Finance

How To Budget When You Hate Budgeting

Published: October 11, 2023

Learn how to manage your finances even if you despise budgeting. Get practical tips and strategies to improve your financial situation with this guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Psychology of Budgeting

- Identifying Your Financial Goals

- Tracking Your Income and Expenses

- Creating a Simple Budgeting System

- Incorporating Automation and Technology

- Finding Creative Ways to Save Money

- Dealing with Budgeting Challenges

- Building an Emergency Fund

- Adjusting and Revisiting Your Budget

- Conclusion

Introduction

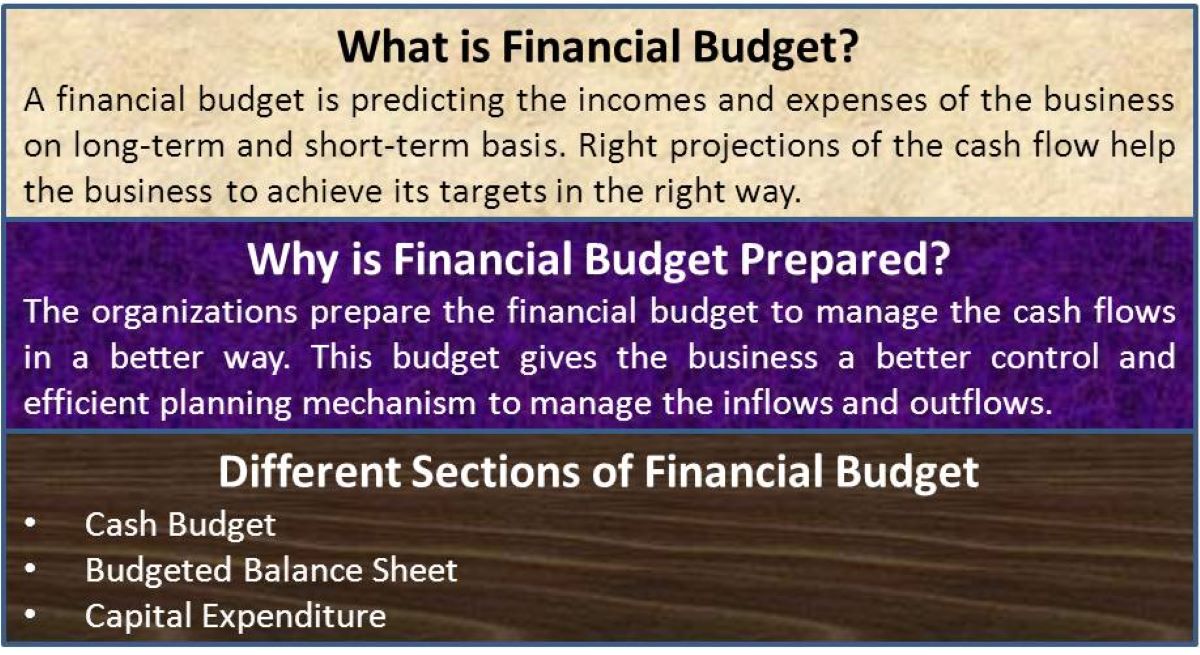

When it comes to managing your personal finances, budgeting is a crucial tool that can help you gain control over your money and achieve your financial goals. However, for some people, the idea of creating and following a budget can seem overwhelming and tedious. If you’re someone who hates budgeting, you’re not alone. The good news is that budgeting doesn’t have to be a daunting task. In fact, with the right approach and mindset, budgeting can become a simple and effective tool to improve your financial situation.

The key to successful budgeting lies in understanding your own psychology and finding a method that works for you. By identifying your financial goals, tracking your income and expenses, and finding creative ways to save money, you can create a budgeting system that aligns with your needs and preferences. In this article, we will explore various strategies and tips to help you budget effectively, even if you hate the idea of budgeting.

