Finance

What Is M&A Investment Banking?

Modified: December 30, 2023

Learn what M&A investment banking entails in the finance industry, and how it plays a crucial role in financial transactions and business acquisitions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of M&A Investment Banking

- Role of M&A Investment Bankers

- M&A Process Overview

- Valuation Techniques Used in M&A

- Financial Analysis in M&A Transactions

- Due Diligence in M&A

- Negotiation and Deal Structuring

- Financing Strategies for M&A Transactions

- Regulatory Considerations in M&A

- Challenges and Risks in M&A Investment Banking

- Conclusion

Introduction

Welcome to the world of M&A investment banking! In today’s fast-paced and competitive business landscape, mergers and acquisitions (M&A) have become an integral part of corporate growth strategies. M&A investment banking plays a crucial role in facilitating these transactions, offering financial advisory services to companies looking to buy or sell their assets, merge with other companies, or raise capital.

M&A investment banking is a specialized field within the broader realm of investment banking. The “M&A” stands for mergers and acquisitions, referring to the consolidation of companies through various financial transactions. Investment bankers in this field serve as intermediaries, representing the interests of buyers or sellers in M&A deals.

These professionals are the deal architects, strategists, and financial advisors who orchestrate complex transactions. They possess an in-depth understanding of financial markets, industry trends, and deal structuring. Additionally, M&A investment bankers possess excellent analytical skills, negotiation prowess, and the ability to navigate regulatory complexities.

As the bridge between buyers and sellers, M&A investment bankers facilitate the entire M&A process. From identifying potential targets or buyers to conducting due diligence, financial analysis, negotiation, and deal structuring, they provide invaluable guidance and expertise.

One of the key goals of M&A investment bankers is to maximize value for their clients while mitigating risks. They assess the financial implications of the transaction, evaluate synergies, and provide recommendations on deal terms and financing strategies.

Throughout this article, we will explore the intricacies of M&A investment banking. We will delve into the roles and responsibilities of M&A investment bankers, the steps involved in the M&A process, valuation techniques, financial analysis, due diligence, negotiation, financing strategies, regulatory considerations, as well as the challenges and risks involved in this dynamic field.

Whether you are a business owner contemplating a sale, a company executive exploring growth opportunities, or a finance enthusiast curious about the world of M&A, this article will provide you with valuable insights into the world of M&A investment banking.

Definition of M&A Investment Banking

M&A investment banking refers to the specialized financial advisory services provided by investment banks to facilitate mergers, acquisitions, and other corporate transactions. It is a field that combines expertise in finance, strategic planning, and deal structuring to help companies achieve their growth objectives.

M&A investment bankers act as intermediaries, working closely with buyers and sellers to ensure a smooth and successful transaction. They assist in various aspects of the deal, including valuation, negotiation, due diligence, and financing. Their goal is to maximize value for their clients while minimizing risks and optimizing the outcome of the transaction.

Investment banks that specialize in M&A have dedicated teams of professionals who possess deep industry knowledge and expertise. They have a thorough understanding of financial markets, industry trends, and regulatory frameworks, allowing them to navigate the complexities of M&A transactions.

The role of M&A investment bankers extends beyond simply facilitating transactions. They also provide strategic guidance to their clients, helping them identify potential target companies or buyers that align with their growth objectives. They conduct extensive financial analysis to assess the feasibility and potential synergies of the transaction.

Furthermore, M&A investment bankers assist in structuring the deal and determining the appropriate financing strategies. They evaluate different options such as debt financing, equity financing, or a combination of both, to ensure that the transaction is financially viable and optimized for the client’s objectives.

In addition to financial expertise, M&A investment bankers also possess strong negotiation and communication skills. They represent their clients’ interests during the negotiation process, working to secure the most favorable terms and conditions for the transaction. Their ability to navigate complex negotiations and build strong relationships with buyers, sellers, and other stakeholders is crucial to the success of the deal.

