Home>Finance>Why Does Dave Ramsey Not Like Whole Life Insurance?

Finance

Why Does Dave Ramsey Not Like Whole Life Insurance?

Published: October 14, 2023

Discover why Dave Ramsey is not a fan of whole life insurance and get insights into the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

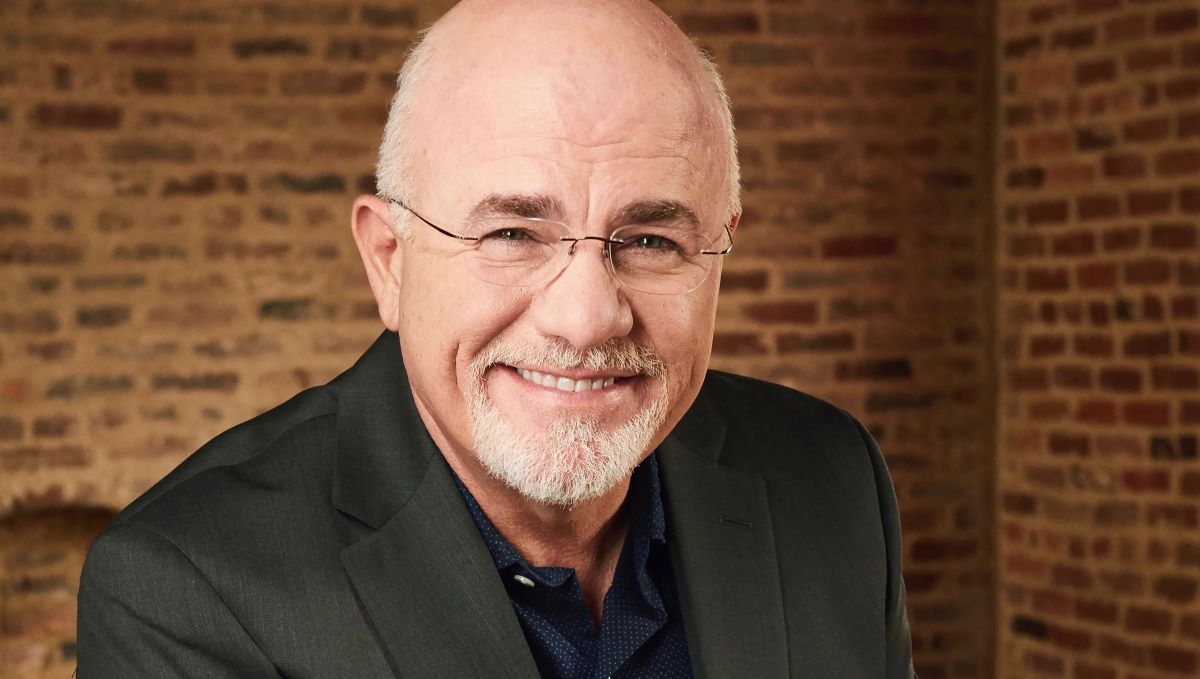

Whole life insurance is a type of life insurance policy that offers lifelong coverage and accumulates cash value over time. While it can provide financial security and peace of mind for some individuals, it has drawn criticism from financial expert Dave Ramsey. Ramsey, renowned for his practical and no-nonsense approach to personal finance, advises against whole life insurance for various reasons.

In this article, we will delve into the reasons behind Dave Ramsey’s disapproval of whole life insurance, the arguments against it, and explore alternative options. It’s important to note that while Ramsey’s views have influenced many individuals, it’s essential to consider different perspectives and evaluate whether whole life insurance suits your specific financial goals and circumstances.

Before we delve into the specifics, let’s first understand what whole life insurance entails.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire duration of the policyholder’s life, as long as premiums are paid. It offers a death benefit to beneficiaries upon the insured’s passing and also generates a cash value component.

The cash value component of whole life insurance grows over time, typically at a fixed or minimum guaranteed interest rate. Policyholders can accumulate cash value through premiums paid, and this value can be utilized in various ways, including taking out loans against the policy or surrendering the policy for its cash value.