Before we dive into the details, it’s important to remember that budgeting is not about restricting yourself or sacrificing your happiness. Instead, it’s about gaining a clear understanding of your financial situation and making informed decisions about how to allocate your money. By having a budget in place, you can have a better sense of your spending habits, make conscious choices about your expenses, and work towards your financial objectives.

So, if you’re ready to take control of your finances and overcome your aversion to budgeting, let’s explore the world of budgeting together and discover how you can create a budgeting system that works for you.

Understanding the Psychology of Budgeting

To effectively budget, it’s essential to understand the psychology behind your feelings towards budgeting. Many people dislike budgeting because it feels restrictive or limiting. However, by reframing your mindset and approaching budgeting in a positive and empowering manner, you can change your perception and make it an enjoyable process.

First, it’s important to recognize that budgeting is not about depriving yourself of the things you enjoy. Instead, it’s about having a clear understanding of your financial situation and prioritizing your spending to align with your goals. By shifting your mindset from restriction to empowerment, you can view budgeting as a tool that empowers you to make conscious choices about how you use your money.

Another aspect of the psychology of budgeting is understanding the underlying emotions and triggers that may influence your spending habits. Many people use retail therapy or impulse purchases as a way to cope with stress or emotions. By being aware of these triggers, you can develop healthier coping mechanisms that don’t involve impulsive spending. Budgeting allows you to become more mindful of your purchases and make intentional decisions based on your financial goals rather than emotional impulses.

Furthermore, budgeting can also provide a sense of security and peace of mind. By having a clear plan for your money, you can reduce financial stress and worry about unexpected expenses. Knowing that you have control over your finances and are actively working towards your goals can be incredibly empowering and boost your overall well-being.

Understanding the psychology behind budgeting is the first step towards overcoming your aversion to it. By reframing your mindset, identifying emotional triggers, and recognizing the sense of security it provides, you can start embracing budgeting as a powerful tool for financial success.

Identifying Your Financial Goals

Before you can create an effective budget, it’s important to have a clear understanding of your financial goals. Identifying your goals will provide the motivation and direction needed to make informed decisions about your money.

Start by asking yourself what you want to achieve financially. Do you want to pay off debt, save for retirement, buy a house, or travel? Take some time to envision your ideal financial future and set specific, measurable goals that align with your aspirations.

Once you’ve identified your goals, break them down into short-term, medium-term, and long-term targets. Short-term goals are those that can be achieved within a year, such as paying off a credit card or saving for a vacation. Medium-term goals may take several years to accomplish, such as saving for a down payment on a house or funding a child’s education. Long-term goals are those that require substantial time and planning, such as building a retirement nest egg or achieving financial independence.

Having defined goals will help you prioritize your spending and determine how much to allocate towards each goal. It will also give you a sense of purpose and direction, making it easier to stay motivated and committed to your budgeting efforts.

Remember, your financial goals may evolve over time, and that’s okay. It’s important to regularly review and reassess your goals to ensure they still align with your values and aspirations. As you achieve one goal, you can replace it with another and continue to make progress towards financial success.

By identifying your financial goals, you can approach budgeting with a clear purpose and motivation. Your goals will serve as a guide to help you make effective financial decisions and stay on track towards achieving the life you envision.

