Home>Finance>Delaware Corporation: Definition, Role Of Usury Laws And Benefits

Finance

Delaware Corporation: Definition, Role Of Usury Laws And Benefits

Published: November 10, 2023

Learn about the definition and role of usury laws for Delaware corporations in the finance industry. Discover the benefits and advantages of establishing a Delaware corporation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Potential of Delaware Corporation: Understanding Usury Laws and Benefits

Welcome to our finance blog! Today, we are diving into the world of Delaware corporations. Whether you are a business owner or an aspiring entrepreneur, understanding the intricacies of different business entities is crucial for your success. In this blog post, we will explore the definition of a Delaware corporation, the role of usury laws, and the benefits it offers. So, let’s get started!

Key Takeaways:

- A Delaware corporation is a business entity formed in the state of Delaware.

- Delaware’s corporate-friendly laws and court system make it an attractive choice for businesses looking to incorporate.

What is a Delaware Corporation?

A Delaware corporation is a business entity that has been incorporated under the laws of the state of Delaware. Many businesses, both small and large, choose to incorporate in Delaware due to its business-friendly environment and favorable legal framework.

The Role of Usury Laws:

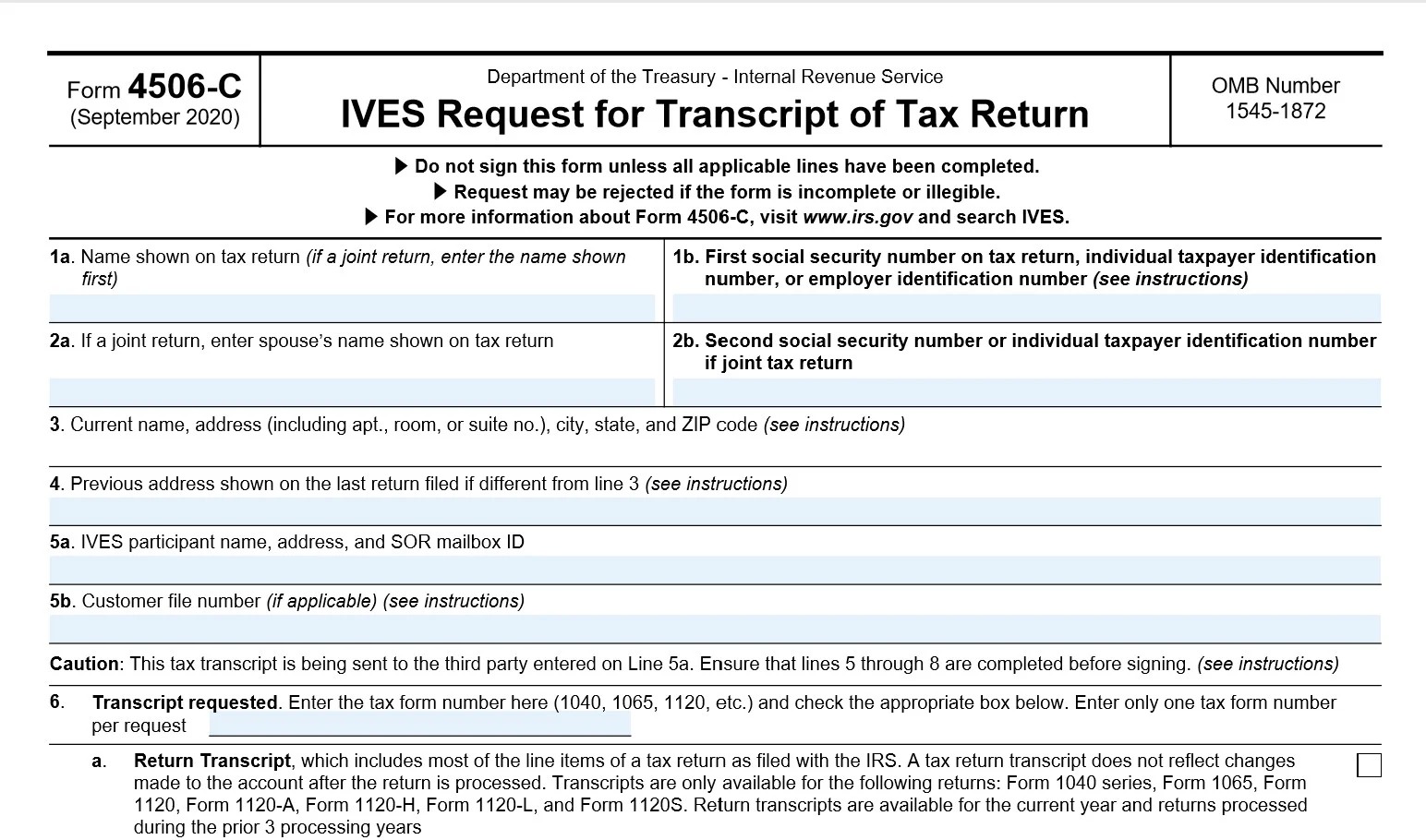

One significant factor that makes Delaware an attractive destination for incorporation is its usury laws. Usury laws dictate the maximum interest rate that lenders can charge on loans. In Delaware, corporations benefit from more relaxed usury laws, allowing them to negotiate more favorable terms with lenders.

By incorporating in Delaware, businesses can take advantage of these lenient usury laws, enabling them to secure financing from lenders at rates that may not be available in other states. This flexibility in structuring loan agreements can give businesses a competitive edge and contribute to their financial growth.

The Benefits of Incorporating in Delaware:

In addition to favorable usury laws, Delaware offers several other benefits for corporations:

- Strong Legal Framework: Delaware has a well-established corporate legal system. The Court of Chancery specializes in resolving corporate disputes, providing businesses with a reliable and efficient judicial process.

- Flexible Business Laws: Delaware’s corporate laws offer flexibility in shareholder rights, governance, and management structures. This flexibility allows businesses to tailor their operations to their specific needs.

- Privacy and Anonymity: Delaware offers privacy protection for directors and officers. Shareholders are not required to disclose their identities, providing a layer of anonymity for those who prefer to keep their business dealings private.

- Tax Advantages: While not the primary focus of this article, it’s worth noting that Delaware offers certain tax advantages for corporations, including no state corporate income tax for companies that do not transact business within the state.

These benefits, combined with Delaware’s corporate-friendly reputation, make it an attractive choice for businesses looking to incorporate and establish a solid foundation for growth and success.

In conclusion, by understanding the definition, role of usury laws, and the benefits associated with incorporating in Delaware, business owners can make informed decisions that align with their goals and aspirations. Delaware offers a unique framework for corporations, providing lenient usury laws, a strong legal system, flexible business laws, privacy protection, and tax advantages.

So, whether you are starting a new venture or considering relocating your existing business entity, exploring the possibilities of incorporating in Delaware might just be the right move for you! Unlock the potential of a Delaware corporation and set yourself on a path to success.