Finance

Where Do I Enter Merchant Fees On Schedule C?

Published: February 24, 2024

Learn how to enter merchant fees on Schedule C for your finance business. Maximize your deductions and stay compliant with IRS regulations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the world of small business finances can be a daunting task, especially when it comes to understanding and reporting merchant fees on Schedule C. As a small business owner, it's crucial to comprehend how these fees impact your financial records and tax obligations. In this comprehensive guide, we will delve into the intricacies of merchant fees, shedding light on their significance and providing clear insights into where and how to report them on Schedule C. By the end of this article, you will have a solid understanding of the role merchant fees play in your business finances and how to accurately reflect them in your tax filings.

Merchant fees are a ubiquitous aspect of conducting business in the modern era, particularly for enterprises that accept electronic payments. Whether you operate an e-commerce store, a brick-and-mortar retail establishment, or a service-based business, chances are you engage in transactions that involve merchant fees. These fees, typically charged by payment processors and credit card companies, represent a cost of doing business that directly impacts your bottom line. Understanding how to properly account for these expenses is essential for maintaining accurate financial records and fulfilling your tax obligations.

In the following sections, we will explore the nuances of merchant fees, including their various forms and the implications they carry for small business owners. We will also provide a step-by-step guide on reporting merchant fees on Schedule C, the tax form used by sole proprietors and single-member LLCs to report business income and expenses. Additionally, we will address other essential considerations related to the reporting of merchant fees, ensuring that you are equipped with the knowledge needed to navigate this aspect of small business finance confidently.

Whether you are a seasoned entrepreneur or just embarking on your business journey, understanding how to handle merchant fees on Schedule C is vital for maintaining financial clarity and compliance. So, let's embark on this informative journey to demystify the realm of merchant fees and empower you to manage your small business finances with confidence and proficiency.

Understanding Merchant Fees

Merchant fees, also known as credit card processing fees or payment processing fees, are charges incurred by businesses when they accept electronic payments from customers. These fees are typically assessed as a percentage of the transaction amount, along with a flat fee for each transaction. While the specific structure of merchant fees can vary based on the payment processor and the type of card used for the transaction, they represent a consistent cost of facilitating electronic payments.

For small business owners, it’s essential to grasp the impact of merchant fees on the overall revenue and profitability of their enterprises. While these fees enable businesses to offer convenient payment options to customers, they also contribute to the operational expenses that directly affect the bottom line. Moreover, the prevalence of electronic payments in today’s commerce landscape underscores the significance of understanding and managing merchant fees effectively.

Merchant fees can encompass a range of charges, including interchange fees, assessment fees, and payment gateway fees. Interchange fees are set by credit card networks such as Visa and Mastercard and are paid by the merchant’s bank to the customer’s bank as compensation for the transaction. Assessment fees, on the other hand, are collected by the card networks for their services, while payment gateway fees pertain to the use of online payment processing services.

It’s important for business owners to discern the components of merchant fees and how they contribute to the overall cost of processing electronic payments. By understanding the breakdown of these fees, entrepreneurs can make informed decisions about payment processing solutions and assess their impact on the financial health of their businesses.

Furthermore, comprehending the dynamics of merchant fees is integral to evaluating the competitiveness of different payment processors and negotiating favorable terms. Given the significant role that electronic payments play in modern commerce, having a clear understanding of merchant fees empowers business owners to optimize their payment processing strategies and minimize the impact of these expenses on their bottom line.

As we delve deeper into the realm of merchant fees, it becomes evident that they represent a fundamental aspect of small business finances, influencing revenue, cost management, and overall financial performance. By gaining a comprehensive understanding of merchant fees, business owners can navigate the complexities of payment processing with confidence and strategic acumen, ultimately enhancing the financial vitality of their enterprises.

Reporting Merchant Fees on Schedule C

When it comes to tax reporting for small businesses, accurately documenting and reporting merchant fees is pivotal for maintaining compliance and gaining a clear view of the financial landscape. For sole proprietors and single-member LLCs, Schedule C of the IRS Form 1040 is the designated platform for reporting business income and expenses, including merchant fees.

