Finance

How To Cancel Indigo Credit Card

Published: October 25, 2023

Looking to cancel your Indigo credit card? Our finance experts provide step-by-step instructions and tips to help you navigate the process smoothly.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Canceling the Indigo Credit Card

- Understanding the Cancellation Process

- Step 1: Reviewing Terms and Conditions

- Step 2: Contacting Customer Service

- Step 3: Submitting a Cancellation Request

- Step 4: Paying Off Outstanding Balances

- Step 5: Confirming the Cancellation

- Potential Impacts of Canceling the Indigo Credit Card

- Alternatives to Canceling the Indigo Credit Card

- Conclusion

Introduction

Welcome to our guide on how to cancel your Indigo credit card. The Indigo credit card is a popular choice for many individuals looking to build or rebuild their credit. However, there may come a time when you decide that it’s time to move on and close your account.

Canceling a credit card can be a straightforward process if you follow the right steps. In this article, we will provide you with a comprehensive guide on how to cancel your Indigo credit card effectively. We’ll cover everything from understanding the reasons for canceling the card to navigating the cancellation process step-by-step.

Keep in mind that canceling a credit card isn’t a decision to be taken lightly. Before proceeding with the cancellation, it’s important to weigh your options and consider the potential impacts it may have on your credit score and financial situation. We’ll also discuss alternatives to canceling your Indigo credit card, so you can make an informed decision that best suits your needs.

Whether you’ve found a better credit card offer or you simply no longer have a use for the Indigo credit card, we’re here to guide you through the cancellation process. So, let’s dive in and learn how to cancel your Indigo credit card.

Reasons for Canceling the Indigo Credit Card

While the Indigo credit card offers numerous benefits, there could be several reasons why you might consider canceling it. Here are some common reasons individuals choose to cancel their Indigo credit card:

- High Annual Fees: The Indigo credit card may come with annual fees that can add up over time. If you find that the fees are outweighing the benefits or rewards, canceling the card may be a viable option.

- Unsatisfactory Rewards Program: If you’re not satisfied with the rewards program offered by the Indigo credit card, such as earning points or cashback, you may want to explore other credit card options that better align with your spending habits and goals.

- Better Credit Card Offers: As your credit improves, you may become eligible for credit cards with better terms, lower interest rates, or more attractive rewards. In such cases, canceling your Indigo credit card and switching to a new card may be a wise decision.

- Change in Financial Situation: If your financial circumstances have changed and you no longer require the Indigo credit card, it might be a good time to cancel it. For example, if you’ve paid off your debts and want to simplify your financial life, closing unnecessary credit card accounts can be part of that strategy.

- Customer Service Issues: Poor customer service experiences can be a valid reason for canceling a credit card. If you have consistently encountered difficulties with Indigo’s customer service or have had unresolved disputes, it may be worth considering canceling the card.

Remember, the decision to cancel your Indigo credit card should be carefully considered based on your specific financial situation and needs. Assessing the reasons behind canceling can help you determine if it’s the right choice for you.

Understanding the Cancellation Process

Canceling a credit card can seem daunting at first, but with a clear understanding of the process, it can be a smooth and straightforward task. Here, we will walk you through the steps involved in canceling your Indigo credit card:

- Step 1: Reviewing Terms and Conditions: Before proceeding with the cancellation, carefully review the terms and conditions of your Indigo credit card. Pay attention to any potential fees or penalties for canceling the card, as well as any outstanding balances you may have.

- Step 2: Contacting Customer Service: To begin the cancellation process, contact Indigo’s customer service department. You can typically find the customer service phone number on the back of your credit card or on the issuer’s website. Inform the representative of your intention to cancel the card and be prepared to provide your account details.

- Step 3: Submitting a Cancellation Request: During your conversation with the customer service representative, you may be asked to submit a written cancellation request. This can be done through email or traditional mail. Be sure to include your account information and a clear statement requesting the cancellation of your Indigo credit card.

- Step 4: Paying Off Outstanding Balances: Before closing your Indigo credit card, it’s essential to pay off any outstanding balances on the account. This ensures that you are not left with any pending payments and helps maintain a positive credit history.

- Step 5: Confirming the Cancellation: After submitting your cancellation request and settling any remaining balances, follow up with Indigo’s customer service to confirm the cancellation of your credit card. Retain any confirmation numbers or documentation provided by the representative for your records.