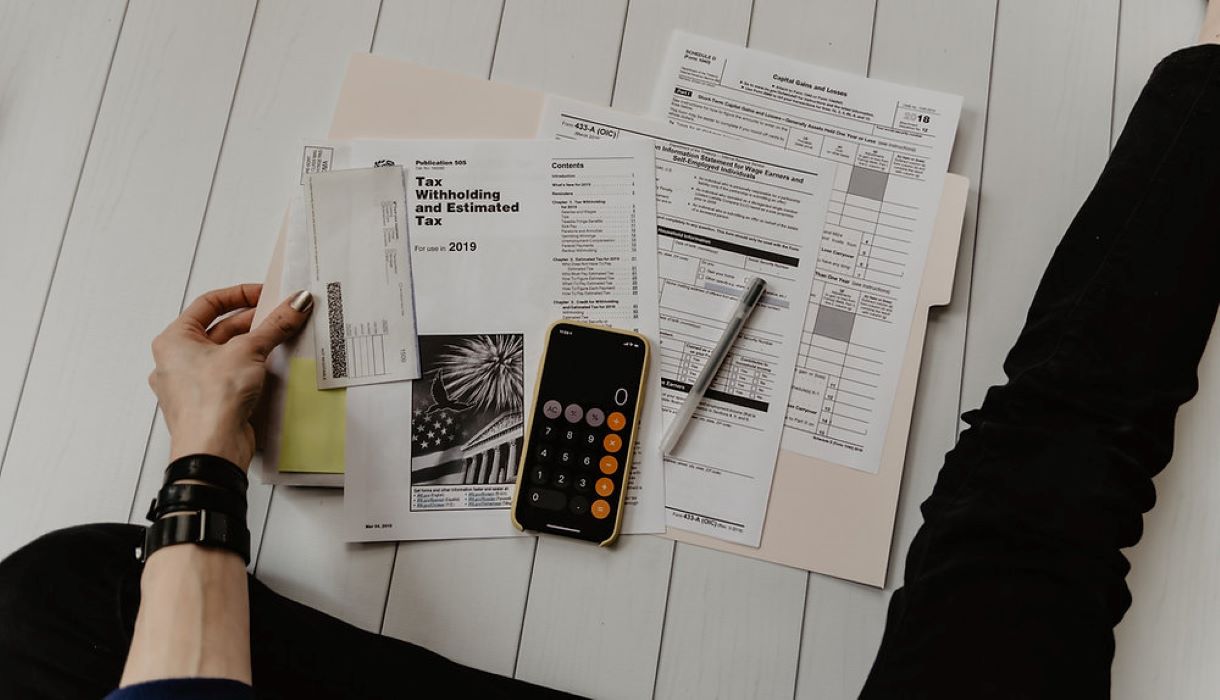

Tracking Your Income and Expenses

One of the fundamental steps in budgeting is tracking your income and expenses. This process involves accurately recording and categorizing every dollar that comes in and goes out of your bank account. Tracking allows you to have a clear picture of your spending habits and identify areas where you can make adjustments.

Start by gathering all your financial records, including bank statements, credit card statements, and receipts. Use a spreadsheet or budgeting app to create categories for your income and expenses. Common categories may include housing, transportation, groceries, entertainment, debt payments, and savings. Be thorough and ensure that every expense is accounted for. This will help you get a comprehensive overview of your financial situation.

Tracking your income is relatively straightforward. Include all sources of income, such as your salary, investments, side hustles, and any other money that comes into your bank account. Be sure to consider both regular and irregular income, as irregular income can present its own challenges in budgeting.

Tracking expenses, on the other hand, requires a bit more effort. It’s important to accurately record every purchase, whether it’s a cup of coffee or a major purchase. You can use receipts, bank statements, or even take advantage of budgeting apps that automatically sync with your bank accounts to categorize transactions. Dedicate a specific time each week or month to review and update your records.

By consistently tracking your income and expenses, you’ll gain insights into your spending patterns and where your money is going. This awareness is crucial in identifying areas where you can make adjustments and save money.

Remember, tracking your income and expenses is an ongoing process. It’s not a one-time task but a habit that you should incorporate into your financial routine. Regularly reviewing your records will help you stay on top of your finances and adjust your budget as needed.

