Finance

What Is Arizona Income Tax Rate

Modified: February 21, 2024

Learn about the Arizona income tax rate and how it affects your finances. Understand the implications of state tax on your income and plan accordingly to optimize your budget.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to personal finance, understanding the tax landscape is crucial for making informed decisions. One important aspect of taxes is the income tax rate, which varies from state to state in the United States. In this article, we will explore the income tax rate in the state of Arizona and provide valuable insights for residents and individuals considering a move to the Grand Canyon State.

Arizona is known for its stunning landscapes, vibrant cities, and a growing economy. As with any state, it relies on revenue from taxes to provide public services and maintain infrastructure. One significant source of revenue is the individual income tax, which is imposed on the income earned by residents and non-residents in Arizona.

Understanding the Arizona income tax rate is essential for budgeting and financial planning. By knowing how much of your income will go towards taxes, you can better manage your finances and plan for future expenses.

In the next sections, we will delve into the specifics of the Arizona income tax, including the rates, tax brackets, deductions, and credits that individuals can take advantage of. Whether you are a current resident or considering a move to Arizona, this information will equip you with the knowledge needed to navigate the state’s tax system.

Understanding Arizona Income Tax

Before we dive into the details of the Arizona income tax rate, let’s first understand what income tax is and how it works. Income tax is a tax imposed by the government on the income earned by individuals or entities such as businesses and corporations. It is typically calculated as a percentage of taxable income.

In Arizona, the income tax is based on a progressive tax system, which means that as your income increases, you move into higher tax brackets and your tax rate increases accordingly. This system aims to ensure that individuals with higher incomes contribute a larger portion of their earnings towards taxes.

The Arizona income tax rate is characterized by a series of tax brackets, each with its own tax rate. These brackets are set based on income thresholds, and the tax rate increases as you move up the income ladder. It is important to note that the income tax rate in Arizona only applies to taxable income, which is the income left after subtracting any allowed deductions or credits.

Understanding your taxable income is essential for accurate tax calculations. It includes various sources of income, such as wages, salaries, tips, rental income, self-employment income, interest, dividends, and capital gains.

Arizona residents are required to file their state income tax returns by the deadline, which is usually April 15th, following the federal tax filing deadline. It is important to file your return on time to avoid penalties and interest charges.

Next, we will explore the tax brackets and rates that apply to Arizona individual income tax, giving you a clearer picture of what you can expect when it comes to your tax liability.

Arizona Individual Income Tax Rates

Arizona imposes its income tax rate based on a progressive tax system, which means that the tax rates increase as your income level rises. As of the latest tax year, the Arizona income tax rates range from 2.59% to 4.50%.

Here is an overview of the current Arizona individual income tax rates:

- 2.59%: Applicable to taxable income up to $10,346 for single filers and $20,692 for married couples filing jointly.

- 3.34%: Applicable to taxable income between $10,347 and $25,861 for single filers, and between $20,693 and $51,721 for married couples filing jointly.

- 4.17%: Applicable to taxable income between $25,862 and $51,721 for single filers, and between $51,722 and $103,441 for married couples filing jointly.

- 4.50%: Applicable to taxable income above $51,721 for single filers and above $103,441 for married couples filing jointly.

It is important to note that these tax rates are subject to change, so it’s always a good idea to check with the Arizona Department of Revenue or a tax professional for the most up-to-date information.

Now that we have an understanding of the tax rates, let’s take a closer look at the tax brackets that determine where your income falls and the corresponding tax rate.

Arizona Income Tax Brackets

Arizona has a progressive income tax system with multiple brackets that determine the tax rate applied to your income. The tax brackets are based on different income thresholds, and each bracket has its own corresponding tax rate.

Here are the current Arizona income tax brackets for single filers and married couples filing jointly:

- Single Filer:

- Up to $10,346: 2.59%

- $10,347 – $25,861: 3.34%

- $25,862 – $51,721: 4.17%

- Above $51,721: 4.50%

- Married Couples Filing Jointly:

- Up to $20,692: 2.59%

- $20,693 – $51,721: 3.34%

- $51,722 – $103,441: 4.17%

- Above $103,441: 4.50%

It is important to note that these income tax brackets are subject to change and may be updated each tax year. Additionally, there may be different brackets for other filing statuses, such as head of household or married filing separately.

Understanding which income bracket you fall into is crucial for determining your tax liability in Arizona. By knowing the applicable tax rate, you can accurately estimate your tax payment and plan your finances accordingly.

