Finance

How Does Chime Credit Card Builder Work

Modified: February 21, 2024

Find out how Chime Credit Card Builder can help you improve your finances and build credit with ease. Discover the benefits and features today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Chime Credit Card Builder?

- Benefits of Using Chime Credit Card Builder

- How to Get Started with Chime Credit Card Builder

- Step 1: Create an Account

- Step 2: Customize Your Credit Card

- Step 3: Review and Submit Application

- Step 4: Receive and Activate Your Chime Credit Card

- Features of Chime Credit Card Builder

- Building Credit with Chime Credit Card Builder

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

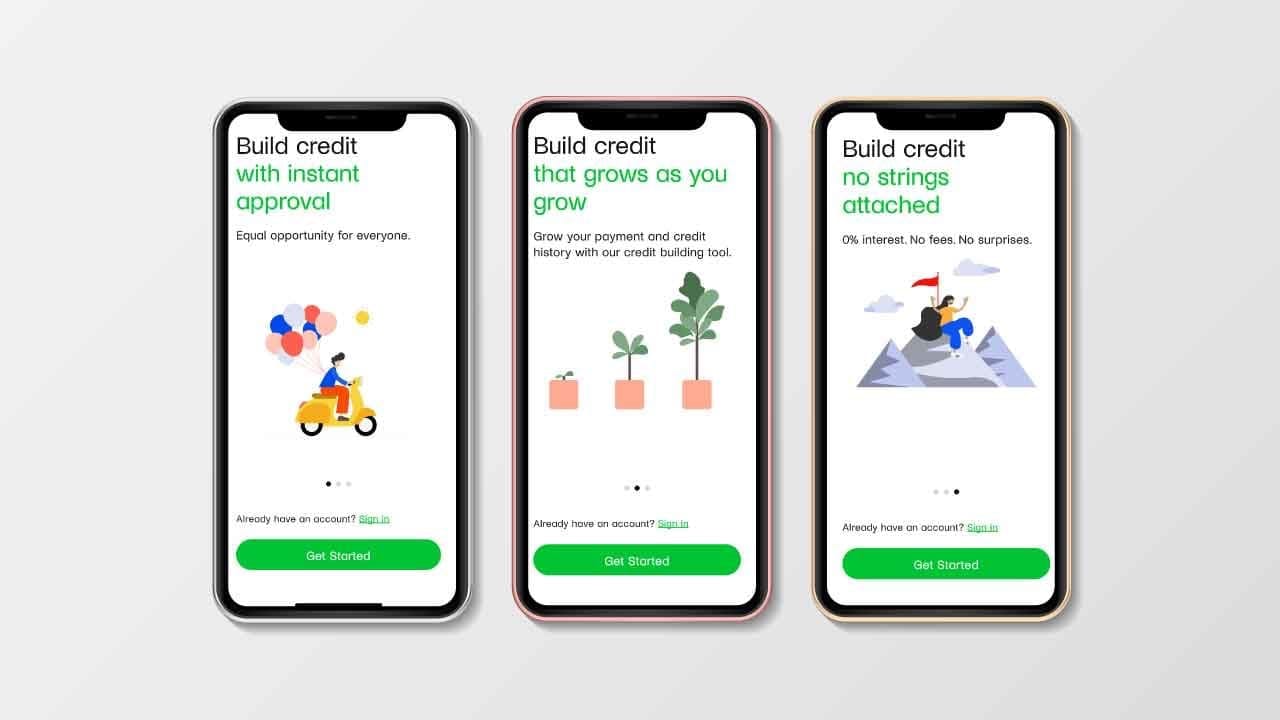

Welcome to the world of Chime Credit Card Builder! If you’re looking for a smart and innovative way to build or rebuild your credit, then look no further. Chime Credit Card Builder is a unique tool designed to help individuals establish or improve their credit history with ease.

Having a good credit score is essential. It not only helps you qualify for loans and credit cards, but it also determines the interest rates you’ll receive. However, building credit can be challenging, especially if you don’t have a credit history or have made some financial mistakes in the past.

