Finance

Why Is My Credit Card Closed

Modified: March 1, 2024

Learn why your credit card was closed and what it means for your finances. Discover the steps you can take to resolve the issue and improve your credit health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Common Reasons for Credit Card Closure

- Inactivity

- Late Payments

- High Credit Utilization

- Fraud or Suspicious Activity

- Breach of Terms and Conditions

- Card Issuer’s Decision

- Impact of Credit Card Closure

- Negative Effects on Credit Score

- Difficulty in Obtaining New Credit

- Steps to Take After a Credit Card Closure

- Review Credit Report for Errors

- Improve Credit Score

- Research and Apply for New Credit Card

- Final Thoughts

Introduction

Having a credit card can be convenient and beneficial for managing your finances. It enables you to make purchases, build credit history, and earn rewards. However, there may come a time when you find yourself asking, “Why is my credit card closed?” Understanding the common reasons behind credit card closures can help you avoid potential pitfalls and maintain a healthy financial profile.

Credit card closure occurs when the issuer decides to terminate your account, rendering it unusable. This can be a frustrating experience, especially if you rely on the card for regular purchases or have a long-standing relationship with the issuer. It’s important to be aware of the factors that can lead to a credit card closure, as well as the implications it can have on your credit score and ability to obtain new credit.

In this article, we will explore the common reasons why credit cards are closed, the impact of closure on your credit score, and the steps you can take after a credit card closure.

Common Reasons for Credit Card Closure

There are several common reasons why credit cards may be closed by the issuer. Understanding these reasons can help you navigate your credit card usage and minimize the risk of account closure. Here are some of the main factors that can lead to a credit card closure:

- Inactivity: If you haven’t used your credit card for an extended period of time, the issuer may choose to close the account. Credit card issuers typically monitor account activity and may consider closing dormant cards to reduce administrative costs.

- Late Payments: Consistently making late payments on your credit card can raise concerns for the issuer. If you fail to make payments on time, your account may be flagged as a risk, leading to potential closure.

- High Credit Utilization: Credit utilization refers to the percentage of your available credit that you are currently using. A high credit utilization ratio can indicate financial instability and may cause the issuer to consider closing your account. It is generally recommended to keep your credit utilization below 30%.

- Fraud or Suspicious Activity: If your credit card is involved in fraudulent transactions or if suspicious activity is detected, the issuer may decide to close the account to protect you and their own interests.

- Breach of Terms and Conditions: Failure to comply with the terms and conditions set forth by the credit card issuer can lead to account closure. This includes activities such as using the card for illegal purposes, exceeding the credit limit, or providing false information on your application.

- Card Issuer’s Decision: In some cases, the credit card issuer may make the decision to close the account for reasons that are specific to their business operations. This could be due to changes in their product offerings, strategic decisions, or other internal factors.

It’s important to keep in mind that credit card closure is at the discretion of the issuer, and they are not obligated to provide detailed reasons for their decision. However, being aware of these common factors can help you be more mindful of your credit card usage and minimize the potential for account closure.

Inactivity

Inactivity is one of the most common reasons why credit cards may be closed by the issuer. If you have a credit card that you haven’t used in a long time, the issuer may choose to close the account due to inactivity.

Credit card issuers often monitor account activity and may decide to close cards that have been dormant for an extended period. The exact timeframe before an account is considered inactive varies between issuers, but it typically ranges from 6 to 12 months of no activity.

There are a few reasons why credit card issuers may choose to close inactive accounts:

- Reduced Administrative Costs: Maintaining active credit card accounts involves various administrative tasks and costs for the issuer. By closing inactive accounts, they can streamline their operations and reduce these expenses.

- Preventing Fraud: Inactive accounts are more vulnerable to fraudulent activity. By closing these accounts, issuers can minimize the risk of unauthorized transactions or identity theft.

- Updating Product Offerings: Credit card issuers may discontinue certain card programs or update their product offerings. In such cases, they may opt to close inactive accounts as part of their overall business strategy.

To prevent your credit card from being closed due to inactivity, it’s important to use your card at least once every few months. Simply making a small purchase and paying it off in full can help keep your account active and ensure that it remains open.

