Home>Finance>How To Move Money From Credit Builder To Spending Account Chime

Finance

How To Move Money From Credit Builder To Spending Account Chime

Published: January 8, 2024

Learn how to transfer funds from your credit builder account to your spending account on Chime. Manage your finances easily and efficiently with Chime.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Chime?

- What is a Credit Builder Account?

- What is a Spending Account?

- Overview of Chime’s Money Transfer Feature

- Step 1: Linking Your Credit Builder Account to Your Spending Account

- Step 2: Initiating a Transfer from Credit Builder to Spending Account

- Step 3: Confirming the Transfer Request

- Step 4: Receiving the Transferred Money in Your Spending Account

- Benefits of Transferring Money from Credit Builder to Spending Account

- Things to Consider Before Initiating a Transfer

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

Welcome to the world of Chime, where managing your finances has never been easier. In this article, we will guide you through the process of moving money from your Credit Builder account to your Spending account with Chime. Whether you’re looking to build credit or access your funds for everyday expenses, Chime has got you covered.

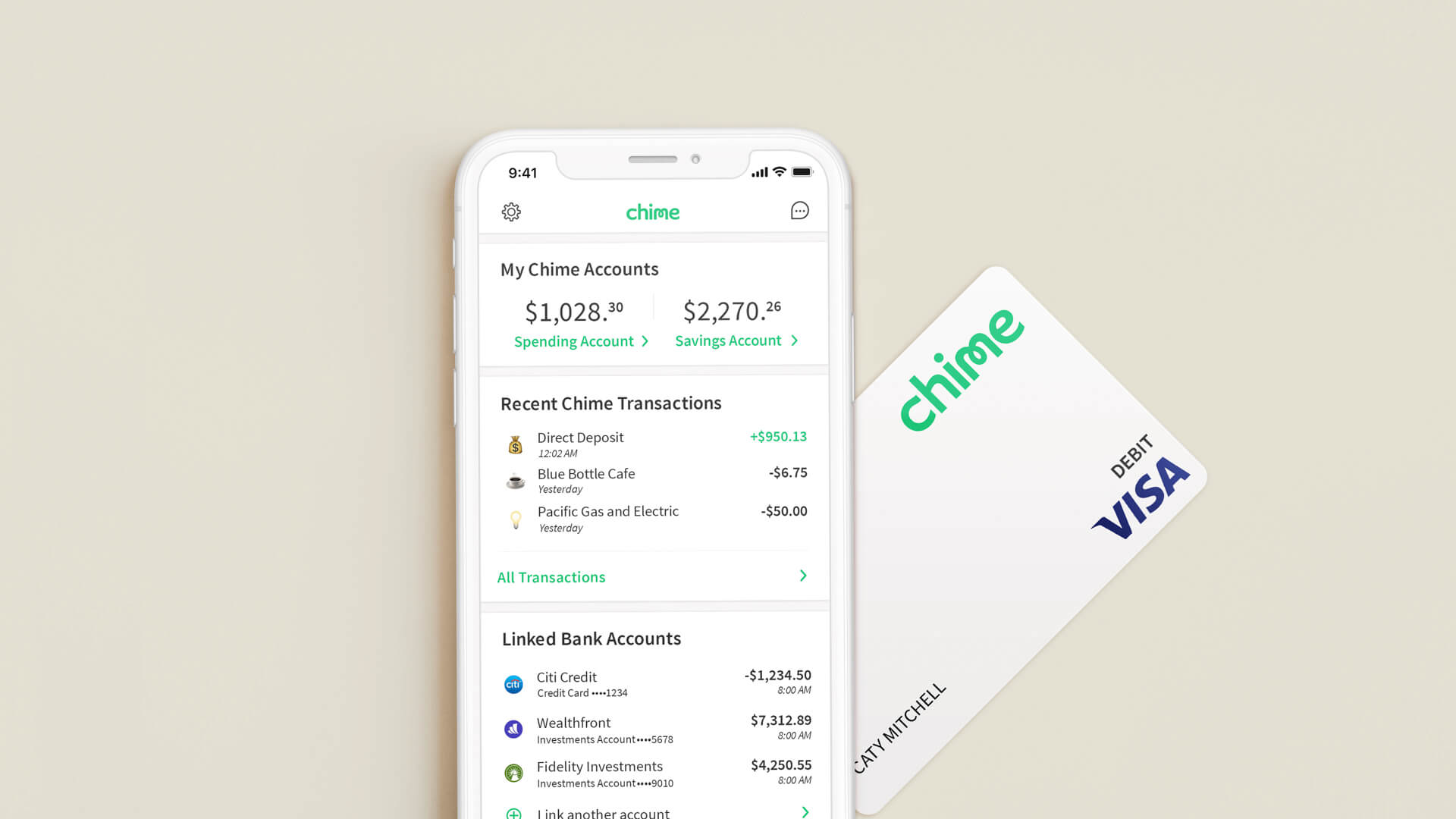

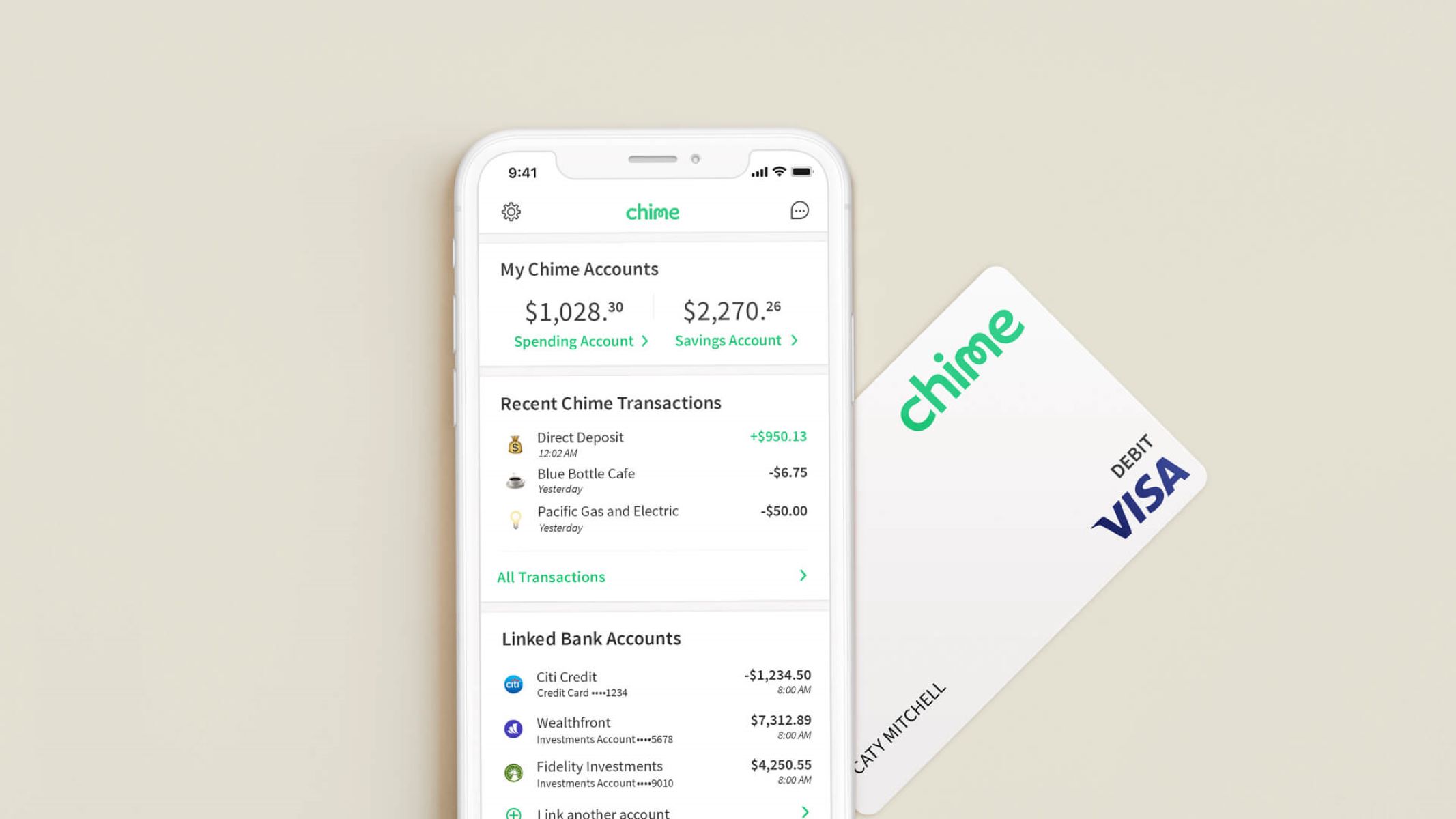

Chime is a modern, mobile banking platform that offers a range of innovative financial products and services. With Chime, you can have access to a Credit Builder account, which helps you establish or improve your credit score, and a Spending account, which is designed for your everyday banking needs.

A Credit Builder account is specifically designed to help you build or rebuild your credit history. Unlike traditional credit cards, Chime’s Credit Builder account allows you to make deposits that are held in a secure account. As you make regular payments on time, Chime reports your positive behavior to major credit bureaus, helping you establish creditworthiness.

