Finance

What Is Bonds Payable On A Balance Sheet

Modified: March 1, 2024

Learn about bonds payable on a balance sheet and their significance in finance. Understand how bonds are classified and valued.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where complex concepts come to life in the form of numbers and spreadsheet calculations. One crucial aspect of finance is understanding the composition of a company’s balance sheet. This financial statement provides a snapshot of a company’s financial position, including its assets, liabilities, and equity.

In this article, we will explore the concept of bonds payable on a balance sheet and its significance in understanding a company’s financial obligations. Bonds payable are a common liability for many companies, especially those that have raised capital through debt issuance.

As businesses seek funding to fuel their operations and growth, bonds payable become a viable option. Bonds are essentially debt instruments that a company issues to investors, who become creditors of the company. Bonds payable represent the outstanding amount that a company owes to its bondholders.

Understanding bonds payable and how they are reported on a balance sheet is crucial for investors, creditors, and other stakeholders. This article will provide a comprehensive overview of bonds payable, explaining their definition, classification on the balance sheet, reporting requirements, and their impact on financial analysis.

So, let’s dive into the world of bonds payable and unravel the complexities behind this fascinating aspect of corporate finance.

Definition of Bonds Payable

Bonds payable, also known as long-term debt or bonds payable long-term, are a type of financial liability that a company incurs when it issues bonds to raise capital. A bond is a debt instrument that represents a loan made by an investor (the bondholder) to the company (the issuer). In return, the issuer promises to repay the bondholder the principal amount at a specified future date (maturity date) and make periodic interest payments.

Bonds payable are typically long-term in nature, with a maturity period exceeding one year. They are a popular financing option for companies looking to raise funds for various purposes, such as expansion, acquisitions, research and development, and debt refinancing.

When a company issues bonds, it enters into a contractual agreement with the bondholders, outlining the terms and conditions of the bond issuance. This agreement, known as the bond indenture, specifies important details such as the coupon rate (interest rate), maturity date, face value (principal amount), and any special features or covenants associated with the bond.

Bond Indenture Components:

- Coupon Rate: The annual interest rate that the bondholder will receive on the bond. It is expressed as a percentage of the bond’s face value.

- Maturity Date: The date on which the issuer is obligated to repay the bondholder the principal amount.

- Face Value: The principal amount of the bond that will be repaid to the bondholder at maturity.

- Interest Payment Dates: The dates on which the issuer will make periodic interest payments to the bondholder.

- Call or Redemption Provision: An optional provision that allows the issuer to redeem the bond before its maturity date, usually at a predetermined price.

- Sinking Fund Requirement: A provision that requires the issuer to make regular contributions to a sinking fund to ensure the availability of funds to repay the bond at maturity.

- Conversion Feature: In some cases, bonds may have the option to be converted into the issuer’s common stock at the bondholder’s discretion.

By issuing bonds, companies can access a wider pool of investors and diversify their sources of capital beyond traditional bank loans or equity financing. Bonds offer fixed interest payments, providing certainty to bondholders, and may offer tax advantages for both issuers and investors.

Now that we have a solid understanding of what bonds payable are let us move on to exploring how they are presented on a company’s balance sheet.