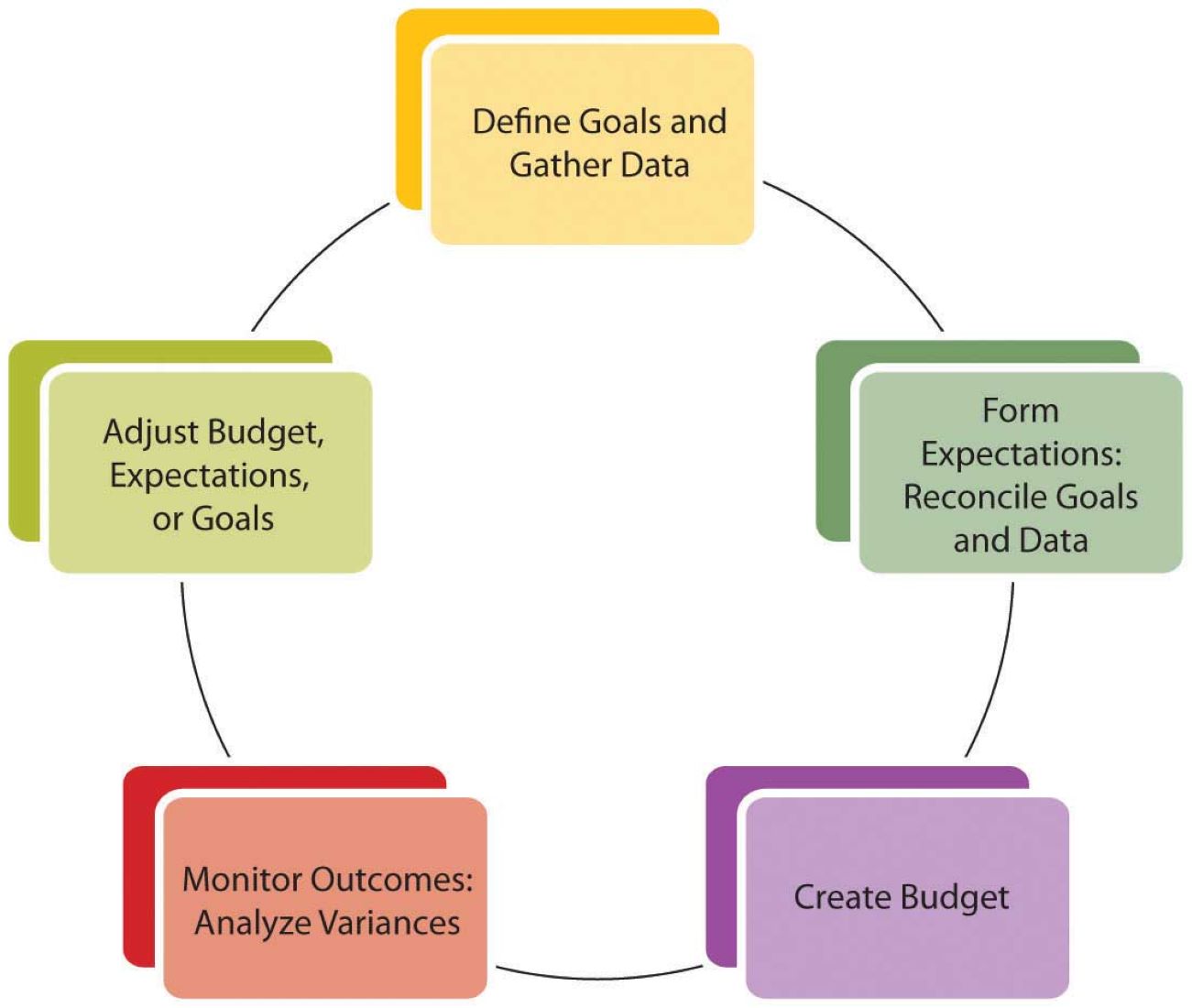

Creating a Simple Budgeting System

While budgeting can seem overwhelming, creating a simple budgeting system can make the process more manageable and effective. Here are some steps to help you develop a straightforward budgeting system:

- Set your budgeting period: Determine whether you want to budget on a monthly, bi-weekly, or weekly basis. Choose a timeframe that aligns with how often you receive income and pay bills.