That’s where Chime Credit Card Builder comes into play. It provides a user-friendly platform that enables you to customize and personalize your own credit card, all while taking steps to improve your credit health. With Chime’s innovative technology and commitment to financial well-being, you can take control of your credit journey and pave the way towards a brighter financial future.

Whether you’re a student, young professional, or someone looking to rebuild their credit, Chime Credit Card Builder offers a welcome solution. In this article, we’ll explore the benefits of using Chime Credit Card Builder, how to get started, and the features that set it apart from traditional credit cards. So, let’s dive in and discover the world of Chime Credit Card Builder!

What is Chime Credit Card Builder?

Chime Credit Card Builder is an innovative financial tool that empowers individuals to take control of their credit journey. It provides a unique opportunity to build or rebuild your credit history by customizing your own credit card. Unlike traditional credit cards, Chime Credit Card Builder is designed with the user’s financial well-being in mind.

With Chime Credit Card Builder, you have the flexibility to personalize your credit card with a variety of options. From selecting your card design to choosing your credit limit, you have the power to tailor your credit card to your specific needs and goals. This customization aspect sets Chime Credit Card Builder apart from other credit-building tools.

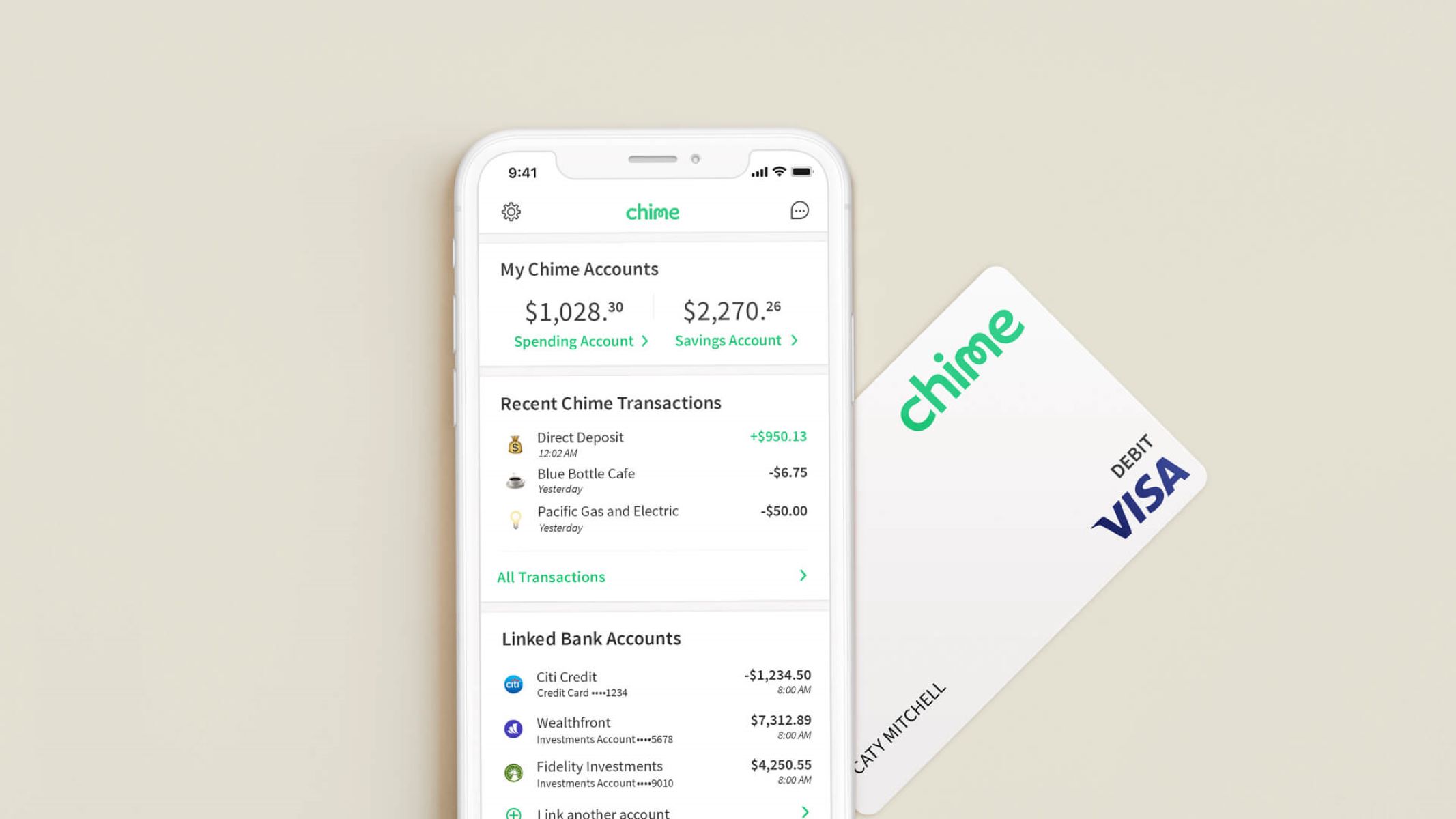

The Chime Credit Card Builder is backed by Chime, a digital banking platform known for its user-friendly mobile app and commitment to providing financial solutions for everyone. Chime believes that everyone deserves access to tools that can help them achieve financial success.

One of the standout features of Chime Credit Card Builder is that it does not require a traditional credit check. This means that individuals with limited or no credit history can still have the opportunity to build their credit. Chime understands that it can be difficult to establish credit when you don’t have a credit history to begin with, and they aim to make the process more accessible.

In addition, Chime Credit Card Builder does not charge any annual fees or hidden charges, making it a cost-effective option for those looking to build credit without breaking the bank. Chime’s commitment to transparency ensures that you won’t be surprised by any unexpected fees or charges.

Chime Credit Card Builder functions like a regular credit card and can be used for purchases wherever Visa is accepted. This means that you can build your credit while enjoying the everyday convenience of a credit card.

