Finance

How To Make A Capital One Credit Card Payment

Published: November 7, 2023

Learn how to make a Capital One credit card payment and manage your finances effectively. Discover helpful tips and step-by-step instructions for hassle-free transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Capital One is a leading financial institution that offers a wide range of credit card options to individuals and businesses. From rewarding cashback cards to travel rewards and low-interest options, Capital One has a card to suit every financial need. As a Capital One cardholder, making timely and convenient credit card payments is crucial to maintaining a good credit history and avoiding unnecessary fees or penalties.

In this article, we will explore the various methods available for making Capital One credit card payments. Whether you prefer to make payments online, through the mobile app, over the phone, or by mail, Capital One provides multiple options to ensure a seamless payment experience. We will also highlight important considerations to keep in mind when making credit card payments to best manage your finances.

By understanding the different payment methods and tips for successful payments, you can confidently and efficiently manage your Capital One credit card payments, keeping your financial track record in good standing while enjoying the benefits of your credit card rewards. So, let’s dive in and explore the options available to make your Capital One credit card payments!

Methods for Making Capital One Credit Card Payments

Capital One offers several convenient methods for making credit card payments to suit your preferences and schedule. Let’s take a closer look at them:

- Online Payment: Making your Capital One credit card payment online is quick and easy. Simply visit the Capital One website and log into your account. Navigate to the “Payments” section and follow the prompts to enter your payment details. You can choose to make a one-time payment or set up automatic monthly payments for added convenience. Capital One’s online payment portal is secure and accessible 24/7, allowing you to make payments at your convenience.

- Mobile App Payment: Capital One’s mobile app provides a user-friendly interface for managing your credit card and making payments on the go. Download the Capital One mobile app from your smartphone’s app store, log in to your account, and select the “Payments” option. From there, you can enter your payment details and submit your payment securely. The app also allows you to set up payment reminders and view your payment history for better financial management.

- Phone Payment: If you prefer to make your credit card payment over the phone, you can do so by contacting Capital One’s customer service line. The automated system will guide you through the payment process, or you can choose to speak with a customer service representative for personalized assistance. Ensure that you have your credit card details and banking information ready when making a phone payment for a smooth and efficient experience.

- Mail Payment: For those who prefer traditional methods, Capital One allows you to make your credit card payment by mail. Simply detach the payment coupon from your credit card statement, enclose it with your check or money order payable to Capital One, and mail it to the address provided on the statement. It is essential to allow sufficient time for the payment to reach Capital One to avoid late fees or penalties.

It’s important to note that regardless of the payment method you choose, always ensure that your payment reaches Capital One on or before the due date to avoid any negative impact on your credit history. Additionally, keep in mind that Capital One may charge a convenience fee for certain payment methods, such as making payments over the phone with a customer service representative.

Now that we have explored the various methods for making Capital One credit card payments, let’s move on to important considerations to keep in mind when making these payments to ensure successful financial management.