- Allocate your income: Start by allocating your income to different categories based on your financial goals and priorities. Aim to allocate a portion towards savings, debt payments, essential expenses, and discretionary spending.

- Track and categorize your expenses: Continuously track your expenses and categorize them according to your budgeting system. This will allow you to identify areas where you’re overspending and make adjustments as needed.

- Adjust and fine-tune: Regularly review your budget and make adjustments to ensure it remains realistic and sustainable. Life circumstances and financial goals may change, so be open to modifying your budget as necessary.

- Use cash envelopes or digital tools: Consider using cash envelopes or budgeting apps to help you stay within your allocated amounts for different spending categories. This can provide a tangible reminder of your budget and help you make more conscious spending decisions.

- Automate savings: Set up automatic transfers to your savings or investment accounts. By automating your savings, you ensure that a predetermined amount is regularly saved without any effort on your part.

Creating a simple budgeting system that suits your needs and preferences will make it easier to manage your finances and monitor your progress towards your financial goals. Make sure to regularly review and adjust your budget to stay on track and ensure its effectiveness.

Remember, simplicity is key. Don’t make your budgeting system overly complicated or rigid, as this can lead to frustration and discouragement. Keep it flexible and adaptable, allowing room for unexpected expenses or changes in income.

With a simple budgeting system in place, you’ll be better equipped to make informed financial decisions, stay organized, and work towards achieving your financial goals.

Incorporating Automation and Technology

In today’s digital age, automation and technology can be powerful tools to streamline your budgeting process and make it more efficient. Incorporating these tools can save you time, reduce human error, and provide greater visibility into your financial situation.

Here are some ways to leverage automation and technology in your budgeting:

- Online banking: Take advantage of online banking features offered by your financial institution. Set up automatic bill payments and transfers to ensure that bills are paid on time and that a portion of your income is directly allocated to savings or debt payments.

- Budgeting apps: There are numerous budgeting apps available that can help you track your income and expenses, categorize transactions, and provide visual reports of your spending patterns. These apps often sync with your bank accounts, making it easier to keep your budget up to date.

- Expense tracking apps: Use expense tracking apps to capture and categorize your expenses on the go. Many apps allow you to take photos of receipts and automatically extract the information, making it easier to track and manage expenses on a day-to-day basis.

- Alerts and reminders: Set up alerts and reminders to notify you of upcoming bills or when you’re approaching the spending limits you’ve set for specific categories. This can help you stay on track and avoid overspending.

- Digital budgeting templates: Use digital budgeting templates or spreadsheets to create and track your budget. These templates often provide formulas and pre-set categories, simplifying the budgeting process.

- Expense aggregators: Consider utilizing expense aggregators that can pull in all your financial accounts into one place. These tools can automatically categorize and analyze your spending across various accounts, giving you a comprehensive view of your finances.

By incorporating automation and technology into your budgeting process, you can save time, reduce the likelihood of errors, and gain valuable insights into your financial habits. Experiment with different tools and resources to find the ones that best fit your needs and preferences.

However, keep in mind that while technology can be a valuable asset in budgeting, it’s important to stay engaged and regularly review your financial information. Technology should never replace your active involvement in managing your money and making informed decisions.

With the right combination of automation and technology, you can simplify and streamline your budgeting process, allowing you to focus more on achieving your financial goals.

Finding Creative Ways to Save Money

Saving money is a key component of effective budgeting, but it doesn’t have to be a daunting task. By thinking outside the box and adopting some creative strategies, you can find unique ways to save money and make your budget more sustainable. Here are some ideas to get you started:

- Meal planning and cooking at home: Eating out can be expensive. Plan your meals in advance, create a grocery shopping list, and cook at home as much as possible. Not only will this save you money, but it can also lead to healthier eating habits.

