Finance

What Are Long-Term Assets On A Balance Sheet

Modified: March 1, 2024

Learn about long-term assets on a balance sheet and their significance in finance. Gain insights into managing and valuing these assets for optimum financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Long-Term Assets

- Importance of Long-Term Assets on a Balance Sheet

- Types of Long-Term Assets

- Property, Plant, and Equipment

- Intangible Assets

- Investments

- Other Long-Term Assets

- Examples of Long-Term Assets

- Valuation and Measurement of Long-Term Assets

- Depreciation and Amortization of Long-Term Assets

- Reporting Long-Term Assets on a Balance Sheet

- Conclusion

Introduction

When analyzing a company’s financial health, one crucial aspect to consider is its balance sheet. The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a given point in time. Among the various components of a balance sheet, long-term assets hold a significant position.

Long-term assets, also known as non-current assets, are resources that a company expects to utilize for more than one year. These assets contribute to a company’s long-term value creation and are crucial for its growth and sustainability. Understanding the concept of long-term assets is essential for investors, shareholders, creditors, and other stakeholders, as it provides insights into a company’s ability to generate future cash flows and meet its long-term obligations.

In this article, we will delve deeper into the world of long-term assets and explore their importance, types, valuation, and reporting on a balance sheet.

Understanding long-term assets assists in evaluating a company’s stability, growth potential, and overall financial performance. It also enables investors to make informed decisions when considering investing in a company.

Now that we have laid the foundation, let’s proceed to the definition of long-term assets and explore their significance on a balance sheet.

Definition of Long-Term Assets

Long-term assets, also known as non-current assets, are resources that a company owns and expects to utilize in its operations for more than one year. These assets are not intended for immediate sale or conversion into cash within the normal operating cycle of the business.

Long-term assets are an essential component of a company’s balance sheet, as they represent the long-term investment and value creation capabilities of the business. They are typically tangible or intangible assets that provide future economic benefits to the company.

Tangible long-term assets include property, plant, and equipment (PP&E), such as land, buildings, machinery, and vehicles. These assets are used in the production or delivery of goods and services and have a useful life of more than one year.

Intangible long-term assets, on the other hand, are non-physical assets that lack physical substance. Examples of intangible assets include patents, trademarks, copyrights, goodwill, and intellectual property rights. These assets contribute to a company’s competitive advantage and are often crucial for its success and market position.

Long-term investments, such as stocks, bonds, and other securities that are held for longer than one year, are also classified as long-term assets. These investments are not actively traded and are typically intended to generate income or gain over an extended period.

In addition to these categories, companies may also have other long-term assets, such as long-term prepaid expenses, deferred tax assets, and pension assets. These assets have a longer time horizon and are not expected to be converted into cash or used up within the current operating cycle of the business.

Overall, the classification of an asset as a long-term asset depends on its expected useful life and the company’s intent to utilize it beyond a year. It is essential to differentiate long-term assets from current assets, which are expected to be consumed or converted into cash within one year or the normal operating cycle of the business, whichever is longer.

Now that we have a clear understanding of the definition of long-term assets, let’s explore why they are important on a balance sheet.

Importance of Long-Term Assets on a Balance Sheet

Long-term assets play a crucial role on a company’s balance sheet, providing valuable insights into its financial health, growth potential, and ability to generate future cash flows. Here are several reasons why long-term assets are important:

- Value Creation: Long-term assets represent the investments made by a company to create value over an extended period. They include resources like property, plant, and equipment, which are essential for production and delivery of goods or services. These assets contribute to the generation of revenue and profitability, allowing the company to expand its operations and grow.

- Financial Stability: Long-term assets provide a measure of a company’s financial stability and sustainability. These assets reflect the company’s ability to maintain and support its operations over the long term. A healthy balance of long-term assets indicates that the company has the resources necessary to meet its long-term obligations and withstand economic downturns or other financial challenges.