Overall, M&A investment banking plays a vital role in the corporate landscape, facilitating transactions that drive growth and create value for companies. Through their financial acumen, strategic guidance, and deal-making skills, M&A investment bankers help businesses navigate the complex world of mergers and acquisitions, ultimately shaping the future of industries and economies.

Role of M&A Investment Bankers

M&A investment bankers play a pivotal role in facilitating mergers and acquisitions, utilizing their expertise in finance, strategic planning, and deal structuring. They work closely with their clients, whether buyers or sellers, to guide them through the entire M&A process and ensure a successful transaction. Let’s explore the key roles and responsibilities of M&A investment bankers:

- Financial Advisory: M&A investment bankers provide valuable financial guidance to their clients. They assist in assessing the financial feasibility of a transaction, evaluating the potential synergies, and determining the appropriate valuation range for the target company. They help their clients understand the financial implications of the deal and provide recommendations on deal terms.

- Deal Sourcing and Evaluation: Investment bankers actively source potential M&A opportunities for their clients. They conduct market research, identify potential target companies or buyers, and evaluate their strategic fit. This involves analyzing industry trends, assessing the competitive landscape, and evaluating growth prospects. By presenting viable opportunities, M&A investment bankers aid their clients in making informed decisions.

- Negotiation and Deal Structuring: M&A investment bankers act as skilled negotiators on behalf of their clients, working to secure the most favorable terms and conditions for the transaction. They assist in deal structuring, determining the appropriate consideration mix (cash, stock, or a combination) and crafting the deal’s legal and financial terms. Their expertise is crucial in striking a balance between the interests of the buyer and seller.

- Due Diligence: M&A investment bankers oversee the due diligence process, which involves conducting a comprehensive assessment of the target company’s financial, legal, operational, and commercial aspects. They work with a team of experts to review and analyze documents, unearth potential risks, and identify areas for further investigation. This enables their clients to make well-informed decisions about the transaction.

- Financing Strategies: M&A investment bankers assist their clients in determining the most suitable financing strategies for the transaction. They evaluate options such as debt financing, equity financing, or a combination of both, taking into account factors such as cost, risk, and the client’s capital structure. By optimizing the financing structure, they ensure that the deal is financially viable and aligned with the client’s objectives.

- Regulatory Compliance: M&A transactions often involve regulatory considerations that must be navigated carefully. M&A investment bankers are well-versed in the regulatory landscape and provide guidance to clients on compliance requirements. They work closely with legal teams to ensure that all necessary approvals and filings are completed, minimizing legal risks and ensuring a smooth transaction process.

The role of M&A investment bankers goes beyond transactional responsibilities. They act as trusted advisors, providing strategic insights to their clients, and helping them navigate complex business decisions. They possess excellent analytical, negotiation, and communication skills, enabling them to forge strong relationships with clients, buyers, sellers, and other stakeholders involved in the deal. M&A investment bankers are instrumental in driving successful M&A transactions, contributing to corporate growth and value creation.

