Finance

What Is Charter Services Charge On Credit Card

Published: October 24, 2023

Learn about finance charges on credit cards and how charter services are affected. Get a clear understanding of the fees associated with credit card usage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Charter Services

- How Charter Services Charge on Credit Cards Work

- Common Types of Charter Services Charges

- Explanation of Charter Services Charge Terminology

- Examples of Charter Services Charges on Credit Card Statements

- Tips for Understanding and Managing Charter Services Charges on Credit Cards

- Conclusion

Introduction

Welcome to the world of credit card charges and fees. One of the charges that credit card users often come across is the “Charter Services Charge.” This charge may sound unfamiliar and confusing, but fear not! In this article, we will explore what charter services charges are, how they work, and provide tips for understanding and managing them on your credit card statements.

Charter services charges are a type of fee that can appear on your credit card statement. They are typically associated with specific services or memberships that you may have signed up for. These charges can vary in amount and frequency depending on the specific charter service and the terms of your agreement. Understanding how these charges work can help you identify them on your statement and manage your finances more effectively.

If you have ever wondered why there is a separate charge labeled as “charter services” on your credit card statement, it is important to know that not all credit card charges are created equal. Some charges are familiar, such as purchases, cash advances, or balance transfers. However, charter services charges may require a little more explanation.

The purpose of this article is to demystify charter services charges and provide you with the knowledge and tools to navigate this aspect of your credit card usage. We will delve into the different types of charter services charges, decipher industry jargon, and provide real-life examples to help you better understand how these charges can impact your finances.

Whether you are a seasoned credit card user or just starting out, understanding how charter services charges work is crucial to managing your financial well-being. So, let’s dive into the world of charter services charges and empower ourselves with knowledge to make informed decisions.

Definition of Charter Services

Before we delve deeper into charter services charges, let’s start by understanding what charter services actually are. Charter services refer to specialized services or memberships that you may have opted for through your credit card issuer or a third-party provider.

These services can include a wide range of benefits and features, depending on the specific charter program. Examples of charter services can include airport lounge access, concierge services, travel insurance, discounted hotel bookings, exclusive event invitations, and more.

Charter services are often designed to enhance the overall credit card experience and provide added value to cardholders. By partnering with various service providers, credit card issuers are able to offer these additional perks to their customers.

It’s important to note that charter services are optional and may come with an additional cost, which can be reflected as a charter services charge on your credit card statement. These charges are separate from your regular purchases or transactions and serve as a way to cover the expenses associated with providing the specific charter service.

Now that we understand the basic definition of charter services, let’s dive into how these charges appear on your credit card statement and how they work.

How Charter Services Charge on Credit Cards Work

When you sign up for a charter service or membership through your credit card issuer or a third-party provider, the associated charges are typically billed directly to your credit card account. These charges may be incurred on a monthly, annual, or one-time basis, depending on the terms of the charter service agreement.

The charter services charge will appear as a separate line item on your credit card statement, labeled as “Charter Services” or with a specific description of the service provided. It is important to review your credit card statement regularly to identify any charter services charges and ensure their accuracy.

The charges themselves can vary in amount, depending on the specific charter service and the level of membership you have opted for. Some charter services may have a fixed monthly or annual fee, while others may charge based on usage or a tiered pricing structure. It is essential to carefully review the terms and conditions of the charter service agreement to understand how the charges are calculated.

Charter services charges are typically subject to the same interest rates and payment terms as other purchases on your credit card. If you carry a balance on your card, these charges will accrue interest until they are paid off. It’s crucial to keep this in mind when budgeting and managing your credit card payments.

It is worth noting that charter services charges are separate from the annual fee that may be associated with your credit card. The annual fee is a standard fee charged for owning the credit card itself, while charter services charges are specific to the additional services or benefits you have chosen to enroll in.

To ensure that you fully understand how charter services charges work on your credit card, carefully read the terms and conditions provided by your credit card issuer or the charter service provider. This will give you a clear understanding of the charges, billing cycles, and any cancellation or refund policies that may be applicable.