If you have a credit card that you don’t plan to use regularly, assess whether it’s worth keeping. Consider the potential impact on your credit score if the account is closed, as well as any associated fees or rewards tied to the card. Closing the account yourself may be a better option in some cases.

Remember, maintaining an active credit card account can demonstrate responsible credit management and contribute to a healthy credit score. It’s important to stay vigilant with your credit card usage and ensure that your accounts remain active to avoid the risk of closure.

Late Payments

Consistently making late payments on your credit card can have serious consequences, including the potential for account closure. Late payments not only incur fees and interest charges but can also reflect poorly on your creditworthiness and financial responsibility.

When you fail to make at least the minimum payment by the due date, your credit card issuer may consider it as a sign of financial instability or irresponsibility, and this can lead to the closure of your account. Here are some key points to understand about late payments and their impact on your credit card:

- Credit Score Impact: Late payments can have a significant negative impact on your credit score. Payment history is a crucial factor in determining your creditworthiness, and even a single missed payment can lower your score. Multiple late payments can worsen the situation and make it harder to obtain credit in the future.

- Penalties and Fees: Making late payments often results in penalties and fees, including late payment fees and increased interest rates. These additional costs can make it even more challenging to pay off your debt and increase the risk of account closure.

- Communication with the Issuer: If you anticipate that you won’t be able to make a payment on time, it’s essential to communicate with your credit card issuer. They may be willing to work with you to establish a payment plan or offer temporary relief, such as waiving late fees. Ignoring the issue and failing to make any payment can increase the likelihood of account closure.

- Rebuilding Trust: If your account is not closed due to late payments, it’s important to rebuild trust with your credit card issuer. Making timely payments moving forward, avoiding late fees, and consistently paying more than the minimum can demonstrate your commitment to responsible credit management.

If you find yourself struggling to make timely payments, it’s crucial to assess your financial situation and explore strategies to improve your payment habits. This may involve creating a budget, prioritizing your expenses, and seeking professional advice if needed. Taking proactive steps to improve your payment history can help prevent account closure and contribute to a healthier financial future.

Remember, consistent and timely payment of your credit card bills is vital for maintaining a good credit score and a positive relationship with your credit card issuer. Aim to make all payments by the due date to avoid the potential consequences associated with late payments.

High Credit Utilization

Credit utilization, or the ratio of your credit card balance to your credit limit, is an important factor in determining your creditworthiness. If you consistently have a high credit utilization, it can raise concerns for your credit card issuer and potentially lead to account closure.

Here’s what you need to know about high credit utilization and its impact on your credit card:

- Impact on Credit Score: Credit utilization plays a significant role in your credit score calculation. When you have a high credit utilization, it can negatively impact your credit score, as it suggests you may be relying too heavily on your available credit.

- Financial Instability: A high credit utilization ratio can also signal financial instability to your credit card issuer. It may indicate that you are living beyond your means or have a high amount of debt relative to your income. This can raise concerns about your ability to repay your debts, potentially leading to account closure.

- Monitoring Credit Utilization: It’s important to regularly monitor your credit utilization and aim to keep it as low as possible. Generally, it is recommended to keep your credit utilization below 30% of your total available credit. This demonstrates responsible credit management and can help you avoid potential account closure.

- Reducing Credit Utilization: If you find that your credit utilization is consistently high, there are several strategies you can employ to reduce it. These include paying off existing balances, requesting a credit limit increase, and using credit cards sparingly to keep balances low.

- Balancing Multiple Credit Cards: If you have multiple credit cards, spreading your balances across them can help lower individual card utilization and improve your overall credit utilization ratio.

To prevent the risk of account closure due to high credit utilization, it is vital to manage your credit responsibly. This involves monitoring your balances, making payments on time, and keeping your credit utilization relatively low. By maintaining a healthy credit utilization ratio, you not only improve your chances of keeping your credit card account open but also contribute to a positive credit profile.

Remember, your credit card issuer wants to see that you can responsibly manage and repay your debts. By keeping your credit utilization in check, you demonstrate your ability to use credit responsibly and reduce the risk of account closure.

