Finance

What Is Passive Income Tax Rate

Published: November 2, 2023

Learn about the passive income tax rate and how it impacts your finances. Discover strategies to minimize taxes and maximize your financial growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Passive Income

- Different Types of Passive Income

- The Concept of Passive Income Tax Rate

- How Passive Income Is Taxed

- Factors Affecting Passive Income Tax Rate

- Strategies to Minimize Passive Income Tax Rate

- Reporting Passive Income on Tax Returns

- Case Studies: Passive Income Tax Rate Examples

- Conclusion

Introduction

Passive income is a term that has gained significant popularity in recent years as people strive to create additional streams of income while minimizing their active involvement. In simple terms, passive income is money earned with minimal effort or ongoing work. It is the opposite of active income, which is income generated through direct participation or labor.

Passive income can come from various sources, including investments, real estate, royalties, and businesses that operate without direct involvement. It provides individuals with the opportunity to earn income even when they are not actively working, allowing them to achieve financial freedom and pursue their desired lifestyle.

While generating passive income can be an appealing prospect, it is essential to understand the implications of passive income tax rates. Just like any other type of income, passive income is subject to taxation by the government.

The passive income tax rate refers to the percentage of tax that individuals must pay on the income they earn through passive sources. It is crucial to have a clear understanding of how passive income is taxed to effectively manage your finances and optimize your tax obligations.

This article aims to provide a comprehensive overview of passive income tax rates, including how they are calculated, the factors that influence them, and strategies to minimize them. By the end, you will have a better understanding of how passive income taxes work and how you can navigate them to maximize your earnings.

Understanding Passive Income

Passive income is income earned from sources that require minimal effort or ongoing work. It is money generated through investments, real estate, dividends, and other ventures that do not require active participation on a daily basis.

Unlike active income, which is earned through traditional employment or self-employment, passive income is not directly tied to the number of hours worked. Instead, it is generated through assets or investments that generate revenue independent of your direct involvement.

Passive income can provide individuals with financial security and independence. By building multiple streams of passive income, individuals can diversify their sources of revenue and reduce the reliance on traditional employment income.

There are several advantages of passive income. Firstly, it allows individuals to earn money while having time to pursue other interests and passions. Whether it’s spending more time with family, traveling, or engaging in hobbies, passive income provides financial freedom and flexibility.

Secondly, passive income has the potential for scalability. Unlike trading time for money in a traditional job, passive income can grow exponentially as individuals invest in different income-generating ventures. With the right investments and strategies, passive income can continue to grow and provide a steady stream of revenue over time.

However, it is important to note that generating passive income requires initial effort and investment. It is not a get-rich-quick scheme, and success often involves careful planning, research, and risk management. Building passive income streams may require upfront capital, time, and ongoing maintenance to ensure they generate consistent returns.

Overall, understanding passive income is essential for individuals looking to diversify their income streams and achieve financial independence. By leveraging passive income opportunities, individuals can create a stable and sustainable source of revenue that significantly contributes to their financial well-being.

Different Types of Passive Income

Passive income can be generated from various sources, each with its own unique characteristics and considerations. Understanding the different types of passive income can help individuals choose the best investment opportunities that align with their financial goals and risk appetite. Here are some common types of passive income:

- Real Estate Rental Income: One of the most popular forms of passive income, real estate rental income involves investing in properties and earning rental payments from tenants. This can include residential properties, commercial spaces, or vacation rentals.

- Dividend Income: Dividend income is generated by investing in stocks or mutual funds that distribute a portion of their earnings to shareholders. It can provide a consistent stream of income based on the performance of the underlying investments.

- Interest Income: Interest income is earned from lending money to others and collecting interest payments in return. This can include investments in bonds, certificates of deposit (CDs), peer-to-peer lending platforms, or even high-yield savings accounts.

