Finance

What Is Digital Finance & How Does It Work?

Modified: September 6, 2023

Discover how digital finance takes advantage of technology to expand financial services to crucial sectors in society. Learn how it helps alleviate poverty.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Digital finance is the access and usage of formal financial services by excluded populations. Such services should cater to customers’ needs. It should also be affordable to customers and sustainable for providers. But expanding access to finance remains a challenge.

In developing countries, for instance, 2.5 billion people lack access to formal financial services. This lack of access to financing needs also applies to over 200 million small businesses. But now, the digitization of business is changing existing industries and creating new ones.

The use of digital finance is extending beyond the usual financial services. This can also be a powerful tool and engine for job creation. Moreover, the digitization helps amplifies business issues and shifts value propositions within and across industries. Thus, find out how digital finance is changing the nature and conduct of industries today.

Photo by Dominic Smith on Flickr

The Importance Of Digital Finance

Digital finance gives civilians and companies access to payments, savings, and credit products without ever stepping into a bank branch. This is possible through digitization. It can turn a smartphone into a wallet, a checkbook, a bank branch, and even an accounting ledger. The advances in technology help solve some of the key challenges of achieving full financial inclusion.

Modern technology is now accelerating innovation and changing the financial services industry. It does this by forcing traditional business models to adapt and transform. This benefits marginalized communities. To illustrate, examples of technology trends include artificial intelligence, automation, big data, distributed ledger technology, and machine learning.

Digital Finance For Individuals

It lowers the cost of providing financial services. For example, digital accounts can be 90% cheaper than the usual ones for banks and other providers to maintain. They even cost as little as $10 per customer. This makes it profitable to provide accounts for lower-income people. The long-held goal of financial inclusion is for individuals.

Photo by rupixen.com on Unsplash

Digital Finance For Small Businesses

The digitization of finance also has an important role to play for small businesses. It not only gives them access to financing but also gives them access to electronic payment systems. It secures financial products and gives a chance to build a financial history.

Key Elements Of Digital Finance

There are three major elements of any digital financial service:

- A digital transactional platform enables customers to use a device to make or receive payments. They can also store electronic value with a bank or nonbank.

- Retail agents that have a digital device can send and receive transaction details. They may also perform other tasks depending on regulations and arrangements with the institution.

- The digital device of the customer serves as a means of transmitting data and information.

An example of Digital Finance is Enterprise Resource Planning (ERP). ERP is the integrated management of business processes. It is often in real-time and mediated by software.

Risks Associated With Digital Finance

Even though the digitization of the financial industry is increasing, there are still corresponding risks that require attention.

New Providers

New institutional types are rapidly increasing in number and potentially expanding. They rely on other financial and non-financial firms for important aspects of their business. As a result, partnerships with multiple providers in the digital delivery of financial services pose risks. First is the lack of transparency, including vis-à-vis treatment of consumers.

Photo by Austin Distel on Unsplash

Such partnerships may create gaps in oversight by the primary provider and other third parties. Data privacy and security may also be an issue. Because the higher the complexity of a partnership, the more there is to be concerned about in terms of supervision and different consumer protection rules.

Use Of Agents

Agents serve as a primary connection between basic financial services and remotely located populations. But even if they provide access to banking, the use of agents carry significant drawbacks. These certain challenges can be a lack of oversight and effective communication. It can lead to a lack of transparency, a higher risk of fraud and theft, and may facilitate abusive behavior towards customers.

Digital Technology

The digitization of financial services is a great trend that increases connectivity. It also allows plugging remote locations into the financial services ecosystem. But there are also constraints to consider such as the varying quality of digital technology. This can have a considerable impact on data privacy and security.

Photo by William Iven from Pixabay

Concerns about data security include hacking risks and the vulnerability of cheap smartphones to malware. Also, unreliable mobile networks and digital transactional platforms can result in an inability to transact. This may be due to network vulnerabilities or technology quality. An example would be lost payment instructions due to a lack of connectivity or dropped messages.

Impact Of Digital Finance To Financial Industry

New technology and digital services have been emerging in the financial sector. It has given way to new services that disrupts the old ones. The digital transformation of finance continues to impact the industry. It is evident in the services we use today such as ApplePay, PayPal or Venmo, among other examples.

Here are the key changes that impact the financial industry:

1. Digital Banking

Before, banks used to offer incentives for opening an account. They also gave customers promises such as no fees, low fees, free checking, or cashback. But now, these features are all offered and expected in digital banking. Banks or credit card companies come with an associated mobile app for their customers to access their accounts online, pay bills and track their expenses.

Photo by Peggy und Marco Lachmann-Anke from Pixabay

2. Fintech

Fintech refers to financial institutions and banks that are looking to make full use of available systems, hardware and software capabilities. Today, it is used for digital banking technologies such as digital wallets, banks, blockchain tech, and more. Fintech is changing the landscape of financial services in many ways through spending tracker, online budgeting tools, and even automated chatbots for customer service.