- Shopping wisely: Take advantage of sales, discounts, and coupons when shopping for groceries, clothing, or other items. Comparison shop online to find the best deals before making a purchase.

- Reduce energy consumption: Lower your monthly utility bills by being conscious of your energy usage. Turn off lights when leaving a room, unplug electronics when not in use, adjust your thermostat, and consider energy-efficient appliances.

- Cancel unused subscriptions: Review your monthly subscriptions and cancel those that you don’t use or need. This could include streaming services, gym memberships, or magazine subscriptions.

- DIY projects and repairs: Instead of hiring professionals for minor repairs or home improvement projects, try doing them yourself. You can find tutorials online or ask for guidance from friends or family members.

- Embrace second-hand items: Consider buying second-hand items for things like furniture, clothing, and household goods. Thrift stores, consignment shops, and online marketplaces can be treasure troves for affordable, quality items.

- Cut back on unnecessary expenses: Identify areas where you can cut back on discretionary spending. This could include reducing dining out, entertainment expenses, or choosing a more affordable phone or internet plan.

- Take advantage of free resources and activities: Look for free or low-cost alternatives to expensive activities. Visit parks, attend community events, utilize library resources, or explore outdoor hobbies that don’t require expensive equipment.

Remember, saving money doesn’t mean sacrificing your quality of life. It’s about being conscious of your spending and making choices that align with your financial goals. By getting creative and finding alternative ways to save, you can achieve a more sustainable budget and make your money go further.

Don’t be afraid to think outside the box and customize these ideas to fit your lifestyle. The goal is to find creative ways to save money that work for you and are enjoyable to implement.

Dealing with Budgeting Challenges

While budgeting is a valuable tool for managing your finances, it’s not always smooth sailing. There are common challenges that many people face when it comes to budgeting. Understanding these challenges and having strategies to overcome them can help you stay on track. Here are some common budgeting challenges and tips for dealing with them:

- Unexpected expenses: Life is full of surprises, and unexpected expenses can easily derail your budget. To prepare for these situations, build an emergency fund that can cover unforeseen costs. Adjust your budget to include a small amount each month for these types of expenses.

- Impulsive spending: Impulse purchases can quickly eat away at your budget. To combat this challenge, put a cooling-off period in place before making any non-essential purchase. Take 24 hours or more to consider whether the item is truly necessary and fits within your budget.

- Inconsistent income: If your income fluctuates, it can be challenging to create a consistent budget. Start by determining your average income over the past several months and build your budget around that. During lean months, cut back on discretionary spending and prioritize essentials.

- Expenses exceeding income: If your expenses consistently exceed your income, it’s essential to reevaluate your budget and make adjustments. Look for areas where you can cut back and explore opportunities to increase your income, such as taking on a side hustle or negotiating a raise at work.

- Lack of motivation: Staying motivated to stick to a budget can be challenging, especially when you’re not seeing immediate results. Remind yourself of your financial goals and the progress you’ve already made. Seek support from friends or online communities to stay motivated and accountable.

- Family or partner disagreements: If you share finances with a partner or have a family, it can be challenging to get everyone on board with the budget. Open and honest communication is key. Set shared goals, discuss priorities, and find common ground. Consider seeking professional help, such as a financial advisor, if needed.

Remember, overcoming budgeting challenges requires patience and perseverance. It’s normal to experience setbacks along the way, but don’t let them discourage you. Celebrate small victories and learn from your mistakes to continuously improve your budgeting skills.

Flexibility is also important. Adjust your budget as necessary to accommodate changes in circumstances or unexpected challenges. A successful budget is one that can adapt to your evolving financial needs.

By acknowledging and addressing these challenges head-on, you can maintain a strong and resilient budget that helps you achieve your financial goals.