- Business Ownership: Owning a business can also generate passive income if it operates successfully without the need for active day-to-day involvement. This can include owning franchises, online businesses, or rental properties managed by a professional team.

- Royalties: Royalties are payments received for the use of intellectual property, such as copyrights, patents, or trademarks. It can come from licensing agreements, publishing books or music, or even royalties earned by artists or inventors.

- Affiliate Marketing: Affiliate marketing involves promoting products or services through referral links and earning a commission for each purchase made by customers referred through your unique affiliate link. It can be done through blogs, social media, or other online platforms.

These are just a few examples of the many ways passive income can be generated. The key is to identify opportunities that align with your interests, skills, and financial goals. Diversifying your passive income portfolio across different sources can provide stability and mitigate risks associated with any single investment.

Before diving into any passive income opportunity, it is crucial to conduct thorough research, seek professional advice if necessary, and assess the potential risks and rewards. Understanding the different types of passive income will help set realistic expectations and choose the right investments to build a robust and sustainable income stream over time.

The Concept of Passive Income Tax Rate

Passive income tax rate refers to the percentage of tax that individuals must pay on the income earned from passive sources. Just like any other type of income, passive income is subject to taxation by the government.

The tax rates for passive income can vary depending on several factors, including the country or jurisdiction you reside in, the specific type of passive income earned, and your overall taxable income. In general, passive income tax rates may be lower than those for active income, but this can vary based on your individual circumstances.

Understanding the concept of passive income tax rates is crucial for managing your finances effectively and optimizing your tax obligations. By knowing how passive income is taxed, you can make informed decisions about investments, deductions, and strategies to minimize your tax liabilities.

It’s important to note that tax laws and regulations can change over time, so it’s always advisable to consult a tax professional or financial advisor to ensure you are compliant with the latest tax regulations and to maximize your tax benefits.

In the next sections, we will delve deeper into how passive income is taxed, the factors that affect passive income tax rates, and strategies you can employ to minimize your tax liabilities.

How Passive Income Is Taxed

Passive income is subject to taxation by the government, and the specific way in which it is taxed can vary based on the country or jurisdiction you reside in. Generally, passive income is taxed in one of two ways: ordinary income tax or capital gains tax.

1. Ordinary Income Tax:

When passive income is treated as ordinary income, it is taxed at the same rates as your active income, such as wages or salary. This means that the tax rate you pay on your passive income will depend on your overall taxable income and the tax brackets applicable in your country. It’s essential to be familiar with the tax rate structure to determine your tax obligations accurately.

2. Capital Gains Tax:

Passive income can also be subject to capital gains tax, especially when it is generated from the sale of investments or assets held for an extended period. In this case, the tax rate on passive income is typically lower than the ordinary income tax rates. The tax rate on capital gains may differ depending on the length of time the asset was held (short-term or long-term) and the tax laws in your jurisdiction.

It’s important to note that certain passive income sources may have specific tax treatment. For example, rental income from real estate often falls under different tax rules and may offer additional deductions or favorable tax treatment compared to other forms of passive income.

Additionally, tax laws and regulations can be complex, and they can change over time. It’s advisable to consult a tax professional or financial advisor to understand the specific tax implications of your passive income sources and to ensure compliance with the applicable tax laws in your jurisdiction.

By understanding how passive income is taxed, you can effectively plan your finances, optimize your tax obligations, and avoid any potential penalties or legal issues related to tax non-compliance.