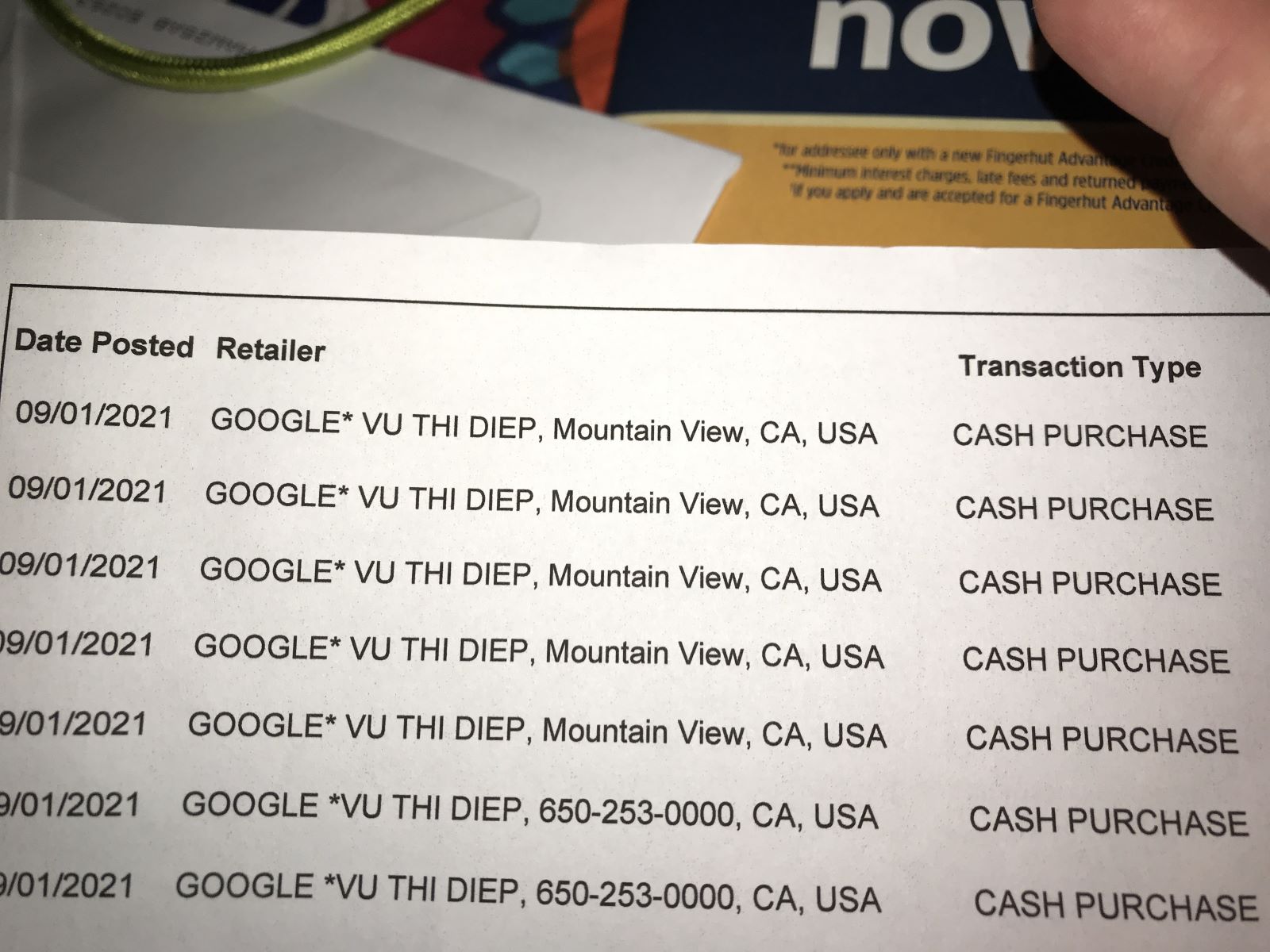

Fraud or Suspicious Activity

Credit card issuers prioritize the security and protection of their customers’ accounts. If your credit card is involved in fraudulent activity or if suspicious transactions are detected, the issuer may choose to close your account to prevent further damage and protect both you and themselves.

Here are some important points to understand about fraud or suspicious activity and its potential impact on your credit card:

- Protecting Your Account: Credit card issuers utilize advanced security measures and monitoring systems to identify fraudulent or suspicious activity. These systems detect unusual spending patterns or transactions that deviate from your typical usage patterns. If they suspect fraudulent activity, they may take immediate action to protect your account.

