Finance

How To Close Accounting Books

Modified: February 21, 2024

Learn how to efficiently close your accounting books for optimal finance management and accuracy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why Closing Accounting Books is Important

- Step 1: Review and Reconcile Accounts

- Step 2: Adjust and Accrue Expenses

- Step 3: Calculate and Record Depreciation

- Step 4: Reconcile and Record Income

- Step 5: Close Revenue and Expense Accounts

- Step 6: Prepare the Balance Sheet

- Step 7: Review and Analyze Financial Statements

- Step 8: Create Closing Entries

- Step 9: Post Closing Trial Balance

- Conclusion

Introduction

When it comes to managing the financial health of a business, closing accounting books is a crucial step in the process. This process involves finalizing the financial records for a particular period and preparing them for the next accounting cycle.

The purpose of closing the books is to ensure accurate and reliable financial statements, which are essential for decision-making, tax compliance, and regulatory requirements. By closing the accounting books, businesses can gain a clear understanding of their financial position, evaluate performance, and identify areas for improvement.

While the specific steps involved in closing the books may vary depending on the complexity of the business and the accounting system used, there are some general practices that can be followed. In this article, we will explore a step-by-step guide on how to effectively close accounting books to ensure a smooth transition to the next reporting period.

Whether you are a small business owner managing your own books or the finance manager of a large corporation, understanding the closing process is essential for accurate financial reporting and analysis. So, let’s dive into the details and discover how to close accounting books effectively.

Why Closing Accounting Books is Important

Closing accounting books is a necessary step in the financial reporting process that holds significant importance for businesses. Here are some key reasons why closing accounting books is crucial:

- Ensuring Accuracy: By closing the books at the end of a reporting period, businesses can ensure the accuracy and integrity of their financial records. This involves thoroughly reviewing and reconciling accounts, identifying any discrepancies or errors, and making necessary adjustments. It helps in presenting a clear and accurate picture of the company’s financial position.

- Compliance with Regulations: Closing the accounting books is essential to comply with regulatory requirements and standards. It involves preparing financial statements in accordance with accounting principles such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Compliance with these standards is crucial for avoiding legal issues, maintaining transparency, and building trust with stakeholders.

- Evaluating Performance: Closing the books enables businesses to evaluate their financial performance for a specific period. It involves analyzing revenue, expenses, and profitability to assess the company’s financial health. By comparing the current period’s performance with previous periods, businesses can identify trends, patterns, and areas for improvement.

- Budgeting and Forecasting: Closing accounting books provides valuable information for budgeting and forecasting purposes. It helps in creating a solid financial foundation for the upcoming period by examining historical data, identifying cost trends, and projecting future revenues and expenses. Accurate financial statements are crucial for setting realistic goals and making informed financial decisions.

- Tax Compliance: Closing accounting books ensures businesses are prepared for tax season. It involves accurately calculating and recording income, expenses, and deductions. By closing the books, businesses can efficiently provide the necessary financial information to tax authorities, reducing the risk of errors, penalties, or audits.

- Preparing for Audits and Stakeholder Engagement: Closing the books is necessary for external audits and stakeholder engagement. It helps in presenting reliable financial statements to auditors, investors, lenders, and other stakeholders. Having well-closed accounting books instills confidence in the financial health of the business and facilitates smoother communication and decision-making.

In summary, closing accounting books is a critical process that ensures financial accuracy, compliance with regulations, performance evaluation, budgeting, tax compliance, and stakeholder engagement. By following best practices and closing the books effectively, businesses can maintain transparency, make informed decisions, and foster financial stability and growth.

Step 1: Review and Reconcile Accounts

The first step in closing accounting books is to review and reconcile all accounts. This involves carefully examining each account to ensure it accurately reflects the financial transactions that occurred during the reporting period.

Here are the key actions to take during this step:

- Bank Reconciliation: Start by reconciling your bank accounts. Compare your internal records with the bank statement to identify any discrepancies. Make adjustments for outstanding checks, deposits in transit, bank fees, and any other items that may affect the accuracy of your bank balances.