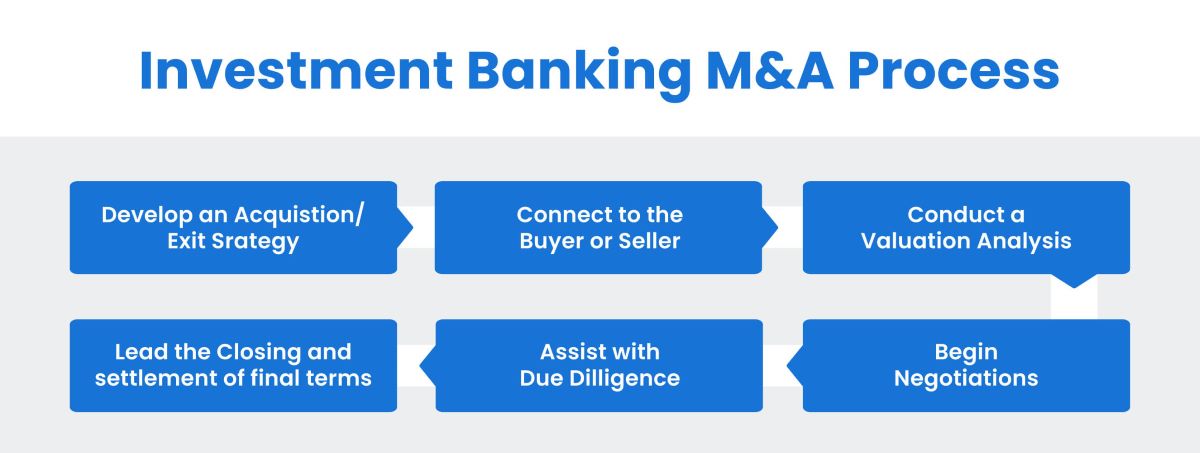

M&A Process Overview

The M&A process is a complex and structured series of steps that companies undertake to complete a merger or acquisition. M&A investment bankers play a crucial role in guiding their clients through each stage of the process. Let’s take a closer look at the key steps involved in the M&A process:

- Strategic Planning: The M&A process begins with strategic planning, where companies outline their objectives and growth strategies. This includes identifying potential synergies, evaluating market opportunities, and determining the strategic fit of the target company.

- Target Identification and Screening: M&A investment bankers assist in identifying potential target companies or buyers that align with the client’s growth objectives. Through market research, industry analysis, and networking, they compile a list of potential targets and conduct initial screenings to assess their suitability.

- Valuation and Financial Analysis: Once a potential target is identified, M&A investment bankers conduct a thorough valuation analysis. This involves assessing the financial performance, cash flow projections, and assets of the target company. Through various valuation techniques, such as discounted cash flow (DCF) analysis or comparable company analysis, M&A investment bankers determine the fair value of the target company.

- Negotiation and Due Diligence: After both the buyer and seller express interest in moving forward, negotiations begin. M&A investment bankers play a pivotal role in negotiating deal terms and structuring the transaction. Once a preliminary agreement is reached, due diligence is conducted to verify the target company’s financial, legal, operational, and commercial aspects. This involves a comprehensive review of documents, data analysis, and expert assessments to identify potential risks and opportunities.

- Deal Execution: With due diligence complete, the parties move forward with finalizing the deal. M&A investment bankers assist in drafting the necessary legal documents, coordinating with legal teams, and obtaining regulatory approvals. Financing strategies are also finalized, and the transaction’s financial elements are arranged, whether through debt financing, equity financing, or a combination of both.

- Post-Merger Integration: After the deal is closed, the focus shifts to integrating the operations and cultures of the merged companies. M&A investment bankers support their clients through this integration process, assisting with combining systems, processes, and teams to realize the anticipated synergies and achieve the desired growth objectives.

Throughout the entire M&A process, M&A investment bankers act as trusted advisors, providing strategic guidance, financial expertise, and deal-making skills. They ensure that the transaction aligns with the client’s objectives, maximizes value, and minimizes risks. By managing the various stages of the process, M&A investment bankers play a vital role in driving successful M&A transactions.

Valuation Techniques Used in M&A

Valuation is a critical process in M&A transactions as it determines the fair value of the target company or assets being acquired. M&A investment bankers employ various valuation techniques to assess the financial worth of a company and support decision-making. Let’s explore some common valuation techniques used in M&A:

- Discounted Cash Flow (DCF) Analysis: DCF analysis is a widely-used valuation method that projects the future cash flows of the target company and discounts them to the present value. M&A investment bankers estimate future cash flows, determine an appropriate discount rate that reflects the risk of the investment, and calculate the net present value (NPV) of the cash flows. DCF analysis considers the time value of money and provides an intrinsic value for the company.

- Comparable Company Analysis: Comparable company analysis compares the target company to similar companies in the same industry or market. M&A investment bankers analyze key financial metrics, such as price-to-earnings ratio (P/E ratio), price-to-sales ratio (P/S ratio), and enterprise value-to-EBITDA ratio (EV/EBITDA), among others. Comparisons can be made based on size, growth rate, profitability, and other relevant factors to assess the relative value of the target company.

