Finance

What Type Of Account Is Bonds Payable

Published: October 11, 2023

Discover the different types of finance accounts, including the significance of bonds payable. Enhance your understanding of finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Bonds payable are a common type of financial instrument used by companies and governments to raise capital. They represent a form of debt financing, where the issuer borrows money from investors and promises to repay the principal amount along with periodic interest payments. Bonds payable are an important part of the financial landscape and play a crucial role in providing companies and governments with the funds they need to invest in new projects, expand operations, or meet financial obligations.

Investing in bonds payable can be an attractive option for investors as well, offering a more stable and predictable return compared to other investment vehicles. Bonds can be bought and sold on the secondary market, allowing investors the opportunity to potentially earn income and capitalize on changes in interest rates. Understanding the different types of bonds payable is crucial for both issuers and investors to make informed decisions and manage their financial portfolios effectively.

In this article, we will explore the various types of bonds payable. From convertible bonds to junk bonds, each type offers different features and benefits, making them suitable for different investment objectives and risk tolerance levels. By understanding the characteristics of each type, investors can make informed decisions and issuers can tailor their bond offerings to meet specific financing needs.

Definition of Bonds Payable

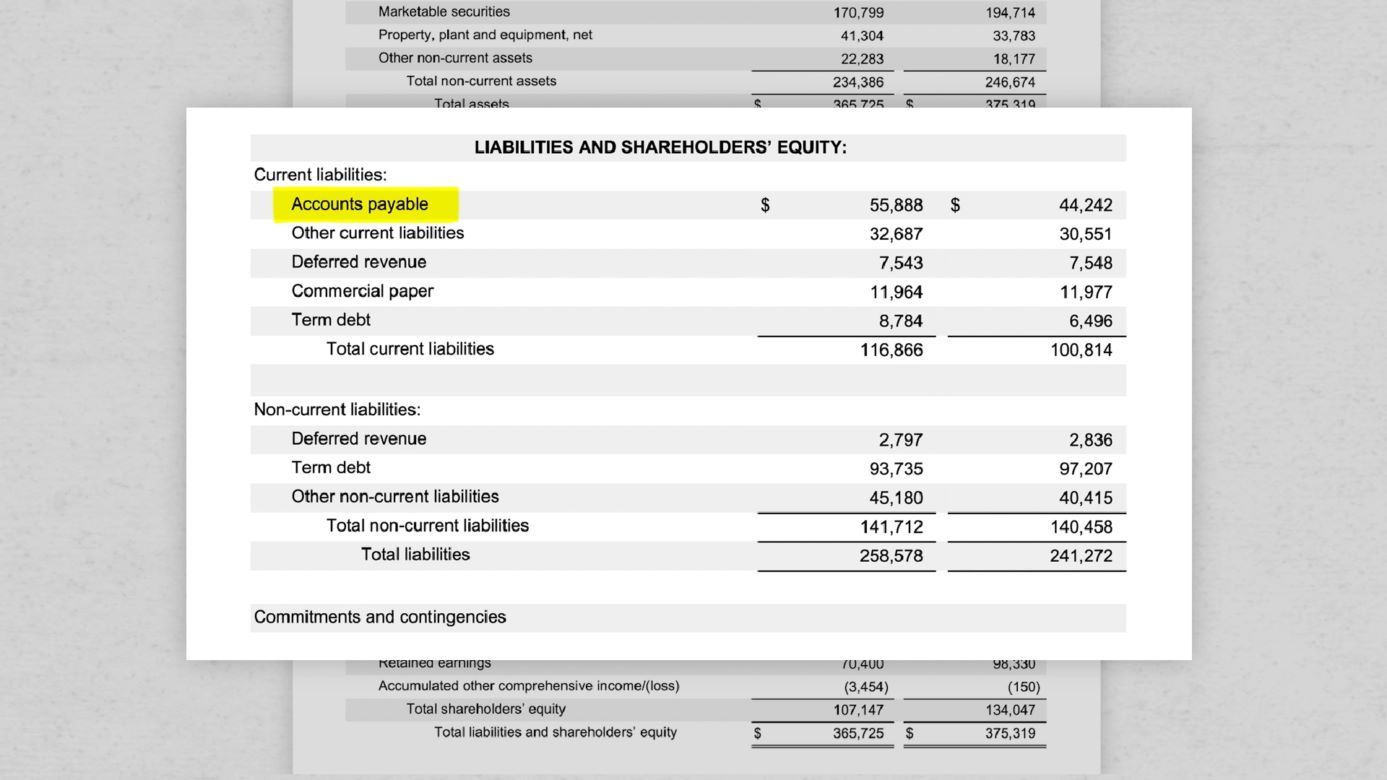

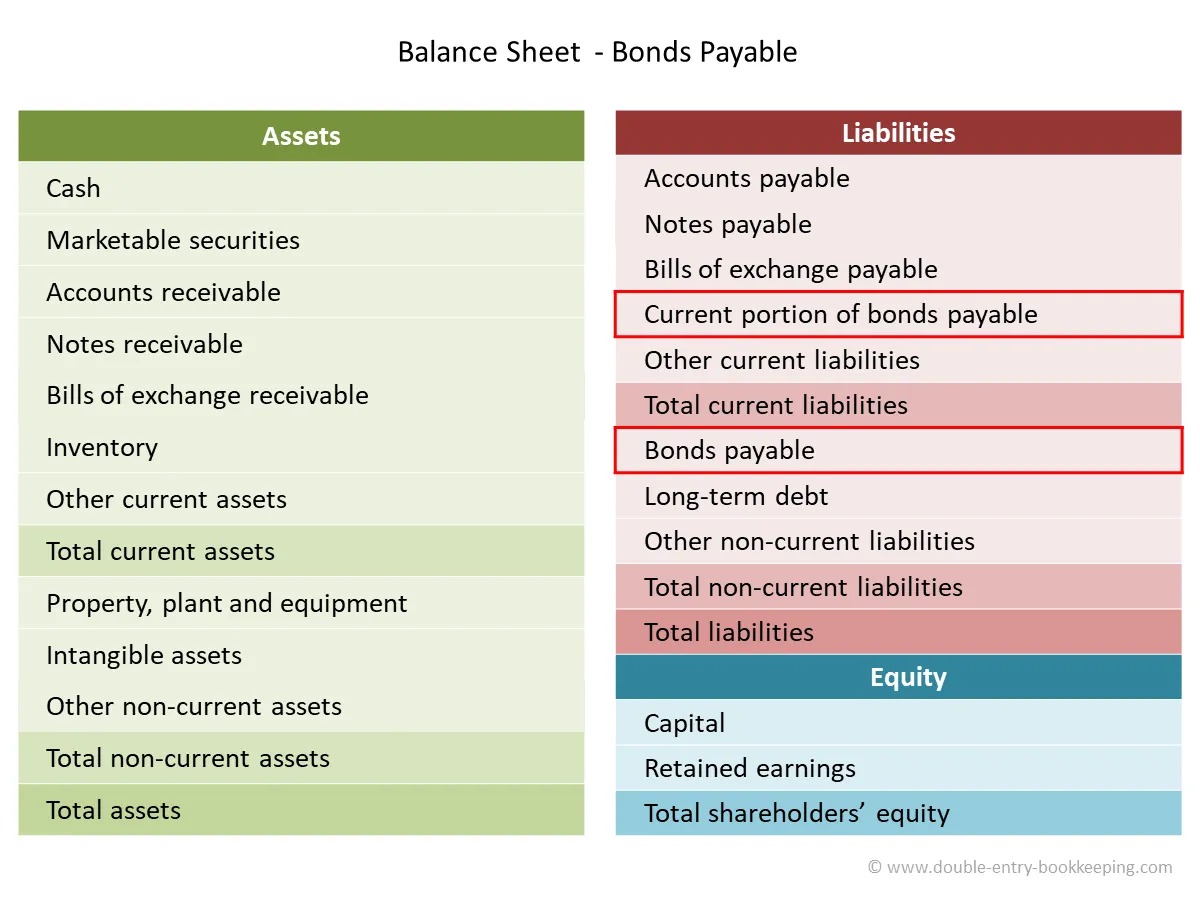

Bonds payable, also known as debt securities or simply bonds, are financial instruments issued by companies, municipalities, and governments to raise capital. They serve as a form of borrowing, where the issuer agrees to repay the principal amount to the bondholders within a specified period. Additionally, interest payments, called coupon payments, are made periodically to compensate the bondholders for lending their money.