- Accounts Receivable: Review your accounts receivable (money owed to your business). Confirm that all outstanding invoices and credit memos are accurately recorded. Follow up on any overdue payments or disputes to ensure accurate reporting of your receivables.

- Accounts Payable: Similarly, review your accounts payable (amounts owed by your business). Verify that all invoices, bills, and credit memos are properly recorded. Check for any outstanding payments or discrepancies and resolve any issues before proceeding.

- Inventory: If your business deals with inventory, perform a physical inventory count and reconcile it with your records. Adjust your inventory valuation for any discrepancies and ensure the accuracy of your inventory balance.

- Fixed Assets: Review your fixed assets, such as property, equipment, and vehicles. Ensure that all additions, disposals, and depreciations are accurately recorded. Make any necessary adjustments to reflect the current value of your fixed assets.

- Accruals and Prepayments: Review any accrued expenses or prepaid expenses that should be recognized in the current period. Accrue for expenses that have been incurred but not yet recorded, and defer any payments made for expenses that relate to future periods.

- General Ledger: Finally, review your general ledger. Analyze the transactions recorded in various accounts to ensure they are accurate and complete. Look for any unusual or questionable entries that may require further investigation.

By thoroughly reviewing and reconciling your accounts, you can identify and resolve any errors, discrepancies, or missing transactions. This step lays the foundation for accurate financial statements and ensures the integrity of your financial records.

Once you have completed the review and reconciliation process, you can move on to the next step of closing accounting books, which is adjusting and accruing expenses.

Step 2: Adjust and Accrue Expenses

After reviewing and reconciling your accounts, the next step in closing accounting books is to adjust and accrue expenses. This step ensures that your financial statements accurately reflect the expenses incurred during the reporting period, even if the actual payment has not been made yet.

Here’s what you need to do during this step:

- Accruals: Determine any expenses that have been incurred but have not yet been recorded or paid. These expenses are known as accruals. Common examples include utility bills, interest expenses, and salaries or wages for the current period. Make sure to accrue for these expenses by debiting the corresponding expense account and crediting the appropriate liability account.

- Deferred Expenses: Review any expenses that have been paid for in advance but relate to a future period. These expenses are known as deferred expenses or prepaid expenses. Examples include insurance premiums, rent, or annual subscriptions. Adjust your financial statements by recognizing a portion of the prepaid expenses as an expense for the current period.

- Depreciation and Amortization: Calculate and record depreciation or amortization expenses for your fixed assets. Depending on the depreciation method used, allocate a portion of the asset’s cost as an expense to reflect its wear and tear or the expiration of its useful life. Debit the depreciation expense account and credit the accumulated depreciation account.

- Bad Debt Provision: If your business extends credit to customers, you may need to make provisions for potential bad debts. Analyze your accounts receivable and identify any doubtful or uncollectible amounts. Make an estimate of the unrecoverable portion and record it as an expense in your financial statements.

- Other Adjustments: Lastly, consider any other necessary adjustments like foreign currency translations, changes in accounting estimates, or corrections of prior period errors. These adjustments help ensure the accuracy and completeness of your financial statements.

By accurately adjusting and accruing expenses, you can provide a more realistic representation of your company’s financial performance for the reporting period. It helps in aligning your financial statements with the matching principle, which states that expenses should be recognized in the period in which they contribute to generating revenue.

Once you have completed this step, you can move on to the next phase of closing accounting books, which involves calculating and recording depreciation for your fixed assets.

Step 3: Calculate and Record Depreciation

In this step of closing accounting books, you will focus on calculating and recording depreciation for your fixed assets. Depreciation is the systematic allocation of the cost of a fixed asset over its estimated useful life. It accounts for the wear and tear, obsolescence, or reduction in value of the asset over time.

Here’s what you need to do during this step:

- Identify Fixed Assets: Compile a list of all your fixed assets, such as buildings, machinery, equipment, and vehicles. Determine the useful life of each asset, which is an estimate of how long the asset will be productive in generating revenue.