On the other hand, a Spending account is a full-service checking account that allows you to manage your money conveniently. With a Spending account, you can deposit funds, make purchases, pay bills, and withdraw cash from ATMs, all while avoiding hidden fees and minimum balance requirements.

Chime’s money transfer feature enables you to move funds from your Credit Builder account to your Spending account seamlessly. Whether you want to use the funds to cover expenses or simply have them readily available, transferring money between your accounts is a straightforward process.

In the following sections, we will guide you step-by-step on how to move money from your Credit Builder account to your Spending account with Chime. We will also discuss the benefits of these transfers and some important factors to consider. So, let’s dive in and discover how Chime can help you effectively manage your finances!

What is Chime?

Chime is a leading mobile banking platform that offers a range of financial services designed to simplify and streamline your banking experience. With Chime, you can access your accounts, manage your money, and make transactions all from the convenience of your smartphone.

One of the key features of Chime is its commitment to providing a fee-free banking experience. Unlike traditional banks that may charge various fees for ATM withdrawals, monthly maintenance, or overdrafts, Chime aims to eliminate these fees, saving you money and providing greater transparency.

Chime offers two main types of accounts: the Credit Builder account and the Spending account. The Credit Builder account is designed to help you establish or improve your credit score, while the Spending account is a full-service checking account for everyday banking needs.

With Chime, you can enjoy a wide range of benefits that make managing your finances a breeze. Some of these benefits include:

- Early direct deposit: Chime gives you the option to receive your paycheck up to two days early when you set up direct deposit.