Overall, Chime Credit Card Builder provides individuals with a practical, accessible, and customizable tool to build or rebuild their credit. It combines the convenience and benefits of a credit card with the flexibility of customization, making it an ideal choice for those looking to take control of their financial future.

Benefits of Using Chime Credit Card Builder

Using Chime Credit Card Builder comes with a range of benefits that can help individuals improve their credit and achieve their financial goals. Here are some key advantages of using Chime Credit Card Builder:

- Customization: One of the biggest benefits of Chime Credit Card Builder is the ability to customize your own credit card. You have the freedom to choose a design that reflects your personality and preferences. Additionally, you can select your desired credit limit based on your financial needs and goals.

- No traditional credit check: Chime Credit Card Builder doesn’t require a traditional credit check, making it an accessible option for individuals with limited or no credit history. This means that even if you’re new to credit or have had past financial challenges, you still have the opportunity to build your credit with Chime.

- No annual fees or hidden charges: Chime Credit Card Builder is designed to be affordable and transparent. There are no annual fees or hidden charges, allowing you to focus on building your credit without worrying about additional costs.

- Savings Account integration: When you use Chime Credit Card Builder, you have the option to link it to a Chime Savings Account. This integration allows you to build savings while paying off your credit card balance. It’s a great way to stay on top of your finances and work towards your financial goals simultaneously.

- Rewards and cash back: Chime Credit Card Builder offers opportunities for rewards and cash back on eligible purchases. This means that while you’re building your credit, you can also earn rewards and enjoy additional benefits. It’s a win-win situation that can make your credit-building journey even more rewarding.

- Mobile app and user-friendly interface: Chime’s intuitive mobile app and user-friendly interface make it easy to manage your Chime Credit Card Builder. You can track your transactions, make payments, and stay updated on your credit-building progress right from your smartphone. It’s convenience at your fingertips.

Overall, the benefits of using Chime Credit Card Builder make it a compelling choice for individuals who want a flexible, accessible, and affordable option to build or rebuild their credit. With customization, transparency, and integrated savings features, Chime Credit Card Builder puts you in control of your credit journey and empowers you to achieve your financial goals.

