Finance

What Is Hawaii Income Tax Rate

Published: November 2, 2023

Learn about the Hawaii income tax rate and how it impacts your finances. Stay informed and make informed financial decisions with our detailed guide on Hawaii's income tax rate.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Income Tax Rates

- Overview of Hawaii Income Tax Rates

- Hawaii Tax Rate for Single Filers

- Hawaii Tax Rate for Married Filing Jointly

- Hawaii Tax Rate for Head of Household

- Hawaii Tax Rate for Married Filing Separately

- Hawaii Tax Rate for Nonresidents

- Additional Taxes and Credits

- Conclusion

Introduction

Welcome to our guide on Hawaii income tax rates! If you are a resident or considering a move to the beautiful island state of Hawaii, understanding the state’s income tax rates is crucial for financial planning. Hawaii has a progressive income tax system, which means that tax rates increase as income levels increase.

Income tax is a primary source of revenue for the state government, and it is used to fund various public services and infrastructure projects. By knowing how income tax rates are structured in Hawaii, you can better estimate your tax liability, make informed financial decisions, and ensure compliance with the state’s tax laws.

In this guide, we will provide you with a comprehensive overview of Hawaii income tax rates. We will explain how these rates are determined and provide detailed information on tax rates for different filing statuses. Additionally, we will discuss additional taxes and credits that may impact your overall tax liability.

Whether you are a single filer, married filing jointly, head of household, married filing separately, or a nonresident, this guide will help you navigate the complexities of Hawaii’s income tax system.

It’s important to note that while this guide provides valuable information, it should not be considered as tax advice. Each individual’s tax situation is unique, and we recommend consulting with a qualified tax professional for personalized guidance.

Now, let’s dive into the details and explore Hawaii’s income tax rate in more depth!

Understanding Income Tax Rates

Before we delve into the specific income tax rates in Hawaii, it’s essential to understand how income tax rates work in general. Income tax rates determine the percentage of your income that you are required to pay in taxes to the state or federal government.

Income tax rates are typically based on a progressive tax system, where higher income levels are subject to higher tax rates. This means that as your income increases, the percentage of your income that you owe in taxes also increases.

It’s important to differentiate between marginal tax rates and effective tax rates. Marginal tax rates are the tax rates applied to each portion of your income within a specific tax bracket. On the other hand, effective tax rates are the average tax rates that you pay on your total income. This is calculated by dividing your total tax liability by your taxable income.

Understanding the different tax brackets and rates is crucial for accurately estimating your tax liability and planning your finances. By knowing the tax rates, you can determine how much of your income you will need to set aside for tax purposes and make informed decisions about deductions and credits.

Keep in mind that income tax rates can vary between states and even within different regions of the same state. Each state has its own set of tax brackets and rates, which are influenced by factors such as state revenue needs, budget priorities, and economic conditions.

Now that we have a basic understanding of income tax rates, let’s move on to exploring the specific income tax rates in Hawaii. Understanding these rates will help you navigate the tax system and plan your finances more effectively.

Overview of Hawaii Income Tax Rates

Hawaii has a progressive income tax system, similar to many other states in the United States. This means that the tax rates increase as your income levels increase. The state of Hawaii uses a series of tax brackets to determine the applicable tax rate for different income levels.

The Hawaii Department of Taxation releases annual tax rate schedules that outline the tax brackets and corresponding rates. The tax rates apply to your “taxable income,” which is the amount of income that is subject to taxation after deductions and exemptions have been taken into account.

As of the latest tax year, the income tax rates in Hawaii range from 1.4% to 11%. These rates apply to all taxable income earned by Hawaii residents, regardless of the source of income. Whether you earn income through wages, self-employment, or investments, you will be subject to Hawaii income tax if you are a resident.

It’s worth noting that Hawaii does not have a standard deduction like the federal government. Instead, taxpayers can choose to itemize deductions or claim the Hawaii standard deduction, which is based on their filing status.

To determine your Hawaii taxable income, you first calculate your federal adjusted gross income (AGI) and then apply state-specific modifications. These modifications may include adding back certain deductions, such as the federal standard deduction, and accounting for any Hawaii-specific tax credits or deductions.

It’s important to regularly check the official Hawaii Department of Taxation website or consult with a tax professional to stay up to date on any changes to the tax rates or deductions.

Now that we have an overview of the income tax rate structure in Hawaii, let’s explore the specific tax rates for different filing statuses in the following sections.

Hawaii Tax Rate for Single Filers

If you are a single filer in Hawaii, your tax rates will be determined based on your taxable income. The tax brackets range from 1.4% to 11%, with different income thresholds for each bracket.