- Automatic savings: With Chime’s Save When You Spend feature, every purchase you make with your Chime debit card is rounded up to the nearest dollar, and the difference is automatically transferred to your savings account.

- Real-time alerts: Chime sends you notifications in real-time whenever there is activity on your account, ensuring that you are always aware of your financial transactions.

- Mobile check deposit: You can easily deposit checks using the Chime mobile app by simply taking a photo of the front and back of the check.

- Fraud protection: Chime offers advanced security features to protect your account, including the ability to instantly block your card in case of loss or suspicious activity.

In addition to these features, Chime provides a user-friendly interface and a seamless online banking experience. You can access your accounts, view transaction history, and set up various banking features all from the Chime mobile app or website.

Overall, Chime is revolutionizing the way people manage their finances by combining innovative technology with customer-centric financial services. Whether you’re looking to build credit, manage your everyday expenses, or save money effortlessly, Chime offers a comprehensive banking solution that puts you in control of your financial well-being.

What is a Credit Builder Account?

A Credit Builder Account is a specialized financial tool offered by Chime that is designed to help individuals establish or rebuild their credit history. It is an innovative approach to building credit that differs from traditional credit cards or loans.

Unlike traditional credit cards, a Credit Builder Account with Chime does not require a credit check or any previous credit history. This makes it accessible to individuals with limited or poor credit history. With a Credit Builder Account, you can take the first step towards improving your creditworthiness.

Here’s how a Credit Builder Account works:

- Deposit: To open a Credit Builder Account, you make an initial deposit that serves as your credit limit. This deposit is held in a secure account and acts as collateral for the account.