- Select Depreciation Method: Choose an appropriate depreciation method for each asset. Common methods include straight-line depreciation, declining balance method, and units of production method. Each method has its own assumptions and calculations for distributing the cost of the asset as an expense over its useful life.

- Calculate Depreciation Expense: Apply the chosen depreciation method to calculate the annual depreciation expense for each asset. Divide the total cost of the asset by its estimated useful life to determine the yearly depreciation amount.

- Record Depreciation Entries: Create journal entries to record the depreciation expense for each asset. Debit the depreciation expense account and credit the accumulated depreciation account. This reduces the value of the asset on the balance sheet and reflects the allocated portion of the asset’s cost as an expense on the income statement.

- Review Depreciation Policies: Periodically review your depreciation policies and ensure they align with industry standards, accounting principles, and tax regulations. Update the useful life and depreciation method as necessary to accurately reflect the usage and value of the assets.

Accurately calculating and recording depreciation is important for several reasons. It helps you allocate the cost of your fixed assets over their respective useful lives, which improves the accuracy of your income statement and balance sheet. Additionally, it provides insights into the aging and value of your assets, assists in tax planning, and supports decision-making regarding asset maintenance, replacement, or disposal.

Once you have completed this step, you can move on to the next phase of closing accounting books, which involves reconciling and recording income transactions.

Step 4: Reconcile and Record Income

In the fourth step of closing accounting books, you will focus on reconciling and recording income transactions. This step involves reviewing all revenue-related accounts and ensuring that they accurately reflect the income earned during the reporting period.

Here’s what you need to do during this step:

- Sales and Revenue: Review your sales records, invoices, and receipts to ensure that all revenue transactions have been accurately recorded. Verify that the revenue amounts are complete, correct, and properly classified based on the nature of the income.

- Reconcile Accounts: Reconcile your revenue accounts, such as sales accounts or service revenue accounts, with supporting documentation. This includes matching the amounts in your accounting records with bank deposits, sales reports, or any other evidence of revenue earned.

- Deferred Revenue: If your business receives advance payments for goods or services that will be provided in the future, assess if any portions of revenue should be deferred. Recognize the deferred revenue as a liability and adjust it accordingly to reflect the revenue that will be earned in future periods.

- Unearned Revenue: On the other hand, if your business has already recognized revenue for goods or services that have not been delivered, adjust the unearned revenue. Defer the portion that corresponds to the current reporting period and recognize it as revenue in the appropriate period.

- Estimate or Provision for Uncollectible Revenue: Analyze your accounts receivable and identify any potentially uncollectible amounts. Make provisions for bad debts by estimating the portion of revenue that may never be collected, and adjust your financial statements accordingly.

- Record Revenue Adjustments: Create journal entries to record any necessary adjustments to your revenue accounts. Debit or credit the appropriate revenue or liability accounts to reflect the correct amount of revenue earned or deferred for the reporting period.

Reconciling and recording income accurately is crucial for presenting a true and fair view of your company’s financial performance. It ensures that your financial statements reflect the revenue generated during the reporting period and that any unearned or deferred income is appropriately recognized.

Once you have completed this step, you can move on to the next phase of closing accounting books, which involves closing revenue and expense accounts.

Step 5: Close Revenue and Expense Accounts

As you proceed with closing accounting books, the fifth step involves closing revenue and expense accounts. This step aims to summarize the performance of your business for the reporting period and prepare the accounts for the next accounting cycle.

Here’s what you need to do during this step:

- Revenue Accounts: Start by closing the revenue accounts, such as sales revenue, service revenue, or interest income. Transfer the balances from these accounts to an intermediate account called the Income Summary account. This consolidation allows you to calculate the net income or loss for the reporting period.

- Expense Accounts: Next, close the expense accounts. This typically includes accounts like salaries and wages, utilities, rent, and office supplies. Add up the balances of these accounts and transfer them to the Income Summary account. This step allows you to determine the total expenses incurred during the reporting period.

- Income Summary Account: Calculate the difference between the total revenues and total expenses in the Income Summary account. If the total revenues exceed the total expenses, the result is net income. If the total expenses exceed the total revenues, the result is a net loss.