Liabilities on the Balance Sheet

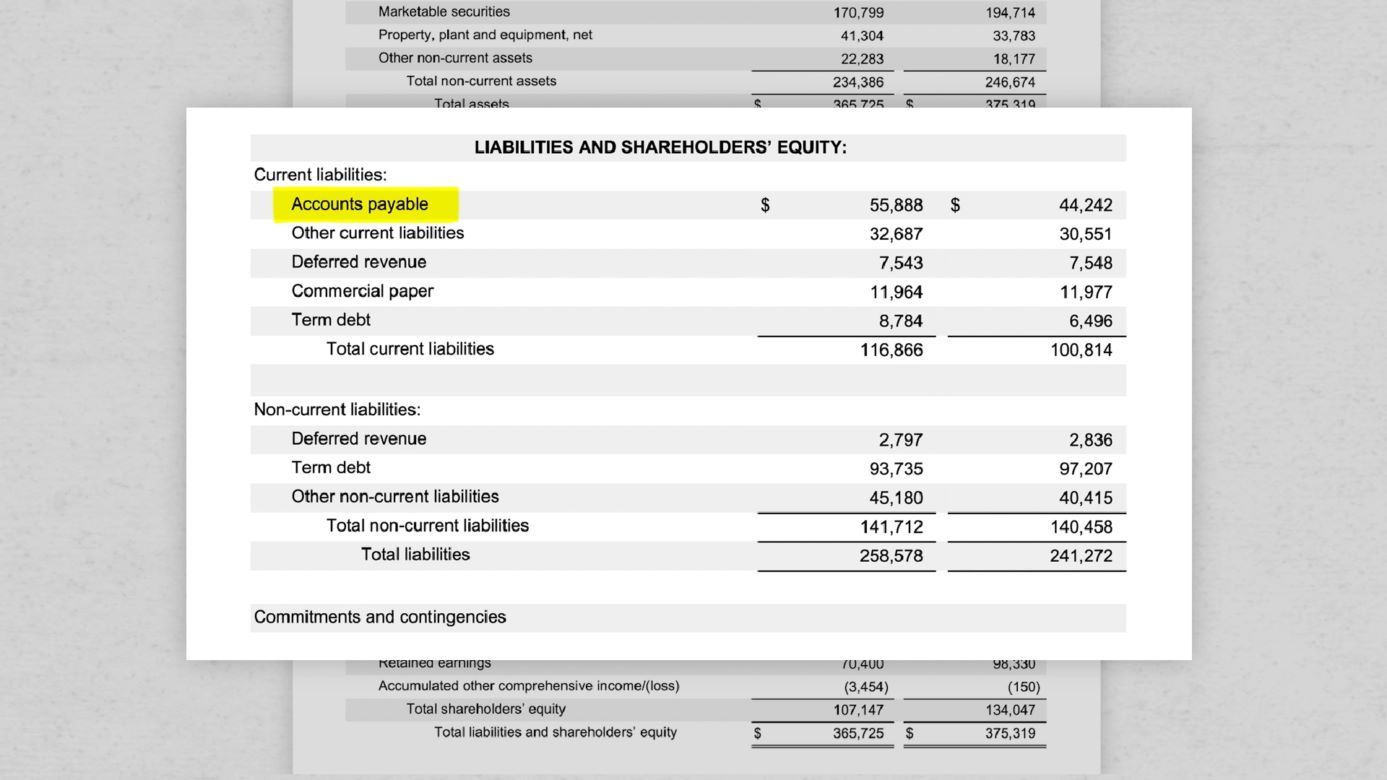

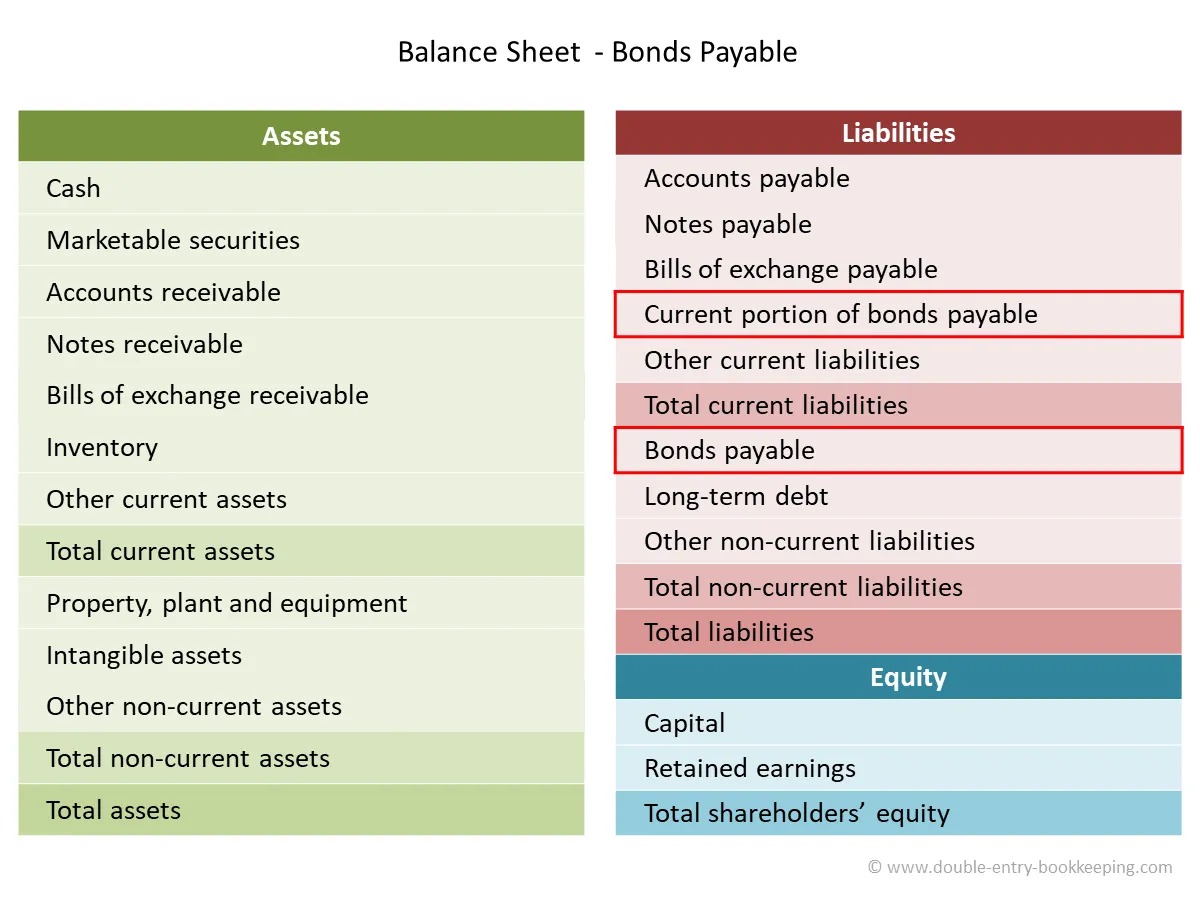

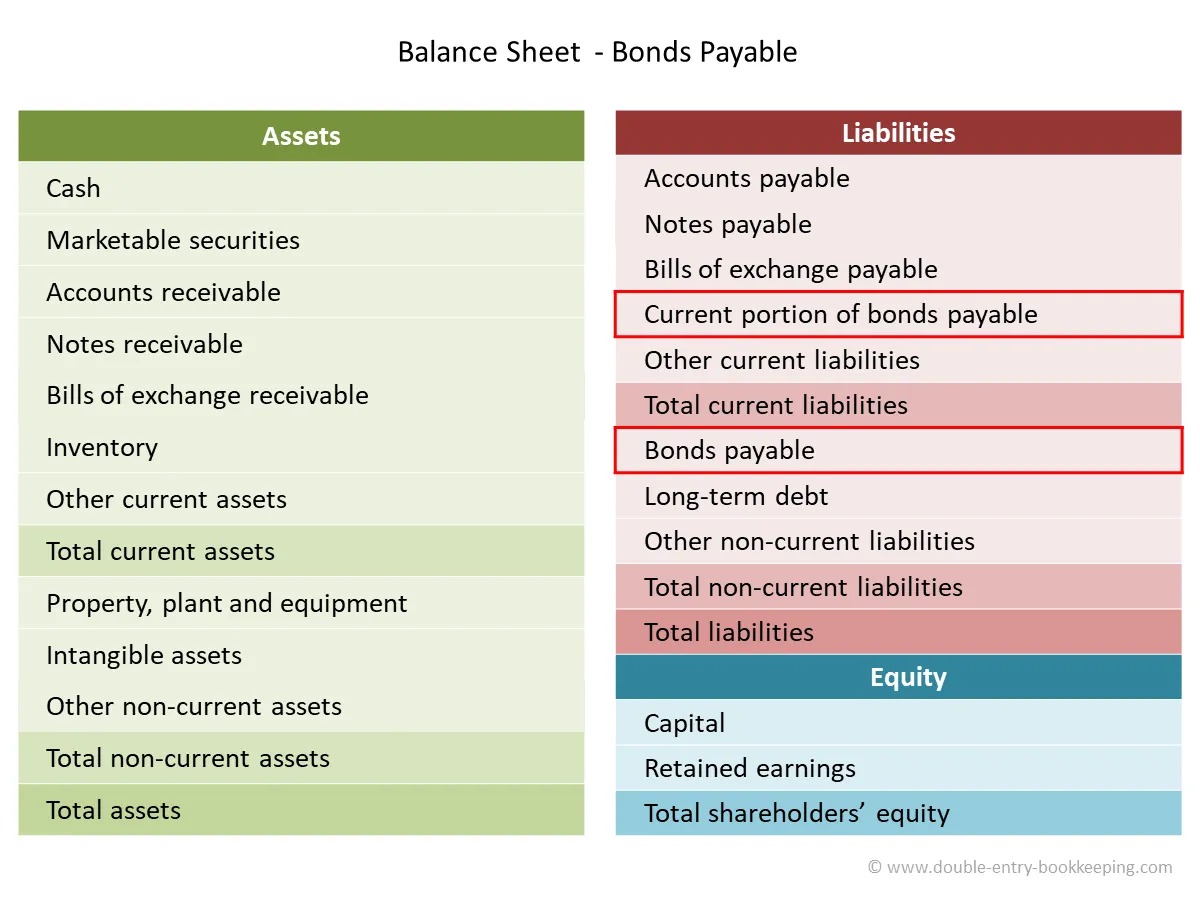

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity. Liabilities, including