Factors Affecting Passive Income Tax Rate

The passive income tax rate can be influenced by various factors that can vary depending on your individual circumstances and the tax laws in your country or jurisdiction. Understanding these factors is essential for effectively managing your passive income tax obligations. Here are some key factors that can affect your passive income tax rate:

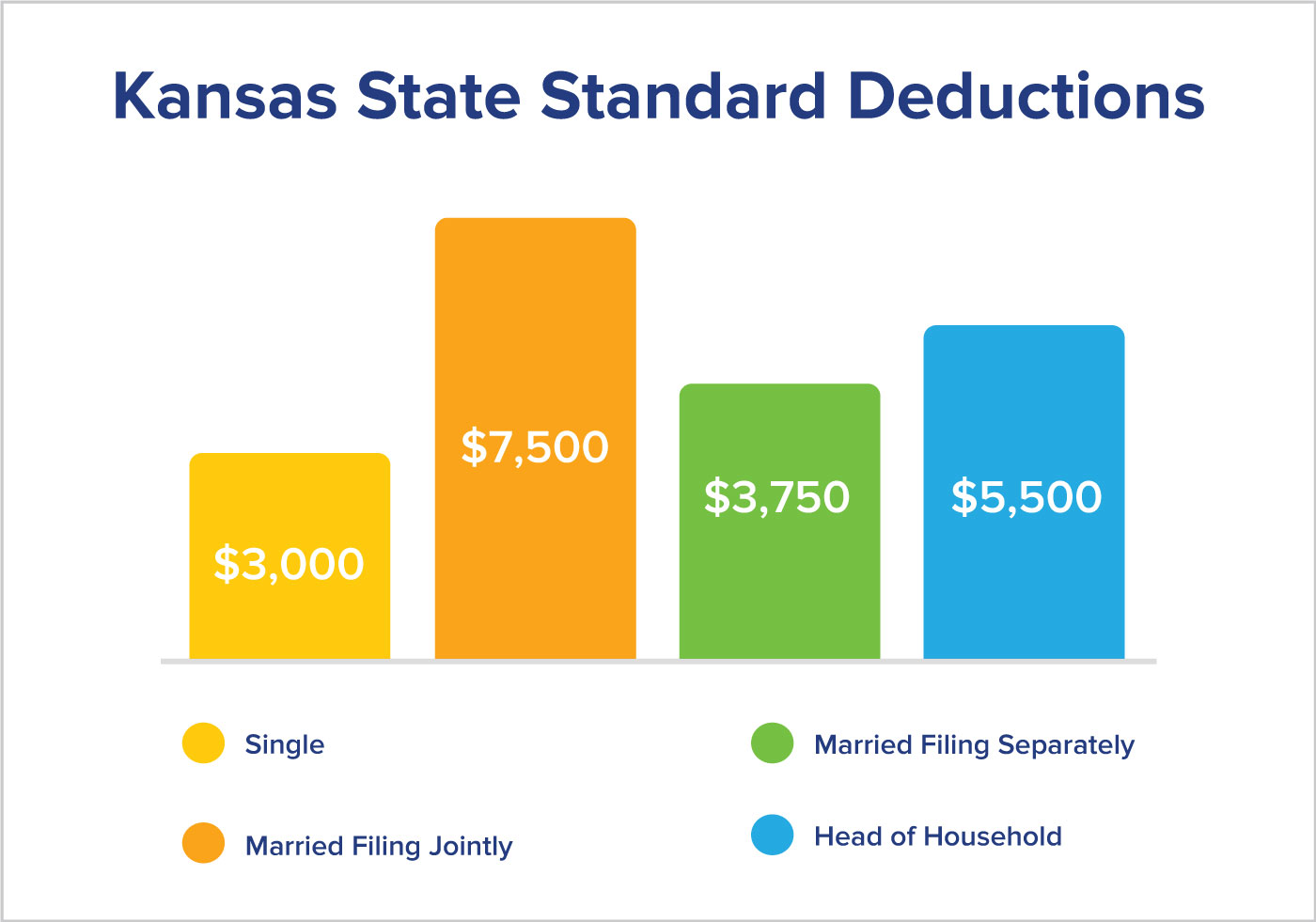

- Income Bracket: Your overall taxable income, including your passive income, can determine the tax bracket you fall into. Tax brackets typically have different tax rates, with higher income levels often subject to higher tax rates. It’s important to be aware of the income thresholds for each tax bracket to assess the impact on your passive income tax rate.