- Retained Earnings: Transfer the net income or net loss from the Income Summary account to the retained earnings account. This adjustment reflects the change in the company’s retained earnings for the reporting period.

- Zero Out Revenue and Expense Accounts: To ensure that revenue and expense accounts start with a zero balance in the new accounting period, close these accounts by transferring their balances to the retained earnings account. Debit each revenue account and credit each expense account.

The purpose of closing revenue and expense accounts is to summarize the financial performance of the business for the reporting period. By closing these accounts and transferring their balances to the Income Summary and retained earnings accounts, you can reset the revenue and expense balances for the new accounting period.

Once this step is complete, you can proceed to the next phase of closing accounting books, which involves preparing the balance sheet.

Step 6: Prepare the Balance Sheet

In the sixth step of closing accounting books, you will focus on preparing the balance sheet. The balance sheet provides a snapshot of your company’s financial position at a specific point in time and is an essential financial statement for stakeholders, investors, and lenders.

Here’s what you need to do during this step:

- Assets: Start by listing all your company’s assets, including current assets (cash, accounts receivable, inventory) and long-term assets (property, equipment, investments). Record the balances of these accounts on the assets side of the balance sheet.

- Liabilities: Next, list all your company’s liabilities, such as accounts payable, loans, and accrued expenses. Record the balances of these accounts on the liabilities side of the balance sheet.

- Owner’s Equity: Calculate the owner’s equity, which represents the residual interest in the business after deducting liabilities from assets. This includes capital contributions, retained earnings, and any other equity accounts. Record the owner’s equity balance on the same side of the balance sheet as liabilities.

- Calculate Total Assets and Liabilities: Sum up the balances of all assets and all liabilities. This will allow you to calculate the total assets and total liabilities for your balance sheet.

- Balance Sheet Equation: Ensure that the equation Assets = Liabilities + Owner’s Equity is balanced. If there is any discrepancy, double-check your calculations and make necessary adjustments to ensure accuracy.

Preparing the balance sheet gives you a clear understanding of your company’s financial position at the end of the reporting period. It provides a snapshot of the company’s assets, liabilities, and equity, allowing stakeholders to assess the company’s solvency, liquidity, and overall financial health.

Once you have prepared the balance sheet, you can move on to the next phase of closing accounting books, which involves reviewing and analyzing the financial statements.

Step 7: Review and Analyze Financial Statements

In the seventh step of closing accounting books, you will review and analyze the financial statements that you have prepared. This step allows you to understand the financial performance and position of your business, and it provides insights into areas of strength and areas that need improvement.

Here’s what you need to do during this step:

- Income Statement Analysis: Start by reviewing the income statement. Analyze the revenue, expenses, and net income or net loss for the reporting period. Look for any significant changes compared to previous periods and consider the factors that contributed to these changes.

- Balance Sheet Analysis: Move on to analyze the balance sheet. Examine the assets, liabilities, and owner’s equity. Assess the liquidity, solvency, and financial stability of your business. Look for any trends or patterns that may indicate potential risks or opportunities.

- Cash Flow Statement Analysis: Finally, review the cash flow statement. Analyze the sources and uses of cash during the reporting period. Evaluate the operating, investing, and financing activities of the business. Consider the cash flow trends and their impact on the overall financial health of the company.

- Key Performance Indicators (KPIs): Calculate and analyze financial ratios and KPIs to gain deeper insights into the financial performance of your business. Examples of important ratios include profitability ratios, liquidity ratios, and efficiency ratios. Compare these ratios to industry benchmarks and historical data to assess your company’s performance.

- Identify Strengths and Weaknesses: Use the information from your financial statements and analysis to identify the strengths and weaknesses of your business. Recognize areas where your business is performing well and areas that may require attention or improvement. This analysis will help you make informed decisions and strategies to drive growth and address any financial challenges.

Reviewing and analyzing the financial statements is crucial for understanding the financial position and performance of your business. It allows you to identify trends, evaluate the effectiveness of past decisions, and make informed projections for the future. Regular financial statement analysis helps you identify areas for improvement and ensures that your business remains on a solid financial footing.