It’s important to note that the cancellation process may vary slightly depending on the terms and policies of your specific Indigo credit card. Always make sure to adhere to the instructions provided by the customer service representative and keep track of any necessary documentation.

Carefully following these steps will help you navigate the cancellation process smoothly, ensuring that your Indigo credit card is successfully closed. Next, we’ll discuss the potential impacts canceling the card may have on your credit and explore some alternatives you may consider.

Step 1: Reviewing Terms and Conditions

Before canceling your Indigo credit card, it is crucial to thoroughly review the terms and conditions associated with your account. This step will ensure that you are aware of any potential fees, penalties, or requirements that may be involved in the cancellation process.

Start by accessing the terms and conditions document provided to you when you first received your Indigo credit card. If you don’t have a physical copy, you can usually find the terms and conditions on the issuer’s website or by contacting their customer service department.

When reviewing the terms and conditions, pay close attention to the following:

- Cancellation Fees: Some credit card issuers may charge a fee for canceling your card before a certain period has passed. Take note of any potential charges or penalties that may apply in the event of cancellation. If there are fees involved, consider whether they outweigh the benefits of keeping the card.

- Outstanding Balances: Verify if you have any outstanding balances on your Indigo credit card account. It’s crucial to pay off these balances before canceling the card to avoid any adverse effects on your credit score.

- Rewards Points: If your Indigo credit card offers a rewards program, understand what will happen to your accumulated rewards points upon cancellation. Some issuers may allow you to redeem your points before closing the account, while others may have specific rules regarding the usage of rewards points.

- Credit Reporting: Familiarize yourself with how the cancellation of your Indigo credit card may impact your credit report. Find out if the card’s closure will be reported as “closed by the customer” or “closed by the issuer.” Understanding how it will be reported can help you anticipate any potential effects on your creditworthiness.

By thoroughly reviewing the terms and conditions, you will have a clear understanding of what to expect during the cancellation process. This knowledge will enable you to make informed decisions and minimize any potential issues that may arise.

Now that you have reviewed the terms and conditions, it’s time to move on to the next step: contacting the customer service department of Indigo to initiate the cancellation process.

Step 2: Contacting Customer Service

Once you have reviewed the terms and conditions and are ready to proceed with canceling your Indigo credit card, the next step is to contact their customer service department. This step is essential as it allows you to initiate the formal cancellation process and provides an opportunity to address any questions or concerns you may have.

Here’s how you can go about contacting Indigo’s customer service:

- Locate the Customer Service Information: The contact information for Indigo’s customer service department can typically be found on the back of your credit card. If not, visit their website or refer to any communications you may have received from them.

- Prepare Your Account Details: Before calling or reaching out to customer service, gather all the necessary information related to your Indigo credit card account. This includes your card number, account balance, and any other relevant details that will help them process your cancellation request.

- Initiate the Call or Online Inquiry: Use the provided customer service phone number or online inquiry form to contact Indigo. Be prepared to explain your intention to cancel the credit card and provide the required account information when prompted.

- Communicate Your Request Clearly: Clearly state that you would like to cancel your Indigo credit card. The customer service representative may ask you some security questions to confirm your identity or inquire about the reason for cancellation. Stay composed and provide accurate responses.

- Address Any Concerns or Inquiries: Use this opportunity to address any questions or concerns you may have about the cancellation process, fees, outstanding balances, or the effect on your credit. The customer service representative should be able to provide clarification and assist you in navigating through any potential obstacles.

During your conversation with Indigo’s customer service, ensure that you take note of the representative’s name, the time and date of the call, and any vital information provided. This documentation can serve as a record of your cancellation request.

Keep in mind that contacting customer service is an important step in the cancellation process, as it officially notifies the credit card issuer of your desire to close the account. Following this step will help you progress smoothly through the cancellation process and set the stage for the next steps to be completed successfully.

Next, we will move on to Step 3, which involves submitting a formal cancellation request to Indigo.

Step 3: Submitting a Cancellation Request

After contacting Indigo’s customer service and expressing your intention to cancel your credit card, the next step is to submit a formal cancellation request. This request serves as a written confirmation of your desire to close your Indigo credit card account and helps ensure a smooth and documented cancellation process.

Here’s how you can submit a cancellation request to Indigo:

- Determine the Preferred Method: Indigo may provide options for submitting a cancellation request, such as via email or traditional mail. Review the instructions provided by their customer service representative to determine the preferred method of communication.

