Finance

How To Check Credit Score PNC

Modified: March 10, 2024

Need to check your credit score with PNC? Learn how to do it and manage your finances effectively with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to check your credit score with PNC! Your credit score plays a crucial role in your financial life and can greatly impact your ability to borrow money, secure favorable interest rates, and even access certain services. PNC, a well-known financial institution, offers convenient options to access and monitor your credit score.

But before we dive into the details, let’s clarify what a credit score is and why it is important. A credit score is a numerical representation of your creditworthiness, which indicates how likely you are to repay borrowed funds. It acts as a measure of your financial responsibility and is calculated based on your credit history, including factors such as payment history, debt utilization, length of credit history, and credit mix.

Your credit score matters because lenders, landlords, and even some employers use it to evaluate your financial reliability. A higher credit score indicates that you are a lower risk borrower, making it easier to qualify for loans and credit cards with better terms. It also reflects positively on your ability to manage your debts and financial obligations.

Now that you understand the importance of your credit score, let’s explore how PNC calculates credit scores and how you can access yours through their services.

What is a credit score?

A credit score is a three-digit number that reflects your creditworthiness and financial behavior. It is a numerical representation of your credit history and is used by lenders, landlords, and other financial institutions to assess your ability to repay debts. In the United States, credit scores are primarily calculated based on information from credit bureaus such as TransUnion, Equifax, and Experian.

There are different scoring models used to calculate credit scores, with the most common one being the FICO score. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Generally, a credit score above 700 is considered good, while scores below 600 may be seen as subprime.

Several factors contribute to your credit score, including:

- Payment history: This is the most significant factor, accounting for approximately 35% of your credit score. It reflects whether you make payments on time, have any late payments or defaults, and if you have any accounts in collections.

- Credit utilization: This accounts for around 30% of your credit score and measures the amount of credit you are using compared to your total available credit. Higher credit utilization ratios can negatively impact your score.

- Length of credit history: The length of time you have held credit accounts, along with the average age of your accounts, contributes to about 15% of your credit score. A longer credit history is generally viewed more favorably.

- Credit mix: The types of credit accounts you have, such as credit cards, mortgages, auto loans, and student loans, impact around 10% of your credit score. A diverse credit mix can be seen as a positive factor.

- New credit inquiries: When you apply for new credit, this can result in a hard inquiry on your credit report, which can temporarily lower your score by a few points. New credit inquiries contribute around 10% of your credit score.

Understanding these factors and how they influence your credit score can help you make informed decisions to improve your financial health. Now that you have a better understanding of what a credit score is, let’s explore why it is important in your financial journey.

Why is your credit score important?

Your credit score plays a crucial role in various aspects of your financial life. Here are some key reasons why your credit score is important:

- Borrowing Power: A good credit score increases your chances of being approved for loans, credit cards, and other forms of credit. Lenders use your credit score to assess the risk of lending you money. With a higher credit score, you are more likely to qualify for credit with favorable terms, such as lower interest rates and higher credit limits.

- Interest Rates: Your credit score can significantly impact the interest rates you receive on loans and credit cards. A higher credit score often translates into lower interest rates, saving you money in the long run. On the other hand, a lower credit score may result in higher interest rates, which can increase the cost of borrowing.

- Housing Opportunities: Landlords and property management companies often check credit scores when evaluating rental applicants. A good credit score can increase your chances of securing a desirable rental property and negotiating favorable lease terms.

- Insurance Premiums: Some insurance companies consider credit scores when determining premiums for auto, home, or renters insurance. A higher credit score may result in lower insurance premiums, ultimately saving you money on coverage.

- Employment Opportunities: Some employers may review credit scores as part of their hiring process, particularly for roles that involve financial responsibility or require access to sensitive financial information. While your credit score alone won’t determine your employability, a poor credit score could raise red flags for some employers.

- Financial Security: Maintaining a good credit score is important for your overall financial security. It reflects your ability to manage debts responsibly and indicates to lenders and financial institutions that you are a reliable borrower. This can open up opportunities for better financial products and services, such as higher credit limits, better rewards programs, and improved financial flexibility.

