Finance

Why Is My FICO Score Not Available

Published: March 6, 2024

Discover why your FICO score may not be available and learn how to improve your finances for a better credit score. Gain insights and tips on managing your financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding one's financial standing is crucial for making informed decisions, and a FICO score plays a pivotal role in assessing an individual's creditworthiness. However, there are instances when individuals encounter challenges in accessing their FICO scores, leading to confusion and frustration. In this article, we will delve into the reasons behind the unavailability of FICO scores and provide actionable steps to address this issue.

A FICO score serves as a numerical representation of an individual's credit risk, influencing their ability to secure loans, obtain favorable interest rates, and even gain approval for rental applications. Given its significance, the unavailability of one's FICO score can be perplexing. Whether you're aiming to monitor your financial progress, prepare for a major purchase, or simply stay informed about your credit standing, the inability to access your FICO score can hinder your financial planning and decision-making process.

This article aims to shed light on the potential reasons behind the unavailability of FICO scores and guide readers on how to navigate this challenge effectively. By understanding the intricacies of FICO scores and the factors that may impact their accessibility, individuals can take proactive measures to obtain their scores and gain valuable insights into their financial health.

Let's embark on a journey to unravel the mysteries surrounding the unavailability of FICO scores and equip ourselves with the knowledge needed to overcome this obstacle. Whether you've encountered this issue firsthand or seek to proactively address potential hurdles in accessing your FICO score, this article will provide valuable insights and actionable solutions to empower you on your financial journey.

Understanding FICO Scores

Before delving into the reasons behind the unavailability of FICO scores, it’s essential to grasp the fundamental aspects of these scores. FICO scores, developed by the Fair Isaac Corporation, are widely used by lenders to assess an individual’s credit risk and determine their creditworthiness. These scores are based on credit reports obtained from major credit bureaus such as Equifax, Experian, and TransUnion, and they provide a numerical representation of an individual’s creditworthiness.