- Compose the Cancellation Request: Regardless of the method chosen, ensure that your cancellation request is clear, concise, and includes all necessary details. Include your name, account number, and a direct statement expressing your desire to cancel the Indigo credit card.

- Include Contact Information: Provide your contact information, such as your phone number and email address, so that Indigo can reach out to you if they need further clarification or to confirm the cancellation request.

- Attach Supporting Documents (if applicable): If there are any supporting documents or evidence that you need to include with your cancellation request, make sure to attach them securely. This could be copies of previous correspondence, account statements, or any other relevant documentation.

- Review and Send: Proofread your cancellation request to ensure accuracy and clarity. Double-check that you have included all the necessary information and that it aligns with the instructions provided by Indigo. Once you are satisfied, send the cancellation request via the designated method (email or mail).

After submitting your cancellation request, keep any confirmation email or mailing receipts as proof of your correspondence. This documentation will be valuable in case any issues or discrepancies arise in the future.

By following these steps to submit a well-crafted cancellation request, you demonstrate your seriousness about canceling your Indigo credit card and provide the necessary information for a smooth processing of your request. In the next step, we will discuss the importance of paying off any outstanding balances on your Indigo credit card before closing the account.

Step 4: Paying Off Outstanding Balances

Before closing your Indigo credit card, it is essential to pay off any remaining balances on the account. Clearing these outstanding balances ensures that you are not left with unpaid debts and helps maintain a positive credit history.

Here’s what you need to do to pay off your Indigo credit card balances:

- Review Your Account Statement: Obtain your most recent account statement or log in to your Indigo online account to review the outstanding balances. Take note of the total amount owed, including any accrued interest or fees.

- Create a Repayment Plan: If you are unable to pay the full amount in one go, devise a repayment plan that fits your budget. Determine how much you can allocate towards your Indigo credit card payments each month until the balance is fully paid off.

- Make Payments: Begin making payments according to your repayment plan. Utilize Indigo’s payment portal, automated payment options, or submit payments manually through other payment methods accepted by the issuer. Ensure that you include your credit card account number and any other required information for accurate processing of your payment.

- Keep Track of Payments: Maintain a record of your payments, including the amount paid, the date, and the method of payment. This documentation will serve as proof of your efforts to settle your outstanding balances in case of any disputes or discrepancies.

- Verify Balance Clearance: Once you have made the final payment to clear your outstanding balances, confirm with Indigo that no remaining debts are associated with your account. Request a statement or written confirmation that your Indigo credit card account is at a zero balance.

By prioritizing the repayment of your outstanding balances, you not only fulfill your financial obligations but also ensure a smooth closure of your Indigo credit card account. It is crucial to settle these balances promptly to avoid accumulating additional interest charges or negative impacts on your credit report.

After successfully paying off your Indigo credit card balances, you are now ready to proceed to the final step of the cancellation process: confirming the cancellation with Indigo. This will be covered in the next section.

Step 5: Confirming the Cancellation

After completing the previous steps of reviewing the terms and conditions, contacting customer service, submitting a cancellation request, and paying off your outstanding balances, the final step is to confirm the cancellation of your Indigo credit card. This step ensures that your account closure is officially acknowledged and that you have peace of mind knowing that the cancellation process is complete.

Here’s how you can confirm the cancellation with Indigo:

- Follow Up with Customer Service: Contact Indigo’s customer service department to confirm that your cancellation request has been received and processed. Use the customer service phone number or email provided to reach out and inquire about the status of your request.

- Provide Necessary Information: Be prepared to provide any requested information to the customer service representative, such as your account details or the reference number of your cancellation request. This will help them locate your account quickly and provide you with the necessary confirmation.

- Request Confirmation: Clearly express your desire to receive confirmation that your Indigo credit card has been canceled. Ask the customer service representative to provide you with written confirmation via email or mail, documenting the closure of your account.

- Review Confirmation Documentation: Once you receive the confirmation from Indigo, carefully review the document to ensure that all the details are correct. Confirm that the cancellation date and any other relevant information align with your records.

- Retain Confirmation for Future Reference: Keep a copy of the confirmation documentation in a safe place for future reference. This documentation serves as proof of your canceled Indigo credit card and can help resolve any disputes or discrepancies that may arise later.

By confirming the cancellation with Indigo, you not only receive peace of mind but also have a record of the closure for your own reference. This step ensures that the cancellation process is officially acknowledged and completed, leaving you with a successfully closed Indigo credit card account.