By understanding the importance of your credit score, you can take proactive steps to maintain or improve it. Now, let’s explore how PNC calculates credit scores and how you can access yours through their services.

How does PNC calculate credit scores?

PNC, like other financial institutions, does not calculate credit scores themselves. Instead, they rely on credit bureaus such as TransUnion, Equifax, and Experian to provide credit score information to their customers. These credit bureaus compile data from various sources, including lenders, creditors, and public records, to create credit reports.

PNC accesses credit score information provided by the credit bureaus to offer comprehensive credit score monitoring services to their customers. The credit bureaus use complex algorithms to calculate credit scores based on the information in your credit report. While the exact formulas used to calculate credit scores are proprietary, several key factors are taken into consideration.

Factors such as payment history, credit utilization, length of credit history, credit mix, and new credit inquiries all play a role in determining your credit score. Each factor is weighted differently, and their impact on your credit score may vary depending on your individual financial situation.

PNC, as a financial institution, provides tools and resources to help you monitor and understand your credit score. They do not influence the credit score calculation itself but provide access to credit score information and tools to help you manage and improve your score.

By partnering with credit bureaus and offering credit score monitoring services, PNC allows their customers to stay informed about their creditworthiness and take appropriate actions to maintain healthy credit scores.

Now that you have an understanding of how PNC accesses credit score information, let’s explore how you can access your credit score through PNC’s services.

How to access your credit score with PNC

PNC offers several convenient options for customers to access their credit scores. Here’s how you can check your credit score with PNC:

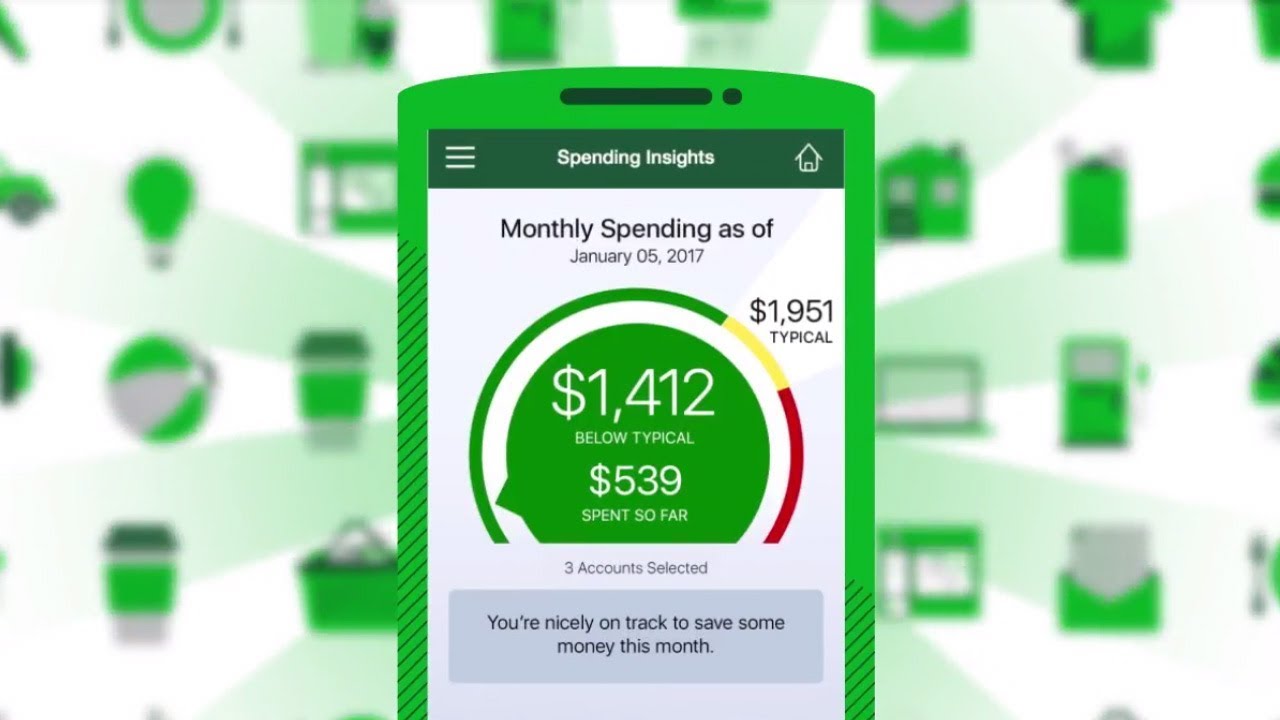

- Online Banking: If you are an existing PNC customer with online banking access, you can easily view your credit score by logging into your account. Navigate to the “Account Summary” or “Credit Score” section, where you will find your current credit score along with other helpful credit information.

- Mobile Banking App: PNC’s mobile banking app also provides access to your credit score. Simply download the PNC mobile app on your smartphone or tablet and log in using your online banking credentials. Once logged in, you can locate your credit score under the “Account Summary” or “Credit Score” section of the app.

- Credit Score Alerts: To ensure that you stay informed about any changes to your credit score, PNC offers credit score alerts. You can sign up for these alerts through PNC’s online banking or mobile banking app. By enabling credit score alerts, you will receive notifications whenever there are significant changes to your credit score.

- PNC Virtual Wallet®: If you are a Virtual Wallet® customer, accessing your credit score is just as easy. Log into your Virtual Wallet® account online or through the mobile app, and you will find your credit score displayed prominently on the account summary page.

It’s important to note that while PNC provides credit score information, the specific credit score model used may vary. PNC typically uses the FICO scoring model, but other credit scoring models such as VantageScore may be offered as well. The credit score provided by PNC is an estimate and may not be the same as the score seen by lenders.

Now that you know how to access your credit score with PNC, let’s walk through the steps to check your credit score using their services.

Steps to check your credit score with PNC

Checking your credit score with PNC is a straightforward process. Follow these steps to access your credit score:

- Step 1: Set up online banking: If you haven’t already, sign up for PNC’s online banking service. You can do this by visiting PNC’s website and selecting the “Enroll in Online Banking” option. Provide the necessary information to create your online banking account.

- Step 2: Log in to your PNC online banking account: After setting up your online banking account, log in using your username and password. Ensure that you have your account details readily available for a smooth login process.

- Step 3: Navigate to your credit score: Once you are logged in, find the “Account Summary” or “Credit Score” section. This is where you will be able to view your credit score and related information. Click on the relevant section to proceed.

- Step 4: View your credit score: In the credit score section, you will find your current credit score displayed. Take the time to review the information provided to gain a better understanding of your creditworthiness.

- Step 5: Explore credit score details: PNC’s credit score section may provide additional details about factors that influence your credit score. Take advantage of this information to identify areas for improvement or to better manage your credit.

- Step 6: Sign up for credit score alerts: Consider enrolling in PNC’s credit score alert service. By doing so, you can receive notifications whenever significant changes occur to your credit score. This can help you stay informed about any potential concerns or improvements in your creditworthiness.

Remember to regularly check your credit score to stay on top of your financial health. Monitoring your credit score can help you identify potential errors, track your progress, and take appropriate actions to improve or maintain a healthy credit score.

Next, let’s explore some additional services offered by PNC that can assist you in credit score monitoring.

Additional services offered by PNC for credit score monitoring

PNC provides additional services beyond simply checking your credit score. These services can help you monitor and manage your credit more effectively. Here are some of the credit score monitoring services offered by PNC:

- Credit Score Trends: PNC offers a feature called Credit Score Trends, which allows you to track your credit score over time. This tool provides a visual representation of your score’s fluctuations, helping you identify patterns and understand how your financial actions impact your creditworthiness.

- Credit Education: PNC understands the importance of credit education and offers resources to help you understand credit-related topics better. They provide educational materials, articles, and interactive tools to help you make informed decisions about your credit and improve your financial knowledge.