- Competitive Advantage: Intangible long-term assets, such as patents, trademarks, and intellectual property, can provide a company with a competitive edge in the market. These assets represent valuable rights and intangible assets that can differentiate the company’s products or services from its competitors. They contribute to the creation of brand value, customer loyalty, and market position.

- Risk Mitigation: Long-term assets can also serve as a hedge against risk and uncertainty. By investing in long-term assets, a company can diversify its revenue streams and reduce its reliance on short-term fluctuations or market volatilities. For example, long-term investments in stocks and bonds can generate consistent income, serving as a buffer during economic downturns.

- Investor Confidence: The presence of substantial long-term assets on a balance sheet can instill confidence in investors and shareholders. It demonstrates the company’s commitment to long-term growth and value creation, indicating that the company has a solid foundation for future success. This can attract potential investors and support the company’s ability to raise capital.

In summary, long-term assets provide significant insights into a company’s financial stability, growth potential, competitive advantage, and ability to generate future cash flows. They play a critical role in shaping the overall financial performance and outlook of a company. By analyzing long-term assets, investors, creditors, and other stakeholders can make informed decisions regarding their involvement with the company.

Now that we understand the importance of long-term assets, let’s explore the various types of long-term assets commonly found on a balance sheet.

Types of Long-Term Assets

Long-term assets encompass different categories that contribute to a company’s long-term value creation and growth. Let’s explore the various types of long-term assets commonly found on a balance sheet:

- Property, Plant, and Equipment (PP&E): Also known as fixed assets, PP&E includes tangible assets used in the production or delivery of goods and services. This category includes land, buildings, machinery, vehicles, and equipment. These assets have a useful life of more than one year and are essential for the ongoing operations of a company.

- Intangible Assets: Intangible assets are non-physical assets that lack physical substance but hold significant value. Examples include patents, trademarks, copyrights, goodwill, and intellectual property rights. Intangible assets represent a company’s intellectual property, brand, reputation, and competitive advantage. They can play a crucial role in the company’s success and market position.

- Investments: Long-term investments are financial assets held by a company for more than one year. These investments are not intended for immediate sale and can include stocks, bonds, mutual funds, and other securities. Long-term investments can generate income through dividends, interest, or capital appreciation.

- Other Long-Term Assets: Besides the above categories, there may be other long-term assets categorized separately. These can include long-term prepaid expenses, deferred tax assets, pension assets, and any other assets that are not expected to be used or consumed within the current operating cycle or one year.

Each type of long-term asset represents a different aspect of a company’s operations and value creation. They contribute to the company’s ability to generate revenue, sustain its competitive position, and provide future economic benefits.

Now that we have explored the types of long-term assets, let’s delve deeper into each category and understand how they contribute to a company’s financial position and performance.

Property, Plant, and Equipment

Property, Plant, and Equipment (PP&E) are tangible long-term assets that play a crucial role in the operations of a company. Also known as fixed assets, PP&E includes a wide range of assets used in the production or delivery of goods and services. Let’s explore the significance of PP&E on a company’s balance sheet:

Types of PP&E:

PP&E can encompass various assets, including:

- Land: The value of the land owned by a company is included in the PP&E category. Land is usually considered a long-term asset as its value tends to appreciate over time.

- Buildings: Structures owned or leased by a company for its operations, such as factories, offices, and warehouses, fall under the category of buildings.

- Machinery and Equipment: This includes any specialized machinery, tools, or equipment utilized in the production process. Examples include manufacturing equipment, vehicles, computers, and software.

- Furniture and Fixtures: Items like desks, chairs, shelves, and other furnishings used within a company’s premises are considered part of the PP&E category.

Importance of PP&E:

PP&E is essential for the ongoing operations and growth of a company. Here are some key reasons why PP&E holds significant importance:

- Revenue Generation: PP&E assets are directly used in the production or delivery of goods and services. They enable a company to generate revenue and fulfill customer demands efficiently.

- Asset Value: Land, buildings, and certain machinery tend to appreciate over time, contributing to the company’s overall asset value.