Now that we have covered the basics of how charter services charges work, let’s explore the common types of charges you may come across.

Common Types of Charter Services Charges

Charter services charges can encompass a wide range of services and benefits, each with their own unique pricing structure. Here are some of the common types of charter services charges you may come across on your credit card statement:

- Airport Lounge Access: If you have a credit card that provides access to airport lounges, there may be a charter services charge associated with this benefit. This charge covers the cost of providing access to these exclusive lounges, where you can enjoy amenities such as comfortable seating, complimentary food and beverages, and access to business facilities.

- Concierge Services: Some credit cards offer concierge services that can assist you with various tasks such as making restaurant reservations, booking tickets to events, or arranging travel accommodations. The charter services charge may cover the expenses associated with providing these personalized concierge services.

- Travel Insurance: Credit cards often provide travel insurance as a benefit to cardholders. This insurance coverage can include trip cancellation/interruption insurance, baggage loss/delay insurance, and emergency medical coverage. The charter services charge may be applied to cover the cost of offering these insurance benefits.

- Discounted Hotel Bookings: Some credit cards offer discounted rates and special offers when booking hotels through specific platforms or partnerships. The charter services charge may be levied as a fee to cover the administrative costs and negotiations associated with providing these discounts.

- Exclusive Event Invitations: Certain credit cards provide access to exclusive events such as concerts, sporting events, or VIP experiences. The charter services charge may be applied to cover the costs of securing these exclusive invitations and managing the event logistics.

These are just a few examples of the common types of charter services charges you may encounter. Other services, such as roadside assistance, travel rewards programs, or extended warranty protection, may also have associated charges depending on your credit card agreement.

It’s important to review your credit card terms and conditions or contact your credit card issuer to understand the specific charter services charges applicable to your card. This will help you manage your finances and make informed decisions about which services are worth the associated fees.

Now that we have explored the common types of charter services charges, let’s demystify some of the terminology you may encounter when reviewing your credit card statement.

Explanation of Charter Services Charge Terminology

When reviewing your credit card statement, you may come across some unfamiliar terminology related to charter services charges. Understanding these terms will help you decipher your statement accurately. Here are some common terms you may encounter:

- Charter Services: This term refers to the specific service or benefit for which you are being charged. It could be a particular membership program, an access fee, or a service fee associated with a specific offering.

- Monthly Fee: Some charter services charges are billed on a monthly basis. This fee is charged regularly, usually on the same date each month, to cover the ongoing costs of providing the service or benefit.

- Annual Fee: While not specific to charter services charges, it’s worth mentioning that some credit cards have an annual fee associated with them. This fee is separate from any charter service charges and is a standard fee for owning and using the credit card.

- Usage-Based Fee: Certain charter services charges are calculated based on your usage or frequency of using the associated service or benefit. For example, if you have a membership that provides discounted hotel bookings, you may be charged based on the number of times you utilize the benefit.

- Tiered Pricing: Some charter services charges may have different pricing tiers depending on the level of service or benefit you have opted for. Higher tiers may offer additional perks or more comprehensive coverage, but also come with a higher charge.

- Additional Cardholder Fees: If you have added an authorized user to your credit card account and they also have access to the charter services, there may be separate fees associated with their usage. These fees will typically be listed separately from the primary cardholder’s charges.

Understanding these terms will help you navigate your credit card statement and ensure that you accurately identify and comprehend the charter services charges on your account. If you still have questions or need further clarification, don’t hesitate to reach out to your credit card issuer or check the terms and conditions of your credit card agreement.

Now that we have explored the terminology, let’s look at some examples of how charter services charges can appear on your credit card statement.