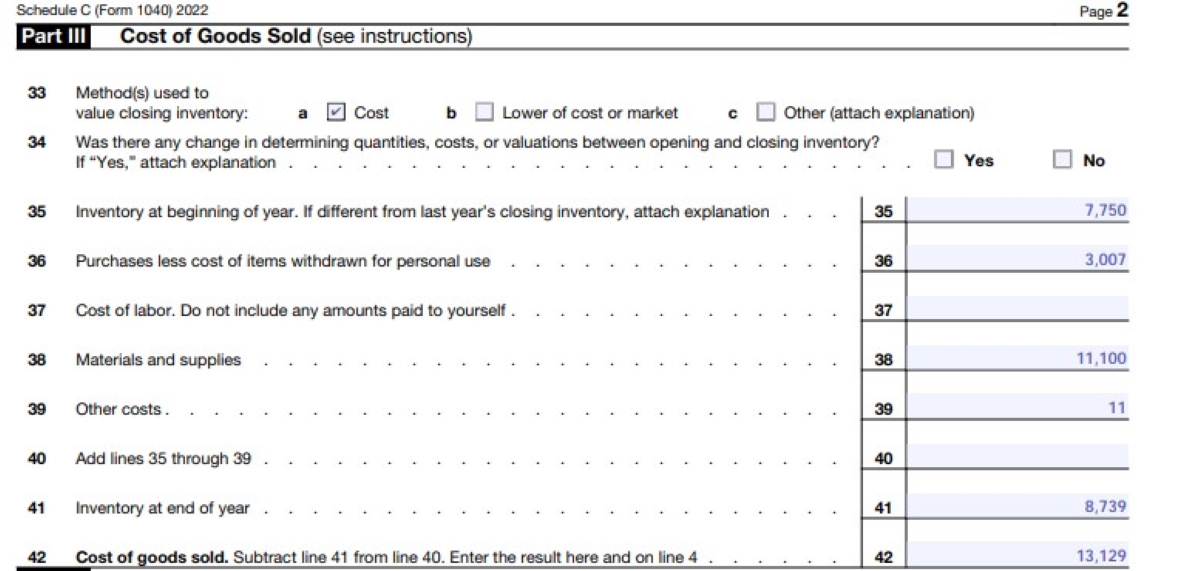

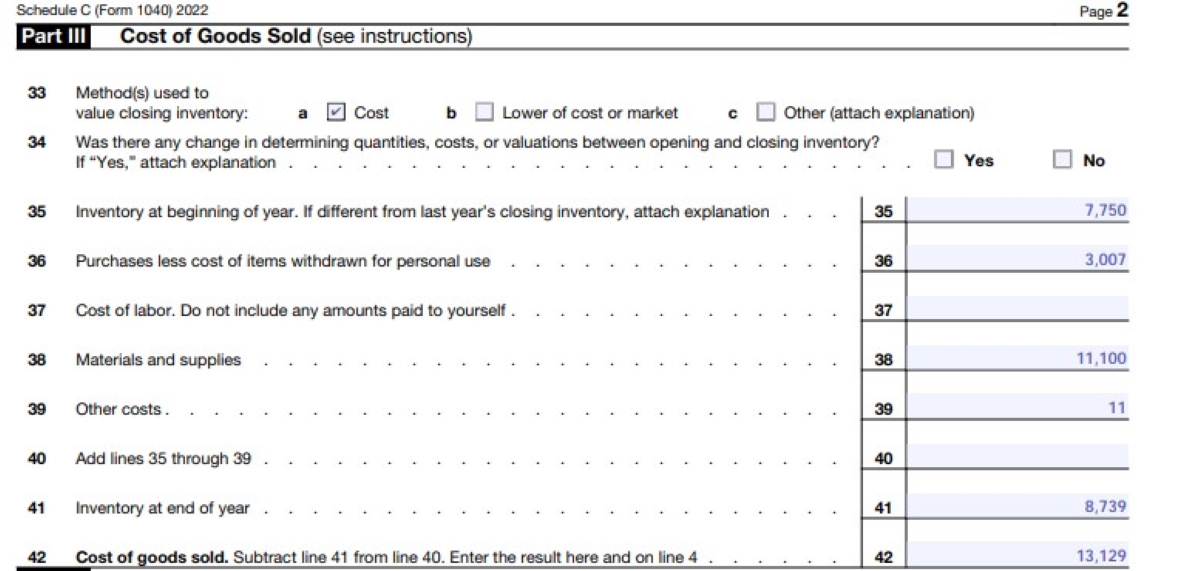

Merchant fees are categorized as part of the “Other Expenses” section on Schedule C, specifically under the “Other Expenses” line (Line 27) of the form. This section allows business owners to itemize various expenses that are not captured in the standard categories, enabling them to provide a comprehensive overview of their operational costs.

