Home>Finance>The 50/20/30 Rule – How to Make Budgeting Easy As Pie

Finance

The 50/20/30 Rule – How to Make Budgeting Easy As Pie

Modified: September 12, 2023

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Money comes and money goes, sometimes more quickly than is intended or desired. Planning for the future can be a daunting task as far as preparing budgets and maintaining goals can go. Budgeting is not impossible, and can be accomplished by adhering to the rules set out by some of these toolkits. For instance, the 50/20/30 rule is a fast and quick way to calculate needs versus wants and where the money from your check is going.

So What Is The 50/20/30 Rule?

Photo from philstar.com

Photo from philstar.com

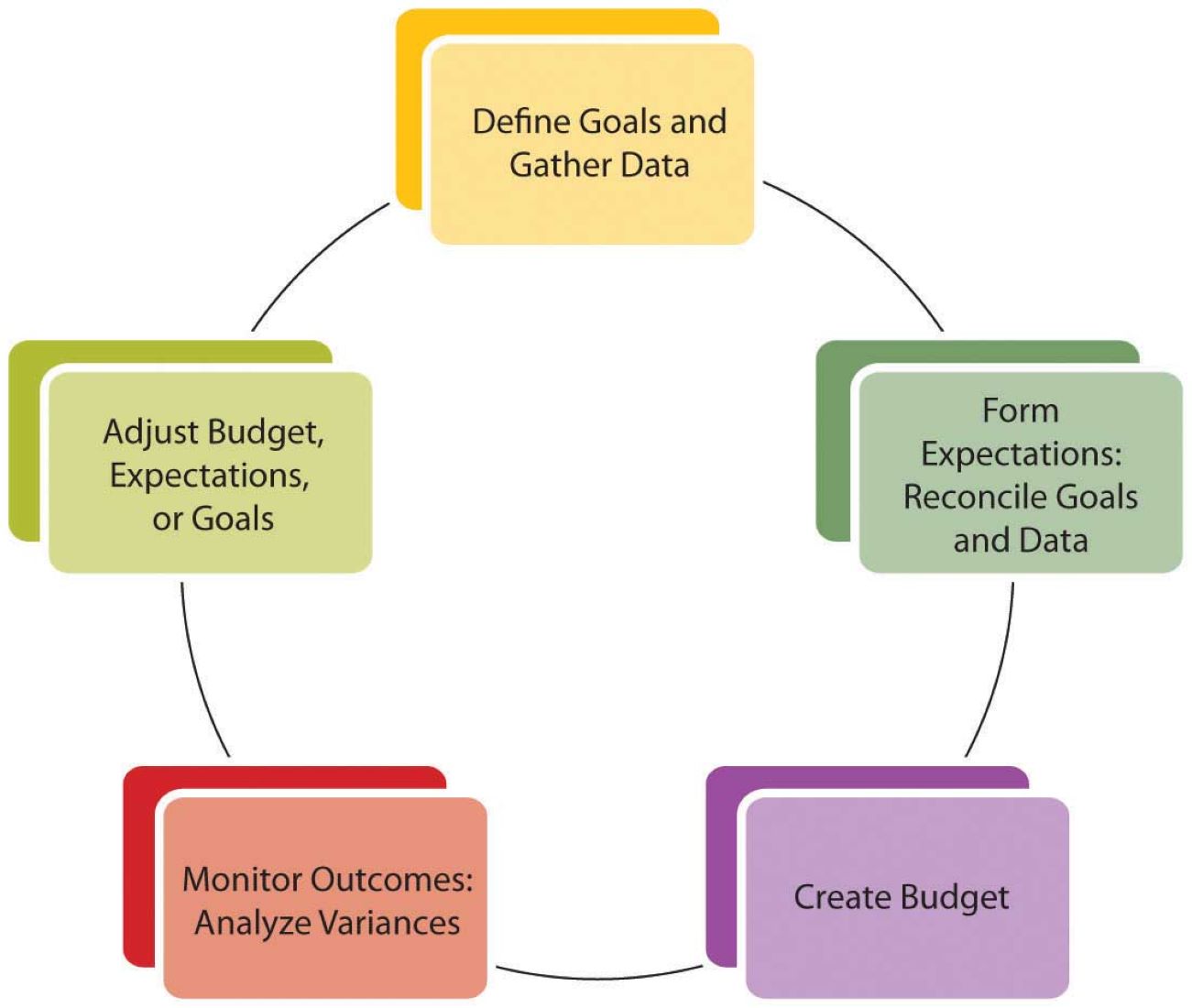

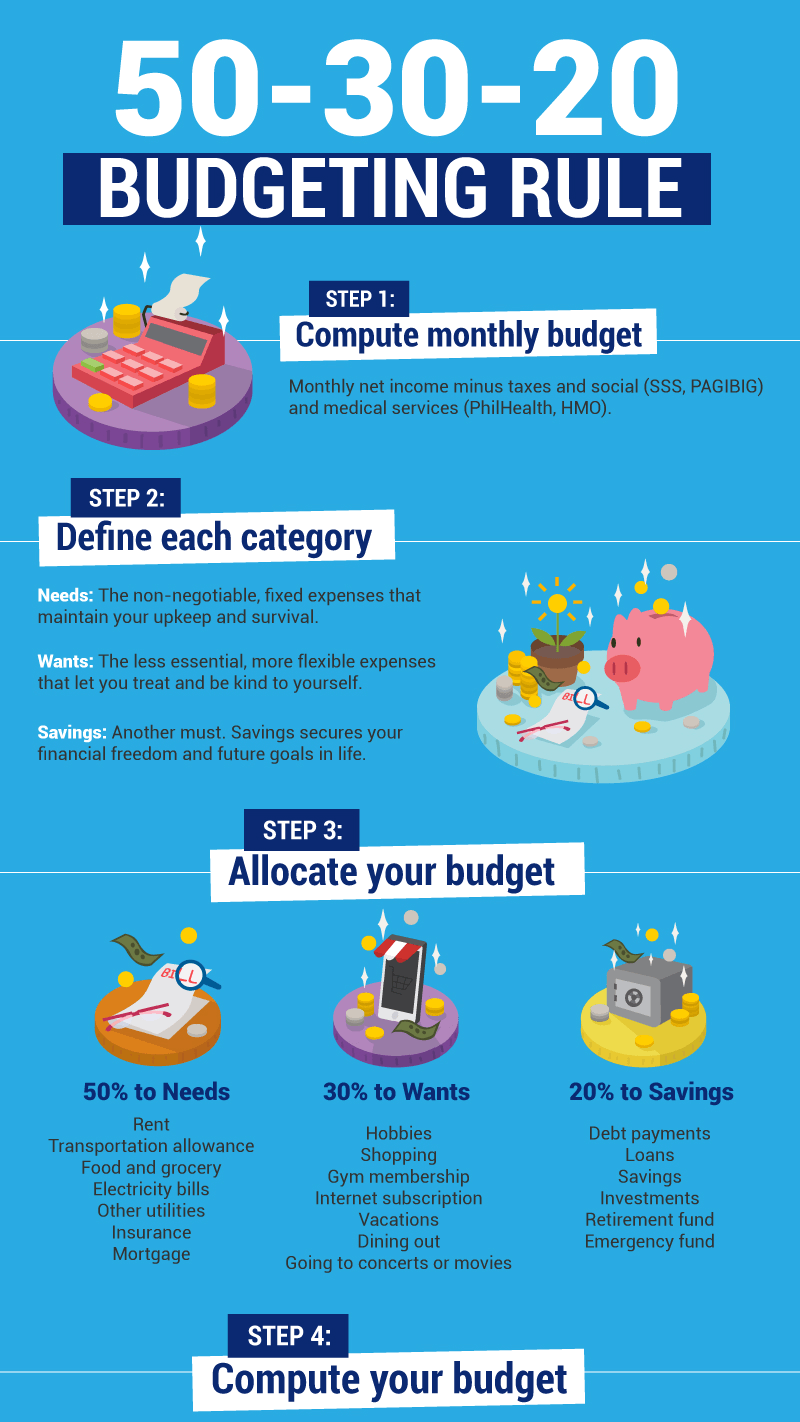

There are all sorts of interpretations of this rule, and you’ll find that many people place different things in varying categories. Among them is that the 50/20/30 rule has to do with dividing out your spending habits into percentages and maintaining goals related to those numbers.

Instead of dealing with a garden variety of categories to sort things into, this rule splits everything into three primary categories. Having to do with things that require mandatory payments as well as more loose and unnecessary transactions.

Each category gets a specific percentage of your take-home income that it is allotted. One category gets 50%, while the second gets 20%, and the third gets 30%.

Let’s Break Down The 50/20/30 Rule

Photo from pexels.com

Photo from pexels.com

As mentioned earlier, there are three sections where each spending habit is organized depending on its importance and relevance to daily lives beginning with the fundamentals. Each category is relatively fluid, depending on you or your family’s needs.