Next, let’s explore some of the deductions and credits available to Arizona residents that can help lower their overall tax burden.

Arizona Tax Deductions and Credits

In addition to the income tax brackets and rates, Arizona offers various deductions and credits that can help individuals reduce their overall tax liability. These deductions and credits can significantly impact the amount of income tax you owe and potentially provide opportunities for tax savings.

Here are some common deductions and credits available to Arizona residents:

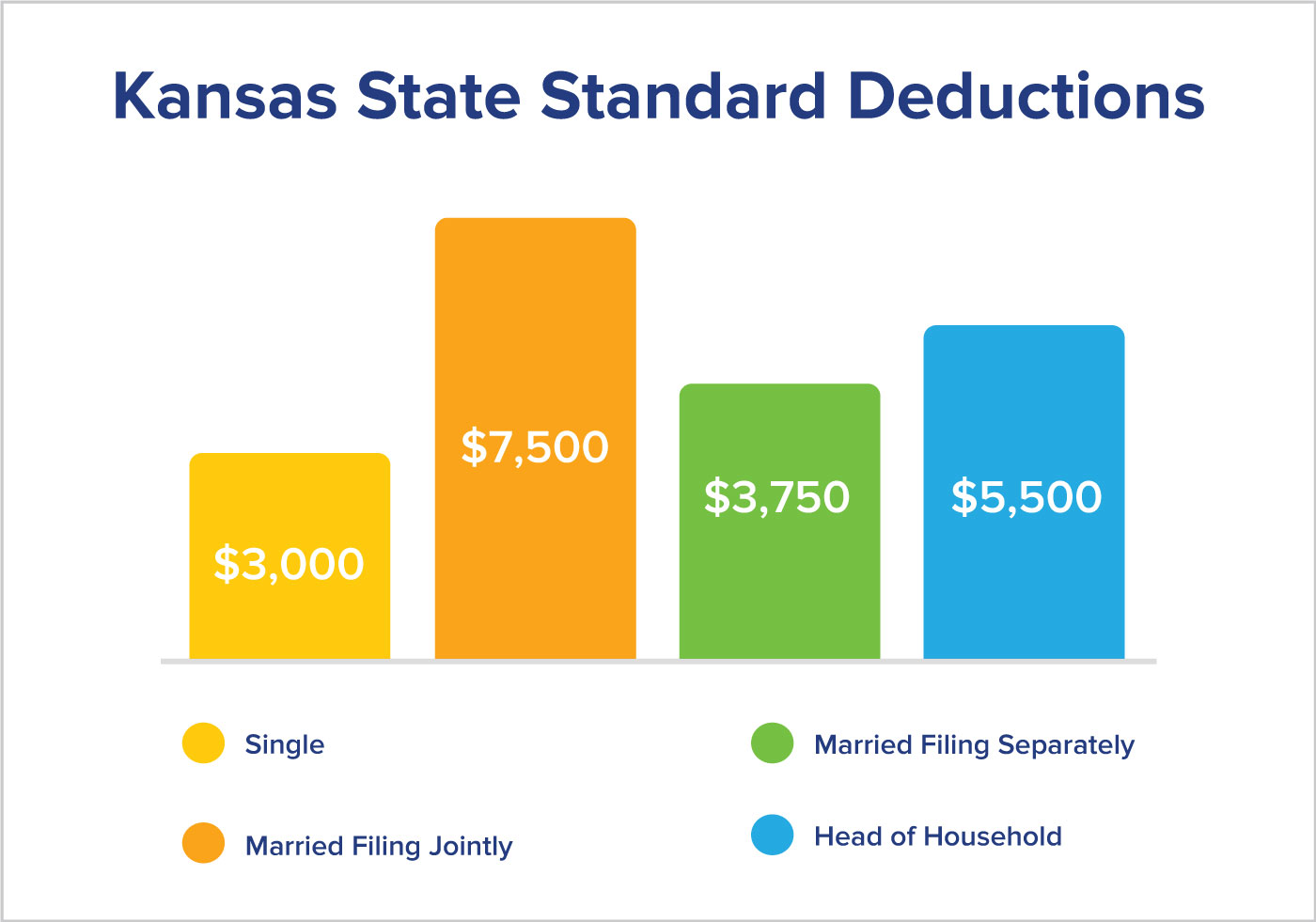

- Standard Deduction: Arizona offers a standard deduction for taxpayers who do not itemize deductions on their federal tax return. The standard deduction amounts vary based on filing status.