Whole life insurance premiums are generally higher compared to term life insurance, which provides coverage for a specific period. A portion of the higher premiums goes towards the death benefit, while the remainder contributes to building cash value.

Now that we have a basic understanding of whole life insurance, let’s explore why Dave Ramsey advises against it and the arguments raised against this insurance product.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire duration of the policyholder’s life, as long as premiums are paid. It offers a death benefit to beneficiaries upon the insured’s passing and also generates a cash value component.

The cash value component of whole life insurance grows over time, typically at a fixed or minimum guaranteed interest rate. Policyholders can accumulate cash value through premiums paid, and this value can be utilized in various ways, including taking out loans against the policy or surrendering the policy for its cash value.

Whole life insurance premiums are generally higher compared to term life insurance, which provides coverage for a specific period. A portion of the higher premiums goes towards the death benefit, while the remainder contributes to building cash value.

One of the significant features of whole life insurance is that it offers lifelong coverage. Unlike term life insurance, which is typically purchased for a specific duration (such as 10, 20, or 30 years), whole life insurance remains in force until the insured’s death, as long as premiums are paid.

In addition to the death benefit, whole life insurance policies also provide a cash value component. This cash value accumulates over time, and policyholders can access it through policy loans or surrendering the policy. The cash value can be used for various purposes, such as supplementing retirement income, paying off debts, or funding emergencies.

When it comes to premium payments, whole life insurance policies can have different structures. Some policies have level premiums, meaning the premium amount remains consistent throughout the policy’s duration. Other policies may have graded premiums, where the premium starts lower and gradually increases over time. Another option is a single premium whole life policy, where the entire premium is paid in one lump sum.

One potential advantage of whole life insurance is that it can provide tax benefits. The death benefit paid to beneficiaries is generally income tax-free, providing financial protection to loved ones. The cash value growth within the policy is also typically tax-deferred, meaning that policyholders won’t owe taxes on the accumulated cash value until they withdraw or borrow against it.

It is worth noting that whole life insurance policies can be complex, and their suitability depends on an individual’s financial goals and circumstances. Consulting with a licensed insurance professional or financial advisor can help determine if whole life insurance aligns with your needs.

Dave Ramsey’s Views on Whole Life Insurance

Dave Ramsey, a well-known personal finance expert and author, is vocal in his criticism of whole life insurance. He believes that this type of insurance is unnecessary for most individuals and often advises against it. Ramsey’s views on whole life insurance can be attributed to a few key factors.

One of the primary reasons Ramsey discourages whole life insurance is the high cost. Compared to term life insurance, whole life premiums can be significantly higher. Ramsey’s philosophy emphasizes having affordable insurance coverage to protect against worst-case scenarios, rather than spending excessive amounts on premium payments.

Ramsey also criticizes the cash value component of whole life insurance policies. While the cash value can be accessed through policy loans or surrendering the policy, Ramsey believes that the returns on the cash value are not worth the high premiums. He argues that individuals can achieve higher returns by investing in other financial vehicles, such as mutual funds or retirement accounts.

Another issue Ramsey has with whole life insurance is the complex nature of these policies. Whole life insurance involves not just insurance coverage, but also a savings or investment component. Ramsey believes that it is better to keep insurance and investments separate to have more control over each aspect and optimize financial outcomes.

Furthermore, Ramsey points out that the commissions earned by insurance agents for selling whole life insurance policies can create conflicts of interest. He argues that agents may be influenced to push these policies for their own financial gain, even if they may not be the best option for the individual seeking coverage.

It is important to note that while Ramsey advises against whole life insurance for the majority of people, there may be specific situations where it can be beneficial. For example, individuals with complex financial needs or high net worth may find whole life insurance valuable for estate planning or tax advantages.

Ultimately, Dave Ramsey’s perspective on whole life insurance stems from his belief in simplicity and minimizing unnecessary expenses. He encourages individuals to focus on building wealth through other means and utilizing affordable term life insurance for risk protection.