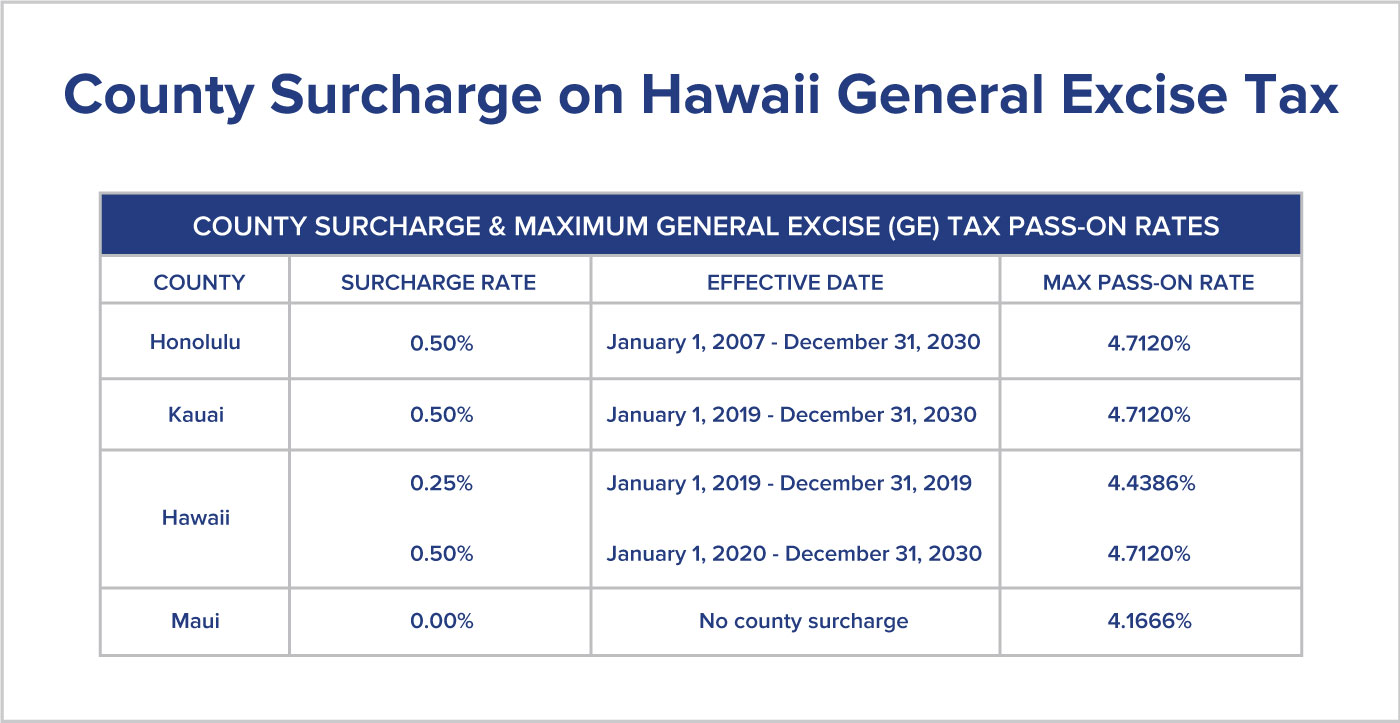

- Tax Laws and Regulations: Tax laws and regulations can vary between countries and jurisdictions. Different regions may have specific tax rules related to passive income, such as special deductions, exemptions, or favorable tax treatment for certain types of passive income. Stay updated with the latest tax regulations to understand how they may affect your passive income tax rate.

- Type of Passive Income: The type of passive income you earn can influence your tax rate. For example, rental income from real estate may have different tax treatment compared to dividends from investments or royalties from intellectual property. It’s important to understand the specific tax rules for each type of passive income to accurately calculate and plan for your tax liabilities.