- Communication with the Issuer: If you notice any unauthorized charges or suspect fraudulent activity on your credit card, it’s crucial to contact your credit card issuer immediately. They will guide you through the process of reporting the fraudulent activity and may close your account temporarily to investigate the issue and prevent further unauthorized use.

- Reopening the Account: If your credit card is closed due to fraud or suspicious activity, you will typically be provided with instructions on how to reopen the account once the investigation is complete. This may involve verifying your identity, reviewing and disputing any fraudulent charges, and following any necessary procedures set by the issuer.

- Preventing Future Fraud: To minimize the risk of fraud on your credit card, it’s important to practice good security habits. This includes safeguarding your credit card information, regularly monitoring your account for any unauthorized transactions, and promptly reporting any suspicious activity to your credit card issuer.

While it can be frustrating to have your account closed due to fraud or suspicious activity, it’s important to remember that the issuer’s primary concern is to protect your account and funds.

By taking proactive steps to protect your credit card information and promptly reporting any suspicious activity, you can minimize the risk of fraud and maintain the security of your credit card account.

Breach of Terms and Conditions

When you open a credit card account, you agree to certain terms and conditions set forth by the card issuer. Failure to adhere to these terms and conditions can result in the closure of your credit card account.

Here are some important points to understand about breach of terms and conditions and its potential impact on your credit card:

- Illegal or Unauthorized Use: Using your credit card for illegal activities or engaging in unauthorized transactions is a clear violation of the terms and conditions. This can include using the card for fraudulent purposes, money laundering, or purchasing illegal substances.

- Exceeding Credit Limit: If you consistently exceed your credit limit or max out your credit card, it can be seen as a breach of the terms and conditions. Credit card issuers typically set credit limits based on your creditworthiness and ability to manage your debt. Going over the limit raises concerns about your financial stability and can result in account closure.

- Providing False Information: Providing false or misleading information when applying for a credit card is considered a breach of the terms and conditions. This can include misrepresenting your income, employment status, or personal details. If the issuer uncovers such discrepancies, they may choose to close your account.

- Defaulting on Payments: Consistently failing to make payments or defaulting on your credit card debt is a serious breach of the terms and conditions. It not only results in fees and penalties but also tarnishes your credit history and decreases your chances of future credit approvals.

It’s crucial to thoroughly review and understand the terms and conditions of your credit card agreement before opening an account. This ensures that you are aware of your responsibilities and obligations as a cardholder.

If you have violated the terms and conditions and your credit card account is closed as a result, it can have significant consequences. It can negatively impact your credit score, make it more difficult to obtain new credit in the future, and damage your relationship with the card issuer.

To avoid breaching the terms and conditions, it’s important to use your credit card responsibly, make payments on time, stay within your credit limit, and provide accurate information during the application process. Adhering to these guidelines can help maintain a positive relationship with your credit card issuer and maximize the benefits of your credit card account.

Card Issuer’s Decision

Sometimes, credit card issuers may decide to close an account for reasons that are specific to their business operations. While these reasons may not be explicitly stated, it is important to understand that the issuer has the authority to make such decisions.

Here are a few factors that may influence the card issuer’s decision to close your credit card account:

- Changes in Product Offerings: Credit card issuers regularly update and modify their product offerings to align with market trends and customer preferences. As a result, they may choose to close accounts linked to older or discontinued credit card programs. This allows them to focus on promoting and maintaining their current product lineup.

- Strategic Business Decisions: The closure of credit card accounts may be part of an issuer’s strategic business plan. They may decide to adjust their target market, refine their risk management practices, or allocate their resources more efficiently. These decisions might impact a subset of customers, leading to account closures.

- Internal Factors: Credit card issuers also consider internal factors such as profitability, risk assessment, and customer retention rates. If your account is deemed unprofitable, presents a high risk, or doesn’t align with the issuer’s customer retention goals, they may choose to close it.

It’s important to note that the card issuer typically provides notice before closing an account. This notice may include information about the closure, the reasons behind the decision, and any necessary steps to transition or close the account.

In the event that your credit card account is closed by the issuer, it is recommended to reach out to them for clarification and further guidance. They can provide you with specific details about the closure and its implications.

