Finance

How To Check FICO Score On Citi App

Published: March 6, 2024

Learn how to easily check your FICO score on the Citi app and stay on top of your finances. Take control of your financial health with this simple guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the digital era, where financial empowerment is just a few taps away. As technology continues to revolutionize the way we manage our finances, accessing your FICO score has become more convenient than ever. In this article, we’ll delve into the seamless process of checking your FICO score using the Citi app, empowering you with the knowledge to make informed financial decisions.

Understanding your FICO score is pivotal in navigating the complex landscape of personal finance. Whether you’re contemplating a major purchase, applying for a loan, or aiming to improve your creditworthiness, your FICO score serves as a crucial barometer of your financial health. With the Citi app, you can effortlessly monitor and comprehend your FICO score, paving the way for sound financial planning and decision-making.

Join us as we embark on a journey through the Citi app, unlocking the gateway to your FICO score and gaining valuable insights into the world of creditworthiness and financial prudence.

Creating a Citi Account

To embark on the journey of FICO score enlightenment through the Citi app, the first step is to create a Citi account. If you’re already a Citi customer, you can seamlessly use your existing credentials to log in to the app. For those who are new to Citi, the process of creating an account is straightforward and user-friendly.

Begin by downloading the Citi mobile app from the App Store or Google Play Store, depending on your device’s operating system. Once installed, open the app and select the option to create a new account. You’ll be prompted to enter personal details such as your name, date of birth, contact information, and Social Security number to verify your identity.

After providing the requisite information, you’ll proceed to set up your login credentials, including a username and password. It’s essential to choose a strong and memorable password to safeguard your account’s security. Additionally, you may be required to set up security questions or enable multi-factor authentication for an added layer of protection.

Upon successfully creating your Citi account, you’ll gain access to a wealth of financial tools and resources, including the ability to monitor your FICO score with ease. The process of creating a Citi account sets the stage for harnessing the power of the Citi app to stay informed about your financial well-being and make informed decisions based on your FICO score.

