Finance

Why Can’t I Use PayPal Credit

Published: January 7, 2024

Discover why you can't use PayPal Credit and explore alternative finance options for your needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

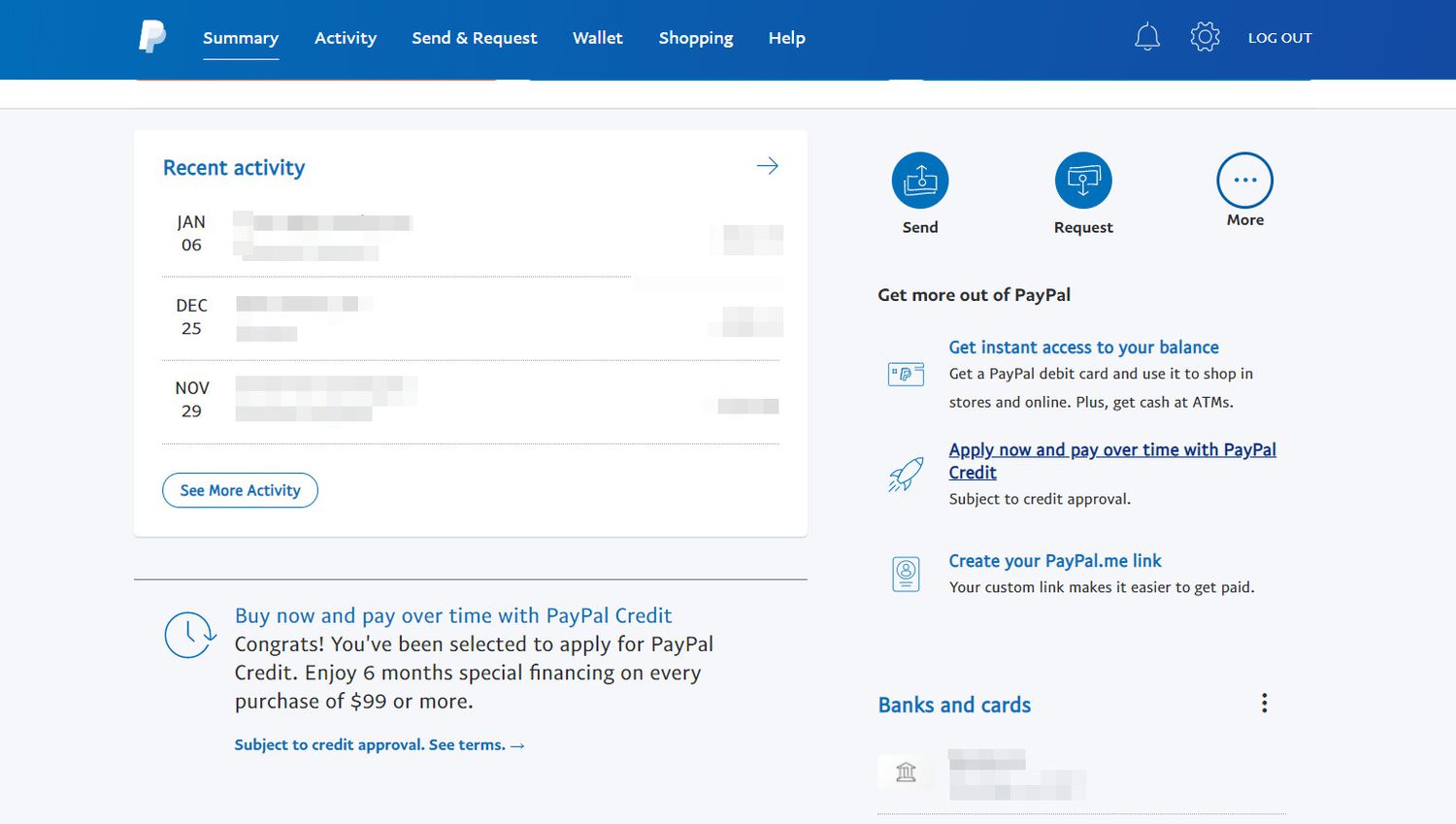

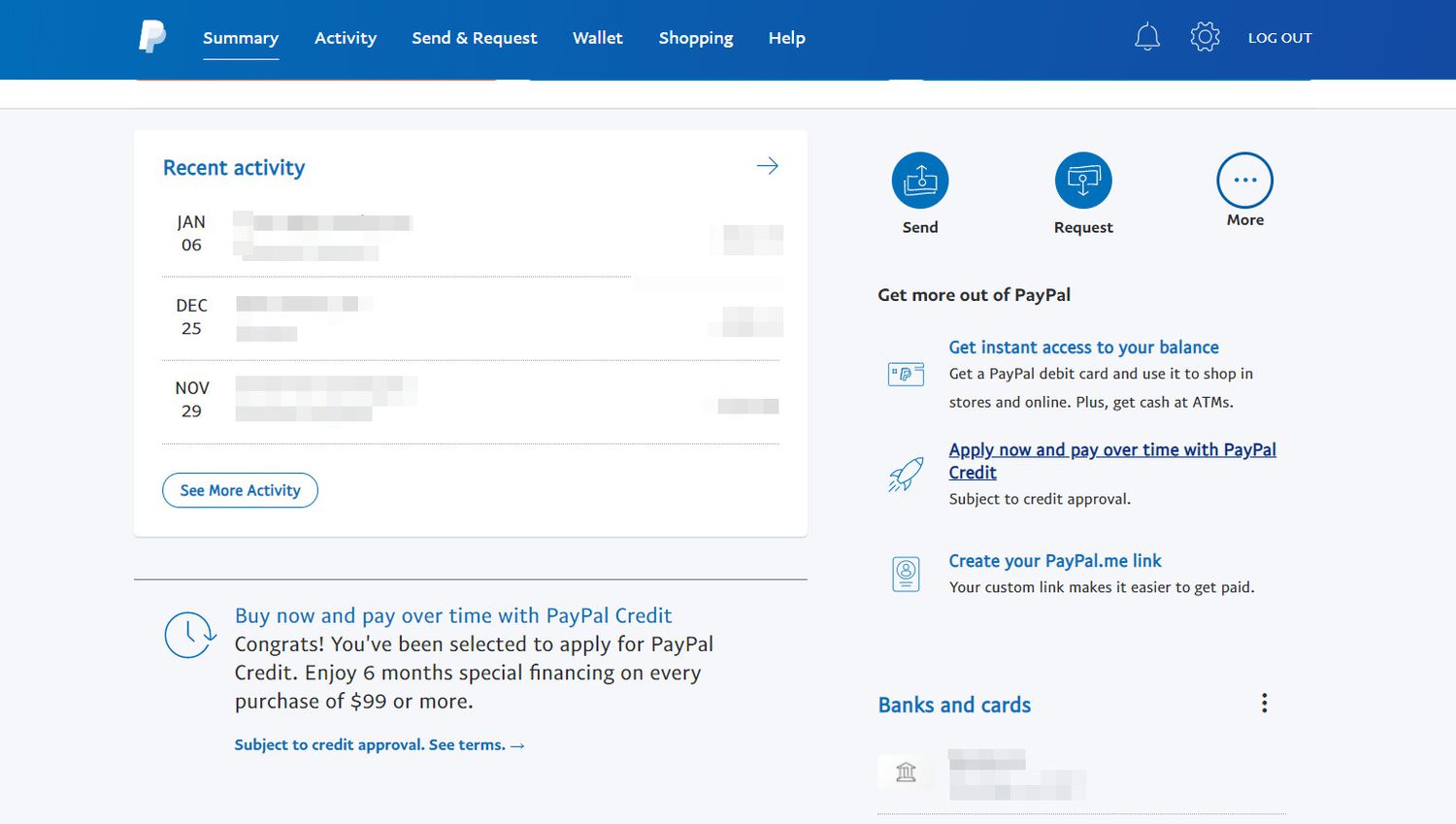

PayPal Credit is a popular payment option offered by PayPal, a leading online payment platform. It allows users to make purchases and pay for them over time. While many people have been able to take advantage of this convenient financing option, some individuals may find themselves questioning why they are unable to use PayPal Credit. In this article, we will dive into the reasons behind the limited availability of PayPal Credit and explore alternative payment options.