While it can be disappointing and inconvenient to have your credit card account closed by the issuer, understanding that it is ultimately their decision can help you navigate the situation more effectively.

If your credit card account is closed, take the opportunity to research and explore other credit card options available in the market. Evaluate the features, rewards, and terms of different cards to find one that aligns with your financial needs.

Impact of Credit Card Closure

When your credit card is closed, it can have various implications on your financial situation and credit profile. Understanding the potential impacts can help you navigate the aftermath of a credit card closure effectively.

- Negative Effects on Credit Score: Credit card closure can have a negative impact on your credit score. The closure itself does not directly lower your score, but it can indirectly affect it in a few ways. Firstly, the closure can impact your credit utilization ratio if you had a balance on the closed card. Additionally, closing a credit card reduces your total available credit, which may raise concerns about your creditworthiness. Lastly, if the closed credit card was one of your oldest accounts, it may shorten your credit history length.

- Difficulty in Obtaining New Credit: A recent credit card closure can make it more challenging to obtain new credit in the short term. Lenders and credit card issuers consider various factors when evaluating credit applications, and a recent closure can raise red flags and impact their decision-making process. It may take time to rebuild your creditworthiness and demonstrate responsible credit management.

- Loss of Benefits and Rewards: Depending on the credit card you had, the closure may result in the loss of specific benefits and rewards associated with the account. This could include cashback, airline miles, or other loyalty perks. Make sure to review the terms and conditions, and any notices provided by the issuer to understand the impact on your rewards and benefits.

While the impact of a credit card closure can be significant, it’s important to remember that it is not permanent, and there are steps you can take to mitigate any negative effects:

- Review Credit Report for Errors: After a credit card closure, it is essential to review your credit report for any errors or inaccuracies associated with the closed account. Dispute any discrepancies and ensure that your credit report reflects accurate information.

- Improve Credit Score: Focus on improving your credit score by practicing responsible credit habits. This includes making timely payments, keeping credit utilization low, and diversifying your credit portfolio.

- Research and Apply for New Credit Card: Once you have taken steps to improve your creditworthiness, research and apply for a new credit card that aligns with your current financial needs and goals.

Remember, while a credit card closure may have temporary setbacks, it is not the end of your financial journey. By actively managing your credit and demonstrating responsible credit behavior, you can rebuild and strengthen your credit profile over time.

Negative Effects on Credit Score

A credit card closure can have a negative impact on your credit score, as it affects several key factors that determine your creditworthiness. It’s important to understand the potential consequences to better manage your credit and financial health.

Here are some ways in which a credit card closure can negatively affect your credit score:

- Credit Utilization Ratio: The closure of a credit card reduces your total available credit, which can increase your credit utilization ratio. This ratio is the percentage of your credit limit that you are currently using. Having a high credit utilization ratio can lower your credit score, as it suggests a higher risk of being overextended on credit.

- Payment History: Closing a credit card may impact your payment history on that account. If the account was in good standing and had a history of on-time payments, its closure could remove the positive payment history associated with it. This could potentially lower your credit score, especially if it was one of your oldest credit accounts.

- Credit Mix: Credit scoring models consider the types of credit accounts you have, including credit cards, loans, and mortgages. Closing a credit card account can reduce the diversity of your credit mix, potentially impacting your credit score. It’s generally beneficial to have a healthy mix of credit types to demonstrate your ability to handle different types of credit responsibly.

- Average Age of Accounts: The closure of a credit card can affect the average age of your credit accounts. If the closed credit card account was one of your oldest accounts, its closure will shorten your credit history length. A shorter credit history can lower your credit score, as lengthier credit history is often seen as more stable and reliable.

It’s important to note that the impact on your credit score will depend on your overall credit history and the specific details of the closure. For individuals with a long and positive credit history, the impact may be minimal. However, for those with a shorter credit history or limited credit accounts, the impact could be more significant.

To minimize the negative effects on your credit score after a credit card closure, consider the following steps:

- Reduce Credit Utilization: If your credit utilization ratio increases due to the closure, focus on paying down other debts and keeping your credit card balances low to mitigate the impact on your score.