Bonds payable are typically sold in the primary market, where the issuer directly sells the bonds to investors. The terms of the bond, including the interest rate, maturity date, and payment frequency, are established at the time of issuance. These terms are outlined in a legal document, known as a bond indenture, which provides the rights and obligations of both the issuer and the bondholders.

Unlike stocks, which represent ownership in a company, bonds represent a creditor relationship. When an investor purchases bonds payable, they are essentially lending money to the issuer, who promises to repay the debt at maturity. Bondholders have a legal claim on the issuer’s assets and are considered ahead of shareholders in the event of bankruptcy or liquidation. This makes bonds a relatively safer investment option compared to stocks, as bondholders have a higher chance of recovering their investment.

The interest rate, or coupon rate, on bonds payable is determined by several factors, such as prevailing market rates, creditworthiness of the issuer, and the time to maturity. Bonds with higher credit ratings and longer maturities generally offer higher coupon rates to compensate investors for the increased risk and longer time commitment. However, the interest rate on bonds remains fixed throughout their term, providing investors with a predictable stream of income over time.

Investors have the option to hold bonds payable until maturity or sell them in the secondary market before the bond’s maturity date. The price of a bond in the secondary market is influenced by various factors, including changes in interest rates, credit ratings, and market demand. If interest rates rise, the value of existing bonds with lower interest rates will decrease, making them less attractive to potential buyers. Conversely, if interest rates fall, the value of existing bonds with higher interest rates may increase, as they offer a more attractive yield compared to newly issued bonds.

In summary, bonds payable are debt securities that allow companies, municipalities, and governments to raise capital by borrowing money from investors. They provide a steady income stream to investors with relatively lower risk compared to stocks. The terms of bonds payable, such as interest rate and maturity date, are established at the time of issuance and can be bought and sold on the secondary market. Understanding the types and features of different bonds payable can help investors make informed investment decisions and manage risk in their portfolios.

Types of Bonds Payable

There are several types of bonds payable, each offering unique features and benefits. Understanding the different types can help investors make informed decisions and issuers tailor their bond offerings to meet specific financing needs. Let’s explore some of the most common types of bonds payable:

- Convertible Bonds: Convertible bonds give bondholders the option to convert their bonds into a specified number of shares of the issuer’s common stock. This feature allows investors to participate in any potential appreciation of the issuer’s stock while still receiving regular interest payments. Convertible bonds are attractive to investors who believe the issuer’s stock price will rise significantly in the future. If the stock price does not rise, the bondholder can still receive interest payments and the return of their principal at maturity.

- Callable Bonds: Callable bonds give the issuer the option to redeem the bonds before the maturity date, usually at a premium to the bond’s face value. This allows the issuer to take advantage of declining interest rates and refinance the debt at a lower cost. While callable bonds provide flexibility to the issuer, they introduce a degree of uncertainty for bondholders, as their investment can be redeemed earlier than expected.

- Zero-Coupon Bonds: Zero-coupon bonds, also known as discount bonds, do not pay periodic interest payments. Instead, they are issued at a discount to their face value and mature at par value. The investor earns a return by buying the bond at a discount and receiving the full face value at maturity. Zero-coupon bonds are attractive to investors looking for long-term, fixed-income investments and are willing to forgo regular interest payments.

- Unsecured Bonds: Unsecured bonds, also known as debentures, are not backed by specific assets of the issuer. They rely solely on the creditworthiness of the issuer for repayment. Unsecured bonds typically offer higher interest rates to compensate investors for the increased risk. Investors should carefully assess the creditworthiness of the issuer when considering unsecured bonds.

