Home>Finance>Treasury Stock Method: Definition, Formula, Example

Finance

Treasury Stock Method: Definition, Formula, Example

Published: February 11, 2024

Learn the definition, formula, and see an example of the treasury stock method in finance. Understand how it can impact stock options and shares.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Treasury Stock Method: Understanding its Definition, Formula, and Example

When it comes to understanding the intricacies of finance, one topic that often perplexes individuals is the treasury stock method. This method plays a critical role in determining a company’s diluted earnings per share (EPS) and is an essential tool for investors and financial analysts alike. In this blog post, we will delve into the definition, formula, and provide a straightforward example to help demystify the treasury stock method.

Key Takeaways:

- The treasury stock method is used to calculate a company’s diluted EPS.

- This method assumes that when in-the-money stock options or other securities are exercised or converted, the proceeds from these transactions are used to repurchase the company’s own shares at the average market price during the reporting period.

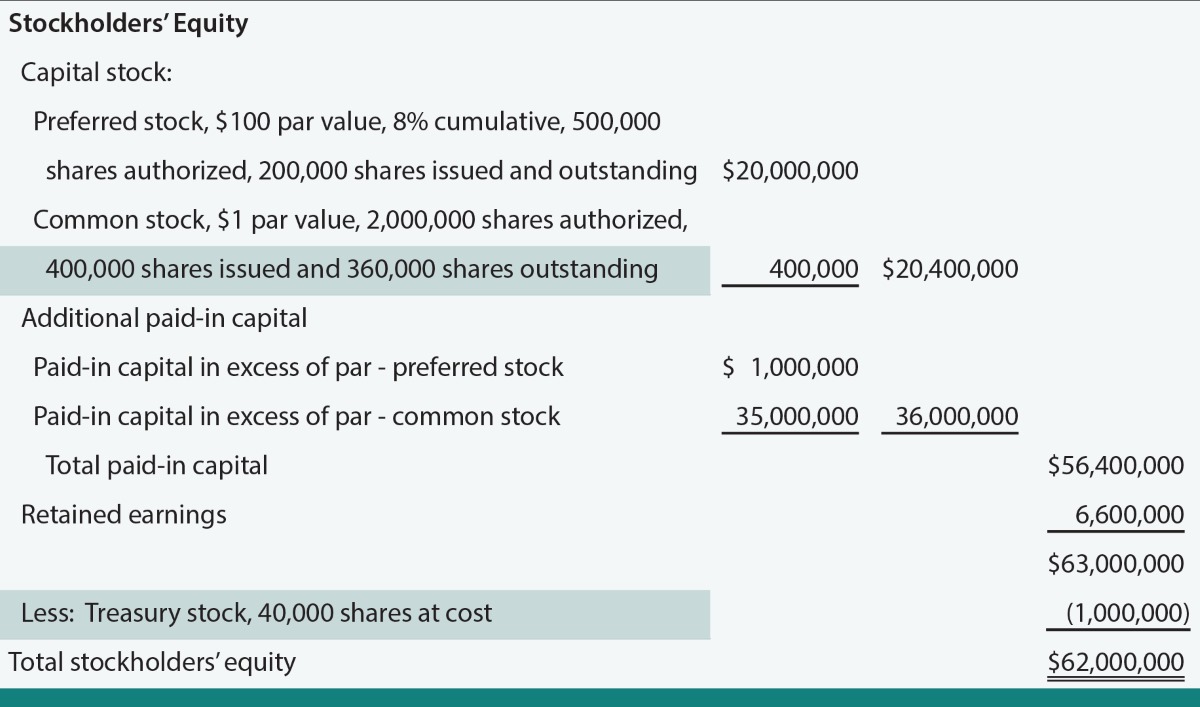

Now that we have established the importance of the treasury stock method, let’s dive into its definition. This method is utilized to determine the impact of potentially dilutive securities on a company’s earnings per share. Dilutive securities could include stock options, stock warrants, convertible preferred stock, or other convertible securities that can be converted into common shares.

The treasury stock method assumes that the proceeds received from the exercise or conversion of these securities are used to buy back some of the company’s outstanding shares at the average market price over a specified period. By doing so, this method calculates the estimated additional shares that would be outstanding if the securities were exercised or converted.

The Formula:

The treasury stock method formula is fairly straightforward:

New shares issued = (Number of dilutive securities * (Average market price – Exercise price)) / Average market price

This formula takes into account the number of dilutive securities, the average market price, and the exercise price. By subtracting the exercise price from the average market price and dividing it by the average market price, we can calculate the number of new shares that would be issued upon the exercise or conversion of the dilutive securities.

Let’s take a look at a simplified example to illustrate the concept:

An Example:

Imagine a company XYZ Corporation has 100,000 stock options outstanding with an exercise price of $50 per share. The average market price of XYZ Corporation’s shares over a specified period is $60. Using the treasury stock method formula, we can calculate the number of new shares that would be issued:

- Number of dilutive securities: 100,000

- Average market price: $60

- Exercise price: $50

By plugging these values into the formula, we can calculate:

New shares issued = (100,000 * ($60 – $50)) / $60 = 16,667

In this example, if all the stock options were exercised, XYZ Corporation would issue approximately 16,667 new shares. This calculated value is then used to determine the diluted EPS, which gives a more accurate representation of a company’s earnings per share when considering potentially dilutive securities.

Conclusion:

In conclusion, the treasury stock method is a crucial calculation used to determine diluted EPS by considering the potential impact of dilutive securities on a company’s shares. By applying the formula to estimate the additional shares that would be issued through exercising or converting these securities, investors and financial analysts gain a clearer perspective on a company’s true earnings per share.

Understanding the treasury stock method enables investors and analysts to make better-informed decisions when evaluating a company’s financial performance and potential future growth. By grasping this integral concept, individuals can navigate the world of finance with greater confidence and expertise.