- Comparable Transaction Analysis: Comparable transaction analysis involves studying recent M&A transactions in the same industry or market to evaluate the target company’s value. M&A investment bankers review similar deals, including transaction multiples, deal terms, and financial details, to determine a valuation range for the target company. This method helps establish a benchmark and provides insight into the market value of the target company.

- Asset-Based Valuation: Asset-based valuation focuses on assessing the net asset value (NAV) of the target company. M&A investment bankers evaluate the company’s assets, including tangible assets like property, equipment, and inventory, as well as intangible assets such as patents and trademarks. They subtract liabilities from the asset value to arrive at the net asset value. While primarily used for asset-heavy industries, this method provides a conservative estimate of the company’s worth.

- Earnings Multiples: M&A investment bankers consider earnings multiples, such as the price-to-earnings (P/E) ratio or the price-to-EBITDA (P/EBITDA) ratio, to ascertain the value of the target company. These multiples compare the company’s earnings or cash flow to its market price or enterprise value. Earnings multiples provide a quick and straightforward way to value a company, especially in industries with stable cash flows and consistent profitability.

It is important to note that each valuation method has its own strengths and limitations. M&A investment bankers often use a combination of techniques to obtain a comprehensive and well-rounded valuation assessment. The choice of valuation method depends on factors such as the industry dynamics, the nature of the target company, the availability of data, and the specific circumstances surrounding the transaction.

By employing robust and rigorous valuation techniques, M&A investment bankers provide their clients with valuable insights into the fair value of the target company. This enables informed decision-making, supports negotiations, and assists in structuring the M&A transaction to maximize value for all parties involved.

Financial Analysis in M&A Transactions

Financial analysis plays a critical role in M&A transactions, providing valuable insights into the financial health and performance of the target company. M&A investment bankers employ a variety of financial analysis methods to evaluate the target company’s financial position, profitability, and growth potential. Let’s explore some key aspects of financial analysis in M&A transactions:

- Financial Statements Analysis: M&A investment bankers delve into the target company’s financial statements, including the balance sheet, income statement, and cash flow statement. They analyze key financial metrics such as revenue growth, profitability margins, liquidity ratios, and leverage ratios. This analysis gives a comprehensive view of the target company’s financial performance and helps identify trends, strengths, and areas for improvement.

- Pro-Forma Analysis: Pro-forma analysis involves creating projected financial statements for the target company post-merger or acquisition. M&A investment bankers use historical financial data and make adjustments to reflect the expected impact of the transaction. Pro-forma analysis helps assess the potential synergies and financial benefits that may arise from the deal, providing a clearer picture of the financial implications for the acquiring company.

- Working Capital Analysis: M&A investment bankers evaluate the target company’s working capital, which includes current assets and liabilities. They assess the efficiency of the company’s working capital management, such as inventory turnover, accounts receivable collection period, and accounts payable payment period. Working capital analysis helps gauge the target company’s liquidity, operational efficiency, and potential working capital needs post-transaction.

- Revenue and Cost Analysis: M&A investment bankers analyze the target company’s revenue streams and cost structure. They assess the revenue composition by product or service, customer segment, geographic region, and distribution channels. They identify revenue drivers and evaluate the sustainability and growth potential of the company’s revenue sources. Cost analysis helps identify cost-saving opportunities, efficiency improvements, and potential synergies post-transaction.

- Profitability and Margin Analysis: M&A investment bankers examine the target company’s profitability and margin trends. They assess gross profit margins, operating profit margins, and net profit margins, comparing them to industry benchmarks and the company’s historical performance. Margin analysis helps identify the company’s strengths, profitability drivers, and areas that require improvement. It also assists in assessing the potential impact on the acquiring company’s overall profitability.

