(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Introduction

When it comes to personal finance, understanding how income taxes work is crucial. In the United States, each state has its own tax regulations, and Kansas is no exception. Whether you’re a resident or a business owner in Kansas, it’s important to be aware of the income tax rates and requirements specific to the state.

Kansas income tax is the state tax imposed on individuals and corporations based on their income. The revenue generated from income taxes is used to fund various public services and infrastructure projects within the state. By understanding the intricacies of Kansas income tax, individuals and businesses can plan their finances better and ensure compliance with tax laws.

This article will provide a comprehensive overview of Kansas income tax, including details about the tax rates, deductions, and filing requirements. Whether you’re a Kansas resident looking to file your personal income tax or a business owner trying to navigate the corporate tax landscape, this guide will provide you with the necessary information to make informed decisions.

The Kansas income tax system follows a progressive tax structure, meaning that as your income increases, the tax rate also increases progressively. This ensures that individuals with higher incomes pay a higher percentage of their earnings in taxes. As of the time of writing this article, the Kansas income tax rates range from 3.1% to a maximum of 5.7%.

It’s important to note that Kansas does not have a local income tax, so individuals and businesses are only responsible for paying the state income tax. However, it’s crucial to stay updated with any changes to the tax code, as rates and regulations may evolve over time. It’s always a good idea to consult with a tax professional or refer to the official Kansas Department of Revenue website for the most accurate and up-to-date information regarding income taxes in the state.

The Kansas income tax rates vary depending on the level of income earned, and they are based on a taxpayer’s federal adjusted gross income (AGI). As mentioned earlier, Kansas utilizes a progressive tax structure, which means that higher-income individuals pay a higher percentage of their income in taxes. It’s important to understand the different income tax rates in order to accurately calculate and plan for your tax obligations in Kansas.

For individual taxpayers, the Kansas income tax rates for the tax year 2021 are as follows:

- 3.1% on the first $15,000 of taxable income

- 5.25% on taxable income between $15,001 and $30,000

- 5.7% on taxable income exceeding $30,000

It’s important to note that these rates may be subject to change in future tax years, so it’s crucial to consult the official Kansas Department of Revenue website or seek advice from a tax professional to ensure accuracy when filing your taxes.

For corporations, the Kansas income tax rate is a flat 4% on net income. This applies to both C corporations and S corporations, which are subject to different federal taxation rules.

Understanding the applicable income tax rates is essential not only for accurately filing your taxes but also for planning your finances effectively. By knowing the rates, you can estimate your tax liability and take advantage of any available deductions or credits to minimize your overall tax burden.

Individual taxpayers in Kansas are subject to a progressive income tax system, meaning that the tax rates increase as income levels rise. It’s important to be familiar with the different tax brackets and rates to accurately calculate and plan for your tax obligations.

As of the tax year 2021, Kansas individual income tax rates are as follows:

- 3.1% on the first $15,000 of taxable income

- 5.25% on taxable income between $15,001 and $30,000

- 5.7% on taxable income exceeding $30,000

To illustrate how the progressive tax system works, let’s consider an example. If your taxable income for the year is $25,000, you’ll pay 3.1% on the first $15,000, which amounts to $465. For the remaining $10,000, you’ll pay 5.25%, resulting in an additional $525. The total tax liability for the year would be $990.

It’s important to note that these tax rates may be subject to change in future tax years. It’s advisable to consult the official Kansas Department of Revenue website or seek advice from a tax professional to ensure accuracy when filing your taxes.

Additionally, Kansas offers various deductions and credits that can further reduce your taxable income or provide tax relief. Some common deductions available to individual taxpayers in Kansas include deductions for mortgage interest, student loan interest, charitable contributions, and medical expenses, among others. These deductions can help lower your overall taxable income and potentially decrease your tax liability.

While navigating the individual income tax rates and deductions may seem overwhelming, utilizing tax software or consulting a tax professional can simplify the process and ensure that you take advantage of all the available opportunities to optimize your tax situation.

In Kansas, both C corporations and S corporations are subject to income taxes. However, the tax rates and regulations differ between these two types of corporations.

For C corporations, the Kansas income tax rate is a flat 4% on net income. This means that regardless of the level of income, C corporations are subject to a consistent tax rate. It’s important for C corporations to accurately calculate their net income and ensure compliance with the state’s tax laws.

