Finance

What Is A+ Credit Score

Modified: February 21, 2024

Discover what a+ credit score means and how it can impact your financial future. Gain valuable insights about finance and creditworthiness.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your personal finances, one of the most important factors lenders consider is your credit score. Your credit score is a numerical representation of your creditworthiness and is used by financial institutions to determine whether or not to extend credit to you, and at what terms.

An A+ credit score is the highest designation a borrower can achieve, indicating a strong credit profile. It signifies a high level of trustworthiness and responsibility in managing credit. Having an A+ credit score can open doors to a range of financial opportunities, including favorable interest rates on loans, credit cards with generous rewards, and even better rental and employment prospects.

In this article, we will delve into what a credit score is, provide an in-depth understanding of what an A+ credit score entails, highlight the benefits of having an A+ credit score, discuss the factors that contribute to achieving this prestigious rating, and provide tips on maintaining and improving your credit score.

What is a Credit Score?

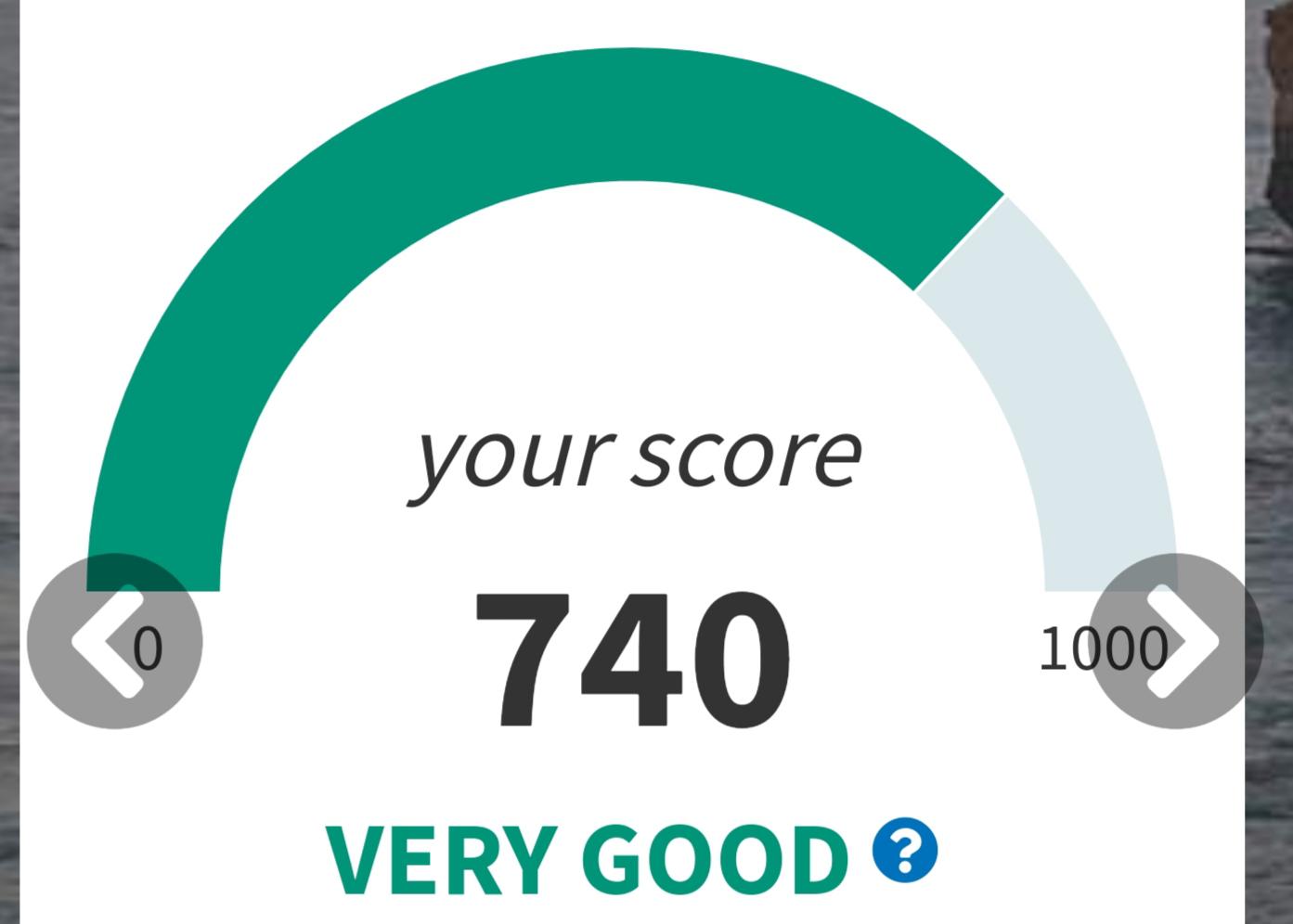

A credit score is a three-digit number that represents your creditworthiness and is used by lenders to assess the risk of lending you money. It is a snapshot of your credit history and provides insight into how responsible you are with managing credit. Credit scores are typically generated by credit bureaus, such as Equifax, Experian, and TransUnion, using mathematical algorithms that consider various factors.