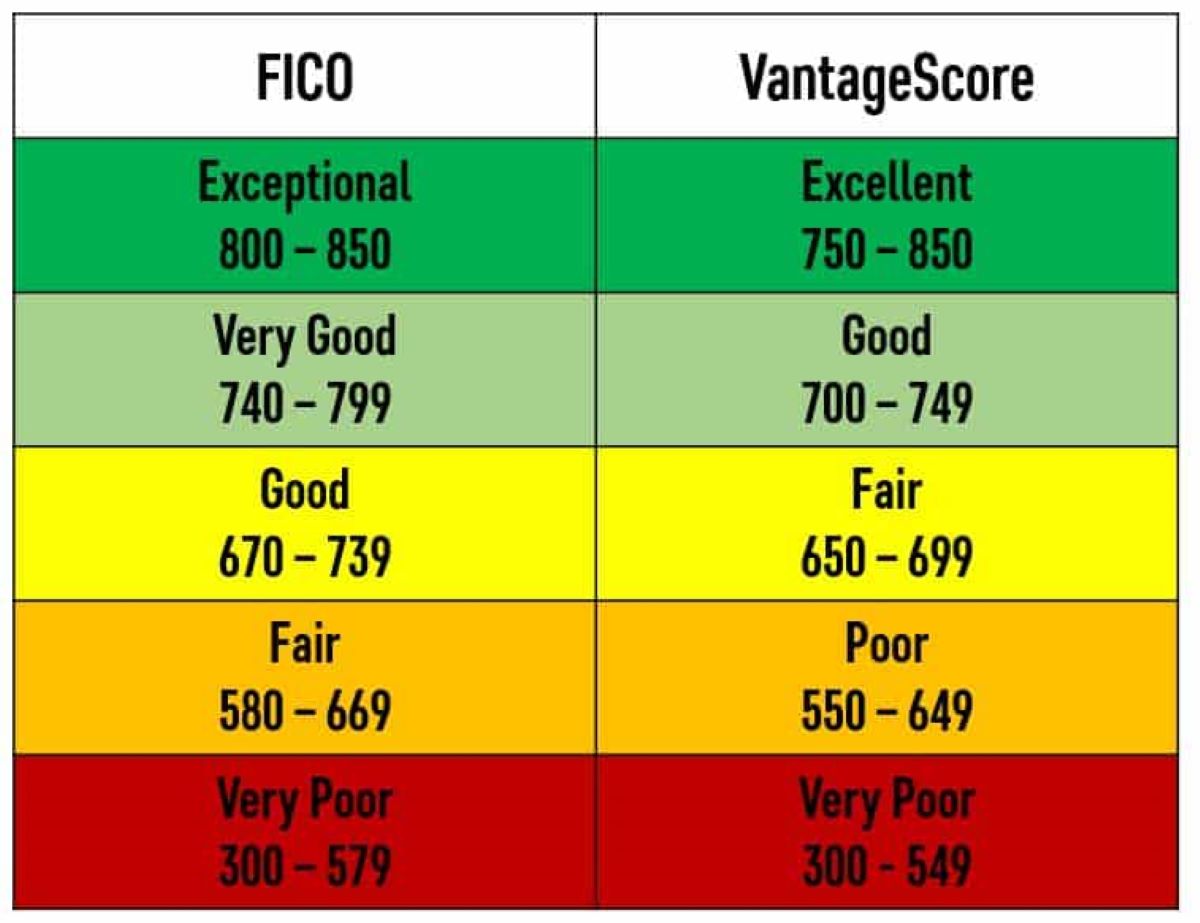

FICO scores typically range from 300 to 850, with higher scores indicating lower credit risk and greater creditworthiness. Lenders use these scores to evaluate the likelihood of a borrower repaying debts responsibly, which influences the terms and conditions offered for loans, credit cards, and other financial products. Understanding the components that contribute to FICO scores is crucial for comprehending their implications and interpreting the factors that may impact their availability.

The key factors that influence FICO scores include:

- Credit Payment History: This encompasses the punctuality of payments, frequency of delinquencies, and any history of bankruptcies or foreclosures.

- Amounts Owed: This factor considers the total debt owed, credit utilization ratios, and the types of accounts with outstanding balances.

- Length of Credit History: The duration of credit accounts and the time since account activity are influential in determining FICO scores.

- New Credit: Opening numerous credit accounts within a short timeframe and the number of recent credit inquiries can impact FICO scores.

- Credit Mix: The diversity of credit accounts, including credit cards, installment loans, mortgages, and other types of credit, contributes to FICO scores.

By comprehending these components, individuals can gain insight into the various aspects of their financial behavior that influence their FICO scores. This understanding is pivotal in navigating the complexities associated with FICO score unavailability and taking proactive measures to address any challenges in accessing this critical financial metric.

Now that we’ve established a foundational understanding of FICO scores, we can explore the potential reasons behind their unavailability and equip ourselves with the knowledge needed to overcome this obstacle.

Reasons for Unavailability

Several factors can contribute to the unavailability of FICO scores, leaving individuals perplexed about their credit standing. Understanding these reasons is crucial for navigating the challenges associated with accessing FICO scores and taking proactive steps to address the underlying issues. Here are some common reasons for the unavailability of FICO scores:

- Insufficient Credit History: Individuals who have limited or no credit history may encounter challenges in obtaining FICO scores. Without a substantial credit history, credit bureaus may struggle to generate a FICO score, leading to its unavailability.

- Identity Verification Issues: In some cases, identity verification issues can hinder the retrieval of FICO scores. This may occur when personal information provided during the score request does not match the information on file with the credit bureaus, leading to authentication hurdles.

- Recent Credit Activity: If an individual has limited recent credit activity, such as no recent loans or credit card accounts, credit bureaus may face difficulty in generating an updated FICO score. A lack of recent credit activity can contribute to the unavailability of FICO scores.

- Errors on Credit Reports: Inaccuracies or discrepancies on credit reports, such as erroneous account information or outdated records, can impact the generation and availability of FICO scores. Resolving these errors is essential for ensuring the accurate calculation and availability of FICO scores.

- Credit Freeze or Lock: Individuals who have placed a credit freeze or lock on their credit reports to prevent unauthorized access may encounter challenges in accessing their FICO scores. These security measures can temporarily restrict access to credit information, leading to score unavailability.

- Unusual Circumstances: Certain unique circumstances, such as identity theft, fraud alerts, or unconventional credit behaviors, can contribute to the unavailability of FICO scores. These atypical situations may necessitate additional steps to verify and retrieve FICO scores.