Once you have completed this step, you can move on to the next phase of closing accounting books, which involves creating closing entries.

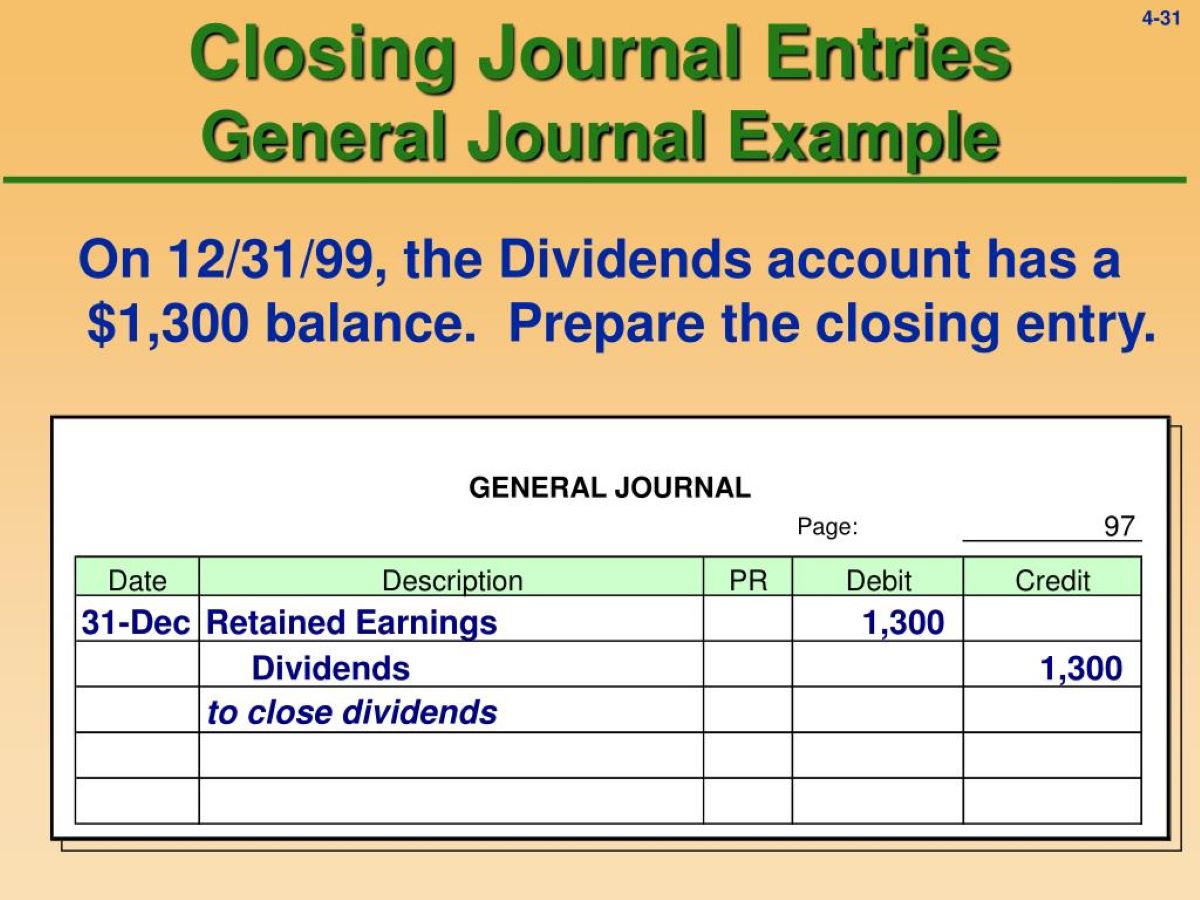

Step 8: Create Closing Entries

In the eighth step of closing accounting books, you will create closing entries to finalize the temporary accounts and transfer their balances to the appropriate permanent accounts. Closing entries are necessary to reset the temporary accounts and prepare them for the next accounting period.

Here’s what you need to do during this step:

- Identify Temporary Accounts: Temporary accounts include revenue, expense, and dividend accounts. These accounts are used to track the financial activity for a specific reporting period.

