Home>Finance>Why Is My Capital One Available Credit 0 After Payment

Finance

Why Is My Capital One Available Credit 0 After Payment

Modified: March 1, 2024

Find out why your Capital One available credit is showing 0 after making a payment. Get insights and solutions for this finance issue here.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Capital One Available Credit

- Common Reasons for Capital One Available Credit Showing 0 After Payment

- Issue with Payment Processing

- Delay in Payment Processing

- Pending Transactions

- Credit Limit Reached

- Reporting Error or Glitch

- How to Check Capital One Available Credit

- Resolving the Issue of Capital One Available Credit Showing 0 After Payment

- Contacting Capital One Customer Support

- Conclusion

Introduction

Have you recently made a payment on your Capital One credit card, only to find that your available credit is now showing as 0? This can be a confusing and frustrating experience, especially if you were expecting your available credit to increase after making a payment. In this article, we will explore the possible reasons behind this issue and provide solutions to help you resolve it.

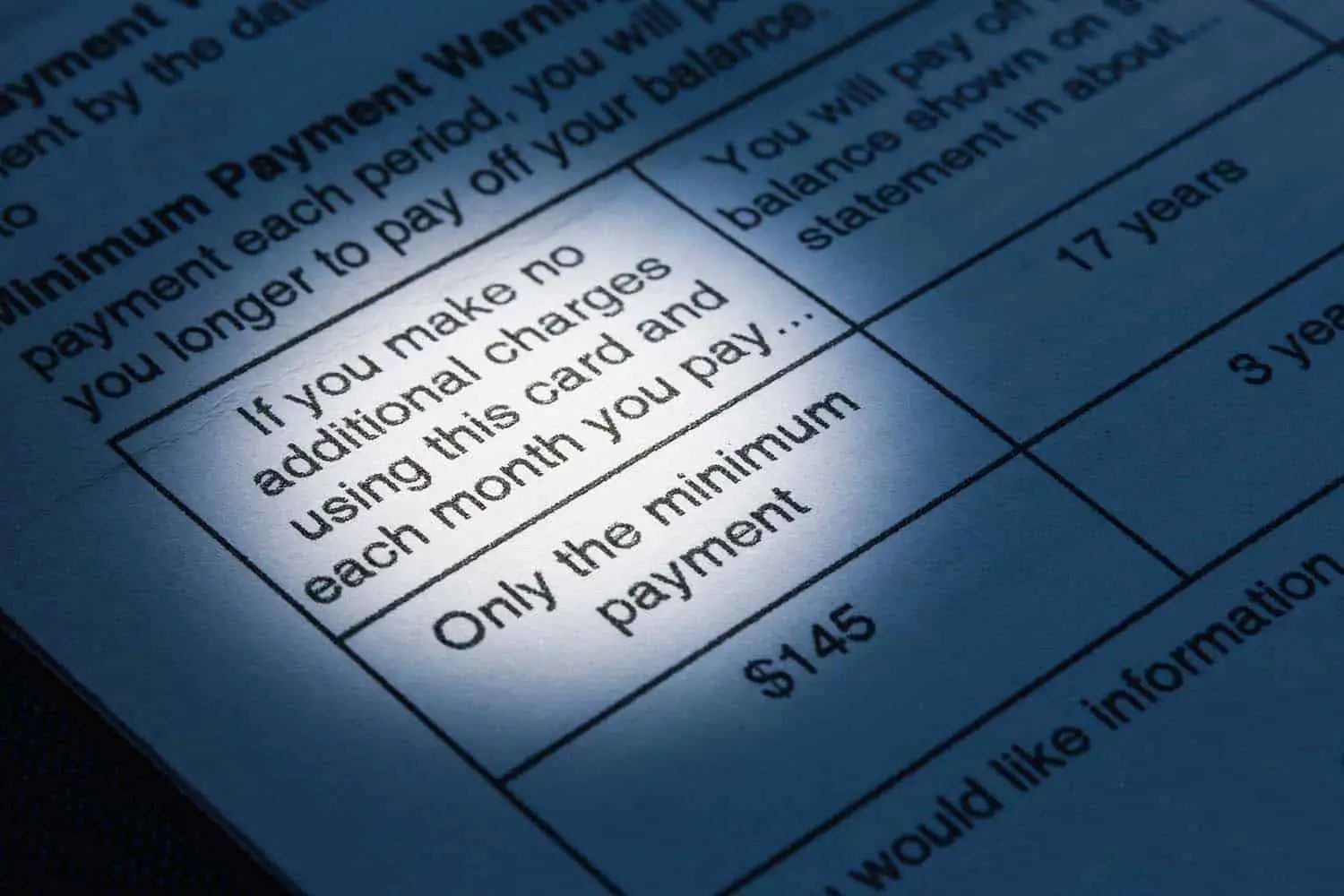

Understanding how available credit works is essential to unraveling this mystery. Available credit refers to the amount of money you can still spend on your credit card without exceeding your credit limit. Typically, your available credit should increase after a payment is made, as the amount you paid off is no longer considered as part of your outstanding balance.

However, there are several factors that could cause your Capital One available credit to show as 0 even after making a payment. It could be due to a temporary glitch in the system, a delay in payment processing, pending transactions, or even reaching your credit limit. By understanding these potential causes, you’ll be better equipped to address the issue and ensure that your available credit is accurately reflected.

In the following sections, we will delve into each possible reason why your Capital One available credit may show as 0 after a payment, and provide step-by-step instructions on how to check your available credit and resolve the issue effectively.

Understanding Capital One Available Credit

Before we dive into the reasons why your Capital One available credit may show as 0 after a payment, it’s important to have a clear understanding of how available credit works.

Available credit is the amount of money you can still spend on your Capital One credit card without exceeding your credit limit. Your credit limit is the maximum amount of money that Capital One has approved for you to borrow.

When you make a payment on your Capital One credit card, it reduces your outstanding balance. This, in turn, should increase your available credit as now you have more funds available to spend.