On the other hand, S corporations, also known as pass-through entities, do not pay taxes at the corporate level in Kansas. Instead, the income generated by an S corporation passes through to the individual shareholders, who then report and pay taxes on their personal income tax returns. This is different from C corporations, where the corporation itself pays taxes at the corporate level.

It’s crucial for businesses to consult with a tax advisor or refer to the official Kansas Department of Revenue website to understand the specific requirements and regulations regarding corporate income tax. Additionally, keeping accurate records and maintaining proper documentation of income and expenses is essential for ensuring compliance and accurate tax reporting.

Aside from income taxes, businesses in Kansas may be subject to other taxes and fees, such as sales tax, property tax, and employer withholding taxes. Familiarizing yourself with these additional tax obligations is important for maintaining financial health and avoiding any penalties or fines.

As regulations and tax laws can change, it’s crucial for businesses to stay informed and seek professional advice to ensure compliance with Kansas income tax regulations and to optimize their tax strategy.

Kansas income tax brackets determine the range of taxable income for which specific tax rates apply. By understanding the income tax brackets, individuals and businesses can accurately calculate their tax liability and plan their finances accordingly. It’s important to note that these brackets may change over time, so it’s advisable to consult the official Kansas Department of Revenue website or seek advice from a tax professional for the most up-to-date information.

As of the tax year 2021, Kansas has the following income tax brackets for individuals:

- 3.1% on taxable income up to $15,000

- 5.25% on taxable income from $15,001 to $30,000

- 5.7% on taxable income over $30,000

Let’s say an individual has a taxable income of $40,000. In this scenario, the first $15,000 is taxed at 3.1%, totaling $465. The next $15,000 is taxed at 5.25%, totaling $787.50. The remaining $10,000 is taxed at 5.7%, totaling $570. Adding these amounts together, the individual’s total tax liability for the year would be $1,822.50.

It’s important to note that these brackets are subject to change, and other factors such as deductions and credits can impact the final tax liability. Therefore, it’s advisable to consult the official Kansas Department of Revenue website or a tax professional for accurate calculations based on current tax laws.

Understanding the income tax brackets allows individuals and businesses to plan their financial activities and take advantage of any potential tax-saving opportunities. By staying informed and utilizing available resources, taxpayers in Kansas can ensure compliance with the state’s income tax regulations while minimizing their tax burden.

