Home>Finance>What Does Suze Orman Say About Whole Life Insurance?

Finance

What Does Suze Orman Say About Whole Life Insurance?

Published: October 15, 2023

Discover Suze Orman's expert opinion on whole life insurance and how it impacts your finances. Gain valuable insights and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to personal finance and investing, there are few voices as prominent and influential as Suze Orman. As a financial guru, author, and television personality, Orman has spent decades educating and advising individuals on how to achieve financial security.

One topic that often sparks debate and controversy is the concept of whole life insurance. Whole life insurance is a type of permanent life insurance that provides both a death benefit and an investment component. It has been marketed as a way to protect loved ones financially while also accumulating cash value over time.

However, Suze Orman takes a critical stance on whole life insurance. She believes that it is often unnecessary and can be a poor use of financial resources for most individuals. Orman’s perspective is rooted in her belief that life insurance should primarily serve the purpose of providing a financial safety net for dependents in the event of the policyholder’s death.

In this article, we will dive deeper into Suze Orman’s viewpoint on whole life insurance and explore the reasons behind her skepticism. We will also discuss the basics of whole life insurance, its pros and cons, and the alternatives that Orman recommends for those seeking financial protection.

Suze Orman’s Perspective on Whole Life Insurance

Suze Orman is known for her straightforward and no-nonsense approach to personal finance. When it comes to whole life insurance, she strongly believes that it is often an unnecessary and costly investment for the majority of individuals.

One of the key aspects of Orman’s critique is the high premiums associated with whole life insurance. Unlike term life insurance, which provides coverage for a specific period of time, whole life insurance is designed to cover the policyholder for their entire lifetime. This longevity of coverage comes with a significantly higher price tag.

According to Orman, the cost of whole life insurance premiums can be a strain on an individual’s budget. She suggests that for most people, the focus should be on affordable term life insurance coverage that provides adequate protection during the years when dependents are financially dependent.

Furthermore, Orman highlights that the investment component of whole life insurance is not as advantageous as it may initially seem. The cash value accumulation in a whole life policy is typically slow and can take many years before it becomes a meaningful asset. Orman argues that individuals are often better off investing their money in other vehicles that offer higher returns, such as a retirement account or a diversified portfolio of stocks and bonds.

Another factor that Orman highlights is the lack of flexibility with whole life insurance. Once a policyholder commits to a whole life insurance policy, they are locked into the coverage and the associated premiums for the duration of the policy. This lack of flexibility can be problematic if individuals’ financial circumstances change over time or if they find more suitable insurance options in the future.

Suze Orman’s perspective on whole life insurance is grounded in her belief that financial decisions should prioritize long-term financial security and flexibility. She emphasizes the importance of understanding one’s financial goals and needs before committing to any insurance product.

In the next sections, we will explore the fundamentals of whole life insurance, its advantages and disadvantages, and the alternatives recommended by Suze Orman for those seeking financial protection.

Understanding the Basics of Whole Life Insurance

Before delving further into Suze Orman’s critique of whole life insurance, it’s important to have a solid understanding of how this type of insurance works.