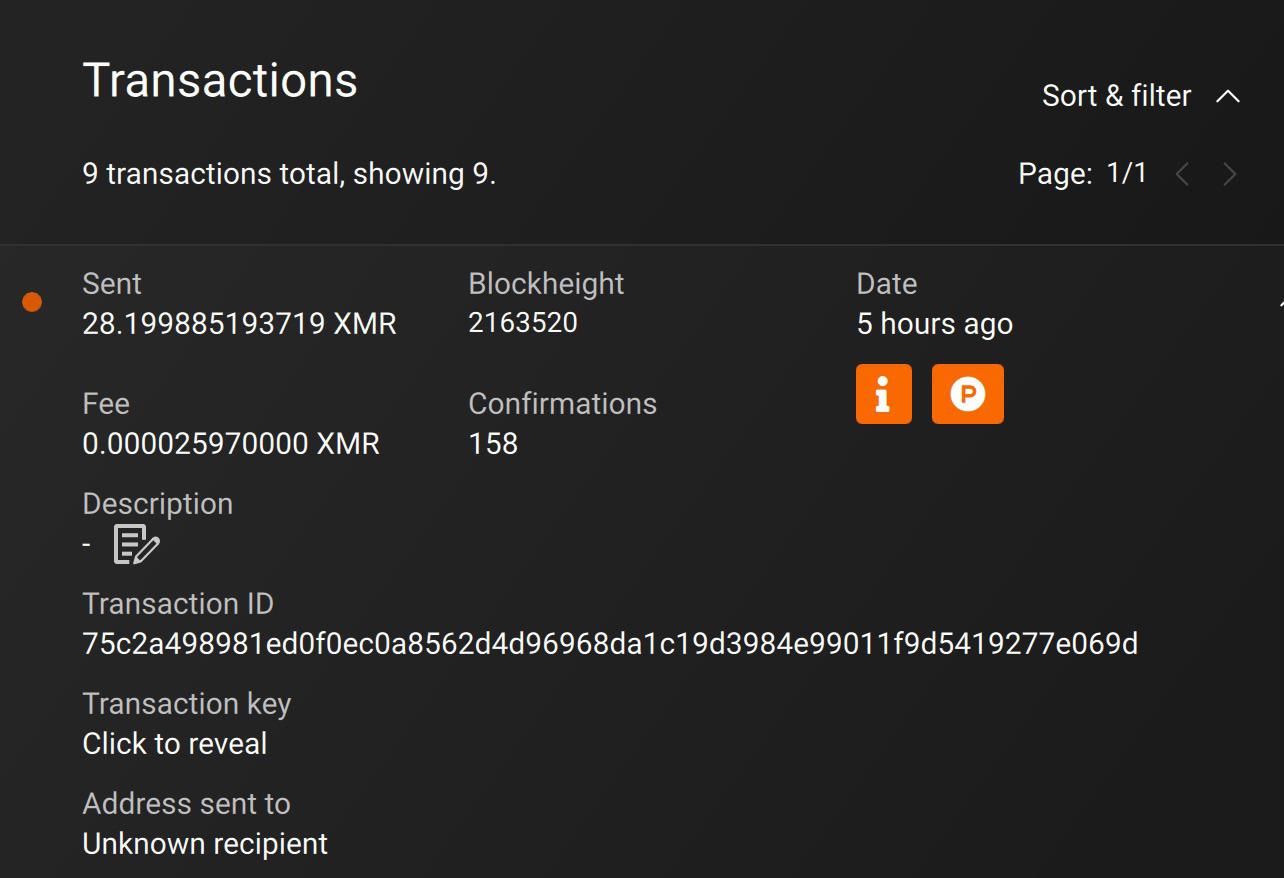

Online Payment

Making your Capital One credit card payment online is a convenient and efficient method that allows you to manage your payments from the comfort of your own home. Here’s a step-by-step guide on how to make an online payment:

- Log in to your Capital One account: Visit the Capital One website and log in to your account using your username and password. If you haven’t registered for an online account, you will need to create one by following the provided instructions.

- Navigate to the “Payments” section: Once logged in, find the “Payments” section. This may be located under the “Account Management” or “My Account” tab, depending on the website’s layout.

- Enter payment details: Follow the prompts to enter your payment details. This typically includes the payment amount, the date of the payment, and the bank account from which the payment will be made. You may also have the option to set up automatic monthly payments for added convenience.

- Review and submit your payment: Take a moment to review the payment details to ensure their accuracy. Double-check the payment amount and the payment date. Once you are satisfied, click on the “Submit” or “Confirm” button to finalize the payment.

- Confirmation: After submitting your payment, you will typically receive a confirmation message or a payment confirmation number. It is a good practice to make a note of this information for your records.

Online payments offer several benefits, including real-time processing, immediate confirmation, and the ability to set up recurring payments. Additionally, you can view your payment history and schedule future payments through the online portal, providing you with greater control over your finances.

It’s important to note that when making an online payment, ensure that you have sufficient funds in your bank account to cover the payment. Insufficient funds or a declined payment may result in additional fees or penalties. Additionally, always schedule your online payment well in advance of the due date to allow for any processing time and to avoid any delays or late fees.

Now that you are familiar with the online payment method for Capital One credit card payments, let’s explore the next method: mobile app payments.