bonds payable, are a key component of the balance sheet and represent the company’s financial obligations.

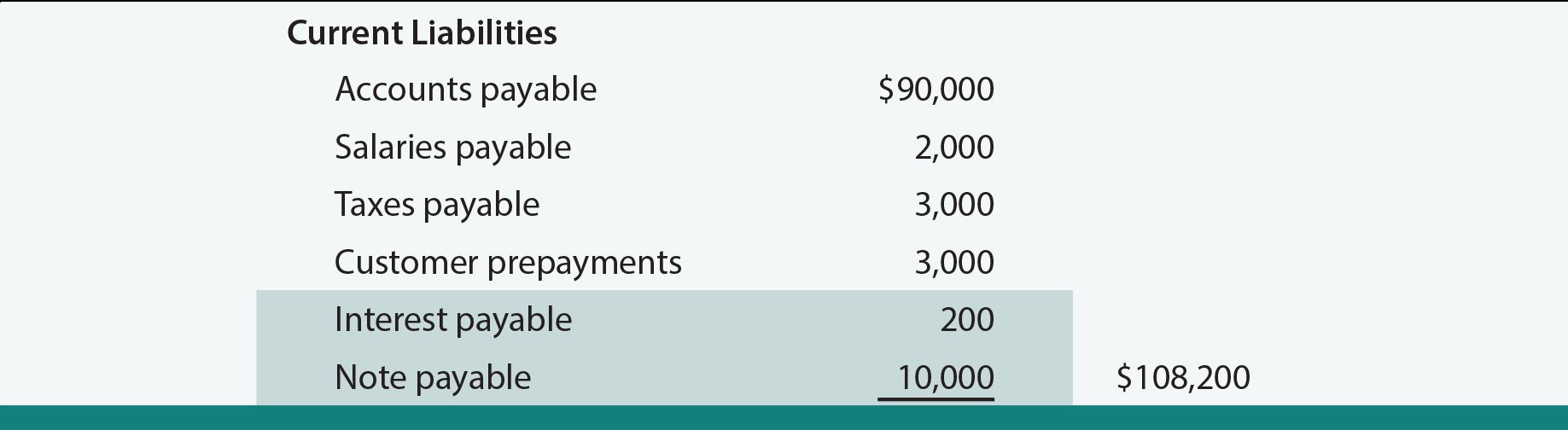

Liabilities are categorized as current liabilities and long-term liabilities. Current liabilities are obligations that are expected to be settled within one year or the normal operating cycle of the business, whichever is longer. These may include accounts payable, accrued expenses, and short-term debt.

