Home>Finance>Treasury Stock (Treasury Shares): Definition, Use On Balance Sheets, And Example

Finance

Treasury Stock (Treasury Shares): Definition, Use On Balance Sheets, And Example

Published: February 11, 2024

Learn about the definition, use, and example of treasury stock (treasury shares) in finance. Understand how it affects balance sheets

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Treasury Stock (Treasury Shares): Definition, Use on Balance Sheets, and Example

Welcome to the “FINANCE” category on our blog! In today’s post, we will be diving into the concept of treasury stock (also known as treasury shares), exploring its definition, its use on balance sheets, and providing an example to help you understand its practical application. So, let’s get started!

Key Takeaways:

- Treasury stock refers to a company’s own shares that it repurchases from its shareholders and keeps in its treasury.

- Companies often repurchase their own shares for various reasons, such as to boost the share price, distribute excess cash to shareholders, or use them for employee stock compensation plans.

What is Treasury Stock?

Treasury stock, or treasury shares, refers to the shares of a company’s stock that it repurchases from its shareholders. These repurchased shares are then held in the company’s treasury and are not considered outstanding for voting or dividend purposes.

When a company repurchases its own shares, it reduces the number of outstanding shares in the market, effectively decreasing the ownership interest of existing shareholders. Treasury stock is recorded as a contra-equity account on the balance sheet, representing the reduction in shareholders’ equity.

It is important to note that treasury stock is different from authorized but unissued shares, which are shares the company could potentially issue in the future but has not yet done so.

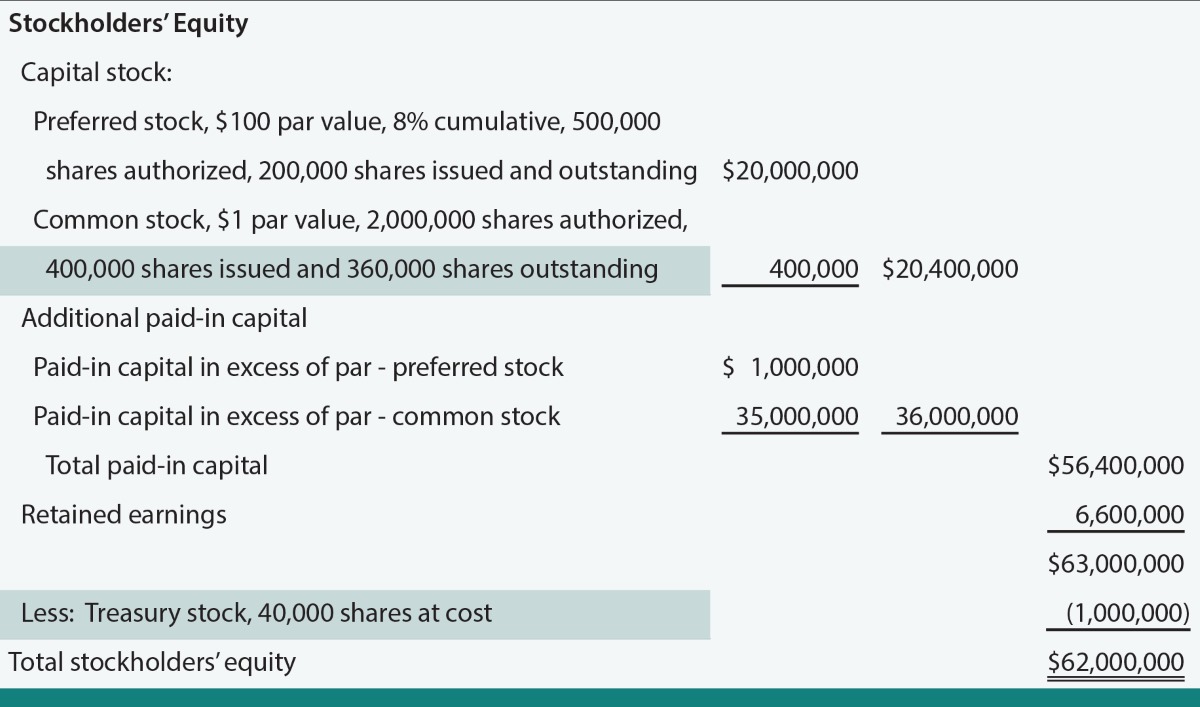

Use of Treasury Stock on Balance Sheets

Treasury stock is reported on a company’s balance sheet under the shareholders’ equity section. It is presented as a negative value deducted from the total shareholders’ equity. The subtraction of treasury stock from shareholders’ equity ensures that the repurchased shares do not have an inflated impact on the company’s financial position.

By repurchasing its own shares, a company can increase the earnings per share (EPS) by reducing the number of outstanding shares. This could potentially boost the stock price and signal confidence to the market about the company’s future performance.

Additionally, companies may use treasury stock for various purposes:

- Stock Price Support: Companies may repurchase their own shares to maintain or increase the stock price, especially when they believe the market undervalues their shares.

- Employee Stock Compensation Plans: Treasury stock can be used to fulfill employee stock option plans or other equity-based compensation programs, providing employees with a stake in the company’s performance.

- Acquisitions and Mergers: Companies can use treasury stock as a currency for potential acquisitions or mergers, using the shares to exchange for other companies’ stock.

- Flexible Dividend Distribution: By holding treasury stock, a company can distribute excess cash to its shareholders through share buybacks instead of paying dividends.

Example of Treasury Stock

Let’s consider an example to illustrate how treasury stock works:

Company XYZ decides to repurchase 10,000 of its outstanding shares in the open market. The repurchased shares are then recorded as treasury stock on the balance sheet at their repurchase cost.

Before the repurchase:

- Total Outstanding Shares: 100,000

- Share Price: $50

After the repurchase:

- Total Outstanding Shares: 90,000

- Treasury Stock: 10,000 shares

- Share Price: Potentially influenced by the repurchase

In this hypothetical scenario, the repurchase of treasury stock reduces the total number of outstanding shares, potentially increasing the EPS and affecting the share price.

Conclusion

Understanding treasury stock is essential for investors and financial analysts as it provides insights into a company’s financial management and strategic decision-making.

In summary, treasury stock refers to a company’s own shares that it repurchases from shareholders, holding them in its treasury and reducing the number of outstanding shares. By using treasury stock, companies can influence the stock price, compensate employees, facilitate acquisitions, and distribute excess cash. Remember, treasury stock is presented as a negative value on the balance sheet under shareholders’ equity.

We hope this blog post has provided you with a clear understanding of treasury stock and its implications on a company’s financial statements. If you have any further questions or would like to explore more topics related to finance, feel free to browse our “FINANCE” category for more valuable insights!