Mobile App Payment

Capital One’s mobile app provides a convenient and user-friendly platform for managing your credit card and making payments directly from your smartphone. Here’s a step-by-step guide on how to make a payment using the Capital One mobile app:

- Download and install the app: Start by downloading the Capital One mobile app from the App Store (for iOS users) or Google Play Store (for Android users). Once installed, open the app and log in to your Capital One account using your username and password.

- Select the credit card account: If you have multiple credit card accounts with Capital One, select the specific account you want to make a payment for from the list provided. This ensures that your payment is applied to the correct account.

- Navigate to the payment section: Look for the “Payments” or “Make a Payment” option in the main menu or on the account dashboard. Tap on this option to proceed.

- Enter payment details: Follow the prompts to enter your payment details. This typically includes the payment amount, the date of the payment, and the bank account from which the payment will be made. You may have additional options, like setting up recurring payments or scheduling future payments.

- Review and submit your payment: Take a moment to review the payment details to ensure their accuracy. Double-check the payment amount, payment date, and the bank account you selected for the payment. Once you are satisfied with the details, tap on the “Submit” or “Confirm” button to finalize the payment.

- Confirmation: After submitting your payment, you will receive a confirmation message or a payment confirmation number within the app. It’s always a good idea to make a note of this information for your records.

Mobile app payments offer the convenience of making payments from anywhere at any time. Additionally, the app provides access to account information, transaction history, and rewards programs, allowing you to stay updated on your credit card activity and rewards status.

Remember to ensure that you have sufficient funds in your connected bank account before making a payment. Insufficient funds may result in additional fees or declined payments. It’s also recommended to schedule your payment well in advance of the due date to allow for any processing time and to avoid late fees or penalties.

Now that you have learned about making mobile app payments for your Capital One credit card, let’s move on to the next method: phone payments.

Phone Payment

If you prefer to make your Capital One credit card payment over the phone, Capital One provides a convenient and secure option to do so. Here’s a step-by-step guide on how to make a phone payment:

- Gather your payment information: Before making a phone payment, ensure you have the necessary information at hand, including your Capital One credit card number, banking information, and the payment amount you wish to make.

- Contact Capital One’s customer service: Dial the toll-free customer service number provided on the back of your Capital One credit card. The automated system will guide you through the payment process.

- Follow the prompts: Listen carefully to the automated prompts and select the option for making a payment. You may be requested to enter your credit card number, zip code, and other identifying information to authenticate your account.

- Enter payment details: Once your account is verified, the system will prompt you to enter your payment details. This typically includes the payment amount and the bank account information from which the payment will be deducted.

- Confirm the payment: Review the payment details on the automated system and ensure their accuracy. Confirm the payment amount and the bank account information before proceeding.

- Record the confirmation number: After completing the payment, the system will provide you with a confirmation number. It is advisable to write down or save this number for your records.

Phone payments offer a simple and convenient way to make your Capital One credit card payment, especially for those who prefer speaking with a customer service representative. The automated system is available 24/7, providing flexibility for making payments outside of traditional business hours.

While making a phone payment, it’s crucial to ensure that you have sufficient funds in your bank account to cover the payment. An insufficient funds situation may lead to declined payments or additional fees. Additionally, schedule your phone payment well in advance of the due date to allow for any processing time and to avoid any delays or late fees.

Now that you are familiar with making phone payments for your Capital One credit card, let’s move on to the next method: mail payments.

Mail Payment

If you prefer to make your Capital One credit card payment through traditional mail, you can do so by sending your payment via postal mail. Here’s how you can make a mail payment:

- Prepare your payment: Start by detaching the payment coupon from your Capital One credit card statement. This payment coupon will include important information such as your account number and the address to which the payment should be sent.

- Write a check or obtain a money order: Write a personal check or obtain a money order payable to Capital One for the desired payment amount. Ensure that the check or money order is correctly filled out and signed.

- Include the payment coupon: Once your payment is ready, enclose it along with the payment coupon in an envelope. Make sure to include your account number on the check or money order to ensure proper identification.

- Mail the payment: Address the envelope to the payment address provided on the payment coupon. Double-check the address for accuracy to ensure that your payment reaches the correct destination.

