Finance

What Is A Bonds Par Value

Published: October 14, 2023

Learn what a bond's par value is and its significance in finance. Understand how par value affects bond pricing and potential returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on bonds and their par value. In the world of finance, bonds are essential tools for both corporations and governments to raise capital. Investors, on the other hand, are attracted to bonds as a means of generating fixed income over a specified period of time. Understanding the concept of par value is crucial for anyone interested in the bond market, as it directly affects the pricing and characteristics of these securities.

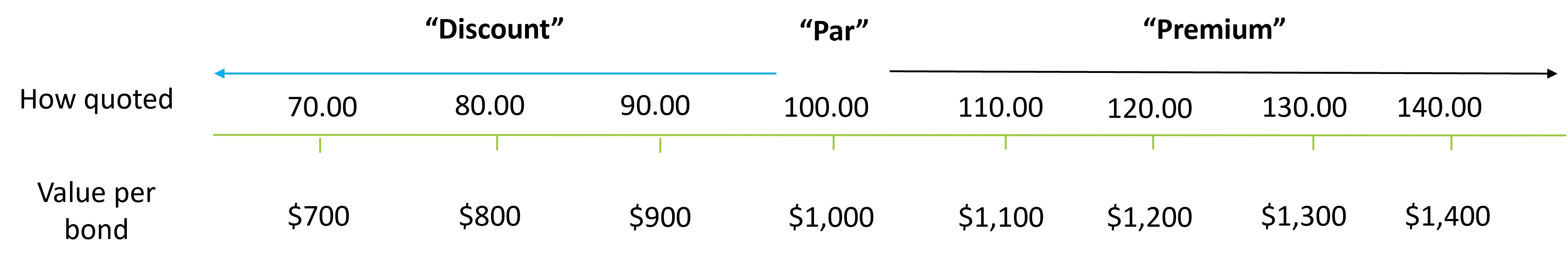

So, what exactly is par value? In simple terms, par value refers to the nominal or face value of a bond. It is the value assigned to the bond at the time of issuance and represents the amount that the issuer is obligated to repay to the bondholder upon maturity. Par value is typically denoted on the bond certificate itself and is usually set at $1,000 or multiples thereof.

However, it is important to note that the par value of a bond does not necessarily reflect its current market price. Bonds can trade in the market at a premium or a discount to their par value based on various factors such as prevailing interest rates, creditworthiness of the issuer, and market demand.

In this guide, we will delve deeper into the concept of par value, exploring its determination, significance, and its impact on bond pricing. We will also discuss the differences between par value and market price, as well as examine securities that have par value. By the end, you will have a thorough understanding of the role that par value plays in the bond market and its implications for both issuers and investors.

Definition of Par Value

Par value, also known as face value or nominal value, represents the predetermined value assigned to a bond at the time of issuance. It is the amount that the issuer promises to repay to the bondholder upon maturity. Par value is typically denoted on the bond certificate and is usually set at $1,000 or multiples thereof.

The par value of a bond serves as a reference point for determining its interest payments and principal repayment. Interest payments, also known as coupon payments, are typically calculated as a fixed percentage of the par value and paid to bondholders at regular intervals, such as annually or semi-annually. For example, if a bond has a par value of $1,000 and a coupon rate of 5%, the bondholder will receive $50 in interest payments each year.

It is important to note that the par value of a bond does not necessarily indicate its current market value. Bonds can trade in the secondary market at a higher price, known as a premium, or at a lower price, known as a discount, to their par value. This fluctuation in market price is influenced by factors such as changes in interest rates, creditworthiness of the issuer, and overall market conditions.

Par value is typically fixed for the duration of the bond’s life and does not change. However, there are exceptions in the case of convertible bonds, which allow bondholders to convert their bonds into a specified number of the issuer’s common stock. In such cases, the par value may be adjusted to reflect the conversion ratio.

It is worth mentioning that some bonds, known as zero-coupon bonds, do not have regular interest payments. Instead, these bonds are issued at a discount to their par value and do not make periodic interest payments. The bondholder receives the par value of the bond at maturity, effectively earning interest through the difference between the discounted purchase price and the par value.

In summary, the par value of a bond represents the nominal value assigned to it at the time of issuance. It is the amount that the issuer is obliged to repay to the bondholder at maturity and serves as the basis for calculating interest payments. However, the market price of a bond may differ from its par value due to fluctuations in interest rates and market demand.