For the latest tax year, here is the breakdown of the tax brackets and rates for single filers:

- Income up to $2,400: 1.4%

- Income over $2,400 up to $4,800: 3.2%

- Income over $4,800 up to $9,600: 5.5%

- Income over $9,600 up to $14,400: 6.4%

- Income over $14,400 up to $19,200: 6.8%

- Income over $19,200 up to $24,000: 7.2%

- Income over $24,000 up to $36,000: 7.6%

- Income over $36,000 up to $48,000: 7.9%

- Income over $48,000 up to $150,000: 8.25%

- Income over $150,000 up to $175,000: 9%

- Income over $175,000 up to $200,000: 10%

- Income over $200,000: 11%

These rates are subject to change, and it’s important to refer to the official Hawaii Department of Taxation website or consult with a tax professional for the most up-to-date information.

As a single filer, you will use the tax rates mentioned above to calculate your tax liability. The higher your taxable income, the higher your tax rate and overall tax liability will be. However, keep in mind that you may be eligible for deductions or credits that can help reduce your tax burden.

It’s important to note that if you have multiple sources of income or complex financial situations, it is recommended to seek assistance from a tax professional who can help optimize your tax planning strategies.

Now that we’ve covered the tax rates for single filers in Hawaii, let’s move on to the next section to explore the tax rates for married couples filing jointly.

Hawaii Tax Rate for Married Filing Jointly

If you are married and filing jointly in Hawaii, your tax rates will be determined based on your combined taxable income. The state uses the same tax brackets as for single filers; however, the income thresholds for each bracket are adjusted for married couples.

For the latest tax year, here is the breakdown of the tax brackets and rates for married couples filing jointly:

- Income up to $4,800: 1.4%

- Income over $4,800 up to $9,600: 3.2%

- Income over $9,600 up to $19,200: 5.5%

- Income over $19,200 up to $28,800: 6.4%

- Income over $28,800 up to $38,400: 6.8%

- Income over $38,400 up to $48,000: 7.2%

- Income over $48,000 up to $72,000: 7.6%

- Income over $72,000 up to $96,000: 7.9%

- Income over $96,000 up to $300,000: 8.25%

- Income over $300,000 up to $350,000: 9%

- Income over $350,000 up to $400,000: 10%

- Income over $400,000: 11%

As with single filers, these rates are subject to change, and it’s crucial to refer to the official Hawaii Department of Taxation website or consult with a tax professional for the most up-to-date information.

For married couples filing jointly, combining your incomes may push you into a higher tax bracket compared to filing separately. It’s important to consider the potential tax advantages or disadvantages of filing jointly versus separately to determine the most advantageous approach for your specific situation.

Remember that deductions and credits can also impact your overall tax liability. As a married couple, you may have unique deductions and credits available to you. It’s advisable to consult with a tax professional who can guide you on how to maximize your tax benefits.

Now that we’ve covered the tax rates for married couples filing jointly, let’s move on to explore the tax rates for individuals who qualify as the head of household.

Hawaii Tax Rate for Head of Household

If you qualify as the head of household in Hawaii, your tax rates will be determined based on your taxable income. The tax brackets and rates for head of household filers are similar to those for single filers, but the income thresholds differ.

For the latest tax year, here is the breakdown of the tax brackets and rates for head of household filers:

- Income up to $3,600: 1.4%

- Income over $3,600 up to $7,200: 3.2%

- Income over $7,200 up to $14,400: 5.5%

- Income over $14,400 up to $21,600: 6.4%

- Income over $21,600 up to $28,800: 6.8%

- Income over $28,800 up to $36,000: 7.2%

- Income over $36,000 up to $54,000: 7.6%

- Income over $54,000 up to $72,000: 7.9%

- Income over $72,000 up to $225,000: 8.25%

- Income over $225,000 up to $262,500: 9%

- Income over $262,500 up to $300,000: 10%

- Income over $300,000: 11%

As with other filing statuses, it’s important to check the official Hawaii Department of Taxation website or consult with a tax professional for the most current and accurate tax rate information.

Qualifying as head of household typically requires being unmarried or considered unmarried for tax purposes, paying more than half the cost of maintaining a household for a qualified dependent, and meeting specific eligibility criteria set by the IRS. Individuals who qualify as head of household may be eligible for certain deductions and credits that can help lower their overall tax liability.

Calculating your tax liability as a head of household involves applying the tax rates mentioned above to your taxable income. However, keep in mind that each individual’s tax situation is unique, and it’s recommended to consult with a tax professional to ensure you are taking advantage of all available deductions and credits.