Now that we’ve covered the five steps of canceling your Indigo credit card, let’s move on to discussing the potential impacts of canceling your card and exploring alternatives to consider.

Potential Impacts of Canceling the Indigo Credit Card

Canceling your Indigo credit card can have various potential impacts on your credit profile and financial situation. It’s essential to be aware of these potential consequences before making a final decision. Here are some factors to consider:

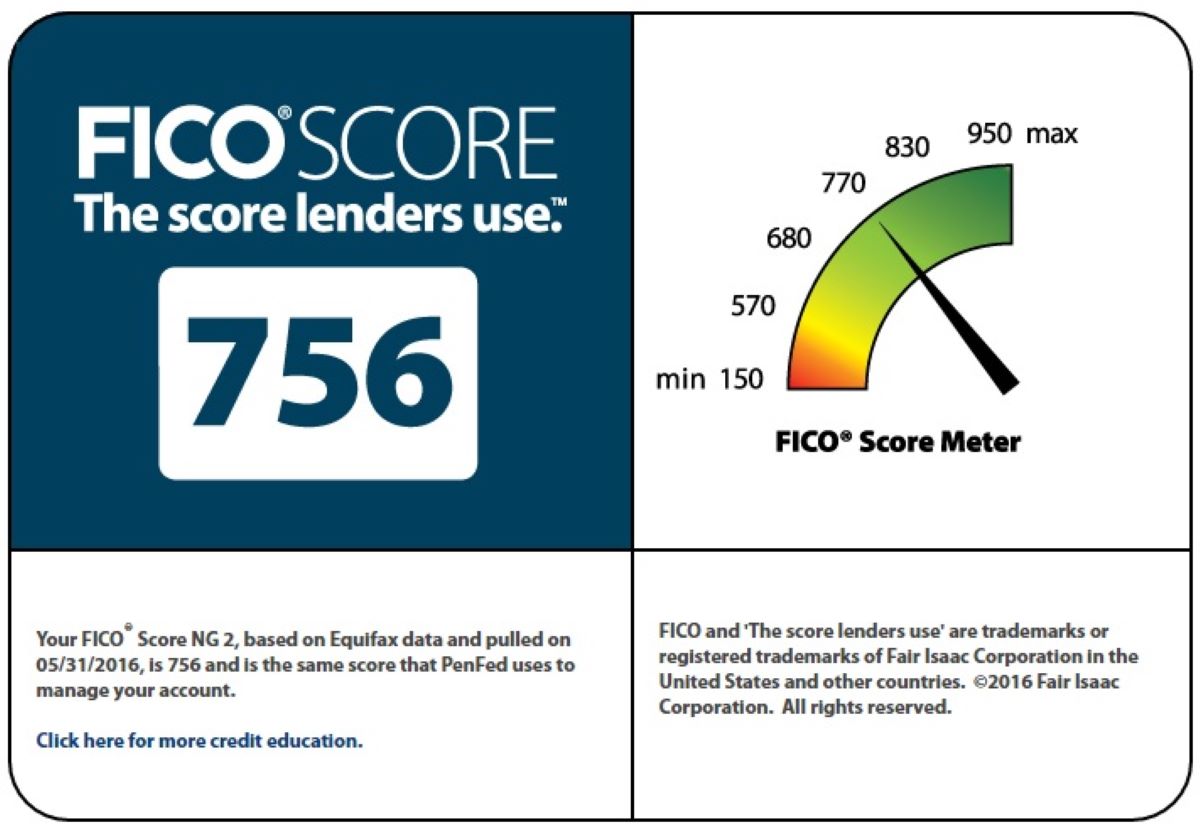

- Credit Utilization Ratio: Canceling your Indigo credit card can affect your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. If you have other credit cards or loans, canceling the Indigo card may reduce your available credit, potentially increasing your credit utilization ratio. However, if you have low balances on other cards and are responsible with your credit usage, the impact may be minimal.

- Length of Credit History: Closing your Indigo credit card may impact the length of your credit history, particularly if it was one of your oldest accounts. A longer credit history is generally seen as more favorable by potential lenders, so consider the age of your Indigo card in relation to your other credit accounts.

- Impact on Credit Score: Canceling a credit card can potentially affect your credit score. Factors such as credit utilization, length of credit history, and the mix of credit accounts contribute to your score. If canceling the Indigo card negatively affects these factors, there may be a temporary decrease in your credit score. However, if you have other active credit accounts and manage them responsibly, any negative impact should be minimal and recoverable over time.