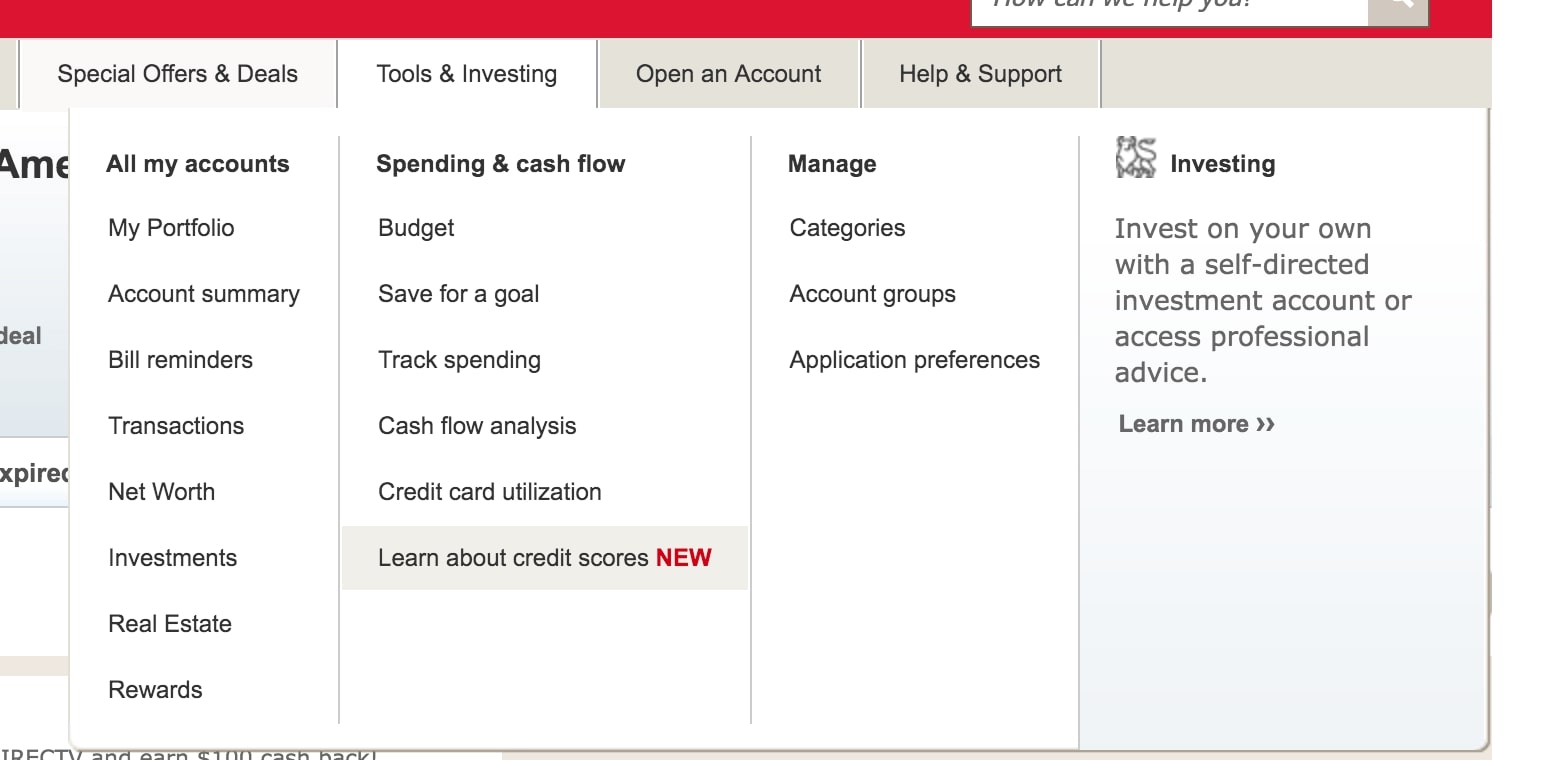

Navigating to the Credit Score Section

Once you’ve successfully created or logged into your Citi account, the next step is to navigate to the credit score section within the Citi app. The user-friendly interface of the app makes this process intuitive, allowing you to access your FICO score with just a few taps.