For example, let’s say your credit limit is $5,000, and your outstanding balance is $2,000. Your available credit would be $3,000 ($5,000 – $2,000). If you make a payment of $500, your outstanding balance reduces to $1,500, and your available credit should increase to $3,500.

However, there are various factors that can influence how your available credit is calculated. These factors can sometimes lead to your available credit showing as 0 even after making a payment. It’s important to understand these factors to effectively address any issues that may arise.

One crucial factor to consider is the timing of your payment. Capital One may not always process your payment immediately. There can be a delay between when you make the payment and when it reflects on your account. During this time, your available credit may appear as 0 even though you have made a payment.

Additionally, pending transactions can also impact your available credit. If you have pending charges or transactions on your account, they may temporarily reduce your available credit until they are fully processed.

It’s also important to remember that your credit limit plays a significant role in determining your available credit. If you have reached or exceeded your credit limit, your available credit will naturally be 0 until you make a payment and reduce your balance.

By understanding these factors, you can gain insight into why your Capital One available credit may show as 0 after a payment. In the following sections, we will address each possible reason in detail and provide guidance on how to resolve the issue.

Common Reasons for Capital One Available Credit Showing 0 After Payment

There are several common reasons why your Capital One available credit may show as 0 after making a payment. Understanding these reasons can help you identify the cause and take appropriate action to resolve the issue. Here are the most common scenarios:

- Issue with Payment Processing: Sometimes, there may be a delay or error in the payment processing system, which can result in your payment not being applied to your account immediately. This can cause your available credit to temporarily show as 0 until the payment is fully processed. It is advisable to wait for a reasonable amount of time for the payment to be reflected before assuming there is an issue.

- Delay in Payment Processing: Even if there is no issue with the payment processing system, there can still be a delay in how long it takes for your payment to be applied to your account. Capital One may take some time to verify and post your payment, especially if it was made close to the due date. During this delay, your available credit may show as 0, but it should be updated once the payment is processed.