These factors include your payment history, the amount of debt you owe, the length of your credit history, the types of credit you have, and new credit applications. The most common credit scoring model used is the FICO score, which ranges from 300 to 850. The higher your credit score, the better your creditworthiness, and the more likely you are to be approved for loans or credit cards.

Having a good credit score is vital because it not only determines whether you can obtain credit but also affects the interest rates you qualify for. A higher credit score means you are seen as a lower risk borrower, allowing you to access better loan terms and lower interest rates. On the other hand, a lower credit score may result in higher interest rates or even denial of credit altogether.

Understanding A+ Credit Score

An A+ credit score is the highest designation a borrower can achieve and is considered excellent credit. It signifies a strong credit history and responsible credit management. While different credit scoring models may have varying ranges, in general, an A+ credit score falls within the top tier of credit scores.

Having an A+ credit score demonstrates to lenders that you have a proven track record of borrowing and paying back loans responsibly. It shows that you are likely to make your payments on time and are a low credit risk. This puts you in a favorable position when applying for loans, credit cards, or other forms of credit.

Financial institutions typically offer their best interest rates and terms to borrowers with A+ credit scores. This means you may be eligible for lower interest rates on mortgages, personal loans, and auto loans, saving you thousands of dollars over the life of the loan. Additionally, credit card issuers often reserve their most lucrative rewards programs and premium card offerings for individuals with excellent credit scores.

Having an A+ credit score also extends beyond borrowing. Landlords and employers often perform credit checks as part of the rental application process or background checks for employment. A strong credit score can give you an edge over other applicants, increasing the chances of being approved for that dream apartment or job opportunity.

It should be noted that achieving an A+ credit score requires consistent financial responsibility and good credit habits over time. It is not just a one-time event but rather a reflection of your long-term creditworthiness.

Benefits of Having an A+ Credit Score

Holding an A+ credit score comes with a multitude of benefits that can positively impact your financial well-being. Let’s explore some of the advantages of having an A+ credit score:

- Access to Better Loan Terms: Lenders view individuals with A+ credit scores as low-risk borrowers. This enables you to secure loans with favorable terms, such as lower interest rates, longer repayment periods, and potentially higher loan amounts.

- Lower Interest Rates on Credit Cards: Credit card companies offer competitive interest rates and more attractive rewards programs to individuals with excellent credit scores. You may qualify for credit cards that provide cash back, travel rewards, or other perks.

- Rental and Housing Opportunities: Landlords often check credit scores during the tenant screening process. With an A+ credit score, you are more likely to be approved for rental properties and may even negotiate better lease terms.

- Higher Chance of Approval for Credit: Whether you’re applying for a personal loan, auto loan, or mortgage, having an A+ credit score increases your likelihood of being approved. Lenders have confidence in your ability to repay the loan on time.

- Potential Employment Advantages: Some employers may conduct credit checks when evaluating job candidates. Having an excellent credit score can give you a competitive edge over other applicants, strengthening your chances of securing employment.

- Utility and Service Providers: Utility companies and service providers may require a credit check when opening accounts for services such as electricity, internet, or cell phone plans. A strong credit score can make the process smoother and may even allow you to avoid hefty deposits.

- Insurance Premium Discounts: Many insurance companies take credit scores into account when determining premiums for auto and home insurance. With an A+ credit score, you may be eligible for lower insurance premiums, saving you money in the long run.

These are just a few of the benefits you can enjoy when you achieve and maintain an A+ credit score. It’s worth the effort to establish and nurture a solid credit history to reap these advantages and secure a strong financial future.

Factors That Contribute to an A+ Credit Score

Several key factors contribute to achieving an A+ credit score. While the specific weight given to each factor may vary between credit scoring models, understanding these factors can help you maintain and improve your credit score. Here are some of the primary factors that contribute to an A+ credit score:

- Payment History: Your payment history is a crucial factor in determining your creditworthiness. Making consistent, on-time payments for all your credit obligations, such as loans, credit cards, and bills, is essential for achieving and sustaining an A+ credit score.

- Credit Utilization Ratio: This ratio refers to the amount of credit you are currently using compared to the total credit available. Keeping your credit utilization low, preferably below 30%, demonstrates responsible credit management and positively impacts your credit score.

- Length of Credit History: The length of time you have had credit accounts is an important consideration. An extensive credit history, marked by a consistent track record of responsible credit usage, can help boost your credit score.

- Types of Credit: Maintaining a healthy mix of credit accounts, such as credit cards, mortgages, and loans, indicates your ability to manage various forms of credit responsibly. This diversity contributes positively to your credit score.