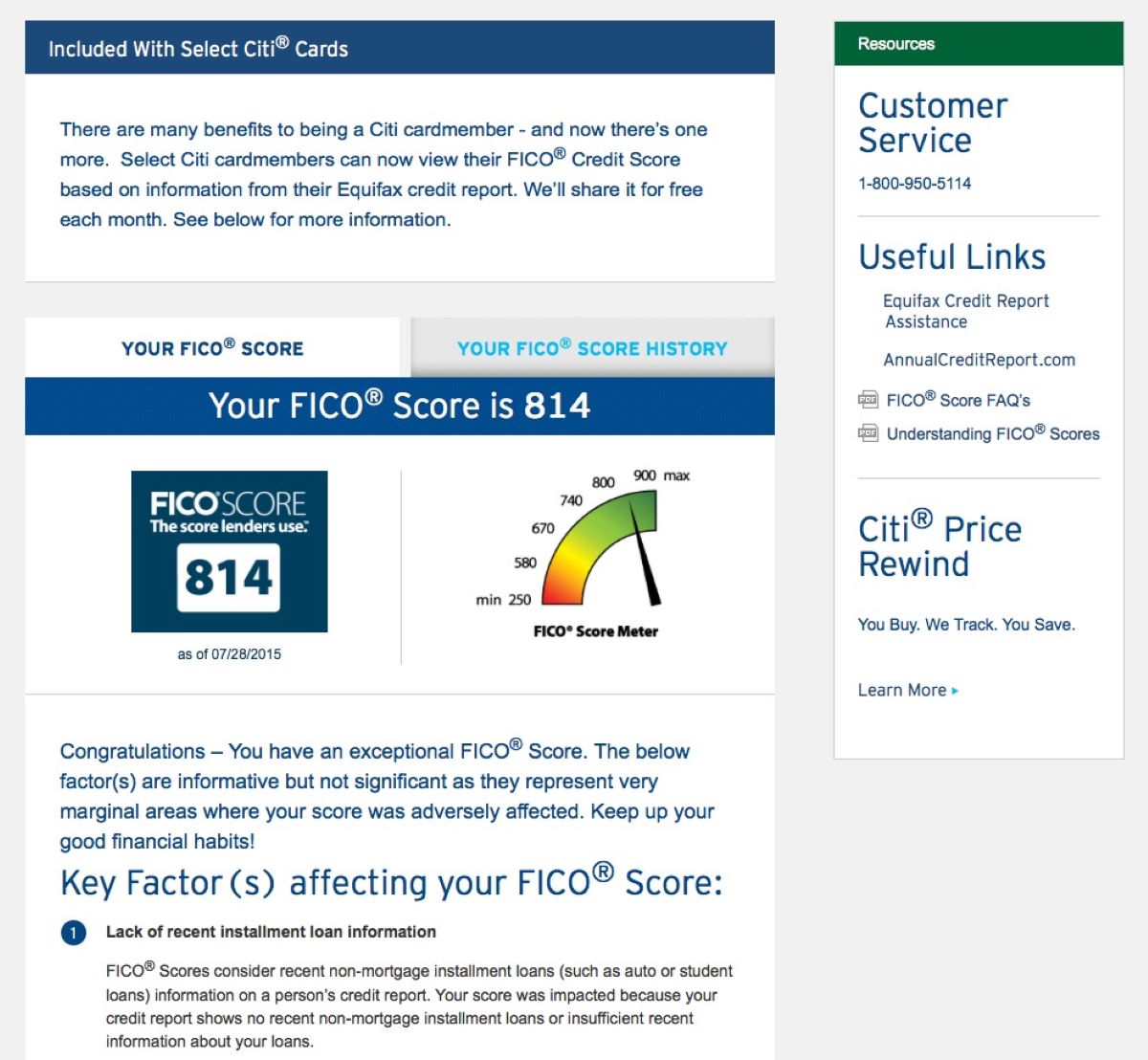

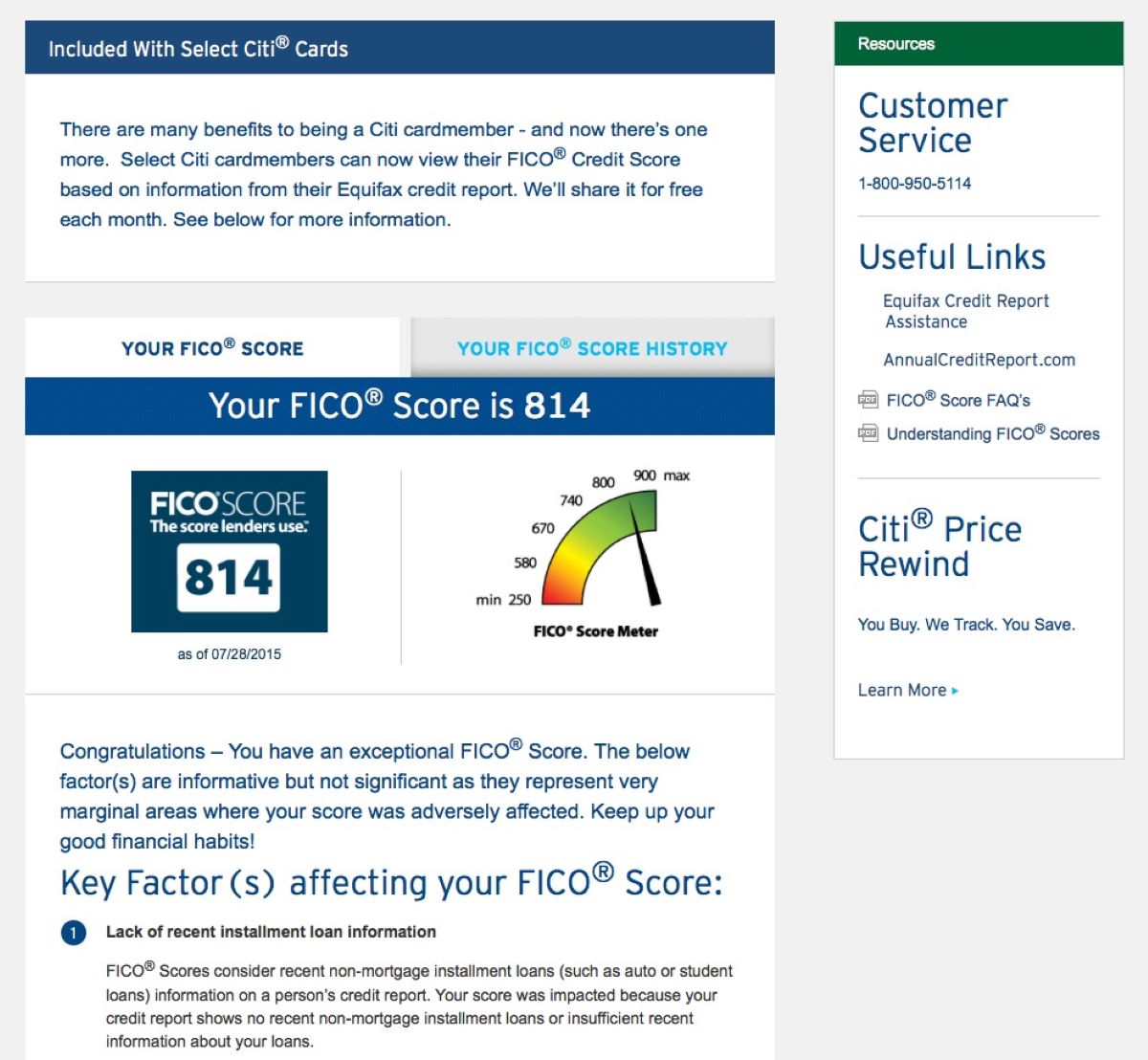

Upon logging into the Citi app, you’ll be greeted by a dashboard that provides an overview of your accounts, transactions, and financial insights. To access your FICO score, navigate to the menu or home screen, where you’ll find a dedicated section for credit-related information. This section may be labeled as “Credit Score,” “FICO Score,” or something similar, depending on the app’s interface and layout.

Once you’ve located the credit score section, you can simply tap on the corresponding icon or link to view your FICO score. Some apps may require you to authenticate your identity using biometric recognition, such as fingerprint or facial recognition, for added security before displaying your FICO score. This additional layer of security ensures that your financial information remains confidential and accessible only to authorized users.

Upon accessing your FICO score, take a moment to review the accompanying details and insights provided by the app. Some platforms offer personalized tips for improving your credit score, understanding the factors influencing your score, and identifying areas for potential financial growth. Leveraging these resources can empower you to make informed decisions and take proactive steps to enhance your financial well-being.

By seamlessly navigating to the credit score section within the Citi app, you can stay informed about your FICO score and gain valuable insights into your creditworthiness, all within the palm of your hand.