- Long-Term Investment: Companies make significant investments in PP&E assets, often requiring substantial capital expenditure. These investments are crucial for the company’s long-term growth and sustainability.

- Competitive Advantage: State-of-the-art machinery and equipment can provide a competitive edge by improving production efficiency, product quality, and innovation.

Depreciation of PP&E:

As PP&E assets are utilized over multiple years, they undergo depreciation. Depreciation is the systematic allocation of the asset’s cost over its estimated useful life. This allocation recognizes the wear and tear, obsolescence, and the diminishing value of the asset. Depreciation expense is reported on the company’s income statement and reduces the net value of PP&E on the balance sheet.

Understanding the value and significance of PP&E assets is crucial for assessing a company’s operational capabilities and long-term growth potential. These assets represent a company’s tangible investments, providing the foundation for generating revenue and sustaining competitive advantage.

Now that we have explored PP&E assets, let’s move on to the next category of long-term assets, which is intangible assets.

Intangible Assets

Intangible assets are an important category of long-term assets that contribute to a company’s value, competitive advantage, and overall success. Unlike tangible assets, intangible assets lack physical substance but hold significant value. Let’s explore the significance of intangible assets on a company’s balance sheet:

Types of Intangible Assets:

Intangible assets can encompass various categories, including:

- Patents: Patents provide legal protection for inventions, granting the owner exclusive rights for a specific period. They offer a competitive advantage by preventing others from using or selling the patented technology or product.

- Trademarks: Trademarks are unique symbols, logos, or names that represent and distinguish a company’s brand or products in the marketplace. They help build brand recognition, customer loyalty, and market position.

- Copyrights: Copyrights protect original creative works, such as books, music, software, or artwork. They ensure that the creator has the exclusive rights to reproduce, distribute, or display the work.

- Goodwill: Goodwill represents the value of a company’s brand reputation, customer relationships, and other intangible factors that contribute to its ongoing profitability. It is typically generated through acquisitions or mergers.

- Intellectual Property: Intellectual property includes a wide range of intangible assets, including trade secrets, proprietary technology, know-how, and inventions. These assets provide a competitive advantage by giving the company unique insights or capabilities in its industry.

Importance of Intangible Assets:

Intangible assets play a critical role in a company’s success and competitive position. Here are several reasons why intangible assets are significant:

- Market Differentiation: Intangible assets, such as trademarks and patents, help differentiate a company’s products or services from competitors. They contribute to brand recognition, customer loyalty, and the ability to command premium pricing.

- Revenue Generation: Intellectual property and other intangible assets can generate revenue through licensing agreements, royalties, or the sale of rights to third parties.

- Barriers to Entry: Acquiring and protecting intangible assets can create barriers to entry for competitors. This can make it more difficult for new entrants to replicate a company’s unique offerings or market position.

- Long-Term Value: Intangible assets can provide long-term value and sustained profitability, as they are often difficult to replicate or substitute.

Valuation and Amortization of Intangible Assets:

Intangible assets are typically recorded on the balance sheet at their acquisition cost. However, their value may change over time due to factors such as technological advancements, market conditions, or legal restrictions. When intangible assets have a limited useful life, they are amortized over that period. Amortization is the process of systematically allocating the asset’s cost over its estimated useful life and is reported as an expense on the company’s income statement.

Understanding the value and importance of intangible assets is crucial when analyzing a company’s overall financial health and growth potential. These assets represent the intangible value drivers that contribute to a company’s competitive advantage and market position.

Now that we have explored intangible assets, let’s move on to the next category of long-term assets, which is investments.

Investments

Investments are a vital category of long-term assets that companies hold for more than one year with the goal of generating income or gaining value. These investments are not actively traded and are typically held as part of a company’s investment strategy. Let’s explore the significance of investments on a company’s balance sheet:

Types of Investments:

Investments can take various forms, including:

- Stocks: Companies may invest in other publicly traded companies by purchasing stocks. These investments represent ownership in other companies and can provide dividends or capital appreciation.