PayPal Credit offers a line of credit that can be used to make purchases on participating websites. It provides customers with the flexibility to pay off their purchases in full within a specified period or to make smaller, affordable monthly payments. This financing option can be especially beneficial for big-ticket purchases or unexpected expenses that may strain a person’s bank account.

However, not everyone is eligible to use PayPal Credit, and the reasons behind this limitation can vary. Understanding the factors that influence the availability of PayPal Credit can help individuals make informed decisions and explore alternative payment methods that suit their needs.

So, why can’t you use PayPal Credit? The answer lies in several possible factors, including your credit history, PayPal account status, and the policies of the merchant you are trying to make a purchase from. Let’s take a closer look at these reasons and explore alternative payment options for those who are unable to utilize PayPal Credit.

Understanding PayPal Credit

PayPal Credit is a digital credit line that allows users to make purchases online and pay for them over time. It provides a flexible financing option that can be particularly useful for individuals who prefer to spread out the cost of their purchases. Here’s how PayPal Credit works:

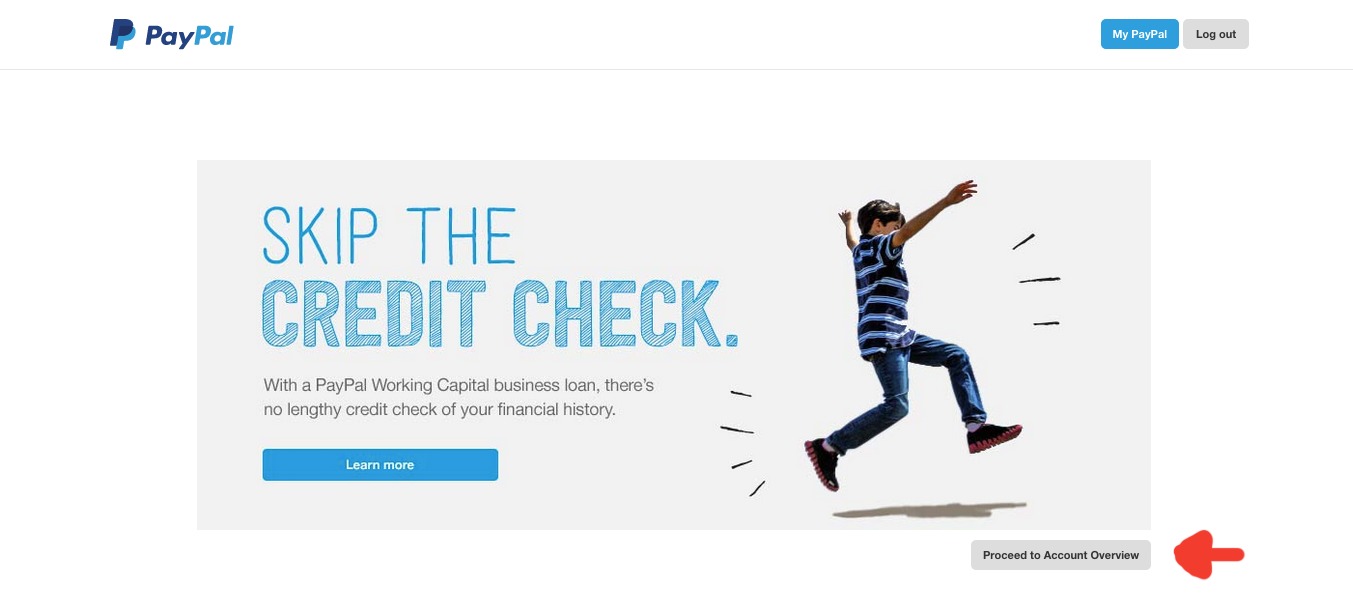

- Application Process: To start using PayPal Credit, you need to apply and get approval from PayPal. The application process typically involves providing personal information and undergoing a credit check. Once approved, you can start using PayPal Credit for eligible purchases.

