Home>Finance>Prepayment: Definition, How It Works, Types, And Penalties

Finance

Prepayment: Definition, How It Works, Types, And Penalties

Modified: February 21, 2024

Learn about prepayment in finance, including its definition, how it works, various types, and potential penalties. Gain a comprehensive understanding of this important financial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Prepayment: Definition, How It Works, Types, and Penalties

Welcome to the Finance category of our blog! Today, we’ll be diving into the topic of prepayment in the realm of personal finance. Ever wondered what prepayment is all about? How does it work? What types of prepayment are there, and are there penalties involved? If these questions have crossed your mind, you’ve come to the right place.

Key Takeaways:

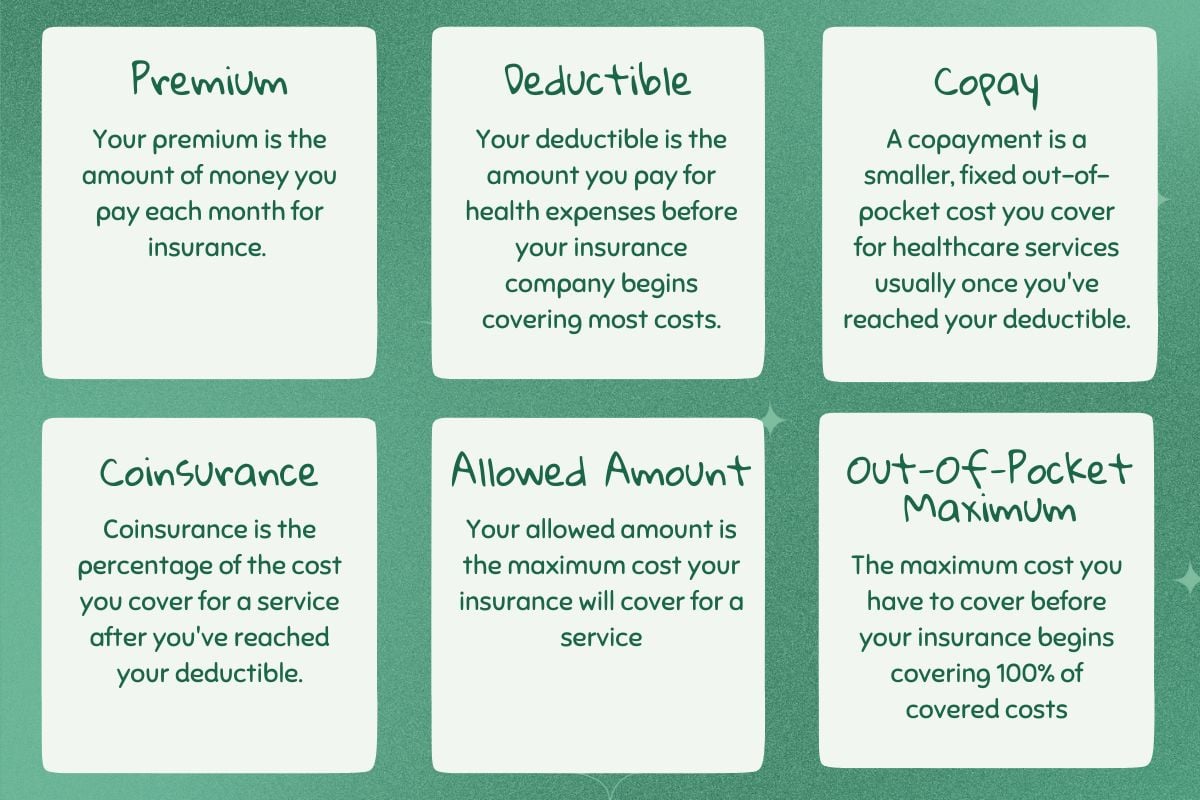

- Prepayment refers to paying off a debt or loan before its scheduled due date, resulting in interest savings and potentially shortening the repayment period.

- There are two primary types of prepayment: Full Prepayment (paying off the entire remaining balance in one lump sum) and Partial Prepayment (paying off a portion of the remaining balance).

Prepayment gives individuals the opportunity to take control of their finances and potentially save money on interest payments. By paying off a debt earlier than expected, you can reduce the overall interest that accrues over time and free up your budget for other financial goals. However, it’s important to understand the ins and outs of prepayment to make informed decisions.

How Does Prepayment Work?

When you sign up for a loan or mortgage, the repayment schedule is typically spread out over a set period, with interest calculations factored in. However, if you come into some extra cash or find yourself in a position to pay off the balance of the loan sooner, prepayment allows you to do just that. The process involves contacting your lender, notifying them of your intention to prepay, and arranging for the necessary payment.

By reducing the outstanding balance of the loan, less interest is charged over time. This can result in significant savings, particularly for long-term loans, such as mortgages. Additionally, prepayment can help you become debt-free earlier, giving you financial freedom and peace of mind.

Types of Prepayment:

- Full Prepayment: This involves paying off the entire remaining balance in one lump sum. It is an excellent option for those who have come into a significant amount of money or wish to rid themselves of a debt completely.

- Partial Prepayment: This entails paying off a portion of the remaining balance, reducing the overall debt but not eliminating it entirely. It is a suitable option if you have a surplus of funds but prefer to retain some liquidity.

It’s essential to consider your unique financial situation and goals before deciding whether to make a full or partial prepayment. Keep in mind that some lenders may have specific conditions or limitations regarding prepayment, so it’s crucial to review your loan agreement or contact your lender for accurate information.

Penalties for Prepayment:

While prepayment can be an advantageous strategy, it’s important to be aware of potential penalties that may be associated with it. Some lenders impose penalties to compensate for the loss of interest income resulting from early repayment. These penalties, also known as prepayment penalties, can range from a percentage of the outstanding balance to a set fee.

Before deciding to prepay a loan, it’s essential to weigh the potential savings against any penalties involved. In some cases, the interest savings may outweigh the penalties, especially for high-interest loans. However, for loans with low-interest rates or minimal remaining balance, it may be more prudent to avoid the fees and continue with the scheduled repayment plan.

Conclusion:

Understanding the concept of prepayment and its various elements empowers individuals to make informed financial decisions. Prepayment can provide opportunities for interest savings and early debt freedom, but it’s crucial to consider your financial goals and potential penalties. Before embarking on a prepayment journey, review your loan agreement and consult with your lender to ensure you are aware of any potential limitations and make the best decision for your financial well-being.

Remember, prepayment is just one tool in your financial arsenal, and it’s essential to consider your overall financial situation and goals holistically. By being informed and proactive, you can take control of your finances and pave the way towards a brighter financial future.