How to Get Started with Chime Credit Card Builder

Getting started with Chime Credit Card Builder is quick and easy. Follow these simple steps to begin your journey towards building or rebuilding your credit:

- Create an Account: The first step is to create an account with Chime. Visit the Chime website or download the Chime mobile app from the App Store or Google Play Store. Sign up using your personal information, such as your name, email address, and phone number. Creating an account only takes a few minutes.

- Customize Your Credit Card: Once you have created your Chime account, you can begin customizing your credit card. Choose from a range of design options that suit your style and personality. Next, select your desired credit limit based on your financial needs and goals. This customization aspect allows you to personalize your credit card and make it uniquely yours.

- Review and Submit Application: After customizing your credit card, review the application details to ensure accuracy. Double-check your personal information and credit card preferences. Once you are satisfied with the information provided, submit your application for review. Chime will perform a soft credit check to verify your identity and process your application.

- Receive and Activate Your Chime Credit Card: If your application is approved, you will soon receive your Chime Credit Card in the mail. Once you receive the card, follow the activation instructions provided. Activating your credit card allows you to start using it for purchases and building your credit.

Once you have activated your Chime Credit Card, you can begin using it for everyday purchases. Remember to make timely payments and keep your credit utilization low to establish a positive payment history and boost your credit score over time.

Additionally, it’s a good idea to link your Chime Credit Card Builder to a Chime Savings Account. This integration allows you to build savings while you work on improving your credit. By making regular and responsible payments, you can build credit and savings simultaneously, setting yourself up for a stronger financial future.

Getting started with Chime Credit Card Builder is a straightforward process that puts you in control of your credit journey. Embrace the customization options, responsible credit management, and integrated savings features to make the most of this innovative credit-building tool.

Step 1: Create an Account

The first step in using Chime Credit Card Builder is to create an account with Chime. Follow these steps to get started:

- Visit the Chime Website or Download the App: To create your Chime account, you can either visit the official Chime website or download the Chime mobile app from the App Store or Google Play Store. Both options provide a seamless and user-friendly experience.

- Sign Up with Your Personal Information: Once you access the Chime platform, you’ll need to sign up using your personal information. This includes entering details such as your name, email address, and phone number. Chime takes privacy and security seriously, so rest assured that your information will be protected.

- Create a Username and Password: After providing your personal information, you will be prompted to create a username and password for your Chime account. Choose a username that is memorable and secure, and create a strong password that combines upper and lowercase letters, numbers, and special characters.

- Verify Your Email and Phone Number: To ensure the security of your Chime account, you’ll need to verify your email and phone number. Chime will send a verification code to your email or phone, so make sure to check your inbox or messages and enter the code provided to complete the verification process.

- Agree to Chime’s Terms and Conditions: Before proceeding, you will need to review and accept Chime’s terms and conditions. Take the time to read through the terms to understand your rights and responsibilities as a Chime user.

- Set Up Your Account Preferences: Once your account is created, you can customize your account preferences. This includes selecting preferences for notifications, alerts, and account settings. Adjust these settings according to your preferences and needs.

- Continue to Chime Credit Card Builder: With your Chime account created, you’re now ready to proceed to the Chime Credit Card Builder. Simply follow the on-screen prompts to begin customizing your credit card and building your credit.

Congratulations! You have successfully completed the first step in using Chime Credit Card Builder. By creating a Chime account, you gain access to a range of financial tools and services designed to help you manage your money effectively and build credit responsibly.

Remember to keep your Chime account credentials confidential and regularly monitor your account for any suspicious activity. With a Chime account, you can take control of your finances and embark on an exciting journey to build credit and achieve your financial goals.

Step 2: Customize Your Credit Card

Once you have created an account with Chime, the next step in using Chime Credit Card Builder is to customize your credit card. This step allows you to personalize your credit card design and choose your desired credit limit. Follow these steps to customize your credit card:

- Select Your Card Design: Chime offers a variety of card designs to choose from. Browse through the available options and select a design that resonates with your personality and style. Whether you prefer a minimalist design or something more vibrant and eye-catching, Chime has options to suit every taste.

- Choose Your Credit Limit: The next customization option is selecting your desired credit limit. Your credit limit determines the maximum amount you can charge to your credit card. Consider your financial needs, spending habits, and capacity to make timely payments when choosing your credit limit. It’s important to select a limit that is comfortable for you and aligns with your budget.