Now that we’ve covered the tax rates for head of household filers in Hawaii, let’s move on to explore the tax rates for married individuals who choose to file separately.

Hawaii Tax Rate for Married Filing Separately

If you are married but choose to file separately in Hawaii, your tax rates will be determined based on your individual taxable income. The tax brackets and rates for married filing separately status are the same as those for single filers.

For the latest tax year, here is the breakdown of the tax brackets and rates for married individuals filing separately:

- Income up to $2,400: 1.4%

- Income over $2,400 up to $4,800: 3.2%

- Income over $4,800 up to $9,600: 5.5%

- Income over $9,600 up to $14,400: 6.4%

- Income over $14,400 up to $19,200: 6.8%

- Income over $19,200 up to $24,000: 7.2%

- Income over $24,000 up to $36,000: 7.6%

- Income over $36,000 up to $48,000: 7.9%

- Income over $48,000 up to $150,000: 8.25%

- Income over $150,000 up to $175,000: 9%

- Income over $175,000 up to $200,000: 10%

- Income over $200,000: 11%

Remember that these tax rates are subject to change, and it’s important to check the official Hawaii Department of Taxation website or consult with a tax professional for the most up-to-date information.

When filing separately, each spouse reports their own income and deductions, and their tax liability is calculated independently. It’s important to consider the potential advantages or disadvantages of filing separately, such as eligibility for certain tax credits or deductions that may be impacted by your filing status.

It’s worth noting that married couples who file separately generally have higher tax rates compared to those who file jointly. However, filing separately may be advantageous in certain situations, such as when one spouse has significant itemized deductions or if there are concerns about potential tax liabilities of the other spouse.

However, it is recommended to consult with a tax professional to determine the most beneficial filing status for your specific circumstances. They can help you navigate the complexities of tax laws and identify potential tax-saving strategies.

Now that we’ve covered the tax rates for married individuals filing separately in Hawaii, let’s move on to explore the tax rates for nonresidents.

Hawaii Tax Rate for Nonresidents

If you are a nonresident of Hawaii but have earned income from sources within the state, you may still be subject to Hawaii income tax. Nonresidents are taxed differently compared to residents, and their tax rates vary based on the type of income earned in Hawaii.

Hawaii uses different tax rates for nonresidents depending on whether the income is classified as “wages or compensation” or “other income.”

For nonresident individuals earning wages or compensation in Hawaii, the tax rates are as follows:

- Income up to $2,400: 1.4%

- Income over $2,400 up to $4,800: 3.2%

- Income over $4,800 up to $9,600: 5.5%

- Income over $9,600 up to $14,400: 6.4%

- Income over $14,400 up to $19,200: 6.8%

- Income over $19,200 up to $24,000: 7.2%

- Income over $24,000 up to $36,000: 7.6%

- Income over $36,000 up to $48,000: 7.9%

- Income over $48,000 up to $150,000: 8.25%

- Income over $150,000 up to $175,000: 9%

- Income over $175,000 up to $200,000: 10%

- Income over $200,000: 11%

For nonresident individuals with other types of income, such as rental income or business income, the tax rate is a flat 7.6% on the net income earned in Hawaii.

It’s important to note that nonresidents may also be subject to federal income tax and the income tax laws of their home state or country. If you are a nonresident with income from Hawaii sources, it is recommended to consult with a tax professional to understand your tax obligations and any potential tax treaty benefits.

Additionally, nonresidents may be eligible for certain deductions or exemptions allowed by Hawaii tax laws. These deductions can help reduce the overall tax liability for nonresidents earning income in the state.

Now that we’ve covered the tax rates for nonresidents in Hawaii, let’s move on to explore any additional taxes and credits that may impact your overall tax liability.

Additional Taxes and Credits

In addition to income tax, there are a few other taxes and credits that may impact your overall tax liability in Hawaii.