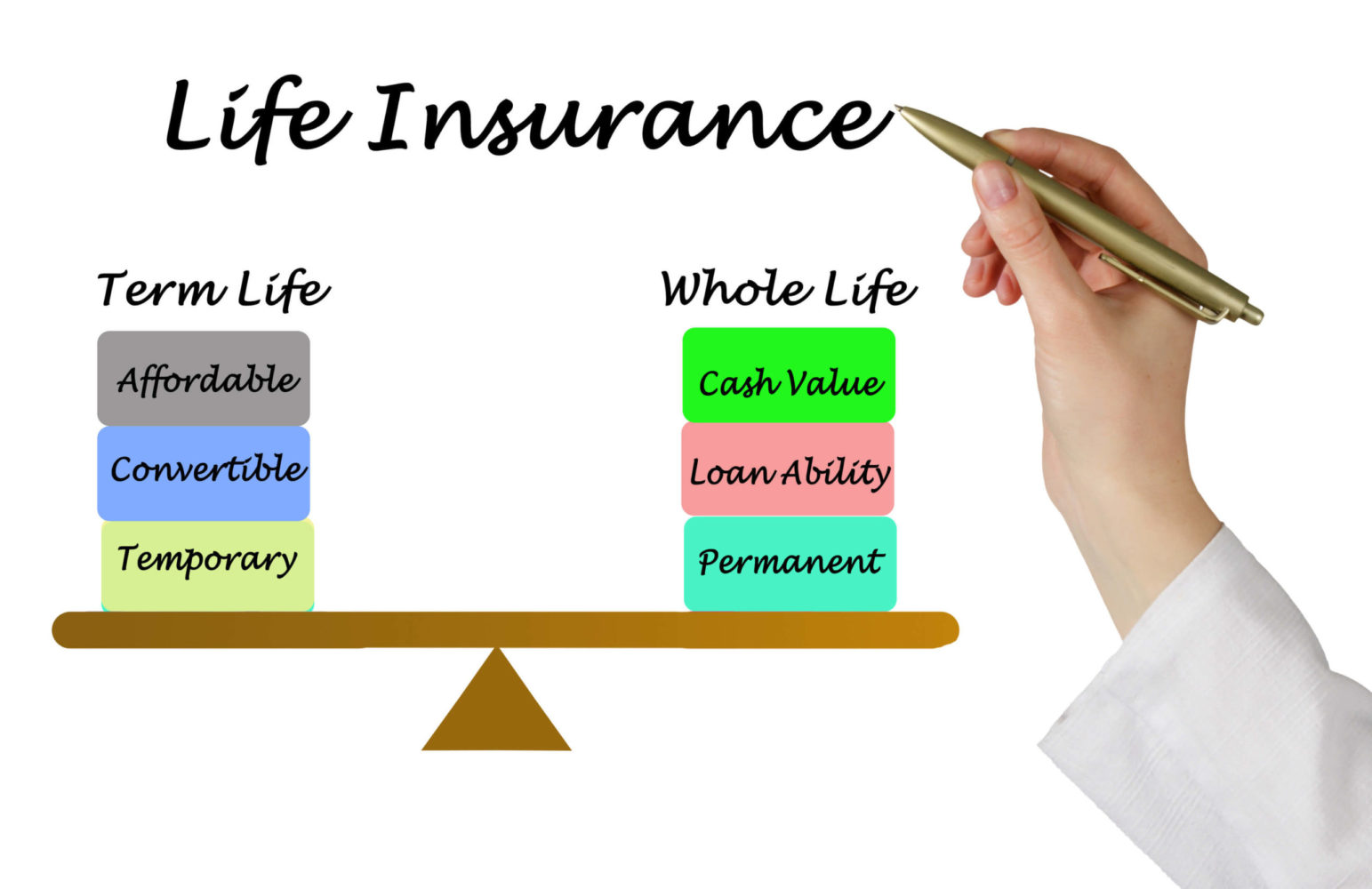

Whole life insurance is a form of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specific period of time (such as 10, 20, or 30 years), whole life insurance does not expire as long as the premiums are paid.

One of the key features of whole life insurance is the dual purpose it serves. In addition to providing a death benefit, whole life insurance also has a cash value component. A portion of the premiums paid by policyholders goes towards building cash value over time.

This cash value works as a savings or investment component within the policy. It grows on a tax-deferred basis and can be accessed by the policyholder during their lifetime through withdrawals or policy loans.

Moreover, whole life insurance provides beneficiaries with a guaranteed death benefit upon the policyholder’s passing. The death benefit is typically a predetermined amount specified in the insurance contract.

Whole life insurance policies come with fixed premiums, meaning the premium amount remains the same throughout the duration of the policy. This can be advantageous for individuals who want stability in their insurance costs.

