Home>Finance>What Is A Red Flag? Definition, Use In Investing, And Examples

Finance

What Is A Red Flag? Definition, Use In Investing, And Examples

Published: January 17, 2024

Discover the meaning of red flags in finance, how they are used in investment decisions, and explore real-life examples to enhance your financial acumen.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the World of Finance: Understanding Red Flags

When it comes to investing, it’s vital to have a keen eye for potential risks and warning signs that could spell trouble for your financial portfolio. That’s where red flags come into play. But what exactly is a red flag? How is it used in investing? And what are some common examples? In this blog post, we’ll delve into the world of red flags and provide you with a comprehensive understanding to help you make more informed investment decisions.

Key Takeaways:

- A red flag is a warning sign or indicator of potential risk associated with an investment.

- Red flags are used by investors to identify potential issues and make informed decisions.

Defining Red Flags

At its core, a red flag is a signal or indication that something may be amiss with an investment opportunity. It acts as a cautionary sign, prompting investors to take a closer look and evaluate the associated risks and potential consequences. Red flags can vary in form and can pertain to various aspects of an investment, such as financial performance, corporate governance, or market conditions.

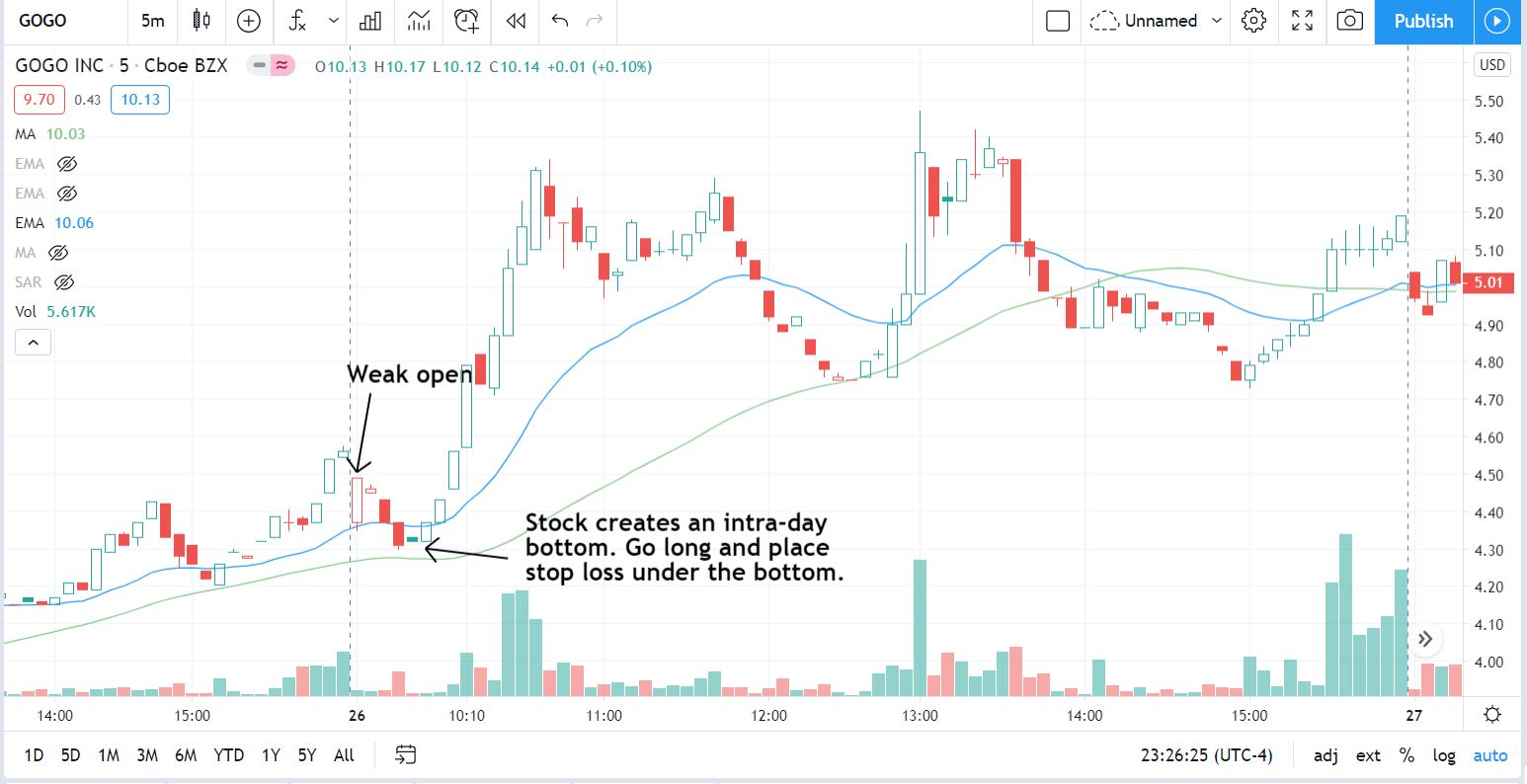

Recognizing Red Flags in Investing

Identifying red flags requires a mix of financial acumen, research, and attention to detail. By paying close attention to the following indicators, investors can spot potential warning signs and make better-informed decisions:

- Inconsistent Financial Performance: A series of declining revenues, inconsistent profit margins, or erratic earnings growth can indicate underlying issues that may affect the long-term viability of an investment.

- Poor Corporate Governance: Weak corporate governance practices, such as insider trading allegations, boardroom disputes, or lack of transparency in financial reporting, can raise significant concerns regarding the management integrity and the overall stability of the investment.

- Unusual Accounting Practices: Unexplained or irregular accounting practices, such as aggressive revenue recognition, off-balance-sheet liabilities, or frequent restatements of financial statements, may suggest potential manipulation or misrepresentation of financial information.

- Excessive Debt Levels: High levels of debt relative to a company’s earnings or cash flow can render an investment vulnerable to economic downturns, interest rate hikes, or increased financing costs.

- Legal or Regulatory Issues: Pending lawsuits, regulatory investigations, fines, or non-compliance with industry regulations can significantly impact an investment’s performance and reputation.

Examples of Red Flags

To give you a clearer understanding, let’s look at a few real-world examples of red flags:

- A company showing consistent losses in financial statements for consecutive quarters or years.

- An executive team with a history of involvement in fraud or unethical business practices.

- A sudden and significant drop in customer satisfaction or a wave of negative reviews and complaints.

- News of a potential data breach or cybersecurity vulnerabilities within a company.

- A surge in customer churn rate, indicating a decline in customer loyalty and satisfaction.

Remember, the presence of a red flag doesn’t automatically mean an investment is doomed. However, it should serve as a signal for further investigation and due diligence before making any investment decisions.

Conclusion

By understanding what red flags are, how to identify them, and being aware of common examples, investors can better protect their financial interests and make more informed decisions. Keep in mind that these warning signs are valuable tools to help you assess the risks associated with an investment, but they should always be considered alongside other factors in a holistic evaluation process. Stay vigilant, stay informed, and let red flags serve as your guide in the vast world of finance.