- Pending Transactions: If you have any pending transactions on your account, they can affect your available credit. The pending charges are temporarily deducted from your available credit until they are fully processed. This can result in your available credit showing as 0 until the pending transactions have been finalized.

- Credit Limit Reached: If you have reached or exceeded your credit limit, your available credit will be 0 until you make a payment to bring down your balance. It’s essential to check your outstanding balance and ensure that you haven’t maxed out your credit limit before assuming there is an issue with your available credit.

- Reporting Error or Glitch: It is possible that there could be a reporting error or a technical glitch that is causing your available credit to be displayed as 0. This is relatively rare but can occur. In such cases, reaching out to Capital One customer support can help in resolving the issue and getting your available credit accurately reflected on your account.

By familiarizing yourself with these common reasons, you can narrow down the possible cause of why your Capital One available credit may show as 0 after making a payment. In the following sections, we will provide step-by-step instructions on how to check your available credit and how to resolve the issue effectively.

Issue with Payment Processing

An issue with payment processing can sometimes be the reason why your Capital One available credit is showing as 0 after making a payment. This can occur due to a delay or error in the payment processing system. Here’s what you can do if you suspect that there is an issue with the payment processing:

1. Wait for a Reasonable Amount of Time: Before assuming that there is an issue with the payment processing, it is advisable to wait for a reasonable amount of time. Sometimes, payments may take a few business days to be fully processed and reflected on your account. During this time, your available credit may temporarily show as 0. Patience is key in this situation.

2. Check Your Payment Confirmation: If you received a confirmation of your payment, either through email or within your online account, it indicates that your payment was successfully submitted. This confirmation can provide reassurance that your payment is in process, even if your available credit is temporarily showing as 0.

3. Monitor Your Account: Keep an eye on your online account or mobile app to track any updates or changes to your available credit. Capital One typically updates your available credit once the payment has been fully processed. If your available credit remains at 0 for an extended period, then it may be time to take further action.

4. Contact Capital One Customer Support: If you believe that there is a genuine issue with the payment processing, it is recommended to reach out to Capital One customer support for assistance. Explain the situation and provide them with any relevant details, such as the date and time of the payment and the confirmation you received. They will be able to investigate the matter and provide guidance on how to resolve the issue.

By following these steps, you can navigate through any potential issues with payment processing that might be causing your Capital One available credit to show as 0. Remember that it’s essential to have patience and give the system enough time to process the payment before assuming that there is a problem.

Delay in Payment Processing

A common reason for your Capital One available credit to show as 0 after making a payment is a delay in payment processing. Even if there are no issues with the payment itself, it can take some time for Capital One to apply the payment to your account. Here’s what you can do if you suspect a delay in payment processing:

1. Allow Sufficient Time for Processing: After making a payment, it’s important to allow sufficient time for the payment to be processed and reflected on your account. Capital One typically states that it may take a few business days for a payment to be fully processed. During this processing period, your available credit may temporarily show as 0. It’s essential to be patient and wait for the payment to be applied before assuming there is a delay.

2. Check Transaction History: Monitor your Capital One online account or mobile app to review your transaction history. Look for the payment transaction to appear in the history. If the transaction is listed with a “pending” status, it means that the payment is still being processed and has not yet been applied to your account. Once the status changes to “posted” or “completed,” your available credit should update accordingly.

3. Consider Payment Method: The method you used to make the payment can also impact the processing time. Payments made by electronic transfer, such as through online bill pay or automatic payments, may take less time to process compared to payments made by check. Electronic transfers are typically faster and allow for quicker updates to your available credit.

4. Contact Capital One Customer Support: If you have allowed sufficient time for the payment to be processed, and your available credit still shows as 0, it may be appropriate to contact Capital One customer support. Explain the situation and provide any relevant details, such as the payment date and method used. They can investigate the delay and provide guidance on how to resolve the issue.

Remember that delays in payment processing are not uncommon, so it’s important to be patient and give the system enough time to process the payment. Monitor your account regularly and reach out to customer support if you have concerns about the processing time.