It’s essential to consider various viewpoints and evaluate your own financial goals and circumstances before making a decision about whole life insurance or any other insurance product.

Arguments Against Whole Life Insurance

While whole life insurance has its proponents, there are several common arguments against this type of insurance. It’s important to consider these points when evaluating whether whole life insurance is the right choice for your financial needs.

1. Cost: Whole life insurance premiums are generally much higher than term life insurance premiums for the same coverage amount. Critics argue that the significant expense of whole life insurance makes it an inefficient way to obtain insurance coverage. Instead, they suggest using term life insurance, which provides coverage for a specific period at a lower cost, and investing the difference in premiums elsewhere for potential higher returns.

2. Cash Value Returns: Another argument against whole life insurance is that the returns on the cash value component may not match the growth potential of other investment vehicles, such as mutual funds or retirement accounts. Critics suggest that individuals can achieve better returns by investing in these alternatives instead of relying on the cash value of a whole life insurance policy.

3. Complexity: Whole life insurance policies can be complex, with various features and riders that may be difficult to understand for the average policyholder. Critics argue that the complexity of these policies makes it challenging to assess the true cost and benefit of the coverage, leading to potential confusion and dissatisfaction.

4. Lack of Flexibility: Whole life insurance policies often have limited flexibility when it comes to changing coverage amounts or premium payments. Once a policy is in place, it can be challenging to modify it to adapt to changing financial circumstances. Critics argue that individuals may be better off with a more flexible insurance product, such as term life insurance, that can be adjusted as needed.

5. Opportunity Cost: Critics also highlight the opportunity cost of investing a significant portion of funds into a whole life insurance policy rather than allocating those funds towards other financial goals, such as paying off debt or saving for retirement. They argue that the premiums paid for whole life insurance could be put to better use in other areas of financial planning.

It is important to note that these arguments are not universally applicable and must be evaluated in the context of an individual’s specific financial goals and circumstances. While these criticisms may hold merit for some individuals, others may find the benefits of whole life insurance, such as lifelong coverage and potential tax advantages, outweigh the drawbacks.

Before making a decision about purchasing whole life insurance, it’s crucial to carefully assess your financial needs and consider alternative insurance options.

Benefits of Whole Life Insurance

While there are criticisms surrounding whole life insurance, it is important to understand that there are also significant benefits to this type of coverage. These benefits can make whole life insurance an attractive option for certain individuals with specific financial circumstances and goals.

1. Lifelong Coverage: One of the main advantages of whole life insurance is that it provides coverage for the entire duration of the policyholder’s life, as long as the premiums are paid. This ensures that loved ones will receive a death benefit upon the insured’s passing, providing financial security and peace of mind.

2. Cash Value Accumulation: Whole life insurance policies accumulate cash value over time. This means that a portion of the premiums paid goes towards building cash value within the policy. The cash value grows over time, typically at a fixed or minimum guaranteed interest rate. Policyholders can access this cash value through policy loans or surrendering the policy if needed.

3. Tax Advantages: Whole life insurance offers potential tax advantages. The death benefit paid to beneficiaries upon the insured’s passing is generally income tax-free. Additionally, the cash value growth within the policy is typically tax-deferred, meaning that policyholders won’t owe taxes on the accumulated cash value until they withdraw or borrow against it. This can be beneficial for individuals looking to minimize their tax burden.

4. Estate Planning Benefits: Whole life insurance can be a valuable tool for estate planning. The death benefit provided by a whole life insurance policy can help pay for estate taxes, ensuring that loved ones receive the intended inheritance without financial strain. It can also provide liquidity to cover other expenses, such as outstanding debts or funeral costs.

5. Guaranteed Coverage: Whole life insurance offers a guaranteed death benefit as long as the premiums are paid. This means that individuals with health conditions or those who may be deemed uninsurable by other life insurance policies can still obtain coverage through whole life insurance.