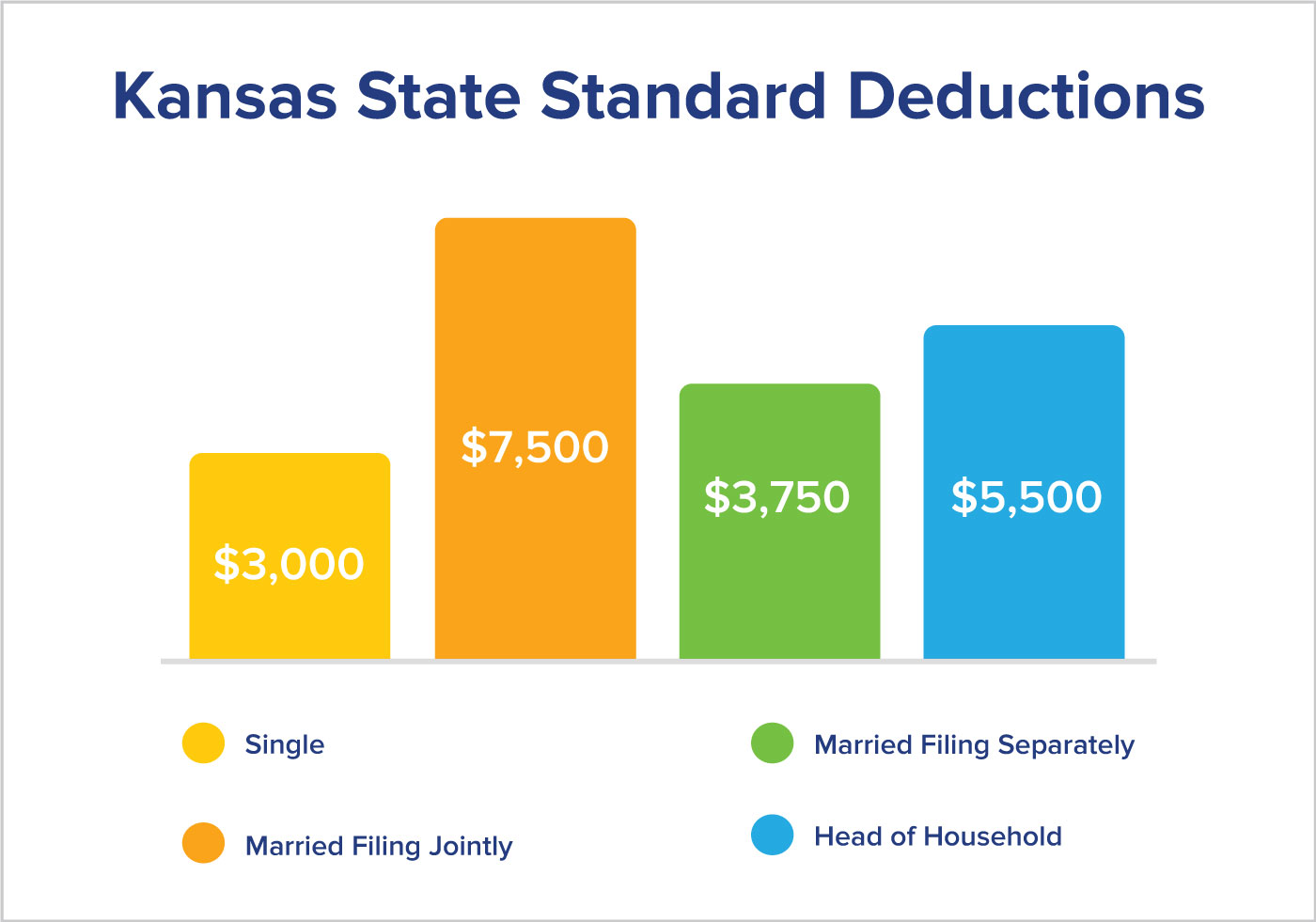

Kansas offers various deductions that can be claimed to reduce taxable income. By taking advantage of these deductions, individuals and businesses can potentially lower their overall tax liability in the state.

Here are some common deductions available to Kansas taxpayers:

- Mortgage Interest Deduction: Kansas allows taxpayers to deduct mortgage interest paid on their primary residence, which can help reduce taxable income.

- Student Loan Interest Deduction: Kansas allows individuals to deduct a percentage of the interest paid on qualifying student loans. This deduction is subject to limitations and restrictions.

- Charitable Contributions: Contributions made to qualifying charitable organizations can be claimed as a deduction on Kansas income tax returns.

- Medical Expense Deduction: Kansas taxpayers may be eligible to deduct qualifying medical expenses that exceed a certain percentage of their adjusted gross income (AGI).

These are just a few examples of the deductions available in Kansas. It’s important to review the official Kansas Department of Revenue website or consult a tax professional for a comprehensive list of deductions and their eligibility criteria.

Additionally, it’s crucial to keep proper documentation and records of all deductible expenses. This includes retaining receipts, invoices, and other supporting documents to substantiate the deductions claimed.

It’s important to note that the eligibility and limitations of deductions may vary, so it’s advisable to consult with a tax professional or refer to the official state guidelines for accurate and up-to-date information when claiming deductions on your Kansas income tax return.

By effectively utilizing the available deductions, taxpayers can reduce their taxable income and potentially lower their overall tax liability in Kansas.

Kansas offers various tax credits that can help reduce the tax liability of individuals and businesses. Unlike deductions, which reduce taxable income, tax credits directly reduce the amount of tax owed. By taking advantage of these credits, taxpayers can potentially reduce their overall Kansas income tax burden.

Here are some common income tax credits available in Kansas:

- Earned Income Tax Credit (EITC): This credit is designed to assist low- to moderate-income individuals and families. The amount of the credit is based on the taxpayer’s income, filing status, and number of qualifying dependents. It can result in a substantial reduction in tax liability or even a refund if the credit exceeds the tax owed.