Pending Transactions

Another possible reason why your Capital One available credit may show as 0 after making a payment is the presence of pending transactions on your account. Pending transactions are charges or transactions that have been authorized but have not yet been fully processed by Capital One. Here’s what you need to know about pending transactions and their impact on your available credit:

1. Temporary Reduction of Available Credit: When you have pending transactions on your account, the funds required to cover those transactions are temporarily deducted from your available credit. This means that until the pending transactions are finalized and posted to your account, your available credit may show as 0 or reduced based on the amount of the pending charges.

2. Allow Time for Processing: The processing time for pending transactions can vary depending on the merchant and the type of transaction. In most cases, pending transactions are typically finalized and posted within a few business days. During this time, it’s important to be patient and allow the transactions to fully process before expecting your available credit to be accurately reflected.

3. Monitor Your Account: Keep a close eye on your online account or mobile app to track the status of your pending transactions. Typically, pending transactions will be labeled as such in your transaction history. As the transactions are processed and posted to your account, your available credit should be updated accordingly.

4. Be Mindful of Overdrafts: If you have pending transactions that can potentially exceed your credit limit, it’s crucial to monitor your account closely to avoid any potential overdrafts. If your available credit is already at 0 and you have pending transactions that will exceed your credit limit, Capital One may decline those transactions or charge you an overdraft fee. To prevent this, consider making an additional payment to increase your available credit or contacting Capital One to discuss potential options.

5. Contact Capital One Customer Support: If you have allowed sufficient time for pending transactions to be finalized and your available credit is still showing as 0, it is advisable to reach out to Capital One customer support. They can provide you with further assistance, investigate any potential issues, and guide you on how to resolve the situation.

By understanding the impact of pending transactions on your available credit and monitoring your account closely, you can better navigate the situation when your Capital One available credit shows as 0 due to pending transactions.

Credit Limit Reached

If your Capital One available credit shows as 0 after making a payment, there is a possibility that you have reached or exceeded your credit limit. When your outstanding balance reaches your credit limit, your available credit automatically becomes 0. Here’s what you need to know about the impact of reaching your credit limit on your available credit:

1. Understanding Your Credit Limit: Your credit limit represents the maximum amount of money that Capital One has approved for you to borrow on your credit card. It is important to be aware of your credit limit and keep track of your outstanding balance to avoid reaching or exceeding it.

2. Available Credit Calculation: Your available credit is calculated by subtracting your outstanding balance from your credit limit. For example, if your credit limit is $5,000 and your outstanding balance is $4,500, your available credit would be $500 ($5,000 – $4,500). If your outstanding balance reaches $5,000 or exceeds it, your available credit will be 0.

3. Managing Your Credit Utilization: Credit utilization is the ratio of your credit card balance to your credit limit. It is an important factor that can affect your credit score. It is generally recommended to keep your credit utilization below 30% to maintain a healthy credit profile. Exceeding your credit limit can have a negative impact on your credit score, so it’s important to be mindful of your spending and manage your credit utilization effectively.

4. Consequences of Reaching Your Credit Limit: When you reach your credit limit, several consequences may occur. Firstly, your available credit becomes 0, meaning you cannot make any further purchases until you make a payment to reduce your balance. Secondly, if you have any pending transactions or recurring charges, they may be declined or result in an overdraft fee. Lastly, exceeding your credit limit can also lead to potential interest charges or penalties imposed by Capital One.

5. Resolving the Issue: To address the issue of reaching your credit limit and allowing for an increase in your available credit, you will need to make a payment towards your outstanding balance. Paying down your balance will reduce your outstanding balance and increase your available credit. It’s essential to review your spending habits and create a budget that allows you to maintain a healthy credit utilization ratio.

6. Contact Capital One Customer Support: If you believe there is an error with your credit limit or have concerns about reaching it, it is advisable to reach out to Capital One customer support. They can provide clarification on your credit limit, offer guidance on managing your credit, and address any other questions or concerns you may have.

By understanding the impact of reaching your credit limit on your available credit, you can take proactive steps to manage your credit effectively and ensure that your available credit is maintained at a reasonable level.