Financial analysis provides key insights into the financial viability, performance, and growth potential of the target company. By examining the target company’s financial statements, conducting pro-forma analysis, evaluating working capital, revenue, cost, and margin analysis, M&A investment bankers help their clients make informed decisions about the transaction.

Additionally, financial analysis assists in the negotiation process, as it provides a foundation for discussions on transaction terms, valuation, and potential value creation. It also helps in formulating post-transaction integration strategies, financial planning, and forecasting for the merged or acquired entity.

Through thorough financial analysis, M&A investment bankers contribute to the overall success of M&A transactions by ensuring that the financial aspects are carefully evaluated, risks are considered, and opportunities for value creation are identified.

Due Diligence in M&A

Due diligence is a crucial step in the M&A process that involves a comprehensive review and analysis of the target company’s financial, legal, operational, and commercial aspects. M&A investment bankers play a key role in overseeing the due diligence process to ensure that their clients have a thorough understanding of the risks, opportunities, and financial implications of the transaction. Let’s explore the importance and key elements of due diligence in M&A:

- Financial Due Diligence: Financial due diligence focuses on evaluating the target company’s financial information to verify its accuracy and assess financial risks. M&A investment bankers examine the historical financial statements, budgets, forecasts, and key financial metrics. They analyze the company’s revenue recognition, cash flow, profitability, and working capital management. Financial due diligence helps identify financial strengths, weaknesses, and any potential issues that could impact the value or success of the transaction.

- Legal Due Diligence: Legal due diligence involves a thorough examination of the target company’s legal documentation, including contracts, licenses, permits, intellectual property rights, litigation history, and compliance with laws and regulations. M&A investment bankers work closely with legal teams to identify any potential legal risks, liabilities, or contingencies that could impact the transaction. Legal due diligence ensures that the buyer has a clear understanding of the legal landscape and potential legal exposures.

- Operational Due Diligence: Operational due diligence focuses on assessing the target company’s operations and processes. M&A investment bankers evaluate the company’s organizational structure, management team, key personnel, technology infrastructure, supply chain, and manufacturing capabilities. They analyze operational performance, efficiency, and potential opportunities for improvement. Operational due diligence helps identify potential operational synergies, integration challenges, and risks associated with the target company’s operations.

- Commercial Due Diligence: Commercial due diligence involves evaluating the target company’s market position, customers, competitors, and growth prospects. M&A investment bankers conduct market research, analyze industry trends, and assess the target company’s customer base, sales pipeline, and marketing strategies. Commercial due diligence helps validate market assumptions, identify growth opportunities, and evaluate the target company’s competitive advantage.

- Environmental and Social Due Diligence: In certain industries and transactions, environmental and social due diligence is necessary to assess the target company’s compliance with environmental and social standards. M&A investment bankers evaluate the company’s environmental impact, social responsibility practices, and any potential liabilities or risks associated with environmental or social issues. This due diligence helps identify potential regulatory or reputational risks and enables the buyer to make informed decisions regarding sustainability and corporate social responsibility.

Through comprehensive due diligence, M&A investment bankers provide their clients with a detailed understanding of the target company, its operations, financial position, legal risks, and growth prospects. This information helps clients assess the risks and opportunities associated with the transaction, negotiate favorable terms, and make informed decisions about whether to proceed with the deal.

It is essential for M&A investment bankers to ensure that due diligence is conducted diligently, efficiently, and in accordance with industry best practices. Thorough due diligence minimizes the risk of unpleasant surprises post-transaction and helps set the foundation for a successful integration and realization of value in the M&A transaction.

Negotiation and Deal Structuring

Negotiation and deal structuring are critical aspects of the M&A process, and M&A investment bankers play a central role in facilitating these components. Negotiation involves discussions between the buyer and seller to reach an agreement on the terms and conditions of the transaction, while deal structuring focuses on establishing the financial and legal framework of the deal. Let’s explore the significance and key elements of negotiation and deal structuring in M&A:

Negotiation:

Negotiation is a delicate process that requires M&A investment bankers to represent their clients’ interests while seeking a mutually beneficial outcome. They work closely with the client to establish negotiation objectives, develop a negotiation strategy, and articulate the client’s value proposition.