Determining Factors of Par Value

Several factors come into play when determining the par value of a bond. These factors are typically established by the issuer or the company issuing the bond and are influenced by various financial considerations. Let’s explore some of the key factors that come into play in determining the par value of a bond:

- Legal Considerations: The par value of a bond is often influenced by legal requirements or restrictions imposed by regulatory bodies. For example, in some jurisdictions, there may be minimum par value requirements for bonds to ensure investor protection and maintain transparency in the financial markets.

- Market Conditions: The prevailing market conditions, including interest rates, inflation, and economic outlook, can have a significant impact on the determination of par value. In periods of high interest rates, issuers may set a higher par value to attract investors with the promise of a higher coupon payment.

- Creditworthiness of the Issuer: The creditworthiness or financial stability of the issuer is an important consideration when determining the par value of a bond. Higher-rated issuers with strong credit profiles are likely to issue bonds with a higher par value, as they pose a lower risk of default, attracting investors looking for safer investment options.

- Type and Purpose of the Bond: Different types of bonds serve different purposes, such as funding infrastructure projects, financing acquisitions, or supporting working capital needs. The type and purpose of the bond can influence the determination of the par value. For example, a bond issued to fund a long-term infrastructure project may have a higher par value to align with the funding requirements.

- Market Demand: The demand for a particular bond in the market can also influence the determination of its par value. If there is a high demand for a specific bond due to its attractive features or issuer reputation, the par value may be adjusted to meet the market demand and achieve optimal pricing.

It is important to note that while these factors play a role in determining the par value, they do not necessarily reflect the actual market value of a bond. The market price of a bond can vary based on supply and demand dynamics, prevailing interest rates, credit market conditions, and other factors beyond the control of the issuer.

In summary, determining the par value of a bond involves a careful analysis of legal requirements, market conditions, creditworthiness of the issuer, type and purpose of the bond, and market demand. These factors collectively help in setting the par value, which serves as a reference point for interest payments and principal repayment.

Significance of Par Value

The par value of a bond holds significant importance for both issuers and investors in the bond market. Let’s explore the key significance of par value:

- Principal Repayment: The par value represents the amount that the issuer is obligated to repay to the bondholder upon maturity. It ensures that bondholders receive the full face value of their investment at the end of the bond’s term. The par value serves as a guarantee for investors, providing clarity on the amount they can expect to receive when the bond reaches maturity.

- Fixed Income Calculation: The par value is used to calculate the fixed interest payments, also known as coupon payments, that bondholders receive. By applying the coupon rate to the par value, investors can ascertain the exact amount of interest income they will earn throughout the life of the bond. This fixed income feature makes bonds an attractive investment option for those seeking steady and predictable returns.

- Creditworthiness Assessment: The par value can also act as an indicator of the creditworthiness or financial stability of the issuer. Higher par values are often associated with issuers with stronger credit profiles, as they are more likely to honor their repayment obligations. Investors use par value as one of the criteria for evaluating the risk associated with different bonds and making investment decisions.

- Comparison Among Bonds: The par value allows investors to make direct comparisons between different bonds in terms of their initial investment amount and potential returns. By considering the par value alongside other factors such as interest rates, maturity dates, and credit ratings, investors can assess the relative attractiveness of different bond offerings and select the ones that align with their investment objectives.

- Bond Pricing: The par value serves as a reference point for pricing bonds in the secondary market. Bonds trading above their par value are said to be trading at a premium, while those trading below their par value are said to be trading at a discount. The relationship between par value and market price helps investors determine whether a bond is overvalued or undervalued in the market.

It is important to note that while the par value provides valuable information and serves as a benchmark for bondholders, it does not reflect the actual market value of a bond. The market price of a bond is influenced by various factors such as interest rate movements, credit ratings, liquidity conditions, and overall market sentiment.

In summary, the par value of a bond holds significance as it guarantees the principal repayment to bondholders, helps calculate fixed interest income, provides insights into the creditworthiness of the issuer, facilitates comparisons among bonds, and aids in bond pricing. Understanding the significance of par value is crucial for both issuers and investors to make informed decisions in the bond market.

Differences Between Par Value and Market Price

While par value and market price are related to the value of a bond, there are distinct differences between the two. Understanding these differences is essential for investors to assess the true worth of a bond. Let’s explore the key differences between par value and market price:

- Definition: Par value refers to the face value or nominal value of a bond, which is the amount that the issuer promises to repay to the bondholder upon maturity. It is a fixed value determined at the time of issuance. Market price, on the other hand, refers to the actual price at which a bond is trading in the market. The market price is influenced by factors such as supply and demand, prevailing interest rates, creditworthiness of the issuer, and overall market sentiment.

