Home>Finance>Why Is QuickBooks Online Telling Me I Have A Grace Period?

Finance

Why Is QuickBooks Online Telling Me I Have A Grace Period?

Published: February 19, 2024

Discover why QuickBooks Online may be indicating a grace period for your finances and how to address this issue effectively. Manage your finances with confidence.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

As a small business owner or finance professional, you rely on QuickBooks Online to keep your financial records in order. However, encountering a "grace period" notification in QuickBooks Online can be perplexing and even concerning. Understanding the implications of this notification and how to address it is crucial for maintaining the financial health of your business.

In this comprehensive guide, we will delve into the concept of grace periods in QuickBooks Online, elucidate the common reasons behind these notifications, and provide practical steps to resolve them. By the end of this article, you will have a clear understanding of why QuickBooks Online may be indicating a grace period and how to navigate this situation effectively.

Whether you're a seasoned QuickBooks user or a newcomer to the platform, this guide will equip you with the knowledge and strategies to manage grace period notifications with confidence. Let's embark on this enlightening journey to demystify grace periods in QuickBooks Online and empower you to take control of your financial management.

Understanding Grace Periods in QuickBooks Online

When QuickBooks Online notifies you about a grace period, it is alerting you to a potential issue with your account. A grace period typically refers to the period after a subscription payment is due but before it is considered late. During this time, you may still have access to certain features and functionalities within QuickBooks Online, despite the overdue payment. It serves as a buffer period to give you an opportunity to rectify the payment status without immediate disruption to your account.

It’s important to recognize that while in a grace period, there may be limitations on the services available to you, and it’s essential to address the outstanding payment promptly to avoid any disruptions to your workflow. Understanding the nature of grace periods and their implications is fundamental to maintaining the seamless operation of your financial management through QuickBooks Online.

Grace periods can vary based on the specific terms of your subscription and the policies of QuickBooks Online. Familiarizing yourself with the duration and conditions of the grace period associated with your account is essential for proactive account management.

Now that we’ve established the fundamental concept of grace periods in QuickBooks Online, let’s explore the common reasons why you may encounter these notifications and gain insights into how to navigate them effectively.

Common Reasons for Grace Periods

Several factors can lead to QuickBooks Online displaying a grace period notification. Understanding these common reasons can help you pinpoint the underlying issue and take appropriate action to resolve it.

- Payment Processing Delays: One of the primary reasons for a grace period notification is a delay in processing your subscription payment. This can occur due to various factors, such as insufficient funds, payment gateway issues, or outdated payment information. It’s essential to review your payment details and address any discrepancies promptly to ensure seamless continuation of your QuickBooks Online services.

- Expired Payment Method: If the credit card or payment method linked to your QuickBooks Online account has expired, it can trigger a grace period notification. Updating your payment information with valid and current details is crucial to avoid interruptions in service and resolve the grace period status.

- Renewal Reminder: Sometimes, a grace period notification may simply serve as a reminder that your subscription is up for renewal. While not necessarily indicative of a payment issue, it prompts you to review and confirm the renewal of your QuickBooks Online subscription to maintain uninterrupted access to essential features.

By identifying the specific reason behind the grace period notification, you can take targeted steps to rectify the situation and prevent any disruption to your financial management workflow. Now, let’s delve into actionable strategies for resolving grace period notifications in QuickBooks Online.