- Investment Duration: The length of time you hold an investment can impact the taxation of your passive income. In some jurisdictions, capital gains tax rates may vary depending on whether the investment is held for the short-term or long-term. Longer-term investments may qualify for lower tax rates, providing potential tax advantages for passive income generated from those assets.

- Structuring and Tax Planning: The way you structure your passive income activities and engage in tax planning can also affect your tax rate. Consult with a tax professional or financial advisor to explore strategies and structures that can help you optimize your passive income tax obligations, such as utilizing tax-efficient investment vehicles or taking advantage of available deductions and credits.

Each individual’s tax situation is unique, and it’s always advisable to seek professional advice to navigate the complexities of the tax system and ensure compliance. By considering these factors and staying informed about tax laws, you can effectively manage your passive income tax rate and make informed decisions about your investments and overall financial planning.

Strategies to Minimize Passive Income Tax Rate

Minimizing your passive income tax rate can help you maximize the after-tax returns on your investments and retain more of your hard-earned income. While tax laws and regulations can vary, here are some general strategies that can help you reduce your passive income tax obligations:

- Take Advantage of Tax Deductions: Be aware of the tax deductions available for your specific type of passive income. Deductions can include expenses related to managing and maintaining your passive income sources, such as rental property expenses, business expenses, or professional fees. Keep detailed records and consult a tax professional to ensure you are claiming all eligible deductions.

- Invest in Tax-Efficient Vehicles: Consider investing in tax-efficient vehicles, such as retirement accounts (e.g., IRAs) or tax-exempt bonds. These investments can provide tax advantages by deferring taxes on your passive income or generating income that is not subject to tax at all. Explore the options available in your jurisdiction and assess how they can align with your financial goals.

- Optimize your Investment Timing: Capital gains tax rates may vary depending on the length of time you hold your investments. If possible, consider holding investments for the long term to potentially qualify for lower tax rates. However, remember that investment decisions should not solely be driven by tax considerations, but rather by a sound investment strategy.

- Consider Investment Structures: Certain investment structures, such as holding assets in a trust or forming a limited liability company (LLC), may offer tax advantages for passive income. Explore these options and consult with legal and tax professionals to determine if structuring your investments in a certain way can help minimize your tax liabilities.

- Geographical Considerations: If you have the flexibility to invest in different jurisdictions, consider the tax implications of each location. Some regions may offer more favorable tax rates or incentives for certain types of passive income. Conduct thorough research or seek professional advice to identify jurisdictions with tax advantages that align with your investment goals.

Keep in mind that tax planning strategies should be in compliance with applicable tax laws and regulations. Consult with a tax professional or financial advisor to evaluate these strategies in the context of your specific financial situation, goals, and jurisdiction. They can provide personalized advice and help you make informed decisions to minimize your passive income tax rate while staying compliant with the law.

By employing these strategies, you can work towards optimizing your passive income tax rate, allowing you to keep more of your earnings and potentially accelerate your journey towards financial independence.

Reporting Passive Income on Tax Returns

When it comes to reporting passive income on your tax returns, it is crucial to ensure accuracy and compliance with tax laws. Failing to report your passive income correctly can lead to penalties, fines, or even legal consequences. Here are some key considerations for reporting passive income on your tax returns:

- Track and Document Income: Keep meticulous records of your passive income, including details of each income source and the amount received. This can include rental income statements, dividend statements, or documentation of sales proceeds from investments. Accurate record-keeping helps ensure you report the correct income on your tax returns.

- Understand Reporting Requirements: Familiarize yourself with the tax forms and schedules specific to reporting passive income. In the United States, for example, you may need to use Schedule E for rental properties or Schedule B for interest and dividend income. Review the instructions provided with each form to ensure you complete them accurately.

- Report Income from All Sources: It is critical to report all your passive income, regardless of the amount. Even if you received a small amount of income from a particular source, it is still necessary to include it on your tax return. Failure to report all income can trigger an audit and potential penalties from tax authorities.