- Payment: Each month, you make a payment towards your Credit Builder Account balance. This payment is reported to major credit bureaus, which helps establish a positive payment history.

- Build Credit: Over time, as you make regular on-time payments, your positive payment behavior is reported to credit bureaus, which can improve your credit score.

Unlike traditional credit cards, Chime’s Credit Builder Account does not allow you to carry a balance or accrue interest charges. This means that you are not accumulating debt or incurring high-interest charges. Instead, you are leveraging your own funds to build credit in a responsible way.

One key advantage of a Credit Builder Account is that it helps you develop healthy financial habits. By making regular payments and managing your account responsibly, you can establish a strong credit history, which is crucial for future financial endeavors such as obtaining a mortgage or getting approved for a loan.

In addition to helping you build credit, Chime’s Credit Builder Account offers features that promote financial literacy and empowerment. Chime provides you with access to your credit score, educational resources, and personalized insights to help you understand and manage your credit better.

Overall, Chime’s Credit Builder Account presents an excellent opportunity for individuals looking to establish or rebuild their credit. By using their own funds and making timely payments, users can build credit history and improve their financial standing. It’s a smart and responsible way to set yourself up for long-term financial success.

What is a Spending Account?

A Spending Account is a full-service checking account offered by Chime that provides you with a convenient and effortless way to manage your everyday banking needs. It is designed to simplify your financial transactions and eliminate the hassle of traditional banking.

With a Chime Spending Account, you can enjoy a range of features and benefits that make managing your money easier and more efficient. Here are some key highlights of a Chime Spending Account:

- No hidden fees: Chime is committed to transparent banking, which means no surprise fees. With a Spending Account, you can avoid monthly maintenance fees, minimum balance requirements, and overdraft fees that are commonly associated with traditional banks.

- Debit card and mobile payments: When you open a Spending Account, you will receive a Chime Visa® Debit Card that allows you to make purchases online or in-store. Additionally, you can link your Chime account to Apple Pay, Google Pay, or Samsung Pay for seamless mobile payments.

- Direct deposit: With Chime, you can set up direct deposit for your paycheck or other recurring income. This allows you to access your funds faster, with the option to receive your money up to two days earlier than traditional banks when your employer processes the payment.

- Bill Pay: Chime’s Spending Account includes a convenient bill pay feature that allows you to easily pay your bills directly from your account. You can set up one-time or recurring payments, ensuring your bills are always paid on time.

- ATM access: Chime provides access to thousands of fee-free ATMs through its extensive ATM network. You can withdraw cash without worrying about incurring costly ATM fees.

- Mobile banking: Chime’s mobile app gives you full control over your Spending Account. You can check your balance, review transaction history, transfer money, and manage your account settings all from the palm of your hand.

Chime’s Spending Account is designed to simplify your financial management and provide you with a hassle-free banking experience. By eliminating unnecessary fees and providing convenient features, Chime allows you to focus on what matters most: your finances.

Whether you need to deposit funds, pay bills, make purchases, or simply keep track of your money, Chime’s Spending Account offers the tools and resources to help you manage your finances effectively. It’s a modern banking solution that puts you in control of your money.

Overview of Chime’s Money Transfer Feature

Chime offers a convenient and seamless money transfer feature that allows you to move funds from your Credit Builder account to your Spending account within the Chime mobile app or website. This feature enables you to access the funds you have deposited into your Credit Builder account and transfer them to your Spending account for everyday expenses or other financial needs.

Here is an overview of how Chime’s money transfer feature works:

- Linking Your Credit Builder Account to Your Spending Account: Before you can transfer money, you need to ensure that your Credit Builder account is linked to your Spending account. This can be done easily within the Chime mobile app or website by following the provided instructions.

- Initiating a Transfer from Credit Builder to Spending Account: Once your accounts are linked, you can initiate a transfer from your Credit Builder account to your Spending account. Simply navigate to the transfer section within the app or website and select the amount you wish to transfer.

- Confirming the Transfer Request: After specifying the amount, you will be prompted to review and confirm the transfer request. Take a moment to double-check the details and ensure everything is accurate before proceeding.