1. Essential Expenditures (50%)

Every person needs essential things to survive. For instance, food, water, shelter, and heat fall under this particular category, which should only contain the expenditures of the utmost importance to your welfare.

Transportation costs can also be included in this set, given the necessity of being able to travel to not only earn your pay but also acquire your fundamentals. 50% of your take-home pay should also be dedicated to this set of needs.

2. Financial Expenditures (20%)

These payments should be directed towards not only planning for future budgets but also for taking care of current ones. Also included are repaying debts that have been accumulated, such as credit card bills and student loans.

If there aren’t any debts to be repaid, this is the place to make contributions to saving or retirement funds; however it is if you’ve decided to manage and maintain those. Meanwhile, 20% of your take-home pay should be set aside for these kinds of expenditures.

3. Entertainment Expenditures (30%)

Admittedly, you probably have the most fun with these expenses. But that fun can sometimes spill over to your other responsibilities and bills, and this is where this sort of budgeting practices can come in.

These expenditures have to do with personal lifestyle and amusement choices. These can include spending on new pairs of shoes, eating at restaurants, and a vacation to Hawaii. Watch out though as this category should also include your Internet, cable, and phone bills. Thus, 30% of your take-home pay should be preserved for these transactions.

Get The Process Going

Photo from pikrepo.com

Photo from pikrepo.com