M&A investment bankers leverage their industry expertise, market knowledge, and understanding of the target company to navigate the negotiation process effectively. They engage in discussions regarding purchase price, payment terms, earn-outs, indemnification provisions, and other key terms of the transaction. Their goal is to secure the most favorable deal terms for their client while maintaining a productive and collaborative relationship with the other party.

Successful negotiation requires active listening, effective communication, and a solution-oriented mindset. M&A investment bankers employ their negotiation skills to bridge the gap between the buyer’s and seller’s expectations, finding common ground to facilitate an agreement that satisfies both parties.

Deal Structuring:

Deal structuring involves designing the financial and legal framework of the transaction to optimize outcomes for both the buyer and seller. M&A investment bankers collaborate with legal teams, tax advisors, and other experts to develop a structure that maximizes value and minimizes risk.

Key aspects of deal structuring include determining the consideration mix (cash, stock, or a combination), determining the purchase price adjustments based on working capital, defining the terms of potential earn-outs or contingencies, and establishing mechanisms for post-closing adjustments and dispute resolution.

M&A investment bankers consider various factors when structuring the deal, such as tax implications, regulatory requirements, financing options, and the client’s strategic objectives. They strive to create a structure that is financially beneficial, aligns with the client’s goals, and ensures a smooth transition and integration process.

Throughout the negotiation and deal structuring process, M&A investment bankers balance the need to protect their clients’ interests while maintaining a collaborative and constructive environment. They navigate the complexities of negotiation, manage expectations, and leverage their expertise to facilitate a successful outcome.

Effective negotiation and deal structuring are crucial for a mutually beneficial and successful M&A transaction. M&A investment bankers play a pivotal role in guiding their clients through these processes, ensuring that the final agreement aligns with their objectives, maximizes value, and sets the stage for a smooth integration and future growth.

Financing Strategies for M&A Transactions

Financing is a critical aspect of M&A transactions, as it provides the necessary capital for the buyer to acquire the target company. M&A investment bankers play an essential role in helping their clients develop financing strategies that align with the transaction’s objectives and financial capabilities. Let’s explore some common financing strategies used in M&A:

- Cash Financing: Cash financing is a straightforward approach where the buyer uses its own available funds to finance the acquisition. This method offers simplicity and speed, as it eliminates the need to secure external financing. However, it can place a significant strain on the buyer’s cash reserves and limit other investment opportunities.

- Debt Financing: Debt financing involves borrowing money from banks, financial institutions, or the capital markets to fund the acquisition. M&A investment bankers help structure the debt financing, considering factors such as the buyer’s creditworthiness, the target company’s cash flow, and the terms and conditions of the debt facility. Debt financing allows the buyer to preserve cash and leverage the target company’s assets and future cash flow to repay the debt over time.

- Equity Financing: Equity financing involves raising capital by issuing new shares or selling a portion of the buyer’s existing shares to investors. M&A investment bankers assist in identifying potential equity investors, conducting valuations, and structuring the equity financing. Equity financing can provide the buyer with additional capital to fund the acquisition, strengthen its balance sheet, and align the interests of new shareholders with the success of the transaction.

- Mezzanine Financing: Mezzanine financing involves a hybrid of debt and equity financing. M&A investment bankers help structure mezzanine financing by creating instruments such as convertible debt or preferred shares. This form of financing combines characteristics of both debt and equity, providing the buyer with a flexible capital structure and potentially higher returns for investors.

- Vendor Financing: In certain cases, the seller may provide financing to the buyer as part of the acquisition. This can be in the form of a loan or deferred payments over a specified period. M&A investment bankers assist in negotiating and structuring vendor financing agreements, balancing the interests of the buyer and seller, and ensuring fair terms for both parties.