When reporting merchant fees on Schedule C, it’s crucial to maintain detailed records of these expenses throughout the tax year. This includes retaining statements from payment processors and financial records that clearly delineate the nature and amount of each fee incurred. By diligently tracking and organizing these expenses, business owners can ensure accurate reporting and substantiation of the fees when filing their taxes.

On Line 27 of Schedule C, business owners can enter the total amount of merchant fees incurred during the tax year. This figure should encompass all credit card processing fees, payment gateway charges, and other related expenses directly associated with electronic payment processing. By consolidating these expenses into a single total, business owners can streamline the reporting process and present a comprehensive picture of their payment processing costs.

It’s important to note that the IRS requires businesses to report all deductible expenses, including merchant fees, in a truthful and accurate manner. Failing to report these expenses or misrepresenting the figures could lead to compliance issues and potential penalties. Therefore, business owners should exercise diligence in documenting and reporting their merchant fees to align with the IRS guidelines and uphold the integrity of their tax filings.

By conscientiously reporting merchant fees on Schedule C, small business owners can leverage this tax deduction to mitigate their taxable income, thereby reducing their overall tax liability. This underscores the significance of accurately capturing and reporting these expenses, as they directly contribute to the financial well-being of the business and its tax position.

As we navigate the intricacies of tax reporting for small businesses, it becomes evident that the proper documentation and reporting of merchant fees on Schedule C are essential for upholding compliance, optimizing tax outcomes, and gaining a comprehensive view of the business’s financial performance.

Other Considerations for Reporting Merchant Fees

While the process of reporting merchant fees on Schedule C is a critical aspect of small business tax compliance, there are additional considerations that business owners should bear in mind to effectively manage and optimize the impact of these expenses.

Firstly, it’s essential for business owners to differentiate between merchant fees and the gross amount of sales or revenue. When recording business income, the gross sales figure should reflect the total revenue generated from customer transactions before deducting the associated merchant fees. This clear demarcation ensures that the business’s income is accurately represented, allowing for a precise assessment of profitability and financial performance.

Moreover, business owners should explore the potential for negotiating favorable terms with their payment processors to mitigate the impact of merchant fees. Many payment processing providers offer varying fee structures and terms, and engaging in negotiations or seeking alternative providers could yield cost-saving opportunities. By proactively assessing and optimizing payment processing arrangements, business owners can effectively manage their merchant fees and enhance their bottom-line profitability.