Sounds easy enough, right? To accurately calculate a 50/20/30 plan, you must first accurately calculate your take-home pay. Remember that your after-tax income is what you will need to start determining percentages, and not the flat rate that you are currently being paid.

After-tax income is defined as being the amount of pay that you actually collect after money has been taken out for state taxes, Social Security, Medicare, and local taxes. If you are self-employed, this number is your gross income minus taxes and business expenses.

Make sure that when you begin your budgeting strategy you have your correct income in mind, as you may negatively affect your results with a faulty number.

Seeing Is Believing

There are several ways to see this plan in action with real-life examples. Take a look at a couple of different situations in which the 50/20/30 rule has been applied.

Example 1

Maddie – This is a young college graduate who has student loan payments and contributes to a Roth IRA every month. She works full-time at a position in the city for a yearly income of $36,000 and $2,250 in take-home pay a month. Thus, her 50/20/30 plan might look a little like this:

Essential Expenditures (50%):

Rent: $750; Transportation: $75; Utilities: $75; Groceries: $200

TOTAL: $1,100 (49%)

Financial Expenditures (20%):

Student loan: $225; Roth IRA contributions: $200; Travel savings fund: $50

TOTAL: $475 (21%)

Entertainment Expenditures (30%):

Phone and cable bill: $75; Miscellaneous expenses: $600

TOTAL: $675 (30%)

Example 2

Austin & Annaliese – This is a middle-aged couple with two daughters preparing to enter college. They both work full-time at different positions and both contribute to a 401k. They, together, earn $150,000 a year with a take-home pay per month of $6,767.