- Receiving the Transferred Money in Your Spending Account: Once the transfer is confirmed, the funds will be moved from your Credit Builder account to your Spending account. The transferred money will then be available for you to use for everyday expenses, bill payments, or any other financial needs.

Chime’s money transfer feature is designed to be quick, secure, and convenient. Transfers typically occur instantly, allowing you to access your funds without delay.

It’s important to note that there may be some limitations on the frequency and amount of transfers you can make. These limits are set to ensure the security and integrity of your accounts. You can refer to Chime’s terms and conditions or contact their customer support for more information regarding these limits.

By using Chime’s money transfer feature, you can make the most of your Credit Builder account by easily accessing the funds you have deposited and using them for your everyday banking needs. It’s a flexible and user-friendly way to manage your finances and have control over your money.

Step 1: Linking Your Credit Builder Account to Your Spending Account

The first step in transferring money from your Credit Builder account to your Spending account with Chime is to ensure that your accounts are properly linked. Linking your Credit Builder account to your Spending account is a simple process that can be done within the Chime mobile app or website. Here’s how:

- Access Your Chime Account: Open the Chime mobile app on your smartphone or visit the Chime website using your preferred web browser. Sign in to your Chime account using your username and password.

- Navigate to Account Settings: Once you are logged in, navigate to the account settings section within the app or website. Look for the option to manage your linked accounts.

- Select Link Accounts: Within the account settings, you should find an option to link accounts. Select this option to begin the process of linking your Credit Builder account to your Spending account.

- Follow the On-Screen Instructions: Chime will provide you with step-by-step instructions on how to link your accounts. Follow the on-screen prompts and provide any necessary information such as account numbers or verification details.

- Verify the Linked Accounts: After providing the required information, Chime may ask you to verify the linked accounts. This can be done through various methods such as providing additional identification details or confirming small deposit amounts.

- Confirm Account Linking: Once the accounts are successfully linked and verified, you will receive a confirmation message. Take a moment to review the details and ensure that the Credit Builder account is correctly linked to your Spending account.

It is important to note that the exact steps for linking your accounts may vary slightly depending on changes in Chime’s interface or updates to their platform. If you encounter any difficulties or have specific questions during the process, reach out to Chime’s customer support for assistance.

Once your accounts are linked, you will have the ability to transfer funds from your Credit Builder account to your Spending account. This will allow you to access the funds you have deposited into your Credit Builder account and use them for everyday expenses or other financial needs.

Now that you have successfully linked your Credit Builder account to your Spending account, let’s move on to the next step in transferring money from your Credit Builder account to your Spending account with Chime.

Step 2: Initiating a Transfer from Credit Builder to Spending Account

After successfully linking your Credit Builder account to your Spending account with Chime, you can now initiate a transfer of funds from your Credit Builder account to your Spending account. This step allows you to access the money you have deposited into your Credit Builder account for your everyday expenses or other financial needs. Follow these simple steps to initiate the transfer:

- Access Your Chime Account: Open the Chime mobile app on your smartphone or visit the Chime website using your preferred web browser. Sign in to your Chime account using your username and password.

- Navigate to the Transfer Section: Once you are logged in, navigate to the transfer section within the Chime app or website. This section is typically labeled as “Transfer” or “Move Money.”

- Select the Transfer Option: Within the transfer section, you should find an option to transfer funds from your Credit Builder account to your Spending account. Select this option to proceed.

- Specify the Transfer Amount: Enter the desired amount you wish to transfer from your Credit Builder account to your Spending account. Ensure that you have sufficient funds available in your Credit Builder account to complete the transfer.

- Review and Confirm Details: Take a moment to review the transfer details, including the amount and the accounts involved. Double-check that everything is accurate, as this cannot be undone once the transfer is confirmed.

- Confirm the Transfer: If you are satisfied with the transfer details, confirm the transfer request. Depending on Chime’s interface, this may involve selecting a “Confirm” or “Transfer” button.

Once you have successfully initiated the transfer, Chime will process the transaction and move the specified amount from your Credit Builder account to your Spending account. The transfer usually happens instantly, allowing you to access the funds immediately.

Keep in mind that Chime may have certain limitations on the frequency and amount of transfers you can make. These limits are in place to ensure the security and integrity of your accounts. If you have any questions or concerns regarding these limits, you can refer to Chime’s terms and conditions or contact their customer support for more information.