- Maintain Timely Payments: Make sure to continue making all your credit card and loan payments on time. A strong payment history remains crucial for your creditworthiness.

- Open New Credit Accounts Wisely: If necessary, consider opening new credit accounts strategically. Be cautious about applying for too many new accounts at once, as each application can result in a hard inquiry on your credit report, which can temporarily lower your credit score.

Remember, while a credit card closure may have a temporary negative impact on your credit score, focusing on responsible credit management and maintaining good financial habits can help you recover and rebuild your credit over time.

Difficulty in Obtaining New Credit

Experiencing a credit card closure can make it more challenging to obtain new credit, at least in the short term. The closure of a credit card account can raise red flags for lenders and credit card issuers, potentially impacting their decision to extend credit to you.

Here’s what you need to know about the potential difficulties in obtaining new credit after a credit card closure:

- Impact on Credit History: Creditors and lenders assess your credit history when evaluating credit applications. The closure of a credit card account, especially if it was closed due to negative factors like late payments or high credit utilization, can raise concerns about your creditworthiness and ability to manage debt responsibly.

- Temporary Lower Credit Score: The closure of a credit card can result in a temporary decrease in your credit score. A lower credit score might affect your eligibility for certain credit products with more stringent credit requirements.

- Increased Risk Perception: A credit card closure can lead to an increased perception of risk by lenders. They might view you as a higher credit risk, particularly if you have a limited credit history or few open accounts. Lenders prefer to extend credit to individuals who have a proven track record of responsible credit management.

- Higher Interest Rates: If you do get approved for new credit after a credit card closure, it’s possible that you may receive higher interest rates. Lenders may view you as a higher-risk borrower, and as a result, they may increase the cost of borrowing by charging higher interest rates.

It’s important to note that while obtaining new credit after a credit card closure might be challenging, it’s not impossible. There are several steps you can take to improve your chances:

- Improve Your Credit Score: Focus on improving your credit score by making timely payments on all your remaining credit accounts, reducing credit utilization, and maintaining a healthy credit mix. Gradually, these positive credit habits can help rebuild your creditworthiness.

- Build a Positive Credit History: If you have limited credit history, consider establishing a positive track record by opening a new credit account, such as a secured credit card or a credit-builder loan. Showing responsible credit behavior over time can help demonstrate your creditworthiness to potential lenders.

- Apply for Credit Wisely: Be selective in your credit applications and avoid applying for multiple credit products simultaneously. Each credit application can result in a hard inquiry on your credit report, which can lower your credit score temporarily.

- Consider Alternative Credit Options: If you’re having difficulty obtaining traditional credit products, explore alternative credit options like credit unions or community banks that might have more flexible lending criteria.

Remember, although a credit card closure can make it more difficult to obtain new credit in the short term, focusing on improving your credit score, establishing a positive credit history, and being strategic in your credit applications can help you gradually regain access to credit in the future.

Steps to Take After a Credit Card Closure

Experiencing a credit card closure can be a disconcerting experience, but there are steps you can take to navigate the situation and minimize any negative impacts. Here are some important steps to consider after a credit card closure:

- Review Your Credit Report: Obtain a copy of your credit report from all major credit bureaus to ensure that the closure has been accurately reflected. Check for any errors or discrepancies and dispute them if necessary.

- Assess the Impact: Understand the potential implications of the credit card closure on your credit score and overall financial well-being. Evaluate factors such as credit utilization, length of credit history, and available credit.

- Strengthen Your Credit Score: Focus on improving your credit score by practicing responsible credit habits. Make payments on time, reduce credit utilization, and diversify your credit mix. Positive credit behavior can help offset the negative effects of the closure and rebuild your creditworthiness.

- Research New Credit Options: Explore alternative credit options and research new credit card products that may be a good fit for your needs. Look for cards with favorable terms, rewards, and benefits. Be cautious about applying for too many new accounts at once to avoid potential negative impacts on your credit score.

- Apply for a New Credit Card: Once you have explored your options and identified a suitable credit card, submit your application. Be prepared to provide accurate and updated information about your financial situation.

- Monitor Your Credit: Stay vigilant about monitoring your credit activity. Regularly review your credit reports, keep track of your credit scores, and set up alerts to notify you of any suspicious or unauthorized activity.