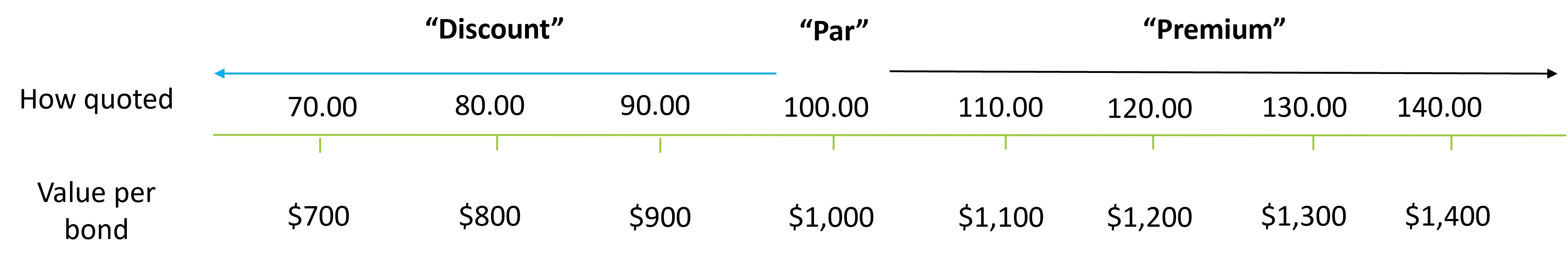

- Relationship: Par value and market price are related but not necessarily equal. Bonds can trade at par when the market price matches the par value. Bonds trading above their par value are considered to be trading at a premium, indicating high demand. Conversely, bonds trading below their par value are considered to be trading at a discount, signaling lower demand.

- Indication of Value: The par value is a fixed amount assigned to the bond at the time of issuance and remains constant throughout its lifespan. It serves as a reference point for interest payments and principal repayment. In contrast, the market price reflects the perceived value of the bond in the secondary market, where supply and demand dynamics determine the price.

- Yield Calculation: The par value is used in calculating the fixed interest payments, or coupon payments, that bondholders receive. The yield, on the other hand, is calculated using the market price of the bond. Yield represents the return an investor can expect to earn from holding the bond, taking into account both the coupon payments and the potential capital gains or losses from changes in market price.

- Market Indicators: The market price of a bond can be a valuable indicator of investor sentiment and market conditions. When bond prices rise, it typically indicates a decrease in interest rates or improved investor confidence. Conversely, when bond prices decline, it may suggest rising interest rates or deteriorating market sentiment. Par value, however, does not fluctuate with market conditions and remains fixed.

It is important for investors to consider both the par value and the market price when evaluating the attractiveness of a bond. While the par value provides information about the principal repayment and fixed interest payments, the market price reflects the current market conditions and investor sentiment. By analyzing the relationship between par value and market price, investors make informed decisions about buying or selling bonds.

In summary, par value represents the face value of a bond, while the market price reflects the bond’s current trading value. Par value is fixed and used for interest and principal calculations, while market price fluctuates based on market demand and supply. Understanding the differences between par value and market price is crucial for investors to assess the true value and potential returns of a bond.

Securities with Par Value

Par value is a term commonly associated with bonds, but it is important to note that other types of securities also have par value. Let’s explore some of the securities that typically have par value:

- Bonds: Bonds are debt securities issued by governments, municipalities, and corporations to raise capital. Bonds carry a fixed par value, which represents the face value of the bond and the amount that will be repaid to bondholders upon maturity.

- Preferred Stocks: Preferred stocks are a type of equity security that combines features of both stocks and bonds. Preferred stocks often have a par value assigned to them, which represents the minimum price at which the stock can be issued or redeemed by the issuer. The par value of preferred stocks helps determine the dividend payments and other rights associated with the stock.

- Convertible Securities: Convertible securities, such as convertible bonds and convertible preferred stocks, give the holder the option to convert the security into a specified number of common shares of the issuer. These securities often have a par value that reflects the conversion ratio and determines the number of common shares the holder will receive upon conversion.

- Debentures: Debentures are unsecured debt instruments issued by corporations without any specific collateral. Debentures carry a specified par value that represents the principal amount that will be repaid to debenture holders upon maturity. Interest payments are typically based on the par value.

