Home>Finance>Placement: Definition And Example In Finance, Regulations & Risks

Finance

Placement: Definition And Example In Finance, Regulations & Risks

Published: January 8, 2024

Discover the meaning and application of placement in the world of finance, including regulations and risks. Explore real-life examples and gain a deeper understanding of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Placement: Definition and Example in Finance, Regulations & Risks

When it comes to finance, “placement” is a term that often comes up in various contexts. But what exactly does it mean? And how does it relate to regulations and risks within the financial industry? In this blog post, we will explore the definition of placement in finance, provide an example to illustrate its application, and discuss its implications in terms of regulations and risks.

Key Takeaways:

- Placement refers to the act of investing or allocating funds into a specific financial instrument or asset.

- It plays a crucial role in the overall investment strategy and can have significant implications for both individuals and institutions.

What is Placement in Finance?

In finance, placement is the process of allocating funds to a particular financial instrument or asset. It involves making decisions on how to invest or distribute capital in order to maximize returns or achieve specific financial goals. The concept of placement is not limited to a specific type of investment or asset class, but rather encompasses a wide range of possibilities, including stocks, bonds, real estate, and even alternative investments such as cryptocurrency or commodities.

Placement is a fundamental aspect of overall investment strategy. The specific placement decisions made by individuals or institutions can vary depending on factors such as risk appetite, investment objectives, and market conditions. Some may choose to focus on diversification and allocate funds across different asset classes to mitigate risk, while others may opt for a more concentrated approach, putting a significant portion of their capital into a single investment opportunity.

Example of Placement in Finance

To better understand how placement works in finance, let’s consider an example. Imagine an individual who has recently come into a substantial sum of money through inheritance. They now face the important decision of how to allocate this newfound wealth wisely.

In this case, the individual may decide to place a portion of the funds into a diversified portfolio, consisting of stocks, bonds, and real estate investment trusts (REITs). By spreading the investment across different asset classes, the individual aims to reduce the overall risk exposure while seeking potential returns from multiple sources. This approach allows the portfolio to benefit from the performance of the different investments and serves as a form of risk management.

On the other hand, another individual with a higher risk appetite may choose to place a significant portion of the funds into a single high-growth stock. While this strategy carries more risk, as the performance of the investment hinges on the success of a single company, it also presents the opportunity for substantial returns if the investment proves successful.

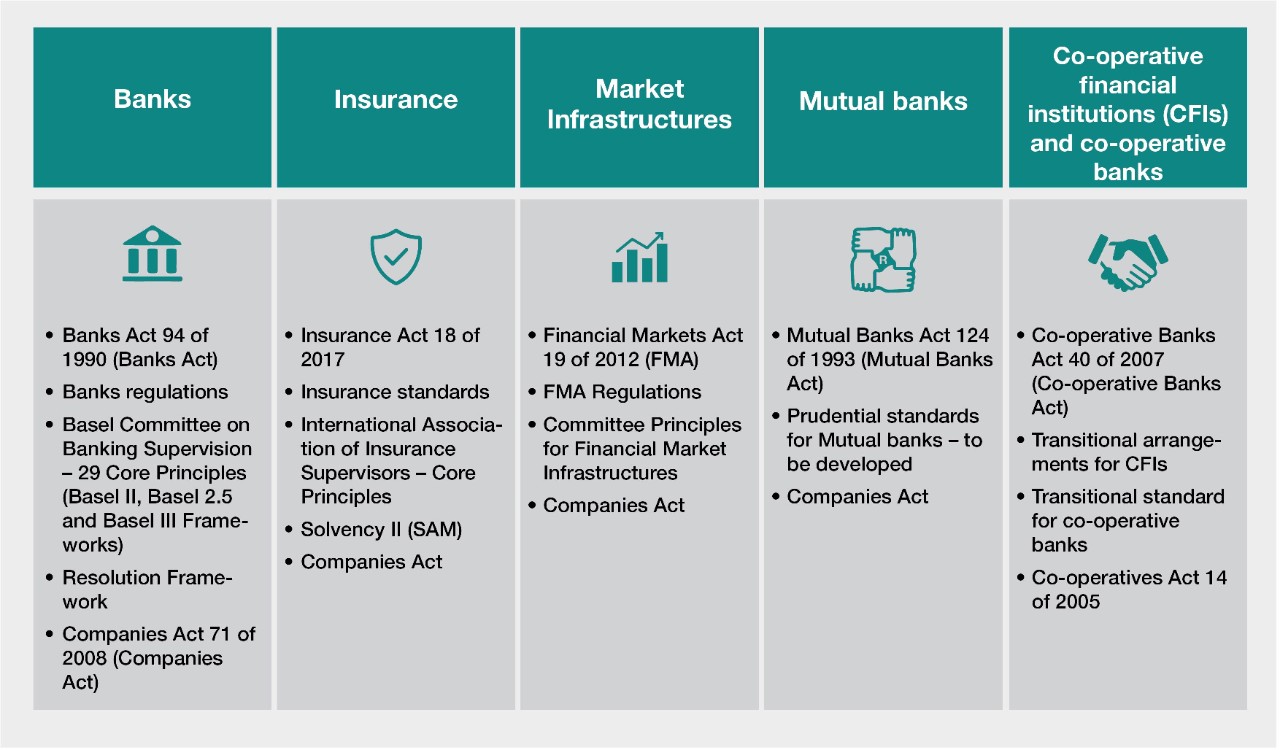

Placement and Regulations

In the financial industry, placement is subject to regulations that aim to promote fair and transparent practices, protect investors, and maintain the stability of the market. These regulations differ across jurisdictions but generally focus on ensuring that investment opportunities are presented accurately and with appropriate disclosures. This helps investors make informed decisions and reduces the likelihood of fraudulent schemes or misleading information.

For instance, financial advisors or institutions that provide placement services may be required to hold specific licenses or registrations, adhere to know-your-customer (KYC) and anti-money laundering (AML) regulations, and provide accurate information about the risks associated with the investments they offer. By imposing these regulations, governments and regulatory bodies seek to maintain integrity and trust in the financial system.

Placement and Risks

Placement in finance is inherently associated with risks. The specific risks involved can vary depending on factors such as the type of investment, market conditions, and the individual’s risk tolerance. Some common risks associated with placement include:

- Market Risk: The potential for investments to decline in value due to fluctuations in the financial markets.

- Liquidity Risk: The risk of not being able to buy or sell an investment quickly and at a fair price.

- Default Risk: The risk of the issuer of a debt instrument being unable to make interest or principal payments as promised.

- Concentration Risk: The risk of overexposure to a specific asset class or investment, which can lead to significant losses if the investment performs poorly.

Understanding and managing these risks is crucial for investors looking to make informed placement decisions. Diversification, thorough research, and regular monitoring of investments can help mitigate some of these risks and enhance the chances of achieving desired financial outcomes.

In conclusion, placement in finance refers to the process of allocating funds to specific financial instruments or assets. It plays a significant role in shaping investment strategies and can have important implications for both individuals and institutions. By understanding the definition of placement, considering relevant examples, and being aware of the regulations and risks involved, investors can make more informed decisions and optimize their financial outcomes.