Understanding Your FICO Score

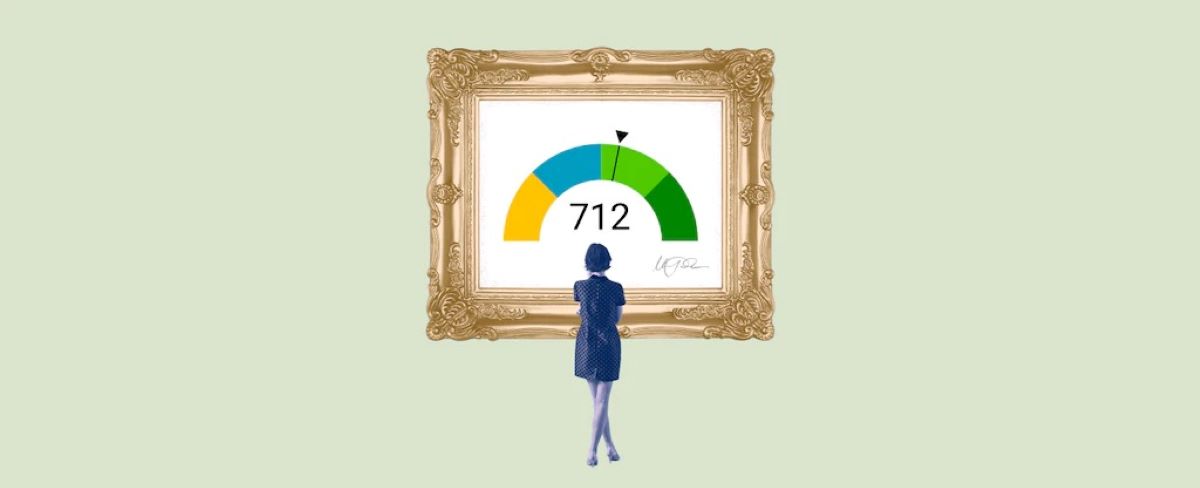

Now that you’ve accessed your FICO score through the Citi app, it’s essential to comprehend the significance of this numerical representation of your creditworthiness. Your FICO score, ranging from 300 to 850, serves as a key indicator used by lenders to evaluate your credit risk and determine the terms of any potential loans or credit extensions.

As you review your FICO score within the app, it’s important to understand the factors that contribute to this three-digit number. The score is calculated based on several key elements, including your payment history, amounts owed, length of credit history, new credit accounts, and the types of credit used. By comprehending the weight of each factor in determining your FICO score, you can gain insights into areas where you can potentially improve your creditworthiness.

Moreover, the Citi app may provide additional context and insights into your FICO score, such as a breakdown of the factors influencing your current score. Understanding these details can empower you to take proactive steps to enhance your credit profile, whether by making timely payments, reducing outstanding debts, or diversifying your credit mix.

Beyond the numerical value, your FICO score reflects your financial responsibility and discipline. A higher score indicates a lower credit risk, potentially leading to more favorable terms when seeking credit or loans. Conversely, a lower score may signal higher risk to lenders, resulting in less favorable terms or potential challenges in obtaining credit.

By comprehending the nuances of your FICO score and the underlying factors that shape it, you can proactively manage your financial behavior and make informed decisions to bolster your creditworthiness. The insights provided by the Citi app can serve as a valuable tool in this journey, offering clarity and guidance as you navigate the realm of credit and financial well-being.

Using Your FICO Score for Financial Decisions

Your FICO score, as accessed through the Citi app, is a powerful tool that can influence a myriad of financial decisions. Whether you’re considering a major purchase, applying for a loan, or seeking to improve your overall financial health, your FICO score serves as a critical factor in these endeavors.

One of the primary areas where your FICO score comes into play is when applying for credit, such as a mortgage, auto loan, or credit card. Lenders use your FICO score to assess your creditworthiness and determine the terms of the credit they may extend to you. A higher FICO score can open doors to more favorable interest rates, higher credit limits, and better loan terms, potentially saving you money in the long run.

Moreover, your FICO score can also impact non-lending decisions, such as securing a rental property or obtaining insurance. Landlords and insurance companies often consider FICO scores as a measure of financial responsibility and reliability, influencing their decisions regarding lease agreements and insurance premiums.