Which financing strategy is employed depends on various factors, including the buyer’s financial situation, the size and complexity of the acquisition, the availability and cost of capital, and the risk appetite of investors. M&A investment bankers analyze these factors and work closely with their clients to determine the most suitable financing structure.

Moreover, M&A investment bankers are skilled at optimizing the capital structure of the acquiring company, balancing debt and equity in a way that minimizes the cost of capital and maximizes value for the buyer. They evaluate the potential impact of different financing strategies on the buyer’s balance sheet, cash flow, and financial ratios.

By carefully considering the financing options and designing the most appropriate capital structure, M&A investment bankers ensure that the M&A transaction is financially viable, minimizes the strain on the buyer’s resources, and sets the stage for future growth and success.

Regulatory Considerations in M&A

Regulatory considerations are a crucial aspect of M&A transactions, as they can significantly impact the feasibility and success of the deal. M&A investment bankers work closely with their clients to navigate the complex regulatory landscape, ensuring compliance with relevant laws and regulations. Let’s explore some key regulatory considerations in M&A:

- Antitrust and Competition: M&A transactions must comply with antitrust and competition laws to prevent anti-competitive behavior and maintain market competitiveness. M&A investment bankers conduct thorough antitrust analyses to assess the potential impact on market concentration. They evaluate the need for obtaining regulatory approvals, such as clearance from competition authorities, and work with legal teams to ensure compliance.

- Foreign Investment Regulations: Cross-border M&A transactions may be subject to foreign investment regulations and restrictions. M&A investment bankers assist in conducting a review of applicable foreign investment laws to understand the requirements and limitations. They ensure compliance with reporting and approval procedures, and address any national security concerns related to the transaction.

- Securities Regulations: If the buyer or target company is publicly traded, M&A transactions must comply with securities regulations. M&A investment bankers work closely with legal and compliance teams to ensure compliance with disclosure requirements, insider trading laws, and applicable securities exchange regulations. They guide their clients through the necessary filings, shareholder communications, and regulatory approvals.

- Industry-Specific Regulations: Certain industries have specific regulations that impact M&A transactions. For example, healthcare acquisitions may require approvals from regulatory bodies governing healthcare providers or pharmaceutical companies. M&A investment bankers conduct industry-specific due diligence to identify and address any regulatory considerations, ensuring compliance with relevant laws and regulations specific to the industry.

- Employee and Labor Regulations: M&A transactions often have implications for employees and their rights. M&A investment bankers help their clients navigate employee and labor regulations, which may include consultation requirements, redundancy considerations, and employee transfer obligations. They work with legal teams to ensure compliance with labor laws and develop strategies to manage any potential employee-related issues during and after the transaction.

- Tax Implications: M&A transactions have significant tax implications for both the buyer and the seller. M&A investment bankers collaborate with tax experts to analyze the tax consequences of the transaction, including income tax, capital gains tax, sales tax, and transfer pricing issues. They help structure the transaction in a tax-efficient manner while ensuring compliance with tax laws and regulations.

M&A investment bankers must remain apprised of regulatory changes, trends, and best practices to effectively navigate the regulatory landscape. By identifying and addressing potential regulatory considerations early in the process, they mitigate risks, minimize delays, and ensure a smooth and compliant transaction. Additionally, they facilitate open communication and cooperation with regulatory authorities, positioning their clients for a successful outcome.

Regulatory compliance is not only essential for completing the M&A transaction but also for maintaining the reputation and integrity of the involved parties. With their deep understanding of regulations and their impact on M&A transactions, M&A investment bankers provide valuable guidance to their clients, helping them navigate through complex regulatory considerations and achieve their strategic objectives.

Challenges and Risks in M&A Investment Banking

M&A investment banking is a dynamic field that presents various challenges and risks. Navigating through these challenges and effectively managing the associated risks is crucial for M&A investment bankers to ensure the success of the transactions they facilitate. Let’s explore some common challenges and risks in M&A investment banking:

- Valuation Accuracy: Determining the accurate valuation of the target company can be challenging due to factors such as market uncertainties, complex financial structures, and varying perspectives on the company’s future performance. M&A investment bankers must employ robust valuation techniques and perform comprehensive due diligence to minimize the risk of overpaying or undervaluing the target company.

