Home>Finance>Earned Income Tax Credit (EITC): Definition And How To Qualify

Finance

Earned Income Tax Credit (EITC): Definition And How To Qualify

Published: November 15, 2023

Learn about the definition and qualification process of the Earned Income Tax Credit (EITC), an important financial benefit for low to moderate-income individuals and families. Find out how you can benefit from this tax credit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Earned Income Tax Credit (EITC)

Are you looking for financial assistance to ease the burden of taxes? If so, you might qualify for the Earned Income Tax Credit (EITC). In this blog post, we will dive into the definition of the EITC and guide you on how to determine if you are eligible for this valuable tax benefit.

Key Takeaways:

- 1. The Earned Income Tax Credit (EITC) is a refundable tax credit designed to assist low-to-moderate income individuals and families.

- 2. To qualify for the EITC, you must meet certain income and filing status requirements.

The Earned Income Tax Credit is a government program that aims to support individuals and families with low-to-moderate income. It is a refundable tax credit, which means that even if you owe no taxes, you can still receive money back as a refund. The EITC can significantly reduce the amount of taxes you owe and potentially provide you with a refund that can be used to cover necessary expenses or build your savings.

Now, let’s take a closer look at the eligibility criteria for the EITC. To qualify, you must meet the following requirements:

- Earned Income: You must have earned income from employment, self-employment, or farming. Passive income, such as interest or dividends, does not count towards the earned income requirement.

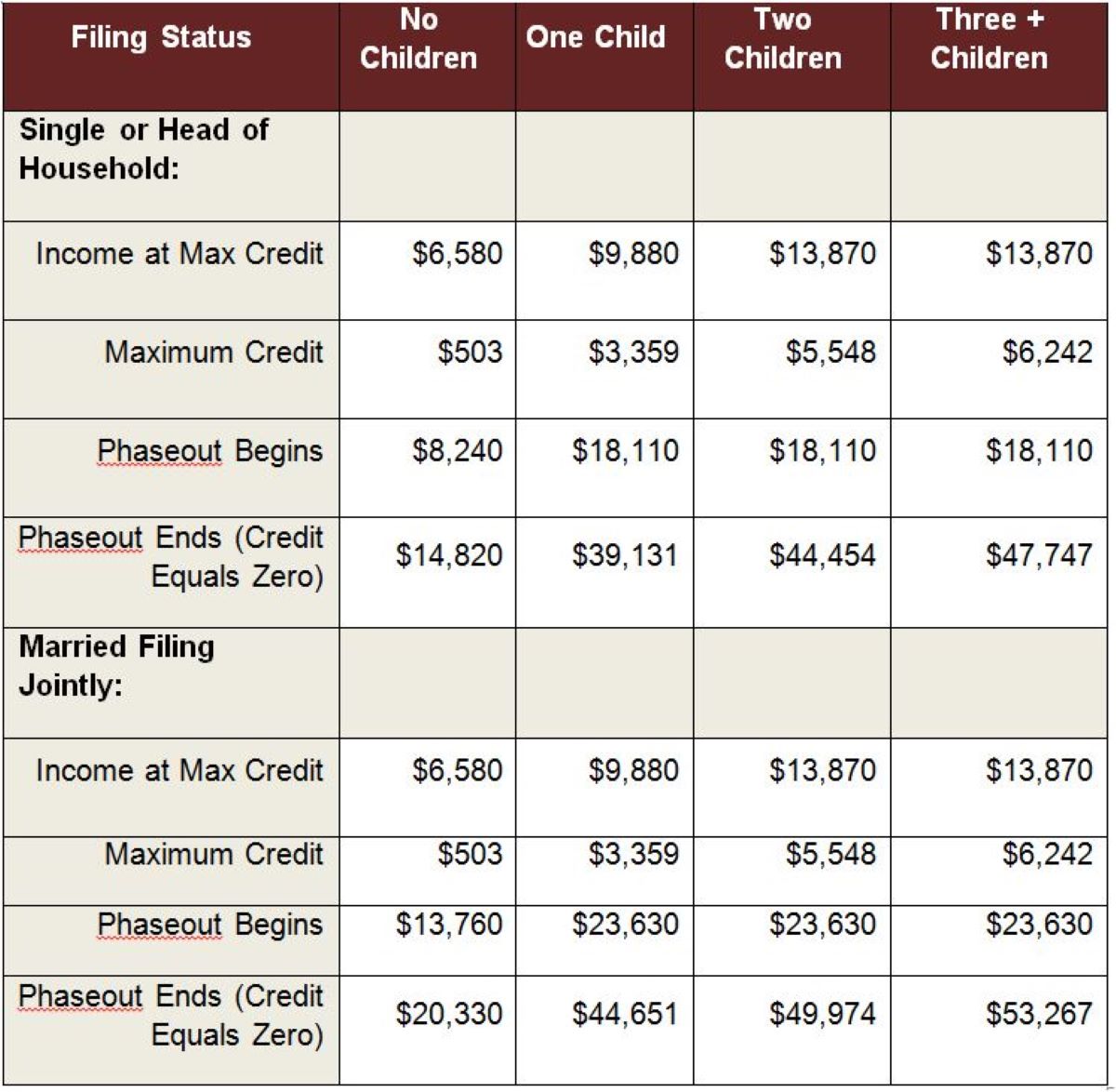

- Adjusted Gross Income (AGI): Your AGI must fall within the income limits set by the IRS for the tax year. These limits vary depending on your filing status and the number of qualifying children you have.

- Filing Status: You must file as Single, Head of Household, Qualifying Widow or Widower with Dependent Child, or Married Filing Jointly. You cannot file as Married Filing Separately.

- Qualifying Children: If you have eligible children, they must meet certain criteria such as age, relationship, residency, and joint return requirements. The number of qualifying children you have also affects the amount of EITC you can receive.

It is important to note that the EITC is subject to change each year, so it’s essential to stay updated with the latest tax laws and regulations. The amount of credit you can receive is based on your income, filing status, and the number of qualifying children you have. The IRS provides an EITC Assistant tool on their website to help you determine your eligibility and estimate the credit amount you may qualify for.

Applying for the Earned Income Tax Credit is relatively straightforward. When filing your annual tax return, you need to complete and attach Schedule EIC to claim the credit. It’s crucial to gather all the necessary documentation and ensure accuracy to maximize your chances of receiving the credit.

The Earned Income Tax Credit has helped millions of individuals and families improve their financial well-being. If you believe you may qualify for this tax credit, reach out to a tax professional or utilize reliable online resources to guide you through the process.

In conclusion, the Earned Income Tax Credit (EITC) is a valuable tax benefit that can provide much-needed relief to individuals and families with low-to-moderate income. By understanding the eligibility requirements and following the necessary steps, you can potentially receive a significant refund that can positively impact your financial situation.