3. Blockchain

Blockchain technology is often associated with Bitcoin and other cryptocurrencies. But it also offers huge possibilities for other areas, such as utilizing strict controls that allow auditable data and smart contracts. The ledger system of Blockchain increases transparency, builds trust with users, and minimizes human error and risk. This is why stock exchanges, banks, and AI companies are exploring uses for this technology.

Photo by Launchpresso on Unsplash

4. AI And Machine Learning

Banks and credit card companies are using AI and machine learning to detect fraudulent activity. Using complex algorithms, the AI program can detect suspicious activity and take action within seconds. These technologies help protect mobile banking, login credentials, and other sensitive data or information.

The Future With Digital Transformation

In the following years, ERP, automation, and cognitive innovation will continue to advance. These will create opportunities to simplify processes and make our jobs easier. Adding other technologies such as AI and blockchain to the mix will only speed up this trend. As this change picks up speed, humans unleash their capacity to add value.

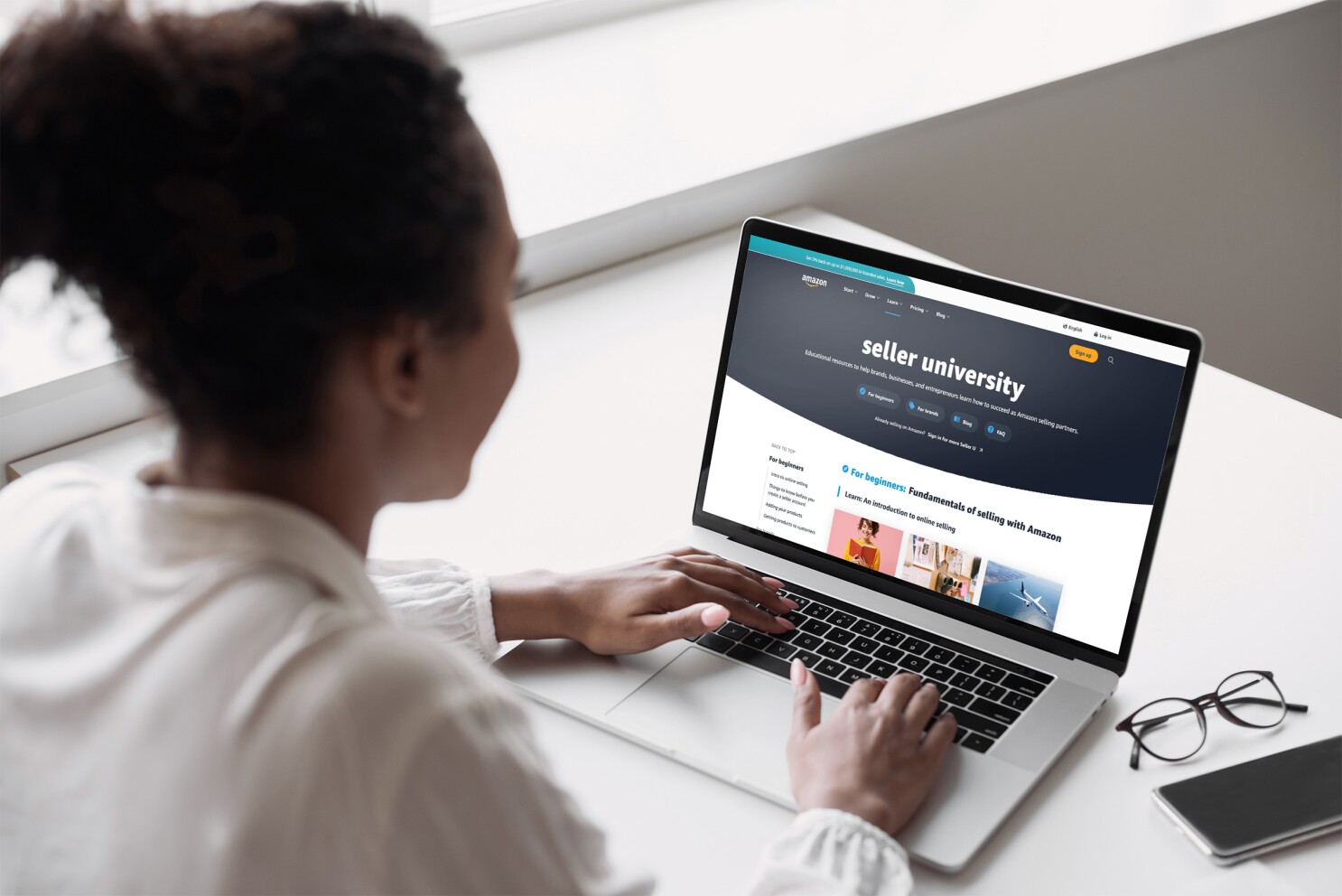

Photo from maxpixels.net

Digital finance will add value to areas that need quality insight and exceptional customer service. Some finance organizations will evolve into full-fledged business service centers. In addition, the on-demand production of both actuals and forecasts will make cycles less relevant. And the old distinction between operational and analytical data will disappear.

With digitization, the financial industry will operate with a new mantra: There is no close. You’re not forecasting once a month or quarterly. It’s all happening in real-time.