Finance

How To Check Credit Score Without SSN

Published: October 21, 2023

Learn how to check your credit score without providing your Social Security Number. Take control of your finances with this valuable finance resource.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having a good credit score is essential for financial stability and flexibility. It impacts your ability to secure favorable loan terms, rent an apartment, or even get a job. But what if you don’t have a Social Security Number (SSN) or simply don’t want to provide it when checking your credit score? Thankfully, there are several options available to individuals who want to check their credit score without SSN.

In this article, we will explore five different methods to check your credit score without SSN. Whether you are an international student, a recent immigrant, or just prefer to keep your SSN private, these methods can help you gain insight into your creditworthiness and take control of your financial future.

It’s important to note that these methods may not give you an exact FICO® credit score, as SSN is typically required for that. However, they can provide you with alternative credit scores or credit assessments that still give you a good idea of where you stand financially. Let’s dive into the different options:

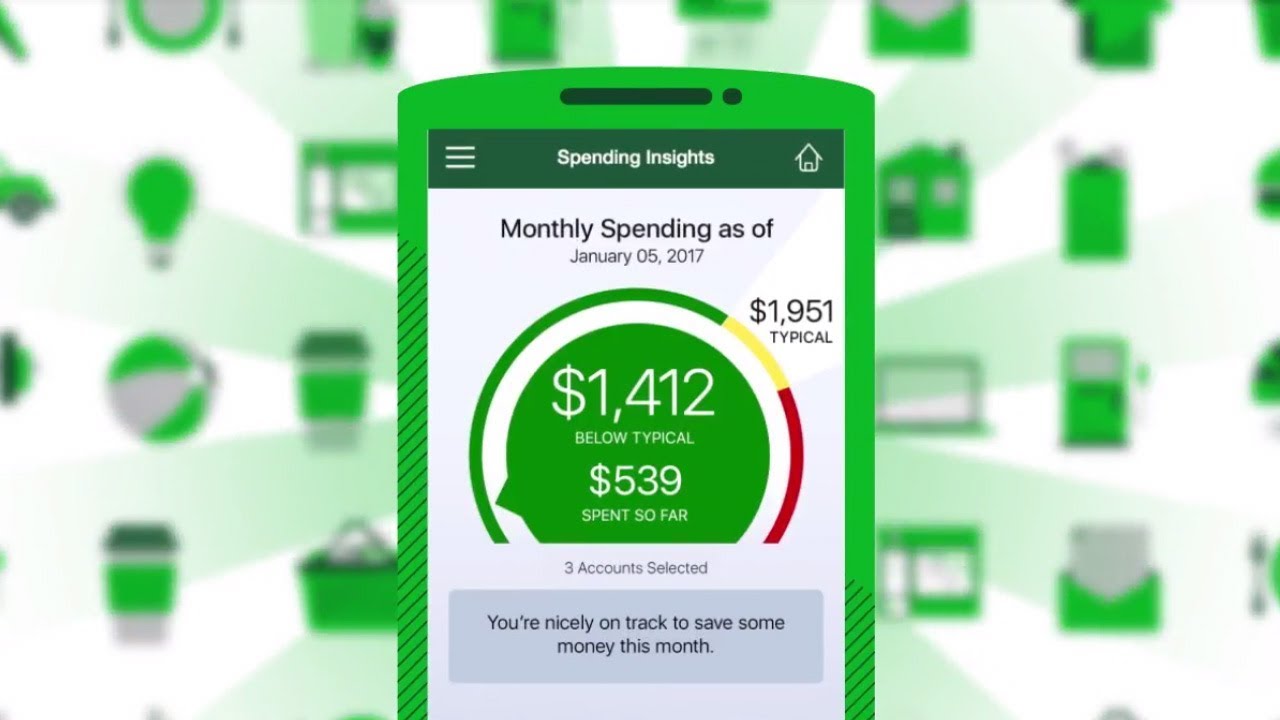

Option 1: Credit Monitoring Services

Credit monitoring services are a convenient and reliable way to keep track of your credit score without needing to provide an SSN. These services work by monitoring your credit activity, including any changes to your score, and providing regular updates and alerts.