It’s important to note that whole life insurance policies tend to be more expensive than term life insurance policies due to the lifetime coverage and the cash value component. The higher premiums associated with whole life insurance are intended to cover the cost of insurance and contribute to the cash value accumulation.

Overall, whole life insurance offers a combination of protection and savings. However, as we will explore in the next section, there are both advantages and disadvantages to consider when evaluating whether whole life insurance is the right choice for you.

Pros and Cons of Whole Life Insurance

Like any financial product, whole life insurance comes with its own set of advantages and disadvantages. It’s important to evaluate these factors to determine if this type of insurance aligns with your personal financial goals and needs.

Let’s start with the advantages:

- Permanent Coverage: Unlike term life insurance, which provides coverage for a specified period of time, whole life insurance provides lifetime coverage. This can offer peace of mind for individuals who want to ensure their loved ones are protected financially, regardless of when they pass away.

- Guaranteed Death Benefit: Whole life insurance policies come with a guaranteed death benefit, which means that the beneficiaries will receive a predetermined amount upon the policyholder’s death. This can provide financial stability and support for surviving family members.

- Cash Value Accumulation: One of the unique features of whole life insurance is the cash value component. Over time, a portion of the premiums paid accumulates as cash value within the policy. This cash value can be accessed by the policyholder through withdrawals or policy loans, providing a potential source of liquidity.

- Tax Advantage: The cash value growth in a whole life insurance policy is tax-deferred, meaning that policyholders do not have to pay taxes on the growth as long as the funds remain within the policy. This can be advantageous for individuals looking for a tax-efficient way to accumulate savings.

Now, let’s explore the potential drawbacks:

- High Cost: Whole life insurance policies tend to be more expensive compared to term life insurance. The higher premiums are used to fund the cash value accumulation and provide lifetime coverage. This can be a deterrent for individuals on a tight budget or those who prioritize affordability.

- Slow Cash Value Growth: While the cash value component can be an attractive feature, the growth potential is often slower compared to other investment options. It can take many years for the cash value to accumulate and become a substantial asset. Individuals looking for higher returns may find better alternatives in the investment market.

- Limited Flexibility: Once committed to a whole life insurance policy, it can be challenging to make changes or adjustments. The fixed premiums and terms may not offer the flexibility needed to adapt to changing financial circumstances. Individuals who anticipate needing more flexibility in their insurance coverage might find other options more suitable.

Ultimately, the decision to pursue whole life insurance should be based on a thorough examination of one’s financial situation, goals, and risk tolerance. It’s crucial to consider these pros and cons and consult with a financial advisor before making a commitment.

Suze Orman’s Critique of Whole Life Insurance

Suze Orman is known for her skepticism towards whole life insurance and has voiced several concerns about its suitability for most individuals. Her critique revolves around key aspects of whole life insurance, including its high costs and lack of flexibility.

One of Orman’s primary concerns is the high premiums associated with whole life insurance. She believes that the cost of whole life insurance can be excessive for the average person, especially when compared to more affordable alternatives such as term life insurance.

According to Orman, the focus should be on prioritizing the coverage needs during the years when dependents are financially dependent. She suggests that individuals should consider term life insurance as a more cost-effective option that provides the necessary protection during these critical periods.

Furthermore, Orman questions the investment component of whole life insurance. While whole life insurance policies do accumulate cash value over time, she argues that the growth is often slow and does not provide substantial returns compared to other investment options. Instead, Orman recommends investing in retirement accounts or diversified portfolios to achieve better long-term financial growth.

Another aspect that Orman criticizes is the lack of flexibility in whole life insurance. Once committed to a whole life insurance policy, individuals are generally locked into the coverage and premiums for the entire duration of the policy. Orman believes that this lack of flexibility can be problematic if one’s financial circumstances change or if more suitable insurance options become available in the future.