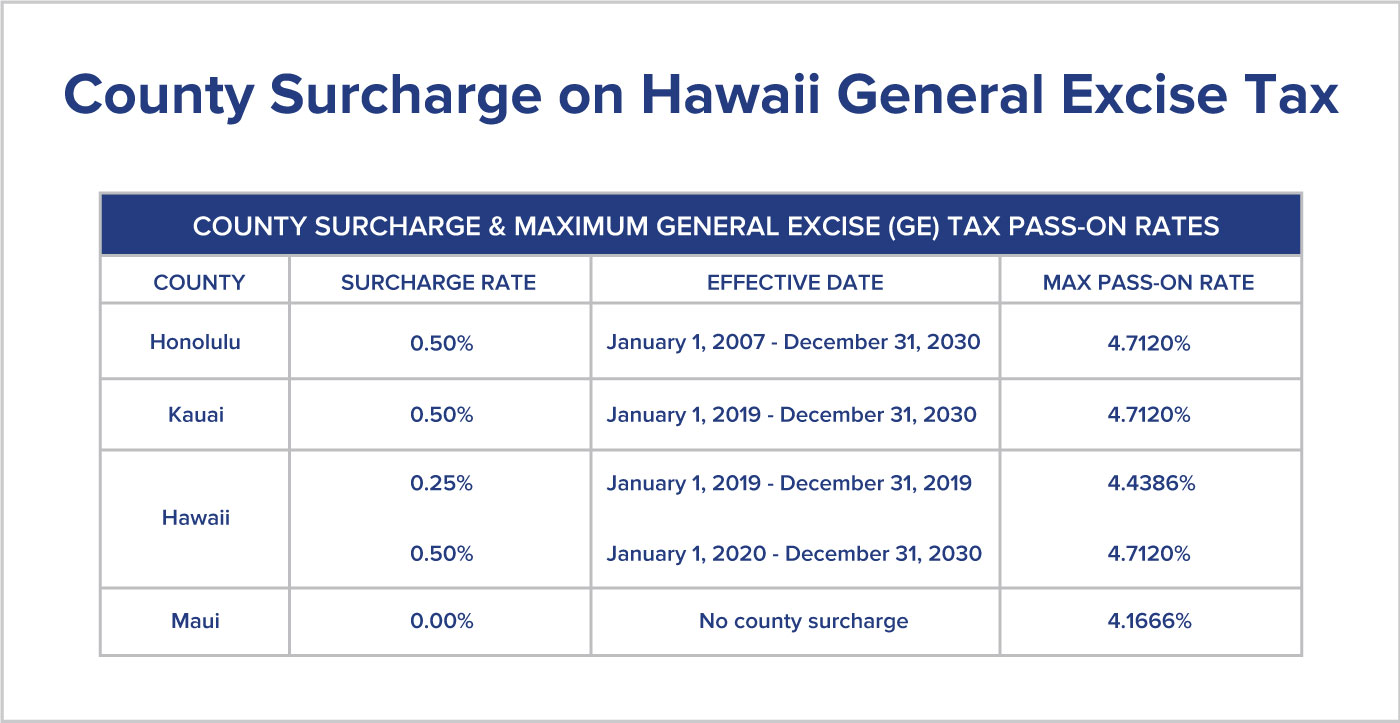

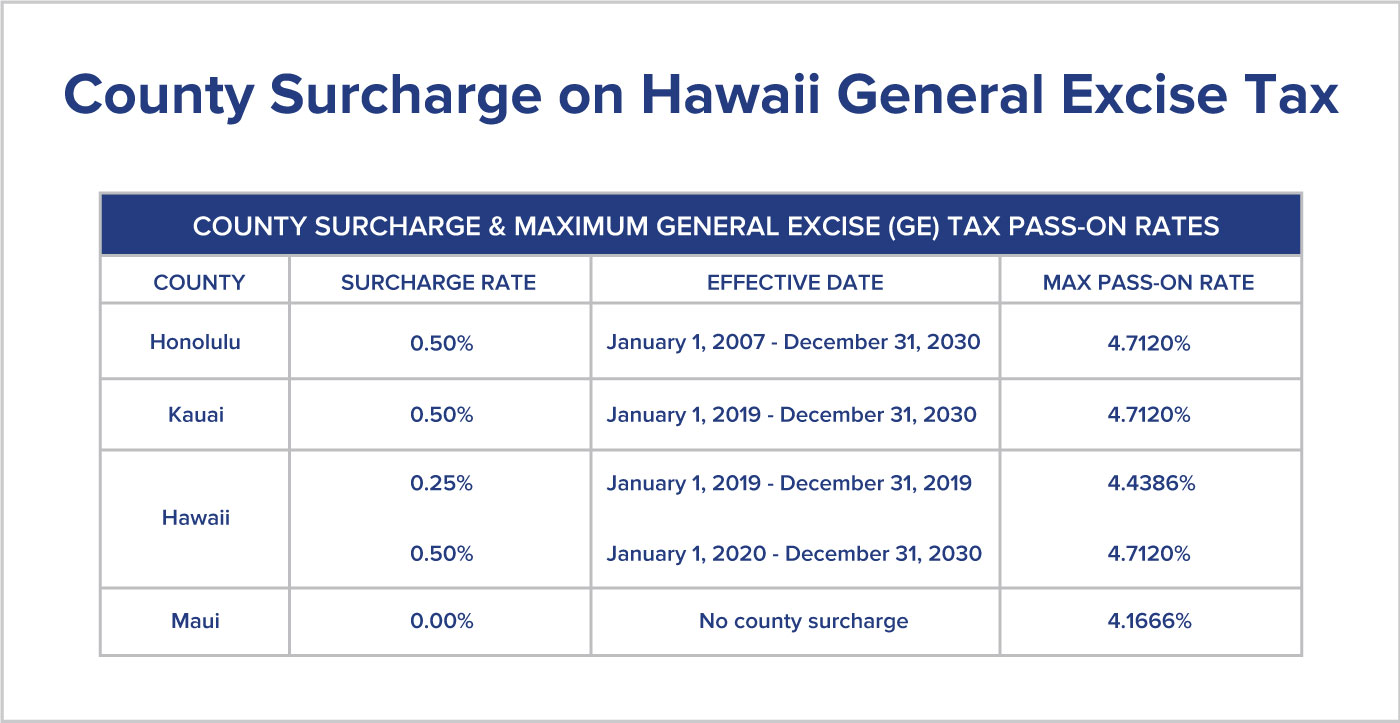

Hawaii General Excise Tax (GET): The General Excise Tax is a tax imposed on business activities in Hawaii. It is similar to a sales tax but is applied to gross income received by businesses. The tax rate varies depending on the type of business activity, with most activities subject to a 4% tax rate. Some specific activities, such as wholesale transactions or certain types of services, may have lower tax rates.

Residential Renewable Energy Tax Credit: Hawaii offers a tax credit for residential renewable energy systems, such as solar water heaters or photovoltaic systems. The credit is equal to 35% of the system cost, up to a maximum credit of $5,000 per system. This credit can help offset the costs of installing renewable energy systems in your home.

Child and Dependent Care Tax Credit: Hawaii provides a tax credit for eligible child and dependent care expenses incurred while working or looking for work. The credit ranges from 20% to 35% of qualifying expenses, depending on your income and the number of eligible dependents. This credit can help reduce the financial burden of child and dependent care expenses.

Retirement Income Exemption: Hawaii offers a retirement income exemption for residents who are 65 years and older. Eligible individuals can exclude a portion of their retirement income from taxable income. The exemption amount varies based on filing status and income level, providing potential tax savings for retirees.

These are just a few examples of additional taxes and credits that may be relevant to your tax situation in Hawaii. It’s important to familiarize yourself with the specific requirements and eligibility criteria for each tax credit or exemption. Consult with a tax professional to determine which credits or exemptions apply to your circumstances and can help reduce your overall tax liability.

Keep in mind that tax laws and regulations can change over time, so it’s essential to stay updated with the latest information from the Hawaii Department of Taxation or consult with a tax professional.