Reporting Error or Glitch

While relatively rare, a reporting error or glitch can occasionally occur, causing your Capital One available credit to show as 0 after making a payment. These errors can be frustrating, but there are steps you can take to address the issue. Here’s what you can do if you suspect a reporting error or glitch:

1. Double-Check Your Payment: Start by double-checking your payment to ensure that it was processed correctly. Verify the payment amount, date, and method of payment to confirm that there were no errors on your end.

2. Review Your Recent Transactions: Take the time to review your recent transactions in your online account or mobile app. Look for any discrepancies or unusual activity that may be affecting your available credit. Sometimes, a transaction may not have been properly posted, leading to an inaccurate available credit balance.

3. Clear Your Browser Cache: A simple but effective troubleshooting step is to clear your browser cache. This will remove any stored data or temporary files that may be causing display issues. After clearing your cache, refresh your account page to see if the available credit displayed correctly.

4. Log Out and Log Back In: Sometimes, logging out of your online account and logging back in can help refresh the system and resolve any temporary glitches. This simple step may rectify the issue and update your available credit accurately.

5. Contact Capital One Customer Support: If you have tried the above steps and the issue persists, it is advisable to reach out to Capital One customer support. Explain the situation, including the details of your payment and any discrepancies you have noticed. They can investigate the issue further, identify any reporting errors or glitches, and provide the necessary assistance to resolve the issue in a timely manner.

6. Be Patient: It’s important to remain calm and patient while resolving a reporting error or glitch. These issues are typically temporary and can be resolved with the assistance of customer support. Avoid making new transactions or payments until the issue is resolved to prevent any further confusion or discrepancies.

While reporting errors or glitches are uncommon, they can happen. By following these steps and reaching out to Capital One customer support, you can confidently address any reporting errors or glitches and ensure that your available credit is accurately reflected.

How to Check Capital One Available Credit

Checking your Capital One available credit is essential to understanding your current credit utilization and making informed financial decisions. Here’s how you can easily check your available credit:

1. Online Account Access: Log into your Capital One online account using your username and password. Once logged in, navigate to the account summary page or dashboard. Here, you should be able to view your available credit along with other relevant account information.

2. Mobile App: If you prefer to access your Capital One account from your mobile device, download the Capital One mobile app from the App Store or Google Play Store. Log in to the app using your credentials, and you should be able to view your available credit on the account overview or dashboard screen.

3. Account Statement: Review your most recent account statement from Capital One. In the statement, you’ll find a breakdown of your credit card activity, including your outstanding balance, credit limit, and available credit.

4. Customer Service: If you are unable to access your account online or through the mobile app, Capital One customer service representatives can provide you with up-to-date information about your available credit. Contact their customer support hotline or use their online chat feature to connect with a representative who can assist you with your inquiry.

5. Automated Phone System: Another option to check your available credit is through Capital One’s automated phone system. Dial their customer service number, enter your account information, and select the option to inquire about your available credit. The automated system should provide you with your available credit details.

By utilizing these methods, you can easily check your Capital One available credit and stay informed about your credit utilization. Regularly monitoring your available credit is an important step in managing your finances and maintaining a healthy credit profile.

Resolving the Issue of Capital One Available Credit Showing 0 After Payment

If your Capital One available credit shows as 0 after making a payment, it’s important to take action to resolve the issue. Here are steps you can follow to address this problem effectively:

1. Verify Payment Processing: Double-check that your payment was successfully processed. Review your payment confirmation, whether it was a transaction receipt, email confirmation, or confirmation within your online account. Ensure that the payment amount and transaction details are accurate.

2. Allow Sufficient Time: Capital One may require some time to process your payment and update your available credit. In most cases, it can take several business days for the payment to be fully processed. During this time, your available credit may temporarily show as 0. Be patient and wait for the payment to be applied before assuming there is an issue.

3. Check for Pending Transactions: Review your account for any pending transactions that might be affecting your available credit. Pending transactions can temporarily reduce your available credit until they are fully processed. Once the transactions are finalized, your available credit should be adjusted accordingly.