- Allow sufficient time: It is essential to allow sufficient time for your mail payment to reach Capital One, especially if you are approaching the payment due date. Postal delivery times may vary, so it’s advisable to mail your payment well in advance to avoid any late fees or penalties.

Mail payments offer a traditional and reliable method for credit card payments. However, it’s important to note that mail payments may take longer to process compared to online or phone payments. Therefore, it’s recommended to consider alternative methods for making urgent or time-sensitive payments.

When making a mail payment, it’s crucial to verify that the payment is addressed correctly and that the payment coupon is included along with your check or money order. Failure to include the payment coupon or providing incomplete information may result in processing delays or misallocation of the payment.

Now that you are familiar with making mail payments for your Capital One credit card, let’s move on to important considerations to keep in mind when making these payments.

Important Considerations for Making Capital One Credit Card Payments

When it comes to making Capital One credit card payments, there are a few important considerations to keep in mind to ensure successful and efficient payment management. Let’s explore these considerations:

- Payment due dates: Always be aware of your credit card payment due dates. Missing a payment or making a late payment can negatively impact your credit score and may result in late fees or penalties. Set reminders or utilize automatic payments to help you stay on top of your payment schedule.

- Sufficient funds: Before making any payment, ensure that you have sufficient funds available in your bank account to cover the payment. An insufficient funds situation can lead to declined payments and potential fees from both your bank and Capital One. Regularly monitor your bank account balance to avoid any surprises.

- Processing time: Different payment methods have varying processing times. Online and mobile app payments are typically processed faster compared to mail or phone payments. Make sure to schedule your payment accordingly to account for any processing time to avoid late payments.

- Security: When making online or mobile app payments, ensure that you are using a secure and trusted network connection. Avoid using public Wi-Fi networks to prevent potential security risks. Capital One maintains high-security standards for its online and mobile app platforms, but it is still important to exercise caution and protect your personal and financial information.

- Payment allocation: If you have multiple credit cards or accounts with Capital One, ensure that your payment is allocated correctly. Specify which credit card or account the payment should be applied to, especially if you have promotional balances or carried balances on different cards.

- Customer service assistance: If you encounter any difficulties or have questions regarding your credit card payment, don’t hesitate to reach out to Capital One’s customer service. They can provide guidance, answer your queries, and assist with payment-related matters.

By keeping these considerations in mind when making your Capital One credit card payments, you can effectively manage your finances, avoid penalties, and maintain a positive credit history. Remember, timely payments are crucial for building a strong credit profile and unlocking the potential benefits and rewards associated with your Capital One credit card.

Now that you are well-informed about the various methods of making Capital One credit card payments and the important considerations to take into account, you can confidently choose the payment method that suits your preferences and manage your payments responsibly.

Take charge of your credit card payments and enjoy the peace of mind that comes with staying on top of your financial obligations.

Conclusion

Making timely and convenient credit card payments is essential for effective financial management, and Capital One provides several methods to cater to individual preferences. Whether you choose to make your payments online, through the mobile app, over the phone, or by mail, Capital One offers a range of options to suit your needs.

Online payments provide the convenience of managing your payments from the comfort of your own home, with the ability to set up recurring payments for added convenience. The Capital One mobile app allows for quick and easy payment processing on the go, along with access to account information and rewards programs.

Phone payments offer a reliable and accessible method for those who prefer personal assistance or have specific payment-related inquiries. Mail payments provide a traditional option, though it may take longer to process compared to other methods.

Regardless of the payment method you choose, it is crucial to stay aware of your payment due dates, maintain sufficient funds in your bank account, and consider the processing time for each payment method. By following these considerations, you can successfully manage your Capital One credit card payments and avoid late fees, penalties, and negative impacts on your credit history.

If you encounter any difficulties or have questions regarding your payments, Capital One’s customer service is available to provide assistance and guidance.

Take control of your financial obligations by utilizing the various payment methods offered by Capital One. By making timely and responsible payments, you can enjoy the benefits and rewards associated with your Capital One credit card while maintaining a positive credit profile.

Remember, the key to successful credit card payment management lies in staying organized, following due dates, and choosing the payment method that best suits your lifestyle and preferences.