- Review Your Choices: After selecting your card design and credit limit, take a moment to review your choices. Ensure that the design you have chosen accurately reflects your preferences and that the credit limit you have selected aligns with your financial goals. This review step allows you to make any necessary adjustments before moving forward.

- Save Your Customized Card: Once you are satisfied with your choices, save your customized credit card settings. This will ensure that your preferences are applied to your Chime Credit Card. Saving your settings allows you to move on to the next step with confidence, knowing that your card has been tailored to your liking.

Customizing your Chime Credit Card is a fun and personal step in the process. It allows you to express your individuality while building or rebuilding your credit. With a customized credit card, you can carry a card that reflects your style and serves as a reminder of your commitment to improving your financial well-being.

Remember, your Chime Credit Card is not just a tool for making purchases, but also a representation of your financial journey. Choose a design and credit limit that aligns with your aspirations and financial goals. This customization feature sets Chime Credit Card Builder apart from traditional credit cards, giving you the opportunity to shape your credit experience according to your unique preferences.

Now that you have customized your Chime Credit Card, you’re one step closer to taking control of your credit journey. The next step is to review and submit your application, which we’ll explore in the following section.

Step 3: Review and Submit Application

After customizing your Chime Credit Card, the next step in using Chime Credit Card Builder is to review and submit your application. This step ensures that all the information provided is accurate and complete before it is sent for processing. Follow these steps to review and submit your application:

- Double-Check Your Information: Before submitting your application, take the time to double-check all the information you have provided. Ensure that your personal details, such as your name, address, and contact information, are accurate. Additionally, review your chosen card design and credit limit to confirm that they align with your preferences.

- Verify Your Application: Some basic verification steps may be required before you can submit your application. This may include confirming your identity through a verification code sent to your email or phone number. Follow the instructions provided to verify your application and ensure its security.

- Review Terms and Conditions: It’s essential to familiarize yourself with the terms and conditions of using Chime Credit Card Builder. Take the time to read through the terms, as they outline your rights and responsibilities as a user. Understanding the terms and conditions will help you make informed decisions regarding your Chime Credit Card.

- Submit Your Application: Once you have reviewed your application and agreed to the terms and conditions, it’s time to submit your application. Click the submit button to send your application for processing. Chime will perform a soft credit check to verify your identity and evaluate your eligibility for the Chime Credit Card.

It’s important to note that Chime Credit Card Builder does not require a traditional credit check, making it an accessible option for individuals with limited or no credit history. Instead, Chime focuses on other factors in the application process, such as identity verification and financial stability.

After submitting your application, it will be reviewed by the Chime team. If your application is approved, you will receive your Chime Credit Card in the mail. The approval process typically takes a few business days. If for any reason your application is not approved, Chime will provide you with further instructions or suggestions to help you on your credit-building journey.

By carefully reviewing and submitting your application, you are taking an important step towards building or rebuilding your credit with Chime Credit Card Builder. The next step is to wait for the arrival of your Chime Credit Card so you can start using it to make purchases and improve your credit health.

Step 4: Receive and Activate Your Chime Credit Card

Once your Chime Credit Card application is approved, the next step in using Chime Credit Card Builder is to receive and activate your physical card. Follow these steps to ensure a smooth process:

- Wait for Card Delivery: After your application is approved, Chime will send your personalized Chime Credit Card to the address provided during the application process. The card will typically arrive within a few business days, although delivery times may vary. Stay tuned for a notification or keep an eye on your mailbox.

- Protect Your Mail: It’s important to stay vigilant and protect your mail until your Chime Credit Card arrives. Keep an eye out for the card’s arrival and promptly retrieve it from your mailbox to prevent any risk of theft or unauthorized access.

- Activate Your Card: Once you have received your Chime Credit Card, it’s time to activate it. This process is usually straightforward and can be completed online or through the Chime mobile app. Follow the activation instructions provided with the card or refer to the Chime website or app for guidance.