Now that you have initiated the transfer from your Credit Builder account to your Spending account, you are one step closer to accessing your funds and using them for your financial needs. Let’s move on to the next step in the process: confirming the transfer request.

Step 3: Confirming the Transfer Request

After initiating the transfer from your Credit Builder account to your Spending account with Chime, the next step is to confirm the transfer request. Confirming the transfer is an important step to ensure that the details of the transaction are accurate before the funds are moved. Follow these steps to confirm your transfer:

- Access Your Chime Account: Open the Chime mobile app on your smartphone or visit the Chime website using your preferred web browser. Sign in to your Chime account using your username and password.

- Go to the Transfer Details: Navigate to the transfer details section within the Chime app or website. This section will provide you with the specific details of the transfer you initiated, including the amount and the accounts involved.

- Review the Transfer Details: Take a moment to carefully review the transfer details to ensure that everything is accurate. Check that the amount being transferred is the desired amount and that the funds are being moved from your Credit Builder account to your Spending account.

- Confirm the Transfer Request: If you are satisfied with the transfer details and everything is accurate, confirm the transfer request. Depending on Chime’s interface, you may need to select a “Confirm” or “Transfer” button to proceed.

Confirming the transfer request is an essential step to verify that the transfer is authorized and to prevent any accidental or unauthorized transactions. It allows you to double-check the transfer details one last time before the funds are moved from your Credit Builder account to your Spending account.

It’s crucial to ensure the accuracy of the transfer details, as once the confirmation is made, the transfer cannot be reversed or modified. If you have any doubts or concerns about the transfer details, it’s best to review them thoroughly or contact Chime’s customer support for assistance.

Once you have confirmed the transfer request, Chime will process the transaction and move the specified amount from your Credit Builder account to your Spending account. The funds should become available in your Spending account shortly after the confirmation.

With the transfer request confirmed, you are one step closer to accessing the transferred funds in your Spending account. Let’s move on to the final step: receiving the transferred money in your Spending account.

Step 4: Receiving the Transferred Money in Your Spending Account

After confirming the transfer request from your Credit Builder account to your Spending account with Chime, the final step is to receive the transferred money in your Spending account. This step allows you to access the funds you have moved and use them for your everyday expenses or financial needs. Follow these steps to receive the transferred money:

- Access Your Chime Account: Open the Chime mobile app on your smartphone or visit the Chime website using your preferred web browser. Sign in to your Chime account using your username and password.

- Check Your Spending Account Balance: Once you are logged in, navigate to your Spending account within the Chime app or website. This section will display your account balance and recent transaction history.

- Verify the Transferred Funds: Check your Spending account balance to ensure that the transferred money is reflected. The funds should be available and ready to use for your everyday expenses or other financial needs.

- Start Using Your Transferred Funds: With the transferred money successfully received in your Spending account, you can start using the funds for various transactions. Make purchases, pay bills, withdraw cash from ATMs, or perform any other financial activities that suit your needs.

Receiving the transferred money in your Spending account signifies that the funds have been successfully moved from your Credit Builder account and are now readily available for your use. You can access your account balance and perform transactions with ease using the Chime mobile app or website.

It’s important to note that Chime’s Spending account offers various features and benefits, such as a Chime Visa® Debit Card, early direct deposit, and no hidden fees. You can take advantage of these features to make the most of your transferred funds and manage your finances efficiently.

Keep in mind that Chime may have certain limitations on the frequency and amount of transfers you can make. These limits are in place to ensure the security and integrity of your accounts. If you have any questions or concerns regarding these limits or the availability of your transferred funds, you can refer to Chime’s terms and conditions or contact their customer support for more information.

Congratulations! You have successfully completed the process of moving money from your Credit Builder account to your Spending account with Chime. You can now enjoy the flexibility and convenience of accessing your funds for your everyday expenses, bill payments, or any other financial needs.

Benefits of Transferring Money from Credit Builder to Spending Account

Transferring money from your Credit Builder account to your Spending account with Chime offers several benefits that can significantly enhance your financial management. Here are some key advantages of making this transfer:

1. Access to Funds: By transferring money from your Credit Builder account to your Spending account, you can access the funds you have deposited into your Credit Builder account and use them for your everyday expenses or financial needs. This provides you with greater flexibility and control over your finances.