- New Credit Applications: Opening multiple new credit accounts within a short period can raise red flags for lenders. It’s important to be mindful of the number of new credit applications you make, as excessive inquiries can negatively impact your credit score.

- Credit History: A long and positive credit history, with no instances of bankruptcy, foreclosures, or collections, helps establish and maintain an A+ credit score. Building a solid credit history takes time and responsible credit management.

Remember, these factors are interrelated, and maintaining a strong credit score requires a holistic approach. Strive to make timely payments, keep your credit utilization ratio low, maintain a diverse credit portfolio, and be cautious when applying for new credit. By focusing on these factors, you can increase your chances of achieving an A+ credit score and enjoy the associated financial benefits.

Maintaining an A+ Credit Score

Maintaining an A+ credit score requires consistent effort and responsible financial habits. Here are some key strategies to help you maintain your excellent credit score:

- Monitor Your Credit: Regularly review your credit reports from the major credit bureaus to ensure accuracy and identify any potential errors. Report any discrepancies immediately to have them corrected.

- Make Timely Payments: Pay all your bills and credit obligations on time. Late payments can have a significant negative impact on your credit score. Set up automatic payments or reminders to help you stay on track.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio under 30%. Pay down balances and avoid maxing out your credit cards. Keeping your utilization low shows responsible credit management.

- Avoid Closing Credit Accounts: Length of credit history is an essential factor in your credit score. Keeping older credit accounts open, even if they have a zero balance, can benefit your credit score by demonstrating a longer and more established credit history.

- Use Credit Responsibly: Avoid excessive borrowing and only take on credit that you can comfortably manage. Use credit cards for necessary expenses and pay off the balances in full each month to avoid accruing high-interest charges.

- Build a Diverse Credit Mix: Having a mix of credit accounts, such as credit cards, loans, and a mortgage, demonstrates your ability to handle different types of credit. However, do not open new accounts just to diversify your credit mix.

- Limit New Credit Applications: Avoid applying for multiple new credit accounts within a short period. Each credit application results in a hard inquiry on your credit report, which can lower your credit score temporarily.

Consistently practicing these habits will help you maintain your A+ credit score and ensure that you continue to qualify for the best loan terms and credit opportunities. Remember, maintaining good credit is a long-term commitment that requires discipline and responsible financial management.

How to Improve Your Credit Score

If your credit score is not as high as you would like it to be, don’t worry. There are steps you can take to improve your credit score over time. Here are some strategies to help you boost your creditworthiness:

- Pay Bills on Time: Consistently making on-time payments is crucial for improving your credit score. Set up payment reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: Paying down credit card balances can have a significant positive impact on your credit score. Aim to keep your credit card utilization ratio below 30% to show responsible credit management.

- Address Delinquent Accounts: If you have any delinquent accounts or collections, work towards resolving them. Contact the creditors or collections agencies to establish payment plans or negotiate settlements.

- Minimize New Credit Applications: Limit the number of new credit applications you make. Each application results in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Build a Positive Credit History: Establishing a positive credit history takes time. Use credit responsibly, make timely payments, and keep accounts open for as long as possible to demonstrate a solid credit history.

- Monitor Your Credit: Regularly monitor your credit reports for any errors or inaccuracies. Dispute any discrepancies with the credit bureaus. You can also consider using credit monitoring services to stay updated on any changes to your credit profile.

- Consider Credit Building Tools: If you’re struggling to qualify for traditional credit, consider credit builder loans or secured credit cards. These can help you establish or rebuild your credit history.

Improving your credit score takes time and discipline. There are no quick fixes, but by implementing these strategies consistently, you can gradually see an improvement in your creditworthiness. Patience and responsible credit management are key.

Conclusion

Your credit score plays a crucial role in your financial life, influencing your ability to secure credit, access favorable loan terms, and even impact your housing and employment opportunities. Achieving and maintaining an A+ credit score is a worthwhile goal that can significantly benefit your financial well-being.

Understanding what a credit score is, the factors that contribute to an A+ credit score, and the benefits of maintaining excellent credit is essential. By practicing responsible credit habits such as making timely payments, keeping credit utilization low, and managing a diverse credit mix, you can increase your chances of achieving an A+ credit score.

However, it’s important to remember that building and maintaining excellent credit is a long-term commitment. Consistency, discipline, and responsible credit management are key to sustaining a high credit score. Regularly monitoring your credit reports, addressing any discrepancies, and practicing good financial habits will help you stay on track.

If your credit score isn’t where you want it to be, don’t despair. Implementing strategies to improve your credit score, such as paying bills on time, reducing credit card balances, addressing delinquent accounts, and building a positive credit history, can help you boost your creditworthiness over time.

In conclusion, your credit score is a powerful financial tool that can open doors to better opportunities and save you money. Aim for an A+ credit score by following the guidelines and strategies outlined in this article. By doing so, you’ll be on your way to achieving a strong credit profile and enjoying the many benefits that come along with it.