When signing up for a credit monitoring service, you’ll typically need to provide personal information such as your name, address, and date of birth. Some services may require additional identification documents, but they generally do not require an SSN.

Once you are enrolled, the credit monitoring service will keep an eye on your credit report and provide you with access to your credit score. You can usually view your score through their online platform or receive it via email.

It’s important to note that credit monitoring services may come at a cost. However, the benefits they offer, such as identity theft protection and credit score tracking, can make it well worth the investment.

When choosing a credit monitoring service, be sure to look for reputable companies with a strong track record in the industry. Reading reviews and comparing features and pricing can help you make an informed decision. Some popular credit monitoring services include Experian, Equifax, and TransUnion.

Keep in mind that credit monitoring services primarily focus on tracking and alerting you to changes in your credit score. While they can give you an estimate of your creditworthiness, they may not provide you with the exact FICO® credit score used by lenders. However, they can still be valuable tools in understanding and managing your credit.

Option 2: Free Credit Report Available Once a Year

Another way to check your credit score without providing an SSN is by taking advantage of the free credit report that is available to consumers once a year. This option is made possible by the Fair Credit Reporting Act (FCRA), which requires the three major credit bureaus – Experian, Equifax, and TransUnion – to provide you with a free copy of your credit report annually.

To obtain your free credit report, you can visit AnnualCreditReport.com, the official website mandated by the FCRA. Fill out the necessary information, including your name, address, date of birth, and other identifying details. While the website may ask for your SSN, it is possible to leave this field blank or enter the last four digits of your SSN.

Once you’ve completed the application, you’ll receive your credit report from each of the three credit bureaus. While the reports won’t include your credit score, they will provide a detailed overview of your credit history, including any accounts, loans, or credit cards associated with your name.

Reviewing your credit report is an important step in understanding your financial standing and ensuring there are no errors or fraudulent activity. By checking your report regularly, you can identify any discrepancies and take action to resolve them. While the free credit report does not come with a credit score, it provides valuable information that can help you gauge your creditworthiness.

It’s important to note that this method allows you to check your credit report once a year for free. If you want to monitor your credit more frequently or obtain your credit score, you may need to explore other options, such as credit monitoring services or alternative credit scoring models.

Option 3: Alternative Credit Scoring Models

While traditional credit scoring models typically require an SSN, there are alternative credit scoring models that can assess your creditworthiness without this requirement. These alternative models take into account a variety of factors beyond credit history, allowing individuals without an SSN to still obtain a credit score.

One popular alternative credit scoring model is the VantageScore. Developed by the three major credit bureaus – Experian, Equifax, and TransUnion – the VantageScore considers a wider range of data points, including utility bill payments, rent payments, and bank account activity, in addition to traditional credit history. This model can provide you with a credit score even if you don’t have an SSN.

There are also specialized lenders and fintech companies that utilize their own alternative credit scoring models. These models often consider factors like income, employment history, and education level, providing a holistic view of your creditworthiness. These lenders may have specific programs or products designed for individuals without an SSN, making it easier to access credit and build a positive credit history.

When exploring alternative credit scoring models, it’s important to do your research and ensure that the organizations or lenders using these models are reputable and reliable. It’s also important to note that these alternative credit scores may not be as widely recognized or accepted by all lenders, so it’s important to consider your specific financial goals and needs.

While alternative credit scoring models can provide you with a credit score without an SSN, it’s still crucial to maintain good financial habits, pay bills on time, and manage your finances responsibly. This will help you build a positive credit history and improve your creditworthiness, regardless of the scoring model being used.

Option 4: Checking with Credit Card Companies

If you already have a credit card or are considering applying for one, checking with the credit card companies themselves can be a viable option to obtain your credit score without needing to provide an SSN.