2. Convenience: Having the transferred money in your Spending account ensures that your funds are easily accessible whenever you need them. You can make purchases, pay bills, withdraw cash from ATMs, and perform other financial transactions conveniently using the Chime mobile app or website.

3. Establishing Credit and Credit History: By making regular and timely payments from your Credit Builder account, you can establish a positive credit history. Transferring money to your Spending account allows for the utilization of these funds, giving you the opportunity to showcase responsible credit behaviors to credit bureaus.

4. Building Creditworthiness: As you establish a positive credit history through your Credit Builder account and use the transferred funds responsibly, your creditworthiness improves. This can open doors for better financial opportunities in the future, such as higher credit limits, lower interest rates, and improved loan eligibility.

5. Financial Empowerment: Transferring money from your Credit Builder account to your Spending account with Chime empowers you to take control of your financial journey. It allows you to manage your funds effectively, make informed financial decisions, and build a solid foundation for your financial well-being.

6. Seamless Integration: Chime’s money transfer feature seamlessly integrates your Credit Builder account and Spending account within the Chime platform. This means you can conveniently monitor your transactions, view account balances, and manage your finances all in one place.

7. No Hidden Fees: Chime is known for its commitment to transparency and fee-free banking. By transferring money between your accounts, you can avoid fees commonly associated with traditional banks, such as monthly maintenance fees or minimum balance requirements.

8. Fast and Secure Transactions: Chime aims to provide fast and secure transactions, ensuring that your transferred funds are available to you instantly. With Chime’s advanced security features, you can have peace of mind knowing that your financial information is protected.

9. Educational Resources: Chime provides educational resources and personalized insights to help you better understand and manage your finances. By actively transferring money from your Credit Builder account to your Spending account, you can benefit from these resources and further improve your financial literacy.

10. Enhanced Financial Management: By utilizing the money transfer feature, you gain greater control over your financial management. With access to your funds and the ability to move them between accounts, you can proactively budget, save, and make the most of your money.

Transferring money from your Credit Builder account to your Spending account with Chime presents a range of benefits that contribute to your financial growth and stability. It allows you to access your funds conveniently, build credit history, and take control of your financial future. Take advantage of this feature to streamline your financial management and maximize the potential of your money.

Things to Consider Before Initiating a Transfer

Before initiating a transfer from your Credit Builder account to your Spending account with Chime, there are a few important factors to consider. Being mindful of these considerations will help ensure a smooth and informed transfer process. Here are some key things to keep in mind:

1. Available Funds: Make sure you have sufficient funds in your Credit Builder account to transfer to your Spending account. Attempting to transfer more than the available balance may result in a declined transaction, delaying the transfer process.

2. Transfer Limits: Chime may have certain limitations on the frequency and amount of transfers you can make. It’s essential to understand these limits, as exceeding them may affect your ability to transfer funds when needed. Familiarize yourself with Chime’s terms and conditions or contact their customer support for specific details regarding transfer limits.

3. Timing of Transfers: Consider the timing of your transfers. Chime’s transfer feature is typically processed instantly, but it’s important to account for potential processing delays or banking holidays that may impact the availability of funds in your Spending account.

4. Financial Goals: Evaluate your financial goals and determine if transferring funds from your Credit Builder account to your Spending account aligns with your overall financial strategy. Consider factors such as building credit, covering expenses, and other financial priorities to ensure that the transfer supports your goals.

5. Responsible Credit Usage: While transferring money from your Credit Builder account to your Spending account can be beneficial for your credit utilization, it’s essential to maintain responsible credit habits. Making timely payments and carefully managing your Spending account balance will contribute to a positive credit history and financial health.

6. Financial Budgeting: Before initiating a transfer, review your budget and ensure that the transferred funds align with your current financial needs and obligations. Consider factors such as monthly bills, upcoming expenses, and savings goals to accurately assess how much money should be transferred.

7. Account Security: Protect the security of your Chime accounts by using strong, unique passwords and enabling two-factor authentication. Regularly monitor your accounts for any suspicious activities and report them to Chime immediately.