- Set Up Your PIN: After activating your Chime Credit Card, you will need to set up a Personal Identification Number (PIN). Your PIN is a four-digit code used to verify your identity when making purchases or performing certain transactions. Choose a PIN that is easy for you to remember but difficult for others to guess. Avoid using obvious combinations like birthdays or sequential numbers.

- Sign the Back of Your Card: To ensure the security of your Chime Credit Card, remember to sign the back of the card upon activation. This adds an extra layer of protection and verifies your ownership of the card.

Once you have activated and personalized your Chime Credit Card, you can start using it for purchases wherever Visa is accepted. Use it responsibly and make timely payments to build a positive credit history and improve your credit score over time.

Remember to always keep your Chime Credit Card in a secure place and report any lost or stolen cards immediately to Chime’s customer support. Protecting your card and using it responsibly will help you maximize its benefits and ensure a positive credit-building experience.

Congratulations! By receiving and activating your Chime Credit Card, you have successfully completed the last step in the Chime Credit Card Builder process. Now, take advantage of its features and benefits to build your credit and work towards your financial goals.

Features of Chime Credit Card Builder

Chime Credit Card Builder offers a range of features that make it a standout option for individuals looking to build or rebuild their credit. Here are some key features that set Chime Credit Card Builder apart:

- Customization Options: Chime Credit Card Builder allows you to customize your credit card to reflect your personal style. Choose from a variety of designs to find one that suits your preferences and personality. Additionally, you can select your desired credit limit, giving you the flexibility to manage your spending and credit utilization.

- No Traditional Credit Check: Unlike traditional credit cards, Chime Credit Card Builder does not require a traditional credit check to be approved. This makes it an accessible option for individuals with limited or no credit history. Chime focuses on other factors, such as identity verification and financial stability, to determine eligibility.

- No Annual Fees or Hidden Charges: Chime Credit Card Builder is designed to be affordable and transparent. There are no annual fees or hidden charges, ensuring that you can focus on building your credit without worrying about extra costs. Chime’s commitment to transparency means that you won’t encounter any unexpected surprises when using your card.

- Integration with Chime Savings Account: Chime Credit Card Builder can be linked to a Chime Savings Account, allowing you to build savings while you work on improving your credit. This integration allows you to save money and pay off your credit card balance simultaneously, promoting responsible financial habits and helping you progress towards your goals.

- Potential for Rewards and Cashback: Chime Credit Card Builder offers opportunities for rewards and cashback on eligible purchases. By using your Chime Credit Card responsibly, you can earn rewards and enjoy additional benefits. This feature allows you to make the most of your credit card usage while building your credit.

- User-friendly Mobile App: Chime provides a user-friendly mobile app that makes managing your Chime Credit Card Builder easy and convenient. The app allows you to view your transaction history, track your spending, make payments, and monitor your credit-building progress. Accessible from your smartphone, the Chime app puts control over your credit in the palm of your hand.

These features make Chime Credit Card Builder a compelling choice for individuals looking to establish or improve their credit history. With customization options, accessibility, transparency, savings integration, and the potential for rewards, Chime Credit Card Builder provides a comprehensive and flexible tool for credit building.

By taking advantage of these features and using your Chime Credit Card responsibly, you can actively work towards your financial goals and establish a positive credit history that opens doors to future opportunities.

Building Credit with Chime Credit Card Builder

Chime Credit Card Builder offers an effective way to build or rebuild your credit history. Through responsible credit card usage and timely payments, you can gradually improve your credit score. Here’s how you can build your credit with Chime Credit Card Builder:

- Make On-Time Payments: Paying your Chime Credit Card bill on time is crucial for building credit. Late payments can negatively impact your credit score, so it’s important to establish a habit of making timely payments. Set up reminders or automatic payments to ensure you never miss a due date.

- Keep Your Credit Utilization Ratio Low: Your credit utilization ratio is the amount of available credit you’re using. It’s advisable to keep this ratio low, ideally below 30%. For example, if your credit limit is $1,000, try to keep your total credit card balances below $300. Keeping your credit utilization low demonstrates responsible credit usage and can positively impact your credit score.