- Close Revenue Accounts: Start by closing the revenue accounts. Debit each revenue account and credit the Income Summary account to transfer the revenue balances.

- Close Expense Accounts: Proceed to close the expense accounts. Credit each expense account and debit the Income Summary account to transfer the expense balances.

- Calculate Net Income or Net Loss: Calculate the net income or net loss by determining the difference between the total revenue and total expenses in the Income Summary account.

- Close Income Summary Account: Transfer the net income or net loss from the Income Summary account to the retained earnings account. Debit the Income Summary account for a net loss or credit it for net income.

- Close Dividend Account (Optional): If your company distributes dividends to its shareholders, close the dividend account. Debit the Retained Earnings account and credit the Dividend account to transfer the dividends paid.

- Verify Balances of Permanent Accounts: Once the closing entries are completed, verify that the balances of the permanent accounts, such as assets, liabilities, and equity accounts, remain unchanged.

Creating closing entries is essential to ensure that the temporary accounts are zeroed out and the financial statements accurately reflect the results of the reporting period. By transferring the balances to the appropriate permanent accounts, you set the stage for a fresh start in the next accounting period.

Once you have completed this step, you can move on to the final phase of closing accounting books, which involves posting the closing entries to the accounts and preparing the post-closing trial balance.

Step 9: Post Closing Trial Balance

In the final step of closing accounting books, you will post the closing entries to the accounts and prepare the post-closing trial balance. This step ensures that the temporary accounts are cleared and that the permanent accounts accurately reflect the balances at the start of the next accounting period.

Here’s what you need to do during this step:

- Post Closing Entries: Transfer the balances of the closing entries to the appropriate accounts. Debit or credit the applicable accounts to update their balances based on the closing entries made in the previous step.

- Verify Account Balances: After posting the closing entries, verify that the permanent accounts (assets, liabilities, and equity accounts) have accurate balances. Ensure that the accounts reflect the correct balances before the start of the new reporting period.

- Prepare Post-Closing Trial Balance: Create a post-closing trial balance by listing all the permanent accounts with their updated balances after the closing entries have been posted. This trial balance serves as a starting point for the next accounting period.

- Ensure Balance Equality: Confirm that the total debits equal the total credits in the post-closing trial balance. If the trial balance is in balance, it indicates that the closing entries have been properly posted, and the accounts are aligned.

- Fix any Discrepancies: If the post-closing trial balance does not balance, review the accounts and their balances to identify any errors or omissions. Make the necessary adjustments to rectify any discrepancies and ensure that the trial balance is accurate.

Posting the closing entries and preparing the post-closing trial balance marks the end of the accounting period. This step ensures that the financial records are up to date and ready for the next reporting period.

With the completion of this step, you have successfully closed the accounting books, and you can now begin the new accounting period with accurate and organized financial records.

Conclusion

Closing accounting books is a critical process that allows businesses to maintain accurate financial records, comply with regulations, evaluate performance, and make informed decisions. Throughout the nine steps outlined in this guide, you have learned how to effectively close accounting books and prepare for the next accounting period.

By reviewing and reconciling accounts, adjusting and accruing expenses, calculating and recording depreciation, reconciling and recording income, closing revenue and expense accounts, preparing the balance sheet, reviewing and analyzing financial statements, creating closing entries, and posting the closing trial balance, you have completed a comprehensive process.

Closing accounting books ensures that the financial statements accurately reflect the business’s performance, position, and cash flow for the reporting period. It allows you to comply with regulations, evaluate profitability, identify areas for improvement, and provide reliable information to stakeholders.

Regular and accurate closing of accounting books enables businesses to make informed decisions based on reliable and up-to-date financial information. It ensures the integrity of financial records and facilitates transparency and accountability.

Remember to tailor the closing process to your specific business needs, accounting system, and industry regulations. Stay up to date with changes in accounting standards and adapt your practices accordingly.

By following the best practices outlined in this guide and leveraging the power of accurate financial reporting, you set your business up for success in achieving financial stability and growth.