Building an Emergency Fund

An emergency fund is a crucial component of financial stability and a vital part of any budgeting plan. It provides a safety net for unexpected expenses, helping you avoid going into debt or dipping into other savings when faced with financial emergencies. Building an emergency fund requires intentional saving and discipline. Here are some steps to help you get started:

- Set a savings goal: Determine how much you want to save in your emergency fund. Financial experts generally recommend setting aside three to six months’ worth of living expenses, but any amount that provides you with a cushion is a good start.

- Make it a priority: Treat building your emergency fund as a non-negotiable expense. Allocate a portion of your income specifically for savings and make it a top priority in your budget.

- Start small: If saving a large sum seems overwhelming, start by setting a smaller savings goal and gradually increase it over time. The key is to get into the habit of saving regularly.

- Automate your savings: Set up automatic transfers from your paycheck or checking account into a separate savings account designated for your emergency fund. This way, you won’t be tempted to spend the money before it has a chance to grow.

- Cut back on non-essential spending: Look for areas in your budget where you can trim expenses. This could include dining out less frequently, reducing entertainment expenses, or finding more affordable alternatives for everyday purchases.

- Supplement your income: Consider taking on a side gig or freelance work to generate extra income that can be directed towards building your emergency fund. Use the additional earnings solely for savings rather than increasing your regular spending.

- Keep your fund accessible: Choose a savings account that is separate from your everyday spending account but still easily accessible when needed. Look for an account with a competitive interest rate to help your savings grow over time.

- Avoid dipping into the fund: Unless faced with a true emergency, resist the temptation to tap into your emergency fund. Maintain discipline and use the fund exclusively for unexpected expenses.

Building an emergency fund takes time and consistency, so be patient with yourself. Remember that every small contribution adds up and brings you closer to your savings goal. Celebrate your progress along the way to stay motivated.

Having an emergency fund provides peace of mind and financial security. It allows you to tackle unexpected expenses without derailing your budget or going into debt. Start building your emergency fund today to protect your financial future.

Adjusting and Revisiting Your Budget

A budget should never be a set-it-and-forget-it document. It’s essential to regularly revisit and adjust your budget to ensure it remains effective and aligned with your financial goals. Life circumstances change, priorities shift, and unexpected expenses arise – all of which may require adjustments to your budget. Here’s how you can effectively adjust and revisit your budget:

- Review your spending: Take the time to review your spending patterns regularly. Identify areas where you may be overspending or where you have successfully cut back. This analysis will help you determine which categories need adjustments in your budget.

- Assess your income: If your income has changed, whether it be through a raise, a job loss, or a career change, reassess your budget to reflect your new financial reality. Adjust your income categories accordingly, allowing for changes in your savings and expense allocations.

- Re-evaluate your financial goals: Periodically review your financial goals and assess whether they need to be amended or updated. This can include shifting priorities, setting new goals, or adjusting timelines. Your budget should align with your current financial objectives.