- Monitor Your Credit: Regularly monitoring your credit is essential. With Chime’s user-friendly mobile app, you can easily keep track of your credit card activity, view transaction history, and access your credit score. Monitoring your credit allows you to identify any potential errors or discrepancies and take appropriate action to rectify them.

- Build Positive Payment History: Consistently making on-time payments builds a positive payment history, which is a significant factor in determining your creditworthiness. Establishing a pattern of responsible credit card usage and repayment demonstrates to lenders that you can manage credit effectively.

- Manage your overall finances: Building credit goes hand in hand with good financial management. Take steps to budget your income, save money, and reduce unnecessary expenses. A comprehensive approach to your finances will not only help you build credit but also contribute to your overall financial health.

Remember, building credit takes time and patience. It’s important to be consistent and responsible with your Chime Credit Card. By practicing good financial habits, keeping your credit utilization low, and making on-time payments, you can gradually improve your credit score and open doors to better financial opportunities.

Chime Credit Card Builder provides you with the tools and resources you need to actively take control of your credit journey. Use it as a stepping stone to build a solid credit foundation and pave the way to a brighter financial future.

Frequently Asked Questions (FAQs)

Here are some common questions about Chime Credit Card Builder:

- What is Chime Credit Card Builder?

- Is Chime Credit Card Builder suitable for people with no credit history?

- Are there any annual fees associated with Chime Credit Card Builder?

- Can I earn rewards with Chime Credit Card Builder?

- How do I make payments for my Chime Credit Card?

- Is there a mobile app for Chime Credit Card Builder?

- What if my Chime Credit Card is lost or stolen?

Chime Credit Card Builder is an innovative tool that allows you to customize your own credit card and build or rebuild your credit history. It offers features like design customization, no traditional credit check, and integration with Chime Savings Account.

Yes, Chime Credit Card Builder is a great option for individuals with limited or no credit history. It doesn’t require a traditional credit check and offers an opportunity to establish credit from scratch.

No, Chime Credit Card Builder does not charge any annual fees or hidden charges. It’s designed to be an affordable option for individuals looking to build or rebuild their credit.

Yes, Chime Credit Card Builder offers the potential to earn rewards and cash back on eligible purchases. By using your card responsibly, you can enjoy the additional perks of rewards programs.

You can make payments for your Chime Credit Card through the Chime mobile app or website. It’s important to make timely payments to avoid any negative impact on your credit score.

Yes, Chime offers a user-friendly mobile app that allows you to manage your Chime Credit Card Builder on the go. You can track transactions, make payments, and monitor your credit-building progress right from your smartphone.

If your Chime Credit Card is lost or stolen, report it immediately to Chime customer support. They will assist you in canceling the card and ordering a replacement to ensure the security of your account.

These FAQs provide some general information about Chime Credit Card Builder. If you have any specific questions or require further assistance, it’s recommended to reach out to Chime’s customer support for detailed and personalized guidance.

Conclusion

Chime Credit Card Builder is a powerful tool for individuals seeking to build or rebuild their credit history. With its customizable features, accessibility, and transparent approach, Chime Credit Card Builder empowers users to take control of their credit journey and work towards their financial goals.

By creating an account, customizing your credit card, and responsibly managing your Chime Credit Card, you can establish positive credit habits and improve your credit score over time. The ability to tailor your credit card design and credit limit adds a personal touch to the credit building process, making it a more engaging and rewarding experience.

With Chime’s commitment to financial well-being, Chime Credit Card Builder stands out in the realm of credit-building tools. Features such as no traditional credit check, no annual fees, potential rewards, and integration with a Chime Savings Account make it a comprehensive solution for individuals at various stages of their credit journey.

Remember to practice responsible credit card usage, such as making timely payments and keeping your credit utilization low, to maximize the benefits of Chime Credit Card Builder. It’s important to monitor your credit, track your progress, and manage your overall financial health alongside building your credit.

Chime Credit Card Builder is more than just a credit card – it’s a stepping stone towards financial empowerment and success. Take advantage of the customization options, transparency, and user-friendly mobile app to build a solid credit foundation for a brighter financial future.

So, why wait? Start your credit-building journey with Chime Credit Card Builder today and pave the way to a stronger credit history and a more secure financial future.