- Credit Line: PayPal Credit assigns you a credit line, which is the maximum amount you can spend using this financing option. The credit line is based on your creditworthiness and payment history.

- Purchase Flexibility: With PayPal Credit, you have the flexibility to choose how you want to pay for your purchases. You can pay in full within the agreed-upon interest-free period (typically 6-12 months) or make minimum monthly payments. Keep in mind that paying in full within the promotional period helps you avoid paying interest.

- Interest Rates and Fees: If you do not pay in full within the promotional period, PayPal Credit charges interest on the remaining balance. The interest rate varies based on your creditworthiness. It’s important to carefully read and understand the terms and conditions to avoid any surprises.

- PayPal Integration: PayPal Credit seamlessly integrates with the PayPal payment platform, allowing users to select it as a payment option during checkout. This makes it convenient to use PayPal Credit for a wide range of online purchases.

It’s worth noting that while PayPal Credit offers a convenient financing option, it may not be available to everyone. The eligibility criteria for PayPal Credit can be influenced by various factors, including credit history, income, and previous PayPal account activity. Additionally, PayPal Credit availability can also vary by country and merchant.

Now that we have a better understanding of how PayPal Credit works, let’s explore the reasons why some individuals may be unable to use this financing option.

Reasons for Limited Availability

While PayPal Credit is a convenient financing option for many, it may not be available to everyone. Several factors can contribute to the limited availability of PayPal Credit. Here are some common reasons why individuals may be unable to use PayPal Credit:

- Creditworthiness: Like any other credit-based service, PayPal Credit considers your creditworthiness when determining your eligibility. If you have a poor credit history or a low credit score, you may not qualify for PayPal Credit. This is because PayPal wants to ensure that borrowers have a high likelihood of repaying their debts.

- Payment History: PayPal also takes into account your payment history with other credit accounts when assessing your eligibility for PayPal Credit. If you have a history of late payments, defaults, or other negative financial behavior, it may impact your chances of being approved for PayPal Credit.

- Income Verification: In some cases, PayPal may require individuals to provide proof of income to ensure that they have the financial means to make payments on their purchases. If you are unable to provide the necessary income verification or if your income is below a certain threshold, you may not be eligible for PayPal Credit.

- Merchant Participation: While PayPal Credit is accepted by many merchants, it is not universally available. Some merchants may choose not to offer PayPal Credit as a payment option on their websites. If you are trying to make a purchase from a merchant that does not support PayPal Credit, you won’t be able to use it for that specific transaction.

- Geographical Restrictions: PayPal Credit availability may also be limited based on your geographical location. The availability of PayPal Credit may vary by country, and certain territories may not have access to this financing option.

It’s essential to keep in mind that the specific reasons for limited availability may vary from person to person. PayPal uses a combination of factors to evaluate each individual’s eligibility for PayPal Credit, and their criteria may change over time.

If you find yourself unable to use PayPal Credit, don’t worry! There are alternative payment options you can explore. Let’s take a look at some popular alternatives in the next section.

Alternative Payment Options

If you are unable to use PayPal Credit, there are several alternative payment options available that can still provide convenience and flexibility. Here are some popular alternatives to consider:

- Credit Cards: Traditional credit cards offer a similar financing option to PayPal Credit. By using a credit card, you can make purchases and have the flexibility to pay off the balance over time. It’s important to find a credit card that suits your needs, offers favorable interest rates, and provides rewards or cashback programs.

- Debit Cards: Debit cards allow you to make purchases using funds available in your bank account. While they don’t offer the same financing capabilities as credit cards or PayPal Credit, they provide a convenient and secure way to make payments without incurring debt.

- Installment Plans: Some merchants offer their own installment plans, allowing you to break down your purchase into smaller, more manageable payments. These plans may come with interest or financing charges, so it’s important to review the terms before committing.

- Buy Now, Pay Later Services: Buy now, pay later (BNPL) services have gained popularity in recent years. These services, like Klarna or Afterpay, allow you to make purchases and pay them off in installments without interest fees, as long as you make timely payments. BNPL services often integrate seamlessly with online retailers.