- Loss of Benefits: Consider the benefits you may be losing by canceling the Indigo credit card. These could include rewards points, cashback programs, or any special features that may be tied to the card. Evaluate the value of these benefits in relation to the decision to cancel.

- Reduced Fraud Protection: Credit cards offer certain protections against fraudulent transactions. Canceling your Indigo credit card means you will lose these protections. However, if you have other credit cards that provide similar fraud protection, the impact may be minimal.

It’s important to note that the specific impacts of canceling your Indigo credit card will vary depending on your overall credit profile and individual circumstances. It’s advisable to review your own financial situation, credit goals, and potential alternatives before making a final decision.

Speaking with a financial advisor or credit counselor can provide additional guidance and insights into how canceling your Indigo credit card may affect you personally.

Now that we have discussed the potential impacts of canceling your Indigo credit card, let’s explore some alternatives you may consider before making a final decision.

Alternatives to Canceling the Indigo Credit Card

Before deciding to cancel your Indigo credit card, it’s worth considering a few alternatives that may better suit your needs. These alternatives can help you maintain a positive credit history, utilize available credit, and potentially enjoy better benefits. Here are some options to explore:

- Downgrade to a No-Fee Card: If the annual fees associated with the Indigo credit card are a concern, consider contacting the issuer to explore the possibility of downgrading to a no-fee card that they offer. This allows you to maintain your credit history and relationship with the issuer while avoiding the burden of annual fees.

- Switch to a Different Card: If you’re dissatisfied with the rewards program or benefits of the Indigo credit card, research and compare other credit card options. Look for cards that align better with your spending habits, financial goals, and desired benefits. This way, you can make a seamless transition to a card that better suits your needs.

- Maintain a Small Balance: If you are concerned about the impact on your credit score or credit utilization ratio from canceling the Indigo credit card, consider keeping a small balance on the card and making regular, on-time payments. This ensures that the card remains active and contributes to your credit history without incurring significant expenses or fees.

- Use the Card Responsibly: If you’re primarily canceling the Indigo credit card due to high fees or unsatisfactory benefits, it may be worth considering whether you can maximize the card’s positive aspects. For example, you can use it sparingly for specific purposes or utilize it for building credit in a responsible manner. This strategy can help maintain a positive credit history while minimizing the associated costs.

- Consider a Balance Transfer: If you have existing balances on your Indigo credit card and are concerned about the associated fees or interest rates, you may consider exploring balance transfer options. Many credit card issuers offer promotional periods with low or zero interest rates for balance transfers, allowing you to consolidate your debts onto a card with more favorable terms.

Remember, the specific alternative that suits you will depend on your unique financial circumstances, credit goals, and preferences. It’s crucial to assess the benefits and drawbacks of each option and choose the one that aligns best with your needs and financial objectives.

If you are unsure about which alternative is most suitable for you, consider seeking advice from a financial professional who can provide personalized recommendations based on your situation.

Now that we have explored alternatives to canceling the Indigo credit card, let’s conclude our guide.

Conclusion

Canceling your Indigo credit card is a decision that requires careful consideration of your financial goals and circumstances. Throughout this guide, we have provided a comprehensive overview of the steps involved in canceling your Indigo credit card, as well as the potential impacts and alternatives to consider.

Before canceling your card, review the terms and conditions, understand the cancellation process, and contact Indigo’s customer service to initiate the formal request. Submit a written cancellation request, pay off any outstanding balances, and confirm the cancellation with Indigo. Be aware of the potential impacts on your credit history, credit score, and other factors, and consider alternatives such as downgrading to a no-fee card, switching to a different card, maintaining a small balance, using the card responsibly, or exploring balance transfer options.

Ultimately, the decision to cancel your Indigo credit card should be based on your individual needs and circumstances. It’s essential to assess the benefits, fees, rewards programs, and other factors associated with the card before making a final decision.

If you are unsure about the best course of action, consider consulting with a financial advisor or credit counselor who can provide personalized guidance tailored to your specific situation.

Remember, canceling your Indigo credit card is just one step in your overall financial journey. Take the time to evaluate your financial goals, build a positive credit history, and make informed decisions that support your long-term financial well-being.

By understanding the cancellation process, weighing the potential impacts, and exploring alternatives, you are equipped to make an informed decision regarding your Indigo credit card. Good luck on your financial journey!