- Manage Existing Credit: Pay close attention to your remaining credit accounts. Make timely payments, keep balances low, and maintain a good payment history. This will demonstrate your ability to manage credit responsibly and can help rebuild trust with lenders.

- Stay Informed: Keep abreast of changes in your credit card issuer’s policies and terms and conditions. Be proactive in understanding your rights and responsibilities as a consumer.

Remember, the closure of a credit card account is not the end of your financial journey. By taking these steps, you can work towards rebuilding your credit, seeking new credit opportunities, and maintaining a healthy financial profile.

Review Credit Report for Errors

After experiencing a credit card closure, it’s important to review your credit report for any errors or discrepancies that may have occurred as a result of the closure. This step is crucial to ensure the accuracy of your credit information and to mitigate any potential negative impacts on your creditworthiness.

Here are some key points to consider when reviewing your credit report after a credit card closure:

- Obtain Your Credit Report: Request a copy of your credit report from all major credit bureaus – Equifax, Experian, and TransUnion. Under federal law, you are entitled to one free credit report from each bureau per year.

- Check for Closure Status: Verify that the closure of your credit card account is accurately reflected on your credit report. Look for the notation indicating that the account was closed and when it was closed.

- Look for Errors: Carefully review all the information on your credit report related to the closed account. Check for any inaccuracies, such as incorrect payment history, credit limits, or balance information. Incorrect information can impact your credit score and overall creditworthiness.

- Dispute Errors: If you identify any errors or discrepancies on your credit report, file a dispute with the appropriate credit bureau. Provide documentation or evidence to support your dispute and request that the errors be corrected or removed from your credit report.

- Monitor Updates: After filing a dispute, monitor your credit report to ensure that the errors are corrected. Credit bureaus have 30 to 45 days to investigate and respond to your dispute, and they will notify you of any changes made to your credit report.

- Request for a Revised Report: Once the errors have been corrected, request an updated copy of your credit report to ensure that the changes have been properly reflected.

Reviewing your credit report and disputing any errors or inaccuracies can help ensure that your credit information is up to date and accurately reflects your creditworthiness. By addressing and rectifying any mistakes, you can maintain a more accurate credit profile and potentially mitigate any negative impacts resulting from the credit card closure.

Remember to regularly monitor your credit reports going forward to stay informed about any changes or updates. This will allow you to promptly address any potential issues and maintain the accuracy and integrity of your credit information.

Improve Credit Score

After a credit card closure, it’s important to focus on improving your credit score. A higher credit score not only demonstrates your creditworthiness but also increases your chances of obtaining future credit on favorable terms. Here are some steps you can take to improve your credit score:

- Make Timely Payments: Consistently making on-time payments is one of the most significant factors in determining your credit score. Set up reminders or automatic payments to ensure you never miss a payment. Paying your bills on time shows lenders that you are responsible and reliable.

- Reduce Credit Utilization: Keep your credit card balances low and aim to keep your credit utilization ratio below 30%. A high credit utilization ratio can negatively impact your credit score. Paying off balances and using your credit cards sparingly can help lower your utilization rate.

- Pay Off Debt: If you have outstanding debt, develop a plan to pay it off strategically. Make larger payments towards debts with higher interest rates or focus on paying off smaller debts first (the “snowball” method) to build momentum and free up more cash to tackle larger debts.

- Diversify Your Credit Mix: Having a mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. If you don’t have a diverse credit mix, consider opening a new credit account responsibly to demonstrate your ability to handle different types of credit.

- Maintain Old Accounts: Consider keeping old credit card accounts open, even if they have a zero balance, to maintain a longer credit history. The length of your credit history affects your credit score, and older accounts show a longer track record of responsible credit management.

- Avoid Opening Multiple Accounts: While it’s important to have a diverse credit mix, avoid opening several new credit accounts within a short time period. Each application results in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Regularly Monitor Your Credit: Stay vigilant by monitoring your credit reports and credit scores regularly. Check for any errors or fraudulent activity and address them promptly. Monitoring your credit allows you to be proactive in maintaining your credit health.

- Be Patient: Improving your credit score takes time and consistency. Focus on practicing responsible credit habits and avoid quick-fix schemes that promise instant results. Over time, your credit score will improve as you demonstrate responsible credit behavior.