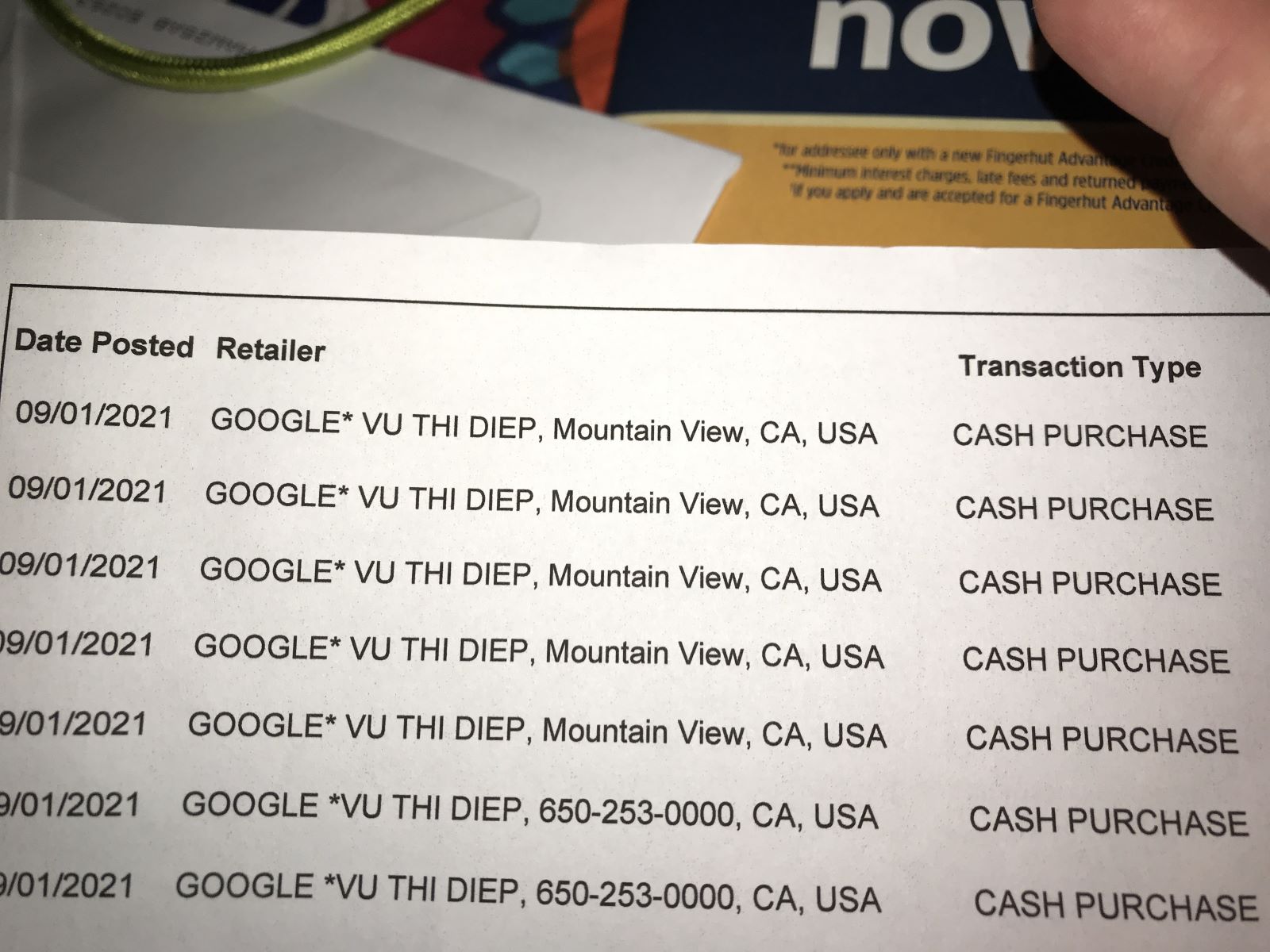

Examples of Charter Services Charges on Credit Card Statements

Charter services charges can vary in terms of how they appear on your credit card statement. Here are a few examples of how these charges might be listed:

- Charter Services – Airport Lounge Access: This entry may appear on your statement when you have a credit card that provides access to airport lounges. The charge will reflect the fee associated with accessing these exclusive lounges.

- Monthly Charter Services Fee: If you have subscribed to a monthly charter service, you may see a line item on your statement labeled as a “Monthly Charter Services Fee.” This charge represents the ongoing cost of the service or membership.