On the other hand, long-term liabilities are obligations that are not expected to be settled within one year. Bonds payable fall under this category, as their maturity period extends beyond the next fiscal year. Other examples of long-term liabilities include long-term debt, lease obligations, pension liabilities, and deferred tax liabilities.

Liabilities on the balance sheet provide important insights into a company’s financial health and its ability to meet its financial obligations. Potential lenders and investors analyze these liabilities to assess the company’s debt burden, liquidity position, and repayment capabilities.

As we focus on bonds payable, it is important to note that they represent a significant long-term liability for a company. The amount of bonds payable reported on the balance sheet reflects the outstanding principal amount of bonds that have been issued by the company.

Now that we understand the role of liabilities, including bonds payable, on the balance sheet, let’s delve deeper into the specifics of bonds payable and how they are explained and classified.

Explanation of Bonds Payable

Bonds payable are a form of long-term debt that companies use to raise capital. They are issued in the form of bonds, which are debt securities that represent a company’s promise to repay the principal amount (face value) to the bondholder at a specified future maturity date. In addition to the principal repayment, bonds also provide periodic interest payments to the bondholder based on the coupon rate.

When a company issues bonds, it essentially borrows money from investors, who become creditors of the company. The company agrees to pay back the principal amount of the bond on the maturity date, along with regular interest payments as specified in the bond indenture. The interest payments are typically made semiannually, although the frequency may vary depending on the terms of the bond.

The terms of the bond, such as the coupon rate, maturity date, and principal amount, are determined at the time of issuance and are specified in the bond indenture. The coupon rate represents the annual interest rate that the company will pay to the bondholder as a percentage of the bond’s face value.

Bonds payable can have different features and characteristics, depending on the issuer’s needs and market conditions. Some bonds may be callable, meaning the issuer has the right to redeem the bonds before their maturity date. This gives the issuer the flexibility to refinance the debt if interest rates decline. Conversely, bonds may also have a conversion feature, allowing bondholders to convert their bonds into the issuer’s common stock if certain conditions are met.

Companies may issue bonds payable for various reasons. They may need funds to finance capital expenditures, research and development, mergers and acquisitions, or to refinance existing debt at more favorable interest rates. Bonds can be an attractive financing option for companies, as they often offer a lower cost of capital compared to equity financing.

From a financial perspective, bonds payable represent a company’s debt obligation. They are considered a liability on the balance sheet and are listed under long-term liabilities. The amount of bonds payable reported on the balance sheet indicates the outstanding principal balance of the bonds issued by the company.

Understanding bonds payable is essential for investors, creditors, and analysts in evaluating a company’s financial position and gauging its ability to meet its long-term debt obligations. It provides insight into a company’s leverage and debt management strategies.

In the next section, we will explore how bonds payable are classified on the balance sheet and the specific reporting requirements.

Classification of Bonds Payable on the Balance Sheet

When it comes to presenting bonds payable on the balance sheet, they are typically classified as a long-term liability. This classification reflects the expected timeline for the repayment of the bonds, which extends beyond the next fiscal year.

On the balance sheet, bonds payable are reported as a separate line item under long-term liabilities, along with other long-term debt obligations. This categorization allows users of financial statements to easily identify the company’s long-term debt obligations and assess its financial leverage.

In addition to the overall classification as long-term liabilities, certain details related to bonds payable are also reported on the balance sheet. These include:

- Principal Amount: The principal amount, also known as the face value or par value of the bonds, represents the original amount borrowed by the company.