Overall, Orman’s critique of whole life insurance centers around its affordability, investment potential, and lack of flexibility. She encourages individuals to assess their specific financial needs and goals before committing to a whole life insurance policy. By considering alternatives and seeking advice from a financial professional, individuals can make informed decisions that align with their overall financial well-being.

Alternatives to Whole Life Insurance Recommended by Suze Orman

While Suze Orman is critical of whole life insurance for most individuals, she does offer alternative options that may be more in line with their financial goals and needs. These alternatives focus on providing adequate protection at a lower cost and offer greater flexibility. Here are some of the alternatives recommended by Suze Orman:

Term Life Insurance: Suze Orman suggests that individuals consider term life insurance as a viable alternative to whole life insurance. Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years, at much more affordable premiums. This allows individuals to prioritize coverage during the years when dependents are financially dependent and adjust their insurance needs as circumstances change.

Investing in Retirement Accounts: Instead of relying on the cash value accumulation within a whole life insurance policy, Orman recommends investing in retirement accounts such as IRAs or 401(k)s. These accounts offer tax advantages and the potential for higher returns over the long term. By investing in retirement accounts, individuals can grow their savings while benefiting from the flexibility to adjust contributions and investment strategies as needed.

Diversified Investment Portfolios: Orman also emphasizes the importance of diversification and the potential for higher returns through diversified investment portfolios. By spreading investments across a range of assets, such as stocks, bonds, and mutual funds, individuals can potentially achieve better long-term growth compared to the cash value accumulation within whole life insurance. It’s crucial to consult with a financial advisor to create a personalized investment strategy based on individual risk tolerance and financial goals.

Emergency Savings Fund: Another alternative that Orman frequently recommends is the establishment of an emergency savings fund. By building a separate fund specifically for unexpected expenses or emergencies, individuals can have a financial safety net in place without solely relying on insurance products. This fund should ideally cover three to six months’ worth of living expenses to provide stability and peace of mind in case of unforeseen circumstances.

It is important to note that these alternatives may not offer the same level of permanent coverage or cash value accumulation as whole life insurance. However, they provide more flexibility and can sometimes be more cost-effective, allowing individuals to allocate their financial resources to other areas that may be more beneficial for their long-term financial well-being.

As with any financial decision, consulting with a qualified financial advisor is crucial to determine the most suitable alternatives based on individual circumstances and goals. A financial professional can provide personalized guidance and help individuals make informed decisions that align with their unique financial situations.

Conclusion

When it comes to whole life insurance, Suze Orman’s perspective is clear – she believes that it is often an unnecessary and costly investment for most individuals. Her critique of whole life insurance centers around its high premiums, slow cash value growth, and lack of flexibility. Orman argues that individuals should prioritize affordable term life insurance coverage during the years when dependents are financially dependent, while seeking higher returns and flexibility through other investment options.

However, it’s important to note that whole life insurance does have its merits. The permanent coverage and guaranteed death benefit can provide long-term financial security and peace of mind for some individuals. The cash value accumulation can also offer a potential source of savings and liquidity. Additionally, whole life insurance may be suitable for high-net-worth individuals or those with complex estate planning needs.

Ultimately, the decision to invest in whole life insurance should be based on a thorough assessment of one’s financial goals, budget, and risk tolerance. It’s important to consider the pros and cons, explore alternative options, and consult with a qualified financial advisor to make an informed decision.

While Suze Orman offers alternative options such as term life insurance, investing in retirement accounts, diversified portfolios, and emergency savings funds, it’s important to remember that everyone’s financial situation is unique. Therefore, it’s crucial to evaluate individual circumstances and seek personalized advice to make the best choices for long-term financial security.

In conclusion, Suze Orman’s perspective serves as a valuable reminder to critically evaluate financial products and ensure they align with one’s overall financial goals and needs. Whole life insurance may not be suitable for everyone, but by being informed and considering alternatives, individuals can make informed decisions to achieve financial wellness and security.