Essential Expenditures (50%):

Mortgage: $1,200; Transportation: $850; Utilities: $150; Groceries: $400

TOTAL: $2,600 (38%)

Financial Expenditures (20%):

549 account contributions: $1,470; Roth IRA contributions: $833; Travel savings fund: $200

TOTAL: $2,503 (37%)

Entertainment Expenditures (30%):

Phone and cable bill: $125; Miscellaneous expenses: $1,539

TOTAL: $1,664 (25%)

As you can tell, there is a little bit of wiggle room as far as the percentages go. It might be nearly impossible to hit the 50%, 30%, and 20% marks on the nose. But that doesn’t mean you shouldn’t try.

Maddie was able to follow her goals fairly closely and continue to pay off her student loans while saving for future expenses as well as retirement.

Meanwhile, Annaliese and Austin were successful in keeping their expenditures down and doing an excellent job of cutting back on entertainment and needs while focusing primarily on contributions to different savings funds.

So Where Did This Rule Come From?

Photo from time.com

Photo from time.com

The 50/20/30 rule was outlined and coined by a mother-daughter duo that co-authored a book together. This book is called All Your Worth: The Ultimate Lifetime Money Plan. In the book this budgeting tool is first introduced and expounded upon, and from then on it has been implemented in many lives worldwide.

Elizabeth Warren, the mother-author, is a Harvard law bankruptcy expert and has since moved on to engage in government politics. Her daughter, Amelia Warren Tyagi, is now the co-founder and president of Business Talent Group.

Personalizing The 50/20/30 Rule

Photo from moody.af.mil

Photo from moody.af.mil

Preparing a 50/20/30 budget might look a little different for you than it might look for your neighbor. Keep in mind that, while it’s a good rule to adhere to in general, it won’t suit any and every need.

Some families may need more money in certain places than in others. For instance, the married couple that we reviewed earlier focused primarily on financial expenses, rather than essential expenses.

Often the case is that when you have a smaller family unit and are well-versed in how to save money and shave off unnecessary expenditures. You’ll be able to place more money in certain categories than in others. Larger families may need to focus on essential expenses. While young single people may be more able to spend less on essential expenses and more on entertainment expenses.

Making The 50/20/30 Rule Profitable For All

While in some situations the 50/20/30 rule may need to be skewed one way or the other. It does serve a healthy purpose in any person or family’s life. Without budgets, spending can become wildly out of control or, the reverse, far too conservative.

Creating the layout for your needs and planning on how to meet them is a perfect way to gain control of your financial well-being. It benefits not only you but also the people around you.

Therefore, knowing precisely what you require and precisely how you’re going to meet that requirement means the easing of anxiety and stress both of which are serious negative contributors to a less content and happy life.

Technology Makes The 50/20/30 Rule Easy

Photo from pxhere.com

Photo from pxhere.com

There are a lot of Internet software programs that can help you keep yourself organized and your budget clear. There are also many websites that provide free or paid services that allow you to maintain a crisp view of your goal. And perhaps help keep you motivated to reach it.

Personal accountants can offer similar services if there are more complex and intricate pieces to your budget that you need personalized help with. These can also be found through using search engines on the Web. After all, help is only ever a click away in today’s age of forward-thinking and information-based technology.

Moving Forward and Onwards

Remember that you or your neighbor are not the only ones in the movement towards reaching a more balanced and future-oriented budget. There are many people out there striving for the same, and there are multitudes of services willing and able to help you out. The 50/20/30 budgeting plan is a brilliant, across-the-board, user-friendly strategy that has the serious potential to re-organize your spending habits and realign your financial life.

However, the first step in waging war against bad spending is merely in the decision to do something about your budget. It is important to step back and realize that it is possible to hold the reigns to your spending, and it is even more possible to defeat negative spending habits and replace them with positive ones.