- Bonds: Bonds are debt instruments issued by governments or corporations. By investing in bonds, companies can earn interest income over the bond’s duration.

- Mutual Funds and ETFs: Companies may invest in mutual funds or exchange-traded funds (ETFs) that pool together funds from multiple investors. These investment vehicles provide diversification and professional management.

- Real Estate: Companies can invest in real estate properties, such as commercial buildings or residential properties, with the intention of generating rental income or capital gains.

- Private Equity and Venture Capital: Companies may invest in privately-held companies to gain exposure to promising startups or growth-stage companies. These investments offer the potential for significant returns but are also associated with higher risks.

Importance of Investments:

Investments hold significant importance for a company and its balance sheet. Here are several reasons why investments are crucial:

- Diversification: Investments allow companies to diversify their asset portfolio and reduce exposure to any single industry or asset class.

- Income Generation: Investments can generate income through dividends, interest, or rental payments. This income stream can contribute to a company’s overall revenue and profitability.

- Capital Appreciation: Companies may invest with the expectation of capital appreciation, where the value of the investment increases over time. This can result in gains when the investment is sold in the future.

- Strategic Partnerships: Investments in other companies can lead to strategic partnerships or collaborations, providing access to new markets, technologies, or expertise.

Reporting Investments:

Investments are typically reported on the balance sheet at their fair market value or the historical cost if the fair market value is not readily available. Depending on the intent and nature of the investment, it may be classified as either long-term or short-term, based on the holding period. Long-term investments are reported as non-current assets on the balance sheet.

Understanding the value and significance of investments is crucial when assessing a company’s overall financial position, diversification strategy, and potential for long-term growth. Investments provide opportunities for income, capital appreciation, and strategic partnerships.

Now that we have explored investments, let’s move on to other long-term assets that may be found on a company’s balance sheet.

Other Long-Term Assets

In addition to property, plant, and equipment (PP&E), intangible assets, and investments, there are other types of long-term assets that can be found on a company’s balance sheet. These assets are classified separately and contribute to a company’s long-term value creation and financial stability. Let’s explore the significance of these other long-term assets:

Examples of Other Long-Term Assets:

Other long-term assets can include:

- Long-Term Prepaid Expenses: Expenses that are paid in advance but will be consumed or utilized over a period longer than one year. Examples can include pre-paid insurance premiums, prepaid rent, or prepaid advertising.

- Deferred Tax Assets: Assets that arise from temporary differences between the book and tax values of certain items. These assets represent future tax benefits that can be utilized to offset future tax liabilities.

- Pension Assets: Assets held within a company’s defined benefit pension plan, which are invested to fund future employee pension obligations.

- Other Long-Term Investments: Investments that do not fit into the traditional categories, such as long-term investments in private equity funds or long-term investment in subsidiaries.

Importance of Other Long-Term Assets:

Other long-term assets contribute to a company’s financial stability and long-term value creation. Here’s why they are important:

- Future Expense Coverage: Long-term prepaid expenses and deferred tax assets represent resources that will provide future economic benefits or offset future expenses.

- Retirement Obligations: Pension assets help ensure that a company has sufficient funds to meet its future pension obligations to employees.

- Long-Term Investment Opportunities: Other long-term investments provide companies with the opportunity to diversify their investment portfolio and potentially earn long-term returns.

Reporting and valuation of these other long-term assets may vary based on accounting principles and company-specific policies. However, they are critical components of a company’s long-term financial position and contribute to its stability and sustainability.

Now that we have explored the various types of long-term assets, let’s move on to the next section, where we will provide examples of long-term assets commonly found on a company’s balance sheet.