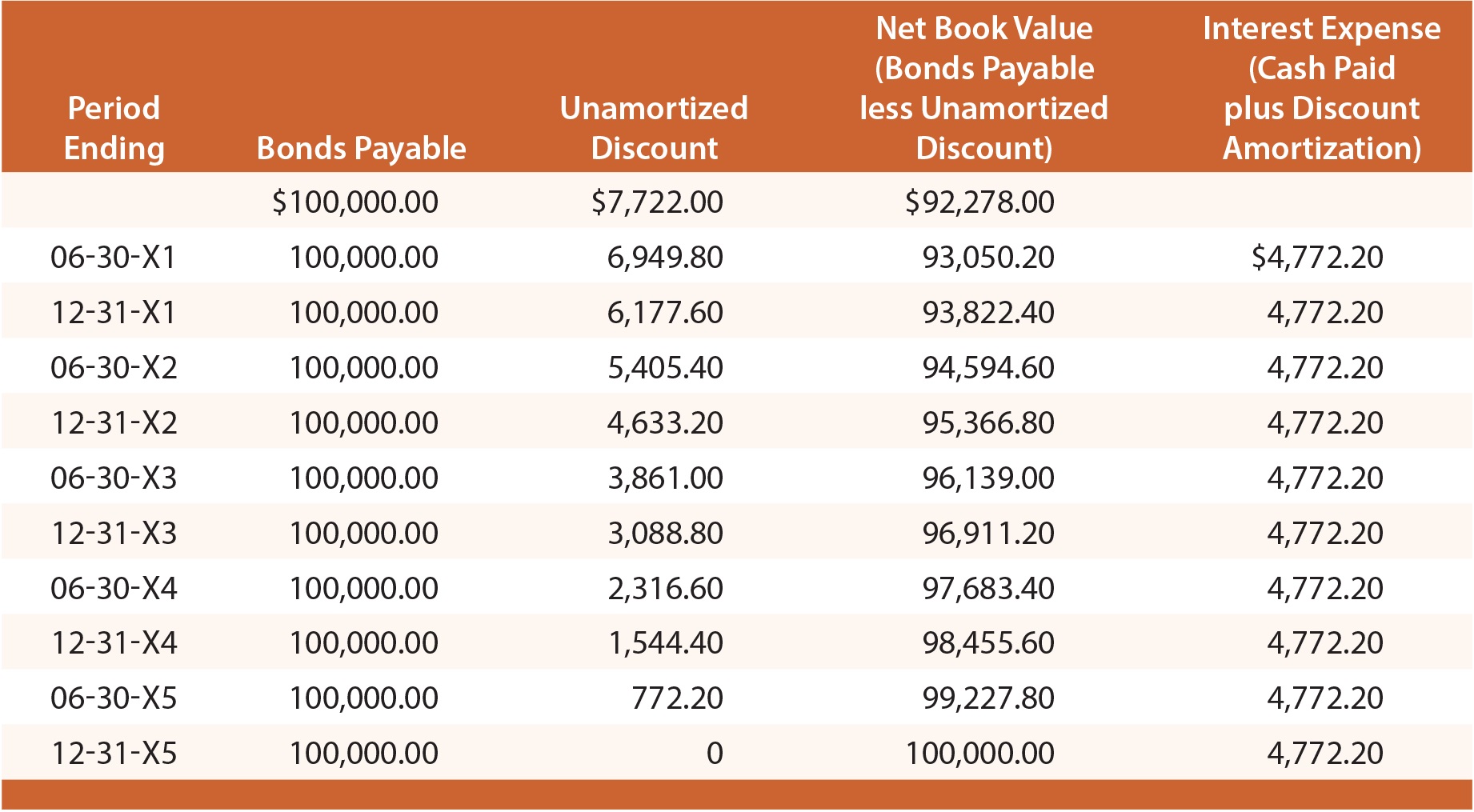

- Unamortized Discount or Premium: If the bonds are issued at a discount or premium to their face value, the balance sheet may report the unamortized portion of this discount or premium. This reflects the remaining amount that needs to be amortized over the life of the bonds.

- Net Bonds Payable: Net bonds payable refers to the adjusted carrying value of the bonds after taking into account any unamortized discount or premium. It represents the amount that the company owes to the bondholders at the reporting date.