It’s important to note that improving your credit score is a gradual process. It requires discipline, patience, and responsible credit management. By implementing these strategies consistently, you will see positive changes in your credit score over time.

Remember, a higher credit score not only opens up more credit opportunities but can also lead to better interest rates and terms, ultimately saving you money in the long run.

Research and Apply for New Credit Card

After experiencing a credit card closure, it may be necessary to research and apply for a new credit card. Finding the right credit card can help you rebuild your credit, access credit benefits, and continue managing your finances effectively. Here’s how you can approach this process:

- Evaluate Your Needs: Consider your financial goals and needs when looking for a new credit card. Determine if you need a card for everyday purchases, travel rewards, balance transfers, or building credit. Understanding your needs will help you narrow down your options and find a card that aligns with your requirements.

- Review Credit Card Terms: Carefully review the terms and conditions of each credit card you are considering. Pay attention to interest rates, annual fees, rewards programs, and any other fees or benefits associated with the card. Make sure they are favorable and tailored to your financial situation.

- Compare Different Cards: Research and compare different credit cards from various issuers. Look for cards that offer competitive interest rates, rewards programs that align with your spending habits, and additional features that may be beneficial to you, such as purchase protection or travel benefits.

- Consider Your Credit Profile: Be mindful of your current credit situation when applying for a new credit card. If your credit score has been impacted by the closure, you may need to look for cards that cater to individuals with fair or average credit. Applying for cards aligned with your credit profile increases the likelihood of approval.

- Submit Applications Strategically: Avoid applying for multiple credit cards at once, as each application results in a hard inquiry on your credit report. Too many inquiries within a short period may negatively impact your credit score. Instead, spread out your applications and focus on the cards with the best fit for your needs.

- Provide Accurate Information: When completing your credit card applications, make sure to provide accurate and up-to-date information about your financial situation. This includes your income, employment status, and any outstanding debts. Being truthful and accurate helps build trust with the credit card issuer.

- Manage New Credit Responsibly: Once you are approved for a new credit card, use it responsibly. Make timely payments, keep balances low, and stay within your credit limit. Responsible credit card management will not only improve your credit score but also set you up for future financial success.

Remember, applying for a new credit card is an opportunity to start fresh and rebuild your credit. Take the time to research and choose a card that fits your financial goals and credit profile. By using your new credit card responsibly, you can continue to improve your creditworthiness and financial well-being.

Final Thoughts

Experiencing a credit card closure can be an unsettling event, but it’s essential to approach it with a proactive mindset and take steps to navigate the situation effectively. Although the closure may have temporary setbacks, it doesn’t have to define your financial future. Here are some key takeaways to keep in mind:

- Understand the Reasons: Familiarize yourself with the common reasons for credit card closure to help you avoid potential pitfalls and maintain a healthy financial profile. This knowledge can guide your credit card usage and reduce the risk of account closure.

- Mitigate Negative Effects: Recognize the potential negative impacts a credit card closure can have on your credit score and ability to obtain new credit. Take proactive steps to review your credit report, dispute any errors, and focus on improving your credit score.

- Learn from the Experience: Use the credit card closure as an opportunity to reassess your credit habits and improve your financial management skills. Analyze the factors that contributed to the closure and incorporate better financial practices moving forward.

- Rebuild Trust: Demonstrate responsible credit behavior to rebuild trust with lenders and creditors. Make timely payments, keep balances low, and diversify your credit mix. These actions will contribute to a positive credit profile and increase your eligibility for credit in the future.

- Research and Apply Wisely: Before applying for a new credit card, thoroughly research your options, compare terms and benefits, and consider your credit profile. Apply for cards strategically to minimize the impact on your credit score and maximize approval chances.

- Monitor Your Credit: Stay vigilant about monitoring your credit reports and credit scores regularly. This will allow you to detect and resolve any errors or unauthorized activities promptly, ensuring the accuracy and security of your credit information.

Remember that a credit card closure is just one hurdle in your financial journey. By being proactive, responsible, and taking steps to improve your creditworthiness, you can overcome the challenges and build a stronger financial future. Learn from the experience, adapt your credit management habits, and work towards a healthy credit profile. With time and perseverance, you can regain financial stability and achieve your financial goals.