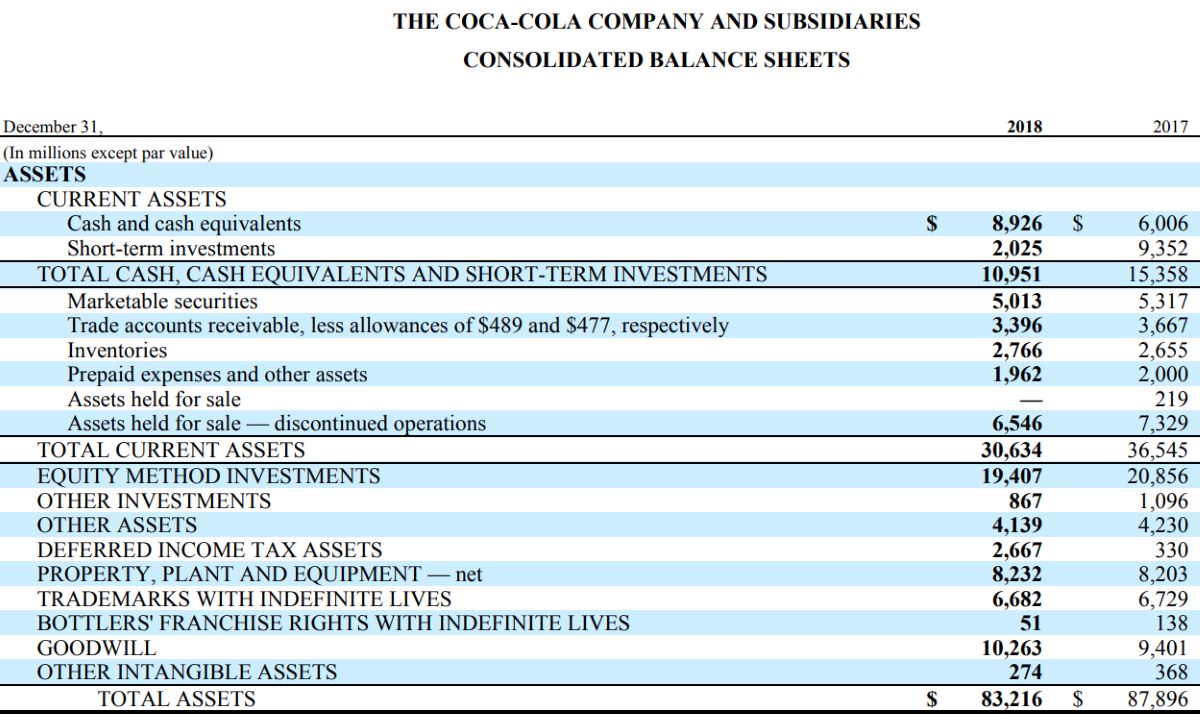

Examples of Long-Term Assets

Long-term assets are diverse and can encompass a wide range of resources that a company expects to utilize for more than one year. These assets contribute to a company’s long-term value creation and financial stability. Let’s explore some common examples of long-term assets:

Property, Plant, and Equipment (PP&E) Examples:

- Land: Real estate properties owned by the company for future development or utilization.

- Buildings: Facilities and structures used for manufacturing, offices, warehousing, or other operational purposes.

- Machinery and Equipment: Specialized machinery, production equipment, or vehicles used in the production process.

- Furniture and Fixtures: Office furniture, fixtures, and equipment used in company premises.

Intangible Asset Examples:

- Patents: Exclusive rights to protect inventions or new technologies developed by the company.

- Trademarks: Distinctive symbols, logos, or names used to represent the company’s brand or products.

- Copyrights: Legal protection for original works of authorship, such as books, music, or software.

- Goodwill: The premium value associated with an acquired company’s reputation, customer relationships, and other intangible factors.

Investment Examples:

- Stocks: Ownership shares in other publicly traded companies, representing equity investments.

- Bonds: Debt instruments issued by governments or corporations that generate fixed interest income.

- Mutual Funds or ETFs: Pooled investment vehicles that offer diversification across various securities.

- Real Estate Properties: Investments in properties intended for rental income generation or capital appreciation.

Other Long-Term Asset Examples:

- Long-Term Prepaid Expenses: Prepaid insurance premiums, rent, or advertising expenses that extend beyond one year.