- Claim Eligible Deductions: Take advantage of any eligible deductions related to your passive income sources. This may include deducting expenses incurred to generate or maintain your passive income, such as property repairs, property management fees, or business-related expenses. Ensure you comply with the specific rules and requirements for each deduction.

- Consider Professional Assistance: If you have multiple or complex passive income streams, it may be beneficial to enlist the help of a tax professional or certified public accountant. They can ensure your tax returns are accurately prepared and help you identify any additional deductions or strategies to minimize your tax liabilities.

Remember, tax laws and reporting requirements can vary by jurisdiction, so it’s essential to be familiar with the rules specific to your country or region. Consulting a tax professional can provide personalized guidance tailored to your circumstances and help ensure you meet all reporting requirements accurately.

By reporting your passive income correctly, you not only comply with tax laws but also ensure that you are maximizing your deductions and minimizing the risk of facing penalties or audits. Take the time to understand the reporting process and seek professional advice if needed, to ensure your tax returns accurately reflect your passive income activities.

Case Studies: Passive Income Tax Rate Examples

Examining case studies can provide practical insights into how passive income is taxed and the potential impact on your tax liabilities. While individual circumstances can vary, here are two hypothetical examples showcasing different scenarios and the associated passive income tax rates.

Case Study 1: Rental Property Income

John is a real estate investor who generates passive income through rental properties. In a given year, his rental income amounts to $50,000. John falls into the 25% tax bracket for ordinary income. In this scenario, his passive income would be taxed at his ordinary income tax rate of 25%. Consequently, he would owe $12,500 in taxes on his rental property income.

Case Study 2: Dividend and Interest Income

Emily is an investor who earns passive income from dividends and interest. Her dividend income amounts to $10,000, and her interest income totals $5,000. In her jurisdiction, dividend and interest income are subject to a separate tax rate of 15%. Therefore, Emily’s passive income tax rate for her dividends and interest would be 15%. As a result, she would owe $2,250 in taxes on her dividend and interest income.

These case studies demonstrate how the type of passive income and tax laws can influence the tax rate individuals need to pay on their passive income. It highlights the importance of understanding the specific tax rules and rates associated with different sources of passive income in your jurisdiction.

It is essential to remember that these case studies are hypothetical examples, and actual tax rates and liabilities may vary depending on individual circumstances, tax brackets, and other factors. Consulting a tax professional can provide accurate guidance based on your specific situation.

By studying case studies and understanding how passive income tax rates can impact your overall taxation, you can better plan your finances, consider tax-efficient investment strategies, and optimize your tax liabilities while complying with applicable tax laws.

Conclusion

Understanding passive income tax rates is crucial for individuals seeking to generate additional sources of income while effectively managing their tax liabilities. Passive income, earned with minimal effort or ongoing work, can be subject to taxation based on various factors, including the type of income, tax laws, and individual circumstances.

In this article, we explored the concept of passive income tax rate, delved into different types of passive income, and examined how passive income is taxed. We also discussed factors that can affect the passive income tax rate and strategies to minimize tax obligations. Additionally, we explored the importance of accurately reporting passive income on tax returns and provided case studies illustrating hypothetical examples of passive income taxation.

It is important to remember that tax laws and regulations can be complex, and they may vary between jurisdictions. Consulting a tax professional or financial advisor is highly recommended to ensure compliance with applicable tax laws, optimize tax planning strategies, and maximize your after-tax returns.

By having a solid understanding of passive income tax rates and implementing effective tax planning strategies, you can make informed financial decisions, minimize your tax burdens, and work towards achieving your financial goals. Embracing passive income opportunities can pave the way for financial independence and a more secure future.

Always stay informed about the latest tax laws and seek professional advice when needed to ensure you are on the right track. With proper knowledge and careful planning, you can navigate the realm of passive income taxation with confidence.