- Secured Bonds: Secured bonds are backed by specific assets or collateral of the issuer. If the issuer defaults, bondholders have a claim on the designated assets. Secured bonds offer a lower level of risk compared to unsecured bonds, as the collateral provides an added layer of protection for investors. Examples of secured bonds include mortgage-backed securities and asset-backed securities.

- Junk Bonds: Junk bonds, also known as high-yield bonds or speculative-grade bonds, are issued by companies with lower credit ratings. These bonds carry a higher risk of default but offer higher yields to compensate investors for the increased risk. Junk bonds can be attractive to investors seeking higher returns but come with a higher level of risk and volatility.

These are just a few examples of the types of bonds payable available in the market. Each type offers different risk-reward profiles, and investors should carefully evaluate their investment goals and risk tolerance before investing in bonds. Additionally, issuers can customize their bond offerings based on their financing needs and market conditions, incorporating features that appeal to potential investors.

By understanding the characteristics and features of different types of bonds payable, investors can build diversified portfolios and effectively manage risk. It is always recommended to consult with a financial advisor or conduct thorough research before making any investment decisions.

Convertible Bonds

Convertible bonds are a unique type of bond that gives bondholders the option to convert their bonds into a specified number of shares of the issuer’s common stock. This feature provides investors with the potential to participate in any future appreciation of the issuer’s stock price while still receiving regular interest payments.

One of the key advantages of convertible bonds is their flexibility. If the issuer’s stock price rises significantly, bondholders can choose to convert their bonds into equity, allowing them to benefit from the potential capital gains. Convertible bonds offer investors the opportunity to participate in the growth potential of the issuer while still having the security of a fixed-income investment.

Convertible bonds are particularly attractive to investors who believe the issuer’s stock price will rise over time. By converting bonds into equity, investors can potentially capture the upside of the issuer’s stock without having to purchase shares directly. Additionally, if the stock price does not rise significantly, bondholders can still receive regular interest payments and the return of their principal at maturity.

From the issuer’s perspective, convertible bonds can be an attractive financing option. They offer the opportunity to raise capital at a lower interest rate compared to issuing traditional bonds since investors are willing to accept a lower coupon rate in exchange for the conversion feature. Convertible bonds can also provide issuers with the opportunity to reduce their overall debt burden if bondholders choose to convert their bonds into equity.

It’s important to note that the conversion ratio, which determines the number of shares received per bond, and the conversion price, which is the price at which the conversion occurs, are predetermined at the time of issuance. These terms are specified in the bond indenture and provide clarity for both investors and issuers.

Investors considering convertible bonds should carefully evaluate the issuer’s stock performance and potential for future growth. Additionally, they should assess the creditworthiness of the issuer to ensure the ability to receive regular interest payments and the return of their principal in case the bonds are not converted.

Overall, convertible bonds offer a unique investment opportunity, combining fixed-income characteristics with the potential for equity-like returns. They provide investors with flexibility and the ability to participate in the growth of the issuer’s stock, while also providing the security of regular interest payments. For issuers, convertible bonds can be an attractive financing option that balances their need for capital while potentially reducing their debt burden.

Callable Bonds

Callable bonds are a type of bond that gives the issuer the option to redeem or “call” the bonds before the scheduled maturity date. This feature allows the issuer to refinance the debt at a lower cost if prevailing interest rates decline. Callable bonds provide issuers with flexibility in managing their debt obligations but introduce a degree of uncertainty for bondholders.

When a bond is called, the issuer repurchases the bonds from bondholders at a specified price, usually at a premium to the bond’s face value. The call price and the terms of the call option are defined in the bond indenture. Typically, issuers will call bonds if they can refinance the debt at a lower interest rate, reducing their borrowing costs and potentially improving their financial position.

From the issuer’s perspective, callable bonds offer several benefits. Firstly, they provide the opportunity to take advantage of favorable market conditions and lower interest rates. If interest rates have significantly decreased since the bond issuance, the issuer can refinance the debt at a lower cost, ultimately reducing their overall interest expense.