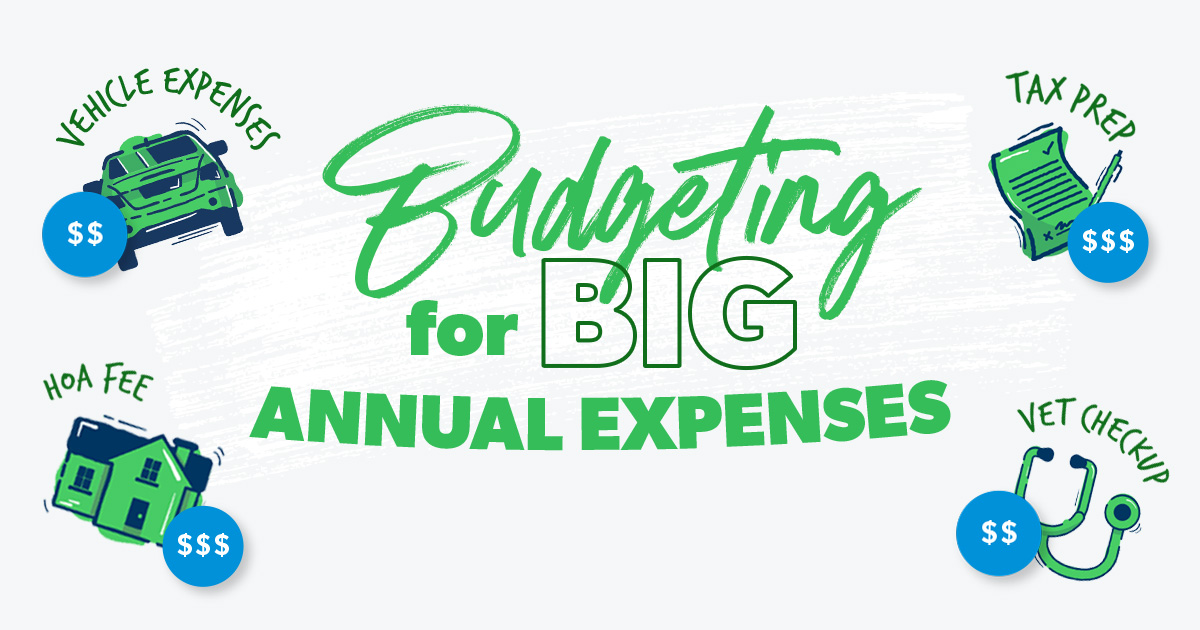

- Anticipate major expenses: Take into account upcoming significant expenses or life events that may impact your budget. This can include things like tuition fees, home renovations, or planned vacations. Make sure to incorporate these expenses into your budget and start saving in advance.

- Monitor changes in bills or subscription costs: Keep track of any changes in your regular bills and subscription costs. Utility bills, insurance premiums, and subscription services can sometimes increase over time. Adjust your budget to account for these changes.

- Be flexible and adaptable: Life is unpredictable, and your budget should be able to adapt to unexpected circumstances. Be prepared to make adjustments as needed and stay flexible with your budgeting approach.

- Seek professional advice when necessary: If you’re struggling to make the necessary adjustments or feel overwhelmed, consider seeking help from a financial advisor. They can provide guidance and expertise in optimizing your budget for your specific financial situation.

Remember, a budget is a flexible tool that should work for you, not against you. Be proactive in revisiting and adjusting your budget whenever needed. Regularly monitoring and tweaking your budget will ensure that it remains effective in helping you achieve your financial goals.

By regularly revisiting and adjusting your budget, you can maintain a realistic and sustainable financial plan that accommodates your changing circumstances and priorities.

Conclusion

Budgeting can be a powerful tool for taking control of your finances and achieving your financial goals. While the process may seem daunting at first, there are various strategies and approaches that can make budgeting simpler and more effective, even if you hate the idea of budgeting.

Understanding the psychology of budgeting and reframing your mindset can help you see budgeting as an empowering tool rather than a restrictive chore. Identifying your financial goals provides direction and motivation, while tracking your income and expenses creates awareness of your spending habits.

Creating a simple budgeting system that suits your needs and preferences, incorporating automation and technology, and finding creative ways to save money make the budgeting process more manageable and enjoyable. However, it’s important to be prepared for challenges that may arise and to have strategies in place to overcome them.

Building an emergency fund provides financial security and protects your budget against unexpected expenses. Finally, regularly adjusting and revisiting your budget ensures that it remains effective and aligned with your evolving circumstances and goals.

Remember, budgeting is a journey, and it requires commitment and consistency. Embrace the process, be flexible, and celebrate each milestone along the way. With time and practice, you’ll develop the skills and habits necessary to navigate your finances with confidence and achieve long-term financial success.

So, whether you’re just starting your budgeting journey or looking to refine your existing budget, take the first step today. Embrace the power of budgeting and create a roadmap to transform your financial future. You have the ability to take control of your finances and turn your financial dreams into a reality.