8. Examine Fees and Terms: While Chime aims to provide fee-free banking, it’s prudent to review their fee schedule and terms and conditions. Familiarize yourself with any potential fees associated with your accounts or transfers to avoid any surprises.

Taking these considerations into account will help you make informed decisions and maximize the benefits of transferring money from your Credit Builder account to your Spending account. By carefully assessing your financial situation and goals, you can confidently initiate transfers that align with your financial plans and improve your overall financial well-being.

Frequently Asked Questions (FAQs)

Here are some common questions and answers related to transferring money from your Credit Builder account to your Spending account with Chime:

Q: How long does it take for the transferred funds to appear in my Spending account?

A: In most cases, transfers from your Credit Builder account to your Spending account with Chime are processed instantly. However, there may be occasional delays due to factors such as processing times or banking holidays.

Q: Are there any fees associated with transferring money between my accounts?

A: Chime aims to provide fee-free banking. However, it’s always a good idea to review Chime’s fee schedule and terms and conditions to ensure you understand any potential fees associated with account transfers or other transactions.

Q: Can I transfer funds from my Spending account to my Credit Builder account?

A: At the moment, Chime’s transfer feature is specifically designed to allow transfers from the Credit Builder account to the Spending account. Transfers in the opposite direction may not be available at this time.

Q: Are there limits on the frequency or amount of transfers I can make?

A: Chime may have certain limitations on the frequency and amount of transfers you can make. These limits are in place to ensure the security and integrity of your accounts. It’s important to review Chime’s terms and conditions or contact their customer support for specific details regarding transfer limits.

Q: Can I set up automatic transfers from my Credit Builder account to my Spending account?

A: Currently, Chime does not offer the option to set up automatic transfers between accounts. However, you can manually initiate transfers as needed through the Chime mobile app or website.

Q: Will transferring money from my Credit Builder account to my Spending account affect my credit score?

A: Transferring money between your accounts should not directly impact your credit score. However, making timely payments from your Credit Builder account and responsibly managing your Spending account balance can contribute to a positive credit history and potentially improve your creditworthiness over time.

Q: What should I do if I encounter any issues or have questions during the transfer process?

A: If you encounter any difficulties or have specific questions regarding the transfer process, it’s best to reach out to Chime’s customer support. They can provide guidance, address your concerns, and ensure a smooth transfer experience.

Keep in mind that the answers provided here are general and may vary depending on your specific circumstances and any updates to Chime’s policies. It’s always recommended to refer to Chime’s official resources or contact their customer support for the most accurate and up-to-date information.

Conclusion

Transferring money from your Credit Builder account to your Spending account with Chime is a seamless and convenient way to access your funds and manage your finances effectively. Whether you’re looking to cover your everyday expenses or build credit history, Chime’s money transfer feature offers a range of benefits to support your financial goals.

By linking your Credit Builder account to your Spending account, you can easily initiate transfers and move funds between the two accounts. This provides you with the flexibility to access the money you have deposited and use it for various financial needs. With Chime’s user-friendly mobile app and website, the transfer process is simple and can be completed within a few easy steps.

The benefits of transferring money from your Credit Builder account to your Spending account are multifaceted. You gain convenient access to your funds, establish credit history, and enjoy the flexibility of Chime’s fee-free banking. By leveraging these features, you can take control of your financial journey and work towards building a solid financial foundation.

However, it’s important to consider certain factors before initiating a transfer. Understanding your available funds, transfer limits, and overall financial goals will ensure a smooth transfer process and align your financial decisions with your objectives. By responsibly managing your accounts and staying aware of any potential fees or limitations, you can maximize the benefits of transferring money between your Chime accounts.

As you explore Chime’s transfer feature, remember to take advantage of the educational resources and insights offered by Chime to enhance your financial literacy and make informed decisions. By utilizing these tools, you can strengthen your financial knowledge and further improve your financial well-being.

In conclusion, transferring money from your Credit Builder account to your Spending account with Chime empowers you to access your funds, build credit history, and manage your finances effortlessly. Take advantage of this feature to make the most of your Chime accounts and take steps towards achieving your financial goals. Start taking control of your finances today with Chime!