- Itemized Deductions: If your itemized deductions exceed the standard deduction amount, you can opt to itemize deductions on your Arizona tax return. Common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions.

- Educator Expenses Credit: Arizona provides a tax credit for eligible educators who purchase classroom supplies. This credit can help offset the costs associated with providing educational materials for students.

- Charitable Contributions: Donations made to qualified charitable organizations can be eligible for a tax credit in Arizona. This credit encourages individuals to support charitable causes and allows them to receive a tax benefit for their generosity.

- Child Tax Credit: Arizona offers a child tax credit, which allows families to reduce their tax liability for each qualifying child they have.

- Arizona Working Poor Credit: This credit is designed to assist low-income individuals and families. It can provide a significant reduction in the tax burden for those who qualify.

These are just a few examples of the deductions and credits available in Arizona. It’s essential to consult the Arizona Department of Revenue or a tax professional to understand the specific eligibility requirements and guidelines for each deduction and credit.

By taking advantage of these deductions and credits, you can potentially lower your tax liability, putting more money back into your pocket.

Now that we have covered the deductions and credits, let’s discuss how to file your Arizona income tax returns.

Filing Arizona Income Tax Returns

Filing your Arizona income tax return is a crucial step in fulfilling your tax obligations and ensuring compliance with the state’s tax laws. Here are the key details you need to know about filing your Arizona income tax return.

Filing Status: The first step in filing your Arizona income tax return is determining your filing status. Common filing statuses include single, married filing jointly, married filing separately, and head of household. Your filing status affects your tax rates and deductions, so it’s important to choose the one that accurately reflects your situation.

Tax Forms: To file your Arizona income tax return, you will need to use the appropriate tax forms. Most individuals will use the Arizona Form 140 for residents or Form 140NR for non-residents. These forms can be downloaded from the Arizona Department of Revenue’s website or obtained through tax preparation software.

Filing Deadlines: The filing deadline for Arizona income tax returns typically aligns with the federal tax filing deadline, which is typically April 15th. However, in some cases, the deadline may be extended if the federal deadline is extended. It’s essential to be aware of the current year’s deadline to avoid late filing penalties and interest charges.

E-Filing and Paper Filing: Arizona allows taxpayers to file their income tax returns electronically (e-filing) or by mail (paper filing). E-filing is generally faster and more convenient, and it also reduces the risk of errors or lost documents. If you choose to paper file, make sure to include all necessary documentation and mail it to the correct address specified by the Arizona Department of Revenue.

Payment Options: If you owe taxes after filing your Arizona income tax return, there are various payment options available. You can pay electronically, by check, or through other secure payment methods specified by the Arizona Department of Revenue. It’s important to submit your payment by the filing deadline to avoid any penalties or interest charges.

Seeking Professional Help: Filing income taxes can be complex, especially if you have unique circumstances or multiple sources of income. Consider seeking the assistance of a tax professional or using tax software to ensure accurate and timely filing.

Remember, filing your Arizona income tax return is an essential responsibility as a taxpayer. By understanding the process and meeting the filing requirements, you can stay compliant with the state’s tax laws and avoid potential penalties.

Now, let’s conclude our discussion on the Arizona income tax rate and its implications.

Conclusion

Understanding the Arizona income tax rate is vital for individuals residing in or considering a move to the Grand Canyon State. By having a clear understanding of the tax brackets, rates, deductions, and credits available, individuals can effectively manage their finances and make informed decisions regarding their tax liability.

Arizona operates under a progressive tax system, meaning that as incomes increase, the tax rate also increases. The tax brackets range from 2.59% to 4.50%, depending on income levels and filing status.

In addition to knowing the tax rates, individuals can take advantage of deductions and credits to reduce their overall tax burden. These include the standard deduction, itemized deductions, tax credits for educators, charitable contributions, child tax credit, and the Arizona Working Poor Credit, among others.

When it comes time to file Arizona income tax returns, individuals should determine their filing status, use the appropriate tax forms, and meet the filing deadlines. They have the option to e-file or paper file their returns and make tax payments through various methods provided by the Arizona Department of Revenue.

To ensure accuracy and compliance, individuals may choose to seek professional help or utilize tax software to navigate the complexities of filing income taxes in Arizona.

In conclusion, understanding the Arizona income tax rate and the associated factors is essential for effective financial planning. By staying informed about the tax brackets, deductions, credits, and filing procedures, individuals can make strategic decisions to optimize their tax liability while complying with the state’s tax laws.