By recognizing these potential reasons for the unavailability of FICO scores, individuals can gain clarity on the underlying factors impacting their accessibility. Moreover, understanding these reasons empowers individuals to take targeted actions to address specific issues and navigate the process of obtaining their FICO scores effectively.

Now that we’ve explored the reasons behind the unavailability of FICO scores, let’s delve into actionable steps that individuals can take to obtain their FICO scores and overcome these challenges.

Steps to Obtain FICO Score

While encountering the unavailability of a FICO score can be frustrating, there are actionable steps that individuals can take to obtain this critical financial metric and gain valuable insights into their credit standing. By navigating the process of obtaining a FICO score effectively, individuals can proactively address the challenges associated with its unavailability. Here are the essential steps to obtain a FICO score:

- Review Credit Reports: Start by reviewing credit reports from major credit bureaus, including Equifax, Experian, and TransUnion. Ensuring the accuracy of the information on these reports is crucial, as it directly influences the calculation and availability of FICO scores.

- Address Errors or Discrepancies: If any errors or discrepancies are identified on credit reports, take proactive measures to dispute and rectify these inaccuracies. Resolving erroneous information is essential for ensuring the accurate calculation and availability of FICO scores.

- Establish Credit History: For individuals with limited or no credit history, establishing a credit history by opening a secured credit card or becoming an authorized user on a family member’s credit card can help in generating a FICO score.

- Lift Credit Freezes or Locks: If a credit freeze or lock is in place, temporarily lift these security measures to facilitate the retrieval of FICO scores. This may involve contacting the credit bureaus to initiate the temporary removal of freezes or locks.

- Request FICO Score from Lenders: In some cases, lenders may provide access to FICO scores as part of their customer services. Reach out to lenders and inquire about the availability of FICO scores or credit monitoring services that include FICO score access.

- Utilize FICO Score Services: FICO offers direct-to-consumer services that allow individuals to obtain their FICO scores and gain insights into the factors influencing their credit standing. Exploring these services can provide a direct avenue for accessing FICO scores.

- Monitor Credit Activity: Engage in regular monitoring of credit activity to ensure that recent credit behaviors contribute to the generation and availability of updated FICO scores. Responsible credit management can positively impact FICO score availability.

By following these steps, individuals can navigate the process of obtaining their FICO scores and address the challenges associated with their unavailability. Whether it involves rectifying errors on credit reports, establishing a credit history, or leveraging direct-to-consumer FICO score services, proactive measures can empower individuals to gain valuable insights into their creditworthiness.

Now that we’ve outlined the steps to obtain a FICO score, it’s essential to recognize the significance of this financial metric and the impact it holds on individuals’ financial well-being.

Conclusion

In conclusion, the unavailability of FICO scores can present challenges for individuals seeking to gain insights into their credit standing and make informed financial decisions. By understanding the reasons behind this unavailability and taking proactive steps to address the underlying issues, individuals can navigate this obstacle effectively and obtain their FICO scores.

It’s essential to recognize that FICO scores play a pivotal role in influencing lending decisions, interest rates, and various aspects of individuals’ financial lives. Therefore, the unavailability of these scores can hinder individuals’ ability to assess their creditworthiness and plan for major financial endeavors.

Through a comprehensive understanding of the factors that impact FICO score availability, individuals can proactively review their credit reports, address errors, and take measures to establish or maintain a robust credit history. Additionally, leveraging direct-to-consumer FICO score services and engaging in responsible credit management can contribute to the accessibility of updated FICO scores.

By following the actionable steps outlined in this article, individuals can overcome the challenges associated with FICO score unavailability and gain valuable insights into their credit standing. Whether it involves rectifying errors on credit reports, lifting credit freezes, or exploring alternative avenues to obtain FICO scores, proactive measures are instrumental in empowering individuals on their financial journeys.

Ultimately, the knowledge gained from accessing FICO scores enables individuals to make informed financial decisions, improve their credit health, and work towards achieving their long-term financial goals. By embracing the proactive approach outlined in this article, individuals can navigate the complexities of FICO score availability and embark on a path towards financial empowerment and resilience.

As we conclude this exploration of FICO score unavailability, it’s evident that with the right strategies and a proactive mindset, individuals can overcome obstacles and gain access to the critical financial information encapsulated in their FICO scores.