The specific presentation and classification of bonds payable on the balance sheet may vary depending on accounting standards and reporting requirements in different jurisdictions. However, the general principle remains consistent – bonds payable are typically reported as a long-term liability and disclosed separately from other current liabilities.

It is important to note that the maturity date of the bonds plays a significant role in determining their classification on the balance sheet. If the maturity date is less than one year from the reporting date, the bonds would be classified as a current liability and reported under current liabilities instead of long-term liabilities.

The proper classification and disclosure of bonds payable on the balance sheet are crucial for users of financial statements to accurately assess a company’s debt obligations and evaluate its financial health.

Now that we have explored the classification of bonds payable on the balance sheet, let’s move on to the reporting requirements and examples of how bonds payable are presented in practice.

Reporting Bonds Payable

Reporting bonds payable on the financial statements involves presenting the relevant information in a clear and concise manner. Companies are required to disclose the details of their bonds payable in the notes to the financial statements to provide transparency and ensure that users have a comprehensive understanding of the bond obligations.

When reporting bonds payable, the following information is typically disclosed:

- Bond Details: This includes the bond identification number, issuance date, maturity date, coupon rate, principal amount, and any special features or covenants associated with the bonds.

- Interest Expense: Companies must report the interest expense incurred during the reporting period related to the bonds payable. This information is usually presented on the income statement as an expense.

- Amortization of Discount or Premium: If the bonds were issued at a discount or premium to their face value, the amortization of the discount or premium must be disclosed. This represents the adjustment made to the carrying value of the bonds over the life of the bonds.

- Debt Maturity Schedule: It is common for companies to provide a schedule outlining the maturity dates of their bonds payable. This helps users understand the timing and amount of future principal repayments.

- Callable or Convertible Bonds: If the bonds have callable or convertible features, companies must provide information about these provisions, including any call or conversion dates and the impact they may have on the bondholders or the company.

In addition to the notes to the financial statements, the bonds payable balance is reported on the balance sheet. As mentioned earlier, bonds payable are typically classified as a long-term liability and listed under the long-term liabilities section. The balance sheet will disclose the carrying value of the bonds payable, which is the principal amount minus any unamortized discount or plus any unamortized premium.

It is important for companies to ensure accurate reporting of their bonds payable to comply with accounting standards and provide relevant information to users of financial statements. This transparency aids in assessing a company’s debt position, repayment obligations, and overall financial stability.

Now that we understand how bonds payable are reported, let’s explore some examples that demonstrate how bonds payable are presented on the financial statements.

Examples of Bonds Payable on a Balance Sheet

Let’s take a look at two examples of how bonds payable may be presented on a balance sheet:

Example 1:

Company XYZ issued $10 million in bonds with a 5% coupon rate, maturing in 10 years. The bonds were issued at par value (face value) of $1,000 each.

| Long-Term Liabilities | Amount |

|---|---|

| Bonds Payable | $10,000,000 |

In this example, the $10 million bonds payable is reported as a single line item under long-term liabilities on the balance sheet. No discount or premium is mentioned, indicating that the bonds were issued at their face value.

Example 2:

Company ABC issued $5 million in bonds with a 10% coupon rate, maturing in 5 years. The bonds were issued at a discount of 5% to their face value.

| Long-Term Liabilities | Amount |

|---|---|

| Bonds Payable | $4,750,000* |

| Less: Unamortized Discount | ($250,000)** |

| Net Bonds Payable | $4,500,000 |

In this example, the bonds payable of $4,750,000 is reported on the balance sheet. The discount of $250,000 represents the difference between the face value and the amount received from investors due to the discounted issuance. The unamortized discount of $250,000 reflects the remaining portion of the discount that needs to be amortized over the life of the bonds. The net bonds payable of $4,500,000 represents the adjusted carrying value after accounting for the unamortized discount.

These examples illustrate how bonds payable can be presented on the balance sheet, including the reporting of any discounts or premiums associated with the issuance of the bonds.

It is important to note that the specific format used for reporting bonds payable may vary depending on accounting standards and the company’s specific reporting requirements. Nonetheless, the presentation and disclosure of bonds payable should provide users of financial statements with a clear understanding of the company’s debt obligations.