Many credit card companies provide their customers with access to their credit scores as a free service. Some companies offer this feature through their online banking portals or mobile apps, while others may provide it upon request via customer service. By logging into your account or contacting the credit card company directly, you can inquire about accessing your credit score.

When checking with credit card companies, it’s important to ensure that they offer credit scores that are relevant to the credit scoring model they use. Most credit card companies provide credit scores based on FICO® credit scores, which are widely accepted and used by lenders. However, it’s always beneficial to confirm the specifics with the credit card company to understand the scoring model being used.

Furthermore, keep in mind that this method is only applicable if you already have a credit card or plan to obtain one. If you don’t have a credit card and are not interested in applying for one, you may want to explore the other options mentioned earlier.

Checking your credit score through credit card companies not only provides you with valuable information about your creditworthiness, but it also allows you to monitor your credit score regularly. This can be beneficial if you’re interested in tracking your progress and identifying any changes or fluctuations in your score over time.

Remember, maintaining a good payment history and responsible credit card usage can positively influence your credit score. Regularly checking your credit score through credit card companies ensures that you stay informed and proactive in managing your credit.

Option 5: Seeking Assistance from a Financial Advisor

If you’re unable to access your credit score through the previous options or simply prefer professional guidance, seeking assistance from a financial advisor can be a valuable choice. A financial advisor can offer expert advice, assess your financial situation, and help you better understand your creditworthiness.

When working with a financial advisor, they can analyze your financial information and provide insights into your credit score. While they may not directly provide you with a credit score, they can help you understand the factors affecting your creditworthiness and guide you in improving your financial standing.

During your consultation with a financial advisor, be sure to discuss your specific circumstances and the reason for wanting to check your credit score without an SSN. They can provide alternative methods or strategies to assess your creditworthiness, such as reviewing your financial history, income, and existing debts.

It’s essential to choose a reputable and qualified financial advisor who specializes in credit and personal finance. Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to ensure their expertise and credibility. You can seek recommendations from friends, family, or colleagues or conduct research online to find the right financial advisor for your needs.

While seeking assistance from a financial advisor may involve additional costs, the guidance and expertise they provide can be invaluable in making informed financial decisions and improving your overall creditworthiness.

Remember, a financial advisor can also assist you in developing a comprehensive financial plan, setting goals, and creating a roadmap to achieve them. Their expertise extends beyond credit scores and can help you navigate other aspects of your financial life, including budgeting, saving, and investing.

By partnering with a financial advisor, you can gain a holistic perspective on your personal finances and receive tailored recommendations to improve your creditworthiness, even if you don’t have an SSN to provide for a traditional credit score check.

Conclusion

Checking your credit score is an important step in understanding your financial health and taking control of your creditworthiness. While providing an SSN is the standard method for obtaining a credit score, there are alternative options available for individuals who want to check their credit score without an SSN.

In this article, we explored five different methods to check your credit score without an SSN. Credit monitoring services are a convenient option that provides regular updates on your credit score and activity. The free annual credit report, available through AnnualCreditReport.com, allows you to review your credit history in detail. Alternative credit scoring models, such as the VantageScore, consider various factors beyond traditional credit history. Checking with credit card companies can provide access to your credit score if you already have a credit card. Finally, seeking assistance from a financial advisor can offer professional advice and guidance on your creditworthiness.

It’s important to note that while these methods may not provide you with the exact FICO® credit score, they can still give you valuable insights into your creditworthiness and help you make informed financial decisions. By utilizing these options, you can stay on top of your credit and take proactive steps to improve your financial standing.

Remember, regardless of the method you choose to check your credit score without an SSN, it’s essential to maintain good financial habits, such as making on-time payments, managing your debts responsibly, and keeping a close eye on your credit activity. These practices will help you build a positive credit history and increase your chances of achieving your financial goals in the long run.

Take advantage of the available options and resources to gain a clearer understanding of your creditworthiness, as this will empower you to make informed decisions and navigate your financial journey with confidence.