- Management Integration: Successfully integrating the management teams and cultures of the acquiring and target companies poses a significant challenge. M&A investment bankers must navigate differences in leadership styles, organizational structures, and corporate cultures to ensure a smooth transition. Poor integration can lead to conflicts, loss of key talent, and hindered synergies.

- Integration of Systems and Operations: Merging the systems, processes, and operations of the acquiring and target companies is a complex task. M&A investment bankers must address potential compatibility issues, redundancies, and gaps in processes to achieve operational synergy. Failure to integrate systems effectively can result in disruptions, decreased productivity, and increased costs.

- Regulatory and Compliance Risks: M&A transactions are subject to various regulatory requirements and compliance obligations. M&A investment bankers must ensure compliance with antitrust and competition laws, foreign investment regulations, securities regulations, and industry-specific regulations. Failure to navigate these regulations and compliance risks effectively can lead to significant financial and reputational consequences.

- Financial Risks: M&A transactions involve financial risks, including potential changes in market conditions, economic downturns, and unexpected deviations from projected financial performance. M&A investment bankers must conduct thorough financial analyses, assess the target company’s financial health, and prepare for potential financial challenges during and after the transaction.

- Integration Costs: Merging two companies involves integration costs, including severance packages, rebranding, IT systems integration, and employee training. M&A investment bankers must accurately estimate these costs and ensure that they align with the overall financial calculations and expected synergies of the transaction.

- Communication and Stakeholder Management: Effective communication is crucial throughout the M&A process, both internally and externally. M&A investment bankers must manage expectations, maintain transparency, and provide regular updates to all stakeholders involved in the transaction. Failure to communicate effectively can lead to misunderstandings, conflicts, and a breakdown in trust.

M&A investment bankers must proactively address these challenges and risks by employing sound strategies, conducting thorough due diligence, and leveraging their expertise in negotiation and deal structuring. By anticipating and mitigating potential risks, they enhance the likelihood of a successful M&A transaction and the achievement of the client’s strategic objectives.

Furthermore, staying informed about industry trends, regulatory changes, and best practices is essential for M&A investment bankers to adapt to the evolving landscape and effectively navigate the challenges and risks inherent in the M&A investment banking sector.

Conclusion

M&A investment banking is a dynamic and multifaceted field that plays a pivotal role in facilitating mergers and acquisitions. M&A investment bankers bring together financial expertise, strategic thinking, and deal-making skills to guide their clients through the complex process of buying, selling, or merging companies. They provide invaluable services, including financial advisory, due diligence, deal structuring, negotiation, and risk management.

Throughout this article, we have explored the various aspects of M&A investment banking, from the definition and role of M&A investment bankers to the intricacies of the M&A process. We discussed valuation techniques, financial analysis, due diligence, negotiation, deal structuring, financing strategies, regulatory considerations, as well as the challenges and risks involved in this field.

M&A investment bankers face numerous challenges and risks, such as accurate valuation, management integration, regulatory compliance, financial risks, and communication management. However, they navigate these challenges by leveraging their skills, knowledge, and experience, ensuring a smooth transaction process and maximizing value for their clients.

Effective M&A investment banking not only facilitates successful transactions but also shapes the future of industries and economies. By aiding companies in their growth strategies, M&A investment bankers contribute to economic development, job creation, and value creation for stakeholders.

In conclusion, M&A investment banking is a vital component of the corporate landscape, enabling companies to seize opportunities, expand their reach, and create value through strategic mergers and acquisitions. With their expertise, M&A investment bankers play a crucial role in driving successful transactions, managing risks, and fostering growth. By navigating regulatory complexities, crafting financing strategies, and addressing various challenges, M&A investment bankers help shape the transformation of businesses, industries, and economies.