- Government and Municipal Bonds: Government and municipal bonds, issued by government entities and municipalities, carry a par value that represents the face value of the bond and the principal amount that will be repaid to bondholders upon maturity. These bonds are often considered safer investments due to the creditworthiness of the issuers.

It is important to note that the presence of a par value does not necessarily indicate the actual market value of these securities. The market price of these securities can fluctuate based on various factors such as interest rate movements, credit ratings, and market demand.

In summary, besides bonds, various securities have par value, including preferred stocks, convertible securities, debentures, and government and municipal bonds. The par value of these securities helps determine their principal repayment, dividend payments, conversion ratios, and other rights associated with the security. Understanding the par value of different securities is crucial for investors to make informed investment decisions.

How Par Value Affects Bond Pricing

The par value of a bond plays a significant role in determining its pricing and overall value in the market. While the market price of a bond can fluctuate based on various factors, the par value establishes the baseline for pricing calculations. Here’s how par value affects bond pricing:

- Coupon Payments: The par value is used to calculate the fixed coupon payments that bondholders receive. The coupon rate is expressed as a percentage of the par value, and the bond issuer pays this fixed percentage as interest to the bondholders. Higher par values result in higher coupon payments, leading to potentially higher overall returns for bondholders.

- Face Value at Maturity: The par value represents the amount that the issuer promises to repay to the bondholder upon maturity. This face value provides assurance to bondholders that they will receive the principal amount they invested. It acts as a commitment from the issuer to honor its repayment obligation, which affects the perceived risk associated with the bond and influences its pricing.

- Premium and Discount: Bonds can trade in the secondary market at a premium or a discount to their par value. When a bond is trading at a premium, it means the market price is higher than its par value. Conversely, a bond trading at a discount indicates that the market price is lower than its par value. The relationship between the market price and the par value provides insights into investor sentiment and market demand for the bond.

- Yield-to-Maturity: The par value is used to calculate the yield-to-maturity (YTM) of a bond. YTM represents the expected rate of return an investor will earn if they hold the bond until its maturity and reinvest all coupon payments at the same yield. The par value is used as the future value to calculate the YTM, which helps investors assess the potential returns and compare bonds with different coupon rates and maturities.

- Issuer’s Creditworthiness: The par value influences the perception of the issuer’s creditworthiness. Higher par values may suggest a lower perceived risk for bondholders, as the issuer is committing to repay a larger principal amount. This can be especially important for investors who prioritize capital preservation and seek bonds from financially stable issuers.

It is important to note that the market price of a bond is not solely determined by its par value. Other factors such as prevailing interest rates, credit ratings, market conditions, and investors’ expectations can cause the bond’s market price to deviate from its par value. As a result, bonds can trade at prices above or below their par value based on market dynamics.

In summary, the par value affects bond pricing by influencing coupon payments, determining the face value at maturity, determining whether a bond is trading at a premium or discount, impacting the yield-to-maturity calculation, and affecting the perceived creditworthiness of the issuer. While par value is an important factor in bond pricing, market conditions and investor sentiment also significantly impact the actual market price of a bond.

Conclusion

Understanding the concept of par value is crucial for anyone interested in the bond market. Par value represents the face value or nominal value of a bond, indicating the amount that will be repaid to bondholders upon maturity. While the par value is fixed throughout the life of a bond, the market price can fluctuate based on factors such as interest rates, creditworthiness of the issuer, and overall market conditions.

Par value serves as a reference point for calculating interest payments, comparing different bonds, and assessing the creditworthiness of the issuer. It also plays a role in bond pricing, as it influences coupon payments, face value at maturity, and the perception of the issuer’s creditworthiness.

However, it is important to note that the market price of a bond can deviate from its par value. Bonds can trade at a premium or a discount to their par value based on market demand and prevailing conditions. Investors should consider both the par value and the market price when evaluating the value and potential returns of a bond.

By understanding the significance of par value and its impact on bond pricing, investors can make informed investment decisions and navigate the bond market with confidence. It is important to stay updated with market conditions, conduct thorough research, and consider various factors beyond just the par value to assess the true value of a bond and its potential risk and returns.

Whether you are an issuer or an investor, recognizing the importance of par value and its role in bond markets is essential. Par value serves as the foundation for understanding bond characteristics, making comparisons, and assessing the financial worth of these securities.

In summary, par value is a fundamental element of bonds and other securities, providing valuable information about their principal repayment, interest payments, and potential returns. By taking into account the par value alongside market dynamics and investor sentiment, individuals can make well-informed decisions in the complex and dynamic world of finance and investing.