities or unauthorized charges, enabling you to address potential issues promptly.

- Explore Financial Planning Opportunities: Utilize this period without a minimum payment obligation to engage in comprehensive financial planning. Consider establishing a budget, setting financial goals, and exploring investment or savings opportunities that align with your long-term aspirations. By leveraging this time effectively, you can lay the groundwork for sustained financial well-being and resilience.

By taking these proactive steps, you can leverage the absence of a minimum payment due to enhance your financial position, optimize your credit card management, and advance toward your financial goals. Embracing a strategic and informed approach to credit utilization empowers you to navigate unique financial scenarios with confidence and clarity, fostering a path toward sustained financial stability and empowerment.

Conclusion

Navigating the intricacies of minimum payments on credit cards and understanding the scenarios where no minimum payment is due empowers individuals to make informed decisions about managing their credit card balances and optimizing their financial well-being. By unraveling the dynamics of minimum payments and their implications, individuals can gain clarity on the factors influencing their credit card statements and leverage strategic opportunities to enhance their financial position.

While the absence of a minimum payment due may initially appear as an anomaly, it presents an opportunity to engage in proactive financial management, expedite debt reduction, and allocate resources strategically. Embracing this scenario with a forward-looking approach enables individuals to optimize their credit card utilization, cultivate financial discipline, and advance toward their long-term financial aspirations.

By recognizing the benefits of paying the full balance, understanding the factors affecting minimum payments, and leveraging strategic steps when no minimum payment is due, individuals can navigate their credit card obligations with confidence and clarity. Proactive financial management, coupled with a comprehensive understanding of credit card dynamics, lays the foundation for sustained financial stability, empowerment, and resilience.

As you embark on your journey toward financial well-being, remember that each financial scenario presents an opportunity for informed decision-making and strategic resource allocation. By harnessing the knowledge and insights gained from understanding minimum payments and their implications, you can navigate the nuances of credit card management with confidence, empowering yourself to achieve your financial goals and aspirations.