Now that we’ve explored additional taxes and credits, let’s conclude this guide.

Conclusion

Understanding the income tax rates in Hawaii is vital for managing your finances and ensuring compliance with state tax laws. Hawaii operates on a progressive income tax system, where tax rates increase as income levels rise. Whether you are a single filer, married filing jointly, head of household, married filing separately, or a nonresident, it is crucial to be aware of the specific tax brackets and rates that apply to your situation.

By knowing the tax rates, you can estimate your tax liability, plan your finances more effectively, and potentially take advantage of deductions and credits that can reduce your overall tax burden. However, it’s important to stay up to date with any changes to tax laws and consult with a qualified tax professional for personalized advice.

Throughout this guide, we have provided an overview of Hawaii’s income tax rates for different filing statuses, including single filers, married filing jointly, head of household, and married filing separately. We have also discussed the tax rates applicable to nonresidents who earn income in Hawaii. Additionally, we explored a few additional taxes and tax credits that can impact your overall tax liability.

Remember, while this guide provides valuable information, it is not a substitute for professional tax advice. Each individual’s tax situation is unique, and it’s recommended to consult with a tax professional who can provide personalized guidance based on your specific circumstances.

By being knowledgeable about Hawaii’s income tax rates and understanding how they apply to your situation, you can effectively manage your tax obligations and optimize your financial planning. Stay informed, seek guidance when needed, and ensure compliance with state tax laws to ensure a smooth and successful financial journey in Hawaii.

Good luck with your tax planning and financial endeavors in Hawaii!