- Concierge Services Charge: If your credit card offers concierge services, you may find a charge labeled as “Concierge Services” on your statement. This charge covers the expenses incurred in fulfilling your requested tasks and services.

- Annual Membership Fee – Travel Insurance: For credit cards that provide travel insurance as a benefit, the associated charge might be listed as an “Annual Membership Fee – Travel Insurance.” This charge covers the cost of including travel insurance in your credit card benefits package.

- Charter Services – Exclusive Event Access: If your credit card grants you access to exclusive events, you may come across a charge titled “Charter Services – Exclusive Event Access.” This charge covers the administrative costs of providing these exclusive experiences.

These examples demonstrate the various ways in which charter services charges can be listed on your credit card statement. The specific description may vary depending on your credit card issuer and the terminology they use for these charges.

Remember to review your credit card statement carefully each month to ensure that you recognize and understand any charter services charges. If you have any concerns or questions about a particular charge, don’t hesitate to reach out to your credit card issuer for clarification.

Now that we have explored examples of charter services charges, let’s proceed to the next section for tips on understanding and managing these charges effectively.

Tips for Understanding and Managing Charter Services Charges on Credit Cards

Charter services charges can sometimes be confusing or unexpected, but with the following tips, you can better understand and manage them on your credit card:

- Review your credit card terms and conditions: Take the time to read and understand the terms and conditions related to charter services charges. This will give you a clear understanding of the services you have enrolled in and the associated fees.

- Monitor your credit card statements: Regularly review your credit card statements to identify any charter services charges. Make sure they align with the services you have signed up for and that you recognize the charges.

- Understand the value of the services: Evaluate the benefits and value that the charter services provide. Consider whether the associated charges are worth the perks and advantages you receive.

- Be aware of cancellation policies: If you no longer find value in a specific charter service, check the cancellation policies outlined in your credit card agreement. Determine if there are any fees or penalties associated with canceling the service.

- Optimize your usage: Make the most of the charter services you have signed up for. Utilize the benefits, discounts, and exclusive offers to maximize the value you get out of the associated charges.

- Track your expenses: Keep track of your overall credit card spending, including charter services charges. This will help you manage your budget effectively and ensure that you are not exceeding your financial limits.

- Reach out for assistance: If you have any questions or concerns about charter services charges on your credit card, don’t hesitate to contact your credit card issuer’s customer service. They can provide clarification and guidance to help you better understand these charges.

- Consider the alternatives: If you find that the charter services charges outweigh the benefits, explore alternative options. Look for credit cards or membership programs that offer similar services at a lower cost or with more favorable terms.

- Pay your balance in full: To avoid accruing interest on charter services charges, strive to pay your credit card balance in full and on time each month. This will help you maintain control over your finances and minimize any additional costs.

By following these tips, you can navigate the world of charter services charges with confidence and ensure that you are getting the most out of the services you have subscribed to.

Now, let’s wrap up our discussion on charter services charges.

Conclusion

Understanding and managing charter services charges on your credit card is essential for effective financial management. By familiarizing yourself with the concept of charter services and the associated charges, you can make informed decisions about which services are worth the additional fees and optimize the value you receive.

Remember to review your credit card terms and conditions, monitor your statements regularly, and track your expenses to ensure that you are aware of any charter services charges on your account. Consider the benefits and perks provided by these services and evaluate if they align with your needs and preferences.

If you decide to cancel a charter service, be mindful of any applicable cancellation fees and policies. Explore alternative options that may offer similar benefits at a lower cost or with more favorable terms. Also, strive to pay your credit card balance in full each month to avoid accruing interest on these charges.

If you have any questions or concerns about charter services charges, don’t hesitate to reach out to your credit card issuer’s customer service for clarification and assistance. They can provide valuable guidance and help you make the most of your credit card benefits.

By following these tips and staying informed, you can effectively understand and manage charter services charges on your credit card, ensuring that you are making the most of the services you have chosen and maintaining control over your finances.

Now go forth armed with knowledge and confidence to navigate the world of credit card charges and make informed choices that align with your financial goals!