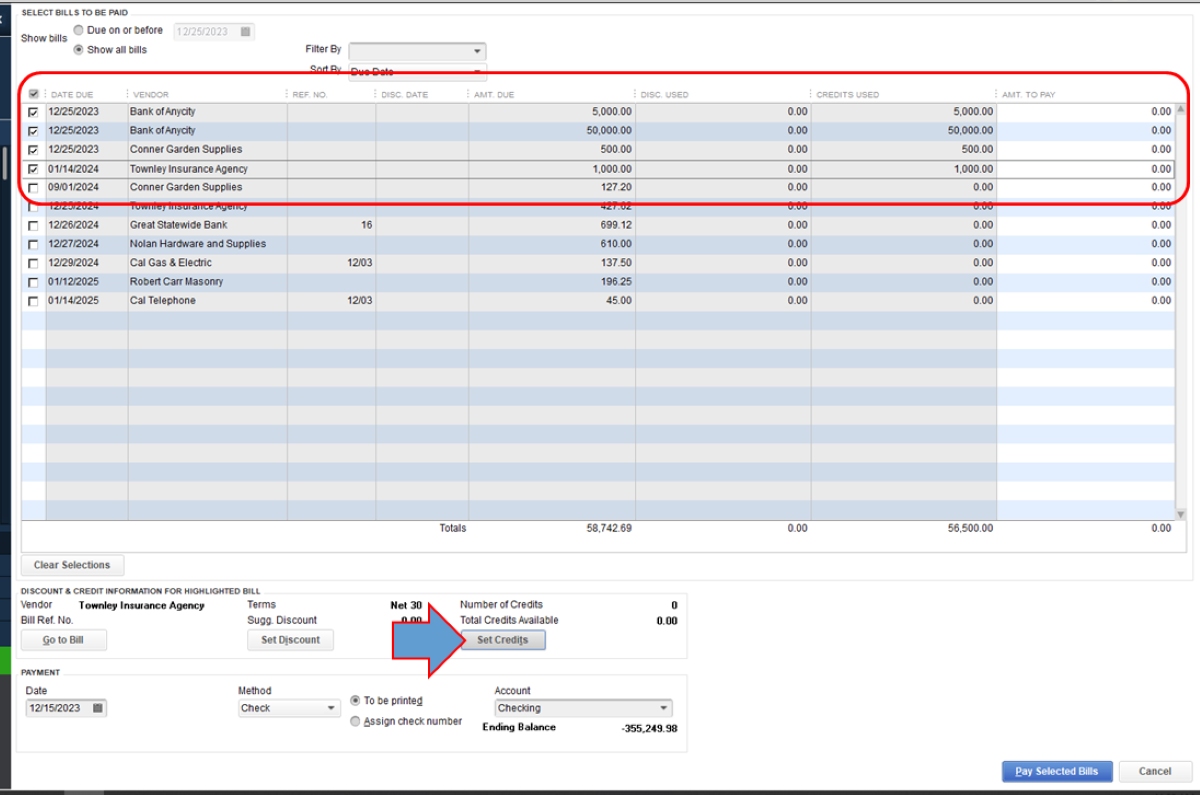

How to Resolve Grace Period Notifications

Resolving grace period notifications in QuickBooks Online involves a systematic approach to address the underlying issues and restore the normal status of your account. Here are actionable steps to navigate and resolve grace period notifications effectively:

- Review Payment Details: Start by reviewing the payment details associated with your QuickBooks Online subscription. Ensure that the payment method on file is valid, up to date, and has sufficient funds to cover the subscription fee.

- Update Payment Information: If you discover that your payment method has expired or requires updating, take prompt action to update the payment information within your QuickBooks Online account. This may involve adding a new credit card or updating the existing payment details to enable seamless processing of future subscription payments.

- Contact Customer Support: If you encounter difficulties resolving the grace period status on your own, don’t hesitate to reach out to QuickBooks Online customer support for assistance. They can provide guidance, troubleshoot payment issues, and offer tailored solutions to help you resolve the grace period notification swiftly.

- Confirm Subscription Renewal: If the grace period notification is related to a pending subscription renewal, review the renewal terms and confirm the continuation of your subscription to prevent any disruptions in service.

- Monitor Payment Status: After taking the necessary steps to address the grace period notification, monitor the payment status within your QuickBooks Online account. Ensure that any updates to payment information or renewal confirmations are reflected accurately to eliminate the grace period status.

By following these proactive measures, you can effectively resolve grace period notifications in QuickBooks Online and maintain uninterrupted access to the robust financial management tools and features offered by the platform.

Conclusion

In conclusion, understanding and addressing grace period notifications in QuickBooks Online is essential for maintaining the seamless operation of your financial management processes. By comprehending the nature of grace periods, identifying common reasons for these notifications, and following actionable steps to resolve them, you can ensure uninterrupted access to the powerful tools and resources provided by QuickBooks Online.

It’s crucial to proactively manage your payment details, stay informed about subscription renewals, and promptly address any issues that may lead to grace period notifications. By doing so, you can mitigate the risk of service disruptions and maintain a streamlined approach to managing your business finances through QuickBooks Online.

Remember, grace periods are designed to provide a temporary buffer for resolving payment-related issues, but it’s in your best interest to address them expediently to avoid any impact on your financial workflows and reporting.

As you navigate the realm of QuickBooks Online and encounter grace period notifications, approach them with confidence, armed with the knowledge and strategies outlined in this guide. By staying proactive and vigilant in managing your account, you can harness the full potential of QuickBooks Online to drive the financial success of your business.

Embrace the empowerment that comes with understanding and effectively resolving grace period notifications, and let QuickBooks Online serve as your steadfast ally in achieving financial clarity and efficiency.