- Child and Dependent Care Credit: Kansas allows a credit for expenses paid for the care of qualifying children or dependents while the taxpayer is working or seeking employment. The credit amount is calculated based on the eligible expenses incurred.

- Alternative Fuel Vehicle Tax Credit: Individuals who purchase or lease eligible alternative fuel vehicles may be eligible for a tax credit. The credit amount varies depending on the type of vehicle and its fuel efficiency.

- School Readiness Tax Credit: This credit is available to individuals and businesses that make qualified contributions to Kansas-based organizations that provide educational services to low-income children.

These are just a few examples of the tax credits available in Kansas. It’s important to review the official Kansas Department of Revenue website or consult a tax professional for a complete list of credits and their eligibility requirements.

It’s crucial to keep accurate records and documentation of any expenses or activities that qualify for these tax credits. This includes maintaining receipts, invoices, and other supporting documents to substantiate the credits claimed.

It’s important to note that tax credits can have limitations, phase-outs, and other restrictions. Therefore, it’s advisable to consult with a tax professional or refer to the official state guidelines for accurate and up-to-date information when claiming tax credits on your Kansas income tax return.

By taking advantage of available tax credits, taxpayers in Kansas can reduce their overall tax obligation and potentially increase their tax refunds, leading to significant savings.

Understanding the filing requirements is crucial to ensure compliance with Kansas income tax laws. It’s important to be aware of the deadlines, filing statuses, and income thresholds that determine whether you need to file a Kansas income tax return.

In general, you are required to file a Kansas income tax return if:

- Your Kansas adjusted gross income (KAGI) exceeds the state’s minimum filing threshold.

- You are claiming any Kansas tax credits.

- You are eligible for a refund.

- You had Kansas income tax withheld from your wages.

- You had any income derived from Kansas sources, even if you are not a resident of Kansas.

The minimum filing thresholds vary based on your filing status. As of the tax year 2021, the filing thresholds for Kansas income tax are as follows:

- Single: $5,500

- Head of Household: $7,700

- Married Filing Jointly: $12,000

- Married Filing Separately: $5,500

It’s important to note that these thresholds are subject to change, so it’s advisable to consult the official Kansas Department of Revenue website or a tax professional for the most up-to-date information.

The deadline for filing your Kansas income tax return typically aligns with the federal income tax filing deadline, which is typically April 15th. However, if April 15th falls on a weekend or holiday, the deadline may be extended. It’s important to stay updated with any changes to the filing deadline and be mindful of any extensions granted by the state.

Additionally, if you are unable to file your Kansas income tax return by the deadline, you can request an extension. However, it’s essential to keep in mind that an extension to file does not grant an extension to pay any taxes owed. If you anticipate owing taxes, it’s advisable to make an estimated payment to avoid penalties and interest.

Filing your Kansas income tax return accurately and on time is crucial to avoid any penalties or fines. It’s always a good idea to consult with a tax professional or use tax software to ensure compliance with all filing requirements and maximize your tax benefits.

Conclusion

Understanding Kansas income tax is essential for individuals and businesses alike. By familiarizing yourself with the tax rates, deductions, credits, and filing requirements, you can ensure compliance with state tax laws while strategically managing your finances.

Kansas utilizes a progressive tax structure for both individual and corporate income taxes, meaning that higher incomes are subject to higher tax rates. It’s crucial to accurately calculate your taxable income and use the appropriate tax brackets to determine your tax liability.

Additionally, taking advantage of available deductions and tax credits can help reduce your overall tax burden. Whether it’s deducting mortgage interest, claiming educational tax credits, or utilizing the earned income tax credit, knowing the eligibility criteria and properly documenting your expenses is essential.

Remember to stay updated with any changes to the Kansas income tax regulations, including filing deadlines and updated rates. Consulting the official Kansas Department of Revenue website or seeking advice from a tax professional will ensure that you have the most accurate and up-to-date information.

Filing your Kansas income tax return accurately and on time is crucial to avoid penalties and fines. Utilizing tax software or seeking assistance from a tax professional can simplify the process and give you peace of mind that your taxes are being handled properly.

By understanding and navigating the world of Kansas income tax, you can effectively manage your financial obligations and optimize your tax strategy, leading to a stronger financial future.