However, callable bonds present a potential disadvantage for bondholders. Once a bond is called, bondholders will receive the call price, but the remaining coupon payments and the potential for further price appreciation are forfeited. This introduces a level of uncertainty and reinvestment risk for bondholders, as they may need to find alternative investments with similar risk-reward profiles to replace the called bonds.

When investing in callable bonds, bondholders should carefully consider the call provisions and the potential impact on their investment strategy. It is important to assess the likelihood of the bonds being called and the potential opportunity cost of reinvesting the proceeds at prevailing interest rates. Additionally, evaluating the creditworthiness of the issuer is crucial to ensure the ability to receive regular interest payments and the return of the principal if the bonds are not called.

Investors should also be aware that callable bonds typically offer higher yields compared to non-callable bonds due to the issuer’s ability to call the bonds before maturity. The higher yield compensates investors for the potential early repayment risk.

In summary, callable bonds provide issuers with flexibility in managing their debt obligations by allowing them to redeem the bonds before the scheduled maturity date. This can be advantageous for issuers if they can refinance the debt at a lower cost. However, callable bonds introduce uncertainty for bondholders, as they may experience early redemption and the need to find alternative investments. Investors should carefully evaluate the call provisions and consider the potential impact on their investment strategy. Understanding the issuer’s creditworthiness is essential to assess the reliability of regular interest payments and the return of principal.

Zero-Coupon Bonds

Zero-coupon bonds, also known as discount bonds, are a type of bond that does not pay regular interest payments, or coupons, to bondholders. Instead, they are issued at a discount to their face value and mature at par value, providing investors with a return through the appreciation of the bond’s value.

Unlike traditional bonds that make periodic interest payments, zero-coupon bonds do not provide a regular income stream. The bondholder’s return is generated by buying the bond at a discount to its face value and receiving the full face value at maturity. The difference between the purchase price and the maturity value represents the interest earned on the investment.

The appeal of zero-coupon bonds lies in their potential for capital appreciation. By purchasing the bond at a discount, investors can benefit from the bond’s appreciation over time. For example, if an investor purchases a zero-coupon bond with a face value of $1,000 and a purchase price of $800, they would receive $1,000 at maturity, resulting in a $200 return.

Zero-coupon bonds are attractive to investors who have long-term investment horizons and desire a fixed-income investment without the need for regular interest payments. They can be particularly useful for individuals who are saving for specific future goals such as education expenses or retirement. The compounding effect of a zero-coupon bond means that the investor’s return is effectively reinvested and compounded over time.

It’s important to note that while zero-coupon bonds provide the potential for capital appreciation, they also come with certain risks. One significant risk is interest rate risk. Since zero-coupon bonds do not provide regular interest payments, they are more sensitive to changes in interest rates. If interest rates rise, the value of existing zero-coupon bonds may decline as they become less desirable compared to bonds offering higher coupon rates. Conversely, if interest rates fall, the value of existing zero-coupon bonds may increase, as they offer a more attractive yield compared to newly issued bonds.

Investors considering zero-coupon bonds should carefully evaluate their investment horizon, risk tolerance, and the potential impact of interest rate fluctuations. Additionally, it’s important to consider the creditworthiness of the issuer to ensure the ability to receive the face value of the bond at maturity.

In summary, zero-coupon bonds offer investors the opportunity for capital appreciation by purchasing bonds at a discount to face value and receiving the full face value at maturity. They are a popular choice for long-term investors seeking fixed-income investments without regular interest payments. However, zero-coupon bonds come with certain risks, including interest rate risk. Investors should carefully evaluate their investment goals and risk tolerance before investing in zero-coupon bonds, as well as assess the creditworthiness of the issuer.

Unsecured Bonds

Unsecured bonds, also known as debentures, are a type of bond that is not backed by specific assets or collateral of the issuer. Unlike secured bonds, which have specific assets pledged as collateral, unsecured bonds rely solely on the creditworthiness and general obligation of the issuer for repayment.