- Deferred Tax Assets: Future tax benefits resulting from temporary differences between book and tax values.

- Pension Assets: Investments held within a company’s defined benefit pension plan to meet future obligations to employees.

- Other Long-Term Investments: Non-standard investments, such as private equity funds or investments in subsidiaries.

These examples illustrate the diverse nature of long-term assets and their importance in supporting a company’s operations, growth, and value creation. The specific composition of long-term assets varies across industries and companies based on their unique business models and strategies.

Now that we have explored the examples of long-term assets, let’s dive into the valuation and measurement considerations for long-term assets.

Valuation and Measurement of Long-Term Assets

The valuation and measurement of long-term assets are critical considerations when preparing a company’s balance sheet. Proper valuation ensures that the presentation of long-term assets accurately reflects their value and assists in assessing a company’s financial position. Let’s explore the key aspects of valuing and measuring long-term assets:

Property, Plant, and Equipment (PP&E) Valuation:

PP&E assets are typically recorded on the balance sheet at their historical cost. This includes the acquisition cost, transportation, installation, and any other directly attributable costs. However, it is important to note that the carrying value of PP&E may change over time due to factors such as depreciation or impairment.

Intangible Asset Valuation:

Valuing intangible assets can be more complex than tangible assets since they lack physical substance. Various approaches, such as cost-based, market-based, or income-based methods, may be used to determine the fair market value of intangible assets. The specific method depends on the nature of the asset and the availability of relevant market data.

Investment Valuation:

Investments are typically valued at their fair market value or the lower of cost or market value. Publicly traded investments, such as stocks and bonds, can be valued based on their market price. For privately held investments or investments without readily available market prices, alternative valuation techniques, such as discounted cash flow analysis, may be employed.

Other Long-Term Asset Valuation:

The valuation of other long-term assets depends on their nature and characteristics. For long-term prepaid expenses, they are initially recorded at the amount paid and subsequently amortized over their expected useful life. Deferred tax assets are measured based on the expected future tax benefits. Pension assets are valued based on the fair value of the underlying investments within the pension fund.

It is important to note that the measurement of long-term assets should conform to the applicable accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards provide guidelines on how to determine the appropriate valuation and measurement techniques for different types of long-term assets.

Accurate valuation and measurement of long-term assets are vital for presenting a true and fair view of a company’s financial position. It ensures transparency, comparability, and facilitates decision-making for investors, creditors, and other stakeholders.

Now that we have covered the valuation and measurement of long-term assets, let’s move on to the important topic of depreciation and amortization.

Depreciation and Amortization of Long-Term Assets

Depreciation and amortization are accounting methods used to allocate the cost of long-term assets over their useful lives. These methods reflect the gradual decline in the value and usefulness of assets as they are utilized in a company’s operations. Let’s explore the significance of depreciation and amortization for long-term assets:

Depreciation of Tangible Assets:

Tangible assets, such as property, plant, and equipment (PP&E), undergo depreciation. Depreciation recognizes the wear and tear, obsolescence, and decrease in value of these assets over time. The cost of acquiring or constructing the asset is spread over its estimated useful life. Common depreciation methods include straight-line, declining balance, and units-of-production.

Amortization of Intangible Assets:

Intangible assets are subject to amortization, which is the process of allocating the asset’s cost over its estimated useful life. Amortization recognizes the consumption of the asset’s economic benefits over time. The specific amortization method depends on the nature of the intangible asset. For example, patents may be amortized over their legal life, while goodwill is subject to impairment testing rather than scheduled amortization.

Reasons for Depreciation and Amortization:

Depreciation and amortization serve several important purposes:

- Matching Principle: Depreciation and amortization expenses are recognized in the same period as the revenue generated from utilizing the long-term asset. This adherence to the matching principle ensures that expenses are properly matched with related revenue.

- Accuracy of Financial Statements: Depreciation and amortization help provide a more accurate reflection of a company’s financial position and profitability by accounting for the consumption and decline in value of long-term assets.