4. Assess Credit Limit Usage: Verify whether you have reached or exceeded your credit limit. If your outstanding balance is equal to or greater than your credit limit, your available credit will naturally be 0. Consider making a payment to reduce your balance and increase your available credit.

5. Monitor Account Activity: Regularly monitor your account activity to ensure there are no reporting errors or glitches. Look for any discrepancies in your transaction history, such as missing or duplicated payments. If you notice any issues, contact Capital One customer support for assistance in resolving them.

6. Contact Capital One Customer Support: If the issue persists or you believe there is an error with your available credit, it’s recommended to reach out to Capital One customer support. Explain the situation, provide any relevant information, and inquire about the status of your payment and available credit. The customer support team can investigate the matter further and help resolve the issue.

7. Maintain Communication: Stay in touch with Capital One throughout the process of resolving the issue. Follow up if necessary and provide any additional information or documentation requested. Keeping open lines of communication will help ensure a faster resolution.

By following these steps and remaining proactive in resolving the issue, you can address the problem of your Capital One available credit showing 0 after making a payment. It’s important to check your available credit regularly to manage your finances effectively and avoid any potential repercussions.

Contacting Capital One Customer Support

If you are experiencing issues with your Capital One available credit showing as 0 after making a payment, it may be necessary to contact Capital One customer support for assistance. Here are the steps to reach out to their support team:

1. Customer Support Hotline: The most common way to contact Capital One customer support is by phone. Look for the customer support hotline number on the back of your credit card or visit the Capital One website to find the appropriate phone number for your specific credit card.

2. Online Chat: Capital One also offers an online chat feature on their website. This can be a convenient way to connect with a customer service representative for assistance. Look for the chat icon on the Capital One website and follow the prompts to begin a chat session.

3. Social Media: Capital One has a presence on major social media platforms such as Facebook, Twitter, and Instagram. You can try reaching out to their customer support team through these channels. Send a direct message outlining your issue and provide any necessary details. Be mindful of not sharing any sensitive account information publicly.

4. Capital One Branch: If you prefer face-to-face assistance, you can visit a local Capital One branch. A representative at the branch will be able to address your concerns and provide guidance on resolving the issue with your available credit.

5. Provide Relevant Information: When contacting Capital One customer support, be prepared to provide relevant information such as your credit card number, recent payment details, and any other pertinent account information. This will help the customer support representative better understand and address your issue.

6. Explain the Issue Clearly: Clearly explain the issue you are facing with your available credit showing as 0 after making a payment. Be concise and provide specific details such as the date and time of the payment, the payment method used, and any confirmation numbers or reference numbers you may have.

7. Be Patient and Polite: While dealing with customer support, it’s important to remain patient and polite. Understand that resolving the issue may take time and multiple interactions. Maintain a calm and professional demeanor throughout the process.

Contacting Capital One customer support is an effective way to receive assistance and resolve any issues with your available credit. By following these steps and providing the necessary information, you’ll be on the path to getting the support you need for a satisfactory resolution.

Conclusion

Experiencing your Capital One available credit showing as 0 after making a payment can be puzzling and worrisome. However, by understanding the possible reasons behind this issue and taking appropriate steps to resolve it, you can regain control of your credit card account.

In this article, we discussed common reasons for your Capital One available credit showing as 0 after a payment, including issues with payment processing, delays in payment processing, pending transactions, reaching your credit limit, and reporting errors or glitches. We also provided guidance on how to check your available credit and offered solutions for resolving the issue effectively.

Remember to verify the processing of your payment, allow sufficient time for the payment to be applied to your account, and check for any pending transactions that may be impacting your available credit. Always stay aware of your credit limit and manage your credit utilization to avoid reaching or exceeding it. In case of reporting errors or glitches, reach out to Capital One customer support for assistance and maintain open communication throughout the resolution process.

Taking prompt action and staying informed will help you address any discrepancies in your available credit, ensuring that it reflects accurately on your Capital One credit card account. By responsibly managing your available credit, you can make the most of your credit card and maintain a healthy financial standing.