When an investor purchases unsecured bonds, they are essentially lending money to the issuer based on their trust and belief in the issuer’s ability to honor its financial obligations. The issuer is contractually obligated to make regular interest payments, typically semi-annually or annually, and repay the principal amount of the bond at maturity.

Unsecured bonds offer several advantages to issuers. Since there is no collateral tied to the bonds, the issuer has more flexibility in allocating their assets and using them for operational or growth purposes. Additionally, the absence of collateral allows issuers to access capital without the need for specific asset valuations or appraisals, simplifying the issuance process.

For investors, unsecured bonds provide the opportunity to earn a fixed income over the life of the bond. These bonds typically offer higher interest rates compared to secured bonds to compensate investors for the increased risk. The risk of investing in unsecured bonds lies in the possibility of the issuer defaulting on their financial obligations if they encounter financial difficulties.

When investing in unsecured bonds, it is crucial to assess the creditworthiness of the issuer. Credit ratings provided by credit rating agencies, such as Standard & Poor’s, Moody’s, and Fitch, can offer insights into the issuer’s ability to repay their debt obligations. Higher-rated issuers are considered to have a lower risk of default, providing more reassurance to bondholders.

Investors should also evaluate the issuer’s financial health, including their revenue, profitability, and debt levels. Analyzing financial statements and industry trends can provide valuable information about the issuer’s ability to generate sufficient cash flows to meet interest payments and repay the principal amount at maturity.

Furthermore, diversification is essential when investing in unsecured bonds. Spreading investments across different issuers and industries can reduce the overall risk in a bond portfolio. This approach helps mitigate any potential losses if one issuer defaults, as the impact will be spread across multiple investments.

Overall, unsecured bonds offer investors the opportunity for fixed-income investments with relatively higher yields compared to secured bonds. However, investors should carefully assess the creditworthiness of the issuer to manage the associated risks. By conducting thorough research and practicing diversification, investors can make informed decisions when investing in unsecured bonds.

Secured Bonds

Secured bonds are a type of bond that is backed by specific assets or collateral of the issuer. Unlike unsecured bonds, which rely solely on the creditworthiness and general obligation of the issuer, secured bonds provide bondholders with an added layer of protection in the event of default.

When an issuer offers secured bonds, they pledge specific assets, such as real estate, equipment, or accounts receivable, as collateral. In case of default, bondholders have a legal claim on the designated assets, providing them with a higher chance of recovering their investment compared to unsecured bondholders.

The presence of collateral makes secured bonds less risky for investors compared to unsecured bonds. In the event of default, the collateral can be liquidated to repay bondholders. This added security often translates into lower interest rates for issuers, as investors perceive secured bonds to have a reduced level of risk.

Secured bonds can take various forms, depending on the type of collateral pledged. Mortgage-backed securities (MBS) are secured bonds backed by a pool of mortgage loans, where the underlying properties serve as collateral. Asset-backed securities (ABS) are another type of secured bond that uses specific assets, such as auto loans, credit card receivables, or student loans, as collateral.

From an investor’s perspective, secured bonds provide a level of safety and protection against default, making them an attractive investment option. The presence of collateral supports the expectation of regular interest payments and the return of the principal at maturity.

When considering investing in secured bonds, it is crucial to assess the quality and value of the underlying collateral. Investors should evaluate the creditworthiness and performance of the issuer, along with the specifics of the collateral. A comprehensive analysis of the issuer’s financial health, industry trends, and any potential risks associated with the collateral is essential in making an informed investment decision.

Furthermore, understanding the priority of the secured bond in the event of default is vital. Senior secured bonds have a higher claim on the collateral compared to junior secured bonds. Investors should consider the ranking of the secured bonds to assess their potential recovery in case of default.

While secured bonds offer added protection, it is still important to analyze the creditworthiness of the issuer. It is possible for an issuer to default despite the presence of collateral. Bondholders should evaluate the issuer’s financial stability, cash flow generation capabilities, and overall risk profile to ensure the likelihood of receiving interest payments and recovering the principal.