- Taxation Benefits: Depreciation and amortization expenses are often tax-deductible, reducing a company’s taxable income and overall tax liability.

- Asset Replacement Planning: Tracking the estimated useful lives of long-term assets assists in evaluating when assets will require replacement or major repairs, aiding in strategic planning and budgeting.

It is important to note that the period over which an asset is depreciated or amortized may differ from its expected useful life. The actual useful life is determined based on the asset’s physical condition, technological advancements, market conditions, and management’s judgment.

Properly recording depreciation and amortization expenses is crucial for the accuracy and transparency of financial statements. It provides stakeholders with a better understanding of a company’s long-term asset utilization, profitability, and cost structure.

Now that we have covered depreciation and amortization of long-term assets, let’s explore how these assets are reported on a company’s balance sheet.

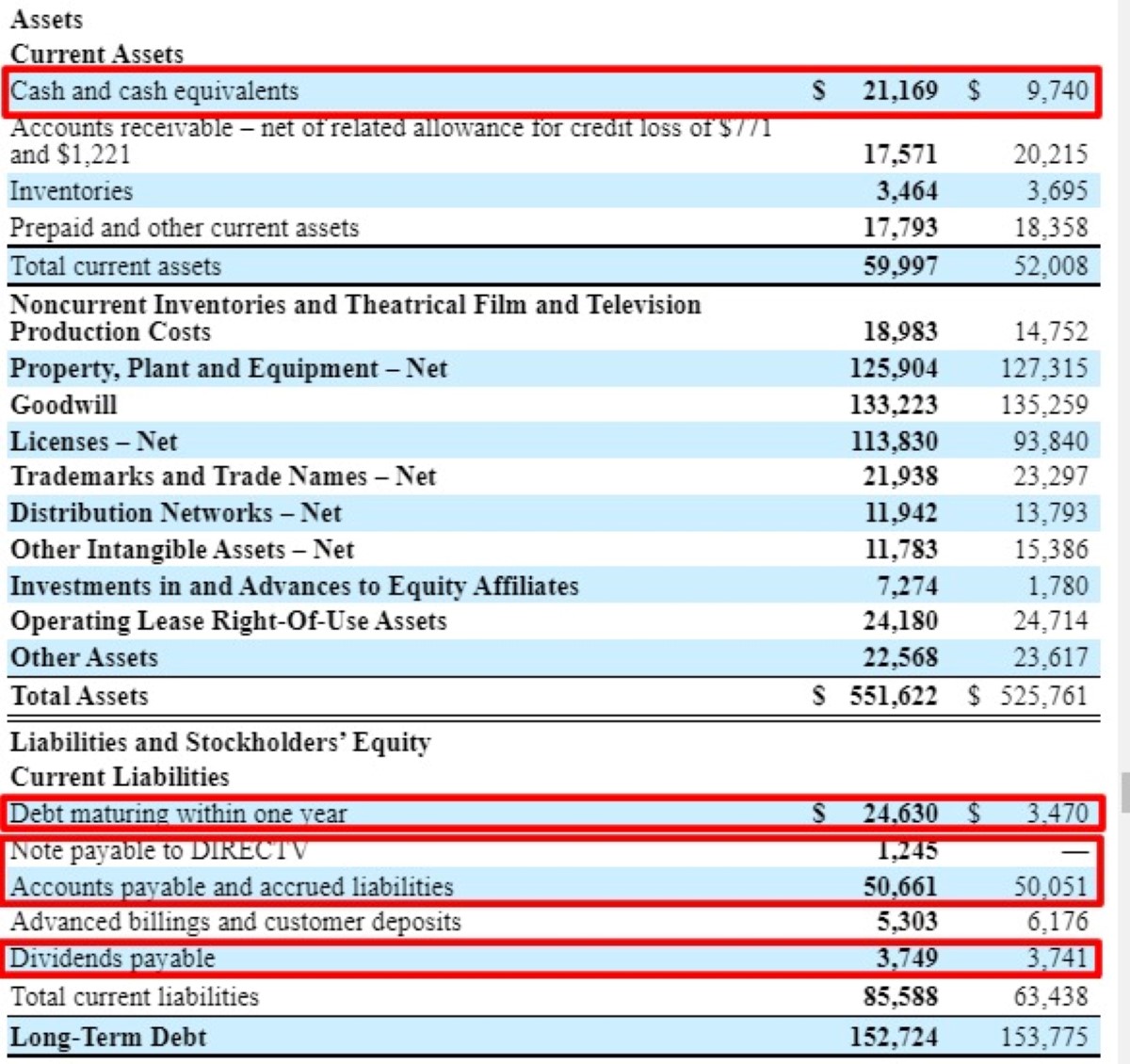

Reporting Long-Term Assets on a Balance Sheet

Long-term assets are reported on a company’s balance sheet, providing valuable information about the investments made by the company and its long-term value creation capabilities. Let’s explore how long-term assets are reported on a balance sheet:

Classification on the Balance Sheet:

Long-term assets are classified as non-current assets on the balance sheet, distinguishing them from current assets that are expected to be converted into cash within a year or the normal operating cycle of the business. The non-current asset section typically includes three main categories: property, plant, and equipment (PP&E), intangible assets, and long-term investments.

Valuation and Carrying Value:

Long-term assets are reported at their historical cost, which is the initial amount paid to acquire or construct the asset. Subsequently, the carrying value of the asset is adjusted for depreciation (for tangible assets) or amortization (for intangible assets) to reflect the decline in its value over time.

Depreciation and Amortization:

Depreciation expense for tangible assets and amortization expense for intangible assets are reported on the income statement. These expenses are subtracted from revenue to determine the company’s operating income or profit. The accumulated depreciation or amortization amount is recorded as a contra-asset account on the balance sheet, reducing the carrying value of the long-term assets.

Relative Significance:

The significance of long-term assets can be assessed by comparing them to other components of the balance sheet. Long-term assets are often compared to liabilities to evaluate a company’s solvency and leverage. Additionally, the ratio of long-term assets to equity can provide insights into a company’s capital structure and financial health.

Disclosure Requirements:

Companies are required to provide detailed disclosures in the footnotes to the financial statements regarding the nature, composition, and significant accounting policies related to their long-term assets. These disclosures help stakeholders understand the specific types of long-term assets held by the company and any relevant valuation or measurement considerations.

Having an accurate portrayal of long-term assets on the balance sheet is crucial for investors, creditors, and other stakeholders when assessing a company’s financial solvency, growth potential, and ability to generate future cash flows.

Now that we understand how long-term assets are reported on a balance sheet, let’s conclude our discussion.

Conclusion

Long-term assets play a vital role in a company’s financial position, growth potential, and long-term sustainability. Understanding the diverse types of long-term assets, their valuation and measurement, and their reporting on the balance sheet is crucial for investors, creditors, and other stakeholders.

Property, plant, and equipment (PP&E) assets, intangible assets, investments, and other long-term assets are all key components that contribute to a company’s value creation and competitive advantage. They represent investments made by the company for long-term growth and profitability.

Depreciation and amortization are important accounting methods that allocate the cost of long-term assets over their useful lives. These methods accurately reflect the decline in value and consumption of these assets over time, providing transparency and accuracy in financial statements.

Proper valuation and reporting of long-term assets on the balance sheet allows stakeholders to assess a company’s financial health, stability, and ability to generate future cash flows. It also provides insights into the company’s investment strategies, diversification, and long-term growth potential.

In conclusion, long-term assets are a crucial aspect of a company’s financial landscape. They provide a foundation for sustainable growth, value creation, and competitive advantage. By understanding the various types of long-term assets, their valuation, measurement, and reporting, investors, creditors, and stakeholders can make informed decisions when evaluating a company’s financial position and future prospects.