- Credit Score Simulator: PNC’s Credit Score Simulator is a valuable tool that allows you to explore hypothetical scenarios and see how they could affect your credit score. You can use this feature to understand the potential impact of actions such as making on-time payments, paying off debts, or opening new credit accounts.

- Credit Score Goals: PNC enables you to set credit score goals based on your financial objectives. You can track your progress toward these goals and receive tips and recommendations on how to improve your credit score and reach your desired target.

- Identity Theft Protection: PNC offers identity theft protection services to safeguard your personal information and credit. With identity theft on the rise, this service can provide added peace of mind by monitoring your credit file for any suspicious activity and helping you resolve issues if identity theft occurs.

These additional services offered by PNC go beyond providing a simple credit score and aim to empower you with the knowledge and tools to take control of your credit. By utilizing these services, you can strengthen your financial position, improve your creditworthiness, and protect yourself from potential fraud or identity theft.

Now that you are familiar with the additional credit score monitoring services offered by PNC, let’s explore some tips to help you improve your credit score.

Tips to improve your credit score

If you’re looking to improve your credit score, there are several strategies you can implement. While it takes time and effort, these tips can help you build a stronger credit profile and increase your creditworthiness. Here are some actionable tips to improve your credit score:

- Pay your bills on time: Late or missed payments can significantly impact your credit score. Make it a priority to pay your bills on time, including credit card payments, loan installments, and utility bills.

- Manage your credit utilization: Aim to keep your credit utilization ratio below 30%. This means using no more than 30% of your available credit. High credit utilization can signal a higher risk to lenders and negatively impact your credit score.

- Pay off debts: Reduce your overall debt by paying off balances on credit cards, loans, and other debts. Focus on high-interest debts first and consider debt consolidation strategies if needed.

- Avoid opening too many new credit accounts: Opening multiple new credit accounts within a short period can raise concerns for lenders. Limit new credit applications and only open new accounts when necessary.

- Maintain older credit accounts: The length of your credit history plays a role in your credit score. Keep older credit accounts open, even if they have a zero balance, to demonstrate a longer credit history.

- Check your credit reports for errors: Regularly review your credit reports from the major credit bureaus to ensure the information is accurate. If you find any errors or discrepancies, dispute them with the credit bureaus to have them corrected.

- Diversify your credit mix: Having a mix of different types of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. However, only pursue credit types that you can manage responsibly.

- Utilize credit monitoring tools: PNC offers credit score monitoring tools that can help you stay informed of any changes to your credit score. These tools can also provide insights and recommendations on how to improve your credit.

- Practice good financial habits: Being financially responsible overall can contribute to an improved credit score. This includes creating and sticking to a budget, avoiding unnecessary debt, and saving for emergencies.

Remember, improving your credit score is a gradual process that requires consistency and diligence. By implementing these tips and making positive financial choices, you can make significant strides in enhancing your creditworthiness over time.

Now that you’re armed with these credit score improvement strategies, take the necessary steps to enhance your credit profile and maximize your financial potential.

Conclusion

Your credit score is a vital aspect of your financial life that can greatly impact your ability to secure loans, access favorable interest rates, and even open doors for housing and employment opportunities. Checking your credit score and monitoring it regularly is essential for staying informed about your creditworthiness and taking proactive steps towards improving your financial health.

In this guide, we explored how to check your credit score with PNC. By utilizing their online banking services or mobile app, you can easily access your credit score and gain valuable insights into your credit profile. Additionally, PNC offers various tools and resources to help you monitor and improve your credit, such as credit score trends, credit education materials, and credit score simulators.

Remember, improving your credit score takes time and effort. Focus on making timely payments, managing your credit utilization, paying off debts, and practicing good financial habits. By following these tips and utilizing the services offered by PNC, you can take control of your credit and work towards a stronger financial future.

Stay informed, stay proactive, and regularly check your credit score. With PNC’s credit monitoring services and the tips provided, you can make informed decisions, improve your creditworthiness, and achieve your financial goals.

Start your journey towards a better credit score today and enjoy the benefits of financial stability and flexibility that come with it.