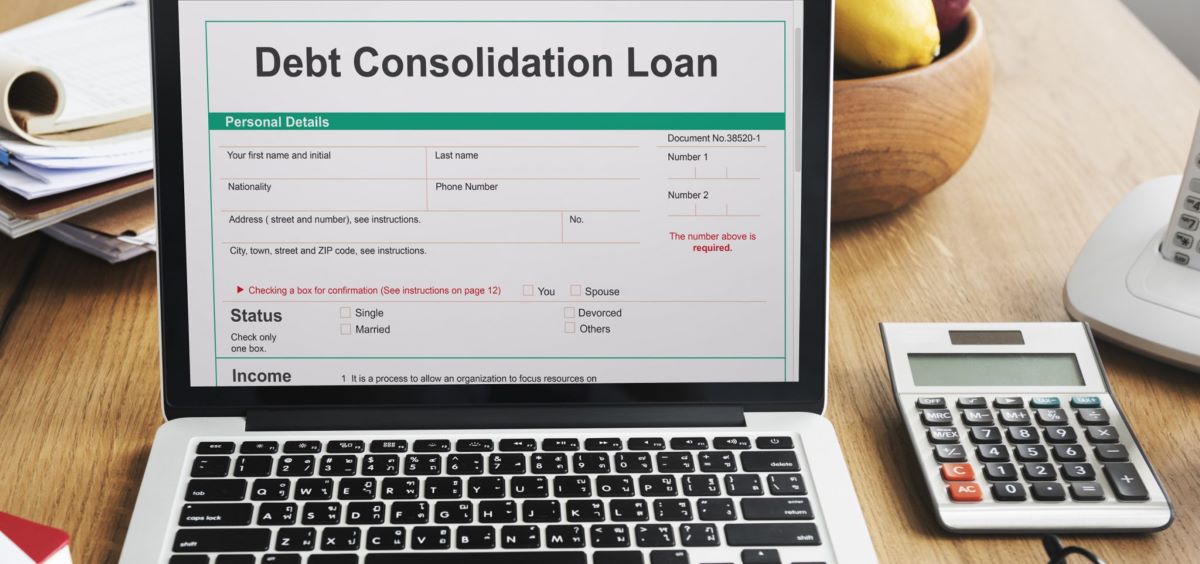

- Traditional Financing: If you’re making a significant purchase, such as a car or home appliance, you may want to consider traditional financing options like personal loans or lines of credit offered by banks or credit unions. These options typically come with specific terms and interest rates, so be sure to compare different lenders and choose the one that best suits your needs.

Remember to consider factors such as interest rates, repayment terms, and your financial situation before choosing an alternative payment option. It’s also important to review and understand the terms and conditions of each option to avoid any unexpected fees or charges.

While PayPal Credit may not be available to everyone, there are several alternative payment methods that can provide similar benefits and convenience. Evaluate your options and choose the one that aligns with your financial goals and preferences.

Conclusion

In conclusion, PayPal Credit is a popular financing option that allows users to make purchases and pay for them over time. However, its availability is limited for various reasons. Factors such as creditworthiness, payment history, income verification, merchant participation, and geographical restrictions can influence eligibility for PayPal Credit.

If you find yourself unable to use PayPal Credit, there are alternative payment options to consider. Credit cards, debit cards, installment plans, buy now pay later services, and traditional financing options provide flexibility and convenience for making purchases.

It’s important to weigh the pros and cons of each alternative payment option and choose the one that aligns with your financial situation and preferences. Consider factors such as interest rates, repayment terms, and fees to make an informed decision.

While PayPal Credit may not be accessible to everyone, it’s crucial to remember that financial circumstances can change. Improving your credit score, maintaining good payment history, and managing your finances responsibly can increase your chances of eligibility for PayPal Credit in the future.

In summary, whether you can or can’t use PayPal Credit, there are alternative payment options available that can help you make purchases and manage your finances effectively. Explore the options, make informed decisions, and enjoy the convenience and flexibility of online shopping with the payment method that best suits your needs.