Now that we have examined examples of how bonds payable can appear on the balance sheet, let’s consider the impact of bonds payable on financial analysis.

Impact of Bonds Payable on Financial Analysis

Bonds payable play a significant role in financial analysis as they provide insights into a company’s debt position and its ability to meet its financial obligations. Here are some key factors to consider when analyzing the impact of bonds payable:

Debt-to-Equity Ratio and Financial Leverage: Bonds payable contribute to a company’s total debt, which is a key component of the debt-to-equity ratio. This ratio measures the proportion of debt to equity financing in a company’s capital structure. A higher debt-to-equity ratio indicates a higher reliance on debt financing and increased financial leverage. It is important to assess this ratio to gauge the company’s risk profile and its ability to withstand economic downturns.

Interest Coverage Ratio: The interest coverage ratio evaluates a company’s ability to meet its interest payment obligations. It is calculated by dividing the company’s earnings before interest and taxes (EBIT) by the interest expense. A higher interest coverage ratio indicates that the company generates sufficient operating income to cover its interest payments comfortably.

Impact on Cash Flow: Bonds payable obligate the company to make periodic interest payments and eventually repay the principal amount. This affects the company’s cash flow as it requires the allocation of funds to service debt. Analyzing the company’s cash flow statement can provide insights into its ability to generate sufficient cash flow to meet its interest and principal repayment obligations.

Creditworthiness and Interest Rates: The presence of bonds payable on a company’s balance sheet can influence its creditworthiness and borrowing costs. Credit rating agencies evaluate a company’s overall debt profile, including bonds payable, when assigning credit ratings. A higher credit rating indicates lower default risk and may result in lower borrowing costs for future debt issuances.

Capital Structure Planning: Bonds payable provide an avenue for companies to access external funding while balancing their capital structure. Analyzing a company’s bond issuance patterns and terms can shed light on its debt management strategies and long-term financing plans.

Investor Perception and Stock Performance: The presence of bonds payable can impact investor perception and stock performance. Investors may view high levels of debt as a potential risk and may demand higher returns to compensate for the increased financial risk. Monitoring the market reaction to a company’s bond issuances and assessing its impact on stock performance can provide insights into investor sentiment.

Conducting a thorough financial analysis that incorporates the impact of bonds payable allows stakeholders to make informed decisions regarding a company’s financial health, risk profile, and long-term viability. It helps identify potential areas of concern and provides a comprehensive understanding of a company’s financial position.

Now that we have explored the impact of bonds payable on financial analysis, let’s conclude our discussion.

Conclusion

Bonds payable are a critical aspect of a company’s financial landscape, representing long-term debt obligations that play a significant role in its capital structure. Understanding the concept of bonds payable, their classification on the balance sheet, and the impact they have on financial analysis is essential for investors, creditors, and other stakeholders.

In this article, we explored the definition of bonds payable and their role as a financing option for companies. We discussed how bonds payable are classified on the balance sheet as a long-term liability, along with other reporting requirements and examples of their presentation on financial statements.

We also examined the impact of bonds payable on financial analysis, including key ratios and metrics used to assess a company’s debt position, financial leverage, and ability to meet its financial obligations. Understanding the implications of bonds payable on a company’s creditworthiness, cash flow, and borrowing costs is vital in evaluating its overall financial health.

Overall, bonds payable provide companies with access to capital while investors receive fixed income through periodic interest payments. By analyzing a company’s debt profile and its ability to manage bonds payable, stakeholders can make informed decisions and gain valuable insights into its financial stability and long-term viability.

As the financial landscape evolves, bonds payable will continue to be a vital component of corporate finance. By staying knowledgeable about bonds payable and their impact on financial statements and analysis, individuals can navigate the complexities of the financial world with confidence.

So, whether you’re an investor, creditor, or simply interested in understanding the intricacies of finance, bonds payable are an essential concept to grasp. They provide a window into a company’s financial obligations, representing a crucial piece of the puzzle when evaluating its financial health and prospects for the future.