In summary, secured bonds provide bondholders with an added layer of protection by using specific assets or collateral as security against default. They offer investors a higher level of safety compared to unsecured bonds. However, it is crucial to analyze the creditworthiness of the issuer and understand the quality and value of the collateral when investing in secured bonds.

Junk Bonds

Junk bonds, also known as high-yield bonds or speculative-grade bonds, are a type of bond issued by companies with lower credit ratings. These bonds carry a higher risk of default compared to investment-grade bonds and typically offer higher yields to compensate investors for the increased risk.

The term “junk bond” can sometimes carry a negative connotation, but it is important to note that investing in these bonds can present opportunities for higher returns. Companies with lower credit ratings often issue junk bonds to access capital when traditional financing options may not be available or affordable.

Investing in junk bonds involves assessing both the creditworthiness of the issuer and the potential for income generation. Lower-rated companies may require additional scrutiny of their financial health, profitability, cash flow, and industry outlook. It is crucial for investors to conduct thorough research or seek guidance from financial advisors before investing in junk bonds.

One of the primary risks associated with junk bonds is the higher likelihood of default. Companies with lower credit ratings may face financial difficulties and may struggle to meet their debt obligations. This exposes bondholders to a higher risk of not receiving interest payments or the return of their principal at maturity.

However, investing in junk bonds can be attractive for investors seeking higher yields and willing to accept higher risk. The higher yield compensates investors for the increased likelihood of default and potential loss of capital. It is important to assess the risk-reward profile of junk bonds within the context of an investor’s overall portfolio and risk tolerance.

Investors should also consider diversification when investing in junk bonds. Spreading investments across different issuers and industries can help mitigate the risk of default by reducing the impact of any single company or sector on the overall portfolio. This diversification strategy can provide a more balanced exposure to the potential upsides and downsides of investing in junk bonds.

Additionally, keeping a close eye on market conditions, economic indicators, and any potential changes in the creditworthiness of issuers is important when investing in junk bonds. Understanding the market environment can help investors make timely adjustments and manage risk effectively.

In summary, junk bonds are bonds issued by companies with lower credit ratings and higher risk of default. They offer higher yields compared to investment-grade bonds but carry a greater risk of loss. Investors should conduct thorough research, assess the creditworthiness of the issuer, and consider diversification when investing in junk bonds. Junk bonds can be an attractive option for investors seeking higher yields, but it is essential to carefully evaluate risk tolerance and investment objectives before venturing into this segment of the bond market.

Conclusion

Bonds payable play a crucial role in the financial landscape, providing companies and governments with a means to raise capital and investors with attractive investment opportunities. By understanding the different types of bonds payable, both issuers and investors can make informed decisions and tailor their strategies to meet their specific needs and goals.

Convertible bonds offer investors the flexibility to convert their bonds into equity, participating in potential stock appreciation while still receiving regular interest payments. Callable bonds provide issuers with the option to redeem the bonds before maturity, allowing them to take advantage of favorable market conditions and potentially reduce their borrowing costs. Zero-coupon bonds provide investors with the potential for capital appreciation by purchasing the bonds at a discount and receiving the full face value at maturity.

Unsecured bonds offer fixed-income investments without specific collateral, relying on the creditworthiness of the issuer. Secured bonds, on the other hand, provide bondholders with added protection as they are backed by specific assets or collateral. Junk bonds present higher risk but offer higher yields for investors willing to accept the increased likelihood of default.

Investors considering bonds payable should conduct thorough research, evaluate creditworthiness, and assess the risk-reward profile of each type of bond. Diversification and monitoring market conditions are essential for managing risk and making informed investment decisions.

In summary, bonds payable provide a range of options for investors and financing solutions for issuers. Whether it’s convertible bonds, callable bonds, zero-coupon bonds, unsecured bonds, secured bonds, or junk bonds, understanding the characteristics and risks of each type empowers investors to make informed decisions and issuers to raise capital effectively.

It is important for both issuers and investors to carefully assess their financial goals, risk tolerance, and market conditions when considering bonds payable. Whether seeking stable income, potential capital appreciation, or a balance between the two, incorporating bonds payable into investment portfolios can help achieve these objectives while managing risk effectively.