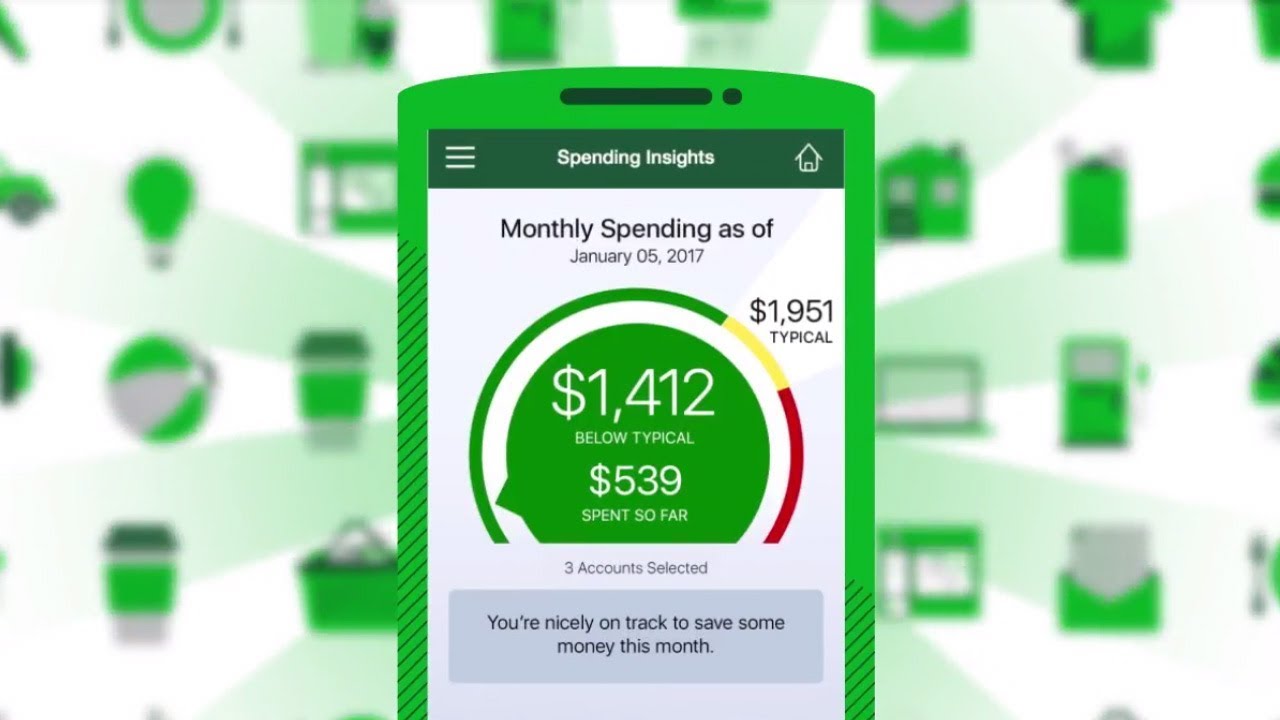

By regularly monitoring your FICO score through the Citi app, you can stay informed about your credit standing and take proactive steps to improve or maintain it. For instance, if you notice a decline in your score, you can investigate the underlying reasons, such as missed payments or high credit utilization, and take corrective actions to address these issues.

Furthermore, the insights provided by the Citi app may offer personalized recommendations for enhancing your credit profile based on your current FICO score and credit history. Leveraging these recommendations can empower you to make strategic financial decisions, whether by paying down debts, diversifying your credit mix, or establishing a solid payment history.

In essence, your FICO score, as made accessible through the Citi app, serves as a compass for navigating the realm of personal finance. By understanding the implications of your score and using it as a guide for financial decisions, you can embark on a path toward greater financial stability and well-being.

Conclusion

Embarking on the journey to understand and leverage your FICO score through the Citi app opens a gateway to financial empowerment and informed decision-making. The seamless access to your FICO score within the app provides a valuable tool for monitoring your creditworthiness and taking proactive steps to enhance your financial health.

By creating a Citi account and navigating to the credit score section within the app, you gain access to a wealth of insights into your credit profile. Understanding your FICO score and the factors that influence it empowers you to make strategic financial decisions, whether when applying for credit, seeking favorable loan terms, or improving your overall financial well-being.

Moreover, the Citi app serves as more than just a portal to your FICO score; it offers personalized recommendations and insights tailored to your credit history, providing actionable steps for enhancing your credit profile. This level of guidance can be instrumental in shaping your financial behavior and fostering long-term financial stability.

As you harness the power of the Citi app to monitor and comprehend your FICO score, remember that your score is not static. It is a reflection of your financial habits and can be influenced by your actions. Regularly checking your FICO score through the app and heeding the insights provided can set you on a path toward continuous improvement and financial prudence.

In closing, the Citi app’s seamless integration of FICO score monitoring offers a holistic approach to personal finance, equipping you with the tools and knowledge to make sound financial decisions. By embracing this digital resource, you can navigate the complexities of credit and lending with confidence, ultimately paving the way for a brighter financial future.