6. Policyholder Control: Whole life insurance policies provide policyholders with control over the cash value component. They can access the cash value through policy loans, which can be used for various purposes, such as supplementing retirement income or funding emergencies. Policyholders can also choose to surrender the policy and receive the accumulated cash value.

It is important to consider these benefits in the context of your specific financial goals and circumstances. While whole life insurance may not be suitable for everyone, it can provide a range of advantages for those who prioritize lifelong coverage, cash value accumulation, and estate planning needs.

Consulting with a licensed insurance professional or financial advisor can help you assess whether whole life insurance aligns with your financial goals and explore other alternatives if needed.

Alternatives to Whole Life Insurance

While whole life insurance may offer certain benefits, it is essential to explore alternative insurance options that may better align with your financial goals and circumstances. Here are some alternatives to consider:

1. Term Life Insurance: Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the policy term. Term life insurance premiums are generally more affordable compared to whole life insurance, making it a suitable option for individuals seeking temporary coverage for specific financial obligations, such as paying off a mortgage or providing for dependents while they are young.

2. Universal Life Insurance: Universal life insurance is a flexible type of permanent life insurance that provides a death benefit but allows for more flexibility in premium payments and death benefit amounts. It also has a cash value aspect, which accumulates over time, and policyholders can access the cash value through policy loans or withdrawals. Universal life insurance can be more affordable than whole life insurance and provides greater flexibility to adjust premiums and death benefits as financial needs change.

3. Indexed Universal Life Insurance: Indexed universal life insurance is another form of permanent life insurance that provides a death benefit and potential cash value growth. The policy’s cash value is tied to the performance of a specific stock market index, allowing policyholders to potentially benefit from market upswings while being protected against market losses. Indexed universal life insurance may appeal to individuals looking for a balance between potential growth and downside protection.

4. Self-Insurance: Self-insuring involves setting aside funds to cover potential financial obligations instead of relying on an insurance policy. This approach is often suitable for individuals who have substantial assets and are confident in their ability to handle unforeseen expenses or generate income to replace lost wages in the event of death. Self-insuring eliminates the need for paying insurance premiums but comes with the responsibility of managing and allocating those funds effectively.

5. Investment-based Strategies: Instead of relying on an insurance policy for financial protection, some individuals choose to invest their money in various investment vehicles, such as stocks, bonds, mutual funds, or retirement accounts. By building a well-diversified investment portfolio, individuals can potentially generate returns that can be used to cover financial obligations or provide for loved ones. However, this approach requires careful planning, continual monitoring of investments, and a strong understanding of the risks involved.

It is crucial to assess your financial goals, risk tolerance, and financial circumstances when considering alternatives to whole life insurance. Consulting with a financial advisor or insurance professional can provide valuable guidance in determining the most suitable insurance solution for your specific needs.

Conclusion

Whole life insurance is a type of insurance that offers lifelong coverage and cash value accumulation. However, it has drawn criticism from financial expert Dave Ramsey, who argues that it is often unnecessary and expensive for most individuals. Despite this, there are still benefits to consider, such as lifelong coverage, cash value accumulation, potential tax advantages, and estate planning benefits.

When evaluating whether whole life insurance is the right choice for your financial needs, it is important to consider the arguments against it, such as the high cost, potentially lower returns on cash value, complexity, lack of flexibility, and opportunity cost. Additionally, exploring alternative insurance options, including term life insurance, universal life insurance, indexed universal life insurance, self-insuring, or investment-based strategies, can provide different approaches to achieving financial protection and meeting your goals.

Ultimately, the decision regarding whole life insurance should be based on a thorough understanding of your financial goals, risk tolerance, and unique circumstances. It is advisable to consult with a licensed insurance professional or financial advisor who can provide personalized guidance and help you navigate the complexities of insurance and investment options.

Remember that while Dave Ramsey’s views on whole life insurance have influenced many, it is important to consider different perspectives and determine what aligns best with your specific financial situation. By doing so, you can make an informed decision and secure the appropriate insurance coverage to protect your loved ones and achieve your financial objectives.