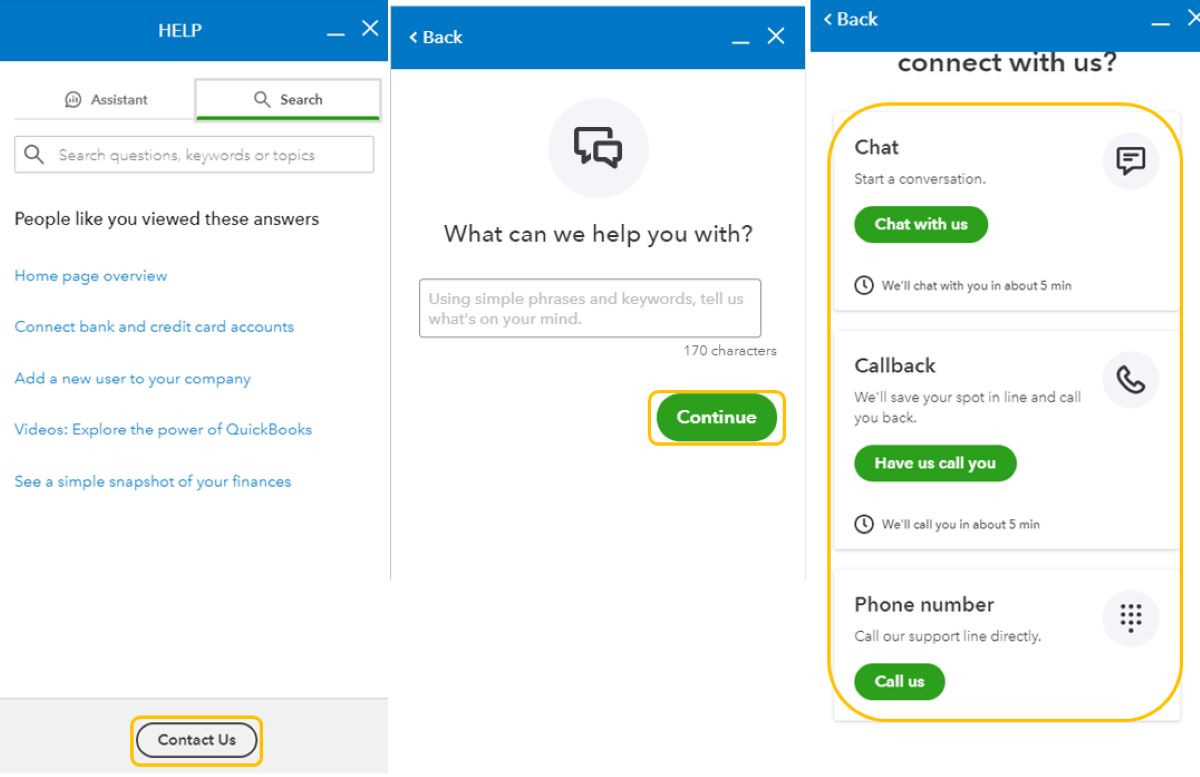

Another vital consideration pertains to the integration of accounting software or financial management platforms to streamline the tracking and reporting of merchant fees. Leveraging technology solutions that automate the recording of these expenses can enhance accuracy, efficiency, and organizational capabilities, ultimately simplifying the tax reporting process and facilitating comprehensive financial oversight.

Furthermore, as electronic payment methods continue to evolve, business owners should stay abreast of industry developments and regulatory changes that may impact merchant fees. Being cognizant of shifting trends in payment processing and relevant legislative updates enables entrepreneurs to adapt their strategies and ensure compliance with evolving standards, thereby safeguarding the financial integrity of their businesses.

Business owners should also consider seeking professional guidance from tax advisors or certified public accountants (CPAs) to navigate the complexities of reporting merchant fees and optimizing tax outcomes. Tax professionals can provide valuable insights, strategic recommendations, and meticulous review of financial records to ensure accurate and compliant reporting of merchant fees, empowering business owners to make informed decisions and maximize tax benefits.

By proactively addressing these considerations, small business owners can effectively manage and optimize the reporting of merchant fees, aligning with best practices, maximizing cost-saving opportunities, and fortifying the financial health of their enterprises.

Conclusion

In the realm of small business finances, the accurate reporting of merchant fees holds significant implications for tax compliance, financial transparency, and operational cost management. As we conclude our exploration of this crucial aspect of business finance, it becomes evident that understanding, documenting, and reporting merchant fees is essential for maintaining financial clarity and optimizing tax outcomes.

By comprehending the multifaceted nature of merchant fees and their impact on the bottom line, small business owners can navigate the complexities of payment processing with confidence and strategic acumen. From delineating the components of merchant fees to leveraging tax deductions through meticulous reporting, this guide has shed light on the pivotal role that these expenses play in the financial landscape of small enterprises.

Moreover, the meticulous reporting of merchant fees on Schedule C empowers business owners to mitigate their taxable income and reduce their overall tax liability, underscoring the tangible benefits of accurately capturing and reporting these expenses. This process not only aligns with IRS guidelines but also contributes to a comprehensive view of the business’s financial performance, enabling informed decision-making and strategic planning.

As small businesses continue to embrace electronic payment methods and navigate the evolving landscape of commerce, staying attuned to industry developments, seeking cost-saving opportunities, and integrating efficient financial management solutions are imperative for effectively managing and optimizing the impact of merchant fees.

Ultimately, by addressing these considerations and adhering to best practices in the reporting of merchant fees, small business owners can fortify the financial health of their enterprises, uphold compliance, and harness tax benefits to bolster their bottom-line profitability.

Armed with a comprehensive understanding of merchant fees and equipped with the insights provided in this guide, business owners are poised to navigate the intricacies of payment processing, tax reporting, and financial management with acumen and efficacy, ultimately fostering the growth and sustainability of their ventures.

As we conclude this comprehensive guide, it is our fervent hope that the knowledge and insights shared herein will empower small business owners to navigate